Reports

Reports

The global turbines market is witnessing a heightened growth phase driven by an unprecedented transition to renewable energy as well as favorable governmental policies and rapid technological advancements. Turbines common to wind, gas, steam, and hydro are central to electricity generation, which is kinetic, thermal, or fluid energy that is converted to electrical energy.

Wind turbines are the most dynamic growth area as they are enhanced by climate commitments, lowering levelized cost of energy (LCOE), and large scale onshore and offshore project deployment. Leading turbine manufacturers are investing in larger turbines, floating offshore platforms, digital monitoring technologies, and recyclable materials that promote sustainability and operational efficiency.

Turbines, for this report, refer to technologies that convert mechanical or natural sources of energy, particularly wind or steam energy, into usable energy. In essence, turbines accomplish this by harvesting energy via wind, gas combustion, steam, or flow of water, which causes the blades of a rotor to turn. Turbines are used for the production of power, industries and their production operations, and renewable energy. Turbines supply a significant portion of the world's demand for energy and are important to the objective of achieving net-zero emissions.

| Attribute | Detail |

|---|---|

| Drivers |

|

The most important growth driver for the turbines market is the global policy-led transition to clean energy, with multilateral institutions and public entities proposing ambitious renewable energy targets, subsidy initiatives, and investment incentives. The turbines that are at the heart of this shift, especially wind and hydro turbines, can produce renewable energy at scale along with providing for the lowest emissions pathway for electricity generation. For example, the European Union's Green Deal has mandated that by 2030 42.5% of energy consumption will be renewable.

These frameworks are also stimulating public and private capital investment toward turbine manufacturing, deployment, and associated infrastructure. This wave of investment has outstripped supply but even more importantly has led to investment and innovation in areas such as larger capacity turbines, recyclable blades, and digitized monitoring to enhance turbine efficiency.

In addition, the R&D grants supporting innovative solutions for construction and deployment of floating offshore wind platforms. The confluence of explicit political will, fiscal policy, and a willingness-to-invest is advancing turbines as a pillar of the global energy transition.

Another impetus is the speed of technological innovation driving turbine efficiency, LCOE down, and applications across every energy segment. Historically, turbine adoption was restricted by higher capital expenditures, limited efficiency, and complex maintenance. However, new materials, improvements in blade aerodynamics, developments in generator design, and the explosion of digital analytics have changed the economics of turbines in entirety. For example, offshore wind turbines now exceed 15 MW for each unit, which means more significant yields, while dramatically lowering the installations required in each project and deployment period.

Action by floating turbine technology is unleashing vast potential in deep-water potential and expanding where geography will permit deeper sites that were once adapted for shallow coastal. Gas and steam turbines have had similar brilliance with innovation with combined-cycle plants exceeding 60% efficiency providing flexible baseload or peak power support.

Additionally, IoT devices, AI predictive maintenance, and condition monitoring systems have lowered downtime, reduced the costs of operations, and extended the life of assets. The ability to recycle turbine blades and employ hybrid composites are minimizing environmental impact, improving sustainability credentials, and improving alignment with ESG priorities of investors & utilities.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

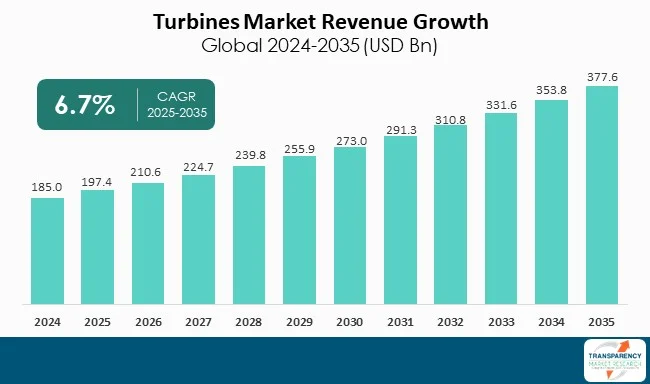

| Market Size Value in 2024 | US$ 185.0 Bn |

| Market Forecast Value in 2035 | US$ 377.6 Bn |

| Growth Rate (CAGR) | 6.7% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Units for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Turbines Market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Turbine Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The turbines market was valued at US$ 185 Bn in 2024

The turbines industry is expected to grow at a CAGR of 6.7% from 2025 to 2035

Policy Incentives & Capital Infusion and technological advancements enhancing efficiency and cost competitiveness

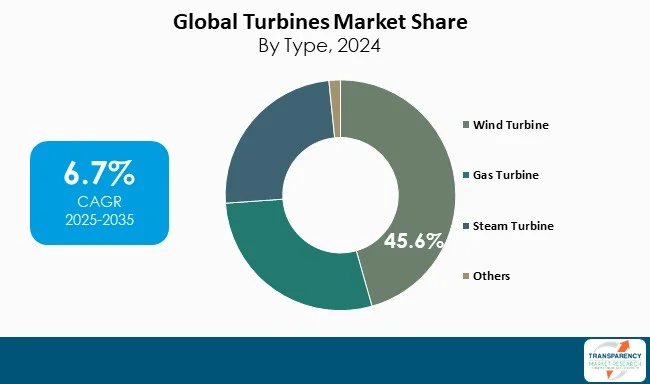

Wind turbine was the largest product type segment and was anticipated to grow at a CAGR of 7.5% during the forecast period

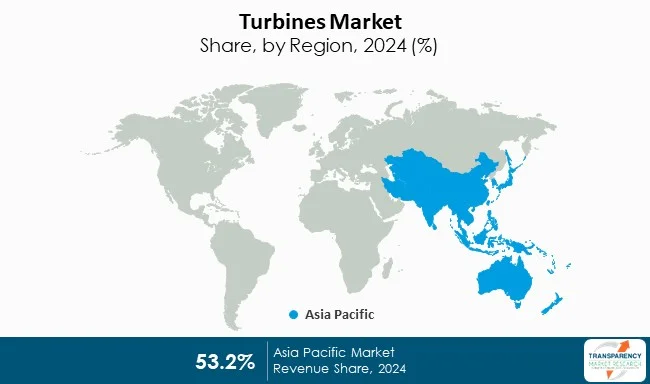

Asia Pacific was the most lucrative region in 2024

General Electric, Mitsubishi Power, Ansaldo Energia, Toshiba Energy Systems & Solutions, MAN Energy Solutions, Rolls-Royce, Fuji Electric are the major players in the Turbines market

Table 1 Global Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 2 Global Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 3 Global Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 4 Global Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 5 Global Market Volume (Units) Forecast, by Technology 2020 to 2035

Table 6 Global Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 7 Global Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 8 Global Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 Global Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 10 Global Market Value (US$ Bn) Forecast, by Fuel Type, 2020 to 2035

Table 11 Global Market Volume (Units) Forecast, by Region, 2020 to 2035

Table 12 Global Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 13 North America Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 14 North America Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 15 North America Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 16 North America Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 17 North America Market Volume (Units) Forecast, by Technology 2020 to 2035

Table 18 North America Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 19 North America Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 20 North America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 North America Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 22 North America Market Value (US$ Bn) Forecast, by Fuel Type, 2020 to 2035

Table 23 North America Market Volume (Units) Forecast, by Country, 2020 to 2035

Table 24 North America Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 25 U.S. Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 26 U.S. Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 27 U.S. Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 28 U.S. Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 29 U.S. Market Volume (Units) Forecast, by Technology 2020 to 2035

Table 30 U.S. Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 31 U.S. Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 32 U.S. Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 U.S. Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 34 U.S. Market Value (US$ Bn) Forecast, by Fuel Type, 2020 to 2035

Table 35 Canada Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 36 Canada Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 37 Canada Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 38 Canada Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 39 Canada Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 40 Canada Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 41 Canada Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 42 Canada Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Canada Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 44 Canada Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 45 Europe Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 46 Europe Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 47 Europe Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 48 Europe Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 49 Europe Market Volume (Units) Forecast, by Technology 2020 to 2035

Table 50 Europe Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 51 Europe Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 52 Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 Europe Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 54 Europe Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 55 Europe Market Volume (Units) Forecast, by Country and Sub-region, 2020 to 2035

Table 56 Europe Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 57 Germany Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 58 Germany Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 59 Germany Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 60 Germany Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 61 Germany Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 62 Germany Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 63 Germany Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 64 Germany Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Germany Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 66 Germany Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 67 France Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 68 France Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 69 France Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 70 France Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 71 France Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 72 France Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 73 France Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 74 France Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 75 France Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 76 France Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 77 U.K. Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 78 U.K. Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 79 U.K. Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 80 U.K. Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 81 U.K. Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 82 U.K. Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 83 U.K. Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 84 U.K. Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 U.K. Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 86 U.K. Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 87 Italy Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 88 Italy Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 89 Italy Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 90 Italy Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 91 Italy Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 92 Italy Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 93 Italy Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 94 Italy Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 95 Italy Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 96 Italy Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 97 Spain Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 98 Spain Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 99 Spain Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 100 Spain Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 101 Spain Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 102 Spain Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 103 Spain Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 104 Spain Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 Spain Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 106 Spain Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 107 Russia & CIS Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 108 Russia & CIS Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 109 Russia & CIS Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 110 Russia & CIS Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 111 Russia & CIS Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 112 Russia & CIS Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 113 Russia & CIS Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 114 Russia & CIS Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 115 Russia & CIS Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 116 Russia & CIS Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 117 Rest of Europe Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 118 Rest of Europe Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 119 Rest of Europe Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 120 Rest of Europe Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 121 Rest of Europe Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 122 Rest of Europe Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 123 Rest of Europe Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 124 Rest of Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Rest of Europe Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 126 Rest of Europe Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 127 Asia Pacific Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 128 Asia Pacific Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 129 Asia Pacific Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 130 Asia Pacific Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 131 Asia Pacific Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 132 Asia Pacific Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 133 Asia Pacific Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 134 Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135 Asia Pacific Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 136 Asia Pacific Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 137 Asia Pacific Market Volume (Units) Forecast, by Country and Sub-region, 2020 to 2035

Table 138 Asia Pacific Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 139 China Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 140 China Market Value (US$ Bn) Forecast, by Turbine Type 2020 to 2035

Table 141 China Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 142 China Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 143 China Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 144 China Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 145 China Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 146 China Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 147 China Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 148 China Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 149 Japan Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 150 Japan Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 151 Japan Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 152 Japan Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 153 Japan Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 154 Japan Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 155 Japan Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 156 Japan Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 Japan Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 158 Japan Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 159 India Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 160 India Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 161 India Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 162 India Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 163 India Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 164 India Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 165 India Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 166 India Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 167 India Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 168 India Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 169 ASEAN Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 170 ASEAN Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 171 ASEAN Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 172 ASEAN Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 173 ASEAN Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 174 ASEAN Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 175 ASEAN Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 176 ASEAN Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 177 ASEAN Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 178 ASEAN Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 179 Rest of Asia Pacific Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 180 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 181 Rest of Asia Pacific Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 182 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 183 Rest of Asia Pacific Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 184 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 185 Rest of Asia Pacific Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 186 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 187 Rest of Asia Pacific Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 188 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 189 Latin America Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 190 Latin America Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 191 Latin America Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 192 Latin America Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 193 Latin America Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 194 Latin America Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 195 Latin America Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 196 Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 197 Latin America Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 198 Latin America Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 199 Latin America Market Volume (Units) Forecast, by Country and Sub-region, 2020 to 2035

Table 200 Latin America Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 201 Brazil Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 202 Brazil Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 203 Brazil Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 204 Brazil Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 205 Brazil Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 206 Brazil Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 207 Brazil Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 208 Brazil Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 209 Brazil Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 210 Brazil Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 211 Mexico Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 212 Mexico Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 213 Mexico Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 214 Mexico Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 215 Mexico Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 216 Mexico Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 217 Mexico Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 218 Mexico Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 219 Mexico Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 220 Mexico Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 221 Rest of Latin America Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 222 Rest of Latin America Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 223 Rest of Latin America Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 224 Rest of Latin America Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 225 Rest of Latin America Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 226 Rest of Latin America Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 227 Rest of Latin America Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 228 Rest of Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 229 Rest of Latin America Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 230 Rest of Latin America Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 231 Middle East & Africa Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 232 Middle East & Africa Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 233 Middle East & Africa Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 234 Middle East & Africa Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 235 Middle East & Africa Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 236 Middle East & Africa Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 237 Middle East & Africa Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 238 Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 239 Middle East & Africa Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 240 Middle East & Africa Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 241 Middle East & Africa Market Volume (Units) Forecast, by Country and Sub-region, 2020 to 2035

Table 242 Middle East & Africa Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 243 GCC Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 244 GCC Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 245 GCC Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 246 GCC Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 247 GCC Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 248 GCC Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 249 GCC Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 250 GCC Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 251 GCC Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 252 GCC Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 253 South Africa Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 254 South Africa Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 255 South Africa Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 256 South Africa Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 257 South Africa Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 258 South Africa Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 259 South Africa Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 260 South Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 261 South Africa Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 262 South Africa Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Table 263 Rest of Middle East & Africa Market Volume (Units) Forecast, by Turbine Type, 2020 to 2035

Table 264 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Turbine Type, 2020 to 2035

Table 265 Rest of Middle East & Africa Market Volume (Units) Forecast, by Power Output, 2020 to 2035

Table 266 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Power Output, 2020 to 2035

Table 267 Rest of Middle East & Africa Market Volume (Units) Forecast, by Technology, 2020 to 2035

Table 268 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 269 Rest of Middle East & Africa Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 270 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 271 Rest of Middle East & Africa Market Volume (Units) Forecast, by Fuel Type, 2020 to 2035

Table 272 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Fuel Type 2020 to 2035

Figure 1 Global Market Volume Share Analysis, by Turbine Type, 2024, 2028, and 2035

Figure 2 Global Market Attractiveness, by Turbine Type

Figure 3 Global Market Volume Share Analysis, by Power Output, 2024, 2028, and 2035

Figure 4 Global Market Attractiveness, by Power Output

Figure 5 Global Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 6 Global Market Attractiveness, by Technology

Figure 7 Global Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 8 Global Market Attractiveness, by Application

Figure 9 Global Market Volume Share Analysis, by Fuel Type, 2024, 2028, and 2035

Figure 10 Global Market Attractiveness, by Fuel Type

Figure 11 Global Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 12 Global Market Attractiveness, by Region

Figure 13 North America Market Volume Share Analysis, by Turbine Type, 2024, 2028, and 2035

Figure 14 North America Market Attractiveness, by Turbine Type

Figure 15 North America Market Attractiveness, by Turbine Type

Figure 16 North America Market Volume Share Analysis, by Power Output, 2024, 2028, and 2035

Figure 17 North America Market Attractiveness, by Power Output

Figure 18 North America Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 19 North America Market Attractiveness, by Technology

Figure 20 North America Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 21 North America Market Attractiveness, by Application

Figure 22 North America Market Volume Share Analysis, by Fuel Type, 2024, 2028, and 2035

Figure 23 North America Market Attractiveness, by Fuel Type

Figure 24 North America Market Attractiveness, by Country and Sub-region

Figure 25 Europe Market Volume Share Analysis, by Turbine Type, 2024, 2028, and 2035

Figure 26 Europe Market Attractiveness, by Turbine Type

Figure 27 Europe Market Volume Share Analysis, by Power Output, 2024, 2028, and 2035

Figure 28 Europe Market Attractiveness, by Power Output

Figure 29 Europe Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 30 Europe Market Attractiveness, by Technology

Figure 31 Europe Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 32 Europe Market Attractiveness, by Application

Figure 33 Europe Market Volume Share Analysis, by Fuel Type, 2024, 2028, and 2035

Figure 34 Europe Market Attractiveness, by Fuel Type

Figure 35 Europe Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 36 Europe Market Attractiveness, by Country and Sub-region

Figure 37 Asia Pacific Market Volume Share Analysis, by Turbine Type, 2024, 2028, and 2035

Figure 38 Asia Pacific Market Attractiveness, by Turbine Type

Figure 39 Asia Pacific Market Volume Share Analysis, by Power Output, 2024, 2028, and 2035

Figure 40 Asia Pacific Market Attractiveness, by Power Output

Figure 41 Asia Pacific Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 42 Asia Pacific Market Attractiveness, by Technology

Figure 43 Asia Pacific Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 44 Asia Pacific Market Attractiveness, by Application

Figure 45 Asia Pacific Market Volume Share Analysis, by Fuel Type, 2024, 2028, and 2035

Figure 46 Asia Pacific Market Attractiveness, by Fuel Type

Figure 47 Asia Pacific Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Asia Pacific Market Attractiveness, by Country and Sub-region

Figure 49 Latin America Market Volume Share Analysis, by Turbine Type, 2024, 2028, and 2035

Figure 50 Latin America Market Attractiveness, by Turbine Type

Figure 51 Latin America Market Volume Share Analysis, by Power Output, 2024, 2028, and 2035

Figure 52 Latin America Market Attractiveness, by Power Output

Figure 53 Latin America Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 54 Latin America Market Attractiveness, by Technology

Figure 55 Latin America Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 56 Latin America Market Attractiveness, by Application

Figure 57 Latin America Market Volume Share Analysis, by Fuel Type, 2024, 2028, and 2035

Figure 58 Latin America Market Attractiveness, by Fuel Type

Figure 59 Latin America Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 60 Latin America Market Attractiveness, by Country and Sub-region

Figure 61 Middle East & Africa Market Volume Share Analysis, by Turbine Type, 2024, 2028, and 2035

Figure 62 Middle East & Africa Market Attractiveness, by Turbine Type

Figure 63 Middle East & Africa Market Volume Share Analysis, by Power Output, 2024, 2028, and 2035

Figure 64 Middle East & Africa Market Attractiveness, by Power Output

Figure 65 Middle East & Africa Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 66 Middle East & Africa Market Attractiveness, by Technology

Figure 67 Middle East & Africa Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 68 Middle East & Africa Market Attractiveness, by Application

Figure 69 Middle East & Africa Market Volume Share Analysis, by Fuel Type, 2024, 2028, and 2035

Figure 70 Middle East & Africa Market Attractiveness, by Fuel Type

Figure 71 Middle East & Africa Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 72 Middle East & Africa Market Attractiveness, by Country and Sub-region