Reports

Reports

Global Workflow Automation and Optimization Software Market: Snapshot

The global workflow automation and optimization software market is primarily dominated by multinational tech giants. The top five players account for well over half the share in the market and are constantly trying to outdo one another through product innovation.

Driving growth in the global market for workflow automation and optimization software is the rising take-up of third platform technologies and soaring popularity of business process automation. Workflow automation and optimization software allows businesses to improve communication, reduce human errors, enable real-time reporting, and allow integration of third-party applications for added benefits. Such advantages are egging organizations to shift toward digitization of business processes.

Cyber threats, however, are acting as a deterrent to the market for workflow automation and optimization software market. In order to tackle the menace, savvy players in the market are trying to develop more secure solutions.

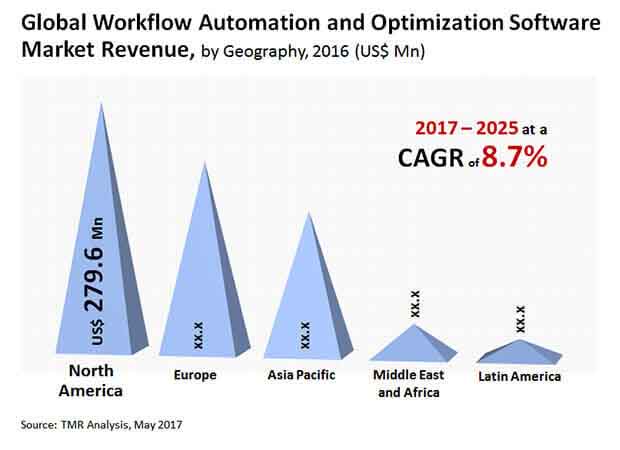

A report by Transparency Market Research forecasts the global market for workflow automation and optimization software to expand at a healthy CAGR of 8.7% from 2017 to 2025 to become worth US$1.456 bn by 2025 from US$0.713 bn in 2016.

BFSI Segment Emerges Market Leader due of Customer-focused Banks

The global market for workflow automation and optimization software can be segmented depending upon end-use into education, banking, financial services, and insurance (BFSI), transportation and logistics, healthcare, manufacturing, retail, telecommunications and information technology (IT), etc. The BFSI sector, of them, held a dominant 21.8% share in the overall revenue in 2016. Expanding at a strong 8.3% CAGR between 2017 and 2025, the segment is expected to continue holding on to its dominant position. The primary reason behind it is banks increasingly leveraging enhanced fraud management solutions, mobile banking, smart automated teller machines (ATMs), etc. to offer better experience of their customers. In the years ahead too, the BFSI segment is predicted to retain its dominant position by holding 24.8% share in the market.

In terms of growth rate, however, the education segment is expected to emerge as a winner by clocking a solid 9.5% CAGR between 2017 and 2025.

Thrust on Automation by Different Organizations Propels North America Market

Geography-wise, Europe, North America, Asia Pacific, South America, and the Middle East and Africa (MEA) are key regions in the global workflow automation and optimization software market. Among them, North America contributes the most to revenue because of massive automation of business processes in the region and also because of the copious number of vendors of workflow automation domiciled in the region. The North America market grossed a revenue of US$279.6 mn in 2016 and rising at a CAGR of 8.6% it will likely gross US$566 mn in 2025. Europe trails North America vis-à-vis revenue.

Asia Pacific is another key region which is slated to outpace all others in terms of growth rate from 2017 to 2025. The growth in the region is expected to be brought about by the quick uptake of workflow automation and optimization software across different industry verticals. Currently, on-premise workflow automation and optimization software segment generates maximum revenue in the market in the region, but going forward, the cloud workflow automation and optimization software will likely expand at a greater pace owing to their rapid adoption by the healthcare, BFSI, and telecommunications sector.

Prominent players operating in the global market for workflow automation and optimization software are Xerox Corporation, Oracle Corporation, International Business Machines Corporation, SAS Institute, Inc., SAP SE, OnviSource, Inc., Boston Software Systems, Flexera Software LLC, JDA Software Group, Inc., and Reva Solutions.

High Adoption of Business Process Automation to Drive Workflow Automation and Optimization Software Market

Multinational engineering behemoths dominate the global workflow automation and optimization software market. About half of the market share is made up of the top five companies and they are actively striving to outperform each other through product innovation. The success of business process automation and growing adoption of third platform technology are likely to foster growth of the global workflow automation and optimization software market in the years to come. Organizations are being lured to digitize their operations to avail these benefits.

However, cyber-attacks are putting a strain on the demand for process automation and optimization applications. Smart industry leaders are working to create more stable and secured options in order to combat the threat.

Threat of Cyber Attacks Pose a Threat toward the Expansion of the Market

The increasing proliferation of third platform technology and the rising demand for business process automation are likely to drive the demand for workflow automation and optimization applications. Business Process Management or BPM comprises software tools for workflow integration and optimization (BPM). It is a technological solution that allows organizations to optimize their systems and operate more effectively. It is developed for use in various end-use verticals. Businesses can make use of workflow automation and optimization tools to reduce errors made by human beings and optimize collaboration. Several companies have begun to digitize their corporate operations as a result of these benefits. These factors are likely to work in favor of the global workflow automation and optimization software market in the years to come.

The danger of cyber attacks, mostly due to the limitations of TCP/IP-based cloud networks, is a roadblock to the rapid adoption of process automation and optimization tools. Vendors in the industry are attempting to address the problem by developing more stable options for their consumers. Apart from that, workers' unwillingness to automate business operations is also limiting demand expansion.

Chapter 1 Preface

Chapter 2 Assumptions and Research Methodology

2.1 Report Assumptions and Acronyms used

2.2 Research Methodology

Chapter 3 Executive Summary - Global Workflow Automation and Optimization Software Market

3.1 Executive Summary

Chapter 4 Global Workflow Automation and Optimization Software Market Overview

4.1 Introduction

4.2 Product Definition and Features

4.3 Market Dynamics: Drivers and Restraints Snapshot Analysis

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.4 Market Attractiveness Analysis, by End-use (2016)

4.5 Competitive Landscape (2016)

Chapter 5 Global Workflow Automation and Optimization Software Market Analysis, By Deployment Type, 2016 – 2025

5.1 Deployment Type, Overview

5.2 Global Workflow Automation and Optimization Software Market Value Share, By Deployment Type, 2016 and 2025

5.3 Global Workflow Automation and Optimization Software Market Analysis, By Deployment Type, 2016 - 2025

5.4 Global Workflow Automation and Optimization Software Market Forecast , By Deployment Type, 2016 - 2025

Chapter 6 Global Workflow Automation and Optimization Software Market Analysis, By End-use, 2016 – 2025

6.1 End-Use, Overview

6.2 Global Workflow Automation and Optimization Software Market Value Share, By End-Use, 2016 and 2025

6.3 Global Workflow Automation and Optimization Software Market Analysis, By Deployment Type, 2016 - 2025

6.4 Global Workflow Automation and Optimization Software Market Forecast , By End-use, 2016 - 2025

Chapter 7 Global Workflow Automation and Optimization Software Market Analysis, By Geography, 2016 – 2025

7.1 Geographical Scenario (By CAGR)

7.2 Global Workflow Automation and Optimization Software Market Value Share, By Geography, 2016 and 2025

Chapter 8 North America Workflow Automation and Optimization Software Market Analysis, 2016 – 2025

8.1 North America Workflow Automation and Optimization Software Market Overview

8.2 North America Workflow Automation and Optimization Software Market Value Share, By Deployment Type, 2016 and 2025

8.3 North America Workflow Automation and Optimization Software Market Forecast, By Deployment Type, 2016 - 2025

8.4 North America Workflow Automation and Optimization Software Market Value Share, By End-Use, 2016 and 2025

8.5 North America Workflow Automation and Optimization Software Market Forecast, By End-use, 2016 - 2025

8.6 North America Workflow Automation and Optimization Software Market Value Share, By Country, 2016 and 2025

8.7 North America Workflow Automation and Optimization Software Market Forecast, By Country, 2016 - 2025

Chapter 9 Europe Workflow Automation and Optimization Software Market Analysis, 2016 – 2025

9.1 Europe Workflow Automation and Optimization Software Market Overview

9.2 Europe Workflow Automation and Optimization Software Market Value Share, By Deployment Type, 2016 and 2025

9.3 Europe Workflow Automation and Optimization Software Market Forecast, By Deployment Type, 2016 - 2025

9.4 Europe Workflow Automation and Optimization Software Market Value Share, By End-Use, 2016 and 2025

9.5 Europe Workflow Automation and Optimization Software Market Forecast, By End-use, 2016 - 2025

9.6 Europe Workflow Automation and Optimization Software Market Value Share, By Country, 2016 and 2025

9.7 Europe Workflow Automation and Optimization Software Market Forecast, By Country, 2016 - 2025

Chapter 10 Asia Pacific Workflow Automation and Optimization Software Market Analysis, 2016 – 2025

10.1 Asia Pacific Workflow Automation and Optimization Software Market Overview

10.2 Asia Pacific Workflow Automation and Optimization Software Market Value Share, By Deployment Type, 2016 and 2025

10.3 Asia Pacific Workflow Automation and Optimization Software Market Forecast, By Deployment Type, 2016 - 2025

10.4 Asia Pacific Workflow Automation and Optimization Software Market Value Share, By End-Use, 2016 and 2025

10.5 Asia Pacific Workflow Automation and Optimization Software Market Forecast, By End-use, 2016 - 2025

10.6 Asia Pacific Workflow Automation and Optimization Software Market Value Share, By Country, 2016 and 2025

10.7 Asia Pacific Workflow Automation and Optimization Software Market Forecast, By Country, 2016 - 2025

Chapter 11 South America Workflow Automation and Optimization Software Market Analysis, 2016 – 2025

11.1 South America Workflow Automation and Optimization Software Market Overview

11.2 South America Workflow Automation and Optimization Software Market Value Share, By Deployment Type, 2016 and 2025

11.3 South America Workflow Automation and Optimization Software Market Forecast, By Deployment Type, 2016 - 2025

11.4 South America Workflow Automation and Optimization Software Market Value Share, By End-Use, 2016 and 2025

11.5 South America Workflow Automation and Optimization Software Market Forecast, By End-use, 2016 - 2025

11.6 South America Workflow Automation and Optimization Software Market Value Share, By Country, 2016 and 2025

11.7 South America Workflow Automation and Optimization Software Market Forecast, By Country, 2016 - 2025

Chapter 12 Middle East & Africa (MEA) Workflow Automation and Optimization Software Market Analysis, 2016 – 2025

12.1 MEA Workflow Automation and Optimization Software Market Overview

12.2 MEA Workflow Automation and Optimization Software Market Value Share, By Deployment Type, 2016 and 2025

12.3 MEA Workflow Automation and Optimization Software Market Forecast, By Deployment Type, 2016 - 2025

12.4 MEA Workflow Automation and Optimization Software Market Value Share, By End-Use, 2016 and 2025

12.5 MEA Workflow Automation and Optimization Software Market Forecast, By End-use, 2016 - 2025

12.6 MEA Workflow Automation and Optimization Software Market Value Share, By Country, 2016 and 2025

12.7 MEA Workflow Automation and Optimization Software Market Forecast, By Country, 2016 - 2025

Chapter 13 Company Profiles

13.1 Xerox Corporation

13.2 Overview

13.3

13.4 SAS Institute, Inc.

13.5 SAP SE

13.6 OnviSource, Inc.

13.7 Boston Software Systems

13.8 Flexera Software LLC

13.9 JDA Software Group, Inc.

13.1 Reva Solutions

List of Tables

Table 01 Global Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Deployment Type, 2016–2025

Table 02 Global Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By End-use, 2016–2025

Table 03 North America Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Deployment Type, 2016–2025

Table 04 North America Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By End-use, 2016–2025

Table 05 North America Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Country, 2016–2025

Table 06 Europe Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Deployment Type, 2016–2025

Table 07 Europe Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By End-use, 2016–2025

Table 08 Europe Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Country, 2016–2025

Table 09 Asia Pacific Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Deployment Type, 2016–2025

Table 10 Asia Pacific Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By End-use, 2016–2025

Table 11 Asia Pacific Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Country, 2016–2025

Table 12 South America Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Deployment Type, 2016–2025

Table 13 South America Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By End-use, 2016–2025

Table 14 South America Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Country, 2016–2025

Table 15 MEA Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Deployment Type, 2016–2025

Table 16 MEA Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By End-use, 2016–2025

Table 17 MEA Workflow Automation and Optimization Software Market Size (USD Mn) Forecast, By Country, 2016–2025

List of Figures

Figure 01 Market Attractiveness Analysis, by End-use, 2016

Figure 02 Global Workflow Automation And Optimization Software Market Share Analysis, By Company

Figure 03 Global Workflow Automation and Optimization Software Market, By Deployment Type, Revenue Share Analysis, 2016 and 2025

Figure 04 On-Premise Workflow Automation and Optimization Software , 2016 - 2025 (USD Mn)

Figure 05 Cloud Workflow Automation and Optimization Software , 2016 - 2025 (USD Mn)

Figure 06 Mixed Workflow Automation and Optimization Software , 2016 - 2025 (USD Mn)

Figure 07 Global Workflow Automation and Optimization Software Market, By End-Use, Revenue Share Analysis, 2016 and 2025

Figure 08 Workflow Automation and Optimization Software for BFSI Segment, 2016 - 2025 (USD Mn)

Figure 09 Workflow Automation and Optimization Software for Education Segment, 2016 - 2025 (USD Mn)

Figure 10 Workflow Automation and Optimization Software for Healthcare Segment, 2016 - 2025 (USD Mn)

Figure 11 Workflow Automation and Optimization Software for Manufacturing Segment, 2016 - 2025 (USD Mn)

Figure 12 Workflow Automation and Optimization Software for Retail Segment, 2016 - 2025 (USD Mn)

Figure 13 Workflow Automation and Optimization Software for Transportation & Logistics Segment, 2016 - 2025 (USD Mn)

Figure 14 Workflow Automation and Optimization Software for Telecommunication & IT Segment, 2016 - 2025 (USD Mn)

Figure 15 Workflow Automation and Optimization Software for Others Segment, 2016 - 2025 (USD Mn)

Figure 16 Geographical Scenario, By CAGR

Figure 17 Global Workflow Automation and Optimization Software Market, By Geography, Revenue Share Analysis, 2016 and 2025

Figure 18 North America Workflow Automation and Optimization Software Market Forecast

Figure 19 North America Workflow Automation and Optimization Software Market, By Deployment Type, Revenue Share Analysis, 2016 and 2025

Figure 20 North America Workflow Automation and Optimization Software Market, By End-Use, Revenue Share Analysis, 2016 and 2025

Figure 21 North America Workflow Automation and Optimization Software Market, By Country, Revenue Share Analysis, 2016 and 2025

Figure 22 Europe Workflow Automation and Optimization Software Market Forecast

Figure 23 Europe Workflow Automation and Optimization Software Market, By Deployment Type, Revenue Share Analysis, 2016 and 2025

Figure 24 Europe Workflow Automation and Optimization Software Market, By End-Use, Revenue Share Analysis, 2016 and 2025

Figure 25 Europe Workflow Automation and Optimization Software Market, By Country, Revenue Share Analysis, 2016 and 2025

Figure 26 Asia Pacific Workflow Automation and Optimization Software Market Forecast

Figure 27 Asia Pacific Workflow Automation and Optimization Software Market, By Deployment Type, Revenue Share Analysis, 2016 and 2025

Figure 28 Asia Pacific Workflow Automation and Optimization Software Market, By End-Use, Revenue Share Analysis, 2016 and 2025

Figure 29 Asia Pacific Workflow Automation and Optimization Software Market, By Country, Revenue Share Analysis, 2016 and 2025

Figure 30 South America Workflow Automation and Optimization Software Market Forecast

Figure 31 South America Workflow Automation and Optimization Software Market, By Deployment Type, Revenue Share Analysis, 2016 and 2025

Figure 32 South America Workflow Automation and Optimization Software Market, By End-Use, Revenue Share Analysis, 2016 and 2025

Figure 33 South America Workflow Automation and Optimization Software Market, By Country, Revenue Share Analysis, 2016 and 2025

Figure 34 MEA Workflow Automation and Optimization Software Market Forecast

Figure 35 MEA Workflow Automation and Optimization Software Market, By Deployment Type, Revenue Share Analysis, 2016 and 2025

Figure 36 MEA Workflow Automation and Optimization Software Market, By End-Use, Revenue Share Analysis, 2016 and 2025

Figure 37 MEA Workflow Automation and Optimization Software Market, By Country, Revenue Share Analysis, 2016 and 2025