Reports

Reports

Analysts’ Viewpoint

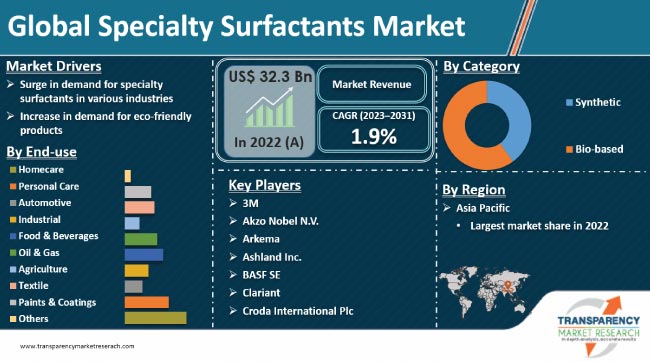

Increase in demand for eco-friendly products is a significant factor driving the global market for specialty surfactants. Growth in end-use industries such as personal care, homecare, food & beverages, pharmaceuticals, paints & coatings, and industrial is creating lucrative specialty surfactants market opportunities for manufacturers.

Manufacturers of specialty surfactants are adopting various strategies to remain competitive in the market. They are developing surfactants with unique properties that meet the specific needs of customers. This involves modification of the molecular structure of surfactants or development of surfactants with specific functional properties. Key players are focusing on reducing production costs by optimizing their manufacturing processes or sourcing raw materials more efficiently.

Specialty surfactants play a key role in various industries due to their unique properties and applications. They are commonly used in personal care and cosmetic products to improve texture, emulsify ingredients, and enhance foam stability. Examples include alkyl glucosides, betaines, and sulfosuccinates.

Specialty surfactants are used in the food & beverages industry as emulsifiers, stabilizers, and foaming agents. They help improve the texture, appearance, and shelf life of food products. Examples include lecithin, mono- and diglycerides, and sorbitan esters.

Demand for specialty surfactants is rising significantly in end-use industries such as homecare, personal care, automotive, industrial, food & beverages, oil & gas, agricultural, textile, and paints & coatings. Growth in demand for personal care and cosmetic products such as shampoos, conditioners, lotions, and creams is augmenting the demand for specialty surfactants. Specialty surfactants are used in these products to improve their properties and performance.

Increase in demand for processed food items and beverages is also driving the growth of the specialty surfactants business. Furthermore, specialty surfactants are used in the oil & gas industry as emulsifiers, demulsifiers, and foamers. Surge in demand for specialty surfactants in the oil & gas sector is augmenting market dynamics.

Growth in the pharmaceutical industry is also fueling market statistics. Specialty surfactants are used as solubilizers, emulsifiers, and stabilizers in the pharmaceutical industry.

Consumers across the globe are increasingly becoming environmentally conscious. They are seeking products that are safe for the environment. Specialty surfactants such as biosurfactants and alkyl polyglucosides are biodegradable. They can break down naturally in the environment. Furthermore, many specialty surfactants are non-toxic and do not harm aquatic life, thus making them ideal for usage in eco-friendly products.

Some specialty surfactants are derived from renewable sources such as plants or microorganisms. Thus, they are sustainable. Specialty surfactants can lower the environmental impact of products by reducing the usage of harmful chemicals and decreasing the carbon footprint.

These benefits render specialty surfactants ideal for usage in eco-friendly products such as cleaning products, personal care products, and agricultural products. Demand for eco-friendly products and specialty surfactants is expected to rise in the next few years, as consumers continue to prioritize sustainability and environmental safety.

The homecare end-use segment is projected to dominate the global market in the near future. Specialty surfactants are widely used in household cleaning products such as laundry detergents, dishwashing detergents, and all-purpose cleaners. Demand for specialty surfactants is high in the homecare sector due to their cleaning, foaming, and emulsifying properties.

Specialty surfactants are essential components of household cleaning products, as they help remove dirt, grease, and stains from surfaces. They also provide excellent foaming and cleaning properties. Additionally, specialty surfactants provide desirable characteristics such as viscosity control, emulsification, and stability in household cleaning products.

Rise in demand for eco-friendly and sustainable cleaning products across the globe is boosting the homecare segment. Specialty surfactants such as biosurfactants and alkyl polyglucosides are derived from renewable sources and are biodegradable. Therefore, they are becoming increasingly popular in household cleaning products.

According to the specialty surfactants market forecast report, Asia Pacific is likely to dominate the global landscape during the forecast period, owing to the rise in population, urbanization, and presence of a strong manufacturing industry in the region.

Demand for personal care and household products is increasing in Asia Pacific, led by the rise in disposable income of the large middle-class population in the region. This is fueling specialty surfactants market growth.

High demand for processed food, beverages, and household products is also augmenting market expansion in the region. Several countries in Asia Pacific have implemented favorable government policies to promote the usage of specialty surfactants in industries such as cosmetics and personal care. This is positively impacting market progress.

The specialty surfactants market size in North America is anticipated to increase at a steady pace during the forecast period.

The global landscape is consolidated, with the presence of several small and medium-sized manufacturers that control majority of the specialty surfactants market share. These players compete with each other and large enterprises.

According to the latest specialty surfactants market research, many businesses are making significant investments in research & development activities, thus leading to the early adoption of next-generation technologies and creation of new products.

Key players are following the latest specialty surfactants market trends and implementing strategies such as development of new products, mergers, and acquisitions. Providing excellent customer service is one of the major strategies adopted by specialty surfactant manufacturers. This involves offering technical support and product information as well as addressing customer complaints and concerns promptly.

Connect Chemicals, 3M, Akzo Nobel N.V., Arkema, Ashland Inc., BASF SE, Clariant, Croda International Plc, Dow, Evonik Industries AG, Huntsman International LLC, Innospec, MITSUI & CO., LTD., Sasol, Solvay, Stepan Company, Sumitomo Corporation, Lambent Technologies, Kao, Cytec, Unilever, and Lonza are prominent specialty surfactants companies operating in the global market.

Each of these players has been profiled in the specialty surfactants market research report based on parameters such as business strategies, recent developments, financial overview, business segments, company overview, and product portfolio.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 32.3 Bn |

| Market Forecast Value in 2031 | US$ 38.1 Bn |

| Growth Rate (CAGR) | 1.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Specialty Surfactants market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 32.3 Bn in 2022.

It is anticipated to grow at a CAGR of 1.9% from 2023 to 2031.

Surge in demand for specialty surfactants in various industries and increase in demand for eco-friendly products.

Homecare was the largest end-use segment in 2022.

Asia Pacific was the most lucrative region in 2022.

Connect Chemicals, 3M, Akzo Nobel N.V., Arkema, Ashland Inc., BASF SE, Clariant, Croda International Plc, Dow, Evonik Industries AG, Huntsman International LLC, Innospec, MITSUI & CO., LTD., Sasol, Solvay, Stepan Company, Sumitomo Corporation, Lambent Technologies, Kao, Cytec, Unilever, and Lonza.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Specialty Surfactants Market Analysis and Forecast, 2023-2031

2.6.1. Global Specialty Surfactants Market Volume (Tons)

2.6.2. Global Specialty Surfactants Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Process Overview

2.12. Cost Structure Analysis

2.12.1. Cost Structure Analysis

3. Economic Recovery Post COVID-19 Impact

3.1. Impact on the Supply Chain of the Specialty Surfactants

3.2. Impact on the Demand of Specialty Surfactants - Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Tons), by Region, 2022

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Type

6.2. Price Comparison Analysis by Application

6.3. Price Comparison Analysis by Region

7. Global Specialty Surfactants Market Analysis and Forecast, by Category, 2023-2031

7.1. Introduction and Definitions

7.2. Global Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

7.2.1. Synthetic

7.2.2. Bio-based

7.3. Global Specialty Surfactants Market Attractiveness, by Category

8. Global Specialty Surfactants Market Analysis and Forecast, by Type, 2023-2031

8.1. Introduction and Definitions

8.2. Global Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

8.2.1. Anionic Surfactants

8.2.2. Cationic Surfactants

8.2.3. Non-ionic Surfactants

8.2.4. Amphoteric Surfactants

8.2.5. Silicone Surfactants

8.2.6. Others

8.3. Global Specialty Surfactants Market Attractiveness, by Type

9. Global Specialty Surfactants Market Analysis and Forecast, by Process, 2023-2031

9.1. Introduction and Definitions

9.2. Global Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

9.2.1. Sulfonation/Sulfation

9.2.2. Esterification

9.2.3. Amination

9.2.4. Others

9.3. Global Specialty Surfactants Market Attractiveness, by Process

10. Global Specialty Surfactants Market Analysis and Forecast, by Application, 2023-2031

10.1. Introduction and Definitions

10.2. Global Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.2.1. Wetting Agents

10.2.2. Emulsifiers

10.2.3. Dispersants

10.2.4. Foaming Agents

10.2.5. Stabilizers

10.2.6. Lubricants

10.2.7. Biocides

10.2.8. Corrosion Inhibitors

10.2.9. Others

10.3. Global Specialty Surfactants Market Attractiveness, by Application

11. Global Specialty Surfactants Market Analysis and Forecast, by End-use, 2023-2031

11.1. Introduction and Definitions

11.2. Global Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.2.1. Homecare

11.2.2. Personal Care

11.2.3. Automotive

11.2.4. Industrial

11.2.5. Food & Beverages

11.2.6. Oil & Gas

11.2.7. Agriculture

11.2.8. Textile

11.2.9. Paints & Coatings

11.2.10. Others

11.3. Global Specialty Surfactants Market Attractiveness, by End-use

12. Global Specialty Surfactants Market Analysis and Forecast, by Region, 2023-2031

12.1. Key Findings

12.2. Global Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Region, 2023-2031

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Latin America

12.2.5. Middle East & Africa

12.3. Global Specialty Surfactants Market Attractiveness, by Region

13. North America Specialty Surfactants Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. North America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

13.3. North America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.4. North America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

13.5. North America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.6. North America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.7. North America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Country, 2023-2031

13.7.1. U.S. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

13.7.2. U.S. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.7.3. U.S. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

13.7.4. U.S. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.7.5. U.S. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

13.7.6. Canada Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

13.7.7. Canada Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.7.8. Canada Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

13.7.9. Canada Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.7.10. Canada Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

13.8. North America Specialty Surfactants Market Attractiveness Analysis

14. Europe Specialty Surfactants Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.3. Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.4. Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

14.5. Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.6. Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.7. Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.7.1. Germany Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.7.2. Germany Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.3. Germany Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

14.7.4. Germany Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.5. Germany. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.6. France Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.7.7. France Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.8. France Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

14.7.9. France Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.10. France. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.11. U.K. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.7.12. U.K. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.13. U.K. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

14.7.14. U.K. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.15. U.K. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.16. Italy Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.7.17. Italy. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.18. Italy. Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

14.7.19. Italy Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.20. Italy Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.21. Russia & CIS Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.7.22. Russia & CIS Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.23. Russia & CIS Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

14.7.24. Russia & CIS Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.25. Russia & CIS Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.26. Rest of Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.7.27. Rest of Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.28. Rest of Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

14.7.29. Rest of Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.30. Rest of Europe Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.8. Europe Specialty Surfactants Market Attractiveness Analysis

15. Asia Pacific Specialty Surfactants Market Analysis and Forecast, 2023-2031

15.1. Key Findings

15.2. Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category

15.3. Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.4. Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

15.5. Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.6. Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.7. Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

15.7.1. China Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

15.7.2. China Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.3. China Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

15.7.4. China Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.5. China Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.7.6. Japan Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

15.7.7. Japan Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.8. Japan Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

15.7.9. Japan Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.10. Japan Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.7.11. India Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

15.7.12. India Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.13. India Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

15.7.14. India Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.15. India Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.7.16. ASEAN Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

15.7.17. ASEAN Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.18. ASEAN Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

15.7.19. ASEAN Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.20. ASEAN Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.7.21. Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

15.7.22. Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.23. Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

15.7.24. Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.25. Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.8. Asia Pacific Specialty Surfactants Market Attractiveness Analysis

16. Latin America Specialty Surfactants Market Analysis and Forecast, 2023-2031

16.1. Key Findings

16.2. Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

16.3. Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

16.4. Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

16.5. Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

16.6. Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

16.7. Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

16.7.1. Brazil Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

16.7.2. Brazil Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

16.7.3. Brazil Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

16.7.4. Brazil Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

16.7.5. Brazil Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

16.7.6. Mexico Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

16.7.7. Mexico Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

16.7.8. Mexico Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

16.7.9. Mexico Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

16.7.10. Mexico Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

16.7.11. Rest of Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

16.7.12. Rest of Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

16.7.13. Rest of Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

16.7.14. Rest of Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

16.7.15. Rest of Latin America Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

16.8. Latin America Specialty Surfactants Market Attractiveness Analysis

17. Middle East & Africa Specialty Surfactants Market Analysis and Forecast, 2023-2031

17.1. Key Findings

17.2. Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

17.3. Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

17.4. Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

17.5. Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

17.6. Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

17.7. Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

17.7.1. GCC Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

17.7.2. GCC Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

17.7.3. GCC Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

17.7.4. GCC Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

17.7.5. GCC Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

17.7.6. South Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

17.7.7. South Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

17.7.8. South Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

17.7.9. South Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

17.7.10. South Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

17.7.11. Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

17.7.12. Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

17.7.13. Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Process, 2023-2031

17.7.14. Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

17.7.15. Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

17.8. Middle East & Africa Specialty Surfactants Market Attractiveness Analysis

18. Competition Landscape

18.1. Market Players - Competition Matrix (by Tier and Size of Companies)

18.2. Market Share Analysis, 2022

18.3. Market Footprint Analysis

18.3.1. By Process

18.3.2. By Application

18.4. Company Profiles

18.4.1. 3M

18.4.1.1. Company Revenue

18.4.1.2. Business Overview

18.4.1.3. Product Segments

18.4.1.4. Geographic Footprint

18.4.1.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.1.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.2. Akzo Nobel N.V.

18.4.2.1. Company Revenue

18.4.2.2. Business Overview

18.4.2.3. Product Segments

18.4.2.4. Geographic Footprint

18.4.2.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.2.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.3. Arkema

18.4.3.1. Company Revenue

18.4.3.2. Business Overview

18.4.3.3. Product Segments

18.4.3.4. Geographic Footprint

18.4.3.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.3.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.4. Ashland Inc.

18.4.4.1. Company Revenue

18.4.4.2. Business Overview

18.4.4.3. Product Segments

18.4.4.4. Geographic Footprint

18.4.4.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.4.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.5. BASF SE

18.4.5.1. Company Revenue

18.4.5.2. Business Overview

18.4.5.3. Product Segments

18.4.5.4. Geographic Footprint

18.4.5.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.5.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.6. Clariant

18.4.6.1. Company Revenue

18.4.6.2. Business Overview

18.4.6.3. Product Segments

18.4.6.4. Geographic Footprint

18.4.6.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.6.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.7. Croda International Plc

18.4.7.1. Company Revenue

18.4.7.2. Business Overview

18.4.7.3. Product Segments

18.4.7.4. Geographic Footprint

18.4.7.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.7.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.8. Dow

18.4.8.1. Company Revenue

18.4.8.2. Business Overview

18.4.8.3. Product Segments

18.4.8.4. Geographic Footprint

18.4.8.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.8.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.9. Evonik Industries AG

18.4.9.1. Company Revenue

18.4.9.2. Business Overview

18.4.9.3. Product Segments

18.4.9.4. Geographic Footprint

18.4.9.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.9.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.10. Huntsman International LLC

18.4.10.1. Company Revenue

18.4.10.2. Business Overview

18.4.10.3. Product Segments

18.4.10.4. Geographic Footprint

18.4.10.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.10.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.11. Innospec

18.4.11.1. Company Revenue

18.4.11.2. Business Overview

18.4.11.3. Product Segments

18.4.11.4. Geographic Footprint

18.4.11.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.11.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.12. MITSUI & CO., LTD.

18.4.12.1. Company Revenue

18.4.12.2. Business Overview

18.4.12.3. Product Segments

18.4.12.4. Geographic Footprint

18.4.12.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.12.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.13. Sasol

18.4.13.1. Company Revenue

18.4.13.2. Business Overview

18.4.13.3. Product Segments

18.4.13.4. Geographic Footprint

18.4.13.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.13.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.14. Solvay

18.4.14.1. Company Revenue

18.4.14.2. Business Overview

18.4.14.3. Product Segments

18.4.14.4. Geographic Footprint

18.4.14.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.14.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.15. Stepan Company

18.4.15.1. Company Revenue

18.4.15.2. Business Overview

18.4.15.3. Product Segments

18.4.15.4. Geographic Footprint

18.4.15.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.15.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.16. Sumitomo Corporation

18.4.16.1. Company Revenue

18.4.16.2. Business Overview

18.4.16.3. Product Segments

18.4.16.4. Geographic Footprint

18.4.16.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.16.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.17. Lambent Technologies

18.4.17.1. Company Revenue

18.4.17.2. Business Overview

18.4.17.3. Product Segments

18.4.17.4. Geographic Footprint

18.4.17.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.17.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.18. Kao

18.4.18.1. Company Revenue

18.4.18.2. Business Overview

18.4.18.3. Product Segments

18.4.18.4. Geographic Footprint

18.4.18.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.18.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.19. Cytec

18.4.19.1. Company Revenue

18.4.19.2. Business Overview

18.4.19.3. Product Segments

18.4.19.4. Geographic Footprint

18.4.19.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.19.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.20. Unilever

18.4.20.1. Company Revenue

18.4.20.2. Business Overview

18.4.20.3. Product Segments

18.4.20.4. Geographic Footprint

18.4.20.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.20.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

18.4.21. Lonza

18.4.21.1. Company Revenue

18.4.21.2. Business Overview

18.4.21.3. Product Segments

18.4.21.4. Geographic Footprint

18.4.21.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.21.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

19. Primary Research: Key Insights

20. Appendix

List of Tables

Table 1: Global Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 2: Global Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 3: Global Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 4: Global Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 5: Global Specialty Surfactants Market Volume (Tons) Forecast, by Process 2023-2031

Table 6: Global Specialty Surfactants Market Value (US$ Bn) Forecast, by Process 2023-2031

Table 7: Global Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 8: Global Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 9: Global Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 10: Global Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 11: Global Specialty Surfactants Market Volume (Tons) Forecast, by Region, 2023-2031

Table 12: Global Specialty Surfactants Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 13: North America Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 14: North America Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 15: North America Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 16: North America Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 17: North America Specialty Surfactants Market Volume (Tons) Forecast, by Process 2023-2031

Table 18: North America Specialty Surfactants Market Value (US$ Bn) Forecast, by Process 2023-2031

Table 19: North America Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 20: North America Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 21: North America Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 22: North America Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 23: North America Specialty Surfactants Market Volume (Tons) Forecast, by Country, 2023-2031

Table 24: North America Specialty Surfactants Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 25: U.S. Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 26: U.S. Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 27: U.S. Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 28: U.S. Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 29: U.S. Specialty Surfactants Market Volume (Tons) Forecast, by Process 2023-2031

Table 30: U.S. Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 31: U.S. Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 32: U.S. Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 33: U.S. Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 34: U.S. Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 35: Canada Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 36: Canada Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 37: Canada Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 38: Canada Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 39: Canada Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 40: Canada Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 41: Canada Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 42: Canada Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 43: Canada Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 44: Canada Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 45: Europe Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 46: Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 47: Europe Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 48: Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 49: Europe Specialty Surfactants Market Volume (Tons) Forecast, by Process 2023-2031

Table 50: Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 51: Europe Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 52: Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 53: Europe Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 54: Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 55: Europe Specialty Surfactants Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 56: Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 57: Germany Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 58: Germany Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 59: Germany Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 60: Germany Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 61: Germany Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 62: Germany Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 63: Germany Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 64: Germany Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 65: Germany Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 66: Germany Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 67: France Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 68: France Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 69: France Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 70: France Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 71: France Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 72: France Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 73: France Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 74: France Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 75: France Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 76: France Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 77: U.K. Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 78: U.K. Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 79: U.K. Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 80: U.K. Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 81: U.K. Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 82: U.K. Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 83: U.K. Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 84: U.K. Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 85: U.K. Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 86: U.K. Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 87: Italy Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 88: Italy Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 89: Italy Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 90: Italy Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 91: Italy Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 92: Italy Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 93: Italy Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 94: Italy Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 95: Italy Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 96: Italy Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 97: Spain Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 98: Spain Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 99: Spain Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 100: Spain Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 101: Spain Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 102: Spain Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 103: Spain Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 104: Spain Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 105: Spain Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 106: Spain Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 107: Russia & CIS Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 108: Russia & CIS Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 109: Russia & CIS Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 110: Russia & CIS Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 111: Russia & CIS Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 112: Russia & CIS Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 113: Russia & CIS Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 114: Russia & CIS Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 115: Russia & CIS Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 116: Russia & CIS Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 117: Rest of Europe Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 118: Rest of Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 119: Rest of Europe Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 120: Rest of Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 121: Rest of Europe Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 122: Rest of Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 123: Rest of Europe Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 124: Rest of Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 125: Rest of Europe Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 126: Rest of Europe Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 127: Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 128: Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 129: Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 130: Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 131: Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 132: Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 133: Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 134: Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 135: Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 136: Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 137: Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 138: Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 139: China Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 140: China Specialty Surfactants Market Value (US$ Bn) Forecast, by Category 2023-2031

Table 141: China Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 142: China Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 143: China Specialty Surfactants Market Volume (Tons) Forecast, by Processe, 2023-2031

Table 144: China Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 145: China Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 146: China Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 147: China Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 148: China Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 149: Japan Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 150: Japan Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 151: Japan Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 152: Japan Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 153: Japan Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 154: Japan Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 155: Japan Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 156: Japan Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 157: Japan Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 158: Japan Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 159: India Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 160: India Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 161: India Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 162: India Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 163: India Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 164: India Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 165: India Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 166: India Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 167: India Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 168: India Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 169: ASEAN Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 170: ASEAN Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 171: ASEAN Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 172: ASEAN Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 173: ASEAN Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 174: ASEAN Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 175: ASEAN Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 176: ASEAN Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 177: ASEAN Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 178: ASEAN Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 179: Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 180: Rest of Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 181: Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 182: Rest of Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 183: Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 184: Rest of Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 185: Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 186: Rest of Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 187: Rest of Asia Pacific Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 188: Rest of Asia Pacific Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 189: Latin America Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 190: Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 191: Latin America Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 192: Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 193: Latin America Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 194: Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 195: Latin America Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 196: Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 197: Latin America Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 198: Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 199: Latin America Specialty Surfactants Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 200: Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 201: Brazil Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 202: Brazil Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 203: Brazil Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 204: Brazil Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 205: Brazil Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 206: Brazil Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 207: Brazil Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 208: Brazil Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 209: Brazil Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 210: Brazil Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 211: Mexico Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 212: Mexico Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 213: Mexico Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 214: Mexico Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 215: Mexico Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 216: Mexico Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 217: Mexico Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 218: Mexico Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 219: Mexico Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 220: Mexico Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 221: Rest of Latin America Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 222: Rest of Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 223: Rest of Latin America Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 224: Rest of Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 225: Rest of Latin America Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 226: Rest of Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 227: Rest of Latin America Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 228: Rest of Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 229: Rest of Latin America Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 230: Rest of Latin America Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 231: Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 232: Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 233: Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 234: Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 235: Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 236: Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 237: Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 238: Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 239: Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 240: Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 241: Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 242: Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 243: GCC Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 244: GCC Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 245: GCC Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 246: GCC Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 247: GCC Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 248: GCC Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 249: GCC Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 250: GCC Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 251: GCC Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 252: GCC Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 253: South Africa Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 254: South Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 255: South Africa Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 256: South Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 257: South Africa Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 258: South Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 259: South Africa Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 260: South Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 261: South Africa Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 262: South Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 263: Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by Category, 2023-2031

Table 264: Rest of Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 265: Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by Type, 2023-2031

Table 266: Rest of Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 267: Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by Process, 2023-2031

Table 268: Rest of Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Process, 2023-2031

Table 269: Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by Application, 2023-2031

Table 270: Rest of Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 271: Rest of Middle East & Africa Specialty Surfactants Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 272: Rest of Middle East & Africa Specialty Surfactants Market Value (US$ Bn) Forecast, by End-use 2023-2031

List of Figures

Figure 1: Global Specialty Surfactants Market Value Share Analysis, by Category, 2022, 2027, and 2031

Figure 2: Global Specialty Surfactants Market Attractiveness, by Category

Figure 3: Global Specialty Surfactants Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 4: Global Specialty Surfactants Market Attractiveness, by Type

Figure 5: Global Specialty Surfactants Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 6: Global Specialty Surfactants Market Attractiveness, by Process

Figure 7: Global Specialty Surfactants Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 8: Global Specialty Surfactants Market Attractiveness, by Application

Figure 9: Global Specialty Surfactants Market Value Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: Global Specialty Surfactants Market Attractiveness, by End-use

Figure 11: Global Specialty Surfactants Market Value Share Analysis, by Region, 2022, 2027, and 2031

Figure 12: Global Specialty Surfactants Market Attractiveness, by Region

Figure 13: North America Specialty Surfactants Market Value Share Analysis, by Category, 2022, 2027, and 2031

Figure 14: North America Specialty Surfactants Market Attractiveness, by Category

Figure 15: North America Specialty Surfactants Market Attractiveness, by Category

Figure 16: North America Specialty Surfactants Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 17: North America Specialty Surfactants Market Attractiveness, by Type

Figure 18: North America Specialty Surfactants Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 19: North America Specialty Surfactants Market Attractiveness, by Process

Figure 20: North America Specialty Surfactants Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 21: North America Specialty Surfactants Market Attractiveness, by Application

Figure 22: North America Specialty Surfactants Market Value Share Analysis, by End-use, 2022, 2027, and 2031

Figure 23: North America Specialty Surfactants Market Attractiveness, by End-use

Figure 24: North America Specialty Surfactants Market Attractiveness, by Country and Sub-region

Figure 25: Europe Specialty Surfactants Market Value Share Analysis, by Category, 2022, 2027, and 2031

Figure 26: Europe Specialty Surfactants Market Attractiveness, by Category

Figure 27: Europe Specialty Surfactants Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 28: Europe Specialty Surfactants Market Attractiveness, by Type

Figure 29: Europe Specialty Surfactants Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 30: Europe Specialty Surfactants Market Attractiveness, by Process

Figure 31: Europe Specialty Surfactants Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 32: Europe Specialty Surfactants Market Attractiveness, by Application

Figure 33: Europe Specialty Surfactants Market Value Share Analysis, by End-use, 2022, 2027, and 2031

Figure 34: Europe Specialty Surfactants Market Attractiveness, by End-use

Figure 35: Europe Specialty Surfactants Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Europe Specialty Surfactants Market Attractiveness, by Country and Sub-region

Figure 37: Asia Pacific Specialty Surfactants Market Value Share Analysis, by Category, 2022, 2027, and 2031

Figure 38: Asia Pacific Specialty Surfactants Market Attractiveness, by Category

Figure 39: Asia Pacific Specialty Surfactants Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 40: Asia Pacific Specialty Surfactants Market Attractiveness, by Type

Figure 41: Asia Pacific Specialty Surfactants Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 42: Asia Pacific Specialty Surfactants Market Attractiveness, by Process

Figure 43: Asia Pacific Specialty Surfactants Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 44: Asia Pacific Specialty Surfactants Market Attractiveness, by Application

Figure 45: Asia Pacific Specialty Surfactants Market Value Share Analysis, by End-use, 2022, 2027, and 2031

Figure 46: Asia Pacific Specialty Surfactants Market Attractiveness, by End-use

Figure 47: Asia Pacific Specialty Surfactants Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 48: Asia Pacific Specialty Surfactants Market Attractiveness, by Country and Sub-region

Figure 49: Latin America Specialty Surfactants Market Value Share Analysis, by Category, 2022, 2027, and 2031

Figure 50: Latin America Specialty Surfactants Market Attractiveness, by Category

Figure 51: Latin America Specialty Surfactants Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 52: Latin America Specialty Surfactants Market Attractiveness, by Type

Figure 53: Latin America Specialty Surfactants Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 54: Latin America Specialty Surfactants Market Attractiveness, by Process

Figure 55: Latin America Specialty Surfactants Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 56: Latin America Specialty Surfactants Market Attractiveness, by Application

Figure 57: Latin America Specialty Surfactants Market Value Share Analysis, by End-use, 2022, 2027, and 2031

Figure 58: Latin America Specialty Surfactants Market Attractiveness, by End-use

Figure 59: Latin America Specialty Surfactants Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 60: Latin America Specialty Surfactants Market Attractiveness, by Country and Sub-region

Figure 61: Middle East & Africa Specialty Surfactants Market Value Share Analysis, by Category, 2022, 2027, and 2031

Figure 62: Middle East & Africa Specialty Surfactants Market Attractiveness, by Category

Figure 63: Middle East & Africa Specialty Surfactants Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 64: Middle East & Africa Specialty Surfactants Market Attractiveness, by Type

Figure 65: Middle East & Africa Specialty Surfactants Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 66: Middle East & Africa Specialty Surfactants Market Attractiveness, by Process

Figure 67: Middle East & Africa Specialty Surfactants Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 68: Middle East & Africa Specialty Surfactants Market Attractiveness, by Application

Figure 69: Middle East & Africa Specialty Surfactants Market Value Share Analysis, by End-use, 2022, 2027, and 2031

Figure 70: Middle East & Africa Specialty Surfactants Market Attractiveness, by End-use

Figure 71: Middle East & Africa Specialty Surfactants Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 72: Middle East & Africa Specialty Surfactants Market Attractiveness, by Country and Sub-region