Reports

Reports

Drones with obstacle detection and collision avoidance sensors are becoming increasingly commonplace in consumer and professional sectors. Since the collision avoidance sensor market is highly fragmented with five leading industry players accounting for ~25% of the market stake, startups are increasing their efforts to develop drones with multiple direction obstacle avoidance sensors. For instance, DJI-a supplier of easy-to-fly drones and aerial photography systems, has gained expertise in the development of drones with multiple direction obstacle detection and collision avoidance technology.

Software algorithms and the SLAM (Simultaneous Localization And Mapping) technology are some of the key drivers powering the collision avoidance sensor market. Companies are increasing their R&D activities to develop sensors with overlapping visual sensing in order to facilitate full obstacle detection. Novel collision avoidance sensors are being integrated with omnidirectional vision. Manufacturers are increasing their production capabilities to develop drones that track people and subjects.

Leading automobile companies are always focused on introducing new and better ways to make driving safer. Hence, companies in the collision avoidance sensor market are teaming up with dedicated engineers and designers to develop technologically smart cars. For instance, leading automobile manufacturer Hyundai has integrated its Hyundai SmartSense™ in vehicles comprising cameras, sensors, and alarms that help occupants achieve improved driving.

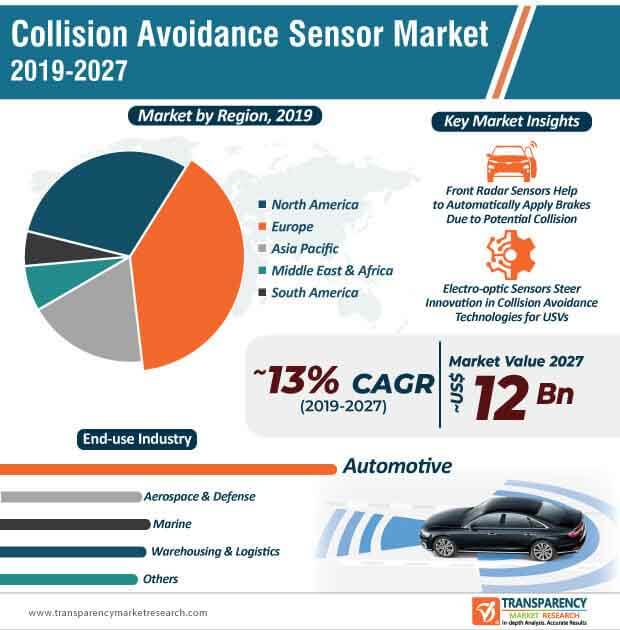

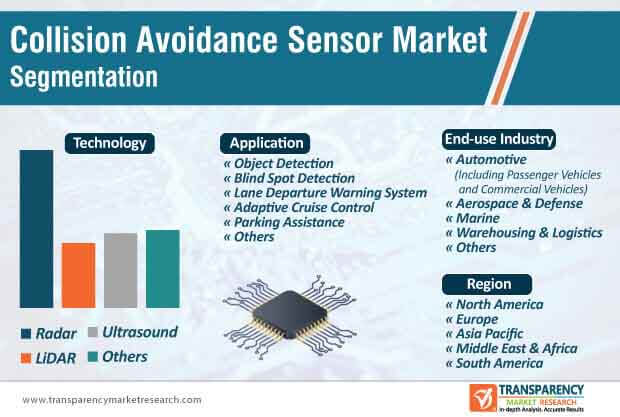

Smart sensor systems possess advantageous attributes such as smart cruise control, lane keeping assist, and driver attention warning to keep a watchful eye on vehicle passengers and other road users. This explains why the revenue of lane departure warning system application segment is estimated for exponential growth in the collision avoidance sensor market. The global market is expected to reach ~US$ 12 Bn by 2027. Key drivers such as the introduction of side mirror cameras are generating value-grab opportunities for companies in the collision avoidance sensor market.

Apart from automotive and warehousing industries, companies in the collision avoidance sensor market are generating revenue streams in the aerospace & defense sector. As such, the market is expected to expand at rapid CAGR of 13% during the forecast period. However, real-time obstacle detection in unmanned aerial vehicles (UAVs) is challenged with several bottlenecks such as problems associated with flight control systems and the communication spectrum in UAVs.

Increased R&D activities in the field of unmanned aircraft systems (UAS) has led to unprecedented growth of the collision avoidance sensor market. However, complete integration of manned-unmanned aviation is still at the nascent stage with limitations pertaining to sense-detect-and-avoid systems and unmanned aviation safety and reliability. Hence, companies are increasing their focus in real-time obstacle detection using monocular vision, which is also instrumental in innovations in collision avoidance sensors. Increasing emphasis on multi-rotor (quadrotor) UAVs is another key driver contributing to market growth. Collision avoidance sensors are playing a pivotal role in manned aviation collision avoidance frameworks, since these frameworks are fully developed and the technology standards continue to improve.

Mobile robots are being highly publicized, owing to their advantages of maximizing operational efficiency. Hence, companies in the collision avoidance sensor market are increasing their research spending to develop flexible Time-of-Flight (ToF) sensor arrays that can offer an easy and cost-effective solution to ensure safety and reliability of mobile robots.

Automation and robotics are the main topics shaping the future of operational efficiency. Mobile robots are anticipated to become increasingly mainstream in warehouses and laboratories in the coming years. This is evident since the revenue of warehousing & logistic end-use industry segment is predicted for significant growth in the market for collision avoidance sensor. Hence, anti-collision systems are being integrated with the ToF technology, which helps to send continuous and modulated light and measures if the robot tracks any obstacles. Companies in the collision avoidance sensor market are increasing their focus in ToF sensor modules, which serve as a cost-efficient solution for multi-directional detection of obstacles using 2D lasers.

Analysts’ Viewpoint

Apart from radar and LiDAR technologies, companies in the collision avoidance sensor market are leveraging opportunities in electro-optic sensors to steer innovations in USVs (Unmanned Surface Vessels). Although military applications are dominating the market landscape, analysts of Transparency Market Research opine that UASs will be more prominent in civilian and public domain applications.

The development of next-gen radars, cameras, and ultrasonic systems is taking place at an unprecedented speed. However, a real-time and streamlined communication between different systems pose as a challenge for companies. Hence, companies should spatially, geometrically, and temporally align data streams to obtain the best of multimodal data fusion in order to make autonomous vehicles highly safe, reliable, and accurate.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Collision Avoidance Sensor Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trends Analysis

4.4. Global Collision Avoidance Sensor Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projection (US$ Mn)

4.4.2. Market Volume Projection (Mn Units)

4.5. Porter’s Five Forces Analysis - Global Collision Avoidance Sensor Market

4.6. Value Chain Analysis - Global Collision Avoidance Sensor Market

4.7. Market Outlook

5. Global Collision Avoidance Sensor Market Analysis and Forecast, by Technology

5.1. Overview & Definitions

5.2. Global Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Technology, 2017–2027

5.2.1. Radar

5.2.2. LiDAR

5.2.3. Ultrasound

5.2.4. Others

5.3. Technology Comparison Matrix

5.4. Global Collision Avoidance Sensor Market Attractiveness, by Technology

6. Global Collision Avoidance Sensor Market Analysis and Forecast, by Application

6.1. Overview & Definitions

6.2. Global Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

6.2.1. Object Detection

6.2.2. Blind Spot Detection

6.2.3. Lane Departure Warning Technology

6.2.4. Adaptive Cruise Control

6.2.5. Parking Assistance

6.2.6. Others

6.2.7. Application Comparison Matrix

6.3. Global Collision Avoidance Sensor Market Attractiveness, by Application

7. Global Collision Avoidance Sensor Market Analysis and Forecast, by End-use Industry

7.1. Overview & Definitions

7.2. Global Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

7.2.1. Automotive

7.2.1.1. Passenger Vehicles

7.2.1.2. Commercial Vehicles

7.3. Aerospace & Defense

7.4. Marine

7.5. Warehousing & Logistics

7.6. Others

7.7. End-use Industry Comparison Matrix

7.8. Global Collision Avoidance Sensor Market Attractiveness, by End-use Industry

8. Global Collision Avoidance Sensor Market Analysis and Forecast, by Region

8.1. Overview

8.2. Global Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Region, 2017–2027

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

8.3. Global Collision Avoidance Sensor Market Attractiveness, by Region

9. North America Collision Avoidance Sensor Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. North America Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Technology, 2017–2027

9.3.1. Radar

9.3.2. LiDAR

9.3.3. Ultrasound

9.3.4. Others

9.4. North America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

9.4.1. Object Detection

9.4.2. Blind Spot Detection

9.4.3. Lane Departure Warning Technology

9.4.4. Adaptive Cruise Control

9.4.5. Parking Assistance

9.4.6. Others

9.5. North America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

9.5.1. Automotive

9.5.1.1. Passenger Vehicles

9.5.1.2. Commercial Vehicles

9.5.2. Aerospace & Defense

9.5.3. Marine

9.5.4. Warehousing & Logistics

9.5.5. Others

9.6. North America Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. North America Collision Avoidance Sensor Market Attractiveness Analysis

9.7.1. By Technology

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe Collision Avoidance Sensor Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Europe Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Technology, 2017–2027

10.3.1. Radar

10.3.2. LiDAR

10.3.3. Ultrasound

10.3.4. Others

10.4. Europe Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

10.4.1. Object Detection

10.4.2. Blind Spot Detection

10.4.3. Lane Departure Warning Technology

10.4.4. Adaptive Cruise Control

10.4.5. Parking Assistance

10.4.6. Others

10.5. Europe Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

10.5.1. Automotive

10.5.1.1. Passenger Vehicles

10.5.1.2. Commercial Vehicles

10.5.2. Aerospace & Defense

10.5.3. Marine

10.5.4. Warehousing & Logistics

10.5.5. Others

10.6. Europe Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

10.6.1. Germany

10.6.2. U.K.

10.6.3. France

10.6.4. Rest of Europe

10.7. Europe Collision Avoidance Sensor Market Attractiveness Analysis

10.7.1. By Technology

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific Collision Avoidance Sensor Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Asia Pacific Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Technology, 2017–2027

11.3.1. Radar

11.3.2. LiDAR

11.3.3. Ultrasound

11.3.4. Others

11.4. Asia Pacific Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

11.4.1. Object Detection

11.4.2. Blind Spot Detection

11.4.3. Lane Departure Warning Technology

11.4.4. Adaptive Cruise Control

11.4.5. Parking Assistance

11.4.6. Others

11.5. Asia Pacific Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

11.5.1. Automotive

11.5.1.1. Passenger Vehicles

11.5.1.2. Commercial Vehicles

11.5.2. Aerospace & Defense

11.5.3. Marine

11.5.4. Warehousing & Logistics

11.5.5. Others

11.6. Asia Pacific Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. Australia

11.6.5. Rest of Asia Pacific

11.7. Asia Pacific Collision Avoidance Sensor Market Attractiveness Analysis

11.7.1. By Technology

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa Collision Avoidance Sensor Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Middle East & Africa Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Technology, 2017–2027

12.3.1. Radar

12.3.2. LiDAR

12.3.3. Ultrasound

12.3.4. Others

12.4. Middle East & Africa Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

12.4.1. Object Detection

12.4.2. Blind Spot Detection

12.4.3. Lane Departure Warning Technology

12.4.4. Adaptive Cruise Control

12.4.5. Parking Assistance

12.4.6. Others

12.5. Middle East & Africa Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

12.5.1. Automotive

12.5.1.1. Passenger Vehicles

12.5.1.2. Commercial Vehicles

12.5.2. Aerospace & Defense

12.5.3. Marine

12.5.4. Warehousing & Logistics

12.5.5. Others

12.6. Middle East & Africa Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Middle East & Africa Collision Avoidance Sensor Market Attractiveness Analysis

12.7.1. By Technology

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America Collision Avoidance Sensor Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. South America Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Technology, 2017–2027

13.3.1. Radar

13.3.2. LiDAR

13.3.3. Ultrasound

13.3.4. Others

13.4. South America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

13.4.1. Object Detection

13.4.2. Blind Spot Detection

13.4.3. Lane Departure Warning Technology

13.4.4. Adaptive Cruise Control

13.4.5. Parking Assistance

13.4.6. Others

13.5. South America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

13.5.1. Automotive

13.5.1.1. Passenger Vehicles

13.5.1.2. Commercial Vehicles

13.5.2. Aerospace & Defense

13.5.3. Marine

13.5.4. Warehousing & Logistics

13.5.5. Others

13.6. South America Collision Avoidance Sensor Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

13.6.1. Brazil

13.6.2. Rest of South America

13.7. South America Collision Avoidance Sensor Market Attractiveness Analysis

13.7.1. By Technology

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Landscape

14.1. Market Players – Competition Matrix

14.2. Global Collision Avoidance Sensor Market Share Analysis (%), by Company (2018)

15. Company Profiles (Details – Overview, Financials, Strategy)

15.1. Robert Bosch GmbH

15.2. Denso Corporation

15.3. Rockwell Collins

15.4. General Electric Company

15.5. Continental AG

15.6. Honeywell International Inc.

15.7. Infineon Technologies AG.

15.8. Magna International Inc.

15.9. Microchip Technology Inc.

15.10. NXP Semiconductor

16. Key Takeaways

List of Tables

Table 01: Global Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 02: Global Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Technology, 2017–2027

Table 03: Global Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 04: Global Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 05: Global Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, by Automotive, 2017–2027

Table 06: Global Collision Avoidance Sensor Market Revenue Forecast, by Region, 2017–2027 (US$ Mn)

Table 07: Global Collision Avoidance Sensor Market Volume (Million Units) Forecast, , by Region, 2017–2027 (US$ Mn)

Table 08: North America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 09: North America Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Technology, 2017–2027

Table 10: North America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 11: North America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 12: North America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, by Automotive, 2017–2027

Table 13: North America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 14: North America Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 15: Europe Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 16: Europe Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Technology, 2017–2027

Table 17: Europe Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 18: Europe Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 19: Europe Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, by Automotive, 2017–2027

Table 20: Europe Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 21: Europe Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 22: Asia Pacific Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 23: Asia Pacific Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Technology, 2017–2027

Table 24: Asia Pacific Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 25: Asia Pacific Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 26: Asia Pacific Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, by Automotive, 2017–2027

Table 27: Asia Pacific Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 28: Asia Pacific Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 29: Middle East & Africa Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 30: Middle East & Africa Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Technology, 2017–2027

Table 31: Middle East & Africa Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 32: Middle East & Africa Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 33: Middle East & Africa Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, by Automotive, 2017–2027

Table 34: Middle East & Africa Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 35: Middle East & Africa Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 36: South America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Technology, 2017–2027

Table 37: South America Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Technology, 2017–2027

Table 38: South America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 39: South America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 40: South America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by End-use Industry, by Automotive, 2017–2027

Table 41: South America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 42: South America Collision Avoidance Sensor Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: North America Collision Avoidance Sensor Market CAGR

Figure 02: Europe Collision Avoidance Sensor Market CAGR

Figure 03: Asia Pacific Collision Avoidance Sensor Market CAGR

Figure 04: Middle East & Africa Collision Avoidance Sensor Market CAGR

Figure 05: South America Collision Avoidance Sensor Market CAGR

Figure 06: Global Collision Avoidance Sensor Market Value Share, by Region, 2018

Figure 07: Global Collision Avoidance Sensor Market Revenue Projection and Y-o-Y Growth, 2017–2027 (US$ Mn and %)

Figure 08: Global Collision Avoidance Sensor Market Volume Projection and Y-o-Y Growth, 2017–2027 (Million Units and %)

Figure 09: Global Collision Avoidance Sensor Market Revenue (US$ Mn)

Figure 10: Global Collision Avoidance Sensor Market, by Technology (2019)

Figure 11: Global Collision Avoidance Sensor Market, by Application (2019)

Figure 12: Global Collision Avoidance Sensor Market, by End-use Industry (2019)

Figure 13: Global Collision Avoidance Sensor Market, by End-use Industry, by Automotive (2019)

Figure 14: Global Collision Avoidance Sensor Market Value Share Analysis, by Technology, 2019 and 2027

Figure 15: Global Collision Avoidance Sensor Market, by Technology, Radar

Figure 16: Global Collision Avoidance Sensor Market, by Technology, LiDAR

Figure 17: Global Collision Avoidance Sensor Market, by Technology, Ultrasound

Figure 18: Global Collision Avoidance Sensor Market, by Technology, Others

Figure 19: Segment Growth Matrix, 2019–27 (%)

Figure 20: Segment Revenue Contribution, 2019–27 (%)

Figure 21: Segment Compounded Growth Matrix (CAGR %)

Figure 22: Global Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Technology

Figure 23: Global Collision Avoidance Sensor Market Value Share Analysis, by Application, 2019 and 2027

Figure 24: Global Collision Avoidance Sensor Market, by Application, Object Detection

Figure 25: Global Collision Avoidance Sensor Market, by Application, Blind Spot Detection

Figure 26: Global Collision Avoidance Sensor Market, by Application, Lane Departure Warning Technology

Figure 27: Global Collision Avoidance Sensor Market, by Application, Adaptive Cruise Control

Figure 28: Global Collision Avoidance Sensor Market, by Application, Parking Assistance

Figure 29: Global Collision Avoidance Sensor Market, by Application, Others

Figure 30: Segment Growth Matrix, 2019–27 (%)

Figure 31: Segment Revenue Contribution, 2019–27 (%)

Figure 32: Segment Compounded Growth Matrix (CAGR %)

Figure 33: Global Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Application

Figure 34: Global Collision Avoidance Sensor Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 35: Global Collision Avoidance Sensor Market, by End-use Industry, Automotive

Figure 36: Global Collision Avoidance Sensor Market, by End-use Industry, Aerospace & Defense

Figure 37: Global Collision Avoidance Sensor Market, by End-use Industry, Marine

Figure 38: Global Collision Avoidance Sensor Market, by End-use Industry, Warehousing & Logistics

Figure 39: Global Collision Avoidance Sensor Market, by End-use Industry, Others

Figure 40: Segment Growth Matrix, 2019–27 (%)

Figure 41: Segment Revenue Contribution, 2019–27 (%)

Figure 42: Segment Compounded Growth Matrix (CAGR %)

Figure 43: Global Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by End-use Industry

Figure 44: Global Collision Avoidance Sensor Market Value Share Analysis, by Region, 2019 and 2027

Figure 45: Global Collision Avoidance Sensor Market, by Region, North America

Figure 46: Global Collision Avoidance Sensor Market, by Region, Europe

Figure 47: Global Collision Avoidance Sensor Market, by Region, Asia Pacific

Figure 48: Global Collision Avoidance Sensor Market, by Region, Middle East & Africa

Figure 49: Global Collision Avoidance Sensor Market, by Region, South America

Figure 50: Global Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Region

Figure 51: North America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 52: North America Collision Avoidance Sensor Market Revenue Y-o-Y Growth Analysis, 2017–2027

Figure 53: North America Collision Avoidance Sensor Market Volume (Million Units) Forecast, 2017–2027

Figure 54: North America Collision Avoidance Sensor Market Volume Y-o-Y Growth Analysis, 2017–2027

Figure 55: North America Collision Avoidance Sensor Market Value Share Analysis, by Technology, 2019 and 2027

Figure 56: North America Collision Avoidance Sensor Market Value Share Analysis, by Application, 2019 and 2027

Figure 57: North America Collision Avoidance Sensor Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 58: North America Collision Avoidance Sensor Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 59: North America Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Technology

Figure 60: North America Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Application

Figure 61: North America Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by End-use Industry

Figure 62: North America Collision Avoidance Sensor Market Attractiveness Analysis, by End-use Industry, Automotive

Figure 63: North America Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Country/Sub-region

Figure 64: Europe Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 65: Europe Collision Avoidance Sensor Market Revenue Y-o-Y Growth Analysis, 2017–2027

Figure 66: Europe Collision Avoidance Sensor Market Volume (Million Units) Forecast, 2017–2027

Figure 67: Europe Collision Avoidance Sensor Market Volume Y-o-Y Growth Analysis, 2017–2027

Figure 68: Europe Collision Avoidance Sensor Market Value Share Analysis, by Technology, 2019 and 2027

Figure 69: Europe Collision Avoidance Sensor Market Value Share Analysis, by Application, 2019 and 2027

Figure 70: Europe Collision Avoidance Sensor Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 71: Europe Collision Avoidance Sensor Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 72: Europe Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Technology

Figure 73: Europe Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Application

Figure 74: Europe Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by End-use Industry

Figure 75: Europe Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Country/Sub-region

Figure 76: Asia Pacific Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 77: Asia Pacific Collision Avoidance Sensor Market Revenue Y-o-Y Growth Analysis, 2017–2027

Figure 78: Asia Pacific Collision Avoidance Sensor Market Volume (Million Units) Forecast, 2017–2027

Figure 79: Asia Pacific Collision Avoidance Sensor Market Volume Y-o-Y Growth Analysis, 2017–2027

Figure 80: Asia Pacific Collision Avoidance Sensor Market Value Share Analysis, by Technology, 2019 and 2027

Figure 81: Asia Pacific Collision Avoidance Sensor Market Value Share Analysis, by Application, 2019 and 2027

Figure 82: Asia Pacific Collision Avoidance Sensor Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 83: Asia Pacific Collision Avoidance Sensor Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 84: Asia Pacific Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Technology

Figure 85: Asia Pacific Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Application

Figure 86: Asia Pacific Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by End-use Industry

Figure 87: Asia Pacific Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Country/Sub-region

Figure 88: Middle East & Africa Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 89: Middle East & Africa Collision Avoidance Sensor Market Revenue Y-o-Y Growth Analysis, 2017–2027

Figure 90: Middle East & Africa Collision Avoidance Sensor Market Volume (Million Units) Forecast, 2017–2027

Figure 91: Middle East & Africa Collision Avoidance Sensor Market Volume Y-o-Y Growth Analysis, 2017–2027

Figure 92: Middle East & Africa Collision Avoidance Sensor Market Value Share Analysis, by Technology, 2019 and 2027

Figure 93: Middle East & Africa Collision Avoidance Sensor Market Value Share Analysis, by Application, 2019 and 2027

Figure 94: Middle East & Africa Collision Avoidance Sensor Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 95: Middle East & Africa Collision Avoidance Sensor Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 96: Middle East & Africa Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Technology

Figure 97: Middle East & Africa Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Application

Figure 98: Middle East & Africa Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by End-use Industry

Figure 99: Middle East & Africa Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Country/Sub-region

Figure 100: South America Collision Avoidance Sensor Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 101: South America Collision Avoidance Sensor Market Revenue Y-o-Y Growth Analysis, 2017–2027

Figure 102: South America Collision Avoidance Sensor Market Volume (Million Units) Forecast, 2017–2027

Figure 103: South America Collision Avoidance Sensor Market Volume Y-o-Y Growth Analysis, 2017–2027

Figure 104: South America Collision Avoidance Sensor Market Value Share Analysis, by Technology, 2019 and 2027

Figure 105: South America Collision Avoidance Sensor Market Value Share Analysis, by Application, 2019 and 2027

Figure 106: South America Collision Avoidance Sensor Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 107: South America Collision Avoidance Sensor Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 108: South America Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Technology

Figure 109: South America Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Application

Figure 110: South America Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by End-use Industry

Figure 111: South America Collision Avoidance Sensor Collision Avoidance Sensor Market Attractiveness Analysis, by Country/Sub-region

Figure 112: Global Collision Avoidance Sensor Market Share Analysis, by Company (2018)