Analysts’ Viewpoint on Market Scenario

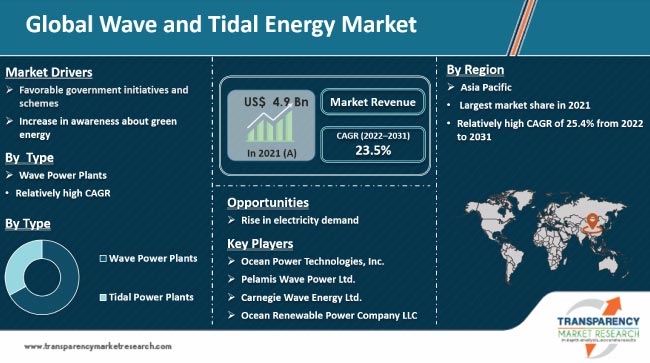

Rise in demand for clean energy sources is projected to drive the global wave and tidal energy industry during the forecast period. Tidal energy is considered a green energy source owing to its zero greenhouse gas emissions. Several companies operating in the global market have started adopting diverse strategies to optimize the use of the available advanced technologies in order to meet the rising demand for sustainable energy. Many government and private companies have increased investments to discover alternative clean energy sources. This is augmenting the global market. Consumers are increasingly preferring sustainable wave and tidal energy over other alternatives due to the growth in environmental concerns around the world. Key players are focusing on recent developments in wave and tidal energy market to increase their global footprint.

Wave and tidal energy is closely associated with the power generation industry. Wave energy (or wave power) refers to the transport and capture of energy by ocean surface waves. The energy captured is then used for various purposes including electricity generation, water desalination, and pumping of water. Wave energy, a type of renewable energy, is estimated to be the largest resource form of ocean energy across the globe. The worsening energy crisis has prompted governments, consumers, and manufacturers to focus on alternative sources of energy. This has put wave and tidal energy that can be harnessed from the oceans in the spotlight.

Development of the wave and tidal energy sector is gaining momentum due to the growth in initiatives by several governments and developing countries to reduce the consumption of fossil fuels and their carbon footprint. Various marketing strategies for the wave and tidal energy market are being adopted by leading players. Companies are developing efficient energy storage systems to store the energy generated from renewable sources. An increase in efforts by market players to develop innovative tidal energy generators and turbines is expected to fuel the market during the forecast period.

Request a sample to get extensive insights into the Wave and Tidal Energy Market

Governments of various countries are increasingly focusing on the installation of wave and tidal energy using favorable schemes and policies. The U.S., China, and Europe are implementing policies such as FiT, investment tax credits, and capital subsidies to augment the installation of wave and tidal energy. Of late, there has been a swift growth in the installed capacity of wave and tidal energy generation, and advancements in price, performance, and technology. Governments of various countries are supporting wave and tidal energy projects through programs and initiatives to help provide solar power at a subsidized cost.

The Government of India has taken initiatives to encourage a number of individuals and companies to opt for wave and tidal energy. For instance, a major tidal wave power project worth Rs.5000 Cr is being proposed in Gujarat's Gulf of Kutch. Governments of various countries are constantly striving to formulate policies to provide ocean tidal energy in order to increase wave and tidal power generation with grid connection convenience. They are also aggressively promoting the use of tidal and ocean energy. Such government initiatives and schemes are expected to positively impact the wave and tidal energy market during the forecast period.

A rise in awareness about green energy and the enactment of stringent government rules and regulations on the emission of greenhouse gases (GHGs) and carbon dioxide are compelling companies to seek more effective alternatives and pollution-free energy generation methods. Tidal wave energy is a worthy alternative to generating energy from fossil fuels. The process of energy generation from fossil fuels leads to the emission of greenhouse gases (GHGs), which can cause serious damage to the environment including global warming, air pollution, and land pollution.

According to the World Wave and Tidal Energy Development Report (WSHPDR), 2020, wave and tidal energy represented approximately 1.5% of the world’s total electricity installed capacity, 4.5% of the total renewable energy capacity, and 7.5% of the total hydropower capacity in the year. Over the last three years, wave and tidal energy production has increased by around 10% across the globe. For instance, India is estimated to have a potential of around 54 gigawatts (GW) of ocean energy - tidal power (12.45 GW) and wave power (41.3 GW) - but it is yet to be of practical use as per the Indian Government’s Ministry of New and Renewable Energy (MNRE). Thus, an increase in awareness about green energy and stringent government regulations on GHG emissions are likely to drive the global market for wave and tidal energy in the next few years.

Request a custom report on the Wave and Tidal Energy Market

In terms of type, the global market has been segmented into wave power plants and tidal power plants. The wave power plants segment held the major share of the global market in 2021. It is estimated to dominate the market during the forecast period. Demand for wave power plants is likely to rise during the forecast period due to the increase in environmental concerns. Consumers are opting for energy generated from the ocean due to its various benefits. This is driving the expansion of wave power plants across the globe. In turn, this is likely to fuel the global wave ad tidal energy market during the forecast period.

Asia Pacific accounted for a prominent share of 43.3% of the global market in 2021. It is anticipated to dominate the global market during the forecast period. In terms of revenue, China held a significant share of this market in Asia Pacific in 2021. A rise in environmental pollution and intensified energy war are some of the key factors expected to boost the future market demand for wave and tidal energy in China during the forecast period.

Europe held the second-largest share of the global wave and tidal energy business in 2021. This trend is expected to continue during the forecast period due to a shift in a movement toward the development of renewable technologies for power production in order to cater to the increase in demand for electricity across the region.

North America is a larger market for wave and tidal energy than Latin America and Middle East & Africa. The growth of this market in North America can be ascribed to the introduction of several incentives by regulators to boost the penetration of renewable resources in primary energy consumption in the region. Ongoing investments in the development of wave and tidal energy projects in the U.S. to meet the demand for electricity are projected to contribute to the growth of the market in the region during the forecast period.

The global wave and tidal energy market are consolidated, with the presence of a few large-scale vendors that control the majority of the share. Most organizations are investing significantly in comprehensive research and development activities. Key players operating in the wave and tidal energy business are Ocean Power Technologies, Inc., Pelamis Wave Power Ltd., Carnegie Wave Energy Ltd., Ocean Renewable Power Company LLC, Tenax Energy, Atlantis Resources Ltd., Aquagen Technologies, S.D.E. Energy Ltd. (WERPO Wave Energy), Marine Current Turbines Ltd., and Aquamarine Power Ltd.

Each of these players has been profiled in the global market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.9 Bn |

|

Market Forecast Value in 2031 |

US$ 40.8 Bn |

|

Growth Rate (CAGR) |

23.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & MW for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global wave and tidal energy industry stood at US$ 4.9 Bn in 2021.

The market is expected to grow at a CAGR of 23.5% from 2022 to 2031.

Increase awareness about green energy and favorable government initiatives and schemes.

The wave power plants segment accounted for a major share of 67.3% of the global wave and tidal energy market in 2021.

Asia Pacific is a more attractive region for vendors in the global market.

Ocean Power Technologies, Inc., Pelamis Wave Power Ltd., Carnegie Wave Energy Ltd., Ocean Renewable Power Company LLC, Tenax Energy, Atlantis Resources Ltd., AquaGen Technologies, S.D.E. Energy Ltd. (WERPO Wave Energy), Marine Current Turbines Ltd., and Aquamarine Power Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Service Provider

2.6.2. List of Dealers/Distributors

2.6.3. List of Potential Customers

2.7. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of Wave and Tidal Energy Sector

3.2. Impact on the Wave and Tidal Energy Market – Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on the Market

5. Global Wave and Tidal Energy Market Analysis and Forecast, by Type, 2022–2031

5.1. Introduction and Definitions

5.2. Global Wave and Tidal Energy Market Volume (MW) and Value (US$ Mn) Forecast, by Type, 2022–2031

5.2.1. Wave Power Plants

5.2.2. Tidal Power Plants

5.3. Global Wave and Tidal Energy Market Attractiveness, by Type

6. Global Wave and Tidal Energy Market Analysis and Forecast, by Region, 2022–2031

6.1. Key Findings

6.2. Global Wave and Tidal Energy Market Volume (MW) and Value (US$ Mn) Forecast, by Region, 2022–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East & Africa

6.2.5. Latin America

6.3. Global Wave and Tidal Energy Market Attractiveness, by Region

7. North America Wave and Tidal Energy Market Analysis, 2022–2031

7.1. Key Findings

7.2. North America Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Type

7.3. North America Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Country

7.3.1. U.S. Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

7.3.2. Canada Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

7.4. North America Wave and Tidal Energy Market Attractiveness Analysis, by Type

7.5. North America Wave and Tidal Energy Market Attractiveness Analysis, by Country

8. Europe Wave and Tidal Energy Market Analysis, 2022–2031

8.1. Europe Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Type

8.2. Europe Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Country and Sub-region

8.2.1. Germany Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

8.2.2. France Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

8.2.3. U.K. Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

8.2.4. Italy Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

8.2.5. Spain Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

8.2.6. Russia Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

8.2.7. Rest of Europe Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

8.3. Europe Wave and Tidal Energy Market Attractiveness Analysis, by Type

8.4. Europe Wave and Tidal Energy Market Attractiveness Analysis, by Country and Sub-region

9. Asia Pacific Wave and Tidal Energy Market Analysis, 2022–2031

9.1. Key Findings

9.2. Asia Pacific Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Type

9.3. Asia Pacific Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Country and Sub-region

9.3.1. China Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

9.3.2. Japan Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

9.3.3. India Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

9.3.4. Rest of Asia Pacific Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

9.4. Asia Pacific Wave and Tidal Energy Market Attractiveness Analysis, by Type

9.5. Asia Pacific Wave and Tidal Energy Market Attractiveness Analysis, by Country and Sub-region

10. Middle East & Africa Wave and Tidal Energy Market Analysis, 2022–2031

10.1. Key Findings

10.2. Middle East & Africa Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Type

10.3. Middle East & Africa Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Country and Sub-region

10.3.1. GCC Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

10.3.2. South Africa Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

10.3.3. Rest of Middle East & Africa Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

10.4. Middle East & Africa Wave and Tidal Energy Market Attractiveness Analysis, by Type

10.5. Middle East & Africa Wave and Tidal Energy Market Attractiveness Analysis, by Country and Sub-region

11. Latin America Wave and Tidal Energy Market Analysis, 2022–2031

11.1. Key Findings

11.2. Latin America Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Type

11.3. Latin America Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Analysis & Forecast, by Country and Sub-region

11.3.1. Brazil Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

11.3.2. Mexico Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

11.3.3. Rest of Latin America Wave and Tidal Energy Market Value (US$ Mn) & Volume (MW) Forecast, by Type

11.4. Latin America Wave and Tidal Energy Market Attractiveness Analysis, by Type

11.5. Latin America Wave and Tidal Energy Market Attractiveness Analysis, by Country and Sub-region

12. Competition Landscape

12.1. Competition Matrix

12.2. Global Wave and Tidal Energy Market Share Analysis, by Company (2021)

12.3. Company Profiles

12.3.1. Ocean Power Technologies, Inc.

12.3.1.1. Company Details

12.3.1.2. Company Description

12.3.1.3. Business Overview

12.3.1.4. Recent Developments

12.3.2. Pelamis Wave Power Ltd.

12.3.2.1. Company Details

12.3.2.2. Company Description

12.3.2.3. Business Overview

12.3.2.4. Financial Details

12.3.2.5. Recent Developments

12.3.3. Carnegie Wave Energy Ltd

12.3.3.1. Company Details

12.3.3.2. Company Description

12.3.3.3. Business Overview

12.3.3.4. Recent Developments

12.3.4. Ocean Renewable Power Company LLC

12.3.4.1. Company Details

12.3.4.2. Company Description

12.3.4.3. Business Overview

12.3.4.4. Recent Developments

12.3.5. Tenax Energy

12.3.5.1. Company Detail

12.3.5.2. Company Description

12.3.5.3. Business Overview

12.3.5.4. Recent Developments

12.3.6. Atlantis Resources Ltd.

12.3.6.1. Company Details

12.3.6.2. Company Description

12.3.6.3. Business Overview

12.3.6.4. Financial Details

12.3.6.5. Recent Developments

12.3.7. AquaGen Technologies

12.3.7.1. Company Details

12.3.7.2. Company Description

12.3.7.3. Business Overview

12.3.7.4. Recent Developments

12.3.8. S.D.E. Energy Ltd. (WERPO Wave Energy)

12.3.8.1. Company Description

12.3.8.2. Business Overview

12.3.8.3. Financial Overview

12.3.8.4. Strategic Overview

12.3.9. Marine Current Turbines Ltd.

12.3.9.1. Company Description

12.3.9.2. Business Overview

12.3.9.3. Financial Overview

12.3.9.4. Strategic Overview

12.3.10. Aquamarine Power Ltd.

12.3.10.1. Company Description

12.3.10.2. Business Overview

12.3.10.3. Financial Overview

12.3.10.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 01: Global Wave and Tidal Energy Market Volume (MW) Forecast, by Type, 2022–2031

Table 02: Global Wave and Tidal Energy Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 03: Global Wave and Tidal Energy Market Volume (MW) Forecast, by Region, 2022–2031

Table 04: Global Wave and Tidal Energy Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 05: North America Wave and Tidal Energy Market Volume (MW) Forecast, By Country, 2022–2031

Table 06: North America Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Country, 2022–2031

Table 07: North America Wave and Tidal Energy Market Volume (MW) Forecast, by Type, 2022–2031

Table 08: North America Wave and Tidal Energy Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 09: U.S. Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 10: U.S. Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 11: Canada Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 12: Canada Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 13: Europe Wave and Tidal Energy Market Volume (MW) Forecast, by Country and Sub-region, 2022–2031

Table 14: Germany Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 15: Germany Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 16: France Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 17: France Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 18: U.K. Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 19: U.K. Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 20: Italy Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 21: Italy Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 22: Spain Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 23: Spain Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 24: Russia Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 25: Russia Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 26: Rest of Europe Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 27: Rest of Europe Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 28: Asia Pacific Wave and Tidal Energy Market Volume (MW) Forecast, by Country and Sub-region, 2022–2031

Table 29: Asia Pacific Wave and Tidal Energy Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 30: Asia Pacific Wave and Tidal Energy Market Volume (MW) Forecast, by Type, 2022–2031

Table 31: Asia Pacific Wave and Tidal Energy Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 32: China Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 33: China Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 35: Japan Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 36: Japan Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 37: India Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 38: India Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 39: Rest of Asia Pacific Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 40: Rest of Asia Pacific Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 41: Middle East & Africa Wave and Tidal Energy Market Volume (MW) Forecast, by Country and Sub-region, 2022–2031

Table 42: Middle East & Africa Wave and Tidal Energy Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 43: Middle East & Africa Wave and Tidal Energy Market Volume (MW) Forecast, by Type, 2022–2031

Table 44: Middle East & Africa Wave and Tidal Energy Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 45: GCC Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 46: GCC Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 47: South Africa Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 48: South Africa Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 49: Rest of Middle East & Africa Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 50: Rest of Middle East & Africa Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 51: Latin America Wave and Tidal Energy Market Volume (MW) Forecast, by Country and Sub-region, 2022–2031

Table 52: Latin America Wave and Tidal Energy Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 53: Latin America Wave and Tidal Energy Market Volume (MW) Forecast, by Type, 2022–2031

Table 54: Latin America Wave and Tidal Energy Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 55: Brazil Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 56: Brazil Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 57: Mexico Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 58: Mexico Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

Table 59: Rest of Latin America Wave and Tidal Energy Market Volume (MW) Forecast, By Type, 2022–2031

Table 60: Rest of Latin America Wave and Tidal Energy Market Value (US$ Mn) Forecast, By Type, 2022–2031

List of Figures

Figure 01: Global Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 02: Global Wave and Tidal Energy Market Size (US$ Mn) Forecast, 2022–2031

Figure 03: Global Wave and Tidal Energy Market Value Share Analysis, by Type, 2020 and 2031

Figure 04: Global Wave and Tidal Energy Market Attractiveness Analysis, by Type, 2022–2031

Figure 05: Global Wave and Tidal Energy Market Value Share Analysis, by Region, 2020 and 2031

Figure 06: Global Wave and Tidal Energy Market Attractiveness Analysis, by Region, 2022–2031

Figure 07: North America Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 08: North America Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 09: North America Wave and Tidal Energy Market Value Share Analysis, by Type, 2020 and 2031

Figure 10: U.S. Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 11: U.S. Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 12: Canada Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 13: Canada Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 14: North America Wave and Tidal Energy Market Attractiveness Analysis, by Type

Figure 15: North America Wave and Tidal Energy Market Attractiveness Analysis, by Country

Figure 16: Europe Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 17: Europe Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 18: Europe Wave and Tidal Energy Market Value Share Analysis, by Type, 2020 and 2031

Figure 19: Germany Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 20: Germany Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 21: France Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 22: France Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 23: U.K. Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 24: U.K. Wave and Tidal Energy Market Value (Mn) Forecast, 2022–2031

Figure 25: Spain Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 26: Spain Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 27: Russia Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 28: Russia Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 29: Italy Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 30: Italy Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 31: Rest of Europe Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 32: Rest of Europe Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 33: Europe Wave and Tidal Energy Market Attractiveness Analysis, by Type

Figure 34: Europe Wave and Tidal Energy Market Attractiveness Analysis, by Country

Figure 35: Asia Pacific Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 36: Asia Pacific Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 37: Asia Pacific Wave and Tidal Energy Market Value Share Analysis, by Type, 2020 and 2031

Figure 38: China Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 39: China Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 40: Japan Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 41: Japan Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 42: India Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 43: India Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 44: Rest of Asia Pacific Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 45: Rest of Asia Pacific Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 46: Asia Pacific Wave and Tidal Energy Market Attractiveness Analysis, by Type

Figure 47: Asia Pacific Wave and Tidal Energy Market Attractiveness Analysis, by Country

Figure 48: Middle East & Africa Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 49: Middle East & Africa Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 50: Middle East & Africa Wave and Tidal Energy Market Value Share Analysis, by Type, 2020 and 2031

Figure 51: GCC Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 52: GCC Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 53: South Africa Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 54: South Africa Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 55: Rest of Middle East & Africa Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 56: Rest of Middle East & Africa Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 57: Middle East & Africa Wave and Tidal Energy Market Attractiveness Analysis, by Type

Figure 58: Middle East & Africa Wave and Tidal Energy Market Attractiveness Analysis, by Country

Figure 59: Latin America Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 60: Latin America Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 61: Latin America Wave and Tidal Energy Market Value Share Analysis, by Type, 2020 and 2031

Figure 62: Brazil Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 63: Brazil Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 64: Mexico Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 65: Mexico Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 66: Rest of Latin America Wave and Tidal Energy Market Volume (MW) Forecast, 2022–2031

Figure 67: Rest of Latin America Wave and Tidal Energy Market Value (US$ Mn) Forecast, 2022–2031

Figure 68: Latin America Wave and Tidal Energy Market Attractiveness Analysis, by Type

Figure 69: Latin America Wave and Tidal Energy Market Attractiveness Analysis, by Country

Figure 70: Global Wave and Tidal Energy Market Share Analysis, by Company (2021)