Reports

Reports

The global contraceptives market is an important aspect of the healthcare system as it aims to prevent unintended pregnancies and alleviate the burden of sexually transmitted diseases (STDs). The key driver is the rise in awareness of family planning, government initiatives, technological improvements in contraceptive methods, and preferences along the continuum of sexual health. More specifically, there is an overall need to respond to unintended pregnancies, increasing demand for reproductive health solutions (RHS), and increasingly appealing innovation such as long-acting reversible contraceptives (LARCs).

Along the way various restraints have been identified including the side-effects of hormonal contraceptives, social stigma attached to certain forms of contraception in certain areas of the globe, and design challenges for new products and regulations on marketing. There are also opportunities in the form of blended access options through OTC (Over-the-counter options), male contraceptive methods, and digital health.

A comprehensive analysis of the global contraceptives market including segmentation analysis, key companies, and an analyst view reliant on legitimate, non-commercial sources such as government websites, NGO sources or health organizations, and when reporting on research by market reports linking to the report itself is avoided.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Increasing acknowledgment of family planning and reproductive health will certainly be a major contributor to the global contraceptives market. As public health authorities, NGOs and governments up the ante on awareness and education about reproductive rights, safe sex, and the health and economic benefits of planned parenthood, more people - especially in developing parts of the world - are looking to contraceptives as a choice in health.

Public health campaigns like global initiatives of Family Planning 2030 and increasing the inclusion of sex education in school curricula are helping to normalize the use of contraceptives, particularly among women and adolescents. Therefore, the increased awareness will not only improve the acceptance of family planning and contraceptives’ use but also facilitate informed decisions about contraceptives’ behavior and increase demand for traditional and modern contraceptive methods while improving health outcomes.

As more people become aware of the connections between reproductive health and the other goals such as education, career plan, and poverty reduction, the use of contraceptives will lead to greater uptake and ultimately predictable growth in the global contraceptives market.

Government support and favorable policies are poised to accelerate the contraceptive market. National and regional governments around the world clearly see the links between family planning, healthcare cost reduction, improving maternal and child health, and even economic growth.

Many governments have initiated policies to improve access to contraceptives through public health programs, cost-reducing subsidies, and increasing awareness. For example, programs such as India's National Family Welfare Program and the US Title X Family Planning Program provide free and/or low-cost contraceptive options to tens of millions of people, particularly in underserved areas.

The expansion of access to birth control has further increased with policies such as including contraceptives in essential medicine lists, thereby allowing pharmacists to prescribe contraceptives, and opting to include contraceptives in covered insurance benefits in many countries.

These policy- and government-led efforts lessen the financial and logistical burden of obtaining access to contraceptives, primarily for those who have no other access. Given that governments around the world have recognized the importance of funding reproductive health as a public health priority, the demand for contraceptive products and services will continue to increase steadily.

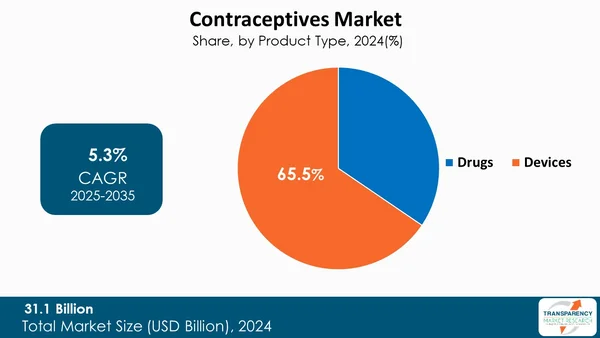

The devices segment is a primary contributor to the growth of the contraceptives market, as both - long-acting and user-independent methods become more prevalent. Devices such as IUDs, implants, and contraceptive patches are being adopted all over the world due to their cost-effectiveness, convenience, and relative use over time, thereby allowing for birth control effective for longer periodsit is even possible that some of these methods will last for years without daily user intervention. These advantages serve to make devices an attractive source of contraceptives, especially for women, as a reliable, low-maintenance way to prevent undesired pregnancies.

Over time, reliability and safety have influenced providers' and users' preferences for these methods Making access to abstinence-free devices easier for users is also being promoted by various governmental programs and NGOs as part of public health efforts within specific segments of the global environment, like in low-access developing countries.

Technological innovations such as hormone-free IUDs and biodegradable implants also create more options for providers and supporting end-user compliance with methods, as use of the device will last longer without daily thought or user intent.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is leading the global contraceptives market because of the high levels of awareness levels, widespread availability of contraceptive products, and strong government support for reproductive health policies. The region is characterized by a higher reach of healthcare services, the presence of comprehensive insurance plans, supportive policies such as the Title X program (in the U.S.) that are readily available and to family planning services. Another reason is high prevalence rates of modern contraceptive use among women in the US and Canada.

.webp)

North America also leads the adoption of long-acting reversible contraceptives such as IUDs or implants that not only align with clinical recommendations but also appeal to the consumers’ desire for low-maintenance options. The presence of major pharmaceutical companies and medical device companies, coupled with connectivity and innovation driven by telehealth and direct-to-consumer as well as continuous consumers’ convenience also enhance product availability.

Low stigma surrounding contraceptives, a high demand for customized delivery and fulfillment of reproductive care, and modern consumer insights also propel North America to the forefront of the contraceptive market.

Pfizer Inc., Pregna International Limited., Bayer AG, Teva Pharmaceutical Industries Ltd., Perrigo Company plc, Church & Dwight Co., Inc., Reckitt Benckiser Group PLC, ANSELL LTD., Karex Berhad., CooperSurgical, Inc., Insud Pharma, Contrel Europe NV, Aetos Pharma Private Limited., SMB Corporation of India and Other Prominent Players

Each of these players has been profiled in the contraceptives market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 31.1 Bn |

| Forecast Value in 2035 | US$ 52.2 Bn |

| CAGR | 5.3% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 31.1 Bn in 2024

It is projected to cross US$ 52.2 Bn by the end of 2035

Growing awareness of family planning and reproductive health and government support and favorable policies

It is anticipated to grow at a CAGR of 5.3% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Pfizer Inc., Pregna International Limited., Bayer AG, Teva Pharmaceutical Industries Ltd., Perrigo Company plc, Church & Dwight Co., Inc., Reckitt Benckiser Group PLC, ANSELL LTD., Karex Berhad, CooperSurgical, Inc., Insud Pharma, Contrel Europe NV, Aetos Pharma Private Limited., SMB Corporation of India and Other Prominent Players

Table 01: Global Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 03: Global Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 04: Global Market Value (US$ Bn) Forecast, By Condom, 2020 to 2035

Table 05: Global Market Value (US$ Bn) Forecast, By Intrauterine Devices (IUDs), 2020 to 2035

Table 06: Global Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 07: Global Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 08: Global Market Value (US$ Bn) Forecast, By Offline Channels, 2020 to 2035

Table 09: Global Market Value (US$ Bn) Forecast, By Online Channels, 2020 to 2035

Table 10: Global Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 11: North America Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 12: North America Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 13: North America Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 14: North America Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 15: North America Market Value (US$ Bn) Forecast, By Condom, 2020 to 2035

Table 16: North America Market Value (US$ Bn) Forecast, By Intrauterine Devices (IUDs), 2020 to 2035

Table 17: North America Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 18: North America Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 19: North America Market Value (US$ Bn) Forecast, By Offline Channels, 2020 to 2035

Table 20: North America Market Value (US$ Bn) Forecast, By Online Channels, 2020 to 2035

Table 21: Europe Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Europe Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 23: Europe Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 24: Europe Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 25: Europe Market Value (US$ Bn) Forecast, By Condom, 2020 to 2035

Table 26: Europe Market Value (US$ Bn) Forecast, By Intrauterine Devices (IUDs), 2020 to 2035

Table 27: Europe Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 28: Europe Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 29: Europe Market Value (US$ Bn) Forecast, By Offline Channels, 2020 to 2035

Table 30: Europe Market Value (US$ Bn) Forecast, By Online Channels, 2020 to 2035

Table 31: Asia Pacific Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 32: Asia Pacific Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 33: Asia Pacific Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 34: Asia Pacific Market Value (US$ Bn) Forecast, By Condom, 2020 to 2035

Table 35: Asia Pacific Market Value (US$ Bn) Forecast, By Intrauterine Devices (IUDs), 2020 to 2035

Table 36: Asia Pacific Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 37: Asia Pacific Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 38: Asia Pacific Market Value (US$ Bn) Forecast, By Offline Channels, 2020 to 2035

Table 39: Asia Pacific Market Value (US$ Bn) Forecast, By Online Channels, 2020 to 2035

Table 40: Latin America Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 41: Latin America Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 42: Latin America Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 43: Latin America Market Value (US$ Bn) Forecast, By Condom, 2020 to 2035

Table 44: Latin America Market Value (US$ Bn) Forecast, By Intrauterine Devices (IUDs), 2020 to 2035

Table 45: Latin America Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 46: Latin America Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 47: Latin America Market Value (US$ Bn) Forecast, By Offline Channels, 2020 to 2035

Table 48: Latin America Market Value (US$ Bn) Forecast, By Online Channels, 2020 to 2035

Table 49: Middle East & Africa Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 50: Middle East & Africa Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 51: Middle East & Africa Market Value (US$ Bn) Forecast, By Devices, 2020 to 2035

Table 52: Middle East & Africa Market Value (US$ Bn) Forecast, By Condom, 2020 to 2035

Table 53: Middle East & Africa Market Value (US$ Bn) Forecast, By Intrauterine Devices (IUDs), 2020 to 2035

Table 54: Middle East & Africa Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 55: Middle East & Africa Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 56: Middle East & Africa Market Value (US$ Bn) Forecast, By Offline Channels, 2020 to 2035

Table 57: Middle East & Africa Market Value (US$ Bn) Forecast, By Online Channels, 2020 to 2035

Figure 01: Global Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Market Revenue (US$ Bn), by Drugs, 2020 to 2035

Figure 04: Global Market Revenue (US$ Bn), by Devices, 2020 to 2035

Figure 05: Global Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 06: Global Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 07: Global Market Revenue (US$ Bn), by 15–44 Years, 2020 to 2035

Figure 08: Global Market Value Share Analysis, By Above 44 Years, 2024 and 2035

Figure 09: Global Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 10: Global Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 11: Global Market Revenue (US$ Bn), by Offline Channel, 2020 to 2035

Figure 12: Global Market Value Share Analysis, By Online Channel, 2024 and 2035

Figure 13: Global Market Revenue (US$ Bn), By Region, 2024 and 2035

Figure 14: Global Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 15: North America Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 16: North America Market Value Share Analysis, by Country, 2024 and 2035

Figure 17: North America Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 18: North America Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 19: North America Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 20: North America Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 21: North America Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 22: North America Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 23: North America Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 24: Europe Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 25: Europe Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 26: Europe Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 27: Europe Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 28: Europe Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 29: Europe Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 30: Europe Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 31: Europe Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 32: Europe Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 33: Asia Pacific Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Asia Pacific Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 35: Asia Pacific Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 36: Asia Pacific Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 37: Asia Pacific Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 38: Asia Pacific Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 39: Asia Pacific Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 40: Asia Pacific Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 41: Asia Pacific Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 42: Latin America Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Latin America Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 44: Latin America Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 45: Latin America Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 46: Latin America Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 47: Latin America Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 48: Latin America Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 49: Latin America Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 50: Latin America Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 51: Middle East & Africa Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 52: Middle East & Africa Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 53: Middle East & Africa Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 54: Middle East & Africa Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 55: Middle East & Africa Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 56: Middle East & Africa Market Value Share Analysis, By Age Group, 2024 and 2035

Figure 57: Middle East & Africa Market Attractiveness Analysis, By Age Group, 2025 to 2035

Figure 58: Middle East & Africa Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 59: Middle East & Africa Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035