Reports

Reports

Global Big Data in Oil and Gas Market: Snapshot

The data generated in the oil and gas industry in growing in terms of variety, volume, and velocity. Therefore, there is a need for new technologies to interpret and integrate such a large amount of data available in structure and unstructured manner. This data is generated on a regular basis from different sources such as geological data, seismic data, well logging data, and others, thus, growing the need for systematic system to analysis this data. Various information technology providers are working cautiously to come up with solution that may create new opportunities to capture the big data market. In addition, researching tools capable to process Big Data in the oil and gas industry are has also gained traction.

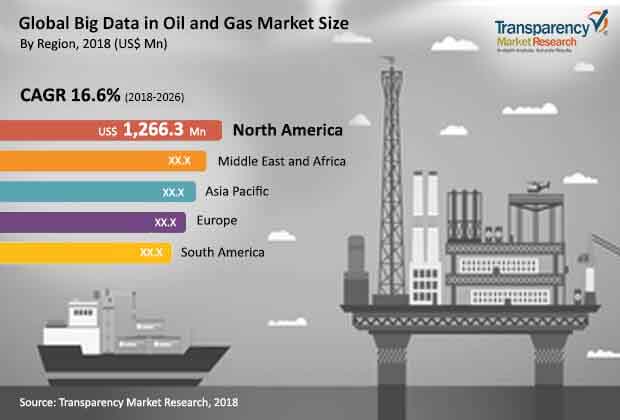

In a recent report published by Transparency Market Research (TMR), the global big data in oil and gas market is projected to rise at a healthy 16.6% CAGR throughout the forecast period between 2018 and 2026. The valuation of the global big data in oil and gas market is projected to reach US$10.93 bn by the end of 2026.

Increasing Spending On IT in Upstream Sector to Boost Demand for Big Data in Oil and Gas Industry

The global big data in oil and gas market is classified on the basis of component, data type, and application. Based on type of data, the market is segmented into structured, unstructured, and semi-structured data. Out of these, unstructured data segment is projected to dominate the market during the forecast period because of rising production of unstructured data from various sources such as well data, sensor data, geological data, environmental data, oceanographic data, and other data sources. Based on component the market is bifurcated into software and services segments. The big data software segment is further divided into data collection, data analytics, data management, and data discovery and visualization. The big data services includes system integration, consulting, operation and maintenance.

On the basis of application, the market is segmented into upstream, midstream, downstream, and administration. According to the report, upstream application segment is likely to hold 50% of the global market. The dominance of this segment is because of rising IT spending in the upstream sector of oil and gas industry.

Increasing Oil Production in North America to Assist Market Growth

Based on regional analysis, North America is leading the market by holding 39% share globally. The reason behind this growth is increasing oil production in the region that further boost the demand for big data analytics to gain operational efficiency. The U.S. leads the production of oil and gas and holds 15% in the total oil production at the global level. Thus, creating lucrative opportunities for adopting big data in oil and gas in the region.

On the other hand, Asia Pacific and the Middle East and Africa are projected to grow significantly over the forecast period. Growing adoption of advanced technology solutions in the oil and gas industry in Russia, Canada, China, the U.S., and across GCC countries is projected to offer lucrative opportunities for the big data in oil and gas market.

The report has also consists of the prominent players in the global big data in oil and gas market. To name some of the major players in the market are HortonWorks, Inc., Hitachi Vantara Corporation, IBM Corporation, Microsoft Corporation, MapR Technologies, Inc., and Oracle Corporation.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary : Global Big Data in Oil & Gas

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.3. Porter’s Five Forces Analysis - Global Big Data in Oil & Gas

4.4. Technology/Product Roadmap

4.5. Ecosystem Analysis - Global Big Data in Oil & Gas

4.6. Market Dynamics

4.6.1. Drivers

4.6.2. Restraints

4.6.3. Opportunities

4.6.4. Impact Analysis of Drivers & Restraints

4.7. Regulations and Policies – By Region

4.8. Big Data Spending Analysis (2017)

4.8.1. IT spending CAPEX analysis for Oil & Gas

4.8.2. IT Spending, by Type (US$ Mn)

4.8.2.1. Hardware

4.8.2.2. Software/Platform

4.8.2.3. Services

4.9. Impact of IoT on Big Data Analytics in Oil & Gas

4.10. Big Data Source Analysis (US$ Mn)

4.10.1. Environmental

4.10.2. Oceanographic

4.10.3. Geological Data

4.10.4. Economic

4.10.5. Others

4.11. Market Outlook

4.12. Competitive Scenario and Trends

4.12.1. List of New Entrants

4.12.2. Mergers & Acquisitions, Expansions

5. Global Big Data in Oil & Gas Analysis and Forecast, by Component

5.1. Overview

5.2. Big Data in Oil & Gas Size (US$ Mn) Forecast, By Component, 2016 - 2026

5.2.1. Software

5.2.1.1. Data Analytics

5.2.1.2. Data Collection

5.2.1.3. Data Discovery and Visualization

5.2.1.4. Data Management

5.2.2. Services

5.2.2.1. Consulting

5.2.2.2. System Integration

5.2.2.3. Operation and Maintenance

5.3. Market Attractiveness by Component

6. Global Big Data in Oil & Gas Analysis and Forecast, by Data Type

6.1. Overview & Definition

6.2. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Data Type, 2016 - 2026

6.2.1. Structured Data

6.2.2. Unstructured Data

6.2.3. Semi-Structured Data

6.3. Market Attractiveness by Data Type

7. Global Big Data in Oil & Gas Analysis and Forecast, by Application

7.1. Overview

7.2. Key Trends

7.3. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Application, 2016 - 2026

7.3.1. Upstream

7.3.1.1. Conventional

7.3.1.2. Unconventional

7.3.2. Midstream

7.3.3. Downstream

7.3.4. Administration

7.4. Market Attractiveness by Application

8. Global Big Data in Oil & Gas Analysis and Forecast, by Region

8.1. Key Findings

8.2. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Region, 2016 - 2026

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

8.3. Market Attractiveness by Region

9. North America Big Data in Oil & Gas Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Big Data in Oil & Gas Size (US$ Mn) Forecast, by Component, 2016 - 2026

9.3.1. Software

9.3.1.1. Data Analytics

9.3.1.2. Data Collection

9.3.1.3. Data Discovery and Visualization

9.3.1.4. Data Management

9.3.2. Services

9.3.2.1. Consulting

9.3.2.2. System Integration

9.3.2.3. Operation and Maintenance

9.4. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Data Type, 2016 - 2026

9.4.1. Structured Data

9.4.2. Unstructured Data

9.4.3. Semi-Structured Data

9.5. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Application, 2016 - 2026

9.5.1. Upstream

9.5.1.1. Conventional

9.5.1.2. Unconventional

9.5.2. Midstream

9.5.3. Downstream

9.5.4. Administration

9.6. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Country, 2016 - 2026

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. by Component

9.7.2. by Data Type

9.7.3. by Application

9.7.4. by Country

10. Europe Big Data in Oil & Gas Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Big Data in Oil & Gas Size (US$ Mn) Forecast, by Component, 2016 - 2026

10.3.1. Software

10.3.1.1. Data Analytics

10.3.1.2. Data Collection

10.3.1.3. Data Discovery and Visualization

10.3.1.4. Data Management

10.3.2. Services

10.3.2.1. Consulting

10.3.2.2. System Integration

10.3.2.3. Operation and Maintenance

10.4. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Data Type, 2016 - 2026

10.4.1. Structured Data

10.4.2. Unstructured Data

10.4.3. Semi-Structured Data

10.5. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Application, 2016 - 2026

10.5.1. Upstream

10.5.1.1. Conventional

10.5.1.2. Unconventional

10.5.2. Midstream

10.5.3. Downstream

10.5.4. Administration

10.6. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Country, 2016 - 2026

10.6.1. Germany

10.6.2. France

10.6.3. UK

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. by Component

10.7.2. by Data Type

10.7.3. by Application

10.7.4. by Country

11. Asia Pacific Big Data in Oil & Gas Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Big Data in Oil & Gas Size (US$) Forecast, by Component, 2016 - 2026

11.3.1. Software

11.3.1.1. Data Analytics

11.3.1.2. Data Collection

11.3.1.3. Data Discovery and Visualization

11.3.1.4. Data Management

11.3.2. Services

11.3.2.1. Consulting

11.3.2.2. System Integration

11.3.2.3. Operation and Maintenance

11.4. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Data Type, 2016 - 2026

11.4.1. Structured Data

11.4.2. Unstructured Data

11.4.3. Semi-Structured Data

11.5. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Application, 2016 - 2026

11.5.1. Upstream

11.5.1.1. Conventional

11.5.1.2. Unconventional

11.5.2. Midstream

11.5.3. Downstream

11.5.4. Administration

11.6. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Country, 2016 - 2026

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. Australia

11.6.5. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. by Component

11.7.2. by Data Type

11.7.3. by Application

11.7.4. by Country

12. Middle East & Africa (MEA) Big Data in Oil & Gas Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Big Data in Oil & Gas Size (US$) Forecast, by Component, 2016 - 2026

12.3.1. Software

12.3.1.1. Data Analytics

12.3.1.2. Data Collection

12.3.1.3. Data Discovery and Visualization

12.3.1.4. Data Management

12.3.2. Services

12.3.2.1. Consulting

12.3.2.2. System Integration

12.3.2.3. Operation and Maintenance

12.4. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Data Type, 2016 - 2026

12.4.1. Structured Data

12.4.2. Unstructured Data

12.4.3. Semi-Structured Data

12.5. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Application, 2016 - 2026

12.5.1. Upstream

12.5.1.1. Conventional

12.5.1.2. Unconventional

12.5.2. Midstream

12.5.3. Downstream

12.5.4. Administration

12.6. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Country, 2016 - 2026

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of MEA

12.7. Market Attractiveness Analysis

12.7.1. by Component

12.7.2. by Data Type

12.7.3. by Application

12.7.4. by Country

13. South America Big Data in Oil & Gas Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. Big Data in Oil & Gas Size (US$ Mn) Forecast, by Component, 2016 - 2026

13.3.1. Software

13.3.1.1. Data Analytics

13.3.1.2. Data Collection

13.3.1.3. Data Discovery and Visualization

13.3.1.4. Data Management

13.3.2. Services

13.3.2.1. Consulting

13.3.2.2. System Integration

13.3.2.3. Operation and Maintenance

13.4. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Data Type, 2016 - 2026

13.4.1. Structured Data

13.4.2. Unstructured Data

13.4.3. Semi-Structured Data

13.5. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Application, 2016 - 2026

13.5.1. Upstream

13.5.1.1. Conventional

13.5.1.2. Unconventional

13.5.2. Midstream

13.5.3. Downstream

13.5.4. Administration

13.6. Big Data in Oil & Gas Size (US$ Mn and Terabytes) Forecast, by Country, 2016 - 2026

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. by Component

13.7.2. by Data Type

13.7.3. by Application

13.7.4. by Industry

13.7.5. by Country

14. Competition Landscape

14.1. Market Player – Competition Matrix

14.2. Market Revenue Share Analysis (%), by Company (2017)

15. Company Profiles(Details – Basic Overview, , Key Competitors, Revenue, Strategy, Recent Developments)

15.1. Accenture\

15.1.1. Overview

15.1.2. SWOT

15.1.3. Financial Overview

15.1.4. Strategy

15.2. Datameer

15.2.1. Overview

15.2.2. SWOT

15.2.3. Financial Overview

15.2.4. Strategy

15.3. Datawatch

15.3.1. Overview

15.3.2. SWOT

15.3.3. Financial Overview

15.3.4. Strategy

15.4. Drillinginfo Inc.

15.4.1. Overview

15.4.2. SWOT

15.4.3. Financial Overview

15.4.4. Strategy

15.5. General Electric

15.5.1. Overview

15.5.2. SWOT

15.5.3. Financial Overview

15.5.4. Strategy

15.6. Hitachi Vantara Corporation

15.6.1. Overview

15.6.2. SWOT

15.6.3. Financial Overview

15.6.4. Strategy

15.7. Hortonworks Inc.

15.7.1. Overview

15.7.2. SWOT

15.7.3. Financial Overview

15.7.4. Strategy

15.8. International Business Machines Corporation

15.8.1. Overview

15.8.2. SWOT

15.8.3. Financial Overview

15.8.4. Strategy

15.9. MapR Technologies, Inc.

15.9.1. Overview

15.9.2. SWOT

15.9.3. Financial Overview

15.9.4. Strategy

15.10. Microsoft Corporation

15.10.1. Overview

15.10.2. SWOT

15.10.3. Financial Overview

15.10.4. Strategy

15.11. Northwest Analytics Inc.

15.11.1. Overview

15.11.2. SWOT

15.11.3. Financial Overview

15.11.4. Strategy

15.12. Oracle Corporation

15.12.1. Overview

15.12.2. SWOT

15.12.3. Financial Overview

15.12.4. Strategy

15.13. OSIsoft

15.13.1. Overview

15.13.2. SWOT

15.13.3. Financial Overview

15.13.4. Strategy

15.14. Palantir Economic Solutions Ltd

15.14.1. Overview

15.14.2. SWOT

15.14.3. Financial Overview

15.14.4. Strategy

15.15. SAP SE

15.15.1. Overview

15.15.2. SWOT

15.15.3. Financial Overview

15.15.4. Strategy

15.16. SAS Institute Inc.

15.16.1. Overview

15.16.2. SWOT

15.16.3. Financial Overview

15.16.4. Strategy

15.17. Capgemini SE

15.17.1. Overview

15.17.2. SWOT

15.17.3. Financial Overview

15.17.4. Strategy

15.18. Cloudera, Inc.

15.18.1. Overview

15.18.2. SWOT

15.18.3. Financial Overview

15.18.4. Strategy

16. Key Takeaways

List of Tables

Table 1: Big Data in Oil and Gas Market, By Data Source (US$ Mn)

Table 2: Global Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table 3: Global Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Software, 2016 - 2026

Table 4: Global Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table 5: Global Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Data Type, 2016 - 2026

Table 6: Global Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Application, 2016 - 2026

Table 7: Global Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Region, 2016 - 2026

Table 8: North America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table 9: North America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Software, 2016 - 2026

Table 10: North America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table 11: North America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Data Type, 2016 - 2026

Table 12: North America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Application, 2016 - 2026

Table 13: North America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

Table 14: Europe Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table 15: Europe Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Software, 2016 - 2026

Table 16: Europe Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table 17: Europe Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Data Type, 2016 - 2026

Table 18: Europe Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Application, 2016 - 2026

Table 19: Europe Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

Table 20: Asia Pacific Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table 21: Asia Pacific Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Software, 2016 - 2026

Table 22: Asia Pacific Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table 23: Asia Pacific Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Data Type, 2016 - 2026

Table 24: Asia Pacific Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Application, 2016 - 2026

Table 25: Asia Pacific Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

Table 26: Middle East and Africa Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table 27: Middle East and Africa Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Software, 2016 - 2026

Table 28: Middle East and Africa Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table 29: Middle East and Africa Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Data Type, 2016 - 2026

Table 31: Middle East & Africa Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

Table 32: South America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Component, 2016 - 2026

Table 33: South America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Software, 2016 - 2026

Table 34: South America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Services, 2016 - 2026

Table 35: South America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Data Type, 2016 - 2026

Table 36: South America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Application, 2016 - 2026

Table 37: South America Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Country, 2016 - 2026

List of Figures

Figure 1: Research Methodology

Figure 2: Big Data in Oil and Gas Market

Figure 3: Global Oil and Gas CAPEX (US$ Bn), 2015 – 2027

Figure 4: Global Oil and Gas IT Spending CAPEX (US$ Bn), 2015 – 2027

Figure 5: Global Oil and Gas IT Spending CAPEX, By Type (US$ Bn)

Figure 6: Global Oil and Gas IT Spending CAPEX, By Type (% Share)

Figure 7: Global Big Data in Oil and Gas Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 8: Global Big Data in Oil and Gas Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 9: Global Big Data in Oil and Gas Market Share Analysis, By Component (2018)

Figure 10: Global Big Data in Oil and Gas Market Share Analysis, By Component (2026)

Figure 11: Global Big Data in Oil and Gas Market Share Analysis, By Software (2018)

Figure 12: Global Big Data in Oil and Gas Market Share Analysis, By Software (2026)

Figure 13: Global Big Data in Oil and Gas Market Share Analysis, By Services (2018)

Figure 14: Global Big Data in Oil and Gas Market Share Analysis, By Services (2026)

Figure 15: Global Big Data in Oil and Gas Market Attractiveness Analysis, By Component, 2016 - 2026

Figure 16: Global Big Data in Oil and Gas Market Attractiveness Analysis, By Software, 2016 - 2026

Figure 17: Global Big Data in Oil and Gas Market Attractiveness Analysis, By Services, 2016 - 2026

Figure 18: Global Big Data in Oil and Gas Market Share Analysis, By Data Type (2018)

Figure 19: Global Big Data in Oil and Gas Market Share Analysis, By Data Type (2026)

Figure 20: Global Big Data in Oil and Gas Market Attractiveness Analysis, By Data Type, 2016 - 2026

Figure 21: Global Big Data in Oil and Gas Market Share Analysis, By Application (2018)

Figure 22: Global Big Data in Oil and Gas Market Share Analysis, By Application (2026)

Figure 23: Global Big Data in Oil and Gas Market Attractiveness Analysis, By Application, 2016 - 2026

Figure 24: Global Big Data in Oil and Gas Market Share Analysis, By Region (2018)

Figure 25: Global Big Data in Oil and Gas Market Share Analysis, By Region (2026)

Figure 26: Global Big Data in Oil and Gas Market Attractiveness Analysis, by Region

Figure 27: North America Big Data in Oil and Gas Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 28: North America Big Data in Oil and Gas Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 29: North America Big Data in Oil and Gas Market Share Analysis, By Component (2018)

Figure 30: North America Big Data in Oil and Gas Market Share Analysis, By Component (2026)

Figure 31:North America Big Data in Oil and Gas Market Share Analysis, By Software (2018)

Figure 32: North America Big Data in Oil and Gas Market Share Analysis, By Software (2026)

Figure 33: North America Big Data in Oil and Gas Market Share Analysis, By Services (2018)

Figure 34: North America Big Data in Oil and Gas Market Share Analysis, By Services (2026)

Figure 35: North America Big Data in Oil and Gas Market Share Analysis, By Data Type (2018)

Figure 36: North America Big Data in Oil and Gas Market Share Analysis, By Data Type (2026)

Figure 37: North America Big Data in Oil and Gas Market Share Analysis, By Application (2018)

Figure 38: North America Big Data in Oil and Gas Market Share Analysis, By Application (2026)

Figure 39: North America Big Data in Oil and Gas Market Share Analysis, By Country (2018)

Figure 40: North America Big Data in Oil and Gas Market Share Analysis, By Country (2026)

Figure 41: North America Big Data in Oil and Gas Market Attractiveness Forecast, By Component, 2016 - 2026

Figure 42: North America Big Data in Oil and Gas Market Attractiveness, By Software, 2016 - 2026

Figure 43: North America Big Data in Oil and Gas Market Attractiveness, By Services, 2016 - 2026

Figure 44: North America Big Data in Oil and Gas Market Attractiveness, By Data Type, 2016 - 2026

Figure 45: North America Big Data in Oil and Gas Market Attractiveness, By Application, 2016 - 2026

Figure 46: Europe Big Data in Oil and Gas Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 47: Europe Big Data in Oil and Gas Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 48: Europe Big Data in Oil and Gas Market Share Analysis, By Component (2018)

Figure 49: Europe Big Data in Oil and Gas Market Share Analysis, By Component (2026)

Figure 50: Europe Big Data in Oil and Gas Market Share Analysis, By Software (2018)

Figure 51: Europe Big Data in Oil and Gas Market Share Analysis, By Software (2026)

Figure 52: Europe Big Data in Oil and Gas Market Share Analysis, By Services (2018)

Figure 53: Europe Big Data in Oil and Gas Market Share Analysis, By Services (2026)

Figure 54: Europe Big Data in Oil and Gas Market Share Analysis, By Data Type (2018)

Figure 55: Europe Big Data in Oil and Gas Market Share Analysis, By Data Type (2026)

Figure 56: Europe Big Data in Oil and Gas Market Share Analysis, By Application (2018)

Figure 57: Europe Big Data in Oil and Gas Market Share Analysis, By Application (2026)

Figure 58: Europe Big Data in Oil and Gas Market Share Analysis, By Country (2018)

Figure 59: Europe Big Data in Oil and Gas Market Share Analysis, By Country (2026)

Figure 60: Europe Big Data in Oil and Gas Market Attractiveness Forecast, By Component, 2016 - 2026

Figure 61: Europe Big Data in Oil and Gas Market Attractiveness, By Software, 2016 - 2026

Figure 62: Europe Big Data in Oil and Gas Market Attractiveness, By Services, 2016 - 2026

Figure 63: Europe Big Data in Oil and Gas Market Attractiveness, By Data Type, 2016 - 2026

Figure 64: Europe Big Data in Oil and Gas Market Attractiveness, By Application, 2016 - 2026

Figure 65: Asia Pacific Big Data in Oil and Gas Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 66: Asia Pacific Big Data in Oil and Gas Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 67: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Component (2018)

Figure 68: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Component (2026)

Figure 69: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Software (2018)

Figure 70: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Software (2026)

Figure 71: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Services (2018)

Figure 72: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Services (2026)

Figure 73: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Data Type (2018)

Figure 74: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Data Type (2026)

Figure 75: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Application (2018)

Figure 76: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Application (2026)

Figure 77: Asia Pacific Big Data in Oil and Gas Market Share Analysis, By Country (2018)

Figure 78: Asia Pacific Talent Big Data in Oil and Gas Market Share Analysis, By Country (2026)

Figure 79: APAC Big Data in Oil and Gas Market Attractiveness Forecast, By Component, 2016 - 2026

Figure 80: APAC Big Data in Oil and Gas Market Attractiveness, By Software, 2016 - 2026

Figure 81: APAC Big Data in Oil and Gas Market Attractiveness, By Services, 2016 - 2026

Figure 82: APAC Big Data in Oil and Gas Market Attractiveness, By Data Type, 2016 - 2026

Figure 83: APAC Big Data in Oil and Gas Market Attractiveness, By Application, 2016 - 2026

Figure 84: Middle East & Africa Big Data in Oil and Gas Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 85: Middle East & Africa Big Data in Oil and Gas Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 86: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Component (2018)

Figure 87: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Component (2026)

Figure 88: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Software (2018)

Figure 89: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Software (2026)

Figure 90: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Services (2018)

Figure 91: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Services (2026)

Figure 92: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Data Type (2018)

Figure 93: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Data Type (2026)

Figure 30: Middle East and Africa Big Data in Oil and Gas Market Revenue (US$ Mn) Forecast, By Application, 2016 - 2026

Figure 94: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Application (2018)

Figure 95: Middle East and Africa Big Data in Oil and Gas Market Share Analysis, By Application (2026)

Figure 96: Middle East & Africa Big Data in Oil and Gas Market Share Analysis, By Country (2018)

Figure 97: Middle East & Africa Big Data in Oil and Gas Market Share Analysis, By Country (2026)

Figure 98: Middle East & Africa Big Data in Oil and Gas Market Attractiveness Forecast, By Component, 2016 - 2026

Figure 99: Middle East & Africa Big Data in Oil and Gas Market Attractiveness, By Software, 2016 - 2026

Figure 100: Middle East & Africa Big Data in Oil and Gas Market Attractiveness, By Services, 2016 - 2026

Figure 101: Middle East & Africa Big Data in Oil and Gas Market Attractiveness, By Data Type, 2016 - 2026

Figure 102: Middle East & Africa Big Data in Oil and Gas Market Attractiveness, By Application, 2016 - 2026

Figure 103: South America Big Data in Oil and Gas Market Revenue (US$ Mn) and Y-o-Y Forecast, 2018– 2026

Figure 104: South America Big Data in Oil and Gas Opportunity Growth Analysis (US$ Mn) Forecast, 2016 – 2026

Figure 105: South America Big Data in Oil and Gas Market Share Analysis, By Component (2018)

Figure 106: South America Big Data in Oil and Gas Market Share Analysis, By Component (2026)

Figure 107: South America Big Data in Oil and Gas Market Share Analysis, By Software (2018)

Figure 108: South America Big Data in Oil and Gas Market Share Analysis, By Software (2026)

Figure 109: South America Big Data in Oil and Gas Market Share Analysis, By Services (2018)

Figure 110: South America Big Data in Oil and Gas Market Share Analysis, By Services (2026)

Figure 111: South America Big Data in Oil and Gas Market Share Analysis, By Data Type (2018)

Figure 112: South America Big Data in Oil and Gas Market Share Analysis, By Data Type (2026)

Figure 113: South America Big Data in Oil and Gas Market Share Analysis, By Application (2018)

Figure 114: South America Big Data in Oil and Gas Market Share Analysis, By Application (2026)

Figure 115: South America Big Data in Oil and Gas Market Share Analysis, By Country (2018)

Figure 116: South America Big Data in Oil and Gas Market Share Analysis, By Country (2026)

Figure 117: South America Big Data in Oil and Gas Market Attractiveness Forecast, By Component, 2016 - 2026

Figure 118: South America Big Data in Oil and Gas Market Attractiveness, By Software, 2016 - 2026

Figure 119: South America Big Data in Oil and Gas Market Attractiveness, By Services, 2016 - 2026

Figure 120: South America Big Data in Oil and Gas Market Attractiveness, By Data Type, 2016 - 2026

Figure 121: South America Big Data in Oil and Gas Market Attractiveness, By Application, 2016 - 2026