Reports

Reports

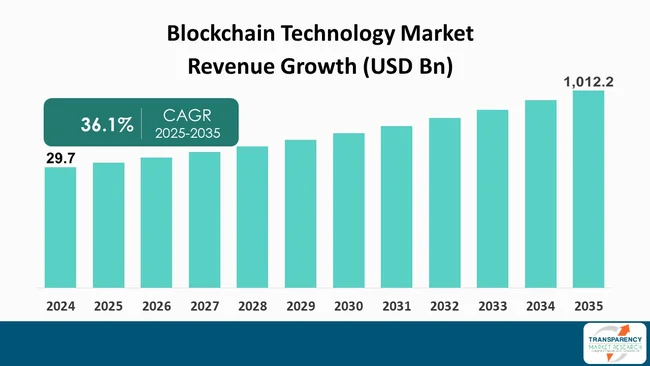

The global Blockchain Technology market size was valued at US$ 29.7 Bn in 2024 and is projected to reach US$ 1,012.2 Bn by 2035, expanding at a CAGR of 36.1% from 2025 to 2035. The market is expanding rapidly due to enhanced security and transparency and rising demand for digital identity.

The blockchain technology market is experiencing rapid growth with rising adoption of cross-border payment networks and decentralized finance (DeFi). The ease of financial intermediation and transaction facilitated by blockchain, along with the enhanced settlement speed, has further popularized its use in banks and financial institutions.

Blockchain technology is also being adopted by organizations in supply chain management as it facilitates monitoring of products in real-time, avoids delays, and thwarts fraud attacks. Blockchain technology has gained prominence in the recent years as the R&D agendas have shifted to combine technologies like artificial intelligence (AI), cloud computing, and internet of things (IoT) with blockchains. Blockchain and IoT networks are picking up pace in supply chain and asset management operations by tracking and underpinning operational efficiencies. The introduction of non-fungible tokens (NFTs) and metaverse platforms is resulting to increase in the usage of gaming content, digital content, and virtual advertising of real estate space.

Numerous vendors are partnering with startups and the other businesses to build BaaS platforms and make blockchain adoption simplified for all businesses. Hybrid blockchain approaches are also being included within solution portfolio of firms to keep things decentralized to a certain degree while also keeping regulatory requirements in mind.

Blockchain technology refers to an electronic, distributed, and decentralized system of an electronic ledger that records transactions on different computers in an invariant, secure, and open manner. Each transaction, or "block", is connected to the previous block through cryptographic methods, creating an unbroken "chain." This design incorporates a feature whereby once data is recorded, it cannot be removed or modified, thereby establishing blockchain as a highly reliable solution for data storage and authentication.

The most prevalent models are Proof of Work (PoW), Proof of Stake (PoS), and newer energy-saving models. These frameworks ensure trust among users within a decentralized system where no one entity has complete control. Through this verification process, blockchain creates an unalterable system that promotes responsibility and confidence across digital platforms.

Blockchain is not only limited to financial transactions but also has numerous applications in various fields such as supply chain management, healthcare, education, and legal services. For example, it allows transparent tracking of products across supply chains, enables secure sharing of medical records, and facilitates contract management via smart contracts. These contracts enable programmed execution of actions when specified criteria are met, thus cutting down on the waiting time and the number of people involved in the process.

Moreover, the blockchain can be a stronghold of innovation in the digital ownership and governance field, which is another significant benefit. The advent of non-fungible tokens (NFTs) has radically changed the manner in which digital assets are owned and exchanged, whereas decentralized autonomous organizations (DAOs) empower community-based decision-making without any influence from a central authority.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Every single transaction made on the blockchain is extremely secure to all authorized participants who can inspect the updates live, i.e. accountability is maintained, while minimizing chances of fraud. Such exposure turns out to be quite important in sectors like the financial market, supply chain, or healthcare.

In the area of the supply chain, for instance, one can speak of the transparency enabled by blockchain technology which allows the traceability of the products’ origin and pathways to companies, thus facilitating the fight against the counterfeiting of the products. In the financial sector, the integration of security and transparency has been instrumental in making cross-border transactions quicker, thereby cutting the reliance on intermediaries, and facilitating adherence to auditing requirements. Firms are leveraging these traits not only to protect their data but also to enhance their customer, partner, and regulator relationships. Global acceptance of blockchain technology in other sectors is one of the drivers of the rising trust and momentum for worldwide market expansion of blockchain technology.

The soaring necessity for digital identities is the main influence that steers the market for blockchain technology, as the demand for secure, reliable, and user-controlled ways of identity verification grows both for individuals and organizations. Typically, identity management systems are substantially based on centralized authorities that are often susceptible to breaches, misuse, and inefficiencies related to the data. Blockchain provides a solution with a non-centralized character in which users have unrestricted access to their data, while there is less dependency on third parties and increased trust and privacy. Such a transformation is especially significant in the current digital-first economy, where the security of online transactions holds a paramount position.

The banking industry, the medical industry, and online businesses turn to blockchain for identity management solutions. For instance, blockchain-based KYC systems not only ease the verification processes but also make them re-usable and more cost-efficient. In the healthcare industry, blockchain patient identities guarantee that individuals remain in full control of their medical histories while at the same time facilitating the secure sharing with authorized parties.

The divergence between the rates of growth of blockchain-driven digital identity solutions and of the cases of identity fraud as well as of cybercrime worldwide is such that the demand for the former is increasing exponentially. Firms are leveraging the current demand by building platforms that are collaborative and thus can be implemented and utilized practically in any industry, which enables a straightforward and trouble-free verification procedure and at the same time keeps the company in line with the regulations.

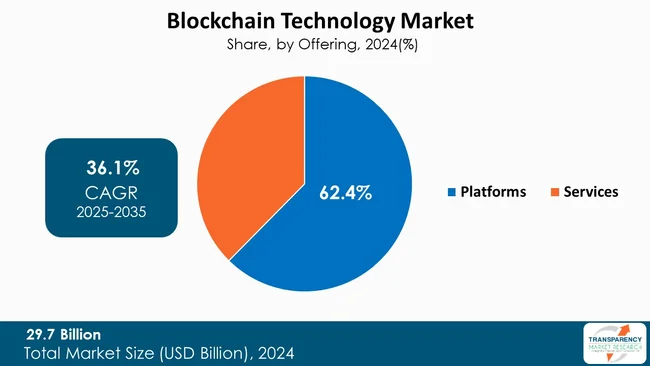

The platforms segment held 62.4% revenue share in the blockchain technology market as platforms supply the most basic requirements for the building of decentralized applications and solutions. With the help of blockchain platforms, the enterprises could not only create solutions but also implement and manage the customized systems that would meet their needs. For instance, there could be systems such as smart contracts, supply chain tracking, and digital identity solutions.

In addition, platforms are the core of the blockchain revolution. They hold up both - public and private networks. The increasing adoption of blockchain-as-a-service (BaaS) models means that clients can have access to these platforms without a large capital expenditure on infrastructure, thus facilitating the proliferation of the platforms segment market leadership.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest market analysis, North America with 36.7% revenue share dominated the blockchain technology market in 2024. This is due to the region's strong technological infrastructure, notable capital expenditures on data security, and swift uptake of the technology across sectors such as healthcare, finance, supply chain, and government. The region's advantages stem from a high-tech digital ecosystem, universal internet access, and the availability of well-qualified professionals, which, combined, gives rise to both - innovation and deployment at a large scale of the blockchain solutions.

Moreover, the favorable regulatory frameworks and the active involvement in the pilot projects have been significant factors for the solidity of the blockchain adoption in North America. Businesses and government institutions are progressively using blockchain for the security of their transactions, digital identity, and provision of being trustworthy in record-keeping.

Firms that propel the blockchain technological market prioritize implementing strategies such as creating energy-efficient and scalable platforms, thereby providing a blockchain-as-a-service (BaaS) model and establishing strategic partnerships. Additionally, they extensively fund a few pilot experiments, consortium partnerships, and hybrid blockchain models in order to facilitate interaction alarms, legal conformity, and transitioning into the market of various industries enabling market growth.

IBM, Microsoft, Oracle, SAP SE, Amazon Web Services, Inc., Accenture, Consensys Software Inc., Ripple Labs Inc., Coinbase, BITMAIN Technologies Holding Company, Binance Academy, Payward, Inc., Gemini Trust Company, LLC, Circle Internet Group, Inc., Chainalysis, Huawei and Hedera Hashgraph, LLC are some of the leading players operating in the global blockchain technology market.

Each of these players has been profiled in the blockchain technology market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 29.7 Bn |

| Forecast Value in 2035 | US$ 1,012.2 Bn |

| CAGR | 36.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Blockchain Technology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Offering

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global blockchain technology market was valued at US$ 29.7 Bn in 2024

The global blockchain technology industry is projected to reach more than US$ 1,012.2 Bn by the end of 2035

Enhanced security and transparency and rising demand for digital identity are some of the factors driving the expansion of blockchain technology market.

The CAGR is anticipated to be 36.1% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

IBM, Microsoft, Oracle, SAP SE, Amazon Web Services, Inc., Accenture, Consensys Software Inc., Ripple Labs Inc., Coinbase, BITMAIN Technologies Holding Company, Binance Academy, Payward, Inc., Gemini Trust Company, LLC, Circle Internet Group, Inc., Chainalysis, Huawei, and Hedera Hashgraph, LLC among others.

Table 01: Global Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 02: Global Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 03: Global Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 04: Global Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 05: Global Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 06: Global Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 07: Global Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 08: Global Blockchain Technology Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America Blockchain Technology Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 10: North America Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 11: North America Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 12: North America Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 13: North America Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 14: North America Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 15: North America Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 16: North America Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 17: U.S. Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 18: U.S. Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 19: U.S. Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 20: U.S. Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 21: U.S. Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 22: U.S. Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 23: U.S. Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 24: Canada Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 25: Canada Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 26: Canada Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 27: Canada Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 28: Canada Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 29: Canada Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Canada Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 31: Europe Blockchain Technology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 32: Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 33: Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 34: Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 35: Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 36: Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 37: Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 38: Europe Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 39: UK Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 40: UK Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 41: UK Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 42: UK Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 43: UK Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 44: UK Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 45: UK Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 46: Germany Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 47: Germany Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 48: Germany Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 49: Germany Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 50: Germany Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 51: Germany Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 52: Germany Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 53: France Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 54: France Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 55: France Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 56: France Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 57: France Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 58: France Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 59: France Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 60: Italy Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 61: Italy Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 62: Italy Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 63: Italy Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 64: Italy Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 65: Italy Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 66: Italy Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 67: Spain Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 68: Spain Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 69: Spain Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 70: Spain Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 71: Spain Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 72: Spain Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 73: Spain Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 74: The Netherlands Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 75: The Netherlands Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 76: The Netherlands Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 77: The Netherlands Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 78: The Netherlands Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 79: The Netherlands Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 80: The Netherlands Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 81: Rest of Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 82: Rest of Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 83: Rest of Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 84: Rest of Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 85: Rest of Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 86: Rest of Europe Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 87: Rest of Europe Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 88: Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 89: Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 90: Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 91: Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 92: Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 93: Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 94: Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 95: Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 96: China Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 97: China Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 98: China Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 99: China Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 100: China Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 101: China Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 102: China Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 103: India Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 104: India Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 105: India Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 106: India Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 107: India Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 108: India Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 109: India Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 110: Japan Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 111: Japan Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 112: Japan Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 113: Japan Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 114: Japan Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 115: Japan Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 116: Japan Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 117: Australia Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 118: Australia Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 119: Australia Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 120: Australia Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 121: Australia Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 122: Australia Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 123: Australia Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 124: South Korea Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 125: South Korea Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 126: South Korea Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 127: South Korea Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 128: South Korea Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 129: South Korea Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 130: South Korea Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 131: ASEAN Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 132: ASEAN Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 133: ASEAN Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 134: ASEAN Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 135: ASEAN Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 136: ASEAN Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 137: ASEAN Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 138: Rest of Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 139: Rest of Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 140: Rest of Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 141: Rest of Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 142: Rest of Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 143: Rest of Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 144: Rest of Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 145: Latin America Blockchain Technology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 146: Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 147: Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 148: Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 149: Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 150: Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 151: Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 152: Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 153: Brazil Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 154: Brazil Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 155: Brazil Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 156: Brazil Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 157: Brazil Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 158: Brazil Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 159: Brazil Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 160: Argentina Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 161: Argentina Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 162: Argentina Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 163: Argentina Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 164: Argentina Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 165: Argentina Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 166: Argentina Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 167: Mexico Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 168: Mexico Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 169: Mexico Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 170: Mexico Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 171: Mexico Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 172: Mexico Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 173: Mexico Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 174: Rest of Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 175: Rest of Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 176: Rest of Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 177: Rest of Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 178: Rest of Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 179: Rest of Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 180: Rest of Latin America Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 181: Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 182: Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 183: Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 184: Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 185: Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 186: Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 187: Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 188: Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 189: GCC Countries Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 190: GCC Countries Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 191: GCC Countries Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 192: GCC Countries Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 193: GCC Countries Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 194: GCC Countries Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 195: GCC Countries Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 196: South Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 197: South Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 198: South Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 199: South Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 200: South Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 201: South Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 202: South Africa Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 203: Rest of Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 204: Rest of Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 205: Rest of Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Deployment Mode, 2020 to 2035

Table 206: Rest of Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Provider, 2020 to 2035

Table 207: Rest of Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 208: Rest of Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 209: Rest of Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Figure 01: Global Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 02: Global Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 03: Global Blockchain Technology Market Revenue (US$ Bn), by Platforms, 2020 to 2035

Figure 04: Global Blockchain Technology Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 05: Global Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 06: Global Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 07: Global Blockchain Technology Market Revenue (US$ Bn), by On-Premises, 2020 to 2035

Figure 08: Global Blockchain Technology Market Revenue (US$ Bn), by Cloud-based, 2020 to 2035

Figure 09: Global Blockchain Technology Market Revenue (US$ Bn), by Hybrid, 2020 to 2035

Figure 10: Global Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 11: Global Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 12: Global Blockchain Technology Market Revenue (US$ Bn), by Application Provider, 2020 to 2035

Figure 13: Global Blockchain Technology Market Revenue (US$ Bn), by Infrastructure Provider, 2020 to 2035

Figure 14: Global Blockchain Technology Market Revenue (US$ Bn), by Middleware Provider, 2020 to 2035

Figure 15: Global Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 16: Global Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 17: Global Blockchain Technology Market Revenue (US$ Bn), by Large Enterprises, 2020 to 2035

Figure 18: Global Blockchain Technology Market Revenue (US$ Bn), by Small & Medium Enterprises (SMEs), 2020 to 2035

Figure 19: Global Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 20: Global Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 21: Global Blockchain Technology Market Revenue (US$ Bn), by Digital Identity, 2020 to 2035

Figure 22: Global Blockchain Technology Market Revenue (US$ Bn), by Exchanges, 2020 to 2035

Figure 23: Global Blockchain Technology Market Revenue (US$ Bn), by Payments, 2020 to 2035

Figure 24: Global Blockchain Technology Market Revenue (US$ Bn), by Smart Contracts, 2020 to 2035

Figure 25: Global Blockchain Technology Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 26: Global Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 27: Global Blockchain Technology Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 28: Global Blockchain Technology Market Revenue (US$ Bn), by BFSI, 2020 to 2035

Figure 29: Global Blockchain Technology Market Revenue (US$ Bn), by Media and Entertainment, 2020 to 2035

Figure 30: Global Blockchain Technology Market Revenue (US$ Bn), by Retail & e-Commerce, 2020 to 2035

Figure 31: Global Blockchain Technology Market Revenue (US$ Bn), by Transportation & Logistics, 2020 to 2035

Figure 32: Global Blockchain Technology Market Revenue (US$ Bn), by Agriculture & Food, 2020 to 2035

Figure 33: Global Blockchain Technology Market Revenue (US$ Bn), by Manufacturing, 2020 to 2035

Figure 34: Global Blockchain Technology Market Revenue (US$ Bn), by Energy & Utilities, 2020 to 2035

Figure 35: Global Blockchain Technology Market Revenue (US$ Bn), by Healthcare & Life Sciences, 2020 to 2035

Figure 36: Global Blockchain Technology Market Revenue (US$ Bn), by IT & Telecom, 2020 to 2035

Figure 37: Global Blockchain Technology Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 38: Global Blockchain Technology Market Value Share Analysis, By Region, 2024 and 2035

Figure 39: Global Blockchain Technology Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 40: North America Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: North America Blockchain Technology Market Value Share Analysis, by Country, 2024 and 2035

Figure 42: North America Blockchain Technology Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 43: North America Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 44: North America Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 45: North America Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 46: North America Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 47: North America Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 48: North America Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 49: North America Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 50: North America Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 51: North America Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: North America Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 53: North America Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 54: North America Blockchain Technology Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 55: U.S. Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: U.S. Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 57: U.S. Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 58: U.S. Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 59: U.S. Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 60: U.S. Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 61: U.S. Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 62: U.S. Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 63: U.S. Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 64: U.S. Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 65: U.S. Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 66: U.S. Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 67: U.S. Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 68: Canada Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Canada Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 70: Canada Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 71: Canada Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 72: Canada Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 73: Canada Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 74: Canada Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 75: Canada Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 76: Canada Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 77: Canada Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 78: Canada Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 79: Canada Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 80: Canada Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 81: Europe Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 82: Europe Blockchain Technology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 83: Europe Blockchain Technology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 84: Europe Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 85: Europe Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 86: Europe Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 87: Europe Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 88: Europe Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 89: Europe Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 90: Europe Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 91: Europe Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 92: Europe Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 93: Europe Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 94: Europe Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 95: Europe Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 96: UK Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 97: UK Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 98: UK Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 99: UK Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 100: UK Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 101: UK Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 102: UK Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 103: UK Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 104: UK Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 105: UK Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 106: UK Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 107: UK Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 108: UK Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 109: Germany Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 110: Germany Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 111: Germany Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 112: Germany Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 113: Germany Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 114: Germany Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 115: Germany Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 116: Germany Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 117: Germany Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 118: Germany Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 119: Germany Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 120: Germany Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 121: Germany Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 122: France Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 123: France Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 124: France Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 125: France Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 126: France Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 127: France Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 128: France Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 129: France Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 130: France Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 131: France Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 132: France Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 133: France Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 134: France Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 135: Italy Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 136: Italy Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 137: Italy Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 138: Italy Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 139: Italy Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 140: Italy Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 141: Italy Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 142: Italy Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 143: Italy Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 144: Italy Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 145: Italy Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 146: Italy Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 147: Italy Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 148: Spain Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 149: Spain Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 150: Spain Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 151: Spain Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 152: Spain Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 153: Spain Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 154: Spain Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 155: Spain Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 156: Spain Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 157: Spain Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 158: Spain Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 159: Spain Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 160: Spain Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 161: The Netherlands Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 162: The Netherlands Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 163: The Netherlands Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 164: The Netherlands Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 165: The Netherlands Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 166: The Netherlands Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 167: The Netherlands Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 168: The Netherlands Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 169: The Netherlands Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 170: The Netherlands Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 171: The Netherlands Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 172: The Netherlands Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 173: The Netherlands Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 174: Rest of Europe Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 175: Rest of Europe Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 176: Rest of Europe Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 177: Rest of Europe Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 178: Rest of Europe Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 179: Rest of Europe Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 180: Rest of Europe Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 181: Rest of Europe Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 182: Rest of Europe Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 183: Rest of Europe Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 184: Rest of Europe Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 185: Rest of Europe Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 186: Rest of Europe Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 187: Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 188: Asia Pacific Blockchain Technology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 189: Asia Pacific Blockchain Technology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 190: Asia Pacific Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 191: Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 192: Asia Pacific Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 193: Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 194: Asia Pacific Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 195: Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 196: Asia Pacific Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 197: Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 198: Asia Pacific Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 199: Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 200: Asia Pacific Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 201: Asia Pacific Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 202: China Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 203: China Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 204: China Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 205: China Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 206: China Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 207: China Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 208: China Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 209: China Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 210: China Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 211: China Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 212: China Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 213: China Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 214: China Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 215: India Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: India Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 217: India Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 218: India Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 219: India Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 220: India Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 221: India Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 222: India Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 223: India Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 224: India Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 225: India Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 226: India Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 227: India Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 228: Japan Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 229: Japan Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 230: Japan Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 231: Japan Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 232: Japan Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 233: Japan Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 234: Japan Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 235: Japan Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 236: Japan Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 237: Japan Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 238: Japan Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 239: Japan Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 240: Japan Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 241: Australia Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 242: Australia Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 243: Australia Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 244: Australia Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 245: Australia Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 246: Australia Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 247: Australia Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 248: Australia Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 249: Australia Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 250: Australia Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 251: Australia Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 252: Australia Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 253: Australia Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 254: South Korea Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 255: South Korea Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 256: South Korea Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 257: South Korea Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 258: South Korea Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 259: South Korea Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 260: South Korea Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 261: South Korea Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 262: South Korea Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 263: South Korea Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 264: South Korea Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 265: South Korea Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 266: South Korea Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 267: ASEAN Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 268: ASEAN Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 269: ASEAN Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 270: ASEAN Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 271: ASEAN Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 272: ASEAN Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 273: ASEAN Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 274: ASEAN Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 275: ASEAN Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 276: ASEAN Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 277: ASEAN Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 278: ASEAN Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 279: ASEAN Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 280: Rest of Asia Pacific Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 281: Rest of Asia Pacific Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 282: Rest of Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 283: Rest of Asia Pacific Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 284: Rest of Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 285: Rest of Asia Pacific Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 286: Rest of Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 287: Rest of Asia Pacific Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 288: Rest of Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 289: Rest of Asia Pacific Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 290: Rest of Asia Pacific Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 291: Rest of Asia Pacific Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 292: Rest of Asia Pacific Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 293: Latin America Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 294: Latin America Blockchain Technology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 295: Latin America Blockchain Technology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 296: Latin America Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 297: Latin America Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 298: Latin America Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 299: Latin America Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 300: Latin America Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 301: Latin America Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 302: Latin America Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 303: Latin America Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 304: Latin America Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 305: Latin America Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 306: Latin America Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 307: Latin America Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 308: Brazil Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 309: Brazil Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 310: Brazil Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 311: Brazil Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 312: Brazil Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 313: Brazil Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 314: Brazil Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 315: Brazil Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 316: Brazil Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 317: Brazil Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 318: Brazil Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 319: Brazil Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 320: Brazil Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 321: Argentina Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 322: Argentina Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 323: Argentina Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 324: Argentina Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 325: Argentina Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 326: Argentina Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 327: Argentina Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 328: Argentina Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 329: Argentina Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 330: Argentina Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 331: Argentina Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 332: Argentina Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 333: Argentina Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 334: Mexico Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 335: Mexico Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 336: Mexico Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 337: Mexico Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 338: Mexico Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 339: Mexico Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 340: Mexico Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 341: Mexico Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 342: Mexico Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 343: Mexico Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 344: Mexico Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 345: Mexico Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 346: Mexico Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 347: Rest of Latin America Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 348: Rest of Latin America Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 349: Rest of Latin America Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 350: Rest of Latin America Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 351: Rest of Latin America Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 352: Rest of Latin America Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 353: Rest of Latin America Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 354: Rest of Latin America Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 355: Rest of Latin America Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 356: Rest of Latin America Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 357: Rest of Latin America Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 358: Rest of Latin America Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 359: Rest of Latin America Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 360: Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 361: Middle East & Africa Blockchain Technology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 362: Middle East & Africa Blockchain Technology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 363: Middle East & Africa Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 364: Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 365: Middle East & Africa Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 366: Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 367: Middle East & Africa Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 368: Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 369: Middle East & Africa Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 370: Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 371: Middle East & Africa Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 372: Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 373: Middle East & Africa Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 374: Middle East & Africa Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 375: GCC Countries Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 376: GCC Countries Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 377: GCC Countries Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 378: GCC Countries Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 379: GCC Countries Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 380: GCC Countries Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 381: GCC Countries Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 382: GCC Countries Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 383: GCC Countries Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 384: GCC Countries Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 385: GCC Countries Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 386: GCC Countries Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 387: GCC Countries Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 388: South Africa Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 389: South Africa Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 390: South Africa Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 391: South Africa Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 392: South Africa Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 393: South Africa Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 394: South Africa Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 395: South Africa Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 396: South Africa Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 397: South Africa Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 398: South Africa Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 399: South Africa Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 400: South Africa Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2036

Figure 401: Rest of Middle East & Africa Blockchain Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 402: Rest of Middle East & Africa Blockchain Technology Market Value Share Analysis, By Offering, 2024 and 2035

Figure 403: Rest of Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 404: Rest of Middle East & Africa Blockchain Technology Market Value Share Analysis, By Deployment Mode, 2024 and 2035

Figure 405: Rest of Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Deployment Mode, 2025 to 2035

Figure 406: Rest of Middle East & Africa Blockchain Technology Market Value Share Analysis, By Provider, 2024 and 2035

Figure 407: Rest of Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Provider, 2025 to 2035

Figure 408: Rest of Middle East & Africa Blockchain Technology Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 409: Rest of Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 410: Rest of Middle East & Africa Blockchain Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 411: Rest of Middle East & Africa Blockchain Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 412: Rest of Middle East & Africa Blockchain Technology Market Value Share Analysis, By End-use Industry, 2024 and 2035