Reports

Reports

Commercialization of Polyolefin to Fuel Demand for Polyolefin Catalysts

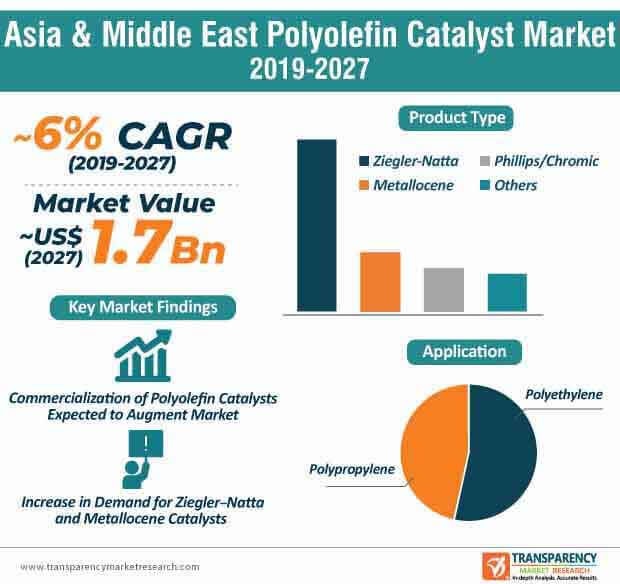

Nearly six decades ago, Giulio Natta and Karl Ziegler discovered the catalytic polymerization of propylene and polymerization. Over the years, polyolefin has gradually emerged as one of the most produced polymers in terms of volume. At present, Ziegler polymers are increasingly being used in the production of films, fibers, plastics, and elastomers, among others. Research and development activities over the past three to four decades have played an important role in the development of new generation of Ziegler-Natta catalysts that are extensively used to manufacture polyolefins such as polyethylene, high-density polyethylene, polypropylene, etc. Considerable investments have been made to improve the traditional Ziegler process, which has enabled the development of a new generation Ziegler-Natta catalysts. In the current scenario, stakeholders in the Asia & Middle East polyolefin catalyst market are expected to devote resources toward research and commercialization of polyolefin, which in turn is expected to influence the growth of the Asia & Middle East polyolefin catalyst market during the forecast period (2019-2027).

The upsurge in the synthesis process of polyolefin wherein polyolefin catalysts are used is expected to generate significant demand for polyolefin catalysts during the assessment period. In addition, the demand for polyolefin, particularly for applications in the oil & gas and energy sectors, is expected to provide lucrative opportunities for stakeholders operating in the current Asia & Middle East polyolefin catalyst market. In a nutshell, research and development coupled with widening applications of polyolefin in an array of industries are expected to drive the Asia & Middle East polyolefin catalyst market to ~US$ 1.7 Bn mark by the end of 2027.

Ziegler-Natta Catalysts to Retain Popularity; Adoption of Metallocene on Rise

The application of polymers continues to expand at a rapid pace, owing to advancements in technology, biochemistry, and emphasis on research and development. Of the different types of polymers that are available, polyolefin spearheads the way in terms of production as well as adoption. The advent of recently developed methyl aluminoxane (MAO)/metallocene catalysts has unlocked the potential of synthesizing polymers with optimum properties, including well-defined microstructure, stereoregularity, and tacticity. Significant progress in polymerization was made due to single active sites on relatively new metallocene catalysts. The popularity and adoption of single-site polyolefin catalysts, including zirconocenes, half titanocene/MAO, etc., is set to grow as they have the ability to control multiple essential parameters, including the degree of linearity, molecular weight distribution, and co-monomer distribution.

Despite the growing interest and demand for metallocene, the Zigler-Natta catalyst is anticipated to remain the most popular catalyst in the Asia & Middle East polyolefin market during the forecast period. Within the polymerization industry, Ziegler-Natta catalysts are increasingly being used to produce polypropylene. The exponential rise in the demand for HDPE, LDPE, and LLDPE has directly impacted the demand for polyolefin catalysts, which is expected to move in the upward trajectory over the course of the forecast period. The surge in demand for these polymers is primarily one of the leading factors that is likely to propel the growth of the Asia & Middle East polyolefin catalyst market in the coming years. In addition, as these polyolefins can be recycled manually, the demand for polyolefin catalysts is projected to witness steady growth during the forecast period.

Stakeholders Focus on Expansion of Product Portfolio and Strategic Partnerships

Stakeholders in the current Asia & Middle East polyolefin catalyst market are focusing on gaining market share by expanding their product portfolio and entering into strategic partnerships with other small-medium sized participants of the Asia & Middle East polyolefin catalyst market. For instance, in October 2019, PQ Group Holdings, a global provider of specialty catalysts, chemicals, materials, etc., with a strong presence in Asia & Middle East, entered into an agreement with INEOS Polyolefin Catalysts. The companies aims to fast-track the commercialization of a few polyethylene catalysts to customers. Moreover, the collaboration will also expand PQ Group’s current catalyst range and provide the company with an opportunity to gain new customers.

While collaborations, mergers, and strategic alliances are the way forward for a number of stakeholders, others are investing resources in research.

Analysts’ Viewpoint

The Asia & Middle East polyolefin catalyst market is expected to grow at a steady CAGR of ~6% during the forecast period. The market growth can be attributed to a range of factors, including a growing focus on research and development and increasing demand for polyethylene, LDPE, polypropylene, and HDPE. In addition, favorable properties of polyolefin catalysts is another factor that will increase the demand for the same in the coming years. Ziegler-Natta catalysts will remain the most popular polyolefin catalyst, followed by the Metallocene catalyst. Stakeholders in the Asia & Middle East polyolefin catalyst market landscape should focus on expanding their market presence through collaborations, launching new products, and adding new products to their existing portfolio.

Asia & Middle East Polyolefin Catalyst Market: Overview

Rising Demand for Polyethylene in Asia & Middle East Drive Polyolefin Catalyst Market

High Demand for High-grade Polyolefin Creates Opportunities for Asia & Middle East Polyolefin Catalyst Market

Expansions, Acquisitions, and New Contracts in Asia & Middle East Polyolefin Catalyst Market

Polypropylene Offers Lucrative Opportunities in Asia & Middle East Polyolefin Catalyst Market

Asia Dominates Asia & Middle East Polyolefin Catalyst Market

Highly Competitive Asia & Middle East Polyolefin Catalyst Market

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Secondary Sources and Acronyms Used

2.3. Research Methodology

3. Executive Summary

3.1. Market Snapshot

3.2. Top Trends

4. Market Overview

4.1. Introduction

4.2. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Porter's Five Forces Analysis

5.2.1. Threat of Substitutes

5.2.2. Bargaining Power of Buyers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of New Entrants

5.2.5. Degree of Competition

5.3. Value Chain Analysis

5.4. Regulatory Scenario

5.5. List of Raw Material Suppliers

5.6. List of Key Manufacturers

5.7. List of Potential Customers

6. Demand–Supply Trend & Pricing Analysis

7. Historical Trend (Value & Volume): 2013–2017

8. CAPEX Analysis: Polypropylene Catalyst Plant

9. Production Cost Analysis: Metallocene Catalyst Plant

10. Sensitivity Analysis: Metallocene Catalyst Plant

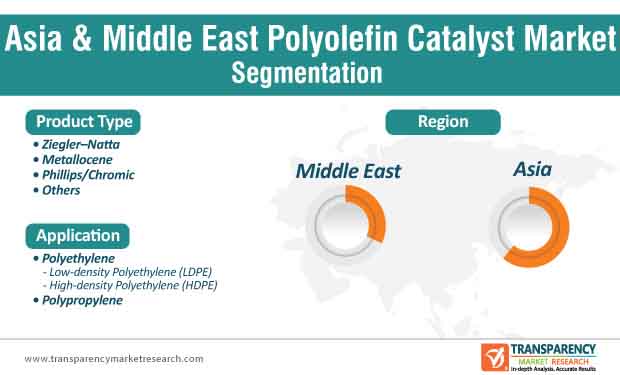

11. Asia & Middle East Polyolefin Catalyst Market Analysis, by Product Type

11.1. Introduction

11.2. Key Findings

11.3. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Product Type, 2018–2027

11.3.1. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Ziegler–Natta, 2018–2027

11.3.2. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Metallocene, 2018–2027

11.3.3. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Phillips/Chromic, 2018–2027

11.3.4. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Others, 2018–2027

11.4. Asia & Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Product Type

12. Asia & Middle East Polyolefin Catalyst Market Analysis, by Application

12.1. Introduction

12.2. Key Findings

12.3. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Application, 2018–2027

12.3.1. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Polyethylene, 2018–2027

12.3.1.1. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Low-density Polyethylene (LDPE), 2018–2027

12.3.1.2. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by High-density Polyethylene (HDPE), 2018–2027

12.3.2. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Polypropylene, 2018–2027

12.4. Asia & Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Application

13. Asia & Middle East Polyolefin Catalyst Market Analysis, by Region, 2018–2027

13.1. Key Findings

13.2. Asia & Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Region, 2018–2027

13.2.1. Asia

13.2.2. Middle East

13.3. Asia & Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Region

14. Asia Polyolefin Catalyst Market Analysis, 2018–2027

14.1. Key Findings

14.2. Asia Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Product Type, 2018–2027

14.3. Asia Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Application, 2018–2027

14.4. Asia Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2018–2027

14.4.1. China Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

14.4.2. China Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.4.3. India Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

14.4.4. India Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.4.5. Japan Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

14.4.6. Japan Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.4.7. South Korea Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

14.4.8. South Korea Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.4.9. Malaysia Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

14.4.10. Malaysia Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.4.11. Singapore Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

14.4.12. Singapore Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.4.13. Rest of Asia Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

14.4.14. Rest of Asia Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

14.5. Asia Polyolefin Catalyst Market Attractiveness Analysis, by Product Type

14.6. Asia Polyolefin Catalyst Market Attractiveness Analysis, by Application

14.7. Asia Polyolefin Catalyst Market Attractiveness Analysis, by Country and Sub-region

15. Middle East Polyolefin Catalyst Market Analysis, 2018–2027

15.1. Key Findings

15.2. Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Product Type, 2018–2027

15.3. Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Application, 2018–2027

15.4. Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2018–2027

15.4.1. Saudi Arabia Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

15.4.2. Saudi Arabia Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

15.4.3. Iran Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

15.4.4. Iran Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

15.4.5. UAE Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

15.4.6. UAE Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

15.4.7. Kuwait Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

15.4.8. Kuwait Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

15.4.9. Rest of Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2018–2027

15.4.10. Rest of Middle East Polyolefin Catalyst Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

15.5. Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Product Type

15.6. Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Application

15.7. Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Country and Sub-region

16. Competition Landscape

16.1. Asia & Middle East Polyolefin Catalyst Market Share Analysis, by Company (2018)

16.2. Competition Matrix

16.3. Market Footprint Analysis

16.3.1. By Region

16.3.2. By Product Type

16.3.3. By Application

16.4. Company Profiles

16.4.1. BASF SE

16.4.1.1. Company Details

16.4.1.2. Company Description

16.4.1.3. Business Overview

16.4.1.4. Financial Overview

16.4.1.5. Strategic Developments

16.4.2. DowDuPont Inc.

16.4.2.1. Company Details

16.4.2.2. Company Description

16.4.2.3. Business Overview

16.4.2.4. Financial Overview

16.4.2.5. Strategic Developments/Recent Developments

16.4.3. ExxonMobil Corporation

16.4.3.1. Company Details

16.4.3.2. Company Description

16.4.3.3. Business Overview

16.4.3.4. Financial Overview

16.4.3.5. Strategic Developments/Recent Developments

16.4.4. Evonik Industries AG

16.4.4.1. Company Details

16.4.4.2. Company Description

16.4.4.3. Business Overview

16.4.4.4. Financial Overview

16.4.4.5. Strategic Developments/Recent Developments

16.4.5. Reliance Industries Limited

16.4.5.1. Company Details

16.4.5.2. Company Description

16.4.5.3. Business Overview

16.4.5.4. Financial Overview

16.4.5.5. Strategic Developments/Recent Developments

16.4.6. AkzoNobel N.V.

16.4.6.1. Company Details

16.4.6.2. Company Description

16.4.6.3. Business Overview

16.4.6.4. Financial Overview

16.4.6.5. Strategic Developments/Recent Developments

16.4.7. SABIC

16.4.7.1. Company Details

16.4.7.2. Company Description

16.4.7.3. Business Overview

16.4.7.4. Financial Overview

16.4.7.5. Strategic Developments/Recent Developments

16.4.8. Clariant

16.4.8.1. Company Details

16.4.8.2. Company Description

16.4.8.3. Business Overview

16.4.8.4. Financial Overview

16.4.8.5. Strategic Developments/Recent Developments

16.4.9. Albermarle Corporation

16.4.9.1. Company Details

16.4.9.2. Company Description

16.4.9.3. Business Overview

16.4.9.4. Financial Overview

16.4.9.5. Strategic Developments/Recent Developments

16.4.10. Mitsubishi Chemical Corporation

16.4.10.1. Company Details

16.4.10.2. Company Description

16.4.10.3. Business Overview

16.4.10.4. Financial Overview

16.4.10.5. Strategic Developments/Recent Developments

16.4.11. Sinopec Corp.

16.4.11.1. Company Details

16.4.11.2. Company Description

16.4.11.3. Business Overview

16.4.11.4. Financial Overview

16.4.11.5. Strategic Developments/Recent Developments

16.4.12. LyondellBasell Industries Holdings B.V.

16.4.12.1. Company Details

16.4.12.2. Company Description

16.4.12.3. Business Overview

16.4.12.4. Financial Overview

16.4.12.5. Recent Developments

16.4.13. W. R. Grace & Co.-Conn.

16.4.13.1. Company Details

16.4.13.2. Company Description

16.4.13.3. Business Overview

16.4.13.4. Financial Overview

16.4.13.5. Strategic Developments/Recent Developments

16.4.14. Nippon Chemical Industrial CO., LTD.

16.4.14.1. Company Details

16.4.14.2. Company Description

16.4.14.3. Business Overview

16.4.14.4. Financial Overview

16.4.14.5. Recent Developments

16.4.15. Chevron Phillips Chemical Company

16.4.15.1. Company Details

16.4.15.2. Company Description

16.4.15.3. Business Overview

16.4.15.4. Financial Overview

16.4.15.5. Recent Developments

List of Tables

Table 01: Capital Investment Analysis, Polypropylene Catalyst Plant

Table 02: Total Production Cost of 25-ton Metallocene Catalyst Plant

Table 03: Sensitivity Analysis for Metallocene Catalyst Plant

Table 04: Asia & Middle East Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 05: Asia & Middle East Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 06: Asia & Middle East Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 07: Asia & Middle East Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 08: Asia Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 09: Asia Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 10: Asia Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 11: Asia Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 12: Asia Polyolefin Catalyst Market Volume (Tons) Forecast, by Country and Sub-region, 2018–2027

Table 13: Asia Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 14: China Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 15: China Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 16: China Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 17: China Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 18: India Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 19: India Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 20: India Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 21: India Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 22: Japan Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 23: Japan Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 24: Japan Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 25: Japan Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 26: South Korea Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 27: South Korea Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 28: South Korea Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 29: South Korea Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 30: Malaysia Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 31: Malaysia Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 32: Malaysia Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 33: Malaysia Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 34: Singapore Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 35: Singapore Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 36: Singapore Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 37: Singapore Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 38: Rest of Asia Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 39: Rest of Asia Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 40: Rest of Asia Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 41: Rest of Asia Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 42: Middle East Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 43: Middle East Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 44: Middle East Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 45: Middle East Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 46: Middle East Polyolefin Catalyst Market Volume (Tons) Forecast, by Country and Sub-region, 2018–2027

Table 47: Middle East Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 48: Saudi Arabia Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 49: Saudi Arabia Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 50: Saudi Arabia Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 51: Saudi Arabia Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 52: Iran Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 53: Iran Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 54: Iran Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 55: Iran Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 56: UAE Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 57: UAE Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 58: UAE Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 59: UAE Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 60: Kuwait Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 61: Kuwait Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 62: Kuwait Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 63: Kuwait Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 64: Rest of Middle East Polyolefin Catalyst Market Volume (Tons) Forecast, by Product Type, 2018–2027

Table 65: Rest of Middle East Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 66: Rest of Middle East Polyolefin Catalyst Market Volume (Tons) Forecast, by Application, 2018–2027

Table 67: Rest of Middle East Polyolefin Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 01: Pricing Analysis, 2018

Figure 02: Asia & Middle East Polyolefin Catalyst Historical Trend Volume (Tons), 2013–2017

Figure 03: Asia & Middle East Polyolefin Catalyst Historical Trend Value (US$ Mn), 2013–2017

Figure 04: Capital Investment for Polypropylene Catalyst

Figure 05: Asia & Middle East Polyolefin Catalyst Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 06: Asia & Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Product Type, 2018

Figure 07: Asia & Middle East Polyolefin Catalyst Market Value Share Analysis, by Application, 2018 and 2027

Figure 08: Asia & Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Application, 2018

Figure 09: Asia Polyolefin Catalyst Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 10: Asia Polyolefin Catalyst Market Value Share Analysis, by Application, 2018 and 2027

Figure 11: Asia Polyolefin Catalyst Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 12: Asia Polyolefin Catalyst Market Value Share Analysis, by Product Type, 2018

Figure 13: Asia Polyolefin Catalyst Market Value Share Analysis, by Application, 2018

Figure 14: Asia Polyolefin Catalyst Market Attractiveness Analysis, by Country and Sub-region, 2018

Figure 15: Middle East Polyolefin Catalyst Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 16: Middle East Polyolefin Catalyst Market Value Share Analysis, by Application, 2018 and 2027

Figure 17: Middle East Polyolefin Catalyst Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 18: Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Product Type, 2018

Figure 19: Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Application, 2018

Figure 20: Middle East Polyolefin Catalyst Market Attractiveness Analysis, by Country and Sub-region, 2018

Figure 21: Asia & Middle East Polyolefin Catalyst Market Share Analysis, by Company (2018)

Figure 22: Market Footprint Analysis, by Region