US Lighting Products Market: Snapshot

Besides the rising residential and non-residential construction, the U.S. lighting products market is immensely gaining from the high demand for retrofitting and renovation across existing U.S. households. According to Transparency Market Research (TMR), the U.S. lighting products market is poised to exhibit a CAGR of 5.0% between 2014 and 2024. At this pace, the market’s valuation will reach US$285.84 bn by 2024 from US$185.65 bn in 2015. By volume, the market stood at 3.86 bn units in 2015.

Recent technological advancements in lamps and bulbs aimed at providing improved energy efficiency have catapulted growth in this market. Not only in the household sector, but the demand for energy-efficient lighting fixtures and products is rising across industries. This has paved way for several market players to come at the fore. Therefore, the increasing demand for highly efficient bulbs with long life spans will aid in the expansion of the U.S. lighting products market.

While the declining construction activities could negatively impact the market, it is forecast to gain from the increasing investment in research and development to put renewable power to use.

Among Standalone Types, Others Segment Forecast to Lose Share in Coming Years

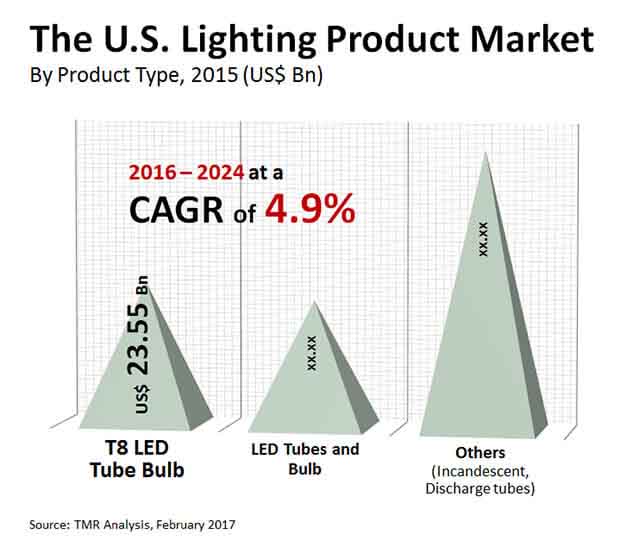

The U.S. lighting products market can be segmented on the basis of lighting fixture, application, standalone type, and retailer. Based on standalone type, T8 LED bulbs and tubes, LED bulbs and others are the key market segments. Of these, the LED tubes held above 23% of the market in 2015, while the others segment emerged dominant with a share of nearly 51%. However, the others segment is expected to lose is shares in the coming years on account of the declining adopting of incandescent bulbs and the correspondingly rising adoption of LED tubes and bulbs in the U.S. This trend is likely to become widespread across commercial as well as residential sectors thus fuelling opportunities for the lighting products manufacturers across the U.S.

Residential Lighting Emerges Dominant among Key Application Segments

Among the key application segments, comprising residential, commercial, industrial, and outdoor applications, the residential lighting segment emerged dominant. It held about 65% of the U.S. lighting products market in 2015. Besides this, the market is gaining traction from the increasing use of LEDs at outdoor places over the last few years. The advance lighting bulbs and lamps are increasingly installed across parking areas and for traffic lights in the country. These factors are indicative of positive run that the lighting products market is forecast to exhibit in the U.S. in the coming years.

Retailers to Focus on Business Strategies to Strengthen their Market Position

Among the leading retailers, Home Depot held the dominant share of 19% in the U.S. lighting products market in 2015. Lowes followed closely, thus emerging as the second-lead with a share of approximately 17% in the overall market. According to TMR, companies such as Costco and Menards are forecast to exhibit considerable growth in the coming years on account of strong business policies aimed at maximizing their market share. Moreover, these enterprises maintain effective supply chain management, which helps them in catering to the rising demand for lighting products in the U.S.

Increasing Installation of Bulbs and Lighting Across End User Industries to Drive US Lighting Products Market

Light acts as an important change marker across almost every industry. The applications of light in different activities such as photography and interior design among others are the growing with rise in population. Growing stringency of regulations in terms of inefficient lighting technologies and rising government efforts toward sustainable development are the key growth drivers. An aggressive decline in the prices of Light-Emitting Diode (LED), coupled with the transformation in energy policies across the world, has been driving the market growth. Moreover, attractive incentives and rebates provided by the governments for the use of LED lighting in several countries will leverage the demand.

The US lighting products market is expected to witness slow recovery in the second half of 2021. The market witnessed a slump in revenue and sales as the COVID-19 pandemic broke out. Several governments issued strict lockdowns and travel restrictions that affected the manufacturing processes. This led to stopping of production processes and logistical operation, hampering market growth. However, with the gradual opening of the global economy, the US lighting products market is expected witness staggered recovery in the coming months.

The lighting products market in the U.S. is treading along a positive curve. The rising installation of bulbs and lighting fixtures across major applications will aid the expansion of the U.S. lighting products market. Growth witnessed in the residential and non-residential constructions will thus have an inevitable impact on the overall demand for lighting products. Besides new constructions, the demand for retrofitting advance bulbs and tubes will emerge as a chief market driver.

As the country focuses on propagating energy-efficiency and implements supportive policies, the U.S. will witness a considerable surge in the demand for lighting products across residential, industrial, commercial, and outdoor applications. Given the scenario, the demand for LED tubes and bulbs has accelerated. In the coming years other market segments are prophesized to benefit as well in response to the rising awareness.

The U.S. Lighting Product Market

|

By Product |

|

|

By Application |

|

|

By Retailers |

|

The US Lighting Products Market is studied from 2016 - 2024

In the end user criterion, the commercial sub-segment is expected to witness the highest CAGR during the forecast period.

Rising adoption of solar in developing and under-developing nations is the current market trend

Demand for Artificial Lights in the Construction Industry is driving the Market.

The Home Depot, Lowes, Target, Wal-Mart, Bed Bath & Beyond, Sam’s Club, Menards, and Costco are among the leading market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : U.S. Lighting Products Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Evolution/Development

4.2. Market Dynamics

4.2.1. Driver

4.2.2. Restraint

4.2.3. Opportunity

4.3. Future Innovative Lighting Products

4.4. U.S. Lighting Products Market Analysis and Forecasts, 2014 – 2024

4.4.1. Market Revenue & Volume Projections (US$ Bn & Bn Units)

4.4.1.1. By Supply Side

4.4.1.2. By Demand Side

4.5. Value Chain Analysis

4.6. Porters Five Force Analysis

5. U.S. Lighting Product Market Size and Forecast, By Standalone Type

5.1. Key Findings

5.2. Key Trends

5.3. Lighting Products Market Size (US$ Bn & Bn Units) and Forecast By Standalone Type, 2014 – 2024

5.3.1. LED Tubes & Bulbs

5.3.2. T8 LED tubes & bulbs

5.3.3. Others(Incandescent, High Intensity Discharge)

5.4. Component Comparison Matrix

5.5. Market Attractiveness By Standalone Type

6. U.S. Lighting Products Market Size and Forecast, By Lighting Fixture

6.1. Key Findings

6.2. Key Trends

6.3. Lighting Products Market Size (US$ Bn & Bn Units) and Forecast By Lighting Fixture, 2014 – 2024

6.3.1. Ceiling Fixtures

6.3.2. Recessed Lighting Fixture

6.3.3. Strip Light Fixture

6.3.4. Others (Chandeliers, Pendants, etc.)

6.4. Component Comparison Matrix

6.5. Market Attractiveness By Lighting Fixture

7. U.S. Lighting Products Market Size and Forecast By Application, 2014 – 2024

7.1. Key Findings

7.2. Key Trends

7.3. Lighting Products Market Size (US$ Bn & Bn Units) and Forecast By Application, 2014 – 2024

7.3.1. Residential Lighting

7.3.1.1. Table Lamps

7.3.1.2. Floor Lamps

7.3.1.3. Desk Lamps

7.3.1.4. Others

7.3.2. Commercial Lighting

7.3.3. Industrial Lighting

7.3.4. Outdoor Lighting (Street Lights, Parking Garage, Landscape, etc.)

7.4. Application Comparison Matrix

7.5. Market Attractiveness By Application

8. U.S. Lighting Products Market Size and Forecast, By Retailers

8.1. Key Findings

8.2. Key Trends

8.3. Lighting Products Market Size (US$ Bn & Bn Units) and Forecast By Retailers, 2014 – 2024

8.3.1. The Home Depot

8.3.2. Lowes

8.3.3. Target

8.3.4. Wal-Mart

8.3.5. Bed Bath & Beyond

8.3.6. Sam's Club

8.3.7. Costco

8.3.8. Menards

8.4. Market Attractiveness By Retailers

9. Competition Landscape

9.1. Market Player – Competition Matrix

9.2. Market Share Analysis By Company (2015)

9.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Strategy)

9.3.1. The Home Depot

9.3.1.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

9.3.1.2. Company Description

9.3.1.3. SWOT Analysis

9.3.1.4. Strategic Overview

9.3.2. Lowes

9.3.2.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

9.3.2.2. Company Description

9.3.2.3. SWOT Analysis

9.3.2.4. Strategic Overview

9.3.3. Target

9.3.3.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

9.3.3.2. Company Description

9.3.3.3. SWOT Analysis

9.3.3.4. Strategic Overview

9.3.4. Wal-Mart

9.3.4.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

9.3.4.2. Company Description

9.3.4.3. SWOT Analysis

9.3.4.4. Strategic Overview

9.3.5. Bed, Bath and Beyond

9.3.5.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

9.3.5.2. Company Description

9.3.5.3. SWOT Analysis

9.3.5.4. Strategic Overview

9.3.6. Sam’s Club

9.3.6.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

9.3.6.2. Company Description

9.3.6.3. SWOT Analysis

9.3.6.4. Strategic Overview

9.3.7. Costco

9.3.7.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

9.3.7.2. Company Description

9.3.7.3. SWOT Analysis

9.3.7.4. Strategic Overview

9.3.8. Menards

9.3.8.1. Company Details (HQ, Foundation Year, Employee Strength)

9.3.8.2. Company Description

9.3.8.3. SWOT Analysis

9.3.8.4. Strategic Overview

10. Key Takeaways

List of Tables

Table 1: The U.S. Lighting Product Market Size (US$ Bn) Forecast, By Standalone Type, 2014 – 2024

Table 2: The U.S. Lighting Product Market Volume (Bn Units) Forecast, By Standalone Type, 2014 – 2024

Table 3: The U.S. Lighting Product Market Size (US$ Bn) Forecast, By Lighting Fixture, 2014 – 2024

Table 4: The U.S. Lighting Product Market Volume (Bn Units) Forecast, By Lighting Fixture, 2014 – 2024

Table 5: The U.S. Lighting Product Market Size (US$ Bn) Forecast, By Application, 2014 – 2024

Table 6: The U.S. Lighting Product Market Volume (Bn Units) Forecast, By Application, 2014 – 2024

Table 7: The U.S. Lighting Product Market Size (US$ Bn) Forecast, By Residential Lighting, 2014 – 2024

Table 8: The U.S. Lighting Product Market Volume (Bn Units) Forecast, By Residential Lighting, 2014 – 2024

Table 9: The U.S. Lighting Product Market Size (US$ Bn) Forecast, By Retailers, 2014 – 2024

Table 10: The U.S. Lighting Product Market Volume (Bn Units) Forecast, By Retailers, 2014 – 2024

List of Figures

Figure 1: The U.S. Lighting Product Market Value Share Analysis Standalone Type, 2016 and 2024

Figure 2: LED Tubes Bulbs Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 3: T8 LED tubes & bulbs Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 4: Others (Incandescent, High Intensity Discharge) Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 5: Comparison Matrix: By Standalone Type

Figure 6: The U.S. Lighting Product Market Attractiveness Analysis, By Standalone Type

Figure 7: The U.S. Lighting Product Market Value Share Analysis, By Lighting Fixture, 2016 and 2024

Figure 8: Ceiling Fixture Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 9: Recessed Lighting Fixture Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 10: Strip Light Fixture Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 11: Others Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 12: Comparison Matrix: By Lighting Fixture

Figure 13: The U.S. Lighting Product Market Attractiveness Analysis, By Lighting Fixture

Figure 14: The U.S. Lighting Product Market Value Share Analysis, By Application, 2016 and 2024

Figure 15: Residential Lighting Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 16: Commercial Lighting Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 17: Industrial Lighting Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 18: Outdoor Lighting Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 19: Comparison Matrix: By Application

Figure 20: The U.S. Lighting Product Market Attractiveness Analysis, By Application

Figure 21: The U.S. Lighting Product Market Value Share Analysis, By Retailers, 2016 and 2024

Figure 22: The Home Depot Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 23: Lowes Graph : (US$ Bn) Forecast, 2014 – 2024

Figure 24: Target Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 25: Wal-Mart Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 26: Bed, Bath and Beyond Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 27: Sam’s Club Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 28: Costco Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 29: Menards Graph: (US$ Bn) Forecast, 2014 – 2024

Figure 30: Comparison Matrix: By Retailers

Figure 31: The U.S. Lighting Product Market Attractiveness Analysis, By Retailers

Figure 32: The U.S. Lighting Product Market Share Analysis (2016)