Global Thin and Ultra-thin Films Market: Snapshot

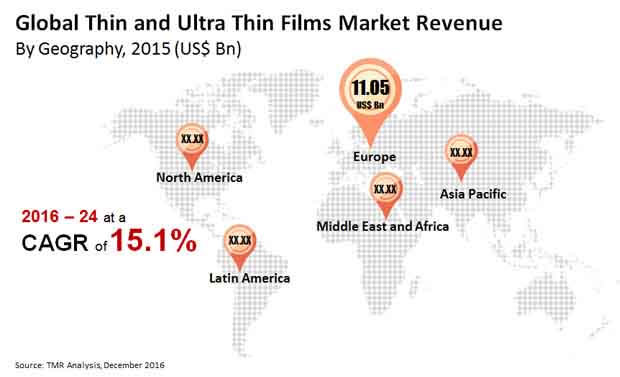

Thin and ultra-thin films are fine layers of materials whose thickness may measure from fractions of a nanometers to several micrometers. These materials are being used in a wide range of electronics, solar cells, and batteries due to the tremendous advantage they offer. Electronic semiconductor devices, solar cells and optical coatings are the main applications benefitting from thin film construction. As per the research report, the global thin and ultra-thin films market was valued at US$32.78 bn in 2015 and is expected to reach a valuation of US$115.41 bn by 2024. All throughout 2016 and 2024, the global market is expected to rise at a CAGR of 15.1%. Ongoing advancements and upcoming trend of miniaturization in semiconductors and solar industry is expected to boost the growth of the overall market in the coming years.

The demand for thin and ultra-thin films have been on the rise due to the intensifying trend of miniaturization of semiconductors and electronic components. Design and development of printed electronics as against thin and ultra-thin films is also supporting this factor. In the coming years, the demand for these films will continue to be on the rise as the aerospace and defense industry will also utilize thin and ultra-thin films as they offer improved speed, power, efficiency, and reduced weight of miniaturized electronics. The demand for renewable energy sources such as solar energy is also estimated to be a major factor driving the thin and ultra-thin films market.

Thin Film Electronics Segment to Lead as Uptake of Electronics Soars

The end users in the global thin and ultra-thin films market are thin film electronics, thin film batteries, and thin film PV. Of these, the thin film electronics segment held the leading share in the global market in terms of revenue in 2015, accounting for nearly 75% of the global market. The soaring usage of electronics such as mobiles, TVs, tablets, and other devices have fostered the growth of this segment. Furthermore, the widening usage of thin and ultra-thin films in microelectronics, which is a critical branch of electronics is expected to boost the share of this segment in the coming years.

Asia Pacific to be Key Consumer of Thin and Ultra-thin Films Market

In terms of geography, the global thin and ultra-thin films market is segmented into North America, Asia Pacific, the Middle East and Africa, Europe, and Latin America. Of these regions, Asia Pacific is anticipated to dominate the global market in the coming years. The growing acceptance of technology across Asia Pacific and the rise of manufacturing activities are likely to give the thin and ultra-thin films market an impetus in the region. Furthermore, strengthening economies of China, Russia, and India are also expected to contribute to the rising revenue of Asia Pacific thin and ultra-thin films market.

North America is also anticipated to show a significant growth rate in the overall market. Adoption of technology, increasing pressure to reduce carbon emissions, and growing acceptance of solar energy have all contributed to the increasing demand for thin and ultra-thin films market.

Key players operating in the global thin and ultrathin films market are China National Building Material Company Ltd., Umicore Group, Ascent Solar Technologies, American Elements, Kaneka Corporation, and Moser Baer India Pvt. Ltd.

Thin and Ultra-thin Films Market to Witness Notable Growth with Double-digit Growth of Electronic Industry

Thin and ultra-thin films are fine layers of materials whose thickness may quantify from parts of a nanometers to a few micrometers. These materials are being utilized in a wide scope of gadgets, sun based cells, and batteries because of the gigantic benefit they offer. Electronic semiconductor gadgets, sunlight based cells and optical coatings are the fundamental applications profiting by thin film development. Thin and ultra-thin films are fine layers of materials whose thickness may gauge from parts of nanometers to a few micrometers. These materials are being utilized in a wide scope of hardware, sun oriented cells, and batteries because of the huge benefit they offer. Electronic semiconductor gadgets, sun based cells and optical coatings are the fundamental applications profiting by thin film development.

The interest for thin and ultra-thin films has been on the ascent because of the escalating pattern of scaling down of semiconductors and electronic segments. Plan and advancement of printed hardware as against thin and ultra-thin films is additionally supporting this factor. In the coming years, the interest for these films will keep on being on the ascent as the aviation and protection industry will likewise use thin and ultra-thin films as they offer improved speed, force, productivity, and decreased load of scaled down hardware. The interest for environmentally friendly power sources, for example, sun oriented energy is likewise assessed to be a main consideration driving the thin and ultra-thin films market.

These driving organizations are focusing on growing their exercises across key topographical areas like Asia Pacific, North America, Europe, Latin America, and the Middle East and Africa. Of these territorial portions, Asia Pacific is projected to overwhelm the worldwide market throughout the given gauge time frame. The development of the district can be ascribed to the expanding acknowledgment the inventive advances combined with rising creation and assembling exercises. Additionally, the thin and ultra-thin films market in Asia Pacific is likewise determined by the flourishing mechanical and gadgets verticals of arising economies like India, Russia, and China.

The Global Thin and Ultra-Thin Films Market has been Segmented into:

|

By End User |

|

|

By Technology |

|

|

By Geography |

|

Chapter 1 Preface

1.1 ResearchScope

1.2 Research Highlights

1.3 Research Objectives

1.4 Key Questions Answered

Chapter 2 Assumptions and Research Methodology

2.1 Report Assumptions

2.2 Acronyms Used

2.3 Research Methodology

Chapter 3 Executive Summary

3.1 Global Thin and Ultra-Thin Films Market Snapshot

3.2 Key Trend Analysis

3.3 Market Share Snapshot Analysis

3.4 Market Opportunity Map

Chapter 4 Market Dynamics

4.1 Introduction

4.2 Drivers and Restraints Snapshot Analysis

4.3 Drivers

4.4 Restraints

4.5 Opportunity Analysis

4.6 Company Market Share Analysis

Chapter 5 Global Thin and Ultra-Thin Films Market Revenue Forecast, by End User, 2016 – 2024 (US$ Bn)

5.1 Overview Key Trend Analysis

5.2 Thin Film Electronics

5.3 Thin Film Batteries

5.4 Thin Film PV

5.5 Others

5.6 Market Attractiveness Analysis

Chapter 6 Global Thin and Ultra-Thin Films Market Revenue Forecast, by Technology, 2016 – 2024 (US$ Bn)

6.1 Introduction

6.2 Printing

6.3 Physical Vapor Deposition (PVD)

6.4 Chemical Vapor Deposition (CVD)

6.5 Market Attractiveness Analysis

Chapter 7 Global Thin and Ultra-Thin Films Market Analysis, 2015-2024, by Region

7.1 Global Regulatory Scenerio

7.2 Introduction

7.3 Thin and Ultra-Thin Films Market Revenue Share Analysis, by Region

Chapter 8 North America Thin and Ultra-Thin Films Market Analysis, 2016 – 2024

8.1 Market Overview

8.2 North America Thin and Ultra-Thin Films Market Revenue Forecast, by End User, 2016 – 2024 (US$ Bn)

8.2.1 Overview

8.2.2 Thin Film Electronics

8.2.3 Thin Film Batteries

8.2.4 Thin Film PV

8.2.5 Others

8.3 North America Thin and Ultra-Thin Films Market Revenue Forecast, by Technology, 2016 – 2024 (US$ Bn)

8.3.1 Overview

8.3.2 Printing

8.3.3 Physical vapor Deposition (PVD)

8.3.4 Chemical vapor Deposition (CVD)

8.4 North America Thin and Ultra-Thin Films Market Revenue Forecast, by Fuel Type, 2016 – 2024 (US$ Bn)

8.4.1 U.S.

8.4.2 Rest of North America

Chapter 9 Europe Thin and Ultra-Thin Films Market Analysis, 2016 – 2024

9.1 Market Overview

9.2 Europe Thin and Ultra-Thin Films Market Revenue Forecast, by End User, 2016 – 2024 (US$ Bn)

9.2.1 Overview

9.2.2 Thin Film Electronics

9.2.3 Thin Film Batteries

9.2.4 Thin Film PV

9.2.5 Others

9.3 Europe Thin and Ultra-Thin Films Market Revenue Forecast, by Technology, 2016 – 2024 (US$ Bn)

9.3.1 Overview

9.3.2 Printing

9.3.3 Physical vapor Deposition (PVD)

9.3.4 Chemical vapor Deposition (CVD)

9.4 Europe Thin and Ultra-Thin Films Market Revenue Forecast, by Country, 2016 – 2024 (US$ Bn)

9.4.1 UK

9.4.2 Germany

9.4.3 Italy

9.4.4 France

9.4.5 Rest of Europe

Chapter 10 Asia Pacific Thin and Ultra-Thin Films Market Analysis, 2016 – 2024 10.1 Market Overview

10.2 Asia Pacific Thin and Ultra-Thin Films Market Revenue Forecast, by End User, 2016 – 2024 (US$ Bn)

10.2.1 Overview

10.2.2 Thin Film Electronics

10.2.3 Thin Film Batteries

10.2.4 Thin Film PV

10.2.5 Others

10.3 Asia Pacific Thin and Ultra-Thin Films Market Revenue Forecast, by Technology, 2016 – 2024 (US$ Bn)

10.3.1 Overview

10.3.2 Printing

10.3.3 Physical vapor Deposition (PVD)

10.3.4 Chemical vapor Deposition (CVD)

10.4 Asia Pacific Thin and Ultra-Thin Films Market Revenue Forecast, by End Users, 2016 – 2024 (US$ Bn)

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia Pacific

Chapter 11 Middle-East and Africa (MEA) Thin and Ultra-Thin Films Market Analysis, 2016 – 2024

11.1 Market Overview

11.2 MEA Thin and Ultra-Thin Films Market Revenue Forecast, by End User, 2016 – 2024 (US$ Bn)

11.2.1 Overview

11.2.2 Thin Film Electronics

11.2.3 Thin Film Batteries

11.2.4 Thin Film PV

11.2.5 Others

11.3 MEA Thin and Ultra-Thin Films Market Revenue Forecast, by Technology, 2016 – 2024 (US$ Bn)

11.3.1 Overview

11.3.2 Printing

11.3.3 Physical vapor Deposition (PVD)

11.3.4 Chemical vapor Deposition (CVD)

11.4 MEA Thin and Ultra-Thin Films Market Revenue Forecast, by Country, 2016 – 2024 (US$ Bn)

11.4.1 UAE

11.4.2 South Africa

11.4.3 Rest of MEA

Chapter 12 Latin America Thin and Ultra-Thin Films Market Analysis, 2016 – 2024

12.1 Key Trends Analysis

12.2 Latin America Thin and Ultra-Thin Films Market Revenue Forecast, by End User, 2016 – 2024 (US$ Bn)

12.2.1 Overview

12.2.2 Thin Film Electronics

12.2.3 Thin Film Batteries

12.2.4 Thin Film PV

12.2.5 Others

12.3 Latin America Thin and Ultra-Thin Films Market Revenue Forecast, by Technology, 2016 – 2024 (US$ Bn)

12.3.1 Overview

12.3.2 Printing

12.3.3 Physical vapor Deposition (PVD)

12.3.4 Chemical vapor Deposition (CVD)

12.6 Latin America Thin and Ultra-Thin Films Market Revenue Forecast, by Country, 2016 – 2024 (US$ Bn)

12.6.1 Brazil

12.6.2 Rest of Latin America

Chapter 13 Company Profiles

13.1 China national Building material Company Ltd

13.1.1 Company Details (HQ, Foundation Year, Employee Strength)

13.1.2 Market Presence, By Segment and Geography

13.1.3 Key Developments

13.1.4 Strategy and Historical Roadmap

13.1.5 Revenue and Y-o-Y Growth

13.2 Umicore Group

13.2.1 Company Details (HQ, Foundation Year, Employee Strength)

13.2.2 Market Presence, By Segment and Geography

13.2.3 Key Developments

13.2.4 Strategy and Historical Roadmap

15.2.5 Revenue and Y-o-Y Growth

13.3 Ascent Solar Technologies Ltd

13.3.1 Company Details (HQ, Foundation Year, Employee Strength)

13.3.2 Market Presence, By Segment and Geography

13.3.3 Key Developments

13.3.4 Strategy and Historical Roadmap

13.3.5 Revenue and Y-o-Y Growth

13.4 American Elememts

13.4.1 Company Details (HQ, Foundation Year, Employee Strength)

13.4.2 Market Presence, By Segment and Geography

13.4.3 Key Developments

13.4.4 Strategy and Historical Roadmap

13.4.5 Revenue and Y-o-Y Growth

13.5 Kaneka Corporation

13.5.1 Company Details (HQ, Foundation Year, Employee Strength)

13.5.2 Market Presence, By Segment and Geography

13.5.3 Key Developments

13.5.4 Strategy and Historical Roadmap

13.5.5 Revenue and Y-o-Y Growth

13.6 Moser Baer India Pvt. Ltd.

13.6.1 Company Details (HQ, Foundation Year, Employee Strength)

13.6.2 Market Presence, By Segment and Geography

13.6.3 Key Developments

13.6.4 Strategy and Historical Roadmap

13.6.5 Revenue and Y-o-Y Growth

13.7 Hanergy Thin Film Power Group Limited

13.7.1 Company Details (HQ, Foundation Year, Employee Strength)

13.7.2 Market Presence, By Segment and Geography

13.7.3 Key Developments

13.7.4 Strategy and Historical Roadmap

13.7.5 Revenue and Y-o-Y Growth

13.8 Corning Incorporated

13.8.1 Company Details (HQ, Foundation Year, Employee Strength)

13.8.2 Market Presence, By Segment and Geography

13.8.3 Key Developments

13.8.4 Strategy and Historical Roadmap

13.8.5 Revenue and Y-o-Y Growth

13.9 E. I. du Pont de Nemours and Company

13.9.1 Company Details (HQ, Foundation Year, Employee Strength)

13.9.2 Market Presence, By Segment and Geography

13.9.3 Key Developments

13.9.4 Strategy and Historical Roadmap

13.9.5 Revenue and Y-o-Y Growth

List of Tables

1 Global Thin and Ultra-Thin Films Market Revenue (US$ Bn) and Forecast, By End User, 2015–2024

2 Global Thin and Ultra-Thin Films Market Revenue (US$ Bn) and Forecast, By Technology, 2015–2024

3 Global Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, By Region Type, 2015–2024

4 North America Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, By End User, 2015–2024

5 North America Thin and Ultra-Thin Films Market Revenue (US$ Bn) and Forecast, By Technology, 2015–2024

6 North America Thin and Ultra-Thin Films Market, By Country 2015 - 2024 (USD Bn)

7 Europe Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, By End User, 2015–2024

8 Europe Thin and Ultra-Thin Films Market Revenue (US$ Bn) and Forecast, By Technology, 2015–2024

9 Europe Thin and Ultra-Thin Films Market, By Country 2015 - 2024 (USD Bn)

10 Asia Pacific Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, By End User, 2015–2024

11 Asia Pacific Thin and Ultra-Thin Films Market Revenue (US$ Bn) Forecast, By Technology, 2015–2024

12 Asia Pacific Thin and Ultra-Thin Films Market, By Country 2015 - 2024 (USD Bn)

13 LATAM Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, By End User, 2015–2024

14 LATAM Thin and Ultra-Thin Films Market Revenue (US$ Bn) Forecast, By Technology, 2015–2024

15 LATAM Thin and Ultra-Thin Films Market, By Country 2015 - 2024 (USD Bn)

16 MEA Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, By End User, 2015–2024

17 MEA Thin and Ultra-Thin Films Market Revenue (US$ Bn) Forecast, By Technology, 2015–2024

18 MEA Thin and Ultra-Thin Films Market, By Country 2015 - 2024 (USD Bn)

List of Figures

1 Research Methodology

2 Market Size, Indicative (US$ Bn)

3 Market Size, By Country (US$ Bn)

4 Growth Trend, By Country, 2015 – 2024

5 Market Share, By Country, 2015 & 2024

6 Global Thin and Ultra-Thin Films Market Value Share Analysis, By End Use, 2015 and 2024

7 Global Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Electronics

8 Global Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Batteries

9 Global Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film PV

10 Global Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Others

11 Global Thin and Ultra-Thin Films Market Value Share Analysis, By Technology, 2015 and 2024

12 Global Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Printing

13 Global Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, PVD 14 Global Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, CVD 15 Global Thin and Ultra-Thin Films Market Value Share Analysis By Region Type, 2016 and 2024

16 Thin and Ultra-Thin Films Market Attractiveness Analysis, By Region Type

17 North America Thin and Ultra-Thin Films Market Value Share Analysis By End User, 2016 and 2024

18 North America Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Electronics

19 North America Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Batteries

20 North America Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film PV

21 North America Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Others

22 North America Thin and Ultra-Thin Films Market Value Share Analysis, By Technology, 2015 and 2024

23 North America Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Printing

24 North America Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, PVD

25 North America Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, CVD

26 Europe Thin and Ultra-Thin Films Market Value Share Analysis, By Cloud Type, 2015 and 2024

27 Europe Thin and Ultra-Thin Films Market Value Share Analysis By End User, 2016 and 2024

28 Europe Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Electronics

29 Europe Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Batteries

30 Europe Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film PV

31 Europe Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Others

32 Europe Thin and Ultra-Thin Films Market Value Share Analysis, By Technology, 2015 and 2024

33 Europe Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Printing

34 Europe Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, PVD

35 Europe Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, CVD

36 Asia Pacific Thin and Ultra-Thin Films Market Value Share Analysis By End User, 2016 and 2024

37 Asia Pacific Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Electronics

38 Asia Pacific Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Batteries

39 Asia Pacific Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film PV

40 Asia Pacific Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Others

41 Asia Pacific Thin and Ultra-Thin Films Market Value Share Analysis, By Technology, 2015 and 2024

42 Asia Pacific Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Printing

43 Asia Pacific Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, PVD

44 Asia Pacific Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, CVD

45 LATAM Thin and Ultra-Thin Films Market Value Share Analysis By End User, 2016 and 2024

46 LATAM Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Electronics

47 LATAM Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Batteries

48 LATAM Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film PV

49 LATAM Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Others

50 LATAM Thin and Ultra-Thin Films Market Value Share Analysis, By Technology, 2015 and 2024

51 LATAM Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Printing

52 LATAM Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, PVD

53 LATAM Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, CVD

54 MEA Thin and Ultra-Thin Films Market Value Share Analysis By End User, 2016 and 2024

55 MEA Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Electronics

56 MEA Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film Batteries

57 MEA Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Thin Film PV

58 MEA Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Others

59 MEA Thin and Ultra-Thin Films Market Value Share Analysis, By Technology, 2015 and 2024

60 MEA Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, Printing

61 MEA Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, PVD

62 MEA Thin and Ultra-Thin Films Market Size (US$ Bn) Forecast, 2015–2024, CVD