Reports

Reports

Asia Pacific Butene-1 Market: Overview

Asia Pacific butene-1 market is spread across all ASEAN countries. However, China represents itself as one of its key contributors in the market. The key reason behind this scenario is presence of key manufacturers and suppliers in the countries. There is lack of sufficient number of prominent manufacturers and suppliers for this chemical compound in other countries of Asia Pacific. China helps in fulfilling the butene-1 requirement of the rest of Asia Pacific countries owing to the county’s greater production than requirement. Similarly, India holds key contribution in the revenue growth of Asia Pacific butene-1 market.

Asia Pacific butene-1 market shows promising growth avenues. It was valued at US$508.6 mn in 2015 and is projected to see stupendous growth to reach at the value of US$787.8 mn by 2026. Moreover, the market will grow at the CAGR of around 4.1% during the period of 2016–2026.

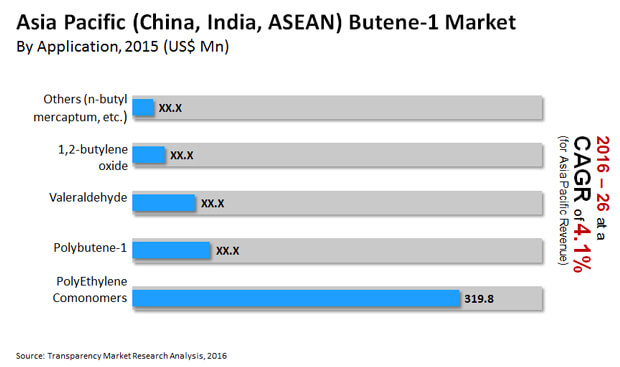

The study segments the Asia Pacific butene-1 market on the basis of applications.

Polyethylene Co-Monomer Segment to Dominate in Market Revenue Generation

LLDPE (linear low density polyethylene) is used in production of a wide range of products. Some of the products created using LLDPE are plastic wrap, plastic bags, pouches, toys, stretch wrap, lids, covers, buckets, pipes, containers, cable covering, and geomembranes. In recent times, the region is witnessing rise in demand for LLDPE from manufactures of these products. This situation has led to represent polyethylene co-monomer as a leading revenue generator segment for the Asia Pacific butene-1 market in the upcoming period.

Another factor propelling the Asia Pacific butene-1 market growth is rising demand for HDPE (high density polyethylene). It is used in the production of numerous products such as plastic bottles, geomembranes, plastic lumber, and corrosion-resistant piping. Growing demand for these products signifies numerous avenues for the manufacturers in the butene-1 market from Asia Pacific.

Polybutylene-1 is used in manufacturing of a wide range of plastic packaging materials. Thus, rising demand from packaging industry is projected to prosper the Asia Pacific butene-1 market in the years to come. Besides, growing demand from consumer goods and automotive exteriors and interiors is helping the market to demonstrate sturdy growth. While the segment holds around 15% market share in Asia Pacific, it is projected to maintain the growth at similar pace during the forecast period.

China to Remain Key Contributor in Market Growth

Based on geographical aspect, the Asia Pacific butene-1 market is spread across countries such as India, China, and ASEAN countries. In 2015, China had around 64.7% share of this market. According to analysts, the country is expected to continue this trend and remain the leading regional player in the forecast period as well. Polyethylene is the main application segment of the Asia Pacific butene-1 market. Growing polyethylene industry in China signifies the increasing demand for the products from butene-1market in Asia Pacific. This increasing demand is projected to help China to be the prominent Asia Pacific butene-1 market region.

Development of numerous industries including consumer goods in China has pushed the demand for polybutylene-1 in the country. At the same time, upward demand graph for automotive exterior and interior products is projected to fuel the Asia Pacific butene-1 market during forecast period. With presence of key vendors and abundant supply of raw material, China has always surpassed the production of butene-1. Owing to this reason, China is major supplier of this product for other Asia Pacific countries. Increasing number of end-user industries and availability of raw materials are projected to fuel the demand for Butene-1 in the in ASEAN sub-regions.

Chemical Companies Improve Production Yield in Asia Pacific Butene-1 Market

The organic compound, 1-butene, is a chemical of vast industrial significance, as it is utilized in several intermediate processes. It is made by dimerization of ethylene. 1-Butene has been used widely in production of certain kinds of polyethylene. The growing demand for the compound in the petrochemical industries is a key trend for revenue growth in the 1-butene market. Over the years, the production processes, particularly in relation to valves used in production machinery, have made striking advances, expanding the potential for manufacturers to boost their yield. Valve manufacturers have been keen on making continuous advances in technologies and new installations have been made in various emerging economies around the world. Growing understanding of branched alkenes have been constantly broadening the horizon for manufacturers in the 1-butene market. Chemical companies have been able to produce 1-butene with varying chemical properties to subsequently use them for complex processes in the petrochemicals. Producers benefit from the adoption of equipment that need less maintenance and cleaning, or need them after quite prolonged duration. These have enabled to vary the operating temperature easier than before. Further, they have been benefited from the factor-cost advantages of developing economies, such as in Asia Pacific.

The COVID-19 pandemic that struck the world in 2019 is still emerging in some parts of the world, marks the second wave of infections for some regional populations. The pandemic has again brought uncertainty in demand and consumption in various industries. This followed a brief period of demand recovery in the later part of 2020 and early part of 2021. The pandemic has brought forth some new, disruptive models for stakeholders in the chemical industry to consider, especially in the Asia Pacific butane-1 market. A growing number of companies have revamped their operational and strategic management models to gain agility in the wake of emerging economic shocks due to recent outbreaks. On the other hand, some players might be forced to explore demand in new application areas to stay lucrative.

1. PREFACE

1.1. MARKET DEFINITION AND SCOPE

1.2. MARKET SEGMENTATION

1.3. KEY RESEARCH OBJECTIVES

1.4. RESEARCH HIGHLIGHTS

1.5. ASSUMPTIONS AND RESEARCH METHODOLOGY

2. EXECUTIVE SUMMARY: ASIA PACIFIC BUTENE-1 MARKET

3. MARKET OVERVIEW

3.1. PRODUCT OVERVIEW

3.2. BUTENE-1 MARKET INDICATORS

3.3. PETROCHEMICALS INDUSTRY –ASIA PACIFIC SCENARIO

3.4. DRIVERS AND RESTRAINTS SNAPSHOT ANALYSIS

3.5. DRIVERS

3.6. RESTRAINTS

3.7. OPPORTUNITY ANALYSIS

3.8. PORTER’S ANALYSIS

3.9. ASIA PACIFIC BUTENE-1 MARKET SIZE, 2015–2026

3.10. RAW MATERIAL PRICE TREND ANALYSIS, 2016–2026

3.11. ASIA PACIFIC BUTENE-1 MARKET: DEMAND–SUPPLY SCENARIO

3.12. ASIA PACIFIC BUTENE-1 PRODUCTION CAPACITY & UTILIZATION RATE (2011–2015)

3.13. ASIA PACIFIC BUTENE-1 PRODUCTION CAPACITY ADDITIONS (PROPOSED/PLANNED), 2016–2026

3.14. ASIA PACIFIC BUTENE-1 PRODUCTION & CONSUMPTION TREND (KILO TONS), 2011–2015

3.15. ASIA PACIFIC BUTENE-1 APPLICATION PATTERN, 2014–2016

3.16. ASIA PACIFIC BUTENE-1 IMPORTS & EXPORTS TREND, 2011–2016

4. ASIA PACIFIC BUTENE-1 MARKET ANALYSIS, BY APPLICATION

4.1. KEY FINDINGS

4.2. INTRODUCTION

4.3. ASIA PACIFIC BUTENE-1 MARKET VALUE SHARE ANALYSIS, BY APPLICATION

4.4. ASIA PACIFIC BUTENE-1 MARKET SIZE (US$ MN) AND VOLUME (KILO TONS), BY APPLICATION

4.5. ASIA PACIFIC BUTENE-1 MARKET ATTRACTIVENESS ANALYSIS, BY APPLICATION

5. ASIA PACIFIC BUTENE-1 MARKET ANALYSIS, BY COUNTRY/SUB-REGION

5.1. ASIA PACIFIC BUTENE-1 MARKET OVERVIEW, COUNTRY ANALYSIS

5.2. ASIA PACIFIC BUTENE-1 MARKET VALUE SHARE ANALYSIS, BY COUNTRY/SUB-REGION

5.3. ASIA PACIFIC BUTENE-1 MARKET FORECAST, BY COUNTRY/SUB-REGION

5.4. CHINA BUTENE-1 MARKET ANALYSIS

5.5. KEY FINDINGS

5.6. BUTENE-1 PRODUCTION IN CHINA, 2015

5.7. INDIA BUTENE-1 MARKET ANALYSIS

5.8. KEY FINDINGS

5.9. BUTENE-1 PRODUCTION IN INDIA, 2015

5.10. ASEAN BUTENE-1 MARKET ANALYSIS

5.11. KEY FINDINGS

5.12. BUTENE-1 PRODUCTION IN ASEAN, 2015

6. Company Profiles

6.1 Evonik Industries

6.1.1. Company Description

6.1.2. Business Overview

6.1.3. SWOT Analysis

6.1.4. Financial Details

6.1.5. Strategic Overview

6.2. Sinopec Corporation

6.2.1. Company Description

6.2.2. Business Overview

6.2.3. SWOT Analysis

6.2.4. Financial Details

6.2.5. Strategic Overview

6.2.6. Strategic Overview

6.3. YEOCHUN NCC CO., LTD.

6.3.2. Company Description

6.3.3. Business Overview

6.3.4. SWOT Analysis

6.3.5. Financial Details

6.3.6. Strategic Overview

6.4. Reliance Industries Limited

6.4.2. Company Description

6.4.3. Business Overview

6.4.4. SWOT Analysis

6.4.5. Financial Details

6.4.6. Strategic Overview

List of Tables

Table 1: Asia Pacific Butene-1 Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2026

List of Figures

Figure 1: Asia Pacific Butene-1 Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2026

Figure 2: Asia Pacific Butene-1 Price Trend Analysis (US$/Kg) 2015–2026

Figure 3: Crude C4: Price Trend Analysis, 2015–2026

Figure 4: Ethylene: Price Trend Analysis, 2015–2026

Figure 5: Production & Demand Scenario, 2015 (Kilo Tons)

Figure 6: Production Capacity & Utilization Rates (2011–2015)

Figure 7: Production & Consumption Trend 2011–2015, Volume (Kilo Tons)

Figure 8: Asia Pacific Butene-1 Application Pattern, 2014–2015

Figure 9: Asia Pacific Butene-1 Application Pattern, 2015–2016

Figure 10: Asia Pacific Imports & Exports Trend 2011–2015, Volume (Kilo Tons)

Figure 11: Asia Pacific Butene-1 Market, Value Share Analysis, by Application Type, 2015 and 2026

Figure 12: Polyethylene Comonomer, 2015–2026 (Kilo Tons) (US$ Mn)

Figure 13: Polybutene-1, 2015–2026 (Kilo Tons) (US$ Mn)

Figure 14: Valeraldehyde, 2015–2026 (Kilo Tons) (US$ Mn)

Figure 15: 1, 2-butylene oxide, 2015–2026 (Kilo Tons) (US$ Mn)

Figure 16: Others (such as n-butyl mercaptan), 2015–2026 (Kilo Tons) (US$ Mn)

Figure 17: Asia Pacific Butene-1 Market Attractiveness Analysis, by Application Type

Figure 18: Asia Pacific Butene-1 Market Size, (Kilo Tons) (US$ Mn) Forecast, 2015–2026

Figure 19: Asia Pacific Butene-1 Market Attractiveness Analysis, by Country

Figure 20: Asia Pacific Butene-1 Market Value Share Analysis, by Country, 2015 and 2026