Reports

Reports

Compressors can be classified as reciprocating and centrifugal compressors. Reciprocating compressors are mostly used for compressing natural gases and other process gases in case gas flow rates are relatively low and desired pressures are high. Centrifugal compressors are located in chemical and process plants, in pipelines that are part of distribution network in ships and drilling fields and which brings gas in the usable form to the market. Natural gas compressors and natural gas engines are also used in the natural gas vehicle (NGV) applications including utilities and public refueling, municipal fleets, school bus and forklift applications. Gas turbine machines are usually deployed in industrial cogeneration, combined heat and power applications and combined-cycle service for power generation. The simple-cycle units of gas turbines are generally deployed in renewable energy power plants.

The natural gas compressors, natural gas engines, gas turbines, centrifugal gas compressors report provides market estimates in term of revenue (US$ Mn) and volume (units) for the period 2012, 2013, and 2014 and forecast for the period 2015-2022. In 2013, United Arab Emirates (UAE) dominated the market for natural gas engines in Middle East region and was valued at US$ 17.1 Mn in the terms of revenue. The growth is mainly driven by growing number of natural gas engines in this region. Additionally, the country is aiming at importing natural gas to cater to domestic demand of steel and aluminum industries. This in turn is expected to drive the infrastructure development across natural gas industry in the country, thus driving the market in the near future. The market for gas turbines was valued at 6,658.0 million in 2013 and is expected to reach US$ 11,184.2 million in 2022, growing at a CAGR of 8.9% from 2015-2022. The growth in gas turbine market is attributed to its adoption in co-generation plants.

Proliferation in number of natural gas vehicles along with other applications such as gas gathering, gas transfer, well head gas recovery, flare elimination has contributed to the growth of natural gas compressors market in the Middle East. The market for natural gas compressors in 2013 was valued at US$ 86.3 million and US$ 82.9 million in Saudi Arabia and United Arab Emirates (UAE) respectively. The growth in natural gas compressors market in Africa is also promising, with Algeria volume shipments accounting 1,561 unit in 2013 and is expected to grow at a CAGR of 12.1% (in terms of volume) from 2015-2022.

The market for gas equipment including natural gas compressors, natural gas engines, gas turbines, and centrifugal gas compressors is moving towards the phase of consolidation with major players trying to increase their portfolio by acquiring leading players in a particular segment. In May 2014, Siemens AG acquired the energy business comprising aero-derivative gas turbine and compressor of Rolls-Royce to cement its place in the power generation and oil and gas industries. Moreover, in September 2014, Siemens AG acquired Dresser-Rand Group Inc. This helped the company to obtain competitive edge over its major competitor GE in the energy business.

Major players in the natural gas engines market include Cummins Inc., Cummins Westport Inc., Westport Power Inc., Weichai Westport Inc. (WWI), Caterpillar Inc., and General Electric. Major players of the natural gas compressors include General Electric, Ingersoll-Rand and Dresser-Rand Group, Inc., (a Siemens business). Few key players of the Gas turbines include Mitsubishi Hitachi Power Systems Ltd., General Electric, and Siemens.

Chapter 1 Preface

1.1 Research Description

1.2 Research Methodology

1.2.1 Secondary Research

1.2.2 Primary Research

Chapter 2 Executive Summary

2.1 Market Snapshot: Asia and MEA Natural Gas Engines, Natural Gas Compressors, Gas Turbines and Centrifugal Gas Compressors Market (2013 & 2022)

2.2 Asia and MEA Natural Gas Engines Market Revenue and Volume, 2012 – 2022 (US$ Million) (Units)

2.3 Asia and MEA Natural Gas Compressors Market Revenue and Volume, 2012 – 2022 (US$ Million) (Units)

2.4 Asia and MEA Gas Turbines Market Revenue and Volume, 2012 – 2022 (US$ Million) (Units)

2.5 Asia and MEA Centrifugal Gas Compressors Market Revenue and Volume, 2012 – 2022 (US$ Million) (Units)

Chapter 3 Asia and MEA Natural Gas Compressors Market Analysis

3.1 Overview

3.2 Asia

3.2.1 Central Asia

3.2.1.1 Kazakhstan

3.2.1.1.1 Kazakhstan Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.1.2 Turkmenistan

3.2.1.2.1 Turkmenistan Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.1.3 Azerbaijan

3.2.1.3.1 Azerbaijan Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.1.4 Rest of Central Asia

3.2.1.4.1 Rest of Central Asia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.2.2 Rest of Asia (South, South-East, South-West Asia)

3.2.2.1 Pakistan

3.2.2.1.1 Pakistan Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.2.2 Myanmar

3.2.2.2.1 Myanmar Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.2.3 Bangladesh

3.2.2.3.1 Bangladesh Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.2.4 Thailand

3.2.2.4.1 Thailand Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.2.5 Malaysia

3.2.2.5.1 Malaysia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.2.6 Indonesia

3.2.2.6.1 Indonesia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.2.7 Vietnam

3.2.2.7.1 Vietnam Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.2.8 Brunei

3.2.2.8.1 Brunei Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.2.9 Papua New Guinea (PNG)

3.2.2.9.1 Papua New Guinea (PNG) Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.2.2.10 Rest of South, South-East, and South-West Asia

3.2.2.10.1 Rest of South, South-East, and South-West Asia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.3 Middle East

1.2 Research Methodology

3.3.1 United Arab Emirates (UAE)

3.3.1.1 UAE Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.3.2 Saudi Arabia

3.3.2.1 Saudi Arabia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.3.3 Kuwait

3.3.3.1 Kuwait Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.3.4 Bahrain

3.3.4.1 Bahrain Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.3.5 Iraq

3.3.5.1 Iraq Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.3.6 Oman

3.3.6.1 Oman Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.3.7 Rest of Middle East

3.3.7.1 Rest of Middle-East Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

3.4 Africa

1.2 Research Methodology

3.4.1 Nigeria

3.4.1.1 Nigeria Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.4.2 Ghana

3.4.2.1 Ghana Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.4.3 Algeria

3.4.3.1 Algeria Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.4.4 Mozambique

3.4.4.1 Mozambique Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.4.5 Angola

3.4.5.1 Angola Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

3.4.6 Rest of Africa

3.4.6.1 Rest of Africa Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

Chapter 4 Asia and MEA Natural Gas Engines Market Analysis

4.1 Overview

4.2 Asia

1.2 Research Methodology

4.2.1 Central Asia

4.2.1.1 Kazakhstan

4.2.1.1.1 Kazakhstan Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.1.2 Turkmenistan

4.2.1.2.1 Turkmenistan Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.1.3 Azerbaijan

4.2.1.3.1 Azerbaijan Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.1.4 Rest of Central Asia

4.2.1.4.1 Rest of Central Asia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.2.2 Rest of Asia (South, South-East, and South-West Asia)

4.2.2.1 Pakistan

4.2.2.1.1 Pakistan Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.2.2 Myanmar

4.2.2.2.1 Myanmar Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.2.3 Bangladesh

4.2.2.3.1 Bangladesh Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.2.4 Thailand

4.2.2.4.1 Thailand Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.2.5 Malaysia

4.2.2.5.1 Malaysia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.2.6 Indonesia

4.2.2.6.1 Indonesia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.2.7 Vietnam

4.2.2.7.1 Vietnam Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.2.8 Brunei

4.2.2.8.1 Brunei Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.2.9 Papua New Guinea (PNG)

4.2.2.9.1 Papua New Guinea (PNG) Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.2.2.10 Rest of South, South-East, and South-West Asia

4.2.2.10.1 Rest of South, South-East and South-West Asia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.3 Middle-East

4.3.1 Natural Gas Marketed Production for 2013 (US$ Mn)

4.3.2 United Arab Emirates (UAE)

4.3.2.1 UAE Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.3.3 Saudi Arabia

4.3.3.1 Saudi Arabia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.3.4 Kuwait

4.3.4.1 Kuwait Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.3.5 Bahrain

4.3.5.1 Bahrain Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.3.6 Iraq

4.3.6.1 Iraq Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.3.7 Oman

4.3.7.1 Oman Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.3.8 Rest of Middle-East

4.3.8.1 Rest of Middle-East Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

4.4 Africa

1.2 Research Methodology

4.4.1 Nigeria

4.4.1.1 Nigeria Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.4.2 Ghana

4.4.2.1 Ghana Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.4.3 Algeria

4.4.3.1 Algeria Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.4.4 Mozambique

4.4.4.1 Mozambique Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.4.5 Angola

4.4.5.1 Angola Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

4.4.6 Rest of Africa

4.4.6.1 Rest of Africa Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

Chapter 5 Asia and MEA Gas Turbines Market Analysis

5.1 Overview

5.2 Asia

1.2 Research Methodology

5.2.1 Central Asia

5.2.1.1 Kazakhstan

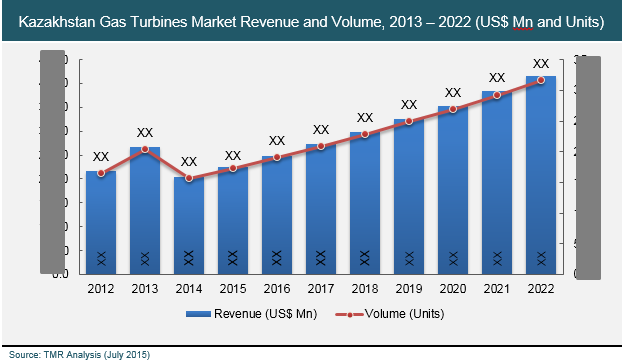

5.2.1.1.1 Kazakhstan Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.1.2 Turkmenistan

5.2.1.2.1 Turkmenistan Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.1.3 Azerbaijan

5.2.1.3.1 Azerbaijan Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.1.4 Rest of Central Asia

5.2.1.4.1 Rest of Central Asia Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.2.2 Rest of Asia (South, South-East, South-West Asia)

5.2.2.1 Pakistan

5.2.2.1.1 Pakistan Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.2.2 Myanmar

5.2.2.2.1 Myanmar Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.2.3 Bangladesh

5.2.2.3.1 Bangladesh Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.2.4 Thailand

5.2.2.4.1 Thailand Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.2.5 Malaysia

5.2.2.5.1 Malaysia Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.2.6 Indonesia

5.2.2.6.1 Indonesia Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.2.7 Vietnam

5.2.2.7.1 Vietnam Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.2.8 Brunei

5.2.2.8.1 Brunei Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.2.9 Papua New Guinea (PNG)

5.2.2.9.1 Papua New Guinea (PNG) Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

5.2.2.10 Rest of South, South-East, and South-West Asia

5.2.2.10.1 Rest of South, South-East, and South-West Asia Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.3.1 United Arab Emirates (UAE)

5.3.1.1 UAE Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.3.2 Saudi Arabia

5.3.2.1 Saudi Arabia Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.3.3 Kuwait

5.3.3.1 Kuwait Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.3.4 Bahrain

5.3.4.1 Bahrain Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.3.5 Iraq

5.3.5.1 Iraq Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.3.6 Oman

5.3.6.1 Oman Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.3.7 Rest of the Middle-East

5.3.7.1 Rest of the Middle-East Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.4.1 Nigeria

5.4.1.1 Nigeria Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.4.2 Ghana

5.4.2.1 Ghana Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.4.3 Algeria

5.4.3.1 Algeria Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.4.4 Mozambique

5.4.4.1 Mozambique Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.4.5 Angola

5.4.5.1 Angola Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

1.2 Research Methodology

5.4.6 Rest of Africa

5.4.6.1 Rest of Africa Gas Turbines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

Chapter 6 Asia and MEA Centrifugal Compressors Market Analysis

6.1 Overview

6.2 Asia

6.2.1 Central Asia

6.2.1.1 Kazakhstan

6.2.1.1.1 Kazakhstan Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.1.2 Turkmenistan

6.2.1.2.1 Turkmenistan Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.1.3 Azerbaijan

6.2.1.3.1 Azerbaijan Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.1.4 Rest of Central Asia

6.2.1.4.1 Rest of Central Asia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2 Rest of Asia (South, South-East, and South-West Asia)

6.2.2.1 Pakistan

6.2.2.1.1 Pakistan Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2.2 Myanmar

6.2.2.2.1 Myanmar Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2.3 Bangladesh

6.2.2.3.1 Bangladesh Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2.4 Thailand

6.2.2.4.1 Thailand Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2.5 Malaysia

6.2.2.5.1 Malaysia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2.6 Indonesia

6.2.2.6.1 Indonesia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2.7 Vietnam

6.2.2.7.1 Vietnam Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2.8 Brunei

6.2.2.8.1 Brunei Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2.9 Papua New Guinea (PNG)

6.2.2.9.1 Papua New Guinea (PNG) Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.2.2.10 Rest of South, South-East, and South-West Asia

6.2.2.10.1 Rest of South, South-East and South-West Asia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.3 Middle-East

6.3.1 United Arab Emirates (UAE)

6.3.1.1 UAE Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.3.2 Saudi Arabia

6.3.2.1 Saudi Arabia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.3.3 Kuwait

6.3.3.1 Kuwait Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.3.4 Bahrain

6.3.4.1 Bahrain Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.3.5 Iraq

6.3.5.1 Iraq Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.3.6 Oman

6.3.6.1 Oman Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.3.7 Rest of Middle-East

6.3.7.1 Rest of Middle-East Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.4 Africa

6.4.1 Nigeria

6.4.1.1 Nigeria Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.4.2 Ghana

6.4.2.1 Ghana Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.4.3 Algeria

6.4.3.1 Algeria Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.4.4 Mozambique

6.4.4.1 Mozambique Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.4.5 Angola

6.4.5.1 Angola Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

6.4.6 Rest of Africa

6.4.6.1 Rest of Africa Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

List of Tables

TABLE 1 Market Snapshot: Asia and MEA Natural Gas Engines, Natural Gas Compressors, Gas Turbines and Centrifugal Gas Compressors Market (2013 & 2022)

List of Figures

FIG. 1 Asia and MEA Natural Gas Engines Market Revenue and Volume, 2012 – 2022 (US$ Million) (Units)

FIG. 2 Asia and MEA Natural Gas Compressors Market Revenue and Volume, 2012 – 2022 (US$ Million) (Units)

FIG. 3 Asia and MEA Gas Turbines Market Revenue and Volume, 2012 – 2022 (US$ Million) (Units)

FIG. 4 Asia and MEA Centrifugal Gas Compressors Market Revenue and Volume, 2012 – 2022 (US$ Million) (Units)

FIG. 5 Kazakhstan Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 6 Turkmenistan Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 7 Azerbaijan Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 8 Rest of Central Asia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 9 Pakistan Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 10 Myanmar Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 11 Bangladesh Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 12 Thailand Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 13 Malaysia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 14 Indonesia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 15 Vietnam Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 16 Brunei Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 17 Papua New Guinea (PNG) Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 18 Rest of South, South-East, and South-West Asia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 19 UAE Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 20 Saudi Arabia Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 21 Kuwait Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 22 Bahrain Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 23 Iraq Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 24 Oman Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 25 Rest of Middle-East Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 26 Nigeria Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 27 Ghana Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 28 Algeria Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 29 Mozambique Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 30 Angola Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 31 Rest of Africa Natural Gas Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 32 Kazakhstan Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 33 Turkmenistan Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 34 Azerbaijan Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 35 Rest of Central Asia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 36 Pakistan Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 37 Myanmar Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 38 Bangladesh Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 39 Thailand Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 40 Malaysia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 41 Indonesia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 42 Vietnam Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 43 Brunei Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 44 Papua New Guinea (PNG) Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 45 Rest of South, South-East and South-West Asia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 46 Natural Gas Marketed Production for 2013 (US$ Mn)

FIG. 47 UAE Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 48 Saudi Arabia Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 49 Kuwait Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 50 Bahrain Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 51 Iraq Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 52 Oman Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 53 Rest of Middle-East Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 54 Nigeria Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 55 Ghana Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 56 Algeria Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 57 Mozambique Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 58 Angola Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 59 Rest of Africa Natural Gas Engines Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 87 Kazakhstan Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 88 Turkmenistan Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 89 Azerbaijan Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 90 Rest of Central Asia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 91 Pakistan Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 92 Myanmar Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 93 Bangladesh Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 94 Thailand Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 95 Malaysia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 96 Indonesia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 97 Vietnam Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 98 Brunei Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 99 Papua New Guinea (PNG) Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 100 Rest of South, South-East and South-West Asia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 101 UAE Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 102 Saudi Arabia Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 103 Kuwait Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 104 Bahrain Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 105 Iraq Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 106 Oman Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 107 Rest of Middle-East Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 108 Nigeria Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 109 Ghana Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 110 Autogas Consumption and Vehicle Fleet - Algeria

FIG. 111 Algeria Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 112 Mozambique Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 113 Angola Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)

FIG. 114 Rest of Africa Centrifugal Compressors Market Revenue and Volume Forecast, 2012 – 2022 (US$ Mn and Units)