Reports

Reports

Growing Consumption of Meat Bolsters Growth in Veterinary Antiseptics Market

The rising demand for meat across countries of Asia Pacific, Latin America, and Rest of the World has led to an increased demand for veterinary antiseptics. The growing number of fitness-conscious people shifting their preference towards a protein-rich diet have spurred a high demand for animal healthcare.

Furthermore, the rising disposable income levels that are allowing consumers to spend on various types of meat are also contributing to the revenues of the veterinary antiseptics market in Asia Pacific, Latin America, and Rest of the World in many direct and indirect ways. Antiseptics are used to heal wounds, prevent infections, sepsis, or putrefaction. They are also used to prepare the skin surface before injecting the animal.

Pet Adoption Emerges as the Key Trend Fueling the Market

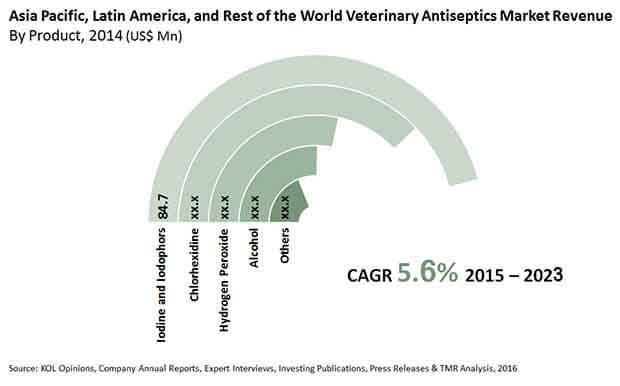

According to the research report published by Transparency Market Research, the opportunity in the Asia Pacific, Latin America, and Rest of the World veterinary antiseptics market will be worth US$401.6 mn by 2023 from US$243.0 mn in 2014. During the forecast period of 2015 and 2023, the market will surge at a CAGR of 5.6%, observes the lead analyst of the research report.

The steady CAGR and positively rising revenues of this market will be attributable to the emerging trend of pet adoption in several developing countries. Pet owners are gradually gaining awareness about safeguarding their pets from infections and diseases, which has reflected on the increased uptake of veterinary antiseptics in the past few years.

Growing Number of Companion and Production Animals Keeps Asia Pacific at the Forefront

Asia Pacific holds the leading share in the veterinary antiseptics market in Asia Pacific, Latin America, and Rest of the World due to a strong presence of production and companion animals. The exponentially rising demand for good quality of animal-based products is expected to bolster this market in the near future. Furthermore, the growing demand for antiseptics for looking after domesticated animals is also adding to the revenues of the veterinary antiseptics market in Asia Pacific.

According to the research report, the veterinary antiseptics market in Asia Pacific with be worth US$401.6 mn by 2023 as the market expands at a steady CAGR of 5.6% between 2015 and 2022. The increasing disposable incomes in China and India are encouraging consumers to adopt pets, which is expected have a positive impact on the overall market in the coming years.

Iodine and Iodophors Segment to Exhibit 6.3% CAGR between 2015 and 2023

On the basis of product, the veterinary antiseptics market in Asia Pacific, Latin America, and Rest of the World is segmented into iodine and iodophors, chlorhexidine, alcohol, hydrogen peroxide, and others. Out of these, the iodine and iodophors segment is expected to grow at the fastest CAGR of 6.3% between 2015 and 2023. During this period, revenue from iodine and iodophors will rise to US$149.4 mn. The popular usage of iodine and iodophors is attributable to its mildness. Thus, it is extensively used for treating both small and large animals. For instance, the most commonly used form of iodophors is povidone-iodine as a solution or a scrub under the popular name of Betadine.

During the same period, the chlorhexidine segment is expected to rise at a CAGR of 5.5% between 2015 and 2023. This antiseptic is largely used for cats, sheep, horses, cows, poultry animals, and dogs for treating their cuts, insect stings, and abrasions. Chlorhexidine is known for improving precipitation of salivary minerals, which leads to calculus in companion animals.

Some of the key players in the market are Continental Manufacturing Chemist, Inc., Indian Immunologicals Ltd., M.B.D. Marketing (S) Pte Ltd., Bayer AG, Merck Animal Health, Merial, and Zoetis, Inc. Acquiring a talent pool by absorbing microbiologists and researchers through collaborations with academies will prove pivotal to the future of the companies.

Table of Contents

Chapter 1 Introduction

1.1 Report Description

1.2 Market Segmentation

1.3 Research Methodology

1.3.1 Secondary Research

1.3.2 Primary Research

1.4 Factors Considered During Market Estimations

1.5 Assumptions and Stipulations

Chapter 2 Executive Summary

Chapter 3 Market Overview

3.1 Introduction

3.2 Market Drivers

3.2.1 Rising demand for animal based food products in emerging market enhancing veterinary care and consumption of antiseptic products

3.2.2 Increasing pet adoption in emerging markets expected to drive sales of companion animal antiseptics

3.3 Market Restraints

3.3.1 Country wise regulatory and approval scenario for veterinary pharmaceutical affecting sales and geographical expansion of antiseptic manufacturers

3.3.2 Declining number of veterinarians affecting sales and usage of antiseptic products in emerging veterinary markets

3.4 Market Opportunities

3.4.1 Focus on companion animal segment

3.5 Regulatory Framework

3.6 Animal Population, by Species (2011, 2012, 2013)

3.6.1 India

3.6.2 China

3.6.3 Japan

3.6.4 Brazil

3.6.5 Argentina

3.6.6 Mexico

3.6.7 Saudi Arabia

3.6.8 Egypt

3.6.9 South Africa

3.8 Value Chain Analysis: Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market

3.9 Pricing and Margin Analysis

3.10 Market Attractiveness Analysis: Asia Pacific, Latin America and Rest of the World Veterinary Antiseptics Market, by Geography

3.11 Market Share Analysis: Asia Pacific, Latin America and Rest of the World Veterinary Antiseptics Market, by Key Players, 2014

Chapter 4 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market, by Product

4.1 Introduction

4.1.1 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market Revenue, by Product, 2013–2023 (USD Million)

4.2 Iodine and Iodophors

4.2.1 Asia Pacific, Latin America, and Rest of the World Iodine and Iodophors Market Revenue, 2013–2023 (USD Million)

4.3 Chlorhexidine

4.3.1 Asia Pacific, Latin America, and Rest of the World Chlorhexidine Market Revenue, 2013–2023 (USD Million)

4.4 Alcohol

4.4.1 Asia Pacific, Latin America, and Rest of the World Alcohol Antiseptics Market Revenue, 2013–2023 (USD Million)

4.5 Hydrogen Peroxide

4.5.1 Asia Pacific, Latin America, and Rest of the World Hydrogen Peroxide Market Revenue, 2013–2023 (USD Million)

4.6 Others

4.6.1 Asia Pacific, Latin America, and Rest of the World Other Antiseptics Market Revenue, 2013–2023 (USD Million)

Chapter 5 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market, by Species

5.1 Introduction

5.1.1 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market Revenue, by Species, 2013–2023 (USD Million)

5.2 Bovine

5.2.1 Asia Pacific, Latin America, and Rest of the World Bovine Antiseptics Market Revenue, 2013–2023 (USD Million)

5.3 Porcine

5.3.1 Asia Pacific, Latin America, and Rest of the World Porcine Antiseptics Market Revenue, 2013–2023 (USD Million)

5.4 Ovine

5.4.1 Asia Pacific, Latin America, and Rest of the World Ovine Antiseptics Market Revenue, 2013–2023 (USD Million)

5.5 Equine

5.5.1 Asia Pacific, Latin America, and Rest of the World Equine Antiseptics Market Revenue, 2013–2023 (USD Million)

5.6 Canine

5.6.1 Asia Pacific, Latin America, and Rest of the World Canine Antiseptics Market Revenue, 2013–2023 (USD Million)

5.7 Feline

5.7.1 Asia Pacific, Latin America, and Rest of the World Feline Antiseptics Market Revenue, 2013–2023 (USD Million)

5.8 Camelidae

5.8.1 Asia Pacific, Latin America, and Rest of the World Camelidae Antiseptics Market Revenue, 2013–2023 (USD Million)

Chapter 6 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market, by Country

6.1 Overview

6.1.1 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market Revenue, by Country, 2013–2023 (USD Million)

6.1.2 Asia Pacific

6.1.2.1 Asia Pacific Veterinary Antiseptics Market Revenue, by Country, 2013–2023 (USD Million)

6.1.2.2 Asia Pacific World Veterinary Antiseptics Market Revenue, by Product, 2013–2023 (USD Million)

6.1.3 Latin America

6.1.3.1 Latin America Veterinary Antiseptics Market Revenue, by Country,2013–2023 (USD Million)

6.1.3.2 Latin America World Veterinary Antiseptics Market Revenue, by Product, 2013–2023 (USD Million)

6.1.4 Rest of the World (RoW)

6.1.4.1 Rest of the World Veterinary Antiseptics Market Revenue, by Country, 2013–2023 (USD Million)

6.1.4.2 Rest of the World Veterinary Antiseptics Market Revenue, by Product, 2013–2023 (USD Million)

Chapter 7 Recommendations

7.1 Focus on companion animal segment

7.2 Collaboration with academic veterinary microbiologists and immunologists

Chapter 8 Company Profiles

8.1 Bayer AG

8.1.1 Company Overview

8.1.2 Financial Overview

8.1.3 Product Portfolio

8.1.4 Business Strategies

8.1.5 Recent Developments

8.2 Continental Manufacturing Chemists, Inc.

8.2.1 Company Overview

8.2.2 Financia Overview

8.2.3 Product Portfolio

8.2.4 Business Strategies

8.2.5 Recent Developments

8.3 Elanco Animal Health, Inc.

8.3.1 Company Overview

8.3.2 Financial Overview

8.3.3 Product Portfolio

8.3.4 Business Strategies

8.3.5 Recent Developments

8.4 Indian Immunologicals Ltd.

8.4.1 Company Overview

8.4.2 Financial Overview

8.4.3 Product Portfolio

8.4.4 Business Strategies

8.4.5 Recent Developments

8.5 M.B.D. Marketing (S) Pte Ltd.

8.5.1 Company Overview

8.5.2 Financial Overview

8.5.3 Product Portfolio

8.5.4 Business Strategies

8.5.5 Recent Developments

8.6 Merck Animal Health (MSD Animal Health)

8.6.1 Company Overview

8.6.2 Financial Overview

8.6.3 Product Portfolio

8.6.4 Business Strategies

8.6.5 Recent Developments

8.7 Merial

8.7.1 Company Overview

8.7.2 Financial Overview

8.7.3 Product Portfolio

8.7.4 Business Strategies

8.7.5 Recent Developments

8.8 Nicosia International

8.8.1 Company Overview

8.8.2 Financial Overview

8.8.3 Product Portfolio

8.8.4 Business Strategies

8.8.5 Recent Developments

8.9 Vallée S.A.

8.9.1 Company Overview

8.9.2 Financial Overview

8.9.3 Product Portfolio

8.9.4 Business Strategies

8.9.5 Recent Developments

8.10 Zoetis, Inc.

8.10.1 Company Overview

8.10.2 Financial Overview

8.10.3 Product Portfolio

8.10.4 Business Strategies

8.10.5 Recent Developments

List of Tables

TABLE 1 Market Snapshot: Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market

TABLE 2 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics, by Product, 2013–2023 (USD Million)

TABLE 3 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics, by Species, 2013–2023 (USD Million)

TABLE 4 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market Revenue, by Country, 2013–2023 (USD Million)

TABLE 5 Asia Pacific Veterinary Antiseptics Market Revenue, by Country, 2013–2023 (USD Million)

TABLE 6 Asia Pacific Veterinary Antiseptics, by Products, 2013–2023 (USD Million)

TABLE 7 Latin America Veterinary Antiseptics Market Revenue, by Country,2013–2023 (USD Million)

TABLE 8 Latin America Veterinary Antiseptics, by Products, 2013–2023 (USD Million)

TABLE 9 Rest of the World Veterinary Antiseptics Market Revenue, by Country, 2013–2023 (USD Million)

TABLE 10 Rest of the World Veterinary Antiseptics, by Products, 2013–2023 (USD Million)

List of Figures

FIG. 1 Veterinary Antiseptics Market Segmentation

FIG. 2 Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market, by Product, 2014 (USD Million)

FIG. 3 Global meat production (Million tons, 1999–2030)

FIG. 4 Value Chain Analysis: Asia Pacific, Latin America, and Rest of the World Veterinary Antiseptics Market

FIG. 5 Market Attractiveness Analysis: Asia Pacific, Latin America and Rest of the World Veterinary Antiseptics Market, by Geography, 2014

FIG. 6 Market Share Analysis: Asia Pacific, Latin America and Rest of the World Veterinary Antiseptics Market, by Key Players, 2014 (Value %)

FIG. 7 Asia Pacific, Latin America, and Rest of the World Iodine and Iodophors Market Revenue, 2013–2023 (USD Million)

FIG. 8 Asia Pacific, Latin America, and Rest of the World Chlorhexidine Market Revenue, 2013–2023 (USD Million)

FIG. 9 Asia Pacific, Latin America, and Rest of the World Alcohol Antiseptics Market Revenue, 2013–2023 (USD Million)

FIG. 10 Asia Pacific, Latin America, and Rest of the World Hydrogen Peroxide Market Revenue, 2013–2023 (USD Million)

FIG. 11 Asia Pacific, Latin America, and Rest of the World Other Antiseptics Market Revenue, 2013–2023 (USD Million)

FIG. 12 Asia Pacific, Latin America, and Rest of the World Bovine Antiseptics Market Revenue, 2013–2023 (USD Million)

FIG. 13 Asia Pacific, Latin America, and Rest of the World Porcine Antiseptics Market Revenue, 2013–2023 (USD Million)

FIG. 14 Asia Pacific, Latin America, and Rest of the World Ovine Antiseptics Market Revenue, 2013–2023 (USD Million)

FIG. 15 Asia Pacific, Latin America, and Rest of the World Equine Antiseptics Market Revenue, 2013–2023 (USD Million)

FIG. 16 Asia Pacific, Latin America, and Rest of the World Canine Antiseptics Market Revenue, 2013–2023 (USD Million)

FIG. 17 Asia Pacific, Latin America, and Rest of the World Feline Antiseptics Market Revenue, 2013–2023 (USD Million)

FIG. 18 Asia Pacific, Latin America, and Rest of the World Camelidae Antiseptics Market Revenue, 2013–2023 (USD Million)

FIG. 19 Bayer AG: Annual Report, 2012–2014 (USD Million)

FIG. 20 Merck Animal Health: Annual Report, 2012–2014 (USD Million)

FIG. 21 Merial (Animal Health Division of Sanofi): Annual Revenue, 2012–2014 (USD Million)

FIG. 22 Zoetis, Inc.: Annual Revenue, 2012–2014 (USD Million)