Reports

Reports

Asia Pacific Offshore Wind Energy Market: Snapshot

Offshore wind power or offshore wind energy, a technology which uses wind farms installed on offshore sites to harvest wind energy to produce electricity, is one of the most promising green energy technology segments in the Asia Pacific region presently. The presence of a large number of high-potential offshore sites in the region, encouraging governments and regulations, and rising foreign investment are all helping drive the market at a significant pace. While the market is a relatively un-untouched aspect of wind energy generation in Asia Pacific, the region, often referred to as the next power and economy hub, is expected to emerge as one of the key investment locations for offshore wind energy in the near future.

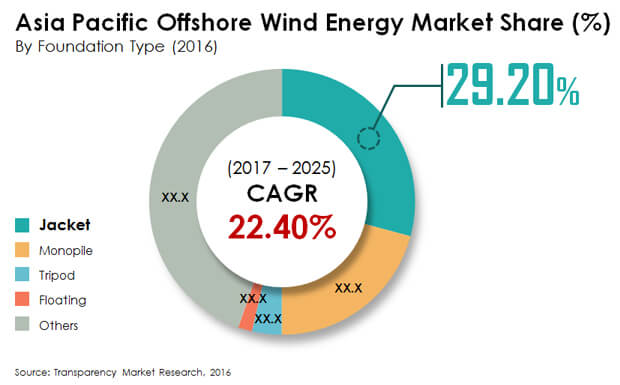

Transparency Market Research estimates that the Asia Pacific offshore wind power market will exhibit an exponential 22.4% CAGR from 2017 to 2025, rising from a valuation of US$8,960.8 mn in 2017 to US$60,201.5 mn by 2025.

Market Witnesses Rising Adoption of High Risk Pile Cap and Ground Mounted Foundations

In terms of type of foundation, the Asia Pacific market for offshore wind energy is segmented in the report into monopole, floating, jacket, tripod, and others. Of these, the others segment, including foundation types such as high risk pile cap (HRPC) and ground mounted foundations, accounted for a massive 44.7% of the overall market in 2016. The segment is expected to continue its strong growth throughout the forecast period as well.

Standing second in terms of share in the Asia Pacific offshore wind energy market, the jacket segment also accounted for a significant share in the market in 2016, while the floating type and tripod segments had limited presence. Tripod and floating segments accounted for minor share of the market as these type of foundations have limited presence due to financial and environmental factors. Market share of the jacket segment is expected to witness a notable drop during the forecast period while the floating type and tripod segments will continue to have minor share in the overall market.

The monopile segment is also estimated to witness a decline in its market share during the forecast period. Monopile foundations are not suited for offshore wind installations in China and other countries like South Korea and Japan have few offshore wind projects lined up with monopile foundations. As a result, their share in the Asia Pacific offshore wind energy market is not projected to witness any rise over the report’s forecast period.

China to Remain Leading Regional Market

Currently in Asia Pacific, China is the only country that has set aside separate targets in its green energy plans of the next few years for offshore wind energy projects. Japan, South Korea and India are expected to emerge as high-potential markets offshore wind energy generation. However, apart from China, other countries in Asia Pacific are yet to commission and/or start constructing utility-scale offshore wind energy projects. China is likely to drive the growth in capacity additions throughout the forecast period. Despite recently reducing its capacity addition targets, China has revised the target of approximately 10GW generation by 2020. China would thus require the addition of at least 1 GW of new offshore wind energy generation capacity annually, post 2016.

Value chain, which includes turbine costs, foundation costs, cabling costs, and installation expenditures, may witness reduction in overall CAPEX during the forecast period. Overall, the maximum cost reductions are expected to be observed in China and India the governments in these countries have devised nodal agencies to monitor and encourage more of offshore wind turbine installations along with grid constructions to the nearest shores. The extent to which cost reductions and supply chain concentration are achieved within the forecast period would be a critical determinant of the expected annual capacity additions in the offshore wind energy sector.

Some of the leading players operating in the Asia Pacific offshore wind energy market are Sinowel Wind Group Co., Ltd., China Ming Yang Wind Power Group Ltd., Siemens Wind Power, Gamesa Corporacion Technologica S.A., Nordex S.E, Vestas Wind Systems A/S, Dong Energy A/S, Suzlon Group, GE Wind Energy, and Goldwind Science Technology Co., Ltd.

Heightening Government Initiatives Supporting Clean Energy to Bring Good Growth Prospects for the Offshore Wind Energy Market

The offshore wind energy market will observe promising growth on the back of the rising demand for renewable energy production around the world. The growing government initiatives regarding the usage of renewable energy and the increasing rise in environmental concerns are the vital factors that will have a large influence on the growth of the offshore wind energy market during the assessment period of 2017-2025.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Asia Pacific Offshore Wind Energy Market

3.1. Asia Pacific Offshore Wind Energy Market Size, US$ Mn, 2016-2025

4. Market Overview

4.1. Introduction

4.1.1. Offshore Wind Energy Market Definition

4.1.2. Industry Developments

4.2. Key Market Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Porter’s Five Force Analysis

4.5. Value Chain Analysis

4.5.1. List of Key Raw Material Suppliers

4.5.2. List of Key Manufacturers

4.5.3. Level of Integration

4.6. Supply Chain Analysis

4.6.1. Project management and development service providers

4.6.2. Offshore wind farm components and equipment suppliers

4.6.3. Balance-of-plant suppliers

4.6.4. Installation and commissioning service providers

4.6.5. Operation and maintenance service providers

4.6.6. Other support services providers

4.7. Regulatory Scenario

4.8. SWOT Analysis

4.9. Product fit requirements – Asia Pacific Scenario

5. Asia Pacific Offshore Wind Energy Market Analysis and Forecasts, By Foundation Type Segment

5.1. Introduction & Definition

5.2. Key Findings

5.3. Market Volume (MW) and Size (US$ Mn) Forecast By Foundation Type Segment, 2016-2025

5.3.1. Mono Pile

5.3.2. Jacket

5.3.3. Tripod

5.3.4. Floating

5.3.5. Others

5.4. Foundation Type Segment Comparison Matrix

5.5. Market Attractiveness By Foundation Type Segment

6. Asia Pacific Offshore Wind Energy Market Analysis and Forecasts, By Country

6.1. Key Findings

6.2. Upcoming Offshore Wind Energy Projects Analysis, by Country, 2017-2025

6.2.1. Project Capacity (MW)

6.2.2. Project Start Date

6.2.3. Expected Project Completion & Online Date

6.2.4. Operator / Owner of the Project

6.3. Market Volume (MW) and Size (US$ Mn) Forecast, by Country, 2016-2025

6.3.1. China (Including Taiwan)

6.3.2. South Korea

6.3.3. Japan

6.3.4. India

6.3.5. Rest of Asia Pacific

6.4. Market Attractiveness, by Country

6.5. China Offshore Wind Energy Market Volume (MW) and Size (US$ Mn) Forecast, by Foundation Type Segment, 2016-2025

6.5.1. Mono Pile

6.5.2. Jacket

6.5.3. Tripod

6.5.4. Floating

6.5.5. Others

6.6. South Korea Offshore Wind Energy Market Volume (MW) and Size (US$ Mn) Forecast, by Foundation Type Segment, 2016-2025

6.6.1. Mono Pile

6.6.2. Jacket

6.6.3. Tripod

6.6.4. Floating

6.6.5. Others

6.7. Japan Offshore Wind Energy Market Volume (MW) and Size (US$ Mn) Forecast, by Foundation Type Segment, 2016-2025

6.7.1. Mono Pile

6.7.2. Jacket

6.7.3. Tripod

6.7.4. Floating

6.7.5. Others

6.8. India Offshore Wind Energy Market Volume (MW) and Size (US$ Mn) Forecast, by Foundation Type Segment, 2016-2025

6.8.1. Mono Pile

6.8.2. Jacket

6.8.3. Tripod

6.8.4. Floating

6.8.5. Others

7. Competition Landscape

7.1. Market Player – Competition Matrix (By Tier and Size of companies)

7.2. Market Share Analysis By Company (2015)

7.3. Product Mapping

7.4. Key Market Players (Details – Overview, Financials, Recent Developments, Strategy)

7.4.1. Sinowel Wind Group Co., Ltd.

7.4.1.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.1.2. Company Description

7.4.1.3. Business Segments, Product Segments

7.4.2. Siemens AG

7.4.2.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.2.2. Company Description

7.4.2.3. Business Segments, Product Segments and Application

7.4.2.4. SWOT Analysis

7.4.2.5. Net Sales (US$ Mn), by Business Segments, 2015

7.4.2.6. Revenue (US$ Bn) & Y-o-Y Growth (%), 2011–2015

7.4.2.7. Strategic Overview

7.4.3. Dong Energy A/S

7.4.3.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.3.2. Company Description

7.4.3.3. Business Segments, Product Segments and Application

7.4.3.4. SWOT Analysis

7.4.3.5. Revenue Share (US$ Mn), by Country, 2015

7.4.3.6. Revenue (US$ Bn) & Y-o-Y Growth (%), 2011–2015

7.4.3.7. Strategic Overview

7.4.4. Gamesa Corporacion Technologica S.A.

7.4.4.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.4.2. Company Description

7.4.4.3. Business Segments, Product Segments

7.4.4.4. SWOT Analysis

7.4.4.5. Revenue (US$ Mn), by Region, 2015

7.4.4.6. Revenue (US$ Bn) & Y-o-Y Growth (%), 2012–2016

7.4.4.7. Strategic Overview

7.4.5. Nordex S.E

7.4.5.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.5.2. Company Description

7.4.5.3. Products and Services

7.4.5.4. SWOT Analysis

7.4.5.5. Revenue (US$ Mn), by Region, 2015

7.4.5.6. Revenue (US$ Bn) & Y-o-Y Growth (%), 2012–2015

7.4.5.7. Strategic Overview

7.4.6. Vestas Wind Systems A/S

7.4.6.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.6.2. Company Description

7.4.6.3. Business Segments, Product Segments

7.4.6.4. SWOT Analysis

7.4.6.5. Revenue (US$ Mn), by Region, 2015

7.4.6.6. Revenue (US$ Bn) & Y-o-Y Growth (%), 2012–2016

7.4.6.7. Strategic Overview

7.4.7. Suzlon Group

7.4.7.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.7.2. Company Description

7.4.7.3. Business Segments, Product Segments

7.4.7.4. SWOT Analysis

7.4.7.5. Revenue (US$ Bn) & Y-o-Y Growth (%), 2012–2016

7.4.7.6. Strategic Overview

7.4.8. China Ming Yang Wind Power Group Ltd.

7.4.8.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.8.2. Company Description

7.4.8.3. Business Segments, Product Segments

7.4.9. GE Wind Energy

7.4.9.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.9.2. Company Description

7.4.9.3. Business Segments, Product Segments and Application

7.4.9.4. SWOT Analysis

7.4.9.5. Revenue Distribution, by Geography (2015) in US$ Mn

7.4.9.6. Revenue (US$ Bn) & Y-o-Y Growth (%), 2011–2015

7.4.9.7. Strategic Overview

7.4.10. Goldwind Science Technology Co., Ltd.

7.4.10.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

7.4.10.2. Company Description

7.4.10.3. Business Segments, Product Segments

List of Tables

Table 01: Asia Pacific Offshore Wind Energy Market Size (US$ Mn) and Volume (MW) Forecast, by Foundation Type, 2016–2025

Table 02: Asia Pacific Offshore Wind Energy Market Size (US$ Mn) and Volume (MW) Forecast, by Country, 2016-2025

Table 03: China Offshore Wind Energy Market Size (US$ Mn) and Volume (MW) Forecast, by Country, 2016-2025

Table 04: Japan Offshore Wind Energy Market Size (US$ Mn) and Volume (MW) Forecast, by Country, 2016-2025

Table 05: South Korea Offshore Wind Energy Market Size (US$ Mn) and Volume (MW) Forecast, by Country, 2016-2025

Table 06: Rest of Asia Pacific Offshore Wind Energy Market Size (US$ Mn) and Volume (MW) Forecast, by Country, 2016-2025

List of Figures

Figure 01: Asia Pacific Offshore Wind Energy Revenue (US$ Mn) Forecast, 2016–2025

Figure 02: Asia Pacific Offshore Wind Energy Market Volume (MW) Forecast, 2016–2025

Figure 03: Asia Pacific Offshore Wind Energy Market Value Share, by Foundation Type, 2017 and 2025

Figure 04: Asia Pacific Offshore Wind Energy Market Attractiveness Analysis, by Foundation Type

Figure 05: Asia Pacific Offshore Wind Energy Market Attractiveness Analysis, by Country

Figure 06: Global Marine Fuel Management Market Share Analysis, by Company (2015)