Reports

Reports

The rising adoption of clean energy and the declining prices of solar modules are driving the solar photovoltaic (PV) installation market. The growing provisions and government incentives, renewable energy target, and growing demand of sustainable sources of power are driving new installations in the residential, commercial, and utility scale applications alike.

PV systems have been scaled up in farm size and power ratings, and have also been made cost-competitive at large scales, which is why they are now a mass-scale energy source. The major players are busy investing in bifacial modules, thin-film PV and intelligent inverters with the idea to maximize the output and lower the whole system costs.

In addition, alliances and entry into new customers (pop-up markets) and bundled service such as operation and maintenance (O&M) are enhancing the structure of the industry. The localization of the supply chains and increase in manufacturing capacities are also providing solutions to issues regarding energy security and fluctuations in costs. In sum, there is a positive market outlook amongst industry leaders aligning with global decarbonization objectives and energy transition incentive.

The solar photovoltaic (PV) installation market is the industry dedicated to the implementation of the PV systems that produce electricity out of sunlight with solar panels. It includes residential, commercial, and utility-scale, which are fueled by increased usage of renewable energy, drop in the price of PV technology, and government incentives. The market has been taking center stage as countries aim at providing sustainable, and low-carbon sources of energy to sustain the growing power demands and climate objectives.

Installing a solar PV system entails the installation of solar panels, inverters, and supporting installations, and all the other balance of system goods that are used to generate solar energy successfully. Applications range between the ability to power domestic and commercial entities to feeding the national grids with electricity via mega solar farms. Residential-level set-ups ensure less reliance on traditional energy use, whereas a commercial and industrial set-up minimizes operating expenses and carbon emissions.

On the utility scale, PV projects are important in rendering national renewable energy capacities. Design, engineering, procurement, construction, and life-sustaining operation and maintenance are also encompassed in the process, thereby creating long-term effectiveness and functionality.

| Attribute | Detail |

|---|---|

| Solar Photovoltaic (PV) Installation Market Drivers |

|

Among the factors that contribute to the growth of the solar photovoltaic (PV) installation market is the steady cost reduction experienced in installations that have boosted the financial viability of solar installations across the globe. In the last ten years, the price of PV modules, inverters, mounting systems, and the balance-of-system devices have reduced significantly due to economies of scale, technology advances, and increased efficiency of the manufacturing process. To give an example, the cost of solar modules has already declined by over 80% since 2010, so solar PV is among the most economically competitive sources of power between fossil fuels and even other renewable resources in most markets.

The cost of equipment and materials means a direct decrease in the capital investment (CAPEX) to install solar systems, either as a residence rooftop solar system or utility-scale farms. This also reduces the cost, which translates into low levelized cost of electricity (LCOE), thereby making solar installations more competitive to investors, developers, and consumers.

Moreover, it is not only the equipment that has seen a drop in installation costs but also labor efficiencies, supply chain costs, and streamlined processes across multiple markets. Firms are mounting better construction technologies, automation, and digitization to cut construction schedules and fewer workers, and, therefore, the total cost again comes down.

Scalability has also been enhanced by the fact that the cost of engineering has diminished given the introduction of standard designs of PV systems. The fact that solar PV projects are becoming cost competitive is increasingly viewed by financial institutions and investors as a lower-risk venture, thereby allowing them to both - attract more financing opportunities and at improved financing rates. In the emerging economies where cost-effectiveness is an important issue, cost dropping has opened the gate to massive integration and overcoming energy gaps creating greater access to clean power.

Rise in global demand for electricity is a significant factor boosting the solar photovoltaic (PV) installation market. Exploding population, accelerated urbanization, and digitization of the industrial sector are factors that are leading to an unprecedented level of energy consumption in both - developed economies as well as in emerging economies.

Conventional use of fossil fuel to generate power is gradually being replaced due to the rising price of fuel as well as the need to conserve the environment and tight regulations imposed on emissions. With that backdrop, solar PV has come into the picture as a scalable, economical, sustainable option that can bring about significant electricity generation increases that could help supply the growing generation need and at the same time, thereby helping in achieving the goals of decarbonization of the globe. Utility-scale solar parks are especially being installed at unprecedented high rates to complement national grids in order to provide reliable power.

Installation of solar PV systems will fulfill two urgent customer needs: low prices and scalability. Due to increased requirement of electricity, there is pressure on governments and utilities to increase capacity in a quick and an efficient manner. Solar projects can be typically built within 12-18 months, similar to or faster than conventional power plants, and thus rendering a promising option to meet both - short-term and long-term capacity needs.

In developing regions like India, Southeast Asia, and Africa, demand for electricity due to industrialization and rural electrification is increasing at a rapid pace, which would require high investments in solar PV projects. At the same time, the developed economies are witnessing demand for electricity owing to rising influx for data centers and electric vehicles (EVs).

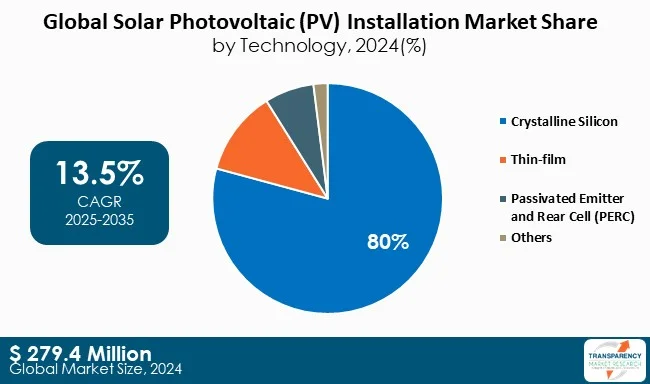

The monocrystalline silicon segment leads the solar photovoltaic (PV) installation market due to solar PVs’ high efficiency, better performance, and sustainability. What makes it less bulky is that it can produce more electricity in small areas of coverage as compared to others and this suits rooftops, burdensome lands, and city projects.

The further innovations such as PERC technology coupled with drop in production costs increase the energy generation and further decrease the levelized cost of electricity. Moreover, the use of the incentives doled out by governments and the focus on sustainability at a global scale are increasing adoption of monocrystalline panels as the most popular option when it comes to residential, commercial, and utility-scale solar installation.

| Attribute | Detail |

|---|---|

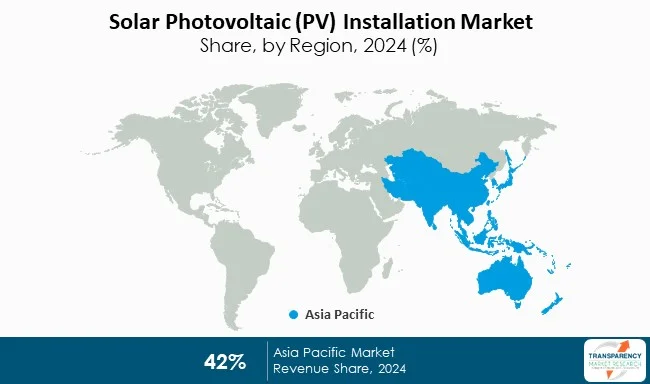

| Leading Region | Asia-Pacific |

Solar photovoltaic (PV) installation market size is dominated by the Asia-Pacific due to strong government support, renewable energy goals, and the decreased costs of solar modules. China is the leader in terms of utility-scale development and overly ambitious national policies, thereby boosting the development of solar, whereas India promotes rooftop and grid-connected solar PV to support the growing electricity demand. Japan and South Korea also have a part of the game with corporation of PVs and the advanced technologies of PVs. Asia-Pacific is the largest and fastest-growing market as the industrialization, urbanization, and a decarbonization pledge steps up the large-scale solar deployment.

A number of manufacturers are driving the solar photovoltaic (PV) installation industry trend with innovation, strategic business expansions, and undertaking mega projects. JA Solar Technology Co., Ltd. is one of the most efficient solar modules producer, and it has expanded its operations worldwide based on utility-scale and commercial PV projects.

SunPower Corporation holds the reputation of high-end PV panels and built-in residential and commercial offerings, thereby focusing on efficiency and long durability. Suntech Power Holding Co. Ltd. rides on its robust manufacturing stronghold in China and through such capabilities it provides cost-competitive modules and turnkey solar installations across the global solar photovoltaic (PV) installation market share.

Sharp Corporation integrates electronics know-how with solar energy and provides highly dependable and efficient PV solutions in either small scale called commercial development or large-scale called utility scale development. Europe-based Acciona SA structures their business nature and spurs innovation and sustainability in the field.

As a major manufacturer of solar manufacturing and implemented projects in India, the Tata Power Solar Systems Ltd. has taken an initiative to meet the local targets of the nation step by step, thereby addressing the residential, commercial, and industrial markets. To increase efficiency and decrease expenses, these companies are investing in the next-generation technologies including bifacial panels, intelligent inverters, energy storage integration, and more.

The presence of strategic partnerships, global projects portfolios, and emphasis on sustainability projects also promotes their competitiveness that makes them critical movers in the expansion of the global solar PV installations business.

| Attribute | Detail |

|---|---|

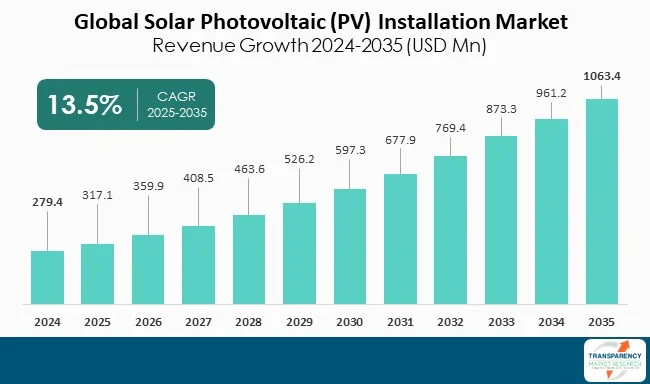

| Market Size Value in 2024 | US$ 279.4 Bn |

| Market Forecast Value in 2035 | US$ 1,063.4 Bn |

| Growth Rate (CAGR) | 13.5% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Technology

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 279.4 Bn in 2024

The market is expected to grow at a CAGR of 13.5% from 2025 to 2035

Declining installation costs increase solar project feasibility and growing electricity demand drives large-scale solar adoption

Crystalline silicon held the largest share under technology segment in 2024

Asia Pacific was the most lucrative region for the solar photovoltaic (PV) installation market in 2024

JA SOLAR Technology Co., Ltd., Solareff (Pty) Ltd, SunPower Corporation, Recurrent Energy, Sharp Corporation, Suntech Power Holding Co. Ltd, Acciona SA, and Tata Power Solar Systems Ltd.

Table 1 Global Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 2 Global Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 3 Global Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type 2020 to 2035

Table 4 Global Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 5 Global Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 6 Global Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model, 2020 to 2035

Table 7 Global Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 8 North America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 9 North America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 10 North America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type 2020 to 2035

Table 11 North America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 12 North America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 13 North America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model, 2020 to 2035

Table 14 North America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 15 USA Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 16 USA Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 17 USA Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 18 USA Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 19 USA Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 20 USA Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model, 2020 to 2035

Table 21 Canada Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 22 Canada Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 23 Canada Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 24 Canada Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25 Canada Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 26 Canada Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 27 Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 28 Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 29 Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 30 Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31 Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 32 Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 33 Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 34 Germany Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 35 Germany Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 36 Germany Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 37 Germany Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 38 Germany Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 39 Germany Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 40 France Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 41 France Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 42 France Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 43 France Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 44 France Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 45 France Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 46 UK Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 47 UK Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 48 UK Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 49 UK Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 50 UK Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 51 UK Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 52 Italy Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 53 Italy Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 54 Italy Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 55 Italy Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 56 Italy Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 57 Italy Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 58 Spain Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 59 Spain Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 60 Spain Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 61 Spain Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 62 Spain Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 63 Spain Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 64 Russia & CIS Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 65 Russia & CIS Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 66 Russia & CIS Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 67 Russia & CIS Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 68 Russia & CIS Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 69 Russia & CIS Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 70 Rest of Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 71 Rest of Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 72 Rest of Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 73 Rest of Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 74 Rest of Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 75 Rest of Europe Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 76 Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 77 Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 78 Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 79 Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 80 Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 81 Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 82 Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 83 China Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 84 China Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 85 China Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 86 China Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 87 China Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 88 China Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 89 Japan Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 90 Japan Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 91 Japan Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 92 Japan Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93 Japan Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 94 Japan Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 95 India Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 96 India Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 97 India Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 98 India Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 99 India Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 100 India Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 101 ASEAN Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 102 ASEAN Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 103 ASEAN Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 104 ASEAN Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 ASEAN Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 106 ASEAN Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 107 Rest of Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 108 Rest of Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 109 Rest of Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 110 Rest of Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 111 Rest of Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 112 Rest of Asia Pacific Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 113 Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 114 Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 115 Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 116 Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 117 Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 118 Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 119 Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 120 Brazil Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 121 Brazil Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 122 Brazil Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 123 Brazil Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 124 Brazil Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 125 Brazil Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 126 Mexico Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 127 Mexico Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 128 Mexico Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 129 Mexico Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 130 Mexico Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 131 Mexico Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 132 Rest of Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 133 Rest of Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 134 Rest of Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 135 Rest of Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 136 Rest of Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 137 Rest of Latin America Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 138 Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 139 Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 140 Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 141 Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 142 Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 143 Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 144 Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 145 GCC Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 146 GCC Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 147 GCC Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 148 GCC Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 149 GCC Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 150 GCC Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 151 South Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 152 South Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 153 South Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 154 South Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 155 South Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 156 South Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Table 157 Rest of Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 158 Rest of Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation, 2020 to 2035

Table 159 Rest of Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Grid Type, 2020 to 2035

Table 160 Rest of Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 161 Rest of Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Installation Service, 2020 to 2035

Table 162 Rest of Middle East & Africa Solar Photovoltaic (PV) Installation Market Value (US$ Bn) Forecast, by Ownership Model 2020 to 2035

Figure 1 Global Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 2 Global Solar Photovoltaic (PV) Installation Market Attractiveness, by Technology

Figure 3 Global Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation, 2024, 2027, and 2035

Figure 4 Global Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation

Figure 5 Global Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Grid Type, 2024, 2027, and 2035

Figure 6 Global Solar Photovoltaic (PV) Installation Market Attractiveness, by Grid Type

Figure 7 Global Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 8 Global Solar Photovoltaic (PV) Installation Market Attractiveness, by Application

Figure 9 Global Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation Service, 2024, 2027, and 2035

Figure 10 Global Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation Service

Figure 11 Global Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Ownership Model, 2024, 2027, and 2035

Figure 12 Global Solar Photovoltaic (PV) Installation Market Attractiveness, by Ownership Model

Figure 13 Global Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 14 Global Solar Photovoltaic (PV) Installation Market Attractiveness, by Region

Figure 15 North America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 16 North America Solar Photovoltaic (PV) Installation Market Attractiveness, by Technology

Figure 17 North America Solar Photovoltaic (PV) Installation Market Attractiveness, by Technology

Figure 18 North America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation, 2024, 2027, and 2035

Figure 19 North America Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation

Figure 20 North America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Grid Type, 2024, 2027, and 2035

Figure 21 North America Solar Photovoltaic (PV) Installation Market Attractiveness, by Grid Type

Figure 22 North America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 23 North America Solar Photovoltaic (PV) Installation Market Attractiveness, by Application

Figure 24 North America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation Service, 2024, 2027, and 2035

Figure 25 North America Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation Service

Figure 26 North America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Ownership Model, 2024, 2027, and 2035

Figure 27 North America Solar Photovoltaic (PV) Installation Market Attractiveness, by Ownership Model

Figure 28 North America Solar Photovoltaic (PV) Installation Market Attractiveness, by Country and Sub-region

Figure 29 Europe Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 30 Europe Solar Photovoltaic (PV) Installation Market Attractiveness, by Technology

Figure 31 Europe Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation, 2024, 2027, and 2035

Figure 32 Europe Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation

Figure 33 Europe Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Grid Type, 2024, 2027, and 2035

Figure 34 Europe Solar Photovoltaic (PV) Installation Market Attractiveness, by Grid Type

Figure 35 Europe Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 36 Europe Solar Photovoltaic (PV) Installation Market Attractiveness, by Application

Figure 37 Europe Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation Service, 2024, 2027, and 2035

Figure 38 Europe Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation Service

Figure 39 Europe Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Ownership Model, 2024, 2027, and 2035

Figure 40 Europe Solar Photovoltaic (PV) Installation Market Attractiveness, by Ownership Model

Figure 41 Europe Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 42 Europe Solar Photovoltaic (PV) Installation Market Attractiveness, by Country and Sub-region

Figure 43 Asia Pacific Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 44 Asia Pacific Solar Photovoltaic (PV) Installation Market Attractiveness, by Technology

Figure 45 Asia Pacific Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation, 2024, 2027, and 2035

Figure 46 Asia Pacific Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation

Figure 47 Asia Pacific Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Grid Type, 2024, 2027, and 2035

Figure 48 Asia Pacific Solar Photovoltaic (PV) Installation Market Attractiveness, by Grid Type

Figure 49 Asia Pacific Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 50 Asia Pacific Solar Photovoltaic (PV) Installation Market Attractiveness, by Application

Figure 51 Asia Pacific Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation Service, 2024, 2027, and 2035

Figure 52 Asia Pacific Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation Service

Figure 53 Asia Pacific Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Ownership Model, 2024, 2027, and 2035

Figure 54 Asia Pacific Solar Photovoltaic (PV) Installation Market Attractiveness, by Ownership Model

Figure 55 Asia Pacific Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 56 Asia Pacific Solar Photovoltaic (PV) Installation Market Attractiveness, by Country and Sub-region

Figure 57 Latin America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 58 Latin America Solar Photovoltaic (PV) Installation Market Attractiveness, by Technology

Figure 59 Latin America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation, 2024, 2027, and 2035

Figure 60 Latin America Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation

Figure 61 Latin America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Grid Type, 2024, 2027, and 2035

Figure 62 Latin America Solar Photovoltaic (PV) Installation Market Attractiveness, by Grid Type

Figure 63 Latin America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 64 Latin America Solar Photovoltaic (PV) Installation Market Attractiveness, by Application

Figure 65 Latin America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation Service, 2024, 2027, and 2035

Figure 66 Latin America Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation Service

Figure 67 Latin America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Ownership Model, 2024, 2027, and 2035

Figure 68 Latin America Solar Photovoltaic (PV) Installation Market Attractiveness, by Ownership Model

Figure 69 Latin America Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 70 Latin America Solar Photovoltaic (PV) Installation Market Attractiveness, by Country and Sub-region

Figure 71 Middle East & Africa Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Technology, 2024, 2027, and 2035

Figure 72 Middle East & Africa Solar Photovoltaic (PV) Installation Market Attractiveness, by Technology

Figure 73 Middle East & Africa Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation, 2024, 2027, and 2035

Figure 74 Middle East & Africa Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation

Figure 75 Middle East & Africa Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Grid Type, 2024, 2027, and 2035

Figure 76 Middle East & Africa Solar Photovoltaic (PV) Installation Market Attractiveness, by Grid Type

Figure 77 Middle East & Africa Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 78 Middle East & Africa Solar Photovoltaic (PV) Installation Market Attractiveness, by Application

Figure 79 Middle East & Africa Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Installation Service, 2024, 2027, and 2035

Figure 80 Middle East & Africa Solar Photovoltaic (PV) Installation Market Attractiveness, by Installation Service

Figure 81 Middle East & Africa Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Ownership Model, 2024, 2027, and 2035

Figure 82 Middle East & Africa Solar Photovoltaic (PV) Installation Market Attractiveness, by Ownership Model

Figure 83 Middle East & Africa Solar Photovoltaic (PV) Installation Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 84 Middle East & Africa Solar Photovoltaic (PV) Installation Market Attractiveness, by Country and Sub-region