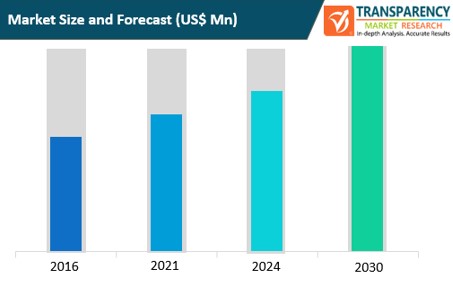

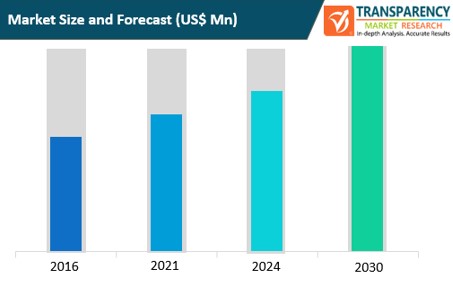

Banking Encryption Software Market: Introduction

- Banking encryption software is a data security platform that enables banks and financial institutions to securely exchange transaction document details with their customers while also protecting their data from cyber-attacks. Banking encryption software services provide a number of advantages, including easy data transaction and high security. Furthermore, banks benefit from encryption software in a variety of ways, including real-time notifications on fraudulent actions, improved database efficiency, and increased security of user financial information. Banking encryption software encrypts and decrypts confidential information for bank customers as required, and as a result, most fintech organizations and banks are using this software across their premises. Furthermore, to protect client information such as customer emails, banker notes, call center transcripts, and survey responses, the financial & banking industry employs encryption technology, which aids in the improvement of business operations.

- The COVID-19 pandemic has positively impacted the banking encryption software market. Since the outbreak of the pandemic, businesses have been increasing their investment in encryption software due to a variety of factors, including increased use of digital financial services and adoption of online payment services. Furthermore, banking encryption software is likely to have a lucrative growth rate during the forecast period due to numerous norms imposed as a result of the pandemic, such as social distancing, digital transformation of the payment industry, and work from home. This, in turn, is anticipated to create significant opportunities for the banking encryption software market during the forecast period.

Global Banking Encryption Software Market: Dynamics

Global Banking Encryption Software Market: Key Drivers

- Increasing use of digital payment technologies such as credit cards, debit cards, and mobile banking by customers is propelling the banking encryption software market. Banking encryption software offers several advantages, including a reduction in fraudulent activities in various banking processes, increased payment security, and enhanced payment transaction services due to the integration of encryption software in electronic payment methods. Financial institutions and banks have been in charge of a large amount of their customers’ personal and financial data. As a result, fintech companies and banks are implementing banking encryption software to improve the security of various critical documents and to protect large volumes of customer financial records. Furthermore, many businesses are implementing this software to generate more insights and better data management, which is expected to boost the banking encryption software market.

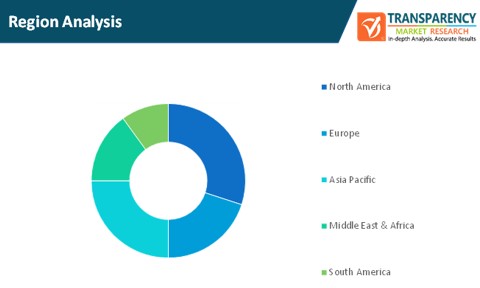

North America to Account for Major Share of Global Banking Encryption Software Market

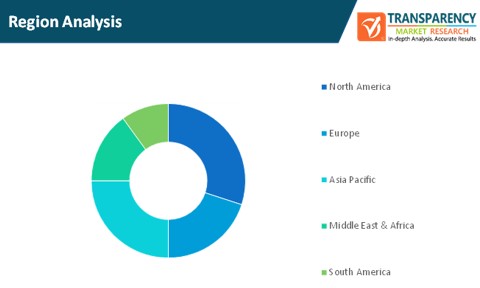

- In terms of region, the global banking encryption software market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- North America dominated the global banking encryption software market and is expected to maintain the leading position over the forecast period. This growth is attributed to an increase in government backing for data security technologies and an increase in demand for encryption software by public and private banks to safeguard and secure data privacy. In addition, one of the primary factors driving demand for banking encryption software in the region is the increasing number of cyber-attacks and risks to information affecting businesses.

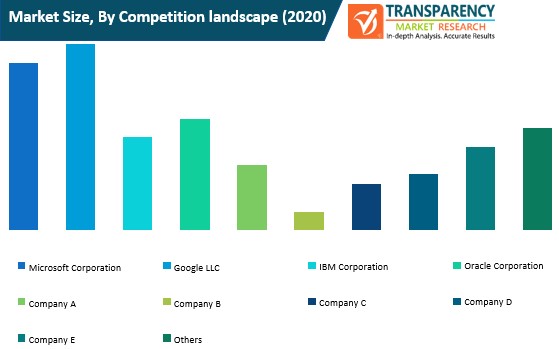

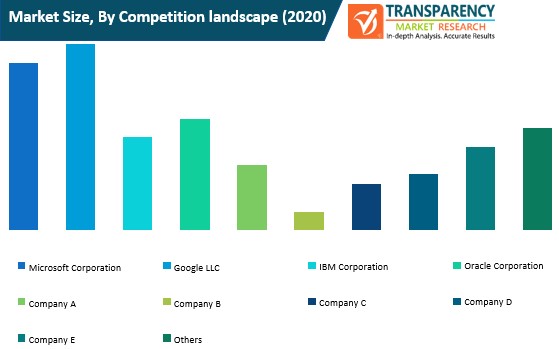

Global Banking Encryption Software Market: Competitive Landscape

Key Players Operating in the Global Banking Encryption Software Market

Providers of banking encryption software are implementing development strategies to enhance their presence and consolidate their share in the market. Banking encryption software providers have adopted major growth strategies such as product acquisitions, partnerships and launches, and forming regional and global distribution networks in order to expand their presence in the market.

Key players operating in the global banking encryption software market include:

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- McAfee, LLC

- Sophos Group Plc

- Thales Group

- Trend Micro Inc.

- WinMagic, Inc.

- Broadcom, Inc.

- Eset, Spol, S.r.o

Global Banking Encryption Software Market: Research Scope

Global Banking Encryption Software Market, by Component

Global Banking Encryption Software Market, by Deployment

Global Banking Encryption Software Market, by Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

Global Banking Encryption Software Market, by Function

- Disk Encryption

- Communication Encryption

- File/Folder Encryption

- Cloud Encryption

- Others

Global Banking Encryption Software Market, by Region

- North America

- Europe

- Germany

- France

- Spain

- Italy

- U.K.

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America