Reports

Reports

Animal Feed Dietary Fibers Market - An Overview

Animal feed forms the most fundamental part of a livestock system and directly or indirectly impacts the overall livestock industry and food chain. Dietary fibers help to improve an animal's intestinal health as well as aid in health management. They also regulate the digestive health of animals and have a positive impact on constipation.

In poultry animals, dietary fibers helps in improved protein and fat digestion, better feed conversion, and better bone mineralization.

The capabilities of meat production have improved by factors such as a rise in feedstock production, genetic and technological advancements, and modern factory farming techniques. An increase in meat and dairy products demand is expected to provide substantial opportunities to the animal feed dietary fibers market in future.

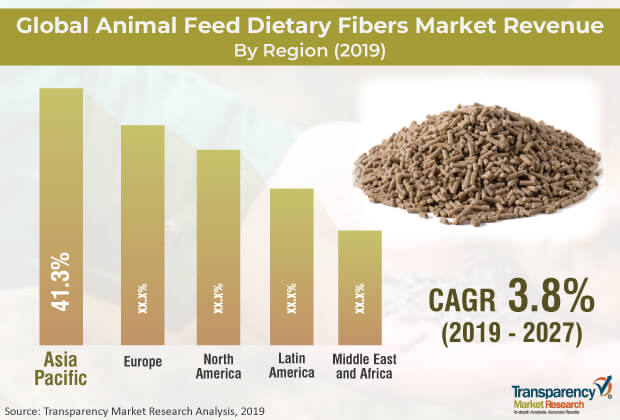

The global animal feed dietary fibers market has been divided into five regions: Europe, Asia Pacific, Middle East & Africa, Latin America, and North America. Asia Pacific was the leader in the global animal feed dietary fibers market in 2018 and is estimated to continue its domination and provide profitable opportunities for the animal feed dietary fibers market in future.

The presence of the compound feed production industry and a rise in the pet population in Asia Pacific are anticipated to be important factors boosting the animal feed dietary fibers market in this region. A change in the livestock industry from a disorganized sector to an organized sector is expected to improve animal feed dietary fibers demand, which, in turn, could boost the animal feed dietary fibers market.

To enhance their geographical presence, animal feed dietary fibers manufacturers are adopting several strategies such as mergers & acquisitions, plant capacity expansion, and distribution channel expansion.

Starter feeds is anticipated to bean emerging application of specialty feed in the upcoming few years. Starter feeds helps in improving feed absorption, and demand for corn and cereals is anticipated to increase the starter feeds production.

Corn provides a sufficient amount of dietary fibers to animals and also promotes the growth of rumen bacterial growth, which improves feed digestibility. Animal diets which are cereal-based are rich in dietary fibers and improve immune function, digestive health, and weight control.

Animal Feed Dietary Fibers Market – Snapshot

Animal feed is the foundation of livestock systems. It directly or indirectly affects the entire livestock sector, as well as the food chain. Dietary fibers are essentially used to improve the intestinal health of animals and their weight management. Animal feed for ruminants, poultry, swine, aquafeed, equine, rabbits, and pets involves specific content of dietary fibers. Dietary fibers such as pea hulls offered by Roquette Frères are used in pet food for dietary management of obesity. Insoluble dietary fiber ingestion stimulates satiety among animals, without adding excessive calories. Dietary fibers also regulate digestive health of animals, with positive impact on constipation. In case of poultry, dietary fibers facilitate better mineralization of bones, better protein and fat digestion, and improved feed conversion. Factors such as modern factory farming methods, technological and genetic advancements, and increase in feedstock production have boosted the capabilities of meat production. Rise in demand for meat and dairy products is anticipated to present significant opportunities to the global animal feed dietary fibers market in the near future.

The global animal feed dietary fibers market has been segmented based on type, application, and region. Based on type, the market has been divided into corn, cereals, grains, pine, potato, spruce, and others (including vegetables, fruits, and sugar beet pulp). In terms of revenue, the corn segment held major share of the market in 2018. Corn provides adequate amounts of dietary fibers to animals. It also promotes rumen bacterial growth, thus enhancing the feed digestibility. The corn segment is projected to dominate the global animal feed dietary fibers market throughout the forecast period. The cereals segment is anticipated to be another key segment in the animal feed dietary fibers market in the next few years. Cereals based animal diets are rich in dietary fiber content and provide improved weight control, improved digestive health, and enhanced immune function.

Based on application, the global animal feed dietary fibers market has been segregated into pet food, compound feed, and specialty feed. In terms of revenue and volume, the compound feed segment constituted the largest share of the global market in 2018. Compound feed is projected to observe robust demand from the key buyers in the animal feed dietary fibers market, including contract growers and animal farmers. The pet food segment is anticipated to expand at a faster pace than other segments during the forecast period. The global population of companion animals or pets is likely to expand substantially in the next few years. Pet owners are increasingly adding nutritional value to their pets’ diet, thereby driving the demand for dietary fibers in pet food. Global demand for pet food is likely to increase, led by the growth in per capita income of the people. Transition in pet diets from table scraps to nutritious feed is expected to positively impact the demand for animal feed dietary fibers during the forecast period.

Starter feeds is likely to be an emerging application of specialty feed in the next few years. Starter feeds enable young animals to adapt to solid feed, and improve feeds absorption. Demand for corn and cereals is estimated to rise in production of starter feed during the forecast period. Rise in concerns about health and environmental impact of meat-heavy diets is anticipated to propel the consumer preference for vegan and vegetarian food products. This is projected to restrain the market to some extent in the near future.

Based on region, the global animal feed dietary fibers market has been classified into Europe, North America, Asia Pacific, Middle East & Africa, and Latin America. Asia Pacific dominated the global animal feed dietary fibers market in 2018. This trend is estimated to continue during the forecast period. The region is projected to create lucrative opportunities for the animal feed dietary fibers market in the near future. The animal feed dietary fibers market in Asia Pacific is likely to expand at a CAGR of exceeding 4% during the forecast period. Presence of well-established compound feed production industry and increase in pet population are expected to be the key factors propelling the market in Asia Pacific. Shift of the livestock industry from an unorganized sector to organized one is anticipated to boost the demand for animal feed dietary fibers during the forecast period.

Key players operating in the global animal feed dietary fibers market include Tate & Lyle, Roquette Frères, Associated British Foods plc, Cargill, Incorporated, ADM, and Ingredion and J. RETTENMAIER & SÖHNE GmbH + Co KG. The market is capital intensive and involves high degree of expertise in equipment management and feed formulation. It further involves significant marketing and promotional efforts. Manufacturers of animal feed dietary fibers are adopting various strategies such as plant capacity expansion, mergers & acquisitions, and distribution channel expansion to strengthen their geographic presence. For instance, in 2017, Roquette Frères built a new headquarters in Asia Pacific that focuses on the food & nutrition segment in the region.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Animal Feed Dietary Fibers Market

3.1. Global Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), 2018–2027

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Market Developments

4.2. Key Market Indicators

4.3. Animal Feed Dietary Fibers Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Porter’s Five Force Analysis

4.5. Value Chain Analysis

4.5.1. List of Key Manufacturers

4.5.2. Level of Integration

4.6. Regulatory Scenario

4.7. Animal Feed Dietary Fibers Market Outlook

5. Global Animal Feed Dietary Fibers Market Analysis and Forecast, by Type

5.1. Introduction & Definitions

5.2. Key Findings

5.3. Global Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, by Type, 2018–2027

5.3.1. Corn

5.3.2. Cereals

5.3.3. Grains

5.3.4. Pine

5.3.5. Potato

5.3.6. Spruce

5.3.7. Others

5.4. Global Animal Feed Dietary Fibers Market Attractiveness, by Type

6. Global Animal Feed Dietary Fibers Market Analysis and Forecast, by Application

6.1. Introduction & Definitions

6.2. Key Findings

6.3. Global Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2018–2027

6.3.1. Pet Food

6.3.2. Compound Feed

6.3.3. Specialty Feed

6.4. Global Animal Feed Dietary Fibers Market Attractiveness, by Application

7. Global Animal Feed Dietary Fibers Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Global Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons) Forecast, by Region, 2018–2027

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. Asia Pacific

7.2.5. Middle East & Africa

7.3. Global Animal Feed Dietary Fibers Market Attractiveness, by Region

8. North America Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons) , 2018–2027

8.1. Key Findings

8.2. North America Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

8.3. North America Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

8.3.1. U.S. Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

8.3.2. U.S. Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

8.3.3. Canada Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

8.3.4. Canada Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

9. Europe Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), 2018–2027

9.1. Key Findings

9.2. Europe Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

9.3. Europe Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

9.3.1. Germany Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

9.3.2. Germany Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

9.3.3. U.K. Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

9.3.4. U.K. Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

9.3.5. France Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

9.3.6. France Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

9.3.7. Spain Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

9.3.8. Spain Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

9.3.9. Italy Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

9.3.10. Italy Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

9.3.11. Russia & CIS Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

9.3.12. Russia & CIS Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

9.3.13. Rest of Europe Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

9.3.14. Rest of Europe Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

10. Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), 2018–2027

10.1. Key Findings

10.2. Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

10.3. Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

10.3.1. China Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

10.3.2. China Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

10.3.3. India Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

10.3.4. India Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

10.3.5. Japan Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

10.3.6. Japan Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

10.3.7. ASEAN Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

10.3.8. ASEAN Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

10.3.9. Rest of Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

10.3.10. Rest of Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

11. Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), 2018–2027

11.1. Key Findings

11.2. Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

11.3. Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

11.3.1. Brazil Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

11.3.2. Brazil Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

11.3.3. Mexico Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

11.3.4. Mexico Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

11.3.5. Rest of Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

11.3.6. Rest of Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

12. Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), 2018–2027

12.1. Key Findings

12.2. Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

12.3. Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

12.3.1. GCC Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

12.3.2. GCC Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

12.3.3. South Africa Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

12.3.4. South Africa Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

12.3.5. Rest of Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Type

12.3.6. Rest of Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) and Volume (Kilo Tons), by Application

13. Competition Landscape

13.1. Market Players – Competition Matrix (by Tier and Size of Companies)

13.2. Global Animal Feed Dietary Fibers Market Share Analysis, by Company (2018)

13.3. Market Footprint Analysis,

13.3.1. By Region

13.3.2. By Application

13.4. Company Profiles (Details: Overview, Financials, Recent Developments, Strategy)

13.4.1. Roquette Frères

13.4.1.1. Company Overview

13.4.1.2. Business Overview

13.4.1.3. Strategic Overview

13.4.2. ADM

13.4.2.1. Company Overview

13.4.2.2. Business Overview

13.4.2.3. Financial Overview

13.4.2.4. Strategic Overview

13.4.3. Cargill, Incorporated

13.4.3.1. Company Overview

13.4.3.2. Business Overview

13.4.3.3. Financial Overview

13.4.3.4. Strategic Overview

13.4.4. Tate & Lyle

13.4.4.1. Company Overview

13.4.4.2. Business Overview

13.4.4.3. Financial Overview

13.4.4.4. Strategic Overview

13.4.5. Ingredion

13.4.5.1. Company Overview

13.4.5.2. Business Overview

13.4.5.3. Financial Overview

13.4.6. J.RETTENMAIER & SÖHNE GmbH + Co KG

13.4.6.1. Company Overview

13.4.6.2. Business Overview

13.4.6.3. Strategic Overview

13.4.7. Associated British Foods plc

13.4.7.1. Company Overview

13.4.7.2. Business Overview

13.4.7.3. Financial Overview

13.4.7.4. Strategic Overview

13.4.8. BENEO

13.4.8.1. Company Overview

13.4.8.2. Business Overview

13.4.8.3. Financial Overview

13.4.9. LONZA Group

13.4.9.1. Company Overview

13.4.9.2. Business Overview

13.4.9.3. Financial Overview

13.4.10. Agromed GmbH

13.4.10.1. Company Overview

13.4.10.2. Business Overview

13.4.11. Tereos

13.4.11.1. Company Overview

13.4.11.2. Business Overview

13.4.11.3. Financial Overview

13.4.12. Kerry Inc.

13.4.12.1. Company Overview

13.4.12.2. Business Overview

13.4.12.3. Financial Overview

13.4.12.4. Strategic Overview

13.4.13. Nexira

13.4.13.1. Company Overview

13.4.13.2. Business Overview

List of Tables

Table 1 Global Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 2 Global Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 3 Global Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 4 Global Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 5 Global Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Region, 2018–2027

Table 6 Global Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Region, 2018–2027

Table 7 North America Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 8 North America Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 9 North America Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 10 North America Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 11 North America Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Country, 2018–2027

Table 12 North America Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Country, 2018–2027

Table 13 U.S. Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 14 U.S. Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 15 U.S. Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 16 U.S. Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 17 Canada Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 18 Canada Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 19 Canada Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 20 Canada Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 21 Europe Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 22 Europe Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 23 Europe Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 24 Europe Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 25 Europe Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 26 Europe Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 27 Germany Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 28 Germany Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 29 Germany Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 30 Germany Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 31 U.K. Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 32 U.K. Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 33 U.K. Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 34 U.K. Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 35 France Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 36 France Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 37 France Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 38 France Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 39 Italy Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 40 Italy Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 41 Italy Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 42 Italy Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 43 Spain Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 44 Spain Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 45 Spain Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 46 Spain Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 47 Russia & CIS Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 48 Russia & CIS Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 49 Russia & CIS Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 50 Russia & CIS Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 51 Rest of Europe Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 52 Rest of Europe Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 53 Rest of Europe Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 54 Rest of Europe Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 55 Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 56 Asia Pacific Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 57 Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 58 Asia Pacific Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 59 Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 60 Asia Pacific Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 61 China Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 62 China Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 63 China Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 64 China Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 65 India Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 66 India Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 67 India Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 68 India Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 69 Japan Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 70 Japan Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 71 Japan Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 72 Japan Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 73 ASEAN Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 74 ASEAN Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 75 ASEAN Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 76 ASEAN Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 77 Rest of Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 78 Rest of Asia Pacific Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 79 Rest of Asia Pacific Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 80 Rest of Asia Pacific Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 81 Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 82 Latin America Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 83 Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 84 Latin America Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 85 Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 86 Latin America Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 87 Brazil Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 88 Brazil Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 89 Brazil Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 90 Brazil Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 91 Mexico Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 92 Mexico Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 93 Mexico Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 94 Mexico Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 95 Rest of Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 96 Rest of Latin America Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 97 Rest of Latin America Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 98 Rest of Latin America Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 99 Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 100 Middle East & Africa Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 101 Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 102 Middle East & Africa Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 103 Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 104 Middle East & Africa Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 105 GCC Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 106 GCC Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 107 GCC Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 108 GCC Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 109 South Africa Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 110 South Africa Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 111 South Africa Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 112 South Africa Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 113 Rest of Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Type, 2018–2027

Table 114 Rest of Middle East & Africa Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Type, 2018–2027

Table 115 Rest of Middle East & Africa Animal Feed Dietary Fibers Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 116 Rest of Middle East & Africa Animal Feed Dietary Fibers Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

List of Figures

Figure 1 Global Animal Feed Dietary Fibers Market Value Share Analysis, by Type, 2018 and 2027

Figure 2 Global Animal Feed Dietary Fibers Market Attractiveness Analysis, by Type

Figure 3 Global Animal Feed Dietary Fibers Market Value Share Analysis, by Application, 2018 and 2027

Figure 4 Global Animal Feed Dietary Fibers Market Attractiveness Analysis, by Application

Figure 5 Global Animal Feed Dietary Fibers Market Value Share Analysis, by Region, 2018 and 2027

Figure 6 Global Animal Feed Dietary Fibers Market Attractiveness Analysis, by Region

Figure 7 North America Animal Feed Dietary Fibers Market Value Share Analysis, by Type, 2018 and 2027

Figure 8 North America Animal Feed Dietary Fibers Market Attractiveness Analysis, by Type, 2018

Figure 9 North America Animal Feed Dietary Fibers Market Value Share Analysis, by Application, 2018 and 2027

Figure 10 North America Animal Feed Dietary Fibers Market Attractiveness Analysis, by Application, 2018

Figure 11 North America Animal Feed Dietary Fibers Market Value Share Analysis, by Country, 2018 and 2027

Figure 12 North America Animal Feed Dietary Fibers Market Attractiveness Analysis, by Country, 2018

Figure 13 Europe Animal Feed Dietary Fibers Market Value Share Analysis, by Type, 2018 and 2027

Figure 14 Europe Animal Feed Dietary Fibers Market Attractiveness Analysis, by Type, 2018

Figure 15 Europe Animal Feed Dietary Fibers Market Value Share Analysis, by Application, 2018 and 2027

Figure 16 Europe Animal Feed Dietary Fibers Market Attractiveness Analysis, by Application, 2018

Figure 17 Europe Animal Feed Dietary Fibers Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 18 Europe Animal Feed Dietary Fibers Market Attractiveness Analysis, by Country and Sub-region, 2018

Figure 19 Asia Pacific Animal Feed Dietary Fibers Market Value Share Analysis, by Type, 2018 and 2027

Figure 20 Asia Pacific Animal Feed Dietary Fibers Market Attractiveness Analysis, by Type, 2018 and 2027

Figure 21 Asia Pacific Animal Feed Dietary Fibers Market Value Share Analysis, by Application, 2018 and 2027

Figure 22 Asia Pacific Animal Feed Dietary Fibers Market Attractiveness Analysis, by Application, 2018 and 2027

Figure 23 Asia Pacific Animal Feed Dietary Fibers Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 24 Asia Pacific Animal Feed Dietary Fibers Market Attractiveness Analysis, by Country and Sub-region, 2018 and 2027

Figure 25 Latin America Animal Feed Dietary Fibers Market Value Share Analysis, by Type, 2018 and 2027

Figure 26 Latin America Animal Feed Dietary Fibers Market Attractiveness Analysis, by Type, 2018 and 2027

Figure 27 Latin America Animal Feed Dietary Fibers Market Value Share Analysis, by Application, 2018 and 2027

Figure 28 Latin America Animal Feed Dietary Fibers Market Attractiveness Analysis, by Application, 2018 and 2027

Figure 29 Latin America Animal Feed Dietary Fibers Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 30 Latin America Animal Feed Dietary Fibers Market Attractiveness Analysis, by Country and Sub-region, 2018 and 2027

Figure 31 Middle East & Africa Animal Feed Dietary Fibers Market Value Share Analysis, by Type, 2018 and 2027

Figure 32 Middle East & Africa Animal Feed Dietary Fibers Market Attractiveness Analysis, by Type, 2018 and 2027

Figure 33 Middle East & Africa Animal Feed Dietary Fibers Market Value Share Analysis, by Application, 2018 and 2027

Figure 34 Middle East & Africa Animal Feed Dietary Fibers Market Attractiveness Analysis, by Application, 2018 and 2027

Figure 35 Middle East & Africa Animal Feed Dietary Fibers Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 36 Middle East & Africa Animal Feed Dietary Fibers Market Attractiveness Analysis, by Country and Sub-region, 2018 and 2027