Reports

Reports

U.S. and EU-5 Prefilled Syringe Small Molecule Market: Overview

The U.S. and EU-5 market for prefilled syringe small molecule is projected to register a remarkable growth rate in the coming years due to notable technological innovations. The market will also be encouraged by the rising demand for point of care administration and changing perspectives towards management medical conditions. For instance, several patients are opting for injectable drug delivery techniques, which is projected to drive the U.S. and EU-5 market for prefilled syringe small molecule.

The fact that usage of prefilled syringes does not require any assistance from trained medical staff, it has eliminated the need for hospitalization, which is benefitting the overall market to a large extent. The research report states that the U.S. and EU-5 prefilled syringes small molecule market will reach a valuation of US$17.1 bn by the end of 2024 from US$9.15 bn in 2015 as the market expands at a CAGR of 6.0 % to 8.0 % during the forecast period of 2016 and 2024.

Development of Biological Products to be an Emerging Trend

The overall market is projected to witness an introduction of a new drug class, which is poised to revolutionize the U.S. and EU-5 prefilled syringes small molecule market. Known as biological products, this drug class requires significantly high investments for both research and development. A score of stability issues and the higher monetary risks are expected to slow down the progress of the global market.

The new drug class is expected to introduce neurological small molecule drugs prefilled syringes, which will open up several lucrative opportunities for the new as well as existing players during the forecast period. For instance, Sandoz’s Glatopa (glatiramer acetate), which has been recently approved by the U.S. FDA has opened up several opportunities for the market in the neurological small molecule drug prefilled syringe segment.

Neurology Drugs Segment Shows Continued Growth due to Lack of Generic Drugs

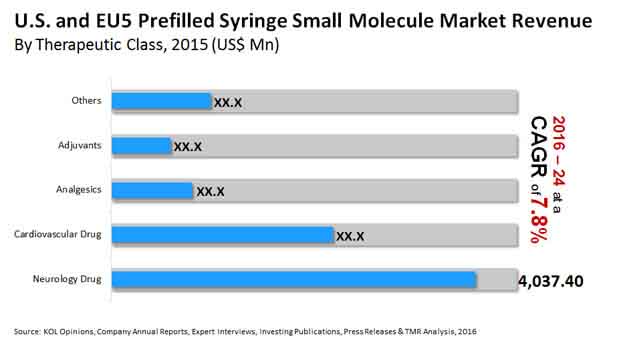

On the basis of therapeutic class, the U.S. and EU-5 prefilled syringes small molecule has been segmented into cardiovascular drugs, analgesics, neurology drug, and adjuvants. The research report indicated that the neurology drugs segment held a dominant share of more than 44% in the U.S. and EU-5 prefilled syringes small molecule market. Analysts anticipate that the segment is estimated to retain a lead in the overall market during the forecast period as well due to the non-availability of several equivalent generic drugs. The most popularly sold brand in the neurology drugs segment is Copaxone. This segment is expected to play a major role in the growing revenue of the overall market in the coming few years.

The demand for cardiovascular and neurological small molecule prefilled syringes will remain high, thus proving to be a strategic growth driver for the market. This demand will be fueled by the high prevalence of emergency situations that require safe and accurate dose delivery often considered to be self-medication.

The report indicates that the cardiovascular small molecule prefilled syringe segment held a share of about 26.91% in the U.S. and EU-5 prefilled syringes small molecule market in 2015. Meanwhile, the share of preference adjuvant small molecules in prefilled syringe like dextrose and normal saline for flush stood at 7.16% of the U.S. and EU-5 prefilled syringes small molecule market in 2015. This segment was valued at US$655.4 mn in 2015. The demand for adjuvant small molecule prefilled syringe is expected to grow steadily in the coming years due to a strong presence of several local players and several distributors in the overall market.

The top players operating in the U.S. and EU-5 prefilled syringe small molecule market are Teva Pharmaceutical Industries Ltd., Mylan N.V., Hospira, Inc (Now Pfizer, Inc.), Becton, Fresenius Kabi, Sanofi, and Dickinson and Company.

Advent of Biological Products to Create Growth Prospects for Prefilled Syringe Small Molecule Market

There will be the introduction of a new drug class to the general market that is ready to transform the global prefilled syringe small molecule market, particularly in the EU-5 and US. This new class of drugs, known as biological products, necessitates substantial investments in activities pertaining to research and development. On the other hand, a number of stability problems and increased monetary risks are anticipated to slow the progress of the global prefilled syringe small molecule market.

During the forecast period, the newest class of drugs is predicted to launch neurological small molecule drugs prefilled syringes and it is likely to offer some profitable prospects for both existing and new participants. For example, Sandoz's Glatopa (glatiramer acetate), which was recently authorized by the US FDA, has created quite a few business opportunities in the neurological small molecule drug prefilled syringe sector. The remarkable range of technological innovations presented in the global prefilled syringe small molecule market is expected to set the tone for highly valued growth in the coming years.

Shift in Preference toward Large Molecules Biologics to Leave Adverse Impact on the Market

The global prefilled syringe small molecule market is likely to bear the consequences of the switch in preference to large molecules biologics. In addition, increasing concerns about inaccuracy in dosages and quality of product quality likely to create difficulties in the market. As a consequence, there has been a sharp increase in the number of product recalls in last few years. Following this incident, a variety of healthcare practitioners are treating patients with different versions of the same medications.

The benefit of simpler injectable drug delivery at residence, on the other hand, is anticipated to spur demand for prefilled syringe small molecule in the near future. This is also likely to lower patient healthcare costs because prefilled syringes eradicate any need for trained medical professionals and healthcare facilities. When treating diabetes, rheumatoid arthritis, and other diseases, the usage of prefilled syringes is expected to rise in the back of the facility to see the vials.

1 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Introduction

1.1 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Report Description

1.2 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Research Methodology

1.3 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Market Segmentation

1.4 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Assumptions & Acronyms

2 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Executive Summary

2.1 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Executive Summary

3 U.S. & EU5 Prefilled Syringes Small Molecules Market Overview

3.1 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Key Market Insights

3.2 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Market Dynamics

3.3 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Porter’s Five Force Analysis

3.4 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Trends

3.5 U.S. & EU5 Prefilled Syringes Small Molecules Market Share (%), by key players

3.6 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Key Insights - Regulatory Approvals-Europe

3.7 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Key Insights - Regulatory Approvals-U.S.

3.8 U.S. & EU5 Prefilled Syringes Small Molecules Market –Disease Prevalence

3.9 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis- List of PFS Small Molecules

3.10 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-PFS Small Molecules Marketers

3.11 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-PFS Small Molecule CMOs

3.12 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By Country/Region

3.13 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By EU5 Countries

3.14 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By Small Molecules Category

3.15 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By Small Molecules Category in U.S.

3.16 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By Small Molecules Category in EU5

3.17 U.S. & EU5 Prefilled Syringes Small Molecules Market-Pricing Analysis

3.18 U.S. & EU5 Prefilled Syringes Small Molecules Market Volume Forecast (Mn Units), 2014-2024, By Small Molecules category

3.19 U.S. & EU5 Prefilled Syringes Small Molecules Market Volume Forecast (Mn Units), 2014-2024, By Small Molecules category in U.S.

3.20 U.S. & EU5 Prefilled Syringes Small Molecules Market Volume Forecast (Mn Units), 2014-2024, By Small Molecules category in EU5

4 U.S & EU5 Prefilled Syringes Small Molecules Market Company Profiles

4.1 U.S. & EU5 Prefilled Syringes Small Molecules Market Analysis-Competition Matrix

4.2 Fresenius Kabi AG

4.2.1 Financial Overview

4.2.2 Product Portfolio

4.2.3 Business Strategies

4.2.4 Recent Developments

4.3 Hospira Inc. (Pfizer’s Subsidiary)

4.3.1 Financial Overview

4.3.2 Product Portfolio

4.3.3 Business Strategies

4.3.4 Recent Developments

4.4 Sanofi

4.4.1 Financial Overview

4.4.2 Product Portfolio

4.4.3 Business Strategies

4.4.4 Recent Developments

4.5 Becton, Dickinson and Company

4.5.1 Financial Overview

4.5.2 Product Portfolio

4.5.3 Business Strategies

4.5.4 Recent Developments

4.6 Teva Pharmaceutical Industries Ltd

4.6.1 Financial Overview

4.6.2 Product Portfolio

4.6.3 Business Strategies

4.6.4 Recent Developments

4.7 Pfizer Inc.

4.7.1 Financial Overview

4.7.2 Product Portfolio

4.7.3 Business Strategies

4.7.4 Recent Developments

4.8 Mylan N.V.

4.8.1 Financial Overview

4.8.2 Product Portfolio

4.8.3 Business Strategies

4.8.4 Recent Developments

List of Tables

Table 1 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By Country/Region

Table 2 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By EU5 Countries

Table 3 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By Small Molecules Category

Table 4 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By Small Molecules Category in U.S.

Table 5 U.S. & EU5 Prefilled Syringes Small Molecules Market Size Forecast (U.S.$ Mn), 2014-2024, By Small Molecules Category in EU5

Table 6 U.S. & EU5 Prefilled Syringes Small Molecules Market Volume Forecast (Mn Units), 2014-2024, By Small Molecules category

Table 7 U.S. & EU5 Prefilled Syringes Small Molecules Market Volume Forecast (Mn Units), 2014-2024, By Small Molecules category in U.S.

Table 8 U.S. & EU5 Prefilled Syringes Small Molecules Market Volume Forecast (Mn Units), 2014-2024, By Small Molecules category in EU5

List of Figures

Figure 1 U.S. and EU5 Prefilled Syringes Small Molecules Market by Small Molecule Therapeutic Category 2015.