Reports

Reports

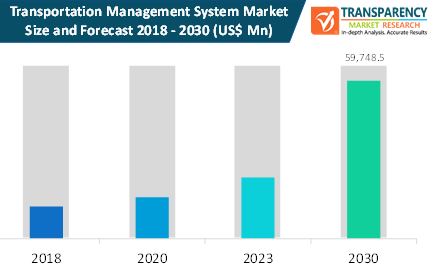

The global market for transportation management systems stood at US$ 12,249.9 Mn in 2018. Rising at a healthy CAGR of 14.3% from 2020 to 2030, the opportunity in this market is likely to touch US$ 59,748.5 Mn by the end of 2030.

A transportation management system (TMS) is a subset of supply chain management and is centered mainly on transportation and logistics. Increasing use of cloud computing technologies for managing supply chain activities is one of the major trends prevailing in the transportation management systems market across the globe. Cloud-based deployments generally need less customization and configuration. These two factors are driving down lifecycle costs, making web-based applications much more attractive and appealing to shippers. Retailers across the globe have realized the importance of technology for achieving real-time visibility of operations to track products as they leave manufacturing facility and move through the supply chain. Thus, retailers are gradually moving away from platform-based solutions and are switching to the cloud. Cloud technologies enable retailers to process huge customer data faster, better match customer demand with a sales season, and offer personalized solutions. Thus, cloud technologies enable mass customization, which is of growing interest to both manufacturers and retailers.

Increasing preference for SaaS based TMS solutions is the major factor driving the TMS market sales growth. Furthermore, the need to replace and update the existing and conventional transportation management systems is expected to support the demand for advanced transportation management solutions. However, lack of awareness among end-users coupled with high deployment cost is the major inhibitor to the growth of the market. Integration of cloud computing and Radio Frequency Identification (RFID) technologies with supply chain management systems offer healthy opportunities for the growth of TMS Market over the forecast period.

Transportation Management System is a major technology tool used by enterprises for enhanced collaboration. Additionally, in order to extend their reach globally, organizations across the world are increasingly focusing on curtailing costs related to their means of communication. This has created immense opportunities for the Transportation Management System market, thereby, leading to development of advanced conferencing solutions and services. Furthermore, considering the rising need to reduce operating costs, there has been a recent shift from the traditional immersive telepresence systems to software solutions in the Transportation Management System market. Enterprises across the world seek to deploy cheaper and scalable cloud-based Transportation Management System solutions to lower the total cost of ownership (TCO).

The integration of automation and functions such as real-time market monitoring coupled with shippers’ desire to ensure supply chain optimization and visibility has ensured an extended application base for transportation management systems. The electrical and electronics, industrial, food and beverage, transportation and logistics and retail sectors have surfaced as the prime application areas of transportation management systems across the world. Among these, the transportation and logistics segment is expected to continue its dominance over the forecast, majorly on account of demand from third-party logistics providers, with road transportation service providers being the largest end-users of TMS solutions. Over the forecast period from 2017 to 2025, the emerging end-use verticals such as food and beverage, retail, and electronics are expected to witness the fastest growth, fueling market momentum. Increasing demand for supply chain optimization and visibility is expected to drive the adoption of TMS across these verticals.

On the basis of the geography, the global market has been categorized into North America, Europe, Asia Pacific, the Middle East and Africa and Latin America. North America, closely followed by Europe, reports a greater deployment of TMS solutions, compared to other regions and is expected to continue doing so over the next few years. Along with the proliferation of cloud-computing technologies, increasing use of RFID technology in the supply chain system has also fueled market momentum in the region. Transportation management system vendors in the region are collaborating with RFID technology providers to develop advanced, integrated solutions and, in turn ensure better returns on R&D investments.

Some other significant players engaged in Transportation Management System market include

The worldwide Transportation Management Systems market worth is projected to reach US$59,748.5 million by the end of 2030.

The Transportation Management Systems market is expected to grow at a CAGR of 14.3% during 2020 to 2030.

Increasing preference for SaaS based TMS solutions is the major factor driving the global transportation management systems market sales growth.

3GTMS, Inc., CargoSmart Ltd., Descartes Systems Group, Inc., Manhattan Associates, Inc., BluJay Solution, One Network Enterprises, JDA Software Group, Inc., Oracle Corporation, SAP SE and Precision Software, Inc. are the key companies involved in Transportation Management Systems market across the world.

North America was the largest regional market for transportation management systems, and the growth in this region is driven by increasing demand for cloud-based on-demand TMS software solutions.

Chapter 1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Methodology

1.3.1. Sources

1.3.1.1. Secondary Research

1.3.1.2. Primary Research

Chapter 2. Executive Summary

2.1. Market Snapshot: Global Transportation Management Systems Market, 2016 & 2025

2.2. Global Transportation Management Systems Market Revenue, 2010 – 2025 (USD Million)

Chapter 3. Transportation Management Systems (TMS) Market Overview

3.1. Introduction

3.2. Market Trends and Future Outlook

3.2.1. Integrating TMS solutions and Yard Management System (YMS) solutions with other supply chain solutions

3.2.2. Evolving TMS Capabilities

3.2.3. Increased Use of Cloud Computing

3.2.3.1. Fast and Easy Installation

3.2.3.2. Low Start-up Cost

3.2.3.3. Growing Need for Broader Visibility

3.3. Functional and Technical Aspects

3.3.1. Planning and Decision Making

3.3.2. Execution of Transportation Plans

3.3.3. Tracking

3.3.4. Measurement

3.4. Market Dynamics

3.4.1. Drivers

3.4.1.1. Aging TMS Installations to Trigger Replacement Demand

3.4.1.2. Growth in Intermodal Transportation to Stimulate Demand for TMS Solutions

3.4.1.3. Growing Popularity of SaaS-based TMS Solutions

3.4.1.4. Impact Analysis of Drivers

3.4.2. Restraints

3.4.2.1. Lack of Awareness among End-Users and High Deployment Cost

3.4.2.2. Impact Analysis of Restraint

3.4.3. Opportunities

3.4.3.1. Cloud Computing and Integration of RFID Technology in Transport Management

3.5. Value Chain Analysis: Global Transportation Management Systems Market

3.6. Value Added Services with TMS

3.6.1. Product Assembly

3.6.2. Pre-Assembly

3.6.3. Sequencing

3.6.4. Packaging Services and Design

3.7. ROI Benefits from Adoption of TMS

3.8. Competitive Landscape

3.8.1. Market Positioning of Key Players, 2016

3.8.2. Competitive Positioning of Key Players, 2016

3.9. Market Attractiveness Analysis – Global Transportation Management Systems Market, by End-Use Applications and Geography, 2016

3.10. Transportation Management Systems (TMS) Market, By End-use Application

3.10.1. Introduction

3.10.2. Global Transportation Management System Market Revenue, by End-Use Application, 2016 – 2025 (USD Million)

3.10.3. Global Transportation Management System Market Revenue, By End-Use Application, 2016 vs 2025 (Value %)

3.10.4. Electrical and Electronics Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

3.10.5. Industrial Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

3.10.6. Food and Beverage Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

3.10.7. Retail Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

3.10.8. Transportation and Logistics Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

3.10.9. Others Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

3.11. Transportation Management Systems (TMS) Market, By Software Deployment

3.11.1. Overview

3.11.2. Global Transportation Management System Market Revenue, by Software Deployment, 2016 – 2025 (USD Million)

3.11.3. Global Transportation Management System Market Revenue, By Software Deployment, 2016 vs. 2025 (Value %)

3.11.4. On-Premise

3.11.4.1. On-Premise Transportation Management System Solutions Market, 2016 – 2025 (USD Million)

3.11.5. On-Demand

3.11.5.1. On-Demand Transportation Management System Solutions Market, 2016 – 2025 (USD Million)

Chapter 4 Transportation Management Systems (TMS) Market, By Geography

4.1. Overview

4.1.1. Global Transportation Management Systems Market Revenue, by Geography, 2016 – 2025 (USD Million)

4.1.2. Global Transportation Management System Market Revenue, By Geography, 2016 vs. 2025 (Value %)

Chapter 5. North America Transportation Management Systems (TMS) Market

5.1. Overview

5.1.1. North America Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

5.1.2. North America Transportation Management Systems Market Revenue, by End-use Application, 2016 – 2025 (USD Million)

5.1.3. North America Transportation Management Systems Market Revenue, by Software Deployment, 2016 – 2025 (USD Million)

5.1.4. North America Transportation Management Systems Market Revenue, by Countries, 2016 – 2025 (USD Million)

Chapter 6. Europe Transportation Management Systems (TMS) Market

6.1. Overview

6.1.1. Europe Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

6.1.2. Europe Transportation Management Systems Market Revenue, by End-Use Application, 2016 – 2025 (USD Million)

6.1.3. Europe Transportation Management Systems Market Revenue, by Software Deployment, 2016 – 2025 (USD Million)

6.1.4. Europe Transportation Management Systems Market Revenue, by Countries, 2016 – 2025 (USD Million)

6.1.5. U.K. : Key Trends and Future Trends in TMS Market

6.1.5.1. U.K. Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

6.1.5.2. U.K. Transportation Management Systems Market Revenue, by End-Use Application, 2016 – 2025 (USD Million)

6.1.5.3. U.K. Transportation Management Systems Market Revenue, by Software Deployment, 2016 – 2025 (USD Million)

Chapter 7. Asia Pacific Transportation Management Systems (TMS) Market

7.1. Overview

7.1.1. Asia Pacific Transportation Management Systems Market Revenue, 2016 – 2025 (USD Million)

7.1.2. Asia Pacific Transportation Management Systems Market Revenue, by End-Use Application, 2016 – 2025 (USD Million)

7.1.3. Asia Pacific Transportation Management Systems Market Revenue, by Software Deployment, 2016 – 2025 (USD Million)

7.1.4. Asia Pacific Transportation Management Systems Market Revenue, by Countries, 2016 – 2025 (USD Million)

Chapter 8. Middle East and Africa Transportation Management Systems (TMS) Market

8.1. Overview

8.1.1. Middle East and Africa Transportation Management System Market Revenue, 2016 – 2025 (USD Million)

8.1.2. Middle East and Africa Transportation Management Systems Market Revenue, by End-Use Application, 2016 – 2025 (USD Million)

8.1.3. Middle East and Africa Transportation Management Systems Market Revenue, by Software Deployment, 2016 – 2025 (USD Million)

8.1.4. Middle East and Africa Transportation Management Systems Market Revenue, by Countries, 2016 – 2025 (USD Million)

Chapter 9. South America Transportation Management Systems (TMS) Market

9.1. Overview

9.1.1. South America Transportation Management Systems Market Revenue, 2016 – 2025 (USD Million)

9.1.2. South America Transportation Management Systems Market Revenue, by End-Use Application, 2016 – 2025 (USD Million)

9.1.3. South America Transportation Management Systems Market Revenue, by Software Deployment, 2016 – 2025 (USD Million)

9.1.4. South America Transportation Management Systems Market Revenue, by Countries, 2016 – 2025 (USD Million)

Chapter 10. Company Profiles

10.1. 3GTMS, Inc.

10.1.1. Company Details (HQ, Foundation Year, Employee Strength)

10.1.2. Market Presence, By Segment and Geography

10.1.3. Recent Developments

10.1.4. Revenue and Operating Profits

10.1.5. Strategic Overview

10.2. CargoSmart Ltd.

10.2.1. Company Details (HQ, Foundation Year, Employee Strength)

10.2.2. Market Presence, By Segment and Geography

10.2.3. Recent Developments

10.2.4. Revenue and Operating Profits

10.2.5. Strategic Overview

10.3. Descartes Systems Group, Inc.

10.3.1. Company Details (HQ, Foundation Year, Employee Strength)

10.3.2. Market Presence, By Segment and Geography

10.3.3. Recent Developments

10.3.4. Revenue and Operating Profits

10.3.5. Strategic Overview

10.4. Manhattan Associates, Inc.

10.4.1. Company Details (HQ, Foundation Year, Employee Strength)

10.4.2. Market Presence, By Segment and Geography

10.4.3. Recent Developments

10.4.4. Revenue and Operating Profits

10.4.5. Strategic Overview

10.5. BluJay Solution

10.5.1. Company Details (HQ, Foundation Year, Employee Strength)

10.5.2. Market Presence, By Segment and Geography

10.5.3. Recent Developments

10.5.4. Revenue and Operating Profits

10.5.5. Strategic Overview

10.6. One Network Enterprises

10.6.1. Company Details (HQ, Foundation Year, Employee Strength)

10.6.2. Market Presence, By Segment and Geography

10.6.3. Recent Developments

10.6.4. Revenue and Operating Profits

10.6.5. Strategic Overview

10.7. JDA Software Group, Inc.

10.7.1. Company Details (HQ, Foundation Year, Employee Strength)

10.7.2. Market Presence, By Segment and Geography

10.7.3. Recent Developments

10.7.4. Revenue and Operating Profits

10.7.5. Strategic Overview

10.8. Oracle Corporation

10.8.1. Company Details (HQ, Foundation Year, Employee Strength)

10.8.2. Market Presence, By Segment and Geography

10.8.3. Recent Developments

10.8.4. Revenue and Operating Profits

10.8.5. Strategic Overview

10.9. SAP SE

10.9.1. Company Details (HQ, Foundation Year, Employee Strength)

10.9.2. Market Presence, By Segment and Geography

10.9.3. Recent Developments

10.9.4. Revenue and Operating Profits

10.9.5. Strategic Overview

10.10. Precision Software, Inc.

10.10.1. Company Details (HQ, Foundation Year, Employee Strength)

10.10.2. Market Presence, By Segment and Geography

10.10.3. Recent Developments

10.10.4. Revenue and Operating Profits

10.10.5. Strategic Overview

List of Tables

TABLE 1 Market Snapshot: Global Transportation Management Systems Market, 2018 & 2030

TABLE 2 Impact Analysis of Drivers

TABLE 3 Impact Analysis of Restraint

TABLE 4 Transportation Management Systems Market Revenue, by End-Use Application, 2018 – 2030 (USD Million)

TABLE 5 Global Transportation Management System Market Revenue, by Software Deployment, 2018 – 2030 (USD Million)

TABLE 6 Global Transportation Management System Market Revenue, by Geography, 2018 – 2030 (USD Million)

TABLE 7 North America Transportation Management Systems Market Revenue, by End-Use Application, 2018 – 2030 (USD Million)

TABLE 8 North America Transportation Management Systems Market Revenue, by Software Deployment, 2018 – 2030 (USD Million)

TABLE 9 North America Transportation Management Systems Market Revenue, by Countries, 2018 – 2030 (USD Million)

TABLE 10 Europe Transportation Management Systems Market Revenue, by End-Use Application, 2018 – 2030 (USD Million)

TABLE 11 Europe Transportation Management Systems Market Revenue, by Software Deployment, 2018 – 2030 (USD Million)

TABLE 12 Europe Transportation Management Systems Market Revenue, by Countries, 2018 – 2030 (USD Million)

TABLE 13 U.K. Transportation Management Systems Market Revenue, by End-Use Application, 2018 – 2030 (USD Million)

TABLE 14 U.K. Transportation Management Systems Market Revenue, by Software Deployment, 2018 – 2030 (USD Million)

TABLE 15 Asia Pacific Transportation Management Systems Market Revenue, by End-Use Application, 2018 – 2030 (USD Million)

TABLE 16 Asia Pacific Transportation Management Systems Market Revenue, by Software Deployment, 2018 – 2030 (USD Million)

TABLE 17 Asia Pacific Transportation Management Systems Market Revenue, by Countries, 2018 – 2030 (USD Million)

TABLE 18 Middle East and Africa Transportation Management Systems Market Revenue, by Application, 2018 – 2030 (USD Million)

TABLE 19 Middle East and Africa Transportation Management Systems Market Revenue, by Software Deployment, 2018 – 2030 (USD Million)

TABLE 20 Middle East and Africa Transportation Management Systems Market Revenue, by Countries, 2018 – 2030 (USD Million)

TABLE 21 South America Transportation Management Systems Market Revenue, by End-Use Application, 2018 – 2030 (USD Million)

TABLE 22 South America Transportation Management Systems Market Revenue, by Software Deployment, 2018 – 2030 (USD Million)

TABLE 23 South America Transportation Management Systems Market Revenue, by Countries, 2018 – 2030 (USD Million)

List of Figures

FIG. 1. Market Segmentation: Global Transportation Management Systems Market

FIG. 1. Global Transportation Management Systems Market Revenue, 2018 – 2025 (USD Million)

FIG. 2. Value Chain Analysis: Global Transportation Management System Market

FIG. 3. Savings from Transportation Management System

FIG. 4. Key Areas in which a TMS Reduces Freight Expenditure

FIG. 5. Competitive Positioning of Key Players, 2019

FIG. 6. Market Attractiveness Analysis – Global Transportation Management Systems Market, by End-Use Application, 2019

FIG. 7. Market Attractiveness Analysis – Global Transportation Management Systems Market, by Geography, 2018

FIG. 8. Global Transportation Management System Market Revenue, By End-Use Application, 2018 vs 2025 (Value %)

FIG. 9. Electrical and Electronics Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 10. Industrial Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 11. Food and Beverage Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 12. Retail Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 13. Transportation and Logistics Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 14. Others (Pharmaceutical and Life Science, etc.) Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 15. Global Transportation Management System Market Revenue, By Software Deployment, 2018 vs. 2030 (Value %)

FIG. 16. On-Premise Transportation Management System Solutions Market, 2018 – 2030 (USD Million)

FIG. 17. On-Demand Transportation Management System Solutions Market, 2018 – 2030 (USD Million)

FIG. 18. Global Transportation Management System Market Revenue, By Geography, 2018 vs. 2030 (Value %)

FIG. 19. North America Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 20. Europe Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 21. U.K. Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 22. Asia Pacific Transportation Management Systems Market Revenue, 2018 – 2030 (USD Million)

FIG. 23. Middle East and Africa Transportation Management System Market Revenue, 2018 – 2030 (USD Million)

FIG. 24. South America Transportation Management Systems Market Revenue, 2018 – 2030 (USD Million)