Reports

Reports

The leading drivers of the global benzaldehyde derivatives market currently include the rising demand for products from the industries of food and beverages, chemicals, agrochemicals, solvents and pharmaceuticals. A rise in the demand for benzaldehyde derivatives in emerging economies from Asia Pacific and the Middle East and Africa is anticipated to further propel the global benzaldehyde derivatives market and is also considered to be a strong opportunity for the globally prominent players. A high demand for solvents from the producers of resins, oils, cellulose acetates, cellulose ethers, and nitrates also presents a key area of opportunities for manufacturers from the global benzaldehyde derivatives market. However, the overall growth rate of this market may receive strong resistance from factors such as growing health concerns of long term exposure to several benzaldehyde derivatives and the growing threat of easily available substitutes in different end-user industries, including propionic and sorbic acids. The global benzaldehyde derivatives market is also being restrained by an overall volatility in crude oil prices and strict regulatory framework surrounding the oil and gas sector.

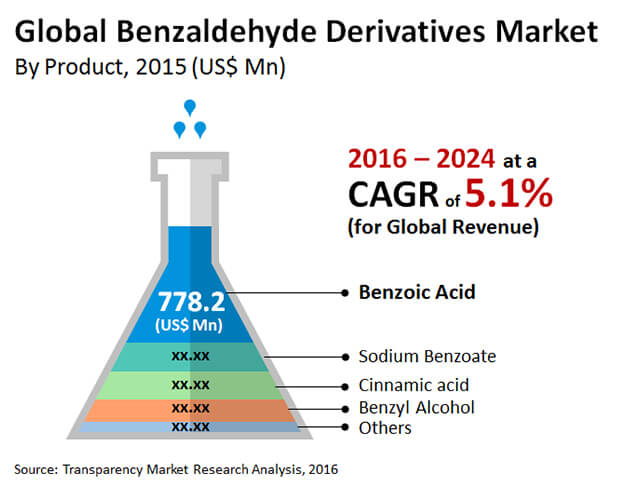

The global benzaldehyde derivative market was valued at US$1.37 bn in 2015 and is expected to reach US$2.14 bn by the end of 2024, after expanding at a CAGR of 5.1 % from 2016 to 2024.

Benzoic acid accounted for the top share in the global benzaldehyde derivatives market in terms of volume as well as revenue generated in 2015, owing to its high rate of use in aromatic products, the food and beverages industry, and the pharmaceutical industry. By volume, benzoic acid was valued at US$778.2 mn within the global benzaldehyde derivatives market in 2015. The share held by benzoic acid in the global benzaldehyde derivatives market is expected to increase over the coming years due to a strong growth in demand from the food and chemicals industries. The growing demand for benzaldehyde derivatives in pharmaceutical and agrochemical industries are also expected to augment their global market over the coming years.

Cinnamic acid also finds large volumes of demand as it is employed in flavors, synthetic indigo dyes and in the manufacture of specific drugs. It is also used in artificial sweeteners within the food industry. Benzoic acid is a commonly used as a food preservative and can inhibit the development of bacteria, molds, and yeasts. Sodium benzoate is another benzaldehyde derivative and finds use in the food industry as well as the pharmaceutical industry. It even has applications in the prevention of surface corrosion.

Asia Pacific held the leading share in the global benzaldehyde derivatives market in terms of volume in 2015. Its nearly 60 % share in the global benzaldehyde derivatives market was attributed to a large consumption base, growth of various end user, and a relatively relaxed regulatory framework that led to a faster rate of development and use in the region’s food and chemical markets. Asia Pacific is expected to also be a highly attractive region till 2024, followed by Europe and North America. China accounted for the leading share in terms of volume within Asia Pacific, followed by Japan and other ASEAN countries. The growth rate of benzaldehyde derivatives in Europe and North America is very slow currently, owing to the maturation of the market and a low rate of product innovations.

Till 2015, the leading players in the global benzaldehyde derivatives market included Emerald Performance Materials, Haihang Industry Co., Ltd, Merck KGaA, Guangzhou Shiny Co., Elan Chemical, Ltd, Kadillac Chemicals Pvt Ltd, Gujarat Alkalis and Chemicals Limited, Wuhan Dico Chemical Co., Ltd , Shimmer Chemicals Pvt. Ltd, Yingcheng Wuhan Organic Material Co., Ltd.

Benzaldehyde Derivatives Market See Massive Potential in Medications and Cosmetics

Aldehyde-derived compounds are well-known for their antimicrobial efficacy, including 4-phenacyloxy benzaldehyde derivatives. Industry players in the benzaldehyde derivatives market are exploring their use in various high-end disinfection applications in different healthcare settings. The growing uptake of antimicrobial agents in these settings is a key driver for sales of various benzaldehyde derivatives. More recently, benzaldehyde derivatives are being studied extensively for pharmaceutical behavior notably as tyrosinase inhibitors. In the past decade, this is opening numerous application areas in the benzaldehyde derivatives market. Some benzalaldehydes have shown potential in making products for the cosmetics, food, and pharmaceutical industries. Since tyrosinase inhibitors show effect as decreasing the excessive accumulation of pigmentation, they are used in various dermatological formulations. Researchers are relying on better theoretical modelling to explore new properties as pharmaceuticals, thereby boosting the benzaldehyde derivatives market. Growing research on studying the pharmaceutical properties of tyrosinase will expand the application potential in all likelihood, as growing body of research has shown in the last 10 – 15 years. Growing application of new technologies for the characterization of aldehyde-based biocides is also favouring the generation of new possibilities for players in the benzaldehyde derivatives market.

The COVID-19 pandemic and the subsequent outbreaks in 2020 and 2021 have caused some of the worst disruptions in the chemical manufacturing. Though there was a brief recovery of economic activities in the last quarter of 2020 and first quarter of 2021, the emergence of new variants has again brought uncertainties in consumer demand and lack of optimism among investors. Thus, the benzaldehyde derivatives market has seen a staggered growth of new manufacturing units. Several companies were also leaning on migrating to new strategic and operational frameworks to reduce the macroeconomic shocks that the pandemic and its outbreaks has caused over the past few months. Even in 2021, the emerging variants of the novel coronavirus continue to alarm governments and businesses. The impacts of all these on dynamics of benzaldehyde derivatives market are yet to unfold in the coming months.

Chapter 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Objectives

Chapter 2 Assumptions and Research Methodology

2.1 Assumptions and Acronyms Used

2.2 Research Methodology

Chapter 3 Executive Summary

3.1 Market Size, Indicative (US$ Mn)

3.2 Top 3 Trends

3.3 Top 2 Drivers

3.4 Top Market Restarint

3.5 Total Market Value in US$ Mn

Chapter 4 Market Overview

4.1 Product Overview

4.2 Drivers and Restraints Analysis

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Value Chain Analysis

4.4 Porter's Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Threat of Substitutes

4.4.3 Threat of New Entrants

4.4.4 Bargaining Power of Suppliers

4.4.5 Degree of Competition

Chapter 5 Global Benzaldehyde Derivatives Market: Price Trend Analysis (US$/Tons)

5.1 Market price, by product

Chapter 6 Global Benzaldehyde Derivatives Market by Product

6.1 Product Overview

6.2 Global Benzaldehyde Derivatives Market Value Share Analysis By Product

6.3 Global Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

6.4 Global Benzaldehyde Derivatives Market Attractiveness Analysis by Product

6.5 Global Benzaldehyde Derivatives Market Value Share Analysis By Region,

6.6 Global Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Region

6.7 Global Benzaldehyde Derivatives Market Attractiveness Analysis, by Region

Chapter 7 North America Benzaldehyde Derivatives Market

7.1 North America Benzaldehyde Derivatives Market Value Share Analysis By Product

7.2 North America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

7.3 North America Benzaldehyde Derivatives Market Value Share Analysis, By Country

7.4 North America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by country

7.5 US Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

7.6 Rest of North America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

Chapter 8 Europe Benzaldehyde Derivatives Market

8.1 Europe Benzaldehyde Derivatives Market Value Share Analysis By Product

8.2 Europe Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

8.3 Europe Benzaldehyde Derivatives Market Value Share Analysis By Country

8.4 Europe Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country

8.5 UK Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

8.6 Germany Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

8.7 France Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

8.8 Spain Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

8.9 Italy Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

8.10 Rest of Europe Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

Chapter 9 Asia-Pacific Benzaldehyde Derivatives Market

9.1 Asia-Pacific Benzaldehyde Derivatives Market Value Share Analysis By Product

9.2 Asia-Pacific Benzaldehyde Derivatives Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

9.3 Asia-Pacific Benzaldehyde Derivatives Market Value Share Analysis By Product

9.4 Asia-Pacific Benzaldehyde Derivatives Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country

9.5 China Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

9.6 Japan Benzaldehyde Derivatives Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

9.7 ASEAN Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

9.8 Rest of Asia Pacific Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

Chapter 10 Middle East and Africa Benzaldehyde Derivatives Market

10.1 Middle East and Africa Benzaldehyde Derivatives Market Value Share Analysis By Product

10.2 Middle East and Africa Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

10.3 Middle East and Africa Benzaldehyde Derivatives Market Value Share Analysis By Country

10.4 Middle East and Africa Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by country

10.5 GCC Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

10.6 SA Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

10.7 SA Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

Chapter 11 Latin America Benzaldehyde Derivatives Market

11.1 Latin America Benzaldehyde Derivatives Market Value Share Analysis, By Product

11.2 Latin America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

11.3 Latin America Benzaldehyde Derivatives Market Value Share Analysis, By Country

11.4 Latin America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by country

11.5 Brazil Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

11.6 Rest of Latin America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by product

Chapter 12 Competition Landscape

12.1 Global Benzaldehyde Derivatives Market Share Analysis By Company

12.2 Competition Matrix

12.3 Company Profiles

12.3.1 Emerald Performance Materials

12.3.1.1 Company Details

12.3.1.2 Company Description

12.3.1.3 Business Overview

12.3.1.4 SWOT Analysis

12.3.1.5 Breakdown of Net sales, by region

12.3.1.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.2 Merck KGaA

12.3.2.1 Company Details

12.3.2.2 Company Description

12.3.2.3 Business Overview

12.3.2.4 SWOT Analysis

12.3.2.5 Breakdown of Net sales, by region

12.3.2.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.3 Haihang Industry Co., Ltd

12.3.3.1 Company Details

12.3.3.2 Company Description

12.3.3.3 Business Overview

12.3.3.4 SWOT Analysis

12.3.3.5 Breakdown of Net sales, by region

12.3.3.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.4 Elan Chemical

12.3.4.1 Company Details

12.3.4.2 Company Description

12.3.4.3 Business Overview

12.3.4.4 SWOT Analysis

12.3.4.5 Breakdown of Net sales, by region

12.3.4.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.5 Guangzhou Shiny Co., Ltd

12.3.5.1 Company Details

12.3.5.2 Company Description

12.3.5.3 Business Overview

12.3.5.4 SWOT Analysis

12.3.5.5 Breakdown of Net sales, by region

12.3.5.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.6 Gujarat Alkalies and Chemicals Limited

12.3.6.1 Company Details

12.3.6.2 Company Description

12.3.6.3 Business Overview

12.3.6.4 SWOT Analysis

12.3.6.5 Breakdown of Netsales of production, by product

12.3.6.6 Revenue (US$ Bn) and Y-o-Y Growth (%), 2012–2015

12.3.7 Kadillac Chemicals Pvt Ltd

12.3.7.1 Company Details

12.3.7.2 Company Description

12.3.7.3 Business Overview

12.3.7.4 SWOT Analysis

12.3.7.5 Breakdown of Net sales, by region

12.3.7.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.8 Shimmer Chemicals

12.3.8.1 Company Details

12.3.8.2 Company Description

12.3.8.3 Business Overview

12.3.8.4 SWOT Analysis

12.3.8.5 Breakdown of Net sales, by region

12.3.8.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.9 Wuhan Dico

12.3.9.1 Company Details

12.3.9.2 Company Description

12.3.9.3 Business Overview

12.3.9.4 SWOT Analysis

12.3.9.5 Breakdown of Net sales, by region

12.3.9.6 Revenue (US$ Bn) and Y-o-Y Growth (%), 2012-2015

12.3.10 Yingcheng Wuhan Organic Material Co., Ltd

12.3.10.1 Company Details

12.3.10.2 Company Description

12.3.10.3 Business Overview

12.3.10.4 SWOT Analysis

12.3.10.5 Breakdown of Net sales, by region

12.3.10.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

Chapter 13 Key Takeaways

13.1 Primary Research-Key Findings

List of Tables

Table 01 Global Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 02 Global Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Region, 2015–2024

Table 03 North America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 04 North America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by country, 2015–2024

Table 05 US Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 06 Rest of North America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 07 Europe Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 08 Europe Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 09 UK Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 10 Germany Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 11 France Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 12 Spain Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 13 Italy Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 14 Rest of Europe Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 15 Asia-Pacific Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 16 Asia-Pacific Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 17 China Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 18 Japan Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 19 ASEAN Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 20 Rest of Asia Pacific Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 21 Middle East and Africa Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 22 Middle East and Africa Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by country, 2015–2024

Table 23 GCC Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 24 SA Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 25 SA Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 26 Latin America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 27 Latin America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by country, 2015–2024

Table 28 Brazil Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 29 Rest of Latin America Benzaldehyde Derivatives Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

List of Figures

Figure 01 Prices of benzaldehyde derivatives, by Product, US$/Ton, 2016–2024

Figure 02 Global Benzaldehyde Derivatives Market Value Share Analysis By Product, 2015 and 2024

Figure 03 Global Benzaldehyde Derivatives Market Attractiveness Analysis , by Product

Figure 04 Global Benzaldehyde Derivatives Market Value Share Analysis By Region, 2015 and 2024

Figure 05 Global Benzaldehyde Derivatives Market Attractiveness Analysis , by Region

Figure 06 North America Benzaldehyde Derivatives Market Value Share Analysis By Product, 2015 and 2024

Figure 07 North America Benzaldehyde Derivatives Market Value Share Analysis By Country, 2015 and 2024

Figure 08 Europe Benzaldehyde Derivatives Market Value Share Analysis By Product , 2015 and 2024

Figure 09 Europe Benzaldehyde Derivatives Market Value Share Analysis By Country , 2015 and 2024

Figure 10 Asia-Pacific Benzaldehyde Derivatives Market Value Share Analysis By Product, 2015 and 2024

Figure 11 Asia-Pacific Benzaldehyde Derivatives Market Value Share Analysis By Product, 2015 and 2024

Figure 12 Middle East and Africa Benzaldehyde Derivatives Market Value Share Analysis By Product, 2015 and 2024

Figure 13 Middle East and Africa Benzaldehyde Derivatives Market Value Share Analysis By Country, 2015 and 2024

Figure 14 Latin America Benzaldehyde Derivatives Market Value Share Analysis, By Product, 2015 and 2024

Figure 15 Latin America Benzaldehyde Derivatives Market Value Share Analysis, By Country , 2015 and 2024

Figure 16 Global Benzaldehyde Derivatives Market Share Analysis By Company (2015)