Artificial Intelligence in Trading: Introduction

- Implementation of artificial intelligence technology in trading or stock market change the overall shape of stock market. Artificial intelligence (AI) in the form of robo-advisers has already entered into the trading market. A robo-adviser simplifies the trading work flow, as it analyzes millions of data points and executes trades at the optimal price.

- Implementation of an AI platform for trading enables easy identification of complex trading patterns on a massive scale across multiple markets in real-time. It also makes daily workflow easier, improves business processes, increases contact center interaction, and reduces communication complexity.

- The global artificial intelligence in trading market is projected to expand at a rapid pace during the forecast period, due to advancements in technologies across the globe

Global Artificial Intelligence in Trading Market: Dynamics

Global Artificial Intelligence in Trading Market: Key Drivers

- Increase in implementation of artificial intelligence in stock market trading is estimated to enhance user experience, which in turn is expected to propel the artificial intelligence in trading market during the forecast period

- Rise in demand for simplification of the workflow of trading and easy analysis of data and execution of trades at the best price is estimated to boost the artificial intelligence in trading market during the forecast period

- Implementation of artificial intelligence and machine learning in trading also enables analysts to forecast markets with greater accuracy, which is a major factor that is likely to propel the artificial intelligence in trading market in the next few years

- Rise in demand for better communication and interaction with the physical environment to accomplish diverse activities in a more efficient and informed manner across the globe is estimated to boost the artificial intelligence in trading market during the forecast period

- A rise in the rate of adoption of cloud computing technologies across various sectors is projected to boost the demand for artificial intelligence in trading

- Emergence of augmented and prescriptive intelligence is also expected to propel the artificial intelligence in trading market during the forecast period

- Increase in rate of adoption of smart technologies, distributed applications, and advent of 5G are anticipated to boost the artificial intelligence in trading market

- Lack of awareness leading to low rate of adoption of artificial intelligence by small and medium trading and stock players is anticipated to hamper the artificial intelligence in trading market during the forecast period

Impact of COVID-19 on the Global Artificial Intelligence in Trading Market

- Increasing cases of COVID-19 across the globe is resulting in economic slowdown and millions of employees are working from home for the first time during this pandemic. This is expected to change the conservative corporate culture. Hence, demand for better observation, study and analysis of market conditions, trading patterns, and data is increasing during this pandemic. This is expected to continue during the forecast period. Hence, COVID-19 has a positive impact on the artificial intelligence in trading market. This is projected to indirectly propel the global artificial intelligence in trading market in the next few years. However, a lack of industrial activity is expected to result in low cash flows, thus hampering the funding of projects.

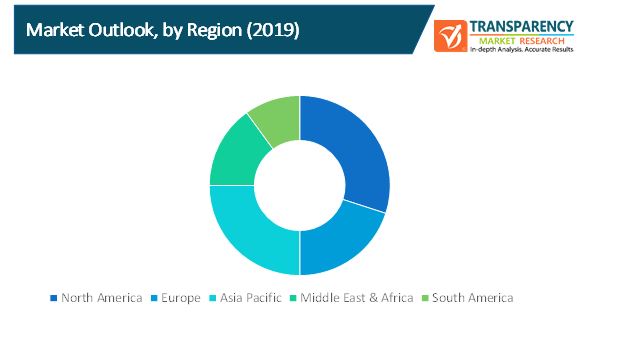

North America to Hold Major Share of Global Artificial Intelligence in Trading Market

- In terms of region, the global artificial intelligence in trading market can be divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America

- North America dominated the global artificial intelligence in trading market in 2019. The U.S. is a key market in the region due to a rise in the adoption of smart technologies and rapid implementation of artificial intelligence in trading by organizations.

- The artificial intelligence in trading market in Asia Pacific is projected to expand at a rapid pace during the forecast period. This can be attributed to a rise in the adoption of digital technologies in the region.

Global Artificial Intelligence in Trading Market: Competition Landscape

Several local, regional, and global players are active in the artificial intelligence in trading market with a strong presence. Rapid technological advancements have created significant opportunities in the global artificial intelligence in trading market.

Key Players Operating in the Global Artificial Intelligence in Trading Market Include:

- Trading Technologies International, Inc.

- GreenKey Technologies, LLC

- IBM Corporation

- Udacity, Inc.

- AITrading

- Trade Ideas, LLC

- Imperative Execution Inc.

- Sentient Investment Management Limited

- Looking Glass Investments LLC

Global Artificial Intelligence in Trading Market: Research Scope

Global Artificial Intelligence in Trading Market, by Enterprise Size

- Small & Medium Enterprise

- Large Enterprise

Global Artificial Intelligence in Trading Market, by End-user

- Automotive

- IT & Telecommunication

- Transportation & Logistics

- Energy & Utilities

- Healthcare

- Retail

- Manufacturing

- Others