Reports

Reports

An automotive VVT system helps prolong engine life, as it adeptly improves performance, fuel economy, or emissions. Automotive VVT systems enhance combustion, enrich engine process, improve engine power, reduce fuel consumption, and reduce emissions. They help improve the emission regulator system and minimize ignition glitches in the spark plug, which are likely to lead to serious drivability issues. The VVT system also allows the usage of a smaller engine to achieve the same performance. These factors are expected to drive the demand for automotive VVT systems considerably during the forecast period. The components used in an automotive VVT system include timing solenoid, timing belt, timing idler/pulley, ECU, CAM, and actuators.

Emission from automobiles accounts for 28% of the overall greenhouse gases produced including carbon dioxide and methane, which hamper the environment. This hampered environment affects the health of human beings by propagating respiratory disorders. Regulatory bodies are enacting stringent norms on carbon emissions of automotive to reduce curb such situations and carbon emission. The VVT system helps change the valve timing according to the IC engine cycle. This lead to lowered carbon emission. This, in turn, is anticipated to boost the automotive VVT system market. Engine life is likely to improve due to a VVT system, as it helps maintain the proper cycle of the engine. Expansion of the global automotive VVT system market can be attributable toward the rapid expansion of the automotive industry, rise sales of passenger and commercial vehicles as well as increase in purchasing power of consumers.

Rise in the emission of polluted gases, such as methane, increases the carbon footprint from the transportation sector, which has led to the development of battery electric vehicles. This in turn is estimated to restrain the IC engine vehicles market during forecast period. The function of the VVT system is directly related to the IC engine of the vehicle and any impact on the IC engine is likely to hamper the automotive VVT system market. The automotive VVT system market in some regions is expanding at a moderate pace, owing to minimal usage of VVT system in battery electrical vehicles. This, in turn is expected to hamper the demand for VVT systems.

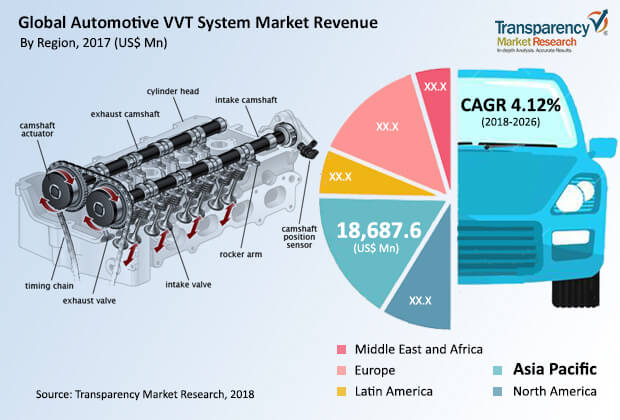

However, maintenance of components of the VVT system, as it is incorporated in the heat affected zone, and introduction of battery electric vehicles in certain regions are restraining factors that are anticipated to hamper the automotive VVT system market during the forecast period. The global automotive VVT system market is anticipated to expand at a CAGR of more than 4% between 2018 and 2026.

Double Over Head Cam (DOHC) valve train design for the VVT system enables a wider angle between intake valve and exhaust valve as compared to the Single Over Head Cam (SOHC), and Over Head Valve (OHV). Consequently, the DOHC VVT system holds a larger share as compared to other valve train designs. This provides a limited airflow at higher engine speeds. The gasoline fuel segment is anticipated to dominate the market by the end of forecast period. This is primarily due to its major application in the passenger and light duty vehicles. The continuous VVT system is anticipated to dominate the market, as the system offers continuous modification of the valve timing. Rising pollution levels, increasing concerns about human health, and impending necessity for efficient cars to curb carbon footprint are projected to boost the demand for these VVT systems.

In 2017, Asia Pacific held a noticeable share of the global automotive VVT systems market. Recent increase in production and demand of vehicles in counties of Latin America is anticipated to boost the market in the region at a significant growth rate in the near future. Latin America is expected to witness lower penetration of battery electric vehicles, as adoption of BEVs is not prominent in the region. The economic dynamos in Asia Pacific such as China, Japan, and South Korea are focusing more on the adoption of battery electric vehicles and are expected to witness restrained growth of VVT system, as battery electrical vehicles are expected to hamper the market of automotive VVT systems. However, Asia Pacific witnesses a considerable demand for VVT systems from the developing countries in South Asia and ASEAN. Decline in car loan interest rates, availability of customized financial schemes, and increase in per capita income of consumers are some factors that are boosting the production of passenger vehicles, which in turn is anticipated to drive the automotive VVT systems market in the region during forecast period.

The automotive VVT system market witnesses the presence of a few major players, as manufacturing of VVT systems is a complicated and expensive affair. Numerous regional players manufacture the components required for the VVT system. These players dominated the market for particular application and aftermarket segments. Major players operating in the global automotive VVT system market include Johnson Controls, Inc., Mikuni American Corporation, Aisin Seiki Co. Ltd., Camcraft, Inc., Federal-Mogul LLC, Eaton Corporation, Hitachi Automotive Systems, Mitsubishi Electric Corporation, Robert Bosch GmbH, DENSO Corporation, Schaeffler AG, Honda Motor Co., Ltd., BorgWarner Inc., and Toyota Motor Corporation. Strategic players are focusing more on mergers and acquisitions with regional players, which provide different components required to fabricate the VVT system in order to develop their businesses. Several key players emphasize more on R&D in order to improve functionality and efficiency of the VVT system.

Automotive VVT System Market to Gain Momentum Owing to Rising Level of Vehicular Pollution Worldwide

The increasing number of automobile production and the rise in the level of pollution levels with release of harmful greenhouse gases into the environment is a prime factor contributing to the growth of the global automotive VVT System Market. An automotive VVT system drags out motor life, as it skillfully improves execution, efficiency, or discharges. Automotive VVT systems upgrade burning, enhance motor cycle, improve motor force, decrease fuel utilization, and diminish discharges. They help improve the emanation controller system and limit start glitches in the sparkle plug, which are probably going to prompt genuine drivability issues. The VVT system additionally permits the use of a more modest motor to accomplish a similar presentation. These components are required to drive the interest for automotive VVT systems impressively in the coming years.

The variable valve timing (VVT) system has gotten ordinary in automotive assembling. Automotive VVT system improves mileage and execution of vehicles. The have become a critical component to control emanation system, including improving the activity of flash fittings. Advances in IC motor cycles have additionally improved the activity of automotive VVT systems. The broad interest in automotive VVT system market originates from severe execution of vehicle discharge standards worldwide throughout the long term. The ascent being used of these in traveler and business vehicles is the key main thrust for the deals on the lookout.

Discharge from cars represents 28% of the general ozone depleting substances including methane and carbon dioxide that causes major hindrances to the climate. This hampered climate influences the soundness of people by proliferating respiratory issues. Administrative bodies are authorizing tough standards on fossil fuel byproducts of automotive to diminish control such circumstances and fossil fuel byproduct. The VVT system helps to adjust the valve timing as per the IC motor cycle, thereby lowering the level of carbon emission, ultimately promoting the automotive VVT system market. Motor life is probably going to improve because of a VVT system, as it keeps up the legitimate pattern of the motor.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Automotive VVT System Market

3.1. Global Automotive VVT System Market Size, Units, US$ Mn, 2017–2026

4. Market Overview

4.1. Introduction

4.1.1. Automotive VVT System Market Definition

4.1.2. Technology Roadmap

4.2. Key Market Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Porter’s Five Force Analysis

4.5. Value Chain Analysis

4.5.1. List of Key Manufacturers

4.5.2. List of Customers

4.5.3. Level of Integration

4.6. SWOT Analysis

5. Global Emission Regulation Analysis

6. Battery Electric Vehicle Impact

7. Price Trend Analysis

8. Global Automotive VVT System Market Analysis and Forecasts, by Fuel Type

8.1. Introduction & Definition

8.2. Key Findings

8.3. Market Size (Units) (US$ Mn) Forecast, by Fuel Type, 2017–2026

8.3.1. Gasoline

8.3.2. Diesel

8.4. Fuel Type Comparison Matrix

8.5. Market Attractiveness, by Fuel Type

9. Global Automotive VVT System Market Analysis and Forecasts, by Methods

9.1. Introduction & Definition

9.2. Key Findings

9.3. Market Size (Units) (US$ Mn) Forecast, by Methods, 2017–2026

9.3.1. Cam Phasing

9.3.2. Cam Changing

9.3.3. Cam Phasing + Changing

9.3.4. Variable Valve Actuation

9.4. Advance Driver Assist Segment Comparison Matrix

9.5. Market Attractiveness By Method

10. Global Automotive VVT System Market Analysis and Forecasts, by Technology

10.1. Introduction & Definition

10.2. Key Findings

10.3. Market Size (Units) (US$ Mn) Forecast, by Technology, 2017–2026

10.3.1. VVT-i

10.3.2. Dual VVT-i

10.3.3. VVT-iE

10.3.4. VVT-iW

10.4. By Technology Comparison Matrix

10.5. Market Attractiveness, by Technology

11. Global Automotive VVT System Market Analysis and Forecasts, by Number of Valves

11.1. Introduction & Definition

11.2. Key Findings

11.3. Market Size (Units) (US$ Mn) Forecast, by Number of Valves, 2017–2026

11.3.1. Less Than 12

11.3.2. 16

11.3.3. Between 17 to 23

11.3.4. More than 24

11.4. Number of Valves Comparison Matrix

11.5. Market Attractiveness, by Number of Valves

12. Global Automotive VVT System Market Analysis and Forecast, by System

12.1. Introduction & Definition

12.2. Key Findings

12.3. Market Size (Units) (US$ Mn) Forecast, by System, 2017–2026

12.3.1. Discrete

12.3.2. Continuous

12.4. Number of Valves Comparison Matrix

12.5. Market Attractiveness, by System

13. Global Automotive VVT System Market Analysis and Forecasts, by Valve Actuation Type

13.1. Introduction & Definition

13.2. Key Findings

13.3. Market Size (Units) (US$ Mn) Forecast, by Valve Actuation Type, 2017–2026

13.3.1. Type I

13.3.2. Type II

13.3.3. Type III

13.3.4. Type IV

13.3.5. Type V

13.4. Valve Actuation Comparison Matrix

13.5. Market Attractiveness, by Valve Actuation Type

14. Global Automotive VVT System Market Analysis and Forecast, by Valve Train

14.1. Introduction & Definition

14.2. Key Findings

14.3. Market Size (Units) (US$ Mn) Forecast, by Valve Train, 2017–2026

14.3.1. Single Overhead Cam (SOHC)

14.3.2. Double Overhead Cam (DOHC)

14.3.3. Over Head Valve (OHV)

14.4. Valve Train Comparison Matrix

14.5. Market Attractiveness, by Valve Train

15. Global Automotive VVT System Market Analysis and Forecast, by Sales Channel

15.1. Introduction & Definition

15.2. Key Findings

15.3. Market Size (Units) (US$ Mn) Forecast, by Sales Channel, 2017–2026

15.3.1. OEM

15.3.2. Aftermarket

15.4. Sales Channel Comparison Matrix

15.5. Market Attractiveness, by Sales Channel

16. Global Automotive VVT System Market Analysis and Forecasts, by Vehicle Type

16.1. Introduction & Definition

16.2. Key Findings

16.3. Market Size (Units) (US$ Mn) Forecast, by Vehicle Type, 2017–2026

16.3.1. Passenger Vehicle

16.3.2. Commercial Vehicle

16.3.2.1. LCV

16.3.2.2. HCV

16.3.3. Electric Vehicle

16.3.3.1. HEV

16.3.3.2. PHEV

16.4. Vehicle Type Comparison Matrix

16.5. Market Attractiveness, By Vehicle Type

17. Global Automotive VVT System Market Analysis and Forecast, by Region

17.1. Key Findings

17.2. Market Size (Units) (US$ Mn) Forecast, by Region, 2017–2026

17.2.1. North America

17.2.2. Latin America

17.2.3. Europe

17.2.4. Asia Pacific

17.2.5. Middle East & Africa

17.3. Market Attractiveness, by Region

18. North America Automotive VVT System Market Size and Forecast (Units) (US$ Mn), 2017–2026

18.1. Key Findings

18.2. North America Market, by Fuel Type

18.2.1. Gasoline

18.2.2. Diesel

18.3. North America Market, by Methods

18.3.1. Cam Phasing

18.3.2. Cam Changing

18.3.3. Cam Phasing + Changing

18.3.4. Variable Valve Actuation

18.4. North America Market, by Technology

18.4.1. VVT-i

18.4.2. Dual VVT-i

18.4.3. VVT-iE

18.4.4. VVT-iW

18.5. North America Market, by Number of Valves

18.5.1. Less Than 12

18.5.2. 16

18.5.3. Between 17 to 23

18.5.4. More than 24

18.6. North America Market, by System

18.6.1. Discrete

18.6.2. Continuous

18.7. North America Market, by Valve Actuation

18.7.1. Type I

18.7.2. Type II

18.7.3. Type III

18.7.4. Type IV

18.7.5. Type V

18.8. North America Market, by Valve Train

18.8.1. Single Overhead Cam (SOHC)

18.8.2. Double Overhead Cam (DOHC)

18.8.3. Over Head Valve (OHV)

18.9. North America Market, by Sales Channel

18.9.1. OEM

18.9.2. Aftermarket

18.10. North America Market, by Vehicle Type

18.10.1. Passenger Vehicle

18.10.2. Commercial Vehicle

18.10.2.1. LCV

18.10.2.2. HCV

18.10.3. Electric Vehicle

18.10.3.1. HEV

18.10.3.2. PHEV

18.11. U.S. Market Size & Forecast, by Fuel Type

18.11.1. Gasoline

18.11.2. Diesel

18.12. U.S. Market Size & Forecast, by Method

18.12.1. Cam Phasing

18.12.2. Cam Changing

18.12.3. Cam Phasing + Changing

18.12.4. Variable Valve Actuation

18.13. U.S. Market Size & Forecast, By Technology

18.13.1. VVT-i

18.13.2. Dual VVT-i

18.13.3. VVT-iE

18.13.4. VVT-iW

18.14. U.S. Market Size & Forecast, by Valve Train

18.14.1. Less Than 12

18.14.2. 16

18.14.3. Between 17 to 23

18.14.4. More than 24

18.15. U.S. Market, by System

18.15.1. Discrete

18.15.2. Continuous

18.16. U.S. Market Size & Forecast, by Valve Actuation

18.16.1. Type I

18.16.2. Type II

18.16.3. Type III

18.16.4. Type IV

18.16.5. Type V

18.17. U.S. Market, by Valve Train

18.17.1. Single Overhead Cam (SOHC)

18.17.2. Double Overhead Cam (DOHC)

18.17.3. Over Head Valve (OHV)

18.18. U.S. Market Size & Forecast, by Sales Channel

18.18.1. OEM

18.18.2. Aftermarket

18.19. U.S. Market Size & Forecast, by Vehicle Type

18.19.1. Passenger Vehicle

18.19.2. Commercial Vehicle

18.19.2.1. LCV

18.19.2.2. HCV

18.19.3. Electric Vehicle

18.19.3.1. HEV

18.19.3.2. PHEV

18.20. Canada Market Size & Forecast, by Fuel Type

18.20.1. Gasoline

18.20.2. Diesel

18.21. Canada Market Size & Forecast, by Method

18.21.1. Cam Phasing

18.21.2. Cam Changing

18.21.3. Cam Phasing + Changing

18.21.4. Variable Valve Actuation

18.22. Canada Market Size & Forecast, by Technology

18.22.1. VVT-i

18.22.2. Dual VVT-i

18.22.3. VVT-iE

18.22.4. VVT-iW

18.23. Canada Market Size & Forecast, by Number of Valves

18.23.1. Less Than 12

18.23.2. 16

18.23.3. Between 17 to 23

18.23.4. More than 24

18.24. Canada Market, by System

18.24.1. Discrete

18.24.2. Continuous

18.25. Canada Market Size & Forecast, by Valve Actuation

18.25.1. Type I

18.25.2. Type II

18.25.3. Type III

18.25.4. Type IV

18.25.5. Type V

18.26. Canada Market, by Valve Train

18.26.1. Single Overhead Cam (SOHC)

18.26.2. Double Overhead Cam (DOHC)

18.26.3. Over Head Valve (OHV)

18.27. Canada Market Size & Forecast, by Sales Channel

18.27.1. OEM

18.27.2. Aftermarket

18.28. Canada Market Size & Forecast, by Vehicle Type

18.28.1. Passenger Vehicle

18.28.2. Commercial Vehicle

18.28.2.1. LCV

18.28.2.2. HCV

18.28.3. Electric Vehicle

18.28.3.1. HEV

18.28.3.2. PHEV

18.29. Comparison Matrix

18.29.1. By Fuel Type

18.29.2. By Methods

18.29.3. By Technology

18.29.4. By Valve Train

18.29.5. By Number of Valves

18.29.6. By System

18.29.7. By Valve Actuation Type

18.29.8. By Sales Channel

18.29.9. By Vehicle

18.30. PEST Analysis

19. Latin America Automotive VVT System Market Size and Forecast (Units) (US$ Mn), 2017–2026

19.1. Key Findings

19.2. Latin America Market, by Fuel Type

19.2.1. Gasoline

19.2.2. Diesel

19.3. Latin America Market, by Method

19.3.1. Cam Phasing

19.3.2. Cam Changing

19.3.3. Cam Phasing + Changing

19.3.4. Variable Valve Actuation

19.4. Latin America Market Size & Forecast, by Technology

19.4.1. VVT-i

19.4.2. Dual VVT-i

19.4.3. VVT-iE

19.4.4. VVT-iW

19.5. Latin America Market, by Number of Valves

19.5.1. Less Than 12

19.5.2. 16

19.5.3. Between 17 to 23

19.5.4. More than 24

19.6. Latin America Market, by System

19.6.1. Discrete

19.6.2. Continuous

19.7. Latin America Market, by Valve Actuation

19.7.1. Type I

19.7.2. Type II

19.7.3. Type III

19.7.4. Type IV

19.7.5. Type V

19.8. Latin America Market, by Valve Train

19.8.1. Single Overhead Cam (SOHC)

19.8.2. Double Overhead Cam (DOHC)

19.8.3. Over Head Valve (OHV)

19.9. Latin America Market, by Sales Channel

19.9.1. OEM

19.9.2. Aftermarket

19.10. Latin America Market, by Vehicle Type

19.10.1. Passenger Vehicle

19.10.2. Commercial Vehicle

19.10.2.1. LCV

19.10.2.2. HCV

19.10.3. Electric Vehicle

19.10.3.1. HEV

19.10.3.2. PHEV

19.11. Brazil Market Size & Forecast, by Fuel Type

19.11.1. Gasoline

19.11.2. Diesel

19.12. Brazil Market Size & Forecast, by Method

19.12.1. Cam Phasing

19.12.2. Cam Changing

19.12.3. Cam Phasing + Changing

19.12.4. Variable Valve Actuation

19.13. Brazil Market Size & Forecast, by Technology

19.13.1. VVT-i

19.13.2. Dual VVT-i

19.13.3. VVT-iE

19.13.4. VVT-iW

19.14. Brazil Market Size & Forecast, by Valve Train

19.14.1. Less Than 12

19.14.2. 16

19.14.3. Between 17 to 23

19.14.4. More than 24

19.15. Brazil Market, by System

19.15.1. Discrete

19.15.2. Continuous

19.16. Brazil Market Size & Forecast, by Valve Actuation

19.16.1. Type I

19.16.2. Type II

19.16.3. Type III

19.16.4. Type IV

19.16.5. Type V

19.17. Brazil, by Valve Train

19.17.1. Single Overhead Cam (SOHC)

19.17.2. Double Overhead Cam (DOHC)

19.17.3. Over Head Valve (OHV)

19.18. Brazil Market Size & Forecast, by Sales Channel

19.18.1. OEM

19.18.2. Aftermarket

19.19. Brazil Market Size & Forecast, by Vehicle Type

19.19.1. Passenger Vehicle

19.19.2. Commercial Vehicle

19.19.2.1. LCV

19.19.2.2. HCV

19.19.3. Electric Vehicle

19.19.3.1. HEV

19.19.3.2. PHEV

19.20. Mexico Market Size & Forecast, by Fuel Type

19.20.1. Gasoline

19.20.2. Diesel

19.21. Mexico Market Size & Forecast, by Method

19.21.1. Cam Phasing

19.21.2. Cam Changing

19.21.3. Cam Phasing + Changing

19.21.4. Variable Valve Actuation

19.22. Mexico Market Size & Forecast, by Technology

19.22.1. VVT-i

19.22.2. Dual VVT-i

19.22.3. VVT-iE

19.22.4. VVT-iW

19.23. Mexico Market Size & Forecast, by Number of Valves

19.23.1. Less Than 12

19.23.2. 16

19.23.3. Between 17 to 23

19.23.4. More than 24

19.24. Mexico Market, by System

19.24.1. Discrete

19.24.2. Continuous

19.25. Mexico Market Size & Forecast, by Valve Actuation

19.25.1. Type I

19.25.2. Type II

19.25.3. Type III

19.25.4. Type IV

19.25.5. Type V

19.26. Mexico Market, by Valve Train

19.26.1. Single Overhead Cam (SOHC)

19.26.2. Double Overhead Cam (DOHC)

19.26.3. Over Head Valve (OHV)

19.27. Mexico Market Size & Forecast, by Sales Channel

19.27.1. OEM

19.27.2. Aftermarket

19.28. Mexico Market Size & Forecast, by Vehicle Type

19.28.1. Passenger Vehicle

19.28.2. Commercial Vehicle

19.28.2.1. LCV

19.28.2.2. HCV

19.28.3. Electric Vehicle

19.28.3.1. HEV

19.28.3.2. PHEV

19.29. Rest of Latin America Market Size & Forecast, by Fuel Type

19.29.1. Gasoline

19.29.2. Diesel

19.30. Rest of Latin America Market Size & Forecast, by Method

19.30.1. Cam Phasing

19.30.2. Cam Changing

19.30.3. Cam Phasing + Changing

19.30.4. Variable Valve Actuation

19.31. Rest of Latin America Market Size & Forecast, by Technology

19.31.1. VVT-i

19.31.2. Dual VVT-i

19.31.3. VVT-iE

19.31.4. VVT-iW

19.32. Rest of Latin America Market Size & Forecast, by Number of Valves

19.32.1. Less Than 12

19.32.2. 16

19.32.3. Between 17 to 23

19.32.4. More than 24

19.33. Rest of Latin America Market, by System

19.33.1. Discrete

19.33.2. Continuous

19.34. Rest of Latin America Market Size & Forecast, by Valve Actuation

19.34.1. Type I

19.34.2. Type II

19.34.3. Type III

19.34.4. Type IV

19.34.5. Type V

19.35. Latin America, by Valve Train

19.35.1. Single Overhead Cam (SOHC)

19.35.2. Double Overhead Cam (DOHC)

19.35.3. Over Head Valve (OHV)

19.36. Rest of Latin America Market Size & Forecast, by Sales Channel

19.36.1. OEM

19.36.2. Aftermarket

19.37. Rest of Latin America Market Size & Forecast, by Vehicle Type

19.37.1. Passenger Vehicle

19.37.2. Commercial Vehicle

19.37.2.1. LCV

19.37.2.2. HCV

19.37.3. Electric Vehicle

19.37.3.1. HEV

19.37.3.2. PHEV

19.38. Comparison Matrix

19.38.1. By Fuel Type

19.38.2. By Methods

19.38.3. By Technology

19.38.4. By Valve Train

19.38.5. By Number of Valves

19.38.6. By Valve Actuation Type

19.38.7. By System

19.38.8. By Sales Channel

19.38.9. By Vehicle

19.39. PEST Analysis

20. Europe Automotive VVT System Market Size and Forecast (Units) (US$ Mn), 2017–2026

20.1. Key Findings

20.2. Europe Market, by Fuel Type

20.2.1. Gasoline

20.2.2. Diesel

20.3. Europe Market, by Method

20.3.1. Cam Phasing

20.3.2. Cam Changing

20.3.3. Cam Phasing + Changing

20.3.4. Variable Valve Actuation

20.4. Europe Market Size & Forecast, by Technology

20.4.1. VVT-i

20.4.2. Dual VVT-i

20.4.3. VVT-iE

20.4.4. VVT-iW

20.5. Europe Market, by Number of Valves

20.5.1. Less Than 12

20.5.2. 16

20.5.3. Between 17 to 23

20.5.4. More than 24

20.6. Europe Market, by System

20.6.1. Discrete

20.6.2. Continuous

20.7. Europe Market, by Valve Actuation

20.7.1. Type I

20.7.2. Type II

20.7.3. Type III

20.7.4. Type IV

20.7.5. Type V

20.8. Europe, by Valve Train

20.8.1. Single Overhead Cam (SOHC)

20.8.2. Double Overhead Cam (DOHC)

20.8.3. Over Head Valve (OHV)

20.9. Europe Market, by Sales Channel

20.9.1. OEM

20.9.2. Aftermarket

20.10. Europe Market, by Vehicle Type

20.10.1. Passenger Vehicle

20.10.2. Commercial Vehicle

20.10.2.1. LCV

20.10.2.2. HCV

20.10.3. Electric Vehicle

20.10.3.1. HEV

20.10.3.2. PHEV

20.11. Germany Market Size & Forecast, by Fuel Type

20.11.1. Gasoline

20.11.2. Diesel

20.12. Germany Market Size & Forecast, by Method

20.12.1. Cam Phasing

20.12.2. Cam Changing

20.12.3. Cam Phasing + Changing

20.12.4. Variable Valve Actuation

20.13. Germany Market Size & Forecast, by Technology

20.13.1. VVT-i

20.13.2. Dual VVT-i

20.13.3. VVT-iE

20.13.4. VVT-iW

20.14. Germany Market Size & Forecast, by Number of Valves

20.14.1. Less Than 12

20.14.2. 16

20.14.3. Between 17 to 23

20.14.4. More than 24

20.15. Germany Market, by System

20.15.1. Discrete

20.15.2. Continuous

20.16. Germany Market Size & Forecast, by Valve Actuation

20.16.1. Type I

20.16.2. Type II

20.16.3. Type III

20.16.4. Type IV

20.16.5. Type V

20.17. Germany Market, by Valve Train

20.17.1. Single Overhead Cam (SOHC)

20.17.2. Double Overhead Cam (DOHC)

20.17.3. Over Head Valve (OHV)

20.18. Germany Market Size & Forecast, by Sales Channel

20.18.1. OEM

20.18.2. Aftermarket

20.19. Germany Market Size & Forecast, by Vehicle Type

20.19.1. Passenger Vehicle

20.19.2. Commercial Vehicle

20.19.2.1. LCV

20.19.2.2. HCV

20.19.3. Electric Vehicle

20.19.3.1. HEV

20.19.3.2. PHEV

20.20. France Market Size & Forecast, by Fuel Type

20.20.1. Gasoline

20.20.2. Diesel

20.21. France Market Size & Forecast, by Method

20.21.1. Cam Phasing

20.21.2. Cam Changing

20.21.3. Cam Phasing + Changing

20.21.4. Variable Valve Actuation

20.22. France Market Size & Forecast, by Technology

20.22.1. VVT-i

20.22.2. Dual VVT-i

20.22.3. VVT-iE

20.22.4. VVT-iW

20.23. France Market Size & Forecast, by Number of Valves

20.23.1. Less Than 12

20.23.2. 16

20.23.3. Between 17 to 23

20.23.4. More than 24

20.24. France Market, by System

20.24.1. Discrete

20.24.2. Continuous

20.25. France Market Size & Forecast, by Valve Actuation

20.25.1. Type I

20.25.2. Type II

20.25.3. Type III

20.25.4. Type IV

20.25.5. Type V

20.26. France Market, by Valve Train

20.26.1. Single Overhead Cam (SOHC)

20.26.2. Double Overhead Cam (DOHC)

20.26.3. Over Head Valve (OHV)

20.27. France Market Size & Forecast, by Sales Channel

20.27.1. OEM

20.27.2. Aftermarket

20.28. France Market Size & Forecast, by Vehicle Type

20.28.1. Passenger Vehicle

20.28.2. Commercial Vehicle

20.28.2.1. LCV

20.28.2.2. HCV

20.28.3. Electric Vehicle

20.28.3.1. HEV

20.28.3.2. PHEV

20.29. U.K. Market Size & Forecast, by Fuel Type

20.29.1. Gasoline

20.29.2. Diesel

20.30. U.K. Market Size & Forecast, by Method

20.30.1. Cam Phasing

20.30.2. Cam Changing

20.30.3. Cam Phasing + Changing

20.30.4. Variable Valve Actuation

20.31. U.K. Market Size & Forecast, by Technology

20.31.1. VVT-i

20.31.2. Dual VVT-i

20.31.3. VVT-iE

20.31.4. VVT-iW

20.32. U.K. Market Size & Forecast, by Number of Valves

20.32.1. Less Than 12

20.32.2. 16

20.32.3. Between 17 to 23

20.32.4. More than 24

20.33. U.K. Market, by System

20.33.1. Discrete

20.33.2. Continuous

20.34. U.K. Market Size & Forecast, by Valve Actuation

20.34.1. Type I

20.34.2. Type II

20.34.3. Type III

20.34.4. Type IV

20.34.5. Type V

20.35. U.K. Market, by Valve Train

20.35.1. Single Overhead Cam (SOHC)

20.35.2. Double Overhead Cam (DOHC)

20.35.3. Over Head Valve (OHV)

20.36. U.K. Market Size & Forecast, by Sales Channel

20.36.1. OEM

20.36.2. Aftermarket

20.37. U.K. Market Size & Forecast, by Vehicle Type

20.37.1. Passenger Vehicle

20.37.2. Commercial Vehicle

20.37.2.1. LCV

20.37.2.2. HCV

20.37.3. Electric Vehicle

20.37.3.1. HEV

20.37.3.2. PHEV

20.38. Spain Market Size & Forecast, by Fuel Type

20.38.1. Gasoline

20.38.2. Diesel

20.39. Spain Market Size & Forecast, by Method

20.39.1. Cam Phasing

20.39.2. Cam Changing

20.39.3. Cam Phasing + Changing

20.39.4. Variable Valve Actuation

20.40. Spain Market Size & Forecast, by Technology

20.40.1. VVT-i

20.40.2. Dual VVT-i

20.40.3. VVT-iE

20.40.4. VVT-iW

20.41. Spain Market Size & Forecast, by Number of Valves

20.41.1. Less Than 12

20.41.2. 16

20.41.3. Between 17 to 23

20.41.4. More than 24

20.42. Spain Market, by System

20.42.1. Discrete

20.42.2. Continuous

20.43. Spain Market Size & Forecast, by Valve Actuation

20.43.1. Type I

20.43.2. Type II

20.43.3. Type III

20.43.4. Type IV

20.43.5. Type V

20.44. Spain Market, by Valve Train

20.44.1. Single Overhead Cam (SOHC)

20.44.2. Double Overhead Cam (DOHC)

20.44.3. Over Head Valve (OHV)

20.45. Spain Market Size & Forecast, by Sales Channel

20.45.1. OEM

20.45.2. Aftermarket

20.46. Spain Market Size & Forecast b Vehicle Type

20.46.1. Passenger Vehicle

20.46.2. Commercial Vehicle

20.46.2.1. LCV

20.46.2.2. HCV

20.46.3. Electric Vehicle

20.46.3.1. HEV

20.46.3.2. PHEV

20.47. Italy Market Size & Forecast, by Fuel Type

20.47.1. Gasoline

20.47.2. Diesel

20.48. Italy Market Size & Forecast, by Method

20.48.1. Cam Phasing

20.48.2. Cam Changing

20.48.3. Cam Phasing + Changing

20.48.4. Variable Valve Actuation

20.49. Italy Market Size & Forecast, by Technology

20.49.1. VVT-i

20.49.2. Dual VVT-i

20.49.3. VVT-iE

20.49.4. VVT-iW

20.50. Italy Market Size & Forecast, by Number of Valves

20.50.1. Less Than 12

20.50.2. 16

20.50.3. Between 17 to 23

20.50.4. More than 24

20.51. Italy Market, by System

20.51.1. Discrete

20.51.2. Continuous

20.52. Italy Market Size & Forecast, by Valve Actuation

20.52.1. Type I

20.52.2. Type II

20.52.3. Type III

20.52.4. Type IV

20.52.5. Type V

20.53. Italy Market, by Valve Train

20.53.1. Single Overhead Cam (SOHC)

20.53.2. Double Overhead Cam (DOHC)

20.53.3. Over Head Valve (OHV)

20.54. Italy Market Size & Forecast, by Sales Channel

20.54.1. OEM

20.54.2. Aftermarket

20.55. Italy Market Size & Forecast, by Vehicle Type

20.55.1. Passenger Vehicle

20.55.2. Commercial Vehicle

20.55.2.1. LCV

20.55.2.2. HCV

20.55.3. Electric Vehicle

20.55.3.1. HEV

20.55.3.2. PHEV

20.56. Rest of Europe Market Size & Forecast, by Fuel Type

20.56.1. Gasoline

20.56.2. Diesel

20.57. Rest of Europe Market Size & Forecast, by Method

20.57.1. Cam Phasing

20.57.2. Cam Changing

20.57.3. Cam Phasing + Changing

20.57.4. Variable Valve Actuation

20.58. Rest of Europe Market Size & Forecast, by Technology

20.58.1. VVT-i

20.58.2. Dual VVT-i

20.58.3. VVT-iE

20.58.4. VVT-iW

20.59. Rest of Europe Market Size & Forecast, by Valve Train

20.59.1. Less Than 12

20.59.2. 16

20.59.3. Between 17 to 23

20.59.4. More than 24

20.60. Rest of Europe Market, by System

20.60.1. Discrete

20.60.2. Continuous

20.61. Rest of Europe Market Size & Forecast, by Valve Actuation

20.61.1. Type I

20.61.2. Type II

20.61.3. Type III

20.61.4. Type IV

20.61.5. Type V

20.62. Rest of Europe Market, by Valve Train

20.62.1. Single Overhead Cam (SOHC)

20.62.2. Double Overhead Cam (DOHC)

20.62.3. Over Head Valve (OHV)

20.63. Rest of Europe Market Size & Forecast, by Sales Channel

20.63.1. OEM

20.63.2. Aftermarket

20.64. Rest of Europe Market Size & Forecast, by Vehicle Type

20.64.1. Passenger Vehicle

20.64.2. Commercial Vehicle

20.64.2.1. LCV

20.64.2.2. HCV

20.64.3. Electric Vehicle

20.64.3.1. HEV

20.64.3.2. PHEV

20.65. Comparison Matrix

20.65.1. By Fuel Type

20.65.2. By Methods

20.65.3. By Technology

20.65.4. By Valve Train

20.65.5. By Valve Actuation Type

20.65.6. By Number of Valves

20.65.7. By System

20.65.8. By Sales Channel

20.65.9. By Vehicle

20.66. PEST Analysis

21. Asia Pacific Automotive VVT System Market Size and Forecast (Units) (US$ Mn), 2017–2026

21.1. Key Findings

21.2. Asia Pacific Market, by Fuel Type

21.2.1. Gasoline

21.2.2. Diesel

21.3. Asia Pacific Market, by Method

21.3.1. Cam Phasing

21.3.2. Cam Changing

21.3.3. Cam Phasing + Changing

21.3.4. Variable Valve Actuation

21.4. Asia Pacific Market Size & Forecast, by Technology

21.4.1. VVT-i

21.4.2. Dual VVT-i

21.4.3. VVT-iE

21.4.4. VVT-iW

21.5. Asia Pacific Market, by Number of Valves

21.5.1. Less Than 12

21.5.2. 16

21.5.3. Between 17 to 23

21.5.4. More than 24

21.6. Asia Pacific Market, by System

21.6.1. Discrete

21.6.2. Continuous

21.7. Asia Pacific Market, by Valve Actuation

21.7.1. Type I

21.7.2. Type II

21.7.3. Type III

21.7.4. Type IV

21.7.5. Type V

21.8. Asia Pacific Market, by Valve Train

21.8.1. Single Overhead Cam (SOHC)

21.8.2. Double Overhead Cam (DOHC)

21.8.3. Over Head Valve (OHV)

21.9. Asia Pacific Market, by Sales Channel

21.9.1. OEM

21.9.2. Aftermarket

21.10. Asia Pacific Market, by Vehicle Type

21.10.1. Passenger Vehicle

21.10.2. Commercial Vehicle

21.10.2.1. LCV

21.10.2.2. HCV

21.10.3. Electric Vehicle

21.10.3.1. HEV

21.10.3.2. PHEV

21.11. China Market Size & Forecast, by Fuel Type

21.11.1. Gasoline

21.11.2. Diesel

21.12. China Market Size & Forecast, by Method

21.12.1. Cam Phasing

21.12.2. Cam Changing

21.12.3. Cam Phasing + Changing

21.12.4. Variable Valve Actuation

21.13. China Market Size & Forecast, by Technology

21.13.1. VVT-i

21.13.2. Dual VVT-i

21.13.3. VVT-iE

21.13.4. VVT-iW

21.14. China Market Size & Forecast, by Number of Valves

21.14.1. Less Than 12

21.14.2. 16

21.14.3. Between 17 to 23

21.14.4. More than 24

21.15. China Market Size & Forecast, by Valve Actuation

21.15.1. Type I

21.15.2. Type II

21.15.3. Type III

21.15.4. Type IV

21.15.5. Type V

21.16. China Market, by Valve Train

21.16.1. Single Overhead Cam (SOHC)

21.16.2. Double Overhead Cam (DOHC)

21.16.3. Over Head Valve (OHV)

21.17. China Market Size & Forecast, by Sales Channel

21.17.1. OEM

21.17.2. Aftermarket

21.18. China Market Size & Forecast, by Vehicle Type

21.18.1. Passenger Vehicle

21.18.2. Commercial Vehicle

21.19. Japan Market Size & Forecast, by Fuel Type

21.19.1. Gasoline

21.19.2. Diesel

21.20. Japan Market Size & Forecast, by Method

21.20.1. Cam Phasing

21.20.2. Cam Changing

21.20.3. Cam Phasing + Changing

21.20.4. Variable Valve Actuation

21.21. Japan Market Size & Forecast, by Technology

21.21.1. VVT-i

21.21.2. Dual VVT-i

21.21.3. VVT-iE

21.21.4. VVT-iW

21.22. Japan Market Size & Forecast, by Number of Valves

21.22.1. Less Than 12

21.22.2. 16

21.22.3. Between 17 to 23

21.22.4. More than 24

21.23. Japan Market, by System

21.23.1. Discrete

21.23.2. Continuous

21.24. Japan Market Size & Forecast, by Valve Actuation

21.24.1. Type I

21.24.2. Type II

21.24.3. Type III

21.24.4. Type IV

21.24.5. Type V

21.25. Japan Market, by Valve Train

21.25.1. Single Overhead Cam (SOHC)

21.25.2. Double Overhead Cam (DOHC)

21.25.3. Over Head Valve (OHV)

21.26. Japan Market Size & Forecast, by Sales Channel

21.26.1. OEM

21.26.2. Aftermarket

21.27. Japan Market Size & Forecast, by Vehicle Type

21.27.1. Passenger Vehicle

21.27.2. Commercial Vehicle

21.28. India Market Size & Forecast, by Fuel Type

21.28.1. Gasoline

21.28.2. Diesel

21.29. India Market Size & Forecast, by Method

21.29.1. Cam Phasing

21.29.2. Cam Changing

21.29.3. Cam Phasing + Changing

21.29.4. Variable Valve Actuation

21.30. India Market Size & Forecast, by Technology

21.30.1. VVT-i

21.30.2. Dual VVT-i

21.30.3. VVT-iE

21.30.4. VVT-iW

21.31. India Market Size & Forecast, by Number of Valves

21.31.1. Less Than 12

21.31.2. 16

21.31.3. Between 17 to 23

21.31.4. More than 24

21.32. India Market, by System

21.32.1. Discrete

21.32.2. Continuous

21.33. India Market Size & Forecast, by Valve Actuation

21.33.1. Type I

21.33.2. Type II

21.33.3. Type III

21.33.4. Type IV

21.33.5. Type V

21.34. India Market, by Valve Train

21.34.1. Single Overhead Cam (SOHC)

21.34.2. Double Overhead Cam (DOHC)

21.34.3. Over Head Valve (OHV)

21.35. India Market Size & Forecast, by Sales Channel

21.35.1. OEM

21.35.2. Aftermarket

21.36. India Market Size & Forecast, by Vehicle Type Segment

21.36.1. Passenger Vehicle

21.36.2. Commercial Vehicle

21.36.2.1. LCV

21.36.2.2. HCV

21.36.3. Electric Vehicle

21.36.3.1. HEV

21.36.3.2. PHEV

21.37. ASEAN Market Size & Forecast, by Fuel Type

21.37.1. Gasoline

21.37.2. Diesel

21.38. ASEAN Market Size & Forecast, by Method

21.38.1. Cam Phasing

21.38.2. Cam Changing

21.38.3. Cam Phasing + Changing

21.38.4. Variable Valve Actuation

21.39. ASEAN Market Size & Forecast, by Technology

21.39.1. VVT-i

21.39.2. Dual VVT-i

21.39.3. VVT-iE

21.39.4. VVT-iW

21.40. ASEAN Market Size & Forecast, by Number of Valves

21.40.1. Less Than 12

21.40.2. 16

21.40.3. Between 17 to 23

21.40.4. More than 24

21.41. ASEAN Market, by System

21.41.1. Discrete

21.41.2. Continuous

21.42. ASEAN Market Size & Forecast, by Valve Actuation

21.42.1. Type I

21.42.2. Type II

21.42.3. Type III

21.42.4. Type IV

21.42.5. Type V

21.43. ASEAN Market, by Valve Train

21.43.1. Single Overhead Cam (SOHC)

21.43.2. Double Overhead Cam (DOHC)

21.43.3. Over Head Valve (OHV)

21.44. ASEAN Market Size & Forecast, by Sales Channel

21.44.1. OEM

21.44.2. Aftermarket

21.45. ASEAN Market Size & Forecast, by Vehicle Type

21.45.1. Passenger Vehicle

21.45.2. Commercial Vehicle

21.46. Rest of Asia Pacific Market Size & Forecast, by Fuel Type

21.46.1. Gasoline

21.46.2. Diesel

21.47. Rest of Asia Pacific Market Size & Forecast, by Method

21.47.1. Cam Phasing

21.47.2. Cam Changing

21.47.3. Cam Phasing + Changing

21.47.4. Variable Valve Actuation

21.48. Rest of Asia Pacific Market Size & Forecast, by Technology

21.48.1. VVT-i

21.48.2. Dual VVT-i

21.48.3. VVT-iE

21.48.4. VVT-iW

21.49. Rest of Asia Pacific Market Size & Forecast, by Number of Valves

21.49.1. Less Than 12

21.49.2. 16

21.49.3. Between 17 to 23

21.49.4. More than 24

21.50. Rest of Asia Pacific Market, by System

21.50.1. Discrete

21.50.2. Continuous

21.51. Rest of Asia Pacific Market Size & Forecast, by Valve Actuation

21.51.1. Type I

21.51.2. Type II

21.51.3. Type III

21.51.4. Type IV

21.51.5. Type V

21.52. Rest of Asia Pacific Market, by Valve Train

21.52.1. Single Overhead Cam (SOHC)

21.52.2. Double Overhead Cam (DOHC)

21.52.3. Over Head Valve (OHV)

21.53. Rest of Asia Pacific Market Size & Forecast, by Sales Channel

21.53.1. OEM

21.53.2. Aftermarket

21.54. Rest of Asia Pacific Market Size & Forecast, by Vehicle Type

21.54.1. Passenger Vehicle

21.54.2. Commercial Vehicle

21.54.2.1. LCV

21.54.2.2. HCV

21.54.3. Electric Vehicle

21.54.3.1. HEV

21.54.3.2. PHEV

21.55. Comparison Matrix

21.55.1. By Fuel Type

21.55.2. By Methods

21.55.3. By Technology

21.55.4. By Valve Train

21.55.5. By Valve Actuation Type

21.55.6. By Number of Valves

21.55.7. By System

21.55.8. By Sales Channel

21.55.9. By Vehicle

21.56. PEST Analysis

22. Middle East & Africa Automotive VVT System Market Size and Forecast (Units) (US$ Mn), 2017–2026

22.1. Key Findings

22.2. Middle East & Africa Market, by Fuel Type

22.2.1. Gasoline

22.2.2. Diesel

22.3. Middle East & Africa Market, by Method

22.3.1. Cam Phasing

22.3.2. Cam Changing

22.3.3. Cam Phasing + Changing

22.3.4. Variable Valve Actuation

22.4. Middle East & Africa Market Size & Forecast, by Technology

22.4.1. VVT-i

22.4.2. Dual VVT-i

22.4.3. VVT-iE

22.4.4. VVT-iW

22.5. Middle East & Africa Market, by Number of Valves

22.5.1. Less Than 12

22.5.2. 16

22.5.3. Between 17 to 23

22.5.4. More than 24

22.6. Middle East & Africa Market, by System

22.6.1. Discrete

22.6.2. Continuous

22.7. Middle East & Africa Market, by Valve Actuation

22.7.1. Type I

22.7.2. Type II

22.7.3. Type III

22.7.4. Type IV

22.7.5. Type V

22.8. Middle East & Africa Market, by Valve Train

22.8.1. Single Overhead Cam (SOHC)

22.8.2. Double Overhead Cam (DOHC)

22.8.3. Over Head Valve (OHV)

22.9. Middle East & Africa Market, by Sales Channel

22.9.1. OEM

22.9.2. Aftermarket

22.10. Middle East & Africa Market, by Vehicle Type

22.10.1. Passenger Vehicle

22.10.2. Commercial Vehicle

22.10.2.1. LCV

22.10.2.2. HCV

22.10.3. Electric Vehicle

22.10.3.1. HEV

22.10.3.2. PHEV

22.11. GCC Market Size & Forecast, by Fuel Type

22.11.1. Gasoline

22.11.2. Diesel

22.12. GCC Market Size & Forecast, by Method

22.12.1. Cam Phasing

22.12.2. Cam Changing

22.12.3. Cam Phasing + Changing

22.12.4. Variable Valve Actuation

22.13. GCC Market Size & Forecast, by Technology

22.13.1. VVT-i

22.13.2. Dual VVT-i

22.13.3. VVT-iE

22.13.4. VVT-iW

22.14. GCC Market Size & Forecast, by Number of Valves

22.14.1. Less Than 12

22.14.2. 16

22.14.3. Between 17 to 23

22.14.4. More than 24

22.15. GCC Market, by System

22.15.1. Discrete

22.15.2. Continuous

22.16. GCC Market Size & Forecast, by Valve Actuation

22.16.1. Type I

22.16.2. Type II

22.16.3. Type III

22.16.4. Type IV

22.16.5. Type V

22.17. GCC Market, by Valve Train

22.17.1. Single Overhead Cam (SOHC)

22.17.2. Double Overhead Cam (DOHC)

22.17.3. Over Head Valve (OHV)

22.18. GCC Market Size & Forecast, by Sales Channel

22.18.1. OEM

22.18.2. Aftermarket

22.19. GCC Market Size & Forecast, by Vehicle Type

22.19.1. Passenger Vehicle

22.19.2. Commercial Vehicle

22.19.2.1. LCV

22.19.2.2. HCV

22.19.3. Electric Vehicle

22.19.3.1. HEV

22.19.3.2. PHEV

22.20. South Africa Market Size & Forecast, by Fuel Type

22.20.1. Gasoline

22.20.2. Diesel

22.21. South Africa Market Size & Forecast, by Method

22.21.1. Cam Phasing

22.21.2. Cam Changing

22.21.3. Cam Phasing + Changing

22.21.4. Variable Valve Actuation

22.22. South Africa Market Size & Forecast, by Technology

22.22.1. VVT-i

22.22.2. Dual VVT-i

22.22.3. VVT-iE

22.22.4. VVT-iW

22.23. South Africa Market Size & Forecast, by Number of Valves

22.23.1. Less Than 12

22.23.2. 16

22.23.3. Between 17 to 23

22.23.4. More than 24

22.24. South Africa Market, by System

22.24.1. Discrete

22.24.2. Continuous

22.25. South Africa Market Size & Forecast, by Valve Actuation

22.25.1. Type I

22.25.2. Type II

22.25.3. Type III

22.25.4. Type IV

22.25.5. Type V

22.26. South Africa Market, by Valve Train

22.26.1. Single Overhead Cam (SOHC)

22.26.2. Double Overhead Cam (DOHC)

22.26.3. Over Head Valve (OHV)

22.27. South Africa Market Size & Forecast, by Sales Channel

22.27.1. OEM

22.27.2. Aftermarket

22.28. South Africa Market Size & Forecast, by Vehicle Type

22.28.1. Passenger Vehicle

22.28.2. Commercial Vehicle

22.28.2.1. LCV

22.28.2.2. HCV

22.28.3. Electric Vehicle

22.28.3.1. HEV

22.28.3.2. PHEV

22.29. Rest of Middle East & Africa Market Size & Forecast, by Fuel Type

22.29.1. Gasoline

22.29.2. Diesel

22.30. Rest of Middle East & Africa Market Size & Forecast, by Method

22.30.1. Cam Phasing

22.30.2. Cam Changing

22.30.3. Cam Phasing + Changing

22.30.4. Variable Valve Actuation

22.31. Rest of Middle East & Africa Market Size & Forecast, by Technology

22.31.1. VVT-i

22.31.2. Dual VVT-i

22.31.3. VVT-iE

22.31.4. VVT-iW

22.32. Rest of Middle East & Africa Market Size & Forecast, by Number of Valves

22.32.1. Less Than 12

22.32.2. 16

22.32.3. Between 17 to 23

22.32.4. More than 24

22.33. Rest of Middle Ease & Africa Market, by System

22.33.1. Discrete

22.33.2. Continuous

22.34. Rest of Middle East & Africa Market Size & Forecast, by Valve Actuation

22.34.1. Type I

22.34.2. Type II

22.34.3. Type III

22.34.4. Type IV

22.34.5. Type V

22.35. Rest of Middle East & Africa Market, by Valve Train

22.35.1. Single Overhead Cam (SOHC)

22.35.2. Double Overhead Cam (DOHC)

22.35.3. Over Head Valve (OHV)

22.36. Rest of Middle East & Africa Market Size & Forecast, by Sales Channel

22.36.1. OEM

22.36.2. Aftermarket

22.37. Rest of Middle East & Africa Market Size & Forecast, by Vehicle Type

22.37.1. Passenger Vehicle

22.37.2. Commercial Vehicle

22.37.2.1. LCV

22.37.2.2. HCV

22.37.3. Electric Vehicle

22.37.3.1. HEV

22.37.3.2. PHEV

22.38. Comparison Matrix

22.38.1. By Fuel Type

22.38.2. By Methods

22.38.3. By Technology

22.38.4. By Valve Train

22.38.5. By Valve Actuation Type

22.38.6. By Number of Valve

22.38.7. By System

22.38.8. By Sales Channel

22.38.9. By Vehicle

22.39. PEST Analysis

23. Company Profiles

23.1. Competitive Landscape (by Tier & Size of Company)

23.2. Company Financials

23.3. Manufacturing Footprint

23.4. Key Executive Matrix

23.5. Executive Bios/ Business expansion/ Key executive changes

23.5.1. Schaeffler AG

23.5.1.1. Company Overview

23.5.1.2. Financial Overview

23.5.1.3. Business Strategy

23.5.1.4. Recent Developments

23.5.2. BorgWarner Inc.

23.5.2.1. Company Overview

23.5.2.2. Financial Overview

23.5.2.3. Business Strategy

23.5.2.4. Recent Developments

23.5.3. AISIN SEIKI

23.5.3.1. Company Overview

23.5.3.2. Financial Overview

23.5.3.3. Business Strategy

23.5.3.4. Recent Developments

23.5.4. Robert Bosch GmbH

23.5.4.1. Company Overview

23.5.4.2. Financial Overview

23.5.4.3. Business Strategy

23.5.4.4. Recent Developments

23.5.5. Camcraft

23.5.5.1. Company Overview

23.5.5.2. Financial Overview

23.5.5.3. Business Strategy

23.5.5.4. Recent Developments

23.5.6. Toyota Motor Corporation

23.5.6.1. Company Overview

23.5.6.2. Financial Overview

23.5.6.3. Business Strategy

23.5.6.4. Recent Developments

23.5.7. Honda Motor Co., Ltd.

23.5.7.1. Company Overview

23.5.7.2. Financial Overview

23.5.7.3. Business Strategy

23.5.7.4. Recent Developments

23.5.8. Federal-Mogul LLC

23.5.8.1. Company Overview

23.5.8.2. Financial Overview

23.5.8.3. Business Strategy

23.5.8.4. Recent Developments

23.5.9. Eaton Corporation

23.5.9.1. Company Overview

23.5.9.2. Financial Overview

23.5.9.3. Business Strategy

23.5.9.4. Recent Developments

23.5.10. Johnson Controls, Inc.

23.5.10.1. Company Overview

23.5.10.2. Financial Overview

23.5.10.3. Business Strategy

23.5.10.4. Recent Developments

23.5.11. Mikuni American Corporation

23.5.11.1. Company Overview

23.5.11.2. Financial Overview

23.5.11.3. Business Strategy

23.5.11.4. Recent Developments

23.5.12. Mitsubishi Electric Corporation

23.5.12.1. Company Overview

23.5.12.2. Financial Overview

23.5.12.3. Business Strategy

23.5.12.4. Recent Developments

23.5.13. Hitachi Automotive Systems

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Business Strategy

15.3.13.4. Recent Developments

23.5.14. DENSO Corporation

15.3.13.5. Company Overview

15.3.13.6. Financial Overview

15.3.13.7. Business Strategy

15.3.13.8. Recent Developments

24. Primary Key Insights

List of Tables

Table 1: Global Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 2: Global Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 3: Global Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 4: Global Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 5: Global Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 6: Global Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 7: Global Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 8: Global Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 9: Global Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 10: Global Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 11: Global Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 12: Global Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 13: Global Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 14: Global Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 15: Global Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 16: Global Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 17: Global Automotive VVT System Market Volume (Million Units) and Forecast, by Sales Channel, 2017–2026

Table 18: Global Automotive VVT System Market Size (US$ Mn) and Forecast, by Sales Channel, 2017–2026

Table 19: Global Automotive VVT System Market Revenue (US$ Mn) Forecast, by Region, 2017–2026

Table 20: Global Automotive VVT System Volume (million units) Forecast, by Region, 2017–2026

Table 21: North America Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 22: North America Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 23: North America Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 24: North America Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 25: North America Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 26: North America Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 27: North America Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 28: North America Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 29: North America Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 30: North America Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 31: North America Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 32: North America Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 33: North America Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 34: North America Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 35: North America Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 36: North America Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 37: North America Automotive VVT System Market Volume (Million Units) and Forecast, by Sales Channel, 2017–2026

Table 38: North America Automotive VVT System Market Size (US$ Mn) and Forecast, by Sales Channel, 2017–2026

Table 39: North America Automotive VVT System Market Size (US$ Mn) Forecast, by Country, 2017–2026

Table 40: North America Automotive VVT System Market Volume (Million Units) Forecast, by Country, 2017–2026

Table 41: U. S. Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 42: U. S. Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 43: U. S. Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 44: U. S. Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 45: U. S. Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 46: U. S. Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 47: U. S. Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 48: U. S. Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 49: U. S. Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 50: U. S. Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 51: U. S. Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 52: U. S. Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 53: U. S. Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 54: U. S. Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 55: U. S. Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 56: U. S. Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 57: Canada Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 58: Canada Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 59: Canada Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 60: Canada Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 61: Canada Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 62: Canada Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 63: Canada Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 64: Canada Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 65: Canada Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 66: Canada Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 67: Canada Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 68: Canada Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 69: Canada Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 70: Canada Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 71: Canada Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 72: Canada Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 73: Latin America Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 74: Latin America Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 75: Latin America Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 76: Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 77: Latin America Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 78: Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 79: Latin America Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 80: Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 81: Latin America Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 82: Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 83: Latin America Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 84: Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 85: Latin America Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 86: Latin America Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 87: Latin America Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 88: Latin America Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 89: Latin America Automotive VVT System Market Volume (Million Units) and Forecast, by Sales Channel, 2017–2026

Table 90: Latin America Automotive VVT System Market Size (US$ Mn) and Forecast, by Sales Channel, 2017–2026

Table 91: Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by Country, 2017–2026

Table 92: Latin America Automotive VVT System Market Volume (Million Units) Forecast, by Country, 2017–2026

Table 93: Brazil Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 94: Brazil Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 95: Brazil Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 96: Brazil Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 97: Brazil Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 98: Brazil Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 99: Brazil Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 100: Brazil Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 101: Brazil Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 102: Brazil Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 103: Brazil Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 104: Brazil Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 105: Brazil Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 106: Brazil Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 107: Brazil Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 108: Brazil Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 109: Mexico Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 110: Mexico Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 111: Mexico Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 112: Mexico Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 113: Mexico Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 114: Mexico Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 115: Mexico Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 116: Mexico Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 117: Mexico Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 118: Mexico Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 119: Mexico Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 120: Mexico Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 121: Mexico Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 122: Mexico Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 123: Mexico Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 124: Mexico Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 125: Rest of Latin America Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 126: Rest of Latin America Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 127: Rest of Latin America Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 128: Rest of Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 130: Rest of Latin America Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 131: Rest of Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 132: Rest of Latin America Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 133: Rest of Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 134: Rest of Latin America Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 135: Rest of Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 136: Rest of Latin America Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 137: Rest of Latin America Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 138: Rest of Latin America Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 139: Rest of Latin America Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 140: Rest of Latin America Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 141: Rest of Latin America Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 142: Europe Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 143: Europe Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 144: Europe Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 145: Europe Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 146: Europe Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 147: Europe Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 148: Europe Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 149: Europe Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 150: Europe Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 151: Europe Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 152: Europe Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 153: Europe Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 154: Europe Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 155: Europe Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 156: Europe Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 157: Europe Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 158: Europe Automotive VVT System Market Volume (Million Units) and Forecast, by Sales Channel, 2017–2026

Table 159: Europe Automotive VVT System Market Size (US$ Mn) and Forecast, by Sales Channel, 2017–2026

Table 160: Europe Automotive VVT System Market Size (US$ Mn) Forecast, by Country and Sub-regions, 2017–2026

Table 161: Europe Automotive VVT System Market Volume (Million Units) Forecast, by Country and Sub-regions, 2017–2026

Table 162: Germany Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 163: Germany Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 164: Germany Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 165: Germany Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 166: Germany Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 167: Germany Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 168: Germany Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 169: Germany Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 170: Germany Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 171: Germany Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 172: Germany Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 173: Germany Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 174: Germany Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 175: Germany Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 176: Germany Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 177: Germany Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 178: U. K. Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 179: U. K. Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 180: U. K. Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 181: U. K. Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 182: U. K. Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 183: U. K. Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 184: U. K. Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 185: U. K. Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 186: U. K. Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 187: U. K. Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 188: U. K. Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 189: U. K. Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 190: U. K. Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 191: U. K. Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 192: U. K. Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 193: U. K. Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 194: France Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 195: France Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 196: France Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 197: France Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 198: France Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 199: France Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 200: France Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 201: France Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 202: France Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 203: France Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 204: France Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 205: France Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 206: France Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 207: France Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 208: France Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 209: France Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 210: Italy Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 211: Italy Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 212: Italy Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 213: Italy Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 214: Italy Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 215: Italy Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 216: Italy Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 217: Italy Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 218: Italy Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 219: Italy Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 220: Italy Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 221: Italy Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 222: Italy Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 223: Italy Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 224: Italy Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 225: Italy Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 226: Spain Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 227: Spain Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 228: Spain Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 229: Spain Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 230: Spain Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 231: Spain Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 232: Spain Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 233: Spain Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 234: Spain Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 235: Spain Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 236: Spain Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 237: Spain Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 238: Spain Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 239: Spain Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 240: Spain Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 241: Spain Automotive VVT System Market Size (US$ Mn) and Forecast, by Vehicle Type, 2017–2026

Table 242: Rest of Europe Automotive VVT System Market Volume (Million Units) and Forecast, by Valve Train, 2017–2026

Table 243: Rest of Europe Automotive VVT System Market Size (US$ Mn) and Forecast, by Valve Train, 2017–2026

Table 244: Rest of Europe Automotive VVT System Market Volume (Million Units) Forecast, by Fuel Type, 2017–2026

Table 245: Rest of Europe Automotive VVT System Market Size (US$ Mn) Forecast, by Fuel Type, 2017–2026

Table 246: Rest of Europe Automotive VVT System Market Volume (Million Units) Forecast, by System Type, 2017–2026

Table 247: Rest of Europe Automotive VVT System Market Size (US$ Mn) Forecast, by System Type, 2017–2026

Table 248: Rest of Europe Automotive VVT System Market Volume (Million Units) Forecast, by Number of Valves, 2017–2026

Table 249: Rest of Europe Automotive VVT System Market Size (US$ Mn) Forecast, by Number of Valves, 2017–2026

Table 250: Rest of Europe Automotive VVT System Market Volume (Million Units) Forecast, by Technology, 2017–2026

Table 251: Rest of Europe Automotive VVT System Market Size (US$ Mn) Forecast, by Technology, 2017–2026

Table 252: Rest of Europe Automotive VVT System Market Volume (Million Units) Forecast, by Methods, 2017–2026

Table 253: Rest of Europe Automotive VVT System Market Size (US$ Mn) Forecast, by Methods, 2017–2026

Table 254: Rest of Europe Automotive VVT System Market Volume (Million Units) and Forecast, by Actuation Type, 2017–2026

Table 255: Rest of Europe Automotive VVT System Market Size (US$ Mn) and Forecast, by Actuation Type, 2017–2026

Table 256: Rest of Europe Automotive VVT System Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026