Analysts’ Viewpoint on Tert-butanol Market Scenario

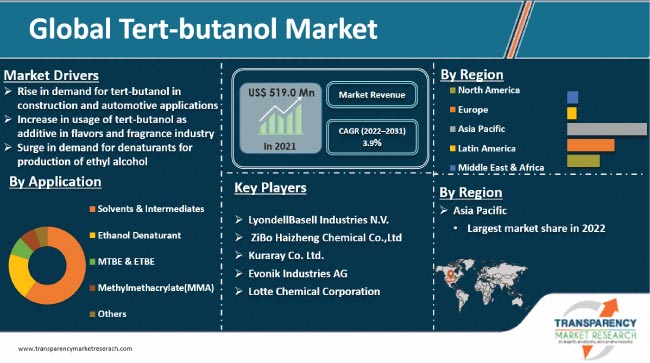

Demand for tert-butanol as a solvent in paint removers, cosmetics, pharmaceuticals, and other industries is increasing across the globe. Excellent solvating characteristics of tertiary butanol are projected to drive the demand for tert-butanol and consequently, propel the market during the forecast period. Tert-butanol is miscible with several solvents, also with water, which makes it ideal for numerous industrial applications. Increase in usage of tert-butanol as a potential freeze-drying agent in the manufacturing of pharmaceutical compounds is expected to fuel its demand in the next few years. However, rise in the availability of substitute products with bio-solvents and other oxo-alcohols is anticipated to restrain the market during the forecast period. Therefore, companies, policymakers, visionaries, and end-users need to work together to increase growth opportunities in the global tert-butanol market.

Tert-butanol, also known as tertiary butyl alcohol (TBA), is one of the four isomers of butanol. It is the simplest alcohol with a tertiary carbon atom. It is naturally found in chickpeas and cassava (a fermentation ingredient for some alcoholic beverages). Tert-butanol is commercially produced as a coproduct from isobutane during the manufacture of propylene oxide. Majority of tertiary butanol is consumed as a chemical intermediate for various products. Moreover, tert butanol cas is largely used as a solvent in various applications. It is also employed as a paint remover ingredient, alcohol denaturant, etc. Rise in demand for tert-butanol in the automotive industry is expected to boost the tert-butanol market size during the forecast period.

Request a sample to get extensive insights into the Tert-butanol Market

Tert-butanol is used as a solvent or co-solvent in paints, coatings, inks, and adhesives. Additionally, it is used in varnishes, resins, gums, dyes, camphor, vegetable oils, fats, waxes, rubbers, and alkaloids. The global building & construction industry is expanding significantly across the globe, typically in expanding economies such as China, India, etc., due to rapid urbanization and industrialization. Demand for tert-butanol in Asia Pacific is expected to rise significantly during the forecast period, owing to growth in the construction sector in the region, which comprises commercial establishments, public infrastructure and utilities, etc.

The global automotive industry has expanded significantly in the last few years in terms of manufacturing processes, materials, and geometries in order to meet the increase in requirements of consumers in terms of mileage and emissions. Perfluoro-tert-butyl alcohol is used in the production of SO2-based electrolytes for rechargeable battery cells with improved stability for electric automotive applications. Asia Pacific is rapidly becoming the global automotive hub for the last few years, primarily due to rise in consumer demand for vehicles. Thus, increase in demand for tert-butanol in the automotive industry is likely to boost the global market during the forecast period.

Flavors and fragrances are extremely complex mixtures of chemicals such as phenylpropanals, cyclohexane derivatives, tertiary alcohols, alkoxy-alkyl phenols, allylic alcohols, tricyclododecane derivatives, and heterocyclic compounds. Tert-butanol is used in fruit essence, perfume production, etc. Flavors and fragrances have a wide range of applications in food, perfumes, toiletries, cosmetics, and chemical industries. Tert-butanol greatly influences the flavor of food products when it is added as a food additive, flavoring agent, or solvent. It is used as a fragrance carrier in personal care products. Rise in demand for traditional scents as well as branded perfumes, air fresheners, and deodorizers is expected to boost the global tert-butanol market share during the forecast period.

Request a custom report on Tert-butanol Market

Tert-butanol can be utilized as a denaturant in the production of ethyl alcohol. Denatured alcohol is a form of ethanol and is also known as methylated spirit. Ethyl alcohol is denatured by using certain denaturants or additives such as methanol, benzol, ether, and perfluoro-tert-butanol. These additives make ethanol a poisonous liquid, with poor odor and taste. This, in turn, makes it unsuitable for human consumption. Rise in inclination of manufacturers toward better denaturant alternatives for denatured alcohol, such as isopropanol and tert-butanol, is expected to drive the global tert-butanol market during the forecast period. Tert-butanol is an excellent solvent and has high oxidation stability. Increase in demand for effective chemical agents for alcohol denaturing is fueling market demand for tert-butanol across the globe.

Increase in stringency of regulatory norms by governments of different countries across the globe to use denatured alcohol in gasoline blending is likely to propel the market during the forecast period. Under the Renewable Fuel Standard (RFS), the Federal Government of the U.S. has mandated the use of renewable fuels, which is driving the use of domestic ethanol in the country. Increase in applications of denatured alcohol in medical disinfectant, cosmetics, specimen preservation, sanding, fuel, pest control, etc., is anticipated to drive the global tert-butanol market in the next few years.

Asia Pacific is expected to dominate the global tert-butanol market during the forecast period. Asia Pacific held 44.3% share of the global market in 2021, and is projected to maintain its share during the forecast period. The growth can be ascribed to the rise in disposable income, increase in population, industrialization, surge in construction activities in the region. Rise in manufacturing capacity of polyurethane, especially in China and India, is a key factor prompting manufacturers to increase their production. This is projected to drive the demand for tert-butanol during the forecast period.

Europe held 26.3% share of the global market in 2021, and the region is expected to hold significant share in the next few years, owing to a rise in construction activities in the region. Furthermore, rise in demand for tert-butanol in chemical synthesis, freeze-drying agents, and flavors & fragrances applications is expected to boost the market during the forecast period.

North America held 18.1% share of the global market in 2021. Demand for tert-butanol in the U.S. is rising due to the reviving economy, increase in government spending on drug delivery, retrofitting, and rise in consumer inclination toward luxury personal care products.

Middle East & Africa is anticipated to be an attractive region for tert-butanol during the forecast period due to rise in applications of tert-butanol in various end-use industries in the region.

The global tert-butanol market is highly consolidated, with a large number of players controlling majority of the share. Expansion of product portfolios and mergers and acquisitions are notable strategies adopted by key players. LyondellBasell Industries N.V., ZiBo Haizheng Chemical Co.,Ltd, Kuraray Co. Ltd., Evonik Industries AG, Lotte Chemical Corporation, Sinopec Corp., Wanhua Chemical Group Co.,Ltd., Avantor, Inc., Zibo DeHong Chemical Technical Co., Ltd., Mitsui Chemicals, Inc., Tiande Chemical Holdings Limited, and Maruzen Petrochemical Co., Ltd. are the prominent entities operating in the global tert-butanol market.

Key players have been profiled in the global tert-butanol market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 519.0 Mn |

|

Market Forecast Value in 2031 |

US$ 768.4 Mn |

|

Growth Rate (CAGR) |

3.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Mn for Value & Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global tert-butanol market stood at US$ 519.0 Mn in 2021.

The global tert-butanol market is expected to grow at a CAGR of 3.9% from 2022 to 2031.

Rise in demand for tert-butanol in construction and automotive applications; increase in usage of tert-butanol as an additive in flavors and fragrance industry; and surge in demand for denaturants for production of ethyl alcohol.

Solvents & intermediates was the largest application segment of the global tert-butanol market that held 60.1% value share in 2021.

Asia Pacific was the most lucrative region of the global tert-butanol market in 2021.

LyondellBasell Industries N.V., ZiBo Haizheng Chemical Co.,Ltd, Kuraray Co. Ltd., Evonik Industries AG, and Lotte Chemical Corporation.

1. Executive Summary

1.1. Tert-butanol Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Materials Providers

2.6.2. List of Tert-butanol Manufacturers

2.6.3. List of Dealers/Distributors

2.6.4. List of Potential Customer

3. COVID-19 Impact Analysis

4. Tert-butanol Market Analysis and Forecast, by Application, 2022–2031

4.1. Introduction and Definitions

4.2. Global Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

4.2.1. Solvents & Intermediates

4.2.1.1. Paints & Coatings

4.2.1.2. Pharmaceutical

4.2.1.3. Flavors & Fragrance

4.2.1.4. Others

4.2.2. Ethanol Denaturant

4.2.3. MTBE & ETBE

4.2.4. Methylmethacrylate (MMA)

4.2.5. Others

4.3. Global Tert-butanol Market Attractiveness, by Application

5. Global Tert-butanol Market Analysis and Forecast, by Region, 2022–2031

5.1. Key Findings

5.2. Global Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2022–2031

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Latin America

5.2.5. Middle East & Africa

5.3. Global Tert-butanol Market Attractiveness, by Region

6. North America Tert-butanol Market Analysis and Forecast, 2022–2031

6.1. Key Findings

6.2. North America Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

6.3. North America Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2022–2031

6.3.1. U.S. Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

6.3.2. Canada Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

6.4. North America Tert-butanol Market Attractiveness Analysis

7. Europe Tert-butanol Market Analysis and Forecast, 2022–2031

7.1. Key Findings

7.2. Europe Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3. Europe Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

7.3.1. Germany Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.2. France Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.3. U.K. Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.4. Italy Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.5. Russia & CIS Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.3.6. Rest of Europe Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.4. Europe Tert-butanol Market Attractiveness Analysis

8. Asia Pacific Tert-butanol Market Analysis and Forecast, 2022–2031

8.1. Key Findings

8.2. Asia Pacific Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application

8.3. Asia Pacific Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

8.3.1. China Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.3.2. Japan Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.3.3. India Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.3.4. ASEAN Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.3.5. Rest of Asia Pacific Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.4. Asia Pacific Tert-butanol Market Attractiveness Analysis

9. Latin America Tert-butanol Market Analysis and Forecast, 2022–2031

9.1. Key Findings

9.2. Latin America Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.3. Latin America Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

9.3.1. Brazil Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.3.2. Mexico Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.3.3. Rest of Latin America Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.4. Latin America Tert-butanol Market Attractiveness Analysis

10. Middle East & Africa Tert-butanol Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. Middle East & Africa Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.3. Middle East & Africa Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

10.3.1. GCC Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.3.2. South Africa Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.3.3. Rest of Middle East & Africa Tert-butanol Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.4. Middle East & Africa Tert-butanol Market Attractiveness Analysis

11. Competition Landscape

11.1. Global Tert-butanol Company Market Share Analysis, 2021

11.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

11.2.1. LyondellBasell Industries N.V.

11.2.1.1. Company Description

11.2.1.2. Business Overview

11.2.1.3. Financial Overview

11.2.1.4. Strategic Overview

11.2.2. ZiBo Haizheng Chemical Co.,Ltd

11.2.2.1. Company Description

11.2.2.2. Business Overview

11.2.2.3. Financial Overview

11.2.2.4. Strategic Overview

11.2.3. Kuraray Co. Ltd.

11.2.3.1. Company Description

11.2.3.2. Business Overview

11.2.3.3. Financial Overview

11.2.3.4. Strategic Overview

11.2.4. Evonik Industries AG

11.2.4.1. Company Description

11.2.4.2. Business Overview

11.2.4.3. Financial Overview

11.2.4.4. Strategic Overview

11.2.5. Lotte Chemical Corporation

11.2.5.1. Company Description

11.2.5.2. Business Overview

11.2.5.3. Financial Overview

11.2.5.4. Strategic Overview

11.2.6. Sinopec Corp.

11.2.6.1. Company Description

11.2.6.2. Business Overview

11.2.6.3. Financial Overview

11.2.6.4. Strategic Overview

11.2.7. Wanhua Chemical Group Co., Ltd.

11.2.7.1. Company Description

11.2.7.2. Business Overview

11.2.7.3. Financial Overview

11.2.7.4. Strategic Overview

11.2.8. Avantor, Inc.

11.2.8.1. Company Description

11.2.8.2. Business Overview

11.2.8.3. Financial Overview

11.2.8.4. Strategic Overview

11.2.9. Zibo DeHong Chemical Technical Co., Ltd.

11.2.9.1. Company Description

11.2.9.2. Business Overview

11.2.9.3. Financial Overview

11.2.9.4. Strategic Overview

11.2.10. Mitsui Chemicals, Inc.

11.2.10.1. Company Description

11.2.10.2. Business Overview

11.2.10.3. Financial Overview

11.2.10.4. Strategic Overview

11.2.11. Tiande Chemical Holdings Limited

11.2.11.1. Company Description

11.2.11.2. Business Overview

11.2.11.3. Financial Overview

11.2.11.4. Strategic Overview

11.2.12. Maruzen Petrochemical Co., Ltd.

11.2.12.1. Company Description

11.2.12.2. Business Overview

11.2.12.3. Financial Overview

11.2.12.4. Strategic Overview

12. Primary Research: Key Insights

13. Appendix

List of Tables

Table 1: Global Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 2: Global Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 3: Global Tert-butanol Market Volume (Tons) Forecast, by Region, 2022–2031

Table 4: Global Tert-butanol Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 5: North America Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 6: North America Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 7: North America Tert-butanol Market Volume (Tons) Forecast, by Country, 2022–2031

Table 8: North America Tert-butanol Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 9: U.S. Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 10: U.S. Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 11: Canada Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 12: Canada Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 13: Europe Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 14: Europe Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 15: Europe Tert-butanol Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 16: Europe Tert-butanol Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 17: Germany Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 18: Germany Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 19: France Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 20: France Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 21: U.K. Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 22: U.K. Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 23: Italy Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 24: Italy Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 25: Spain Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 26: Spain Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 27: Russia & CIS Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 28: Russia & CIS Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 29: Rest of Europe Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 30: Rest of Europe Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 31: Asia Pacific Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 32: Asia Pacific Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 33: Asia Pacific Tert-butanol Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 34: Asia Pacific Tert-butanol Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 35: China Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 36: China Tert-butanol Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 37: Japan Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 38: Japan Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 39: India Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 40: India Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 41: ASEAN Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 42: ASEAN Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 43: Rest of Asia Pacific Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 44: Rest of Asia Pacific Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 45: Latin America Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 46: Latin America Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 47: Latin America Tert-butanol Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 48: Latin America Tert-butanol Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 49: Brazil Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 50: Brazil Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 51: Mexico Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 52: Mexico Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 53: Rest of Latin America Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 54: Rest of Latin America Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 55: Middle East & Africa Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 56: Middle East & Africa Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 57: Middle East & Africa Tert-butanol Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 58: Middle East & Africa Tert-butanol Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 59: GCC Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 60: GCC Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 61: South Africa Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 62: South Africa Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 63: Rest of Middle East & Africa Tert-butanol Market Volume (Tons) Forecast, by Application, 2022–2031

Table 64: Rest of Middle East & Africa Tert-butanol Market Value (US$ Mn) Forecast, by Application, 2022–2031

List of Figures

Figure 1: Global Tert-butanol Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 2: Global Tert-butanol Market Attractiveness, by Application

Figure 3: Global Tert-butanol Market Volume Share Analysis, by Region, 2021, 2025, and 2031

Figure 4: Global Tert-butanol Market Attractiveness, by Region

Figure 5: North America Tert-butanol Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 6: North America Tert-butanol Market Attractiveness, by Application

Figure 7: North America Tert-butanol Market Attractiveness, by Application

Figure 8: North America Tert-butanol Market Attractiveness, by Country and Sub-region

Figure 9: Europe Tert-butanol Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 10: Europe Tert-butanol Market Attractiveness, by Application

Figure 11: Europe Tert-butanol Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 12: Europe Tert-butanol Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Tert-butanol Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 14: Asia Pacific Tert-butanol Market Attractiveness, by Application

Figure 15: Asia Pacific Tert-butanol Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 16: Asia Pacific Tert-butanol Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Tert-butanol Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 18: Latin America Tert-butanol Market Attractiveness, by Application

Figure 19: Latin America Tert-butanol Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 20: Latin America Tert-butanol Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Tert-butanol Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 22: Middle East & Africa Tert-butanol Market Attractiveness, by Application

Figure 23: Middle East & Africa Tert-butanol Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Middle East & Africa Tert-butanol Market Attractiveness, by Country and Sub-region