Reports

Reports

As the ever-evolving SARS-CoV-2 continues to spread with the risk of infecting people with Delta and Delta Plus variants, companies in the commercial vehicle steering column market are adopting contingency planning to predict possible future outcomes. The commercial transportation segment is striving to ensure that the supplies of essential goods are not disrupted. As such, the ongoing COVID-19 pandemic is anticipated to lead to a drop in sales of commercial vehicles due to poor market sentiments.

It has been found that India’s commercial vehicle sector dependency on China is moderate. Such findings are helping companies in the commercial vehicle steering column market to emerge resilient during the unprecedented times. However, the pandemic coupled with financial profiles of fleet operators and price hikes, as the transition to BS-VI emission norms will have an impact on the commercial vehicle sales.

Power steering systems are expected to dominate the highest revenue among all steering system types in the commercial vehicle steering column market. The fast-growing challenges in the transportation and logistics industries demand economic solutions. Bosch Mobility Solutions - a comprehensive expertise in vehicle technology with software solutions and services is offering its Servotwin® electro-hydraulic steering system for heavy commercial vehicles.

Companies in the commercial vehicle steering column market are providing speed-dependent steering assistance with active reverse in electro-hydraulic steering systems, which are enabling automated driving functions.

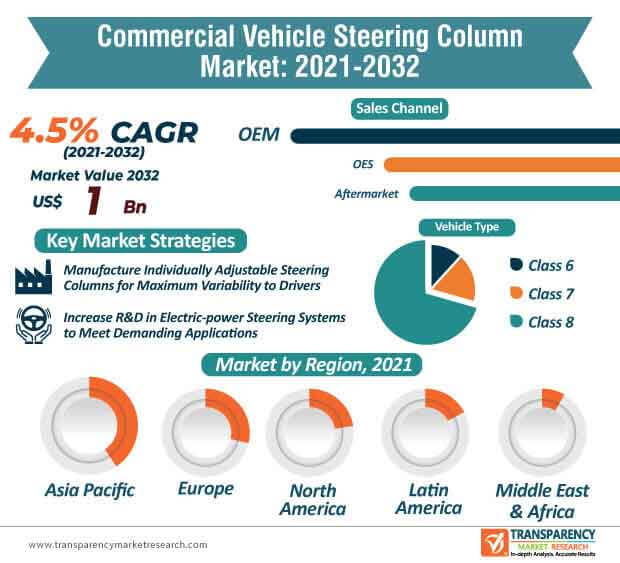

The commercial vehicle steering column market is expected to advance at a modest CAGR of 4.5% during the forecast period. Custom steering systems are bringing a significant change in the commercial transportation and logistics industries. These systems are in high demand in the U.K., since increasing number of people work in the haulage and logistics industry. Pailton Engineering - a global leader in the design and manufacture of commercial & military steering systems, is increasing efforts to incorporate bespoke designs in systems that require low maintenance.

Vehicles working in sub-zero temperatures such as in Canada and those operating in hot climates including the Middle East or Australia have fueled the demand for custom commercial vehicle steering columns.

Commercial vehicles are subject to constant technological development. Manufacturers in the commercial vehicle steering column market are gravitating toward electric-power steering systems. Close co-operation with vehicle manufacturers right from early stage of development ensures efficient adaptation of steering columns as per new vehicle concepts. Thus, to boost credibility credentials, OEMs are increasing their manufacturing in operating cylinders, steering shafts, steering pumps, and bevel gearboxes.

Companies in the commercial vehicle steering column market are realizing that electric-power steering systems are laying the foundation of driver assistance systems in commercial vehicles. OEMs are strengthening their supply chains by supplying components to local commercial vehicle workshops and local production sites with technical know-how. Robust, reliable, and highly accurate steering systems are gaining importance in commercial vehicles.

Analysts’ Viewpoint

Since the automotive industry contributes to ~50% of India’s manufacturing GDP, stakeholders in the commercial vehicle steering column market are redesigning their business processes with an extensive use of emerging technologies amid the coronavirus pandemic. The commercial vehicle steering column market is expected to cross US$ 1 Bn by 2032. However, fast-growing challenges in the haulage and logistics industries are increasing market competition. Hence, companies should increase focus on electrohydraulic steering systems and custom steering systems to meet the demanding needs of customers. Compact hydraulic steering systems integrated with mechanical steering gear are ideal for heavy commercial vehicles.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2018-2032

1.2. Demand & Supply Side Trends

1.3. TMR Analysis and Recommendations

1.4. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.3.3. PESTEL Analysis

2.3.4. Value Chain Analysis

2.4. Regulatory Scenario

2.5. Key Trend Analysis

2.6. Technology Roadmap

2.7. Pricing Analysis

2.7.1. Cost Structure Analysis

2.7.2. Profit Margin Analysis

3. COVID-19 Impact Analysis

4. Key OEMs/ Commercial Vehicle Brands and Models

4.1. By Country

4.1.1. For instance, in the U. S., Volvo Group Global (Class 8) including Volvo FMX and Volvo VM series has higher demand

4.1.2. For instance, in India, Tata Trucks (Class 6 & 7) including Ultra series & Prima Series has huge demand

4.2. Production Numbers for Commercial Vehicle by Brand in each country, 2018-2019

5. Global Commercial Vehicle Steering Column Market, by Column Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Column Type, 2018-2032

5.2.1. Adjustable Commercial Vehicle Steering Columns

5.2.2. Power Adjustable Commercial Vehicle Steering Columns

5.2.3. Tilt-Adjustable Commercial Vehicle Steering Columns

5.2.4. Non-Adjustable Commercial Vehicle Steering Columns

5.2.5. Power One touch Adjustability

5.2.6. Touch Control Electronic Transmission Shifter Commercial Vehicle Steering Column

5.2.7. Energy Absorbing Commercial Vehicle Steering Columns

6. Global Commercial Vehicle Steering Column Market, by Steering System

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Steering System, 2018-2032

6.2.1. Manual Worm & Roller Steering System

6.2.2. Power Steering System

6.2.2.1. Electric Power Steering

6.2.2.2. Hydraulic Power Steering

6.2.3. Manual Recirculating Ball & Nut Steering System

6.2.4. Manual Rack And Pinion Steering System

7. Global Commercial Vehicle Steering Column Market, by Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2018-2032

7.2.1. Class 6

7.2.2. Class 7

7.2.3. Class 8

8. Global Commercial Vehicle Steering Column Market, by Sales Channel

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Sales Channel, 2018-2032

8.2.1. OEM

8.2.2. OES

8.2.3. Aftermarket/ Replacement

9. Global Commercial Vehicle Steering Column Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Region, 2018-2032

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

10. North America Commercial Vehicle Steering Column Market

10.1. Market Snapshot

10.2. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Column Type, 2018-2032

10.2.1. Adjustable Commercial Vehicle Steering Columns

10.2.2. Power Adjustable Commercial Vehicle Steering Columns

10.2.3. Tilt-Adjustable Commercial Vehicle Steering Columns

10.2.4. Non-Adjustable Commercial Vehicle Steering Columns

10.2.5. Power One touch Adjustability

10.2.6. Touch Control Electronic Transmission Shifter Commercial Vehicle Steering Column

10.2.7. Energy Absorbing Commercial Vehicle Steering Columns

10.3. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Steering System, 2018-2032

10.3.1. Manual Worm & Roller Steering System

10.3.2. Power Steering System

10.3.2.1. Electric Power Steering

10.3.2.2. Hydraulic Power Steering

10.3.3. Manual Recirculating Ball & Nut Steering System

10.3.4. Manual Rack And Pinion Steering System

10.4. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2018-2032

10.4.1. Class 6

10.4.2. Class 7

10.4.3. Class 8

10.5. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Sales Channel, 2018-2032

10.5.1. OEM

10.5.2. OES

10.5.3. Aftermarket/ Replacement

10.6. Key Country Analysis – North America Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2018-2032

10.6.1. U.S.

10.6.2. Canada

11. U. S. Commercial Vehicle Steering Column Market

11.1. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Column Type, 2018-2032

11.1.1. Adjustable Commercial Vehicle Steering Columns

11.1.2. Power Adjustable Commercial Vehicle Steering Columns

11.1.3. Tilt-Adjustable Commercial Vehicle Steering Columns

11.1.4. Non-Adjustable Commercial Vehicle Steering Columns

11.1.5. Power One touch Adjustability

11.1.6. Touch Control Electronic Transmission Shifter Commercial Vehicle Steering Column

11.1.7. Energy Absorbing Commercial Vehicle Steering Columns

11.2. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Steering System, 2018-2032

11.2.1. Manual Worm & Roller Steering System

11.2.2. Power Steering System

11.2.2.1. Electric Power Steering

11.2.2.2. Hydraulic Power Steering

11.2.3. Manual Recirculating Ball & Nut Steering System

11.2.4. Manual Rack And Pinion Steering System

11.3. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2018-2032

11.3.1. Class 6

11.3.2. Class 7

11.3.3. Class 8

11.4. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Sales Channel, 2018-2032

11.4.1. OEM

11.4.2. OES

11.4.3. Aftermarket/ Replacement

12. Canada Commercial Vehicle Steering Column Market

12.1. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Column Type, 2018-2032

12.1.1. Adjustable Commercial Vehicle Steering Columns

12.1.2. Power Adjustable Commercial Vehicle Steering Columns

12.1.3. Tilt-Adjustable Commercial Vehicle Steering Columns

12.1.4. Non-Adjustable Commercial Vehicle Steering Columns

12.1.5. Power One touch Adjustability

12.1.6. Touch Control Electronic Transmission Shifter Commercial Vehicle Steering Column

12.1.7. Energy Absorbing Commercial Vehicle Steering Columns

12.2. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Steering System, 2018-2032

12.2.1. Manual Worm & Roller Steering System

12.2.2. Power Steering System

12.2.2.1. Electric Power Steering

12.2.2.2. Hydraulic Power Steering

12.2.3. Manual Recirculating Ball & Nut Steering System

12.2.4. Manual Rack And Pinion Steering System

12.3. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2018-2032

12.3.1. Class 6

12.3.2. Class 7

12.3.3. Class 8

12.4. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Sales Channel, 2018-2032

12.4.1. OEM

12.4.2. OES

12.4.3. Aftermarket/ Replacement

13. Europe Commercial Vehicle Steering Column Market

13.1. Market Snapshot

13.2. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Column Type, 2018-2032

13.2.1. Adjustable Commercial Vehicle Steering Columns

13.2.2. Power Adjustable Commercial Vehicle Steering Columns

13.2.3. Tilt-Adjustable Commercial Vehicle Steering Columns

13.2.4. Non-Adjustable Commercial Vehicle Steering Columns

13.2.5. Power One touch Adjustability

13.2.6. Touch Control Electronic Transmission Shifter Commercial Vehicle Steering Column

13.2.7. Energy Absorbing Commercial Vehicle Steering Columns

13.3. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Steering System, 2018-2032

13.3.1. Manual Worm & Roller Steering System

13.3.2. Power Steering System

13.3.2.1. Electric Power Steering

13.3.2.2. Hydraulic Power Steering

13.3.3. Manual Recirculating Ball & Nut Steering System

13.3.4. Manual Rack And Pinion Steering System

13.4. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2018-2032

13.4.1. Class 6

13.4.2. Class 7

13.4.3. Class 8

13.5. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Sales Channel, 2018-2032

13.5.1. OEM

13.5.2. OES

13.5.3. Aftermarket/ Replacement

13.6. Key Country Analysis – Europe Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2018-2032

13.6.1. Germany

13.6.2. U. K.

13.6.3. France

13.6.4. Italy

13.6.5. Spain

13.6.6. Nordic Countries

13.6.7. Russia & CIS

13.6.8. Rest of Europe

14. Asia Pacific Commercial Vehicle Steering Column Market

14.1. Market Snapshot

14.2. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Column Type, 2018-2032

14.2.1. Adjustable Commercial Vehicle Steering Columns

14.2.2. Power Adjustable Commercial Vehicle Steering Columns

14.2.3. Tilt-Adjustable Commercial Vehicle Steering Columns

14.2.4. Non-Adjustable Commercial Vehicle Steering Columns

14.2.5. Power One touch Adjustability

14.2.6. Touch Control Electronic Transmission Shifter Commercial Vehicle Steering Column

14.2.7. Energy Absorbing Commercial Vehicle Steering Columns

14.3. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Steering System, 2018-2032

14.3.1. Manual Worm & Roller Steering System

14.3.2. Power Steering System

14.3.2.1. Electric Power Steering

14.3.2.2. Hydraulic Power Steering

14.3.3. Manual Recirculating Ball & Nut Steering System

14.3.4. Manual Rack And Pinion Steering System

14.4. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2018-2032

14.4.1. Class 6

14.4.2. Class 7

14.4.3. Class 8

14.5. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Sales Channel, 2018-2032

14.5.1. OEM

14.5.2. OES

14.5.3. Aftermarket/ Replacement

14.6. Key Country Analysis – Asia Pacific Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2018-2032

14.6.1. China

14.6.2. India

14.6.3. Japan

14.6.4. ASEAN Countries

14.6.5. South Korea

14.6.6. ANZ

14.6.7. Rest of Asia Pacific

15. Middle East & Africa Commercial Vehicle Steering Column Market

15.1. Market Snapshot

15.2. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Column Type, 2018-2032

15.2.1. Adjustable Commercial Vehicle Steering Columns

15.2.2. Power Adjustable Commercial Vehicle Steering Columns

15.2.3. Tilt-Adjustable Commercial Vehicle Steering Columns

15.2.4. Non-Adjustable Commercial Vehicle Steering Columns

15.2.5. Power One touch Adjustability

15.2.6. Touch Control Electronic Transmission Shifter Commercial Vehicle Steering Column

15.2.7. Energy Absorbing Commercial Vehicle Steering Columns

15.3. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Steering System, 2018-2032

15.3.1. Manual Worm & Roller Steering System

15.3.2. Power Steering System

15.3.2.1. Electric Power Steering

15.3.2.2. Hydraulic Power Steering

15.3.3. Manual Recirculating Ball & Nut Steering System

15.3.4. Manual Rack And Pinion Steering System

15.4. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2018-2032

15.4.1. Class 6

15.4.2. Class 7

15.4.3. Class 8

15.5. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Sales Channel, 2018-2032

15.5.1. OEM

15.5.2. OES

15.5.3. Aftermarket/ Replacement

15.6. Key Country Analysis – Middle East & Africa Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2018-2032

15.6.1. GCC

15.6.2. South Africa

15.6.3. Turkey

15.6.4. Rest of Middle East & Africa

16. Latin America Commercial Vehicle Steering Column Market

16.1. Market Snapshot

16.2. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Column Type, 2018-2032

16.2.1. Adjustable Commercial Vehicle Steering Columns

16.2.2. Power Adjustable Commercial Vehicle Steering Columns

16.2.3. Tilt-Adjustable Commercial Vehicle Steering Columns

16.2.4. Non-Adjustable Commercial Vehicle Steering Columns

16.2.5. Power One touch Adjustability

16.2.6. Touch Control Electronic Transmission Shifter Commercial Vehicle Steering Column

16.2.7. Energy Absorbing Commercial Vehicle Steering Columns

16.3. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Steering System, 2018-2032

16.3.1. Manual Worm & Roller Steering System

16.3.2. Power Steering System

16.3.2.1. Electric Power Steering

16.3.2.2. Hydraulic Power Steering

16.3.3. Manual Recirculating Ball & Nut Steering System

16.3.4. Manual Rack And Pinion Steering System

16.4. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2018-2032

16.4.1. Class 6

16.4.2. Class 7

16.4.3. Class 8

16.5. Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, by Sales Channel, 2018-2032

16.5.1. OEM

16.5.2. OES

16.5.3. Aftermarket/ Replacement

16.6. Key Country Analysis – Latin America Commercial Vehicle Steering Column Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2018-2032

16.6.1. Brazil

16.6.2. Mexico

16.6.3. Argentina

16.6.4. Rest of Latin America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Ranking, 2020

17.2. Key Strategy Analysis

17.2.1. Strategic Overview - Expansion, M&A, Partnership

17.2.2. Product & Marketing Strategy

17.3. Pricing comparison among key players

17.4. Company Analysis for each player (Company Overview, Company Footprint, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability)

17.5. Company Profile/ Key Players

17.5.1. Bosch Germany

17.5.1.1. Company Overview

17.5.1.2. Company Footprint

17.5.1.3. Production Locations

17.5.1.4. Product Portfolio

17.5.1.5. Competitors & Customers

17.5.1.6. Subsidiaries & Parent Organization

17.5.1.7. Recent Developments

17.5.1.8. Financial Analysis

17.5.1.9. Profitability

17.5.2. C.O.B.O International, Italy

17.5.2.1. Company Overview

17.5.2.2. Company Footprint

17.5.2.3. Production Locations

17.5.2.4. Product Portfolio

17.5.2.5. Competitors & Customers

17.5.2.6. Subsidiaries & Parent Organization

17.5.2.7. Recent Developments

17.5.2.8. Financial Analysis

17.5.2.9. Profitability

17.5.3. Continental AG

17.5.3.1. Company Overview

17.5.3.2. Company Footprint

17.5.3.3. Production Locations

17.5.3.4. Product Portfolio

17.5.3.5. Competitors & Customers

17.5.3.6. Subsidiaries & Parent Organization

17.5.3.7. Recent Developments

17.5.3.8. Financial Analysis

17.5.3.9. Profitability

17.5.4. Coram Group

17.5.4.1. Company Overview

17.5.4.2. Company Footprint

17.5.4.3. Production Locations

17.5.4.4. Product Portfolio

17.5.4.5. Competitors & Customers

17.5.4.6. Subsidiaries & Parent Organization

17.5.4.7. Recent Developments

17.5.4.8. Financial Analysis

17.5.4.9. Profitability

17.5.5. Delphi Automotive PLC

17.5.5.1. Company Overview

17.5.5.2. Company Footprint

17.5.5.3. Production Locations

17.5.5.4. Product Portfolio

17.5.5.5. Competitors & Customers

17.5.5.6. Subsidiaries & Parent Organization

17.5.5.7. Recent Developments

17.5.5.8. Financial Analysis

17.5.5.9. Profitability

17.5.6. Denso Corporation

17.5.6.1. Company Overview

17.5.6.2. Company Footprint

17.5.6.3. Production Locations

17.5.6.4. Product Portfolio

17.5.6.5. Competitors & Customers

17.5.6.6. Subsidiaries & Parent Organization

17.5.6.7. Recent Developments

17.5.6.8. Financial Analysis

17.5.6.9. Profitability

17.5.7. Flaming River Industries Inc

17.5.7.1. Company Overview

17.5.7.2. Company Footprint

17.5.7.3. Production Locations

17.5.7.4. Product Portfolio

17.5.7.5. Competitors & Customers

17.5.7.6. Subsidiaries & Parent Organization

17.5.7.7. Recent Developments

17.5.7.8. Financial Analysis

17.5.7.9. Profitability

17.5.8. Hella KGaA Hueck

17.5.8.1. Company Overview

17.5.8.2. Company Footprint

17.5.8.3. Production Locations

17.5.8.4. Product Portfolio

17.5.8.5. Competitors & Customers

17.5.8.6. Subsidiaries & Parent Organization

17.5.8.7. Recent Developments

17.5.8.8. Financial Analysis

17.5.8.9. Profitability

17.5.9. JTEKET Corporation

17.5.9.1. Company Overview

17.5.9.2. Company Footprint

17.5.9.3. Production Locations

17.5.9.4. Product Portfolio

17.5.9.5. Competitors & Customers

17.5.9.6. Subsidiaries & Parent Organization

17.5.9.7. Recent Developments

17.5.9.8. Financial Analysis

17.5.9.9. Profitability

17.5.10. Knorr-Bremse AG

17.5.10.1. Company Overview

17.5.10.2. Company Footprint

17.5.10.3. Production Locations

17.5.10.4. Product Portfolio

17.5.10.5. Competitors & Customers

17.5.10.6. Subsidiaries & Parent Organization

17.5.10.7. Recent Developments

17.5.10.8. Financial Analysis

17.5.10.9. Profitability

17.5.11. Mando Halla Company

17.5.11.1. Company Overview

17.5.11.2. Company Footprint

17.5.11.3. Production Locations

17.5.11.4. Product Portfolio

17.5.11.5. Competitors & Customers

17.5.11.6. Subsidiaries & Parent Organization

17.5.11.7. Recent Developments

17.5.11.8. Financial Analysis

17.5.11.9. Profitability

17.5.12. Marimba Auto

17.5.12.1. Company Overview

17.5.12.2. Company Footprint

17.5.12.3. Production Locations

17.5.12.4. Product Portfolio

17.5.12.5. Competitors & Customers

17.5.12.6. Subsidiaries & Parent Organization

17.5.12.7. Recent Developments

17.5.12.8. Financial Analysis

17.5.12.9. Profitability

17.5.13. Nexteer Automotive

17.5.13.1. Company Overview

17.5.13.2. Company Footprint

17.5.13.3. Production Locations

17.5.13.4. Product Portfolio

17.5.13.5. Competitors & Customers

17.5.13.6. Subsidiaries & Parent Organization

17.5.13.7. Recent Developments

17.5.13.8. Financial Analysis

17.5.13.9. Profitability

17.5.14. NSK

17.5.14.1. Company Overview

17.5.14.2. Company Footprint

17.5.14.3. Production Locations

17.5.14.4. Product Portfolio

17.5.14.5. Competitors & Customers

17.5.14.6. Subsidiaries & Parent Organization

17.5.14.7. Recent Developments

17.5.14.8. Financial Analysis

17.5.14.9. Profitability

17.5.15. Pailton Engineering Ltd

17.5.15.1. Company Overview

17.5.15.2. Company Footprint

17.5.15.3. Production Locations

17.5.15.4. Product Portfolio

17.5.15.5. Competitors & Customers

17.5.15.6. Subsidiaries & Parent Organization

17.5.15.7. Recent Developments

17.5.15.8. Financial Analysis

17.5.15.9. Profitability

17.5.16. Schaeffler, Germany

17.5.16.1. Company Overview

17.5.16.2. Company Footprint

17.5.16.3. Production Locations

17.5.16.4. Product Portfolio

17.5.16.5. Competitors & Customers

17.5.16.6. Subsidiaries & Parent Organization

17.5.16.7. Recent Developments

17.5.16.8. Financial Analysis

17.5.16.9. Profitability

17.5.17. ThyssenKrupp

17.5.17.1. Company Overview

17.5.17.2. Company Footprint

17.5.17.3. Production Locations

17.5.17.4. Product Portfolio

17.5.17.5. Competitors & Customers

17.5.17.6. Subsidiaries & Parent Organization

17.5.17.7. Recent Developments

17.5.17.8. Financial Analysis

17.5.17.9. Profitability

17.5.18. TRW Automotive

17.5.18.1. Company Overview

17.5.18.2. Company Footprint

17.5.18.3. Production Locations

17.5.18.4. Product Portfolio

17.5.18.5. Competitors & Customers

17.5.18.6. Subsidiaries & Parent Organization

17.5.18.7. Recent Developments

17.5.18.8. Financial Analysis

17.5.18.9. Profitability

17.5.19. Other Key Players

List of Tables

Table 1: Global Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Column Type, 2018-2032

Table 2: Global Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Column Type, 2018-2032

Table 3: Global Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Vehicle Type, 2018-2032

Table 4: Global Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Vehicle Type, 2018-2032

Table 5: Global Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Sales Channel, 2018-2032

Table 6: Global Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Sales Channel, 2018-2032

Table 7: Global Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 8: Global Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 9: Global Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Region, 2018-2032

Table 10: Global Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Region, 2018-2032

Table 11: North America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Column Type, 2018-2032

Table 12: North America Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Column Type, 2018-2032

Table 13: North America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Vehicle Type, 2018-2032

Table 14: North America Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Vehicle Type, 2018-2032

Table 15: North America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Sales Channel, 2018-2032

Table 16: North America Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Sales Channel, 2018-2032

Table 17: North America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 18: North America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 19: North America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Country , 2018-2032

Table 20: North America Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Country , 2018-2032

Table 21: U.S. Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Column Type, 2018-2032

Table 22: U.S. Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Column Type, 2018-2032

Table 23: U.S. Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Vehicle Type, 2018-2032

Table 24: U.S. Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Vehicle Type, 2018-2032

Table 25: U.S. Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Sales Channel, 2018-2032

Table 26: U.S. Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Sales Channel, 2018-2032

Table 27: U.S. Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 28: U.S. Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 29: Canada Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Column Type, 2018-2032

Table 30: Canada Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Column Type, 2018-2032

Table 31: Canada Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Vehicle Type, 2018-2032

Table 32: Canada Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Vehicle Type, 2018-2032

Table 33: Canada Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Sales Channel, 2018-2032

Table 34: Canada Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Sales Channel, 2018-2032

Table 35: Canada Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 36: Canada Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 37: Europe Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Column Type, 2018-2032

Table 38: Europe Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Column Type, 2018-2032

Table 39: Europe Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Vehicle Type, 2018-2032

Table 40: Europe Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Vehicle Type, 2018-2032

Table 41: Europe Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Sales Channel, 2018-2032

Table 42: Europe Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Sales Channel, 2018-2032

Table 43: Europe Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 44: Europe Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 45: Europe Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Country and Sub-region, 2018-2032

Table 46: Europe Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018-2032

Table 47: Asia Pacific Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Column Type, 2018-2032

Table 48: Asia Pacific Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Column Type, 2018-2032

Table 49: Asia Pacific Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Vehicle Type, 2018-2032

Table 50: Asia Pacific Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Vehicle Type, 2018-2032

Table 51: Asia Pacific Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Sales Channel, 2018-2032

Table 52: Asia Pacific Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Sales Channel, 2018-2032

Table 53: Asia Pacific Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 54: Asia Pacific Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 55: Asia Pacific Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Country and Sub-region, 2018-2032

Table 56: Asia Pacific Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018-2032

Table 57: Middle East & Africa Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Column Type, 2018-2032

Table 58: Middle East & Africa Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Column Type, 2018-2032

Table 59: Middle East & Africa Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Vehicle Type, 2018-2032

Table 60: Middle East & Africa Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Vehicle Type, 2018-2032

Table 61: Middle East & Africa Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Sales Channel, 2018-2032

Table 62: Middle East & Africa Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Sales Channel, 2018-2032

Table 63: Middle East & Africa Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 64: Middle East & Africa Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 65: Middle East & Africa Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Country and Sub-region, 2018-2032

Table 66: Middle East & Africa Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018-2032

Table 67: Latin America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Column Type, 2018-2032

Table 68: Latin America Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Column Type, 2018-2032

Table 69: Latin America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Vehicle Type, 2018-2032

Table 70: Latin America Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Vehicle Type, 2018-2032

Table 71: Latin America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Sales Channel, 2018-2032

Table 72: Latin America Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Sales Channel, 2018-2032

Table 73: Latin America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 74: Latin America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Steering System, 2018-2032

Table 75: Latin America Commercial Vehicle Steering Column Market Volume (Million Units) Forecast, by Country and Sub-region, 2018-2032

Table 76: Latin America Commercial Vehicle Steering Column Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018-2032

List of Figures

Figure 1: Global Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Column Type, 2018-2032

Figure 2: Global Commercial Vehicle Steering Column Market, Incremental Opportunity, by Column Type, Value (US$ Mn), 2021-2031

Figure 3: Global Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Vehicle Type, 2018-2032

Figure 4: Global Commercial Vehicle Steering Column Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 5: Global Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Sales Channel, 2018-2032

Figure 6: Global Commercial Vehicle Steering Column Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2021-2031

Figure 7: Global Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Steering System, 2018-2032

Figure 8: Global Commercial Vehicle Steering Column Market, Incremental Opportunity, by Steering System, Value (US$ Mn), 2021-2031

Figure 9: Global Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Region, 2018-2032

Figure 10: Global Commercial Vehicle Steering Column Market, Incremental Opportunity, by Region, Value (US$ Mn), 2021-2031

Figure 11: North America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Column Type, 2018-2032

Figure 12: North America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Column Type, Value (US$ Mn), 2021-2031

Figure 13: North America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Vehicle Type, 2018-2032

Figure 14: North America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 15: North America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Sales Channel, 2018-2032

Figure 16: North America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2021-2031

Figure 17: North America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Steering System, 2018-2032

Figure 18: North America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Steering System, Value (US$ Mn), 2021-2031

Figure 19: North America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Country, 2018-2032

Figure 20: North America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Country, Value (US$ Mn), 2021-2031

Figure 21: U.S. Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, 2018-2032

Figure 22: U.S. Commercial Vehicle Steering Column Market Share 2020 (Column Type, Steering System, Vehicle Type)

Figure 23: Canada Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, 2018-2032

Figure 24: Canada Commercial Vehicle Steering Column Market Share 2020 (Column Type, Steering System, Vehicle Type)

Figure 25: Europe Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Column Type, 2018-2032

Figure 26: Europe Commercial Vehicle Steering Column Market, Incremental Opportunity, by Column Type, Value (US$ Mn), 2021-2031

Figure 27: Europe Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Vehicle Type, 2018-2032

Figure 28: Europe Commercial Vehicle Steering Column Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 29: Europe Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Sales Channel, 2018-2032

Figure 30: Europe Commercial Vehicle Steering Column Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2021-2031

Figure 31: Europe Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Steering System, 2018-2032

Figure 32: Europe Commercial Vehicle Steering Column Market, Incremental Opportunity, by Steering System, Value (US$ Mn), 2021-2031

Figure 33: Europe Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Country and Sub-region, 2018-2032

Figure 34: Europe Commercial Vehicle Steering Column Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2021-2031

Figure 35: Asia Pacific Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Column Type, 2018-2032

Figure 36: Asia Pacific Commercial Vehicle Steering Column Market, Incremental Opportunity, by Column Type, Value (US$ Mn), 2021-2031

Figure 37: Asia Pacific Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Vehicle Type, 2018-2032

Figure 38: Asia Pacific Commercial Vehicle Steering Column Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 39: Asia Pacific Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Sales Channel, 2018-2032

Figure 40: Asia Pacific Commercial Vehicle Steering Column Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2021-2031

Figure 41: Asia Pacific Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Steering System, 2018-2032

Figure 42: Asia Pacific Commercial Vehicle Steering Column Market, Incremental Opportunity, by Steering System, Value (US$ Mn), 2021-2031

Figure 43: Asia Pacific Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Country and Sub-region, 2018-2032

Figure 44: Asia Pacific Commercial Vehicle Steering Column Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2021-2031

Figure 45: Middle East & Africa Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Column Type, 2018-2032

Figure 46: Middle East & Africa Commercial Vehicle Steering Column Market, Incremental Opportunity, by Column Type, Value (US$ Mn), 2021-2031

Figure 47: Middle East & Africa Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Vehicle Type, 2018-2032

Figure 48: Middle East & Africa Commercial Vehicle Steering Column Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 49: Middle East & Africa Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Sales Channel, 2018-2032

Figure 50: Middle East & Africa Commercial Vehicle Steering Column Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2021-2031

Figure 51: Middle East & Africa Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Steering System, 2018-2032

Figure 52: Middle East & Africa Commercial Vehicle Steering Column Market, Incremental Opportunity, by Steering System, Value (US$ Mn), 2021-2031

Figure 53: Middle East & Africa Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Country and Sub-region, 2018-2032

Figure 54: Middle East & Africa Commercial Vehicle Steering Column Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2021-2031

Figure 55: Latin America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Column Type, 2018-2032

Figure 56: Latin America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Column Type, Value (US$ Mn), 2021-2031

Figure 57: Latin America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Vehicle Type, 2018-2032

Figure 58: Latin America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 59: Latin America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Sales Channel, 2018-2032

Figure 60: Latin America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2021-2031

Figure 61: Latin America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Steering System, 2018-2032

Figure 62: Latin America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Steering System, Value (US$ Mn), 2021-2031

Figure 63: Latin America Commercial Vehicle Steering Column Market Value (U$ Mn) Forecast, by Country and Sub-region, 2018-2032

Figure 64: Latin America Commercial Vehicle Steering Column Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2021-2031