Reports

Reports

Piperonyl Butoxide (PBO) Market – An Overview

It is no surprise that food security is gaining prominence world over and is a direct outcome of rapidly growing demand for food and shrinking farmlands. Governments across the world are thus focusing upon this problem area in a major way. As per Transparency Market Research, from 2016 to 2024, the piperonyl butoxide market is set to grow at a moderate growth rate in terms of revenue and demand. And, use of chemicals such as piperonyl butoxide in the improvement of yield will play a significant role in the growth of this market.

This will also manifest itself in the form of higher market worth and an increase in new and lucrative growth opportunities for players operating the playfield. Some of the significant factors that promise to keep the Piperonyl Butoxide (PBO) Market buoyant over the forecast period mentioned above are spelled out below:

Piperonyl Butoxide Market: Snapshot

The global market for piperonyl butoxide (PBO) is rather consolidated and is primarily driven by the ever increasing demand for food. The rapid increase in the global population has raised food security concerns and several underdeveloped and developing countries still lack proper infrastructure for the storage and distribution of food grains. A significant rise in yield is possible through the usage of crop protection chemicals such as insecticides. This has resulted in the high demand for piperonyl butoxide.

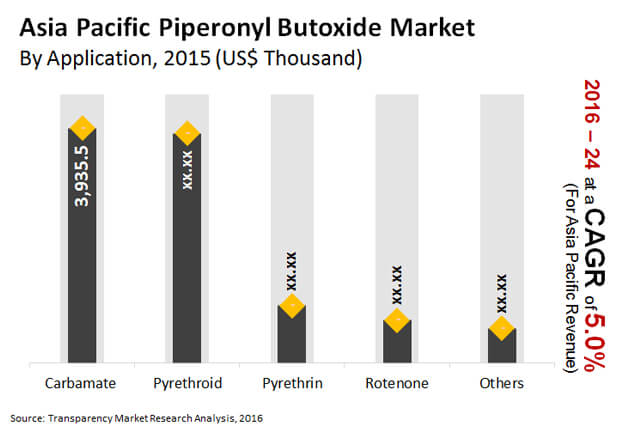

In terms of revenue, the piperonyl butoxide market was valued at US$10.02 mn in 2015 and is projected to reach US$15.45 mn by 2024, expanding at a steady CAGR of 5.0% from 2016 to 2024. The demand for PBO, on the other hand, is likely to increase at a CAGR of 3.9% during the forecast period.

Carbamate to Witness Significant Rise in Demand in the Agriculture Sector

The key applications of piperonyl butoxide include pyrethrin, pyrethroid, carbamate, rotenone, permethrin, bioallethrin, deltamethrin, and bioresmethrin. Carbamate constituted the leading share in the piperonyl butoxide market in 2015, followed by pyrethroid. These two segments cumulatively accounted for a share of over 75% in the PBO market in 2015.

Carbamate, pyrethrin, and pyrethroid are part of a relatively newer generation of insecticides. Pyrethrin and pyrethroid insecticides are currently preferred by farmers for their lower and toxicity.

Carbamate is the key revenue generator as well as the key consumer of piperonyl butoxide. Derived from carbamic acid, carbamate is used to control or kill insects and finds application in the agriculture sector as well as in homes. The growing usage of insecticides for crop protection and the rising demand for food are likely to boost the demand for carbamate in the coming years.

China to Lead APAC PBO Market by Volume and Revenue

The Asia Pacific PBO market is segmented on the basis of geography into China, Japan, India, ASEAN, and Rest of APAC. China accounted for the leading share in the piperonyl butoxide market in 2015, accounting for a demand share of more than 45% that year. The growing usage of insecticides for crop protection in the county, coupled with the rising demand for food, is likely to boost the demand for piperonyl butoxide in China. China is not only the leading revenue generator and consumer of PBO, but the country is also expected to expand at the fastest pace over the course of the forecast period.

Japan and India are also prominent markets for piperonyl butoxide in Asia Pacific. In addition to these, Bangladesh and countries in Southeast Asia have been experiencing a strong demand for crop protection chemicals since the past few years. This is anticipated to boost the demand for piperonyl butoxide during the forecast period.

Key players operating in the piperonyl butoxide market include ENDURA P.IVA, Sumitomo Chemical Co., Ltd., Wujiang Shuguang Chemical Co., Ltd., Tokyo Chemical Industry Co., Ltd., Alfa Aesar, Capot Chemical Co., Ltd., Hem Corporation, Shanghai Skyblue Chemical Co., Ltd., and Zhejiang Rayfull Chemicals Co., Ltd.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Asia Pacific Piperonyl Butoxide Market, (Tons) (US$ Thousand) 2015 – 2024

4. Market Overview

4.1. Product Overview

4.2. Key Industry Developments

4.3. Market Indicators

4.4. Drivers and Restraints Snapshot Analysis

4.5. Drivers

4.6. Restraints

4.7. Opportunity Analysis

4.8. Asia Pacific Piperonyl Butoxide Market Analysis and Forecasts

4.8.1 Asia Pacific Piperonyl Butoxide Market Size (US$ Thousand) and Volume (Tons) Forecast, 2015–2024

4.8.2 Asia-Pacific Piperonyl Butoxide Average Price (US$/ Kg) 2015–2024

4.9. Piperonyl Butoxide Market: Asia-Pacific Supply Demand Scenario

4.10. Porter’s Analysis

4.11. Value Chain Analysis

4.12. Piperonyl Butoxide Market Outlook

5. Piperonyl Butoxide Market Analysis by Application Type

5.1. Key Findings

5.2. Introduction

5.3. Asia Pacific Piperonyl Butoxide Market Value Share Analysis, by Application Type(Tons) (US$ Thousand) 2015 – 2024

5.4. Piperonyl Butoxide Market Forecast by Application

5.4.1. Pyrethrin

5.4.2. Pyrethroid

5.4.3. Carbamate

5.4.4. Rotenone

5.4.5. Others

5.5. Application Comparison Matrix

5.6. Piperonyl Butoxide Market Attractiveness Analysis by Application Type

5.7. Key Trends

6. Asia Pacific Piperonyl Butoxide Market Analysis

6.1. Key Findings

6.2. Asia Pacific Piperonyl Butoxide Market Overview

6.3. Asia Pacific Market Value Share Analysis, by Country, (Tons) (US$ Thousand) 2015 – 2024

6.4. Asia Pacific Market Forecast by Country

6.4.1. China Piperonyl Butoxide Market Analysis

6.4.2. Japan Piperonyl Butoxide Market Analysis

6.4.3. India Piperonyl Butoxide Market Analysis

6.4.4. ASEAN Piperonyl Butoxide Market Analysis

6.4.5. Rest of Asia Pacific Piperonyl Butoxide Market Analysis

6.5. Market Trends

7. Competition Landscape

7.1. Asia Pacific Piperonyl Butoxide Market Share Analysis, by Company (2015)

7.2. Competition Matrix

7.3. Key Profiles

7.3.1 ENDURA P.IVA

7.3.1.1 Company Details

7.3.1.2 Company Description

7.3.1.3 Business Overview

7.3.1.4 SWOT Analysis

7.3.1.5 Strategic Overview

7.3.2 Sumitomo Chemical Co., Ltd.

7.3.2.1 Company Details

7.3.2.2 Company Description

7.3.2.3 Business Overview

7.3.2.4 SWOT Analysis

7.3.2.5 Strategic Overview

7.3.3 Wujiang Shuguang Chemical Co., Ltd.

7.3.3.1 Company Details

7.3.3.1 Company Description

7.3.3.2 Business Overview

7.3.3.3 SWOT Analysis

7.3.3.4 Strategic Overview

7.3.4 Tokyo Chemical Industry Co., Ltd.

7.3.4.1 Company Details

7.3.4.2 Company Description

7.3.4.3 Business Overview

7.3.4.4 SWOT Analysis

7.3.4.5 Strategic Overview

7.3.5 Alfa Aesar

7.3.5.1 Company Details

7.3.5.2 Company Description

7.3.5.3 Business Overview

7.3.5.4 SWOT Analysis

7.3.5.5 Strategic Overview

7.4. Other Profiles

7.4.1 Capot Chemical Co., Ltd.

7.4.1.1 Company Details

7.4.1.2 Company Description

7.4.1.3 Business Overview

7.4.2 Hem Corporation

7.4.2.1 Company Details

7.4.2.2 Company Description

7.4.2.3 Business Overview

7.4.3 Shanghai Skyblue Chemical Co., Ltd.

7.4.3.1 Company Details

7.4.3.2 Company Description

7.4.3.3 Business Overview

7.4.4 Zhejiang Rayfull Chemicals Co., Ltd.

7.4.4.1 Company Details

7.4.4.2 Company Description

7.4.4.3 Business Overview

7.4.5 Nanchang Yangpu Natural Flavors & Fragrances Co., Ltd.

7.4.5.1 Company Details

7.4.5.2 Company Description

7.4.5.3 Business Overview

7.4.6 TriveniInterchem Pvt. Ltd.

7.4.6.1 Company Details

7.4.6.2 Company Description

7.4.6.3 Business Overview

7.4.7 ZhongshanBestchem Co., Ltd.

7.4.7.1 Company Details

7.4.7.2 Company Description

7.4.7.3 Business Overview

7.4.8 Jiaxing Barton Chemicals Inc.

7.4.8.1 Company Details

7.4.8.2 Company Description

7.4.8.3 Business Overview

List of Tables

Table 1: Asia Pacific Piperonyl Butoxide Market Size (US$ Thousand) and Volume (Tons) Forecast, by Application Type, 2015–2024

Table 2: Asia Pacific Piperonyl Butoxide Market Size (US$ Thousand) and Volume (Tons) Forecast, by Country, 2015–2024

List of Figures

Figure 1: Asia Pacific Piperonyl Butoxide Market Size (US$ Thousand) and Volume (Tons) Forecast, 2015–2024

Figure 2: Asia-Pacific Piperonyl Butoxide Average Price (US$/ Kg) 2015–2024

Figure 3: Asia Pacific Piperonyl Butoxide Market Value Share Analysis by Product Type, 2015 and 2024

Figure 4: Piperonyl Butoxide Market Attractiveness Analysis by Application Type

Figure 5: Asia Pacific Piperonyl Butoxide Market Size (US$ Thousand) and Volume (Tons) Forecast, 2015–2024

Figure 6: Asia Pacific Piperonyl Butoxide Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 7: Asia Pacific Market Attractiveness Analysis by Country/Region

Figure 8: Asia Pacific Market Value Share Analysis, by Country, 2015 and 2024

Figure 9: Asia Pacific Piperonyl Butoxide Market Share Analysis, by Company (2015)