Reports

Reports

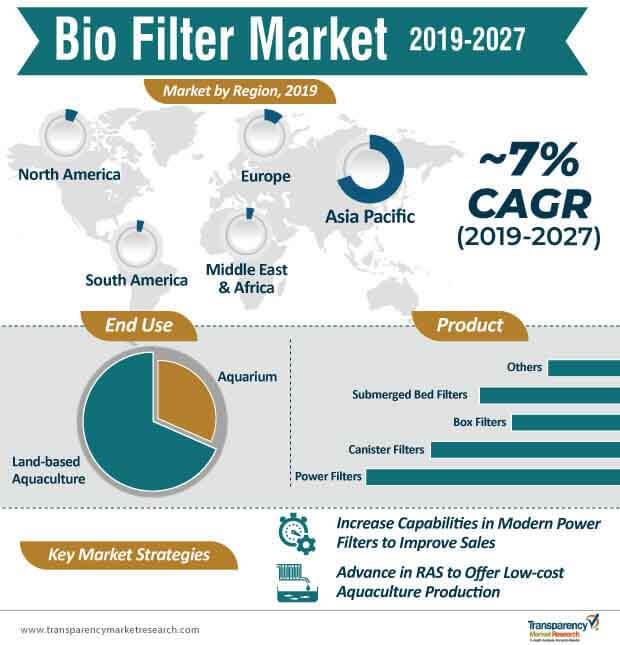

Since companies are getting competitive at increasing their expertise in new technologies for bio filters, manufacturers are pressured to keep up-to-date with latest aquarium filtration trends in the aquaculture landscape. Companies in the bio filter market are increasing their focus on modern power filters that have different capabilities, to suit the specific needs of customers. As such, power filters account for the highest revenue amongst all products in the bio filter market, with a projected value of ~US$ 1.3 billion by 2027. Thus, to increase sales, stakeholders are rolling out special offers and discounts for customers who purchase two or more filters. They are gaining steady profit by selling proprietary cartridges and filter materials.

Ceramic rings are gaining popularity as an affordable and effective bio media. They are increasingly being used in aquariums, and offer powerful biological filtration by keeping the tanks safe from dangerous chemicals. Ceramic rings are anticipated to dominate market growth in terms of value and volume, with an estimated production output of ~460,500 units by 2027, in the bio filter market.

Since customers encounter an increased buildup of ammonia and nitrites excreted by fish, ceramic rings help in the breeding of beneficial bacteria. However, customers need to be assured that these ceramic rings do not filter contaminated water, and only encourage beneficial bacteria to grow on the rings.

Manufacturers in the bio filter market are tapping into new opportunities, such as the growing adoption of self cleaning fliters aquariums at homes and office spaces. This trend of self-cleaning aquariums is gaining increased traction, as cleaning tanks can be a tedious task for many customers, especially the millennial population who have busy work schedules. Manufacturers in the bio filter market are developing self-cleaning aquariums that are built, incorporated with a combination of cleaning methods such biological filtration along with mechanical and chemical processes. The aesthetic appeal of these innovative aquariums is emerging as a trend for gifting purposes. As such, there is growing demand for small, compact, and aesthetically-beautiful aquariums in the market landscape.

Another trend that is likely to positively influence growth for the bio filter market is the increasing adoption of saltwater aquarium biological filters. Choosing the right biological filter material helps in the breeding of beneficial bacteria in aquariums. Manufacturers in the bio filter market are introducing canister-style filters that are available in various styles and sizes. A lot of consumers are choosing canister-style filters, since they offer multi-functional operations, as these filters contain a number of chambers that can hold a variety of materials that perform several functions.

Growth in the popularity of land-based aquaculture has propelled the expansion of the bio filter market. As such, land-based aquaculture is projected to dominate in terms of value and volume, in the bio filter market, with an estimated output of ~26,000 units by the end of 2027. Thus, companies in the bio filter market are increasing the efficacy of recirculating aquaculture systems (RAS) to meet the growing needs of customers in the aquaculture space. However, RAS are limited by the availability of water and buildup of toxic ammonia excreted by the fish.

Many fish farmers with limited infrastructure and resources are deprived of the access to high-end technological RAS systems, which is likely to hamper the growth of land-based aquaculture. Since small- and medium-scale fish farmers have limited capital, purchasing technologically-advanced RAS becomes an expensive affair for them. To solve these problems, manufacturers in the bio filter landscape are aiming to develop RAS through cost-effective technology, to increase the availability of advanced RAS for small- and medium-scale fish farmers. For instance, Aqua-Spark - a global investment company for sustainable aquaculture businesses, announced a collaboration with BioFishency - an aquaculture solutions provider, to develop simple-to-operate RAS that would help fish farmers increase their yield and save expensive resources such as land and water.

Analysts’ Viewpoint

Apart from ceramic rings, bio balls also serve as an effective alternative for biological filtration. This is evident as bio balls are estimated for the second-highest revenue amongst all filter media in the bio filter market, with a value projection of ~US$ 10 billion by the end of 2027. Asia Pacific is a lucrative market to invest in, since the region accounts for ~89% of global aquaculture production, according to the State of World Fisheries and Aquaculture, 2018, FAO.

However, the introduction of eco-friendly techniques in the landscape of self-cleaning aquariums, such as aquarium kits with garden beds, pose a threat to the demand for biological filtration materials. Thus, manufacturers should focus on expanding their portfolios in improved biological materials, such as bio glass, carbon-filled bio balls, and undergravel filters.

1. Section 1. Preface

1.1. Market Definitions and Overview

1.2. Market Segmentation and Scope

1.3. Key Research Objectives

1.4. Research Highlights

2. Section 2. Assumptions and Acronyms

3. Section 3. Research Methodology

4. Section 4. Executive Summary : Bio Filter

5. Section 5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Supply side

5.3.2. Demand Side

5.4. Key Market Indicators

5.4.1. Commercial and Residential Sector Overview

5.4.2. Overall Aquarium Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Bio Filter Market Analysis and Forecast,2017 – 2027

5.8.1. Market Volume Projections (Thousand Units), 2017 – 2027

5.8.2. Market Value Projections (US$ Mn), 2017 - 2027

6. Section 6. Global Bio Filter Market Analysis and Forecast, by Product

6.1. Definitions/ Overview

6.2. Bio Filter Market(US$ Mn and Thousand Units), by Product, 2017 – 2027

6.2.1. Power Filter

6.2.2. Canister Filter

6.2.3. Box Filter

6.2.4. Submerged Bed Filter

6.2.5. Others

6.3. Global Incremental Opportunity, by Product

7. Section 7. Global Bio Filter Market Analysis and Forecast, by Filter Media

7.1. Definitions/ Overview

7.2. Bio Filter Market(US$ Mn and Thousand Units), by Filter Media, 2017 – 2027

7.2.1. Ceramic Rings

7.2.2. Bio Balls

7.2.3. Moving Bed Filter Media

7.2.4. Others

7.3. Global Incremental Opportunity, by Filter Media

8. Section 8. Global Bio Filter Market Analysis and Forecast, by End Use

8.1. Definitions/ Overview

8.2. Bio Filter Market(US$ Mn and Thousand Units), by End Use, 2017 – 2027

8.2.1. Aquarium

8.2.1.1. Residential

8.2.1.2. Commercial

8.2.2. Land Based Aquaculture

8.3. Global Incremental Opportunity, by End Use

9. Section 9. Global Bio Filter Market Analysis and Forecast, by Distribution Channel

9.1. Definitions/ Overview

9.2. Bio Filter Market(US$ Mn and Thousand Units), by Distribution Channel, 2017 – 2027

9.2.1. Online

9.2.2. Offline

9.2.2.1. Specialty Store

9.2.2.2. Pet Supply Store

9.2.2.3. Others

9.3. Global Incremental Opportunity, by Distribution Channel

10. Section 10. Global Bio Filter Market Analysis and Forecast, by Region

10.1. Definitions/ Overview

10.2. Bio Filter Market(US$ Mn and Thousand Units), by Region, 2017 – 2027

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

10.3. Global Incremental Opportunity, by Region

11. Section 11. North America Bio Filter Market Analysis and Forecast

11.1. Regional Snapshot

11.1.1. By Product

11.1.2. By Filter Media

11.1.3. By End Use

11.1.4. By Distribution Channel

11.1.5. By Country

11.2. Key Trend Analysis

11.2.1. Supply side

11.2.2. Demand Side

11.3. Price Trend Analysis

11.4. Bio Filter Market (US$ Mn and Thousand Units), by Product, 2017 – 2027

11.4.1. Power Filter

11.4.2. Canister Filter

11.4.3. Box Filter

11.4.4. Submerged Bed Filter

11.4.5. Others

11.5. Bio Filter Market (US$ Mn and Thousand Units), by Filter Media, 2017 – 2027

11.5.1. Ceramic Rings

11.5.2. Bio Balls

11.5.3. Moving Bed Filter Media

11.5.4. Others

11.6. Bio Filter Market (US$ Mn and Thousand Units), by End Use, 2017 – 2027

11.6.1. Aquarium

11.6.1.1. Residential

11.6.1.2. Commercial

11.6.2. Land Based Aquaculture

11.7. Bio Filter Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 – 2027

11.7.1. Online

11.7.2. Offline

11.7.2.1. Specialty Store

11.7.2.2. Pet Supply Store

11.7.2.3. Others

11.8. Bio Filter Market (US$ Mn and Thousand Units), by Country & Sub-region, 2017 – 2027

11.8.1. The U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Incremental Opportunity Analysis

12. Section 12. Europe Bio Filter Market Analysis and Forecast

12.1. Regional Snapshot

12.1.1. By Product

12.1.2. By Filter Media

12.1.3. By End Use

12.1.4. By Distribution Channel

12.1.5. By Country

12.2. Key Trend Analysis

12.2.1. Supply side

12.2.2. Demand Side

12.3. Price Trend Analysis

12.4. Bio Filter Market (US$ Mn and Thousand Units), by Product, 2017 – 2027

12.4.1. Power Filter

12.4.2. Canister Filter

12.4.3. Box Filter

12.4.4. Submerged Bed Filter

12.4.5. Others

12.5. Bio Filter Market (US$ Mn and Thousand Units), by Filter Media, 2017 – 2027

12.5.1. Ceramic Rings

12.5.2. Bio Balls

12.5.3. Moving Bed Filter Media

12.5.4. Others

12.6. Bio Filter Market (US$ Mn and Thousand Units), by End Use, 2017 – 2027

12.6.1. Aquarium

12.6.1.1. Residential

12.6.1.2. Commercial

12.6.2. Land Based Aquaculture

12.7. Bio Filter Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 – 2027

12.7.1. Online

12.7.2. Offline

12.7.2.1. Specialty Store

12.7.2.2. Pet Supply Store

12.7.2.3. Others

12.8. Bio Filter Market (US$ Mn and Thousand Units), by Country& Sub-region, 2017 – 2027

12.8.1. Germany

12.8.2. France

12.8.3. UK

12.8.4. Italy

12.8.5. Rest of Europe

12.9. Incremental Opportunity Analysis

13. Section 13. Asia Pacific Bio Filter Market Analysis and Forecast

13.1. Regional Snapshot

13.1.1. By Product

13.1.2. By Filter Media

13.1.3. By End Use

13.1.4. By Distribution Channel

13.1.5. By Country

13.2. Key Trend Analysis

13.2.1. Supply side

13.2.2. Demand Side

13.3. Price Trend Analysis

13.4. Bio Filter Market (US$ Mn and Thousand Units), by Product, 2017 – 2027

13.4.1. Power Filter

13.4.2. Canister Filter

13.4.3. Box Filter

13.4.4. Submerged Bed Filter

13.4.5. Others

13.5. Bio Filter Market (US$ Mn and Thousand Units), by Filter Media, 2017 – 2027

13.5.1. Ceramic Rings

13.5.2. Bio Balls

13.5.3. Moving Bed Filter Media

13.5.4. Others

13.6. Bio Filter Market (US$ Mn and Thousand Units), by End Use, 2017 – 2027

13.6.1. Aquarium

13.6.1.1. Residential

13.6.1.2. Commercial

13.6.2. Land Based Aquaculture

13.7. Bio Filter Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 – 2027

13.7.1. Online

13.7.2. Offline

13.7.2.1. Specialty Store

13.7.2.2. Pet Supply Store

13.7.2.3. Others

13.8. Bio Filter Market (US$ Mn and Thousand Units), by Country & Sub-region, 2017 – 2027

13.8.1. China

13.8.2. India

13.8.3. Japan

13.8.4. Rest of Asia Pacific

13.9. Incremental Opportunity Analysis

14. Section 14. Middle East & Africa Bio Filter Market Analysis and Forecast

14.1. Regional Snapshot

14.1.1. By Product

14.1.2. By Filter Media

14.1.3. By End Use

14.1.4. By Distribution Channel

14.1.5. By Country

14.2. Key Trend Analysis

14.2.1. Supply side

14.2.2. Demand Side

14.3. Price Trend Analysis

14.4. Bio Filter Market (US$ Mn and Thousand Units), by Product, 2017 – 2027

14.4.1. Power Filter

14.4.2. Canister Filter

14.4.3. Box Filter

14.4.4. Submerged Bed Filter

14.4.5. Others

14.5. Bio Filter Market (US$ Mn and Thousand Units), by Filter Media, 2017 – 2027

14.5.1. Ceramic Rings

14.5.2. Bio Balls

14.5.3. Moving Bed Filter Media

14.5.4. Others

14.6. Bio Filter Market (US$ Mn and Thousand Units), by End Use, 2017 – 2027

14.6.1. Aquarium

14.6.1.1. Residential

14.6.1.2. Commercial

14.6.2. Land Based Aquaculture

14.7. Bio Filter Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 – 2027

14.7.1. Online

14.7.2. Offline

14.7.2.1. Specialty Store

14.7.2.2. Pet Supply Store

14.7.2.3. Others

14.8. Bio Filter Market (US$ Mn and Thousand Units), by Country & Sub-region, 2017 – 2027

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Incremental Opportunity Analysis

15. Section 15. South America Bio Filter Market Analysis and Forecast

15.1. Regional Snapshot

15.1.1. By Product

15.1.2. By Filter Media

15.1.3. By End Use

15.1.4. By Distribution Channel

15.1.5. By Country

15.2. Key Trend Analysis

15.2.1. Supply side

15.2.2. Demand Side

15.3. Price Trend Analysis

15.4. Bio Filter Market (US$ Mn and Thousand Units), by Product, 2017 – 2027

15.4.1. Power Filter

15.4.2. Canister Filter

15.4.3. Box Filter

15.4.4. Submerged Bed Filter

15.4.5. Others

15.5. Bio Filter Market (US$ Mn and Thousand Units), by Filter Media, 2017 – 2027

15.5.1. Ceramic Rings

15.5.2. Bio Balls

15.5.3. Moving Bed Filter Media

15.5.4. Others

15.6. Bio Filter Market (US$ Mn and Thousand Units), by End Use, 2017 – 2027

15.6.1. Aquarium

15.6.1.1. Residential

15.6.1.2. Commercial

15.6.2. Land Based Aquaculture

15.7. Bio Filter Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 – 2027

15.7.1. Online

15.7.2. Offline

15.7.2.1. Specialty Store

15.7.2.2. Pet Supply Store

15.7.2.3. Others

15.8. Bio Filter Market (US$ Mn and Thousand Units), by Country & Sub-region, 2017 – 2027

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Incremental Opportunity Analysis

16. Section 16. Competition Landscape

16.1. Competition Dash Board (2018)

16.2. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Product Innovation, Strategy & Business Overview)

16.2.1. Aqua Design Amano

16.2.1.1. Company Overview

16.2.1.2. Sales Area/Geographical Presence

16.2.1.3. Revenue

16.2.1.4. Product Innovation

16.2.1.5. Strategy & Business Overview

16.2.2. Aquaneering, Inc.

16.2.2.1. Company Overview

16.2.2.2. Sales Area/Geographical Presence

16.2.2.3. Revenue

16.2.2.4. Product Innovation

16.2.2.5. Strategy & Business Overview

16.2.3. Azoo Corporation

16.2.3.1. Company Overview

16.2.3.2. Sales Area/Geographical Presence

16.2.3.3. Revenue

16.2.3.4. Product Innovation

16.2.3.5. Strategy & Business Overview

16.2.4. EHEIM GmbH & Co. KG

16.2.4.1. Company Overview

16.2.4.2. Sales Area/Geographical Presence

16.2.4.3. Revenue

16.2.4.4. Product Innovation

16.2.4.5. Strategy & Business Overview

16.2.5. Rolf C. Hagen, Inc.

16.2.5.1. Company Overview

16.2.5.2. Sales Area/Geographical Presence

16.2.5.3. Revenue

16.2.5.4. Product Innovation

16.2.5.5. Strategy & Business Overview

16.2.6. Marukan Co., LTD.

16.2.6.1. Company Overview

16.2.6.2. Sales Area/Geographical Presence

16.2.6.3. Revenue

16.2.6.4. Product Innovation

16.2.6.5. Strategy & Business Overview

16.2.7. Penn-Plax

16.2.7.1. Company Overview

16.2.7.2. Sales Area/Geographical Presence

16.2.7.3. Revenue

16.2.7.4. Product Innovation

16.2.7.5. Strategy & Business Overview

16.2.8. Qian Hu Corporation Limitedr

16.2.8.1. Company Overview

16.2.8.2. Sales Area/Geographical Presence

16.2.8.3. Revenue

16.2.8.4. Product Innovation

16.2.8.5. Strategy & Business Overview

16.2.9. Spectrum Brands, Inc.

16.2.9.1. Company Overview

16.2.9.2. Sales Area/Geographical Presence

16.2.9.3. Revenue

16.2.9.4. Product Innovation

16.2.9.5. Strategy & Business Overview

16.2.10. Tropical Marine Centre

16.2.10.1. Company Overview

16.2.10.2. Sales Area/Geographical Presence

16.2.10.3. Revenue

16.2.10.4. Product Innovation

16.2.10.5. Strategy & Business Overview

16.2.11. Waterlife Research Ind. Ltd.

16.2.11.1. Company Overview

16.2.11.2. Sales Area/Geographical Presence

16.2.11.3. Revenue

16.2.11.4. Product Innovation

16.2.11.5. Strategy & Business Overview

16.2.12. Zoo Med Laboratories, Inc.

16.2.12.1. Company Overview

16.2.12.2. Sales Area/Geographical Presence

16.2.12.3. Revenue

16.2.12.4. Product Innovation

16.2.12.5. Strategy & Business Overview

16.2.13. Dymax

16.2.13.1. Company Overview

16.2.13.2. Sales Area/Geographical Presence

16.2.13.3. Revenue

16.2.13.4. Product Innovation

16.2.13.5. Strategy & Business Overview

16.2.14. Aquael

16.2.14.1. Company Overview

16.2.14.2. Sales Area/Geographical Presence

16.2.14.3. Revenue

16.2.14.4. Product Innovation

16.2.14.5. Strategy & Business Overview

16.2.15. Gulfstream Tropical Aquarium Inc.

16.2.15.1. Company Overview

16.2.15.2. Sales Area/Geographical Presence

16.2.15.3. Revenue

16.2.15.4. Product Innovation

16.2.15.5. Strategy & Business Overview

17. Section 17. Key Takeaways

List of Tables

Table 1: Global Bio Filter Market Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Table 2: Global Bio Filter Market Value (US$ Mn) Forecast, by Product, 2017 – 2027

Table 3: Global Bio Filter Market Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Table 4: Global Bio Filter Market Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Table 5: Global Bio Filter Market Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Table 6: Global Bio Filter Market Value (US$ Mn) Forecast, by End use, 2017 – 2027

Table 7: Global Bio Filter Market Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Table 8: Global Bio Filter Market Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Table 9: Global Bio Filter Market Volume (Thousand Units) Forecast, by Region, 2017 – 2027

Table 10: Global Bio Filter Market Value (US$ Mn) Forecast, by Region, 2017 – 2027

Table 11: North America Bio Filter Market Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Table 12: North America Bio Filter Market Value (US$ Mn) Forecast, by Product, 2017 – 2027

Table 13: North America Bio Filter Market Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Table 14: North America Bio Filter Market Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Table 15: North America Bio Filter Market Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Table 16: North America Bio Filter Market Value (US$ Mn) Forecast, by End use, 2017 – 2027

Table 17: North America Bio Filter Market Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Table 18: North America Bio Filter Market Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Table 19: North America Bio Filter Market Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Table 20: North America Bio Filter Market Value (US$ Mn) Forecast, by Country, 2017 – 2027

Table 21: Europe Bio Filter Market Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Table 22: Europe Bio Filter Market Value (US$ Mn) Forecast, by Product, 2017 – 2027

Table 23: Europe Bio Filter Market Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Table 24: Europe Bio Filter Market Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Table 25: Europe Bio Filter Market Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Table 26: Europe Bio Filter Market Value (US$ Mn) Forecast, by End use, 2017 – 2027

Table 27: Europe Bio Filter Market Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Table 28: Europe Bio Filter Market Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Table 29: Europe Bio Filter Market Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Table 30: Europe Bio Filter Market Value (US$ Mn) Forecast, by Country, 2017 – 2027

Table 31: Asia Pacific Bio Filter Market Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Table 32: Asia Pacific Bio Filter Market Value (US$ Mn) Forecast, by Product, 2017 – 2027

Table 33: Asia Pacific Bio Filter Market Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Table 34: Asia Pacific Bio Filter Market Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Table 35: Asia Pacific Bio Filter Market Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Table 36: Asia Pacific Bio Filter Market Value (US$ Mn) Forecast, by End use, 2017 – 2027

Table 37: Asia Pacific Bio Filter Market Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Table 38: Asia Pacific Bio Filter Market Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Table 39: Asia Pacific Bio Filter Market Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Table 40: Asia Pacific Bio Filter Market Value (US$ Mn) Forecast, by Country, 2017 – 2027

Table 41: Middle East & Africa Bio Filter Market Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Table 42: Middle East & Africa Bio Filter Market Value (US$ Mn) Forecast, by Product, 2017 – 2027

Table 43: Middle East & Africa Bio Filter Market Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Table 44: Middle East & Africa Bio Filter Market Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Table 45: Middle East & Africa Bio Filter Market Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Table 46: Middle East & Africa Bio Filter Market Value (US$ Mn) Forecast, by End use, 2017 – 2027

Table 47: Middle East & Africa Bio Filter Market Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Table 48: Middle East & Africa Bio Filter Market Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Table 49: Middle East & Africa Bio Filter Market Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Table 50: Middle East & Africa Bio Filter Market Value (US$ Mn) Forecast, by Country, 2017 – 2027

Table 51: South America Bio Filter Market Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Table 52: South America Bio Filter Market Value (US$ Mn) Forecast, by Product, 2017 – 2027

Table 53: South America Bio Filter Market Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Table 54: South America Bio Filter Market Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Table 55: South America Bio Filter Market Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Table 56: South America Bio Filter Market Value (US$ Mn) Forecast, by End use, 2017 – 2027

Table 57: South America Bio Filter Market Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Table 58: South America Bio Filter Market Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Table 59: South America Bio Filter Market Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Table 60: South America Bio Filter Market Value (US$ Mn) Forecast, by Country, 2017 – 2027

List of Figures

Figure 1: Global Bio Filter Market, Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Figure 2: Global Bio Filter Market, Value (US$ Mn) Forecast, by Product, 2017 – 2027

Figure 3: Global Bio Filter Market, Incremental Opportunity (US$ Mn), by Product, 2019-2027

Figure 4: Global Bio Filter Market Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Figure 5: Global Bio Filter Market Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Figure 6: Global Bio Filter Market, Incremental Opportunity (US$ Mn), by Filter Media, 2019-2027

Figure 7: Global Bio Filter Market Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Figure 8: Global Bio Filter Market Value (US$ Mn) Forecast, by End use, 2017 – 2027

Figure 9: Global Bio Filter Market, Incremental Opportunity (US$ Mn), by End use, 2019-2027

Figure 10: Global Bio Filter Market Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Figure 11: Global Bio Filter Market Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Figure 12: Global Bio Filter Market, Incremental Opportunity (US$ Mn), by Distribution Channel, 2019-2027

Figure 13: Global Bio Filter Market Volume (Thousand Units) Forecast, by Region, 2017 – 2027

Figure 14: Global Bio Filter Market Value (US$ Mn) Forecast, by Region, 2017 – 2027

Figure 15: Global Bio Filter Market, Incremental Opportunity (US$ Mn), by Region, 2019-2027

Figure 16: North America Bio Filter Market, Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Figure 17: North America Bio Filter Market, Value (US$ Mn) Forecast, by Product, 2017 – 2027

Figure 18: North America Bio Filter Market, Incremental Opportunity (US$ Mn), by Product, 2019-2027

Figure 19: North America Bio Filter Market, Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Figure 20: North America Bio Filter Market, Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Figure 21: North America Bio Filter Market, Incremental Opportunity (US$ Mn), by Filter Media, 2019-2027

Figure 22: North America Bio Filter Market, Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Figure 23: North America Bio Filter Market, Value (US$ Mn) Forecast, by End use, 2017 – 2027

Figure 24: North America Bio Filter Market, Incremental Opportunity (US$ Mn), by End use, 2019-2027

Figure 25: North America Bio Filter Market, Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Figure 26: North America Bio Filter Market, Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Figure 27: North America Bio Filter Market, Incremental Opportunity (US$ Mn), by Distribution Channel, 2019-2027

Figure 28: North America Bio Filter Market, Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Figure 29: North America Bio Filter Market, Value (US$ Mn) Forecast, by Country, 2017 – 2027

Figure 30: North America Bio Filter Market, Incremental Opportunity (US$ Mn), by Country, 2019-2027

Figure 31: Europe Bio Filter Market, Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Figure 32: Europe Bio Filter Market, Value (US$ Mn) Forecast, by Product, 2017 – 2027

Figure 33: Europe Bio Filter Market, Incremental Opportunity (US$ Mn), by Product, 2019-2027

Figure 34: Europe Bio Filter Market, Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Figure 35: Europe Bio Filter Market, Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Figure 36: Europe Bio Filter Market, Incremental Opportunity (US$ Mn), by Filter Media, 2019-2027

Figure 37: Europe Bio Filter Market, Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Figure 38: Europe Bio Filter Market, Value (US$ Mn) Forecast, by End use, 2017 – 2027

Figure 39: Europe Bio Filter Market, Incremental Opportunity (US$ Mn), by End use, 2019-2027

Figure 40: Europe Bio Filter Market, Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Figure 41: Europe Bio Filter Market, Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Figure 42: Europe Bio Filter Market, Incremental Opportunity (US$ Mn), by Distribution Channel, 2019-2027

Figure 43: Europe Bio Filter Market, Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Figure 44: Europe Bio Filter Market, Value (US$ Mn) Forecast, by Country, 2017 – 2027

Figure 45: Europe Bio Filter Market, Incremental Opportunity (US$ Mn), by Country, 2019-2027

Figure 46: Asia Pacific Bio Filter Market, Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Figure 47: Asia Pacific Bio Filter Market, Value (US$ Mn) Forecast, by Product, 2017 – 2027

Figure 48: Asia Pacific Bio Filter Market, Incremental Opportunity (US$ Mn), by Product, 2019-2027

Figure 49: Asia Pacific Bio Filter Market, Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Figure 50: Asia Pacific Bio Filter Market, Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Figure 51: Asia Pacific Bio Filter Market, Incremental Opportunity (US$ Mn), by Filter Media, 2019-2027

Figure 52: Asia Pacific Bio Filter Market, Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Figure 53: Asia Pacific Bio Filter Market, Value (US$ Mn) Forecast, by End use, 2017 – 2027

Figure 54: Asia Pacific Bio Filter Market, Incremental Opportunity (US$ Mn), by End use, 2019-2027

Figure 55: Asia Pacific Bio Filter Market, Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Figure 56: Asia Pacific Bio Filter Market, Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Figure 57: Asia Pacific Bio Filter Market, Incremental Opportunity (US$ Mn), by Distribution Channel, 2019-2027

Figure 58: Asia Pacific Bio Filter Market, Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Figure 59: Asia Pacific Bio Filter Market, Value (US$ Mn) Forecast, by Country, 2017 – 2027

Figure 60: Asia Pacific Bio Filter Market, Incremental Opportunity (US$ Mn), by Country, 2019-2027

Figure 61: Middle East & Africa Bio Filter Market, Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Figure 62: Middle East & Africa Bio Filter Market, Value (US$ Mn) Forecast, by Product, 2017 – 2027

Figure 63: Middle East & Africa Bio Filter Market, Incremental Opportunity (US$ Mn), by Product, 2019-2027

Figure 64: Middle East & Africa Bio Filter Market, Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Figure 65: Middle East & Africa Bio Filter Market, Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Figure 66: Middle East & Africa Bio Filter Market, Incremental Opportunity (US$ Mn), by Filter Media, 2019-2027

Figure 67: Middle East & Africa Bio Filter Market, Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Figure 68: Middle East & Africa Bio Filter Market, Value (US$ Mn) Forecast, by End use, 2017 – 2027

Figure 69: Middle East & Africa Bio Filter Market, Incremental Opportunity (US$ Mn), by End use, 2019-2027

Figure 70: Middle East & Africa Bio Filter Market, Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Figure 71: Middle East & Africa Bio Filter Market, Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Figure 72: Middle East & Africa Bio Filter Market, Incremental Opportunity (US$ Mn), by Distribution Channel, 2019-2027

Figure 73: Middle East & Africa Bio Filter Market, Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Figure 74: Middle East & Africa Bio Filter Market, Value (US$ Mn) Forecast, by Country, 2017 – 2027

Figure 75: Middle East & Africa Bio Filter Market, Incremental Opportunity (US$ Mn), by Country, 2019-2027

Figure 76: South America Bio Filter Market, Volume (Thousand Units) Forecast, by Product, 2017 – 2027

Figure 77: South America Bio Filter Market, Value (US$ Mn) Forecast, by Product, 2017 – 2027

Figure 78: South America Bio Filter Market, Incremental Opportunity (US$ Mn), by Product, 2019-2027

Figure 79: South America Bio Filter Market, Volume (Thousand Units) Forecast, by Filter Media, 2017 – 2027

Figure 80: South America Bio Filter Market, Value (US$ Mn) Forecast, by Filter Media, 2017 – 2027

Figure 81: South America Bio Filter Market, Incremental Opportunity (US$ Mn), by Filter Media, 2019-2027

Figure 82: South America Bio Filter Market, Volume (Thousand Units) Forecast, by End use, 2017 – 2027

Figure 83: South America Bio Filter Market, Value (US$ Mn) Forecast, by End use, 2017 – 2027

Figure 84: South America Bio Filter Market, Incremental Opportunity (US$ Mn), by End use, 2019-2027

Figure 85: South America Bio Filter Market, Volume (Thousand Units) Forecast, by Distribution Channel, 2017 – 2027

Figure 86: South America Bio Filter Market, Value (US$ Mn) Forecast, by Distribution Channel, 2017 – 2027

Figure 87: South America Bio Filter Market, Incremental Opportunity (US$ Mn), by Distribution Channel, 2019-2027

Figure 88: South America Bio Filter Market, Volume (Thousand Units) Forecast, by Country, 2017 – 2027

Figure 89: South America Bio Filter Market, Value (US$ Mn) Forecast, by Country, 2017 – 2027

Figure 90: South America Bio Filter Market, Incremental Opportunity (US$ Mn), by Country, 2019-2027