Reports

Reports

Analysts’ Viewpoint

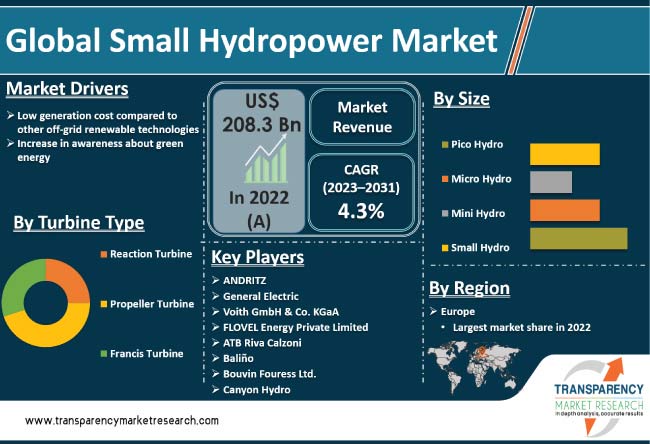

Increase in emphasis on renewable energy sources and government assistance through regulations & incentives are driving the global small hydropower market. Small hydropower is a suitable alternative for energy generated from fossil fuels. Surge in demand for clean and sustainable power is expected to propel the market in the next few years. Furthermore, rise in need for decentralized power generation in rural areas is another major factor propelling the global small hydropower market demand.

Technological developments, such as enhanced turbine designs, automation, and control systems, offer lucrative opportunities to market players. Manufacturers are focusing on improving effectiveness, performance, and cost-effectiveness of small hydropower projects.

Small hydropower harnesses the power of flowing or falling water to generate electricity. It is a renewable energy source that produces clean and sustainable power, contributing to reducing greenhouse gas emissions and mitigating climate change. Small hydropower plant generally has a capacity of less than 10 megawatts (MW).

The global small hydropower industry has experienced robust growth in the past few years. Increase in energy demand, need for decentralized power generation, and environmental concerns are driving the global market.

Market dynamics and growth potential of small hydropower vary across regions. Countries with favorable topography, abundant water resources, and supportive policies have witnessed significant development in small hydropower.

Developing regions, especially those with rural or remote areas lacking access to electricity, often turn to small hydropower to meet their energy needs and stimulate economic growth.

Small hydropower projects benefit from economies of scale; as the project size increases, the cost per unit of electricity generated tends to decrease. Small hydropower projects have a capacity below 10 MW; these can still benefit from scale advantages compared to micro-scale or decentralized renewable energy systems.

Small hydro is one of the cleanest and environment-friendly forms of renewable energy. It does not entail fuel cost. Its low operational and maintenance cost makes it one of the cost-efficient sources of energy.

Small hydro plants have efficiency of more than 90%. Therefore, these are highly efficient and favored sources of renewable energy. Small hydro plants have longer lifespan of up to 50 years. This makes them reliable and cost-effective source of energy conversion.

Small hydro has high-capacity utilization factor up to 50%. This results in higher output wind and solar power, which account for 25% and 20%, respectively. Small hydro plants can be operated continuously at any temperature and wind condition. Thus, these are cost-effective and flexible.

Rise in awareness about green energy and enactment of stringent government rules and regulations on emission of greenhouse gases (GHGs) and carbon dioxide are compelling companies to seek more effective alternative and pollution-free energy generation methods.

Small hydropower is a worthy alternative for energy generated from fossil fuels. The process of energy generation from fossil fuels emits greenhouse gases (GHGs), which can cause serious damage to the environment including global warming, air pollution, and land pollution.

According to the World Small Hydropower Development Report (WSHPDR) 2021, small hydropower represents approximately 1.5% of the world’s total electricity installed capacity, 4.5% of the total renewable energy capacity, and 7.5% of the total hydropower capacity.

Increase in awareness about the benefits of small hydro power, such as its low environmental impact, reliability, and cost-effectiveness, is expected to drive global small hydropower market size in the next few years.

Governments, investors, and other stakeholders are increasingly investing in small hydropower projects. Global trend toward sustainable development is also driving the small hydropower market value. The United Nations Sustainable Development Goals (SDGs), for instance, include a target to increase the share of renewable energy in the global energy mix. This has led to increased support for small hydro power, as it is a reliable and sustainable source of energy that can help achieve this goal.

In terms of type, the small hydro segment accounted for the largest global small hydropower market share in 2022. A significant portion of the hydroelectric power available worldwide comes from small hydropower.

Small hydropower plays an important part in decentralized and scattered power generation, even though large-scale hydropower projects (above 10 MW) make up the majority of the overall hydropower capacity.

Small hydropower is the market leader in several regions, particularly those with a wealth of water resources and geography that is conducive to small-scale efforts. A major power source, hydropower can be produced in countries with mountains or rivers.

Small hydropower projects are often deployed in remote and rural areas that lack access to centralized electricity grids. These projects provide a reliable and sustainable source of energy, improving energy access and supporting local development in underserved regions.

Local communities could benefit significantly from small hydropower plants. They frequently incorporate community ownership, participation, and revenue-sharing processes, allowing local stakeholders to benefit from the project's financial gains. This empowerment increases the significance of small hydropower in promoting inclusive and sustainable development.

Europe is home to several nations that are actively constructing and utilizing small-scale hydropower projects. Significant small hydropower capacity and favorable laws are present in countries such as Norway, Sweden, and Switzerland, which are encouraging the industry's expansion. The European Small Hydropower Association (ESHA) promotes the development of small hydropower in the area and propagates best practices.

Some of the world's biggest markets for small hydropower are in Asia Pacific. Countries such as China, India, and Indonesia have significant small hydropower plants due to large populations, wide river systems, and need of electricity. In order to promote the development of small hydropower, these countries have established supportive policies and incentives in place.

Countries in Latin America possess substantial small hydropower potential, with Brazil, Peru, and Colombia leading in installations. The region benefits from abundant water resources and presence of river systems in various topographies. Governments in the region have implemented policies to promote small hydropower as a clean energy source for both rural and urban areas.

The market consists of several small to medium-sized of players who compete with each other and large enterprises. Companies have made significant investment in research & development activities, leading to early adoption of next-generation technologies and the creation of new plants.

The small hydropower market report considers product portfolios and mergers and acquisitions as the key strategies adopted by prominent players such as ANDRITZ, General Electric, Voith GmbH & Co. KGaA, FLOVEL Energy Private Limited, ATB Riva Calzoni, Baliño, Bouvin Fouress Ltd., Canyon Hydro, CKD Blansko, and Energiteknikk.

Each of these players has been profiled in the small hydropower market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 208.3 Bn |

|

Market Forecast Value in 2031 |

US$ 304.2 Bn |

|

Growth Rate (CAGR) |

4.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2022 |

|

Quantitative Tons |

US$ Bn for Value & MW for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Small Hydropower Market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 208.3 Bn in 2022

It is expected to expand at a CAGR of 4.3% from 2023 to 2031

Low generation cost compared to other off-grid renewable technologies and increase in awareness about green energy are propelling the global market

Small hydro was the largest type segment in 2022

Europe was the most lucrative region in 2022

ANDRITZ, General Electric, Voith GmbH & Co. KGaA, FLOVEL Energy Private Limited, ATB Riva Calzoni, Baliño, Bouvin Fouress Ltd., Canyon Hydro, Ltd., CKD Blansko, and Energiteknikk are the prominent players in the market.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Suppliers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/Distributors

2.6.4. List of Potential Customers

2.7. Product Specification Analysis

2.8. Overview of Manufacturing Process

2.9. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2022

5. Price Trend Analysis

6. Global Small Hydropower Market Analysis and Forecast, by Turbine Type, 2023-2031

6.1. Introduction and Definitions

6.2. Global Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

6.2.1. Reaction Turbine

6.2.2. Propeller Turbine

6.2.3. Francis Turbine

6.3. Global Small Hydropower Market Attractiveness, by Turbine Type

7. Global Small Hydropower Market Analysis and Forecast, by Size, 2023-2031

7.1. Introduction and Definitions

7.2. Global Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

7.2.1. Pico Hydro

7.2.2. Micro Hydro

7.2.3. Mini Hydro

7.2.4. Small Hydro

7.3. Global Small Hydropower Market Attractiveness, by Size

8. Global Small Hydropower Market Analysis and Forecast, by End-use, 2023-2031

8.1. Introduction and Definitions

8.2. Global Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

8.2.1. Residential

8.2.2. Industrial

8.2.3. Commercial

8.3. Global Small Hydropower Market Attractiveness, by End-use

9. Global Small Hydropower Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Global Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Small Hydropower Market Attractiveness, by Region

10. North America Small Hydropower Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

10.3. North America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

10.4. North America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

10.5. North America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country, 2023-2031

10.5.1. U.S. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

10.5.2. U.S. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

10.5.3. U.S. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

10.5.4. Canada Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

10.5.5. Canada Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

10.5.6. Canada Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

10.6. North America Small Hydropower Market Attractiveness, Analysis

11. Europe Small Hydropower Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

11.3. Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

11.4. Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.5. Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

11.5.1. Germany Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

11.5.2. Germany Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

11.5.3. Germany Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.5.4. France Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

11.5.5. France Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

11.5.6. France Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.5.7. U.K. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

11.5.8. U.K. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

11.5.9. U.K. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.5.10. Italy Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

11.5.11. Italy. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

11.5.12. Italy Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.5.13. Russia & CIS Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

11.5.14. Russia & CIS Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

11.5.15. Russia & CIS Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.5.16. Rest of Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

11.5.17. Rest of Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

11.5.18. Rest of Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.6. Europe Small Hydropower Market Attractiveness, Analysis

12. Asia Pacific Small Hydropower Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type

12.3. Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

12.4. Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5. Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

12.5.1. China Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

12.5.2. China Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

12.5.3. China Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5.4. Japan Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

12.5.5. Japan Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

12.5.6. Japan Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5.7. India Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

12.5.8. India Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

12.5.9. India Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5.10. ASEAN Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

12.5.11. ASEAN Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

12.5.12. ASEAN Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5.13. Rest of Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

12.5.14. Rest of Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

12.5.15. Rest of Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.6. Asia Pacific Small Hydropower Market Attractiveness, Analysis

13. Latin America Small Hydropower Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

13.3. Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

13.4. Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.5. Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

13.5.1. Brazil Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

13.5.2. Brazil Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

13.5.3. Brazil Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.5.4. Mexico Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

13.5.5. Mexico Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

13.5.6. Mexico Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.5.7. Rest of Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

13.5.8. Rest of Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

13.5.9. Rest of Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.6. Latin America Small Hydropower Market Attractiveness, Analysis

14. Middle East & Africa Small Hydropower Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

14.3. Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

14.4. Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.5. Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.5.1. GCC Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

14.5.2. GCC Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

14.5.3. GCC Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.5.4. South Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

14.5.5. South Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

14.5.6. South Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.5.7. Rest of Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

14.5.8. Rest of Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

14.5.9. Rest of Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.6. Middle East & Africa Small Hydropower Market Attractiveness, Analysis

15. Competition Landscape

15.1. Global Small Hydropower Market Company Market Share Analysis, 2022

15.2. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

15.2.1. ANDRITZ

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. General Electric

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. Voith GmbH & Co. KGaA

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. FLOVEL Energy Private Limited

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. ATB Riva Calzoni

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.6. Baliño

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.7. Bouvin Fouress Ltd.

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.8. Canyon Hydro

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.9. CKD Blansko

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

15.2.10. Energiteknikk

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. Financial Overview

15.2.10.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 2: Global Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 3: Global Small Hydropower Market Forecast, by Size, 2023-2031

Table 4: Global Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 5: Global Small Hydropower Market Forecast, by End-use, 2023-2031

Table 6: Global Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 7: Global Small Hydropower Market Forecast, by Region, 2023-2031

Table 8: Global Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Region, 2023-2031

Table 9: North America Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 10: North America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 11: North America Small Hydropower Market Forecast, by Size, 2023-2031

Table 12: North America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 13: North America Small Hydropower Market Forecast, by End-use, 2023-2031

Table 14: North America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 15: North America Small Hydropower Market Forecast, by Country, 2023-2031

Table 16: North America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country, 2023-2031

Table 17: U.S. Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 18: U.S. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 19: U.S. Small Hydropower Market Forecast, by Size, 2023-2031

Table 20: U.S. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 21: U.S. Small Hydropower Market Forecast, by End-use, 2023-2031

Table 22: U.S. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 23: Canada Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 24: Canada Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 25: Canada Small Hydropower Market Forecast, by Size, 2023-2031

Table 26: Canada Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 27: Canada Small Hydropower Market Forecast, by End-use, 2023-2031

Table 28: Canada Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 29: Europe Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 30: Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 31: Europe Small Hydropower Market Forecast, by Size, 2023-2031

Table 32: Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 33: Europe Small Hydropower Market Forecast, by End-use, 2023-2031

Table 34: Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 35: Europe Small Hydropower Market Forecast, by Country and Sub-region, 2023-2031

Table 36: Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 37: Germany Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 38: Germany Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 39: Germany Small Hydropower Market Forecast, by Size, 2023-2031

Table 40: Germany Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 41: Germany Small Hydropower Market Forecast, by End-use, 2023-2031

Table 42: Germany Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 43: France Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 44: France Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 45: France Small Hydropower Market Forecast, by Size, 2023-2031

Table 46: France Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 47: France Small Hydropower Market Forecast, by End-use, 2023-2031

Table 48: France Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 49: U.K. Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 50: U.K. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 51: U.K. Small Hydropower Market Forecast, by Size, 2023-2031

Table 52: U.K. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 53: U.K. Small Hydropower Market Forecast, by End-use, 2023-2031

Table 54: U.K. Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 55: Italy Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 56: Italy Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 57: Italy Small Hydropower Market Forecast, by Size, 2023-2031

Table 58: Italy Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 59: Italy Small Hydropower Market Forecast, by End-use, 2023-2031

Table 60: Italy Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 61: Spain Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 62: Spain Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 63: Spain Small Hydropower Market Forecast, by Size, 2023-2031

Table 64: Spain Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 65: Spain Small Hydropower Market Forecast, by End-use, 2023-2031

Table 66: Spain Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 67: Russia & CIS Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 68: Russia & CIS Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 69: Russia & CIS Small Hydropower Market Forecast, by Size, 2023-2031

Table 70: Russia & CIS Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 71: Russia & CIS Small Hydropower Market Forecast, by End-use, 2023-2031

Table 72: Russia & CIS Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 73: Rest of Europe Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 74: Rest of Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 75: Rest of Europe Small Hydropower Market Forecast, by Size, 2023-2031

Table 76: Rest of Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 77: Rest of Europe Small Hydropower Market Forecast, by End-use, 2023-2031

Table 78: Rest of Europe Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 79: Asia Pacific Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 80: Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 81: Asia Pacific Small Hydropower Market Forecast, by Size, 2023-2031

Table 82: Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 83: Asia Pacific Small Hydropower Market Forecast, by End-use, 2023-2031

Table 84: Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 85: Asia Pacific Small Hydropower Market Forecast, by Country and Sub-region, 2023-2031

Table 86: Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 87: China Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 88: China Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type 2023-2031

Table 89: China Small Hydropower Market Forecast, by Size, 2023-2031

Table 90: China Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 91: China Small Hydropower Market Forecast, by End-use, 2023-2031

Table 92: China Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 93: Japan Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 94: Japan Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 95: Japan Small Hydropower Market Forecast, by Size, 2023-2031

Table 96: Japan Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 97: Japan Small Hydropower Market Forecast, by End-use, 2023-2031

Table 98: Japan Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 99: India Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 100: India Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 101: India Small Hydropower Market Forecast, by Size, 2023-2031

Table 102: India Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 103: India Small Hydropower Market Forecast, by End-use, 2023-2031

Table 104: India Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 105: ASEAN Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 106: ASEAN Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 107: ASEAN Small Hydropower Market Forecast, by Size, 2023-2031

Table 108: ASEAN Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 109: ASEAN Small Hydropower Market Forecast, by End-use, 2023-2031

Table 110: ASEAN Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 111: Rest of Asia Pacific Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 112: Rest of Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 113: Rest of Asia Pacific Small Hydropower Market Forecast, by Size, 2023-2031

Table 114: Rest of Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 115: Rest of Asia Pacific Small Hydropower Market Forecast, by End-use, 2023-2031

Table 116: Rest of Asia Pacific Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 117: Latin America Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 118: Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 119: Latin America Small Hydropower Market Forecast, by Size, 2023-2031

Table 120: Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 121: Latin America Small Hydropower Market Forecast, by End-use, 2023-2031

Table 122: Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 123: Latin America Small Hydropower Market Forecast, by Country and Sub-region, 2023-2031

Table 124: Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 125: Brazil Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 126: Brazil Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 127: Brazil Small Hydropower Market Forecast, by Size, 2023-2031

Table 128: Brazil Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 129: Brazil Small Hydropower Market Forecast, by End-use, 2023-2031

Table 130: Brazil Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 131: Mexico Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 132: Mexico Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 133: Mexico Small Hydropower Market Forecast, by Size, 2023-2031

Table 134: Mexico Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 135: Mexico Small Hydropower Market Forecast, by End-use, 2023-2031

Table 136: Mexico Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 137: Rest of Latin America Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 138: Rest of Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 139: Rest of Latin America Small Hydropower Market Forecast, by Size, 2023-2031

Table 140: Rest of Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 141: Rest of Latin America Small Hydropower Market Forecast, by End-use, 2023-2031

Table 142: Rest of Latin America Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 143: Middle East & Africa Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 144: Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 145: Middle East & Africa Small Hydropower Market Forecast, by Size, 2023-2031

Table 146: Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 147: Middle East & Africa Small Hydropower Market Forecast, by End-use, 2023-2031

Table 148: Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 149: Middle East & Africa Small Hydropower Market Forecast, by Country and Sub-region, 2023-2031

Table 150: Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 151: GCC Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 152: GCC Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 153: GCC Small Hydropower Market Forecast, by Size, 2023-2031

Table 154: GCC Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 155: GCC Small Hydropower Market Forecast, by End-use, 2023-2031

Table 156: GCC Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 157: South Africa Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 158: South Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 159: South Africa Small Hydropower Market Forecast, by Size, 2023-2031

Table 160: South Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 161: South Africa Small Hydropower Market Forecast, by End-use, 2023-2031

Table 162: South Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 163: Rest of Middle East & Africa Small Hydropower Market Forecast, by Turbine Type, 2023-2031

Table 164: Rest of Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Turbine Type, 2023-2031

Table 165: Rest of Middle East & Africa Small Hydropower Market Forecast, by Size, 2023-2031

Table 166: Rest of Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by Size, 2023-2031

Table 167: Rest of Middle East & Africa Small Hydropower Market Forecast, by End-use, 2023-2031

Table 168: Rest of Middle East & Africa Small Hydropower Market Volume (MW) and Value (US$ Bn) Forecast, by End-use, 2023-2031

List of Figures

Figure 1: Global Small Hydropower Market Volume Share Analysis, by Turbine Type, 2022, 2025, and 2031

Figure 2: Global Small Hydropower Market Attractiveness, by Turbine Type

Figure 3: Global Small Hydropower Market Volume Share Analysis, by Size, 2022, 2025, and 2031

Figure 4: Global Small Hydropower Market Attractiveness, by Size

Figure 5: Global Small Hydropower Market Volume Share Analysis, by End-use, 2022, 2025, and 2031

Figure 6: Global Small Hydropower Market Attractiveness, by End-use

Figure 7: Global Small Hydropower Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 8: Global Small Hydropower Market Attractiveness, by Region

Figure 9: North America Small Hydropower Market Volume Share Analysis, by Turbine Type, 2022, 2025, and 2031

Figure 10: North America Small Hydropower Market Attractiveness, by Turbine Type

Figure 11: North America Small Hydropower Market Volume Share Analysis, by Size, 2022, 2025, and 2031

Figure 12: North America Small Hydropower Market Attractiveness, by Size

Figure 13: North America Small Hydropower Market Volume Share Analysis, by End-use, 2022, 2025, and 2031

Figure 14: North America Small Hydropower Market Attractiveness, by End-use

Figure 15: North America Small Hydropower Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 16: North America Small Hydropower Market Attractiveness, by Country

Figure 17: Europe Small Hydropower Market Volume Share Analysis, by Turbine Type, 2022, 2025, and 2031

Figure 18: Europe Small Hydropower Market Attractiveness, by Turbine Type

Figure 19: Europe Small Hydropower Market Volume Share Analysis, by Size, 2022, 2025, and 2031

Figure 20: Europe Small Hydropower Market Attractiveness, by Size

Figure 21: Europe Small Hydropower Market Volume Share Analysis, by End-use, 2022, 2025, and 2031

Figure 22: Europe Small Hydropower Market Attractiveness, by End-use

Figure 23: Europe Small Hydropower Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Europe Small Hydropower Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Small Hydropower Market Volume Share Analysis, by Turbine Type, 2022, 2025, and 2031

Figure 26: Asia Pacific Small Hydropower Market Attractiveness, by Turbine Type

Figure 27: Asia Pacific Small Hydropower Market Volume Share Analysis, by Size, 2022, 2025, and 2031

Figure 28: Asia Pacific Small Hydropower Market Attractiveness, by Size

Figure 29: Asia Pacific Small Hydropower Market Volume Share Analysis, by End-use, 2022, 2025, and 2031

Figure 30: Asia Pacific Small Hydropower Market Attractiveness, by End-use

Figure 31: Asia Pacific Small Hydropower Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 32: Asia Pacific Small Hydropower Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Small Hydropower Market Volume Share Analysis, by Turbine Type, 2022, 2025, and 2031

Figure 34: Latin America Small Hydropower Market Attractiveness, by Turbine Type

Figure 35: Latin America Small Hydropower Market Volume Share Analysis, by Size, 2022, 2025, and 2031

Figure 36: Latin America Small Hydropower Market Attractiveness, by Size

Figure 37: Latin America Small Hydropower Market Volume Share Analysis, by End-use, 2022, 2025, and 2031

Figure 38: Latin America Small Hydropower Market Attractiveness, by End-use

Figure 39: Latin America Small Hydropower Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 40: Latin America Small Hydropower Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Small Hydropower Market Volume Share Analysis, by Turbine Type, 2022, 2025, and 2031

Figure 42: Middle East & Africa Small Hydropower Market Attractiveness, by Turbine Type

Figure 43: Middle East & Africa Small Hydropower Market Volume Share Analysis, by Size, 2022, 2025, and 2031

Figure 44: Middle East & Africa Small Hydropower Market Attractiveness, by Size

Figure 45: Middle East & Africa Small Hydropower Market Volume Share Analysis, by End-use, 2022, 2025, and 2031

Figure 46: Middle East & Africa Small Hydropower Market Attractiveness, by End-use

Figure 47: Middle East & Africa Small Hydropower Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 48: Middle East & Africa Small Hydropower Market Attractiveness, by Country and Sub-region