Reports

Reports

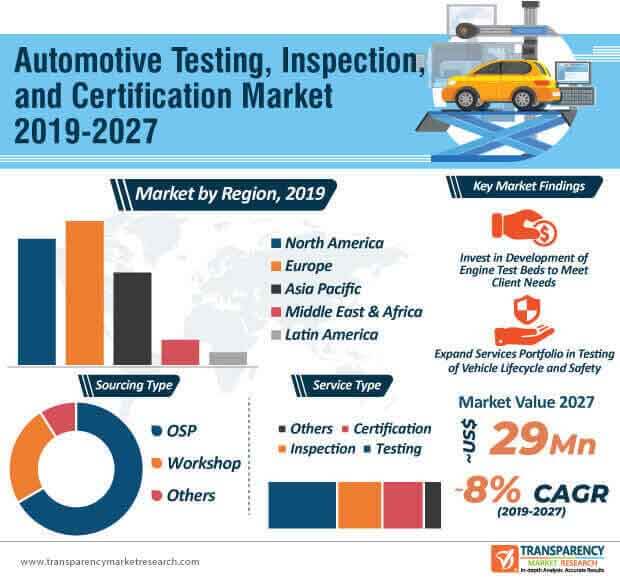

The concept of TIC (Testing, Inspection, and Certification) is gradually becoming commonplace due to increased awareness about environmental regulations. Companies in the automotive testing, inspection, and certification market are leveraging opportunities in government as well as in the leasing and fleet companies to generate new revenue streams. This explains why testing and certification services are projected for tremendous growth and the market for automotive testing, inspection, and certification is estimated to reach a value of ~US$ 29 Bn by 2027.

In order to capitalize on the demand for TIC services, companies are launching new laboratory buildings to expand their reach. For instance, Intertek Group Plc.- a leading Total Quality Assurance provider to industries worldwide, announced the launch of their new laboratory building in San Antonio, housing its transportation technologies services. Companies in the automotive testing, inspection, and certification market are exploring multiple services such as chemical testing, emissions testing, and mechanical testing for automotive components.

The projected increase in vehicle connectivity has fueled the demand for automotive testing, inspection, and certification services. The ever-evolving needs of occupants have led to advancements in wireless automotive technologies. Key drivers such as industry 4.0 and IoT are contributing toward the growth of the automotive testing, inspection, and certification market. Wireless communication technologies are playing a crucial role in the safety of occupants. Thus, growing consumer demands for automated and connected mobility solutions are resulting in exponential growth of the automotive testing, inspection, and certification market, which is anticipated to progress at a CAGR of ~8% during the forecast period.

Long range and short range applications of connected mobility solutions involve the global navigation satellite system and Near Field Communication (NFC). Hence, companies in the market for automotive testing, inspection, and certification are increasing their efficacy in industry-specific tests to focus on the functionality and efficiency of technologies. For instance, TÜV SÜD- a leading technical service corporation, is providing FCC (Federal Communications Commission) and GMA (Generic Multi-Access) (GMA) compliance for wireless and safety requirements.

The automotive testing, inspection, and certification market is largely fragmented, as eight leading players account for ~20% of the market stake. However, heavy regulations associated with wireless equipment in vehicles pose a barrier for market growth.

Since several different regulatory boards in the market for automotive testing, inspection, and certification are introducing regulations, it is difficult for carmakers to get their products certified from regulatory authorities. Big enterprises in the automotive testing, inspection, and certification market are suffering exorbitant costs in the pursuit of their certification and smaller new entrants are falling short on expertise in order to succeed in the highly competitive automotive industry. Hence, there is growing demand for establishment of a uniform global regulatory authority that streamlines certification requirements of carmakers.

It is crucial for new entrants in the market for automotive testing, inspection, and certification to gain industry-specific expertise in wireless technologies and other aspects associated with industry 4.0 in the coming years.

Strategic alliances of companies in the automotive testing, inspection, and certification market has led to the emergence of automated vehicle inspection. For instance, WeProov— an inspection mobile solution company, collaborated with the Bernard Group, one of the largest distributors of industry vehicles in France, to introduce their venture ProovStation to innovate in automated vehicle inspection services. As such, companies dealing in automated vehicle inspection services are tapping business expansion opportunities in France. This is evident, since the automotive testing, inspection, and certification market in Europe is estimated to witness significant growth in the near future.

Companies in the market for automotive testing, inspection, and certification are generating incremental opportunities through automated vehicle inspection services with the help of blockchain and AI technologies. Novel inspection services are being pervasively replaced by custom and time-efficient technological solutions. Companies are innovating in platforms that connect IT of vehicles with the API (Application Program Interface) of the novel software platforms.

Analysts’ Viewpoint

Ensuring safety and reliability in transportation services has become one of the key focus points for companies in the automotive testing, inspection, and certification market. In order to comply with strict environmental regulations, companies are increasing their efficacy in emissions testing for all-terrain vehicles (ATVs) and motorcycles, among others.

Several different regulations such as the Radio Equipment Directive (RED) in Europe and the Federal Communications Commission (FCC) in the U.S. have created ambiguity among companies resulting in revenue losses while pursuing certification of products. Hence, both leading and small-scale companies should specialize in extensive R&D of regulatory framework of different regions to comply with industry-ready technologies such as wireless connectivity, IoT, and AI.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Automotive Testing, Inspection, and Certification Market

3.1. Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn), 2018?2027

4. Market Overview

4.1. Introduction

4.2. Global Market: Macro Economic Factors

4.2.1. Market Definition

4.2.2. Key Industry Developments

4.3. Key Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. Porter’s Five Force Analysis

4.6. Value Chain Analysis

4.6.1. List of Key Manufacturers

4.6.2. List of Customers

4.6.3. Level of Integration

4.7. Regulatory Scenario

4.8. SWOT Analysis

5. Key Trend Analysis

5.1. Service Type/ Technology Trend

5.2. Industry Trend

6. Automotive Testing, Inspection, and Certification Market: Manufacturer’s Perspective

7. Global Automotive Testing, Inspection, and Certification Market: Outline Market

7.1. North America

7.2. Europe

7.3. Asia Pacific

7.4. Middle East and Africa

7.5. Latin America

8. Key Players Customers for Camshaft

8.1. Key Supplier

8.2. Who Supplies Whom

9. Service Type Portfolio/ Innovation for Camshaft

9.1. Key Supplier

9.2. Recent Development by key players

10. Global Automotive Testing, Inspection, and Certification Market Analysis and Forecast, by Service Type

10.1. Introduction & Definition

10.2. Market Growth & Y-O-Y projection

10.3. Basis Point Share (BPS) Analysis

10.4. Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018?2027

10.4.1. Testing

10.4.2. Inspection

10.4.3. Certification

10.4.4. Others

10.5. Global Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Service Type

11. Global Automotive Testing, Inspection, and Certification Market Analysis and Forecast, by Sourcing Type

11.1. Introduction & Definition

11.2. Market Growth & Y-O-Y projection

11.3. Basis Point Share (BPS) Analysis

11.4. Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018?2027

11.4.1. OSP

11.4.2. Workshop

11.4.3. Others

11.5. Global Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Sourcing Type

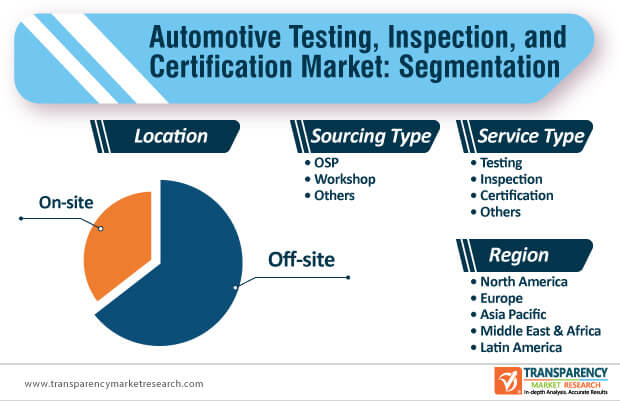

12. Global Automotive Testing, Inspection, and Certification Market Analysis and Forecast, by Location

12.1. Introduction & Definition

12.2. Market Growth & Y-O-Y projection

12.3. Basis Point Share (BPS) Analysis

12.4. Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018?2027

12.4.1. Off-site

12.4.2. On-site

12.5. Global Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Location

13. Global Automotive Testing, Inspection, and Certification Market Analysis and Forecast, by Region

13.1. Market Growth & Y-O-Y projection

13.2. Basis Point Share (BPS) Analysis

13.3. Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Region, 2018?2027

13.3.1. North America

13.3.2. Latin America

13.3.3. Europe

13.3.4. Asia Pacific

13.3.5. Middle East & Africa

13.4. Global Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Region

14. North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018?2027

14.1. Key Findings

14.2. Market Snapshot

14.3. North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

14.3.1. Testing

14.3.2. Inspection

14.3.3. Certification

14.3.4. Others

14.4. North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

14.4.1. OSP

14.4.2. Workshop

14.4.3. Others

14.5. North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

14.5.1. Off-site

14.5.2. On-site

14.6. North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country

14.6.1. U.S.

14.6.2. Canada

14.7. U.S. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

14.7.1. Testing

14.7.2. Inspection

14.7.3. Certification

14.7.4. Others

14.8. U.S. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

14.8.1. OSP

14.8.2. Workshop

14.8.3. Others

14.9. U.S. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

14.9.1. Off-site

14.9.2. On-site

14.10. Canada Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

14.10.1. Testing

14.10.2. Inspection

14.10.3. Certification

14.10.4. Others

14.11. Canada Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

14.11.1. OSP

14.11.2. Workshop

14.11.3. Others

14.12. Canada Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

14.12.1. Off-site

14.12.2. On-site

15. Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018?2027

15.1. Key Findings

15.2. Market Snapshot

15.3. Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

15.3.1. Testing

15.3.2. Inspection

15.3.3. Certification

15.3.4. Others

15.4. Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

15.4.1. OSP

15.4.2. Workshop

15.4.3. Others

15.5. Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

15.5.1. Off-site

15.5.2. On-site

15.6. Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country and Sub-region

15.6.1. Germany

15.6.2. U.K.

15.6.3. France

15.6.4. Italy

15.6.5. Spain

15.6.6. Rest of Europe

15.7. Germany Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

15.7.1. Testing

15.7.2. Inspection

15.7.3. Certification

15.7.4. Others

15.8. Germany Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

15.8.1. OSP

15.8.2. Workshop

15.8.3. Others

15.9. Germany Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

15.9.1. Off-site

15.9.2. On-site

15.10. U.K. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

15.10.1. Testing

15.10.2. Inspection

15.10.3. Certification

15.10.4. Others

15.11. U.K. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

15.11.1. OSP

15.11.2. Workshop

15.11.3. Others

15.12. U.K. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

15.12.1. Off-site

15.12.2. On-site

15.13. France Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

15.13.1. Testing

15.13.2. Inspection

15.13.3. Certification

15.13.4. Others

15.14. France Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

15.14.1. OSP

15.14.2. Workshop

15.14.3. Others

15.15. France Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

15.15.1. Off-site

15.15.2. On-site

15.16. Italy Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

15.16.1. Testing

15.16.2. Inspection

15.16.3. Certification

15.16.4. Others

15.17. Italy Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

15.17.1. OSP

15.17.2. Workshop

15.17.3. Others

15.18. Italy Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

15.18.1. Off-site

15.18.2. On-site

15.19. Spain Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

15.19.1. Testing

15.19.2. Inspection

15.19.3. Certification

15.19.4. Others

15.20. Spain Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

15.20.1. OSP

15.20.2. Workshop

15.20.3. Others

15.21. Spain Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

15.21.1. Off-site

15.21.2. On-site

15.22. Rest of Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

15.22.1. Testing

15.22.2. Inspection

15.22.3. Certification

15.22.4. Others

15.23. Rest of Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

15.23.1. OSP

15.23.2. Workshop

15.23.3. Others

15.24. Rest of Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

15.24.1. Off-site

15.24.2. On-site

16. Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018?2027

16.1. Key Findings

16.2. Market Snapshot

16.3. Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

16.3.1. Testing

16.3.2. Inspection

16.3.3. Certification

16.3.4. Others

16.4. Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

16.4.1. OSP

16.4.2. Workshop

16.4.3. Others

16.5. Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

16.5.1. Off-site

16.5.2. On-site

16.6. Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country

16.6.1. China

16.6.2. India

16.6.3. Japan

16.6.4. ASEAN

16.6.5. Rest of Asia Pacific

16.7. China Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

16.7.1. Testing

16.7.2. Inspection

16.7.3. Certification

16.7.4. Others

16.8. China Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

16.8.1. OSP

16.8.2. Workshop

16.8.3. Others

16.9. China Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

16.9.1. Off-site

16.9.2. On-site

16.10. India Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

16.10.1. Testing

16.10.2. Inspection

16.10.3. Certification

16.10.4. Others

16.11. India Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

16.11.1. OSP

16.11.2. Workshop

16.11.3. Others

16.12. India Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

16.12.1. Off-site

16.12.2. On-site

16.13. Japan Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

16.13.1. Testing

16.13.2. Inspection

16.13.3. Certification

16.13.4. Others

16.14. Japan Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

16.14.1. OSP

16.14.2. Workshop

16.14.3. Others

16.15. Japan Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

16.15.1. Off-site

16.15.2. On-site

16.16. ASEAN Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

16.16.1. Testing

16.16.2. Inspection

16.16.3. Certification

16.16.4. Others

16.17. ASEAN Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

16.17.1. OSP

16.17.2. Workshop

16.17.3. Others

16.18. ASEAN Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

16.18.1. Off-site

16.18.2. On-site

16.19. Rest of Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

16.19.1. Testing

16.19.2. Inspection

16.19.3. Certification

16.19.4. Others

16.20. Rest of Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

16.20.1. OSP

16.20.2. Workshop

16.20.3. Others

16.21. Rest of Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

16.21.1. Off-site

16.21.2. On-site

17. Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018?2027

17.1. Key Findings

17.2. Market Snapshot

17.3. Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

17.3.1. Testing

17.3.2. Inspection

17.3.3. Certification

17.3.4. Others

17.4. Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

17.4.1. OSP

17.4.2. Workshop

17.4.3. Others

17.5. Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

17.5.1. Off-site

17.5.2. On-site

17.6. Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country and Sub-region

17.6.1. GCC

17.6.2. South Africa

17.6.3. Rest of Middle East & Africa

17.7. GCC Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

17.7.1. Testing

17.7.2. Inspection

17.7.3. Certification

17.7.4. Others

17.8. GCC Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

17.8.1. OSP

17.8.2. Workshop

17.8.3. Others

17.9. GCC Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

17.9.1. Off-site

17.9.2. On-site

17.10. South Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

17.10.1. Testing

17.10.2. Inspection

17.10.3. Certification

17.10.4. Others

17.11. South Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

17.11.1. OSP

17.11.2. Workshop

17.11.3. Others

17.12. South Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

17.12.1. Off-site

17.12.2. On-site

17.13. Rest of Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

17.13.1. Testing

17.13.2. Inspection

17.13.3. Certification

17.13.4. Others

17.14. Rest of Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

17.14.1. OSP

17.14.2. Workshop

17.14.3. Others

17.15. Rest of Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

17.15.1. Off-site

17.15.2. On-site

18. Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018?2027

18.1. Key Findings

18.2. Market Snapshot

18.3. Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

18.3.1. Testing

18.3.2. Inspection

18.3.3. Certification

18.3.4. Others

18.4. Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

18.4.1. OSP

18.4.2. Workshop

18.4.3. Others

18.5. Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

18.5.1. Off-site

18.5.2. On-site

18.6. Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country and Sub-region

18.6.1. Brazil

18.6.2. Mexico

18.6.3. Rest of Latin America

18.7. Brazil Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Types

18.7.1. Testing

18.7.2. Inspection

18.7.3. Certification

18.7.4. Others

18.8. Brazil Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

18.8.1. OSP

18.8.2. Workshop

18.8.3. Electric Vehicle

18.9. Brazil Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

18.9.1. Off-site

18.9.2. On-site

18.10. Mexico Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

18.10.1. Testing

18.10.2. Inspection

18.10.3. Certification

18.10.4. Others

18.11. Mexico Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

18.11.1. OSP

18.11.2. Workshop

18.11.3. Others

18.12. Mexico Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

18.12.1. Off-site

18.12.2. On-site

18.13. Rest of Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type

18.13.1. Testing

18.13.2. Inspection

18.13.3. Certification

18.13.4. Others

18.14. Rest of Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type

18.14.1. OSP

18.14.2. Workshop

18.14.3. Others

18.15. Rest of Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location

18.15.1. Off-site

18.15.2. On-site

19. Competition Landscape

19.1. Market Share Analysis, by Company (2018)

19.2. Market Player Competition Matrix (By Tier and Size of the Company)

19.3. Company Financials

19.4. Executive Bios/ Business expansion/ Key executive changes

19.5. Manufacturing Footprint

19.6. Service Type Innovation

19.7. Key Market Players / Potential Players (Details – Overview, Overall Revenue, Recent Developments, Strategy)

19.7.1. SGS SA

19.7.1.1. Overview

19.7.1.2. Overall Revenue

19.7.1.3. Recent Developments

19.7.1.4. Strategy

19.7.2. Bureau Veritas

19.7.2.1. Overview

19.7.2.2. Overall Revenue

19.7.2.3. Recent Developments

19.7.2.4. Strategy

19.7.3. DEKRA

19.7.3.1. Overview

19.7.3.2. Overall Revenue

19.7.3.3. Recent Developments

19.7.3.4. Strategy

19.7.4. Intertek Group Plc.

19.7.4.1. Overview

19.7.4.2. Overall Revenue

19.7.4.3. Recent Developments

19.7.4.4. Strategy

19.7.5. TUV SUD

19.7.5.1. Overview

19.7.5.2. Overall Revenue

19.7.5.3. Recent Developments

19.7.5.4. Strategy

19.7.6. DNV GL

19.7.6.1. Overview

19.7.6.2. Overall Revenue

19.7.6.3. Recent Developments

19.7.6.4. Strategy

19.7.7. TUV Rheinland

19.7.7.1. Overview

19.7.7.2. Overall Revenue

19.7.7.3. Recent Developments

19.7.7.4. Strategy

19.7.8. Applus+

19.7.8.1. Overview

19.7.8.2. Overall Revenue

19.7.8.3. Recent Developments

19.7.8.4. Strategy

19.7.9. ALS Limited

19.7.9.1. Overview

19.7.9.2. Overall Revenue

19.7.9.3. Recent Developments

19.7.9.4. Strategy

19.7.10. TUV NORD GROUP

19.7.10.1. Overview

19.7.10.2. Overall Revenue

19.7.10.3. Recent Developments

19.7.10.4. Strategy

19.7.11. MISTRAS Group, Inc.

19.7.11.1. Overview

19.7.11.2. Overall Revenue

19.7.11.3. Recent Developments

19.7.11.4. Strategy

List of Tables

Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 2: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 3: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 4: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Region, 2018–2027

Table 8: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 5: North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 6: North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 7: North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 8: North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country, 2018–2027

Table 9: U.S. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 10: U.S. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 11: U.S. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 12: Canada Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 13: Canada. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 14: Canada. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 15: Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 16: Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 17: Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 18: Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country and Sub-regions, 2018–2027

Table 19: Germany Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 20: Germany Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 21: Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 22: U.K. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 23: U.K. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 24: U.K. Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 25: France Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 26: France Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 27: France Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 28: Italy Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 29: Italy Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 30: Italy Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 31: Spain Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 32: Spain Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 33: Spain Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 34: Rest of Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 35: Rest of Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 36: Rest of Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 37: Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 38: Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 39: Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 40: Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country and Sub-regions, 2018–2027

Table 41: China Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 42: China Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 43: China Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 44: India Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 45: India Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 46: India Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 47: Japan Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 48: Japan Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 49: Japan Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 50: ASEAN Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 51: Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 52: ASEAN Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 53: Rest of Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 54: Rest of Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 55: Rest of Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 56: Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 57: Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 58: Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 59: Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country and Sub-regions, 2018–2027

Table 60: GCC Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 61: GCC Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 62: GCC Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 63: South Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 64: South Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 65: South Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 66: Rest of MEA Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 67: Rest of MEA Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 68: Rest of MEA Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 69: Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 70: Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 71: Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 72: Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Country and Sub-regions, 2018–2027

Table 73: Mexico Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 74: Mexico Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 75: Mexico Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 76: Brazil Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 77: Brazil Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 78: Brazil Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 79: Rest of Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Service Type, 2018–2027

Table 80: Rest of Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Location, 2018–2027

Table 81: Rest of Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Sourcing Type, 2018–2027

Table 82: Product Mapping

List of Figures

Figure 1: Global Automotive Testing, Inspection, and Certification Market Snapshot

Figure 2: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018–2027

Figure 3: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018–2027

Figure 4: Global Automotive Testing, Inspection, and Certification Market, Y-o-Y Growth (%), 2018–2027

Figure 5: Global Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 6: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Testing, 2018–2027

Figure 7: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Inspection, 2018–2027

Figure 8: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Certification, 2018–2027

Figure 9: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Others, 2018–2027

Figure 10: Global Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Service Type

Figure 11: Global Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Location, 2018 and 2027

Figure 12: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Off-site, 2018–2027

Figure 13: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by On-site, 2018–2027

Figure 14: Global Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Location

Figure 15: Global Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Sourcing Type, 2018 and 2027

Figure 16: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by OSP, 2018–2027

Figure 17: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Workshop, 2018–2027

Figure 18: Global Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, by Others, 2018–2027

Figure 19: Global Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 20: Global Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Region, 2018 and 2027

Figure 21: Global Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Region

Figure 22: North America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018–2027

Figure 23: North America Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Country

Figure 24: North America Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 25: North America Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Location, 2018 and 2027

Figure 26: North America Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Sourcing Type, 2018 and 2027

Figure 27: North America Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Country, 2018 and 2027

Figure 28: North America Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Service Type

Figure 29: North America Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Location

Figure 30: North America Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 31: Europe Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018–2027

Figure 32: Europe Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Country and Sub-region

Figure 33: Europe Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 34: Europe Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Location, 2018 and 2027

Figure 35: Europe Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Sourcing Type, 2018 and 2027

Figure 36: Europe Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 37: Europe Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Service Type

Figure 38: Europe Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Location

Figure 39: Europe Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 40: Asia Pacific Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018–2027

Figure 41: Asia Pacific Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Country and Sub-regions

Figure 42: Asia Pacific Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 43: Asia Pacific Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Location, 2018 and 2027

Figure 44: Asia Pacific Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Sourcing Type, 2018 and 2027

Figure 45: Asia Pacific Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Country and Sub-regions, 2018 and 2027

Figure 46: Asia Pacific Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Service Type

Figure 47: Asia Pacific Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Location

Figure 48: Asia Pacific Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 49: Middle East & Africa Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018–2027

Figure 50: Middle East & Africa Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Country and Sub-regions

Figure 51: Europe Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 52: Middle East & Africa Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Location, 2018 and 2027

Figure 53: Middle East & Africa Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Sourcing Type, 2018 and 2027

Figure 54: Middle East & Africa Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Country and Sub-regions, 2018 and 2027

Figure 55: Middle East and Africa Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Service Type

Figure 56: Middle East and Africa Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Service Type

Figure 57: Middle East & Africa Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 58: Latin America Automotive Testing, Inspection, and Certification Market Value (US$ Mn) Forecast, 2018–2027

Figure 59: Latin America Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Country and Sub-regions

Figure 60: Latin America Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 61: Latin America Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Location, 2018 and 2027

Figure 62: Latin America Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Sourcing Type, 2018 and 2027

Figure 63: Latin America Automotive Testing, Inspection, and Certification Market Value Share Analysis, by Country and Sub-regions, 2018 and 2027

Figure 64: Latin America Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Service Type

Figure 65: Latin America Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Location

Figure 66: Latin America Automotive Testing, Inspection, and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 67: Global Automotive Testing, Inspection, and Certification Market Share Analysis, by Company (2018)

Figure 68: Competition Matrix (1/2)

Figure 69: Competition Matrix (2/2)