Reports

Reports

The automotive sector has evolved at a rapid pace over the past couple of decades, owing to technological advancements and continual innovations. Automotive transmission systems have also witnessed a fair share of development in recent times. For instance, significant improvement in speed number, widening ratio spread, and enhanced efficiency & shift quality are some of the major areas wherein advancements have occurred in the automotive transmission systems sphere. In recent years, the automotive sector is gradually moving toward electrification due to stringent legislations and guidelines pertaining to vehicle emission. The global demand for passenger vehicles, heavy commercial vehicles, and light commercial vehicles has experienced a steady growth over the past few years. However, the demand in 2020 has witnessed an unforeseen decline due to the COVID-19 pandemic.

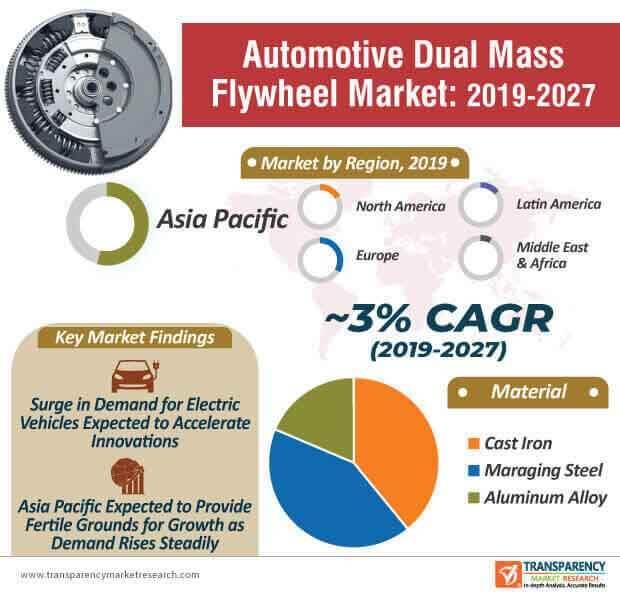

The automotive industry in major developing countries including India and China are expected to witness a modest growth over the next couple of years. The growth rate of the global automotive dual mass flywheel market is expected to take a hit in 2020. However, as the market will start to recover in the latter half of the forecast period, market players should focus on tapping into abundant opportunities in the Asia Pacific region. At the back of these factors, along with the speculated rise in the demand for automotive vehicles, the global automotive dual mass flywheel is expected to attain a market value of ~US$ 8 Bn by the end of 2030.

Market players in the current automotive dual mass flywheel market are expected to take into account the evolving landscape of the automotive sector and align their product development operations with modern-day industrial requirements. In the current scenario, automotive dual mass flywheels play an imperative role in minimizing vibration, reducing noise reduction within the automotive powertrain, addressing challenges associated with engine knocking, and enhancing the overall smoothness of the shift, among others. At present, theoretical and experimental research activities within the automotive dual mass flywheel market are on the rise and the focus is on gaining insights pertaining to the torsional performance of the dual mass flywheel market during the forecast period. Several studies are emphasizing on the effect of automotive dual mass flywheels on the overall performance of torsional vibration in hybrid electric vehicles.

Recent research activities are increasingly investigating the potential of motor torque control techniques to minimize torsional vibration. Market players operating in the current automotive dual mass flywheel market are also focusing on automotive dual mass flywheel dynamics modeling.

As the automotive sector continues to make a gradual transition toward hybrid and electric vehicles, participants of the global automotive dual mass flywheel market are expected to roll out flywheels that are in tune with the demands of automotive transmission systems of hybrid and electric vehicles. Companies operating in the current market landscape are increasingly deploying resources to improve the noise vibration and harshness (NVH), shifting, and control technology of electric vehicles. In addition, companies are also focused on addressing the existing challenges in automotive transmission, including noise reduction wherein clunking, rattling, whining, bearing, and shifting are the main sound types. The demand for automotive dual mass flywheel is on the rise, particularly from automotive manufacturers to minimize fluctuation between the transmission system and engine. As shifting strategies and control technologies continue to mature, owing to technological advancements, they are likely to accelerate innovations during the forecast period.

With the advent of the COVID-19 pandemic, market players are expected to focus on marketing their products on digital platforms to enhance their brand visibility. Furthermore, market players should are also expected to collaborate with regional market leaders to improve their market share. While inorganic growth strategies are likely to gain significant traction, companies should assess the repercussions of the COVID-19 pandemic on their business structure and formulate effective strategies to stay relevant in the current market landscape. The growing demand from automotive manufacturers is likely to remain the key for the development of global automotive dual mass flywheel market in the coming years.

Analysts’ Viewpoint

The global automotive dual mass flywheel market is expected to grow at a modest CAGR of ~3% during the forecast period. The market growth can be primarily attributed to the surge in demand for automotive vehicles worldwide, technological advancements, and growing focus on minimizing torsional vibration in automotive transmission systems. Market players should focus on improving their brand visibility by leaning on digital marketing strategies and inorganic growth strategies, including mergers and acquisitions.

1. Preface

1.1. Market Definition and Scope

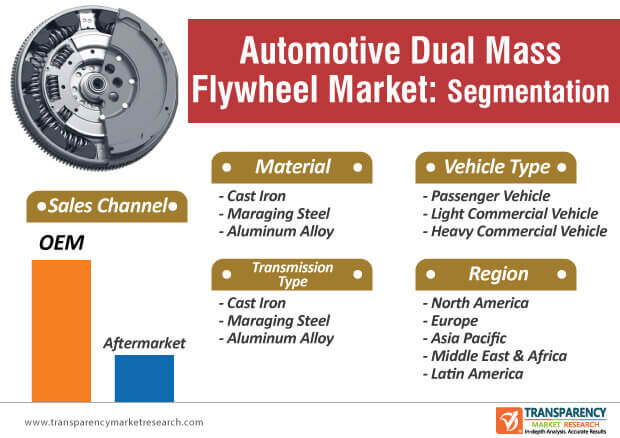

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Automotive Dual Mass Flywheel Market

3.1. Global Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn), 2019?2030

4. Market Overview

4.1. Introduction

4.2. Global Market: Macro Economic Factors

4.2.1. Market Definition

4.2.2. Key Industry Developments

4.3. Key Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. Porter’s Five Force Analysis

4.6. Value Chain Analysis

4.6.1. List of Key Manufacturers

4.6.2. List of Customers

4.6.3. Level of Integration

4.7. Regulatory Scenario

4.8. SWOT Analysis

5. Global Snapshot:

5.1. Matured/ Key Countries

5.2. Emerging Countries

6. Automotive Dual Mass Flywheel Market: Technology Roadmap

7. Key Trend Analysis

7.1. Vehicle Type/ Technology Trend

7.2. Industry Trend

8. Automotive Dual Mass Flywheel Market: Manufacturer’s Perspective

9. Global Automotive Dual Mass Flywheel Market: Outline Market

9.1. North America

9.2. Europe

9.3. Asia Pacific

9.4. Middle East & Africa

9.5. Latin America

10. Global Automotive Dual Mass Flywheel Market Analysis and Forecast, by Transmission Type

10.1. Introduction & Definition

10.2. Market Growth & Y-O-Y projection

10.3. Basis Point Share (BPS) Analysis

10.4. Global Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type, 2019?2030

10.4.1. Manual

10.4.2. Semi-automatic

10.4.3. Automatic

10.5. Global Automotive Dual Mass Flywheel Market Attractiveness Analysis, by Transmission Type

11. Global Automotive Dual Mass Flywheel Market Analysis and Forecast, by Material

11.1. Introduction & Definition

11.2. Market Growth & Y-O-Y projection

11.3. Basis Point Share (BPS) Analysis

11.4. Global Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material, 2019?2030

11.4.1. Cast Iron

11.4.2. Maraging Steel

11.4.3. Aluminum Alloys

11.5. Global Automotive Dual Mass Flywheel Market Attractiveness Analysis, by Material

12. Global Automotive Dual Mass Flywheel Market Analysis and Forecast, by Vehicle Type

12.1. Introduction & Definition

12.2. Market Growth & Y-O-Y projection

12.3. Basis Point Share (BPS) Analysis

12.4. Global Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type, 2019?2030

12.4.1. Passenger Vehicle

12.4.2. Light Commercial Vehicle

12.4.3. Heavy Commercial Vehicle

12.5. Global Automotive Dual Mass Flywheel Market Attractiveness Analysis, by Vehicle Type

13. Global Automotive Dual Mass Flywheel Market Analysis and Forecast, by Sales Channel

13.1. Introduction & Definition

13.2. Market Growth & Y-O-Y projection

13.3. Basis Point Share (BPS) Analysis

13.4. Global Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel, 2019?2030

13.4.1. OEM

13.4.2. Aftermarket

13.5. Global Automotive Dual Mass Flywheel Market Attractiveness Analysis, by Sales Channel

14. Global Automotive Dual Mass Flywheel Market Analysis and Forecast, by Region

14.1. Market Growth & Y-O-Y projection

14.2. Basis Point Share (BPS) Analysis

14.3. Global Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Region, 2019?2030

14.3.1. North America

14.3.2. Latin America

14.3.3. Europe

14.3.4. Asia Pacific

14.3.5. Middle East & Africa

14.4. Global Automotive Dual Mass Flywheel Market Attractiveness Analysis, by Region

15. North America Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn) Forecast, 2019?2030

15.1. Key Findings

15.2. Market Snapshot

15.3. North America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

15.3.1. Manual

15.3.2. Semi-automatic

15.3.3. Automatic

15.4. North America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

15.4.1. Cast Iron

15.4.2. Maraging Steel

15.4.3. Aluminum Alloys

15.5. North America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

15.5.1. Passenger Vehicle

15.5.2. Light Commercial Vehicle

15.5.3. Heavy Commercial Vehicle

15.6. North America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

15.6.1. OEM

15.6.2. Aftermarket

15.7. North America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Country

15.7.1. U.S.

15.7.2. Canada

15.8. U.S. Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

15.8.1. Manual

15.8.2. Semi-automatic

15.8.3. Automatic

15.9. U.S. Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

15.9.1. Cast Iron

15.9.2. Maraging Steel

15.9.3. Aluminum Alloys

15.10. U.S. Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

15.10.1. Passenger Vehicle

15.10.2. Light Commercial Vehicle

15.10.3. Heavy Commercial Vehicle

15.11. U.S. Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

15.11.1. OEM

15.11.2. Aftermarket

15.12. Canada Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

15.12.1. Manual

15.12.2. Semi-automatic

15.12.3. Automatic

15.13. Canada Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

15.13.1. Cast Iron

15.13.2. Maraging Steel

15.13.3. Aluminum Alloys

15.14. Canada Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

15.14.1. Passenger Vehicle

15.14.2. Light Commercial Vehicle

15.14.3. Heavy Commercial Vehicle

15.15. Canada Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

15.15.1. OEM

15.15.2. Aftermarket

16. Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn) Forecast, 2019?2030

16.1. Key Findings

16.2. Market Snapshot

16.3. Europe Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

16.3.1. Manual

16.3.2. Semi-automatic

16.3.3. Automatic

16.4. Europe Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

16.4.1. Cast Iron

16.4.2. Maraging Steel

16.4.3. Aluminum Alloys

16.5. Europe Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

16.5.1. Passenger Vehicle

16.5.2. Light Commercial Vehicle

16.5.3. Heavy Commercial Vehicle

16.6. Europe Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

16.6.1. OEM

16.6.2. Aftermarket

16.7. Europe Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Country and Sub-region

16.7.1. Germany

16.7.2. U.K.

16.7.3. France

16.7.4. Italy

16.7.5. Spain

16.7.6. Rest of Europe

16.8. Germany Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

16.8.1. Manual

16.8.2. Semi-automatic

16.8.3. Automatic

16.9. Germany Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

16.9.1. Cast Iron

16.9.2. Maraging Steel

16.9.3. Aluminum Alloys

16.10. Germany Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

16.10.1. Passenger Vehicle

16.10.2. Light Commercial Vehicle

16.10.3. Heavy Commercial Vehicle

16.11. Germany Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

16.11.1. OEM

16.11.2. Aftermarket

16.12. U.K. Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

16.12.1. Cast Iron

16.12.2. Maraging Steel

16.12.3. Aluminum Alloys

16.13. U.K. Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

16.13.1. Manual

16.13.2. Semi-automatic

16.13.3. Automatic

16.14. U.K. Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

16.14.1. Passenger Vehicle

16.14.2. Light Commercial Vehicle

16.14.3. Heavy Commercial Vehicle

16.15. U.K. Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

16.15.1. OEM

16.15.2. Aftermarket

16.16. France Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

16.16.1. Manual

16.16.2. Semi-automatic

16.16.3. Automatic

16.17. France Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

16.17.1. Cast Iron

16.17.2. Maraging Steel

16.17.3. Aluminum Alloys

16.18. France Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

16.18.1. Passenger Vehicle

16.18.2. Light Commercial Vehicle

16.18.3. Heavy Commercial Vehicle

16.19. France Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

16.19.1. OEM

16.19.2. Aftermarket

16.20. Italy Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

16.20.1. Manual

16.20.2. Semi-automatic

16.20.3. Automatic

16.21. Italy Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

16.21.1. Cast Iron

16.21.2. Maraging Steel

16.21.3. Aluminum Alloys

16.22. Italy Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

16.22.1. Passenger Vehicle

16.22.2. Light Commercial Vehicle

16.22.3. Heavy Commercial Vehicle

16.23. Italy Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

16.23.1. OEM

16.23.2. Aftermarket

16.24. Spain Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

16.24.1. Manual

16.24.2. Semi-automatic

16.24.3. Automatic

16.25. Spain Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

16.25.1. Cast Iron

16.25.2. Maraging Steel

16.25.3. Aluminum Alloys

16.26. Spain Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

16.26.1. Passenger Vehicle

16.26.2. Light Commercial Vehicle

16.26.3. Heavy Commercial Vehicle

16.27. Spain Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

16.27.1. OEM

16.27.2. Aftermarket

16.28. Rest of Europe Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

16.28.1. Manual

16.28.2. Semi-automatic

16.28.3. Automatic

16.29. Rest of Europe Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

16.29.1. Cast Iron

16.29.2. Maraging Steel

16.29.3. Aluminum Alloys

16.30. Rest of Europe Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

16.30.1. Passenger Vehicle

16.30.2. Light Commercial Vehicle

16.30.3. Heavy Commercial Vehicle

16.31. Rest of Europe Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

16.31.1. OEM

16.31.2. Aftermarket

17. Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn) Forecast, 2019?2030

17.1. Key Findings

17.2. Market Snapshot

17.3. Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

17.3.1. Manual

17.3.2. Semi-automatic

17.3.3. Automatic

17.4. Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

17.4.1. Cast Iron

17.4.2. Maraging Steel

17.4.3. Aluminum Alloys

17.5. Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

17.5.1. Passenger Vehicle

17.5.2. Light Commercial Vehicle

17.5.3. Heavy Commercial Vehicle

17.6. Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

17.6.1. OEM

17.6.2. Aftermarket

17.7. Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Country

17.7.1. China

17.7.2. India

17.7.3. Japan

17.7.4. ASEAN

17.7.5. Rest of Asia Pacific

17.8. China Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

17.8.1. Manual

17.8.2. Semi-automatic

17.8.3. Automatic

17.9. China Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

17.9.1. Cast Iron

17.9.2. Maraging Steel

17.9.3. Aluminum Alloys

17.10. China Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

17.10.1. Passenger Vehicle

17.10.2. Light Commercial Vehicle

17.10.3. Heavy Commercial Vehicle

17.11. China Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

17.11.1. OEM

17.11.2. Aftermarket

17.12. India Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

17.12.1. Manual

17.12.2. Semi-automatic

17.12.3. Automatic

17.13. India Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

17.13.1. Cast Iron

17.13.2. Maraging Steel

17.13.3. Aluminum Alloys

17.14. India Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

17.14.1. Passenger Vehicle

17.14.2. Light Commercial Vehicle

17.14.3. Heavy Commercial Vehicle

17.15. India Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

17.15.1. OEM

17.15.2. Aftermarket

17.16. Japan Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

17.16.1. Manual

17.16.2. Semi-automatic

17.16.3. Automatic

17.17. Japan Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

17.17.1. Cast Iron

17.17.2. Maraging Steel

17.17.3. Aluminum Alloys

17.18. Japan Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

17.18.1. Passenger Vehicle

17.18.2. Light Commercial Vehicle

17.18.3. Heavy Commercial Vehicle

17.19. Japan Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

17.19.1. OEM

17.19.2. Aftermarket

17.20. ASEAN Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

17.20.1. Manual

17.20.2. Semi-automatic

17.20.3. Automatic

17.21. ASEAN Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

17.21.1. Cast Iron

17.21.2. Maraging Steel

17.21.3. Aluminum Alloys

17.22. ASEAN Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

17.22.1. Passenger Vehicle

17.22.2. Light Commercial Vehicle

17.22.3. Heavy Commercial Vehicle

17.23. ASEAN Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

17.23.1. OEM

17.23.2. Aftermarket

17.24. Rest of Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

17.24.1. Manual

17.24.2. Semi-automatic

17.24.3. Automatic

17.25. Rest of Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

17.25.1. Cast Iron

17.25.2. Maraging Steel

17.25.3. Aluminum Alloys

17.26. Rest of Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

17.26.1. Passenger Vehicle

17.26.2. Light Commercial Vehicle

17.26.3. Heavy Commercial Vehicle

17.27. Rest of Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

17.27.1. OEM

17.27.2. Aftermarket

18. Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn) Forecast, 2019?2030

18.1. Key Findings

18.2. Market Snapshot

18.3. Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

18.3.1. Manual

18.3.2. Semi-automatic

18.3.3. Automatic

18.4. Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

18.4.1. Cast Iron

18.4.2. Maraging Steel

18.4.3. Aluminum Alloys

18.5. Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

18.5.1. Passenger Vehicle

18.5.2. Light Commercial Vehicle

18.5.3. Heavy Commercial Vehicle

18.6. Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

18.6.1. OEM

18.6.2. Aftermarket

18.7. Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Country and Sub-region

18.7.1. GCC

18.7.2. South Africa

18.7.3. Rest of Middle East & Africa

18.8. GCC Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

18.8.1. Manual

18.8.2. Semi-automatic

18.8.3. Automatic

18.9. GCC Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

18.9.1. Cast Iron

18.9.2. Maraging Steel

18.9.3. Aluminum Alloys

18.10. GCC Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

18.10.1. Passenger Vehicle

18.10.2. Light Commercial Vehicle

18.10.3. Heavy Commercial Vehicle

18.11. GCC Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

18.11.1. OEM

18.11.2. Aftermarket

18.12. South Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

18.12.1. Manual

18.12.2. Semi-automatic

18.12.3. Automatic

18.13. South Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

18.13.1. Cast Iron

18.13.2. Maraging Steel

18.13.3. Aluminum Alloys

18.14. South Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Fuel Type

18.14.1. Passenger Vehicle

18.14.2. Light Commercial Vehicle

18.14.3. Heavy Commercial Vehicle

18.15. South Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

18.15.1. OEM

18.15.2. Aftermarket

18.16. Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

18.16.1. Manual

18.16.2. Semi-automatic

18.16.3. Automatic

18.17. Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

18.17.1. Cast Iron

18.17.2. Maraging Steel

18.17.3. Aluminum Alloys

18.18. Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

18.18.1. Passenger Vehicle

18.18.2. Light Commercial Vehicle

18.18.3. Heavy Commercial Vehicle

18.19. Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

18.19.1. OEM

18.19.2. Aftermarket

19. Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn) Forecast, 2019?2030

19.1. Key Findings

19.2. Market Snapshot

19.3. Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

19.3.1. Manual

19.3.2. Semi-automatic

19.3.3. Automatic

19.4. Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

19.4.1. Cast Iron

19.4.2. Maraging Steel

19.4.3. Aluminum Alloys

19.5. Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

19.5.1. Passenger Vehicle

19.5.2. Light Commercial Vehicle

19.5.3. Heavy Commercial Vehicle

19.6. Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

19.6.1. OEM

19.6.2. Aftermarket

19.7. Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Country and Sub-region

19.7.1. Brazil

19.7.2. Mexico

19.7.3. Rest of Latin America

19.8. Brazil Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

19.8.1. Manual

19.8.2. Semi-automatic

19.8.3. Automatic

19.9. Brazil Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

19.9.1. Cast Iron

19.9.2. Maraging Steel

19.9.3. Aluminum Alloys

19.10. Brazil Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

19.10.1. Passenger Vehicle

19.10.2. Light Commercial Vehicle

19.10.3. Heavy Commercial Vehicle

19.11. Brazil Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

19.11.1. OEM

19.11.2. Aftermarket

19.12. Mexico Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

19.12.1. Manual

19.12.2. Semi-automatic

19.12.3. Automatic

19.13. Mexico Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

19.13.1. Cast Iron

19.13.2. Maraging Steel

19.13.3. Aluminum Alloys

19.14. Mexico Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

19.14.1. Passenger Vehicle

19.14.2. Light Commercial Vehicle

19.14.3. Heavy Commercial Vehicle

19.15. Mexico Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

19.15.1. OEM

19.15.2. Aftermarket

19.16. Rest of Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Transmission Type

19.16.1. Manual

19.16.2. Semi-automatic

19.16.3. Automatic

19.17. Rest of Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Material

19.17.1. Cast Iron

19.17.2. Maraging Steel

19.17.3. Aluminum Alloys

19.18. Rest of Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type

19.18.1. Passenger Vehicle

19.18.2. Light Commercial Vehicle

19.18.3. Heavy Commercial Vehicle

19.19. Rest of Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Sales Channel

19.19.1. OEM

19.19.2. Aftermarket

20. Competition Landscape

20.1. Market Share Analysis, by Company (2019)

20.2. Market Player Competition Matrix (By Tier and Size of the Company)

20.3. Company Financials

20.4. Executive Bios/ Business expansion/ Key executive changes

20.5. Manufacturing Footprint

20.6. Vehicle Type Innovation

20.7. Key Market Players / Potential Players (Details – Overview, Overall Revenue, Recent Developments, Strategy)

20.7.1. AISIN SEIKI Co., Ltd.

20.7.1.1. Overview

20.7.1.2. Overall Revenue

20.7.1.3. Recent Developments

20.7.1.4. Strategy

20.7.2. American Axle & Manufacturing, Inc.

20.7.2.1. Overview

20.7.2.2. Overall Revenue

20.7.2.3. Recent Developments

20.7.2.4. Strategy

20.7.3. AMS Automotive

20.7.3.1. Overview

20.7.3.2. Overall Revenue

20.7.3.3. Recent Developments

20.7.3.4. Strategy

20.7.4. AmTech International

20.7.4.1. Overview

20.7.4.2. Overall Revenue

20.7.4.3. Recent Developments

20.7.4.4. Strategy

20.7.5. EXEDY Globalparts

20.7.5.1. Overview

20.7.5.2. Overall Revenue

20.7.5.3. Recent Developments

20.7.5.4. Strategy

20.7.6. JMT Auto Limited

20.7.6.1. Overview

20.7.6.2. Overall Revenue

20.7.6.3. Recent Developments

20.7.6.4. Strategy

20.7.7. Lavacast

20.7.7.1. Overview

20.7.7.2. Overall Revenue

20.7.7.3. Recent Developments

20.7.7.4. Strategy

20.7.8. Linamar Corporation

20.7.8.1. Overview

20.7.8.2. Overall Revenue

20.7.8.3. Recent Developments

20.7.8.4. Strategy

20.7.9. LMB Euroseals (PTY) LTD

20.7.9.1. Overview

20.7.9.2. Overall Revenue

20.7.9.3. Recent Developments

20.7.9.4. Strategy

20.7.10. Platinum Driveline

20.7.10.1. Overview

20.7.10.2. Overall Revenue

20.7.10.3. Recent Developments

20.7.10.4. Strategy

20.7.11. Schaeffler AG

20.7.11.1. Overview

20.7.11.2. Overall Revenue

20.7.11.3. Recent Developments

20.7.11.4. Strategy

20.7.12. Skyway Precision, Inc

20.7.12.1. Overview

20.7.12.2. Overall Revenue

20.7.12.3. Recent Developments

20.7.12.4. Strategy

20.7.13. Tilton Engineering

20.7.13.1. Overview

20.7.13.2. Overall Revenue

20.7.13.3. Recent Developments

20.7.13.4. Strategy

20.7.14. Valeo SA

20.7.14.1. Overview

20.7.14.2. Overall Revenue

20.7.14.3. Recent Developments

20.7.14.4. Strategy

20.7.15. ZF Friedrichshafen AG

20.7.15.1. Overview

20.7.15.2. Overall Revenue

20.7.15.3. Recent Developments

20.7.15.4. Strategy

List of Tables

Table 1: Global Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 2: Global Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 3 : Global Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 4: Global Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 5 : Global Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 6: Global Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 7: Global Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 8: Global Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 9: Global Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Region, 2019?2030

Table 10: Global Automotive Dual Mass Flywheel Market Value (US$ Mn), by Region, 2019?2030

Table 11: North America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 12: North America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 13: North America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 14: North America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 15: North America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 16: North America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 17: North America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 18: North America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 19: North America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Country, 2019?2030

Table 20: North America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Country, 2019?2030

Table 21: U.S. Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 22: U.S. Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 23: U.S. Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 24: U.S. Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 25: U.S. Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 26: U.S. Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 27: U.S. Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 28: U.S. Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 29: Canada Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 30: Canada Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 31: Canada Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 32: Canada Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 33: Canada Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 34: Canada Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 35: Canada Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 36: Canada Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 37: Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 38: Europe Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 39: Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 40: Europe Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 41: Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 42: Europe Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 43: Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 44: Europe Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 45: Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Country and Sub-region, 2019?2030

Table 46: Europe Automotive Dual Mass Flywheel Market Value (US$ Mn), by Country and Sub-region, 2019?2030

Table 47: Germany Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 48: Germany Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 49: Germany Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 50: Germany Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 51: Germany Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 52: Germany Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 53: Germany Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 54: Germany Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 55: U.K. Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 56: U.K. Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 57: U.K. Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 58: U.K. Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 59: U.K. Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 60: U.K. Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 61: U.K. Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 62: U.K. Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 63: France Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 64: France Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 65: France Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 66: France Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 67: France Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 68: France Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 69: France Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 70: France Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 71: Italy Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 72: Italy Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 73: Italy Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 74: Italy Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 75: Italy Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 76: Italy Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 77: Italy Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 78: Italy Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 79: Spain Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 80: Spain Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 81: Spain Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 82: Spain Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 83: Spain Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 84: Spain Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 85: Spain Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 86: Spain Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 87: Rest of Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 88: Rest of Europe Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 89: Rest of Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 90: Rest of Europe Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 91: Rest of Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 92: Rest of Europe Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 93: Rest of Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 94: Rest of Europe Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 95: Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 96: Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 97: Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 98: Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 99: Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 100: Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 101: Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 102: Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 103: Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Country and Sub-region, 2019?2030

Table 104: Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn), by Country and Sub-region, 2019?2030

Table 105: China Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 106: China Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 107: China Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 108: China Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 109: China Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 110: China Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 111: China Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 112: China Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 113: India Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 114: India Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 115: India Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 116: India Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 117: India Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 118: India Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 119: India Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 120: India Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 121: Japan Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 122: Japan Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 123: Japan Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 124: Japan Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 125: Japan Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 126: Japan Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 127: Japan Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 128: Japan Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 129: ASEAN Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 130: ASEAN Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 131: ASEAN Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 132: ASEAN Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 133: ASEAN Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 134: ASEAN Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 135: ASEAN Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 136: ASEAN Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 137: Rest of Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 138: Rest of Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 139: Rest of Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 140: Rest of Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 141: Rest of Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 142: Rest of Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 143: Rest of Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 144: Rest of Asia Pacific Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 145: Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 146: Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 147: Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 148: Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 149: Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 150: Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 151: Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 152: Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 153: Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Country and Sub-region, 2019?2030

Table 154: Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Country and Sub-region, 2019?2030

Table 155: GCC Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 156: GCC Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 157: GCC Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 158: GCC Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 159: GCC Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 160: GCC Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 161: GCC Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 162: GCC Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 163: South Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 164: South Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 165: South Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 166: South Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 167: South Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 168: South Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 169: South Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 170: South Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 171: Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 172: Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 173: Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 174: Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 175: Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 176: Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 177: Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 178: Rest of Middle East & Africa Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 179: Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 180: Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 181: Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 182: Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 183: Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 184: Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 185: Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 186: Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 187: Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Country and Sub-region, 2019?2030

Table 188: Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Country and Sub-region, 2019?2030

Table 189: Brazil Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 190: Brazil Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 191: Brazil Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 192: Brazil Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 193: Brazil Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 194: Brazil Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 195: Brazil Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 196: Brazil Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 197: Mexico Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 198: Mexico Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 199: Mexico Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 200: Mexico Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 201: Mexico Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 202: Mexico Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 203: Mexico Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 204: Mexico Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

Table 205: Rest of Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Vehicle Type, 2019?2030

Table 206: Rest of Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Vehicle Type, 2019?2030

Table 207: Rest of Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Transmission Type, 2019?2030

Table 208: Rest of Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Transmission Type, 2019?2030

Table 209: Rest of Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Material, 2019?2030

Table 210: Rest of Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Material, 2019?2030

Table 211: Rest of Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units), by Sales Channel, 2019?2030

Table 212: Rest of Latin America Automotive Dual Mass Flywheel Market Value (US$ Mn), by Sales Channel, 2019?2030

List of Figures

Figure 1: Global Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn), 2019?2030

Figure 2: Global Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2019

Figure 3: Global Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2030

Figure 4: Global Automotive Dual Mass Flywheel Market Attractiveness, by Vehicle Type, 2019

Figure 5: Global Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2019

Figure 6: Global Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2030

Figure 7: Global Automotive Dual Mass Flywheel Market Attractiveness, by Transmission Type, 2019

Figure 8: Global Automotive Dual Mass Flywheel Market Share, by Material, 2019

Figure 9: Global Automotive Dual Mass Flywheel Market Share, by Material, 2030

Figure 10: Global Automotive Dual Mass Flywheel Market Attractiveness, by Material, 2019

Figure 11: Global Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2019

Figure 12: Global Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2030

Figure 13: Global Automotive Dual Mass Flywheel Market Attractiveness, by Sales Channel, 2019

Figure 14: Global Automotive Dual Mass Flywheel Market Share, by Region, 2019

Figure 15: Global Automotive Dual Mass Flywheel Market Share, by Region, 2030

Figure 16: Global Automotive Dual Mass Flywheel Market Attractiveness, by Region, 2019

Figure 17: North America Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn), 2019?2030

Figure 18: North America Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2019

Figure 19: North America Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2030

Figure 20: North America Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2019

Figure 21: North America Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2030

Figure 22: North America Automotive Dual Mass Flywheel Market Share, by Material, 2019

Figure 23: North America Automotive Dual Mass Flywheel Market Share, by Material, 2030

Figure 24: North America Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2019

Figure 25: North America Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2030

Figure 26: North America Automotive Dual Mass Flywheel Market Share, by Country, 2019

Figure 27: North America Automotive Dual Mass Flywheel Market Share, by Country, 2030

Figure 28: Europe Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn), 2019?2030

Figure 29: Europe Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2019

Figure 30: Europe Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2030

Figure 31: Europe Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2019

Figure 32: Europe Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2030

Figure 33: Europe Automotive Dual Mass Flywheel Market Share, by Material, 2019

Figure 34: Europe Automotive Dual Mass Flywheel Market Share, by Material, 2030

Figure 35: Europe Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2019

Figure 36: Europe Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2030

Figure 37: Europe Automotive Dual Mass Flywheel Market Share, by Country and Sub-region, 2019

Figure 38: Europe Automotive Dual Mass Flywheel Market Share, by Country and Sub-region, 2030

Figure 39: Asia Pacific Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn), 2019?2030

Figure 40: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2019

Figure 41: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2030

Figure 42: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2019

Figure 43: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2030

Figure 44: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Material, 2019

Figure 45: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Material, 2030

Figure 46: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2019

Figure 47: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2030

Figure 48: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Country and Sub-region, 2019

Figure 49: Asia Pacific Automotive Dual Mass Flywheel Market Share, by Country and Sub-region, 2030

Figure 50: Middle East & Africa Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn), 2019?2030

Figure 51: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2019

Figure 52: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2030

Figure 53: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2019

Figure 54: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2030

Figure 55: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Material, 2019

Figure 56: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Material, 2030

Figure 57: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2019

Figure 58: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2030

Figure 59: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Country and Sub-region, 2019

Figure 60: Middle East & Africa Automotive Dual Mass Flywheel Market Share, by Country and Sub-region, 2030

Figure 61: Latin America Automotive Dual Mass Flywheel Market Volume (Thousand Units) and Value (US$ Mn), 2019?2030

Figure 62: Latin America Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2019

Figure 63: Latin America Automotive Dual Mass Flywheel Market Share, by Vehicle Type, 2030

Figure 64: Latin America Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2019

Figure 65: Latin America Automotive Dual Mass Flywheel Market Share, by Transmission Type, 2030

Figure 66: Latin America Automotive Dual Mass Flywheel Market Share, by Material, 2019

Figure 67: Latin America Automotive Dual Mass Flywheel Market Share, by Material, 2030

Figure 68: Latin America Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2019

Figure 69: Latin America Automotive Dual Mass Flywheel Market Share, by Sales Channel, 2030

Figure 70: Latin America Automotive Dual Mass Flywheel Market Share, by Country and Sub-region, 2019

Figure 71: Latin America Automotive Dual Mass Flywheel Market Share, by Country and Sub-region, 2030