Reports

Reports

MTBE, a fuel oxygenate, is solely utilized as a fuel added substance. Fuel oxygenates don't normally appear in gasoline. Rather, they are added to build gasoline's oxygen content. By expanding it, gasoline fires up better, hence bringing down destructive emission from vehicles and reducing pollution. MTBE was first utilized as a fuel oxygenate in the United States in 1979. In 1992, MTBE started to be utilized in higher focuses to satisfy oxygenate needs set by the 1990 Clean Air Act Amendments (CAA). As a feature of the Energy Policy Act of 2005, Congress evacuated the oxygen content need for reformulated gasoline. In answer to this Act, organizations have changed from MTBE to ethanol. Since 2005, MTBE has not been utilized in noteworthy amounts in the gasoline business.

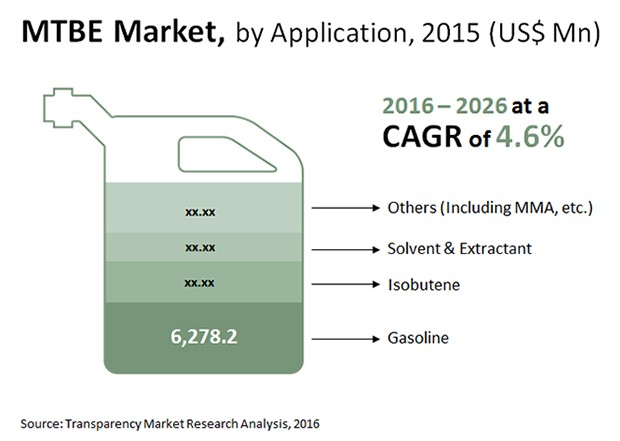

The Methyl Tertiary Butyl Ether (MTBE) market is projected to reach US$10.9 bn by 2026 from an estimated US$6.7 bn in 2015, at a CAGR of 4.6% from 2016 to 2026. Major reason boosting the MTBE market are the rising demand from the gasoline use, growing demand for the MTBE oxygenate, along with stringent environmental regulations in the emerging economies.

High-Consumption of Gasoline Lead the Global Methyl Tertiary-Butyl Ether (MTBE) Market

In view of application, the global MTBE market is divided in to gasoline, isobutene, solvent and extraction, and MMA. Among these, the gasoline portion is expected to lead the MTBE market amid the estimate time frame. The greater part of the MTBE is utilized for gasoline mixing because of its high utilization regarding volume. At the point when utilized in gasoline motors, it allows decrease in the thumping impact that leads to inefficient consuming and motor harm. MTBE has been utilized in gasoline since 1979 because of ecological and wellbeing concerns. The utilization of MTBE as gasoline added substance began with the substitution of metallic added substances, for example, lead and Methylcyclopentadienyl Manganese Tricarbonyl (MMT).

Asia Pacific Holds a Bright Future in the Methyl Tertiary-Butyl Ether (MTBE) Market

APAC is the largest consumer of MTBE for gasoline blending due to the expanding vehicle fleets and growing urbanization in the region. Geographically, Asia-Pacific market occupied the largest share in MTBE consumption. The widespread availability of MTBE as a cheap feedstock, coupled with it being an attractive substitute to aromatics in gasoline, is driving the Asia-Pacific market. Europe and North America will also prevail as major markets for methyl tertiary-butyl ether, in terms of value. There has been a steady expansion of the refinery sector in these regions since the recent past. Anti-knocking properties of MTBE suits well to reduce wear & tear of the heavy-duty machinery in this sector.

Occupancy of numerous key suppliers is a major factor responsible for the fragmented nature of the global methyl tertiary-butyl ether market. Leading players in the market have prominent geographical presence coupled with enormous production facilities situated in countries including The U.S. and China. Growing demand for MTBE across various end-use industries has intensified the competition among players, compelling them to develop and offer high-quality products at competitive prices. Key players elucidated in the report include Reliance Industries Ltd., PETRONAS, LyondellBasell Ind. Holdings B.V., and Evonik Industries AG.

Valuable Use in the Petroleum Segment bolsters Methyl Tertiary Butyl Ether Market

The methyl tertiary butyl ether (MTBE) market is expected to gain extensive growth across the assessment period of 2016-2026 on the back of the rising demand from the gasoline sector. The overwhelming use of methyl tertiary butyl ether in gasoline engines due to its high oxygen content is bringing tremendous growth opportunities.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Asia Pacific MTBE Market

4. Market Overview

4.1. Product Overview

4.2. MTBE Market Indicators

4.3. Petrochemicals Industry –Asia Pacific Scenario

4.4. Drivers and Restraints Snapshot Analysis

4.5. Drivers

4.6. Restraints

4.7. Opportunity Analysis

4.8. Porter’s Analysis

4.9. Asia Pacific MTBE Market Size, 2015–2026

4.10. Raw Material Price Trend Analysis, 2016–2026

4.11. Asia Pacific MTBE Market: Demand–Supply Scenario

4.12. Asia Pacific MTBE Production Capacity & Utilization Rate (2011–2015)

4.13. Asia Pacific MTBE Production Capacity Additions (Proposed/Planned), 2016–2026

4.14. Asia Pacific MTBE Production & Consumption Trend (Kilo Tons), 2011–2015

4.15. Asia Pacific MTBE Application Pattern, 2014–2016

4.16. Asia Pacific MTBE Imports & Exports Trend, 2011–2016

5. Asia Pacific MTBE Market Analysis, by Application

5.1. Key Findings

5.2. Introduction

5.3. Asia Pacific MTBE Market Value Share Analysis, by Application

5.4. Asia Pacific MTBE Market Size (US$ Mn) and Volume (Kilo Tons), by Application

5.5. Asia Pacific MTBE Market Attractiveness Analysis, by Application

6. Asia Pacific MTBE Market Analysis, by Country/Sub-region

6.1. Asia Pacific MTBE Market Overview, Country Analysis

6.2. Asia Pacific MTBE Market Value Share Analysis, by Country/Sub-region

6.3. Asia Pacific MTBE Market Forecast, by Country/Sub-region

6.4. China MTBE Market Analysis

6.5. Key Findings

6.6. MTBE Production in China, 2015

6.7. India MTBE Market Analysis

6.8. Key Findings

6.9. MTBE Production in India, 2015

6.10. ASEAN MTBE Market Analysis

6.11. Key Findings

6.12. MTBE Production in ASEAN, 2015

7. Company Profiles

7.1. Evonik Industries

7.1.1. Company Description

7.1.2. Business Overview

7.1.3. SWOT Analysis

7.1.4. Financial Details

7.1.5. Strategic Overview

7.2. Petroliam Nasional Berhad (PETRONAS)

7.2.1. Company Description

7.2.2. Business Overview

7.2.3. SWOT Analysis

7.2.4. Financial Details

7.2.5. Strategic Overview

7.3. Sinopec Corporation

7.3.1. Company Description

7.3.2. Business Overview

7.3.3. SWOT Analysis

7.3.4. Financial Details

7.3.5. Strategic Overview

7.4. LyondellBasell Industries Holdings B.V.

7.4.1. Company Description

7.4.2. Business Overview

7.4.3. SWOT Analysis

7.4.4. Financial Details

7.4.5. Strategic Overview

7.5. PetroChina Company Limited

7.5.1. Company Description

7.5.2. Business Overview

7.5.3. SWOT Analysis

7.5.4. Financial Details

7.5.5. Strategic Overview

7.6. Reliance Industries Limited

7.6.1. Company Description

7.6.2. Business Overview

7.6.3. SWOT Analysis

7.6.4. Financial Details

7.6.5. Strategic Overview

7.7. YEOCHUN NCC CO., LTD.

7.7.1. Company Description

7.7.2. Business Overview

7.7.3. SWOT Analysis

7.7.4. Financial Details

7.7.5. Strategic Overview

7.8. Shandong Yuhuang Chemical (Group) Co., Ltd

7.8.1. Company Description

7.8.2. Business Overview

7.8.3. SWOT Analysis

7.8.4. Strategic Overview

7.9. Zibo Qixiang Petrochemical Group Ltd

7.9.1. Company Description

7.9.2. Business Overview

7.9.3. SWOT Analysis

7.9.4. Strategic Overview

7.10. Heilongjiang Anruijia Petrochemical Co., Ltd

7.10.1. Company Description

7.10.2. Business Overview

7.10.3. SWOT Analysis

7.10.4. Strategic Overview

List of Tables

Table 1 Asia Pacific MTBE Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, By Country, 2015–2026

List of Figures

Figure 1 Asia Pacific MTBE Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2026

Figure 2 Asia Pacific MTBE Application Price Trend Analysis (US$/Kg), 2015–2026

Figure 3 Methanol Prices, 2016–2026 (US$/Ton)

Figure 4 Isobutylene Prices, 2016–2026 (US$/Ton)

Figure 5 Production & Demand Scenario (Kilo Tons), 2015

Figure 6 Asia Pacific MTBE Production Capacity & Utilization Rate (2011–2015)

Figure 7 Asia Pacific MTBE Production Capacity Additions (Proposed/Planned), 2016–2026

Figure 8 Asia Pacific MTBE Production & Consumption Trend (Kilo Tons), 2011–2015

Figure 9 Asia Pacific MTBE Application Pattern, 2014–2015

Figure 10 Asia Pacific MTBE Application Pattern, 2015–2016

Figure 11 Asia Pacific MTBE Imports & Exports Trend (Kilo Tons), 2011–2016

Figure 12 Asia Pacific MTBE Market Value Share Analysis, by Application, 2015 and 2026

Figure 13 Gasoline Additive (US$ Mn), 2015–2026

Figure 14 Isobutene (US$ Mn), 2015–2026

Figure 15 Solvent & Extractant, 2015–2026 (US$ Mn)

Figure 16 Other Applications, 2015–2026 (US$ Mn)

Figure 17 Asia Pacific MTBE Market Attractiveness Analysis, by Application

Figure 18 Asia Pacific MTBE Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2026

Figure 19 Asia Pacific MTBE Market Attractiveness Analysis, by Country/Sub-region

Figure 20 Asia Pacific MTBE Market Value Share Analysis, by Country/Sub-region, 2015 and 2026