Reports

Reports

Global Supervisory Control and Data Acquisition (SCADA) Market: Snapshot

The global of supervisory control and data acquisition (SCADA) market has gained significant momentum in the recent times. The rising awareness among consumers regarding the benefits of SCADA, such as the real-time detection of faults in machinery, reduction in the amount of defects in the output, decline in production cost, and various other advantages it offers to production processes, is boosting this market substantially. The increasing deployment of SCADA systems in the electrical and the oil and gas sectors to reduce losses and optimize production is also adding to the growth of this market significantly.

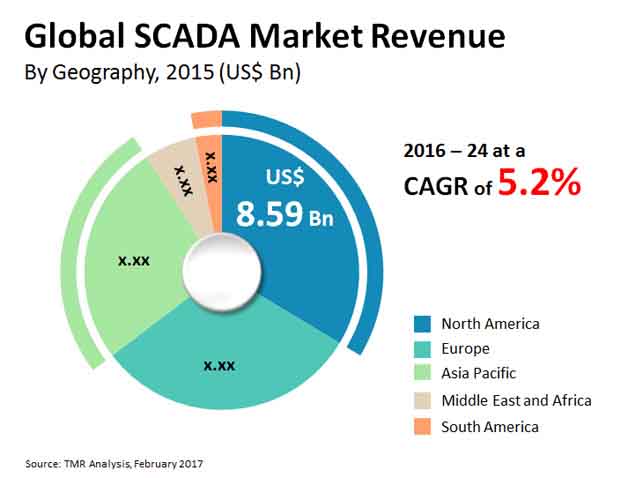

In terms of revenue, the global SCADA market was valued at US$25.56 bn in 2015. Estimated to expand at a CAGR of 5.20% from 2016 to 2024, the revenues in this market will touch US$40.18 bn by the end of 2024.

Demand for SCADA Systems to Remain High from Electrical Power Industry

The electrical power, oil and gas, manufacturing, water and wastewater, transportation, chemicals, food and beverages, telecommunication, and the pharmaceuticals industries are key end users of SCADA systems across the world. The electrical power industry has been registering a higher demand for these systems than other end users and is likely to remain doing so over the forthcoming years, thanks to the increasing application of SCADA in total grid automation projects various developing countries, such as India and China, which have concentrated on improving their infrastructure in order to curb power distribution and transmission losses.

Apart from this, the ability of SCADA systems to restore power post outrage, re-route power from excess capacity areas to areas approaching overload, collect historical data for trend analysis, and decrease manual labor by relocating affected sections remotely, is also projected to keep the demand for these systems in the electrical power industry high in the years to come.

North America to Maintain Dominance

Regionally, North America, Asia Pacific, Europe, the Middle East and Africa, and South America are considered as the main segments of the worldwide market for SCADA. North America, among these, led the global market in 2015 with a share of 33.6%. Researchers predict that this regional market will retain its lead over the coming years, thanks to the increasing demand for process automation systems in a number of industries, such as the electrical power and the oil and gas sectors. The escalating financial and technological investments for reliable and sophisticated power management is also anticipated to propel the North America SCADA market in the near future.

With Germany surfacing as the leading contributor, Europe emerged second in the global market in 2015. The regional market is expected to remain the same till 2024. The increasing demand for advanced power, oil and gas, and water and wastewater infrastructures and the growing need for effective power generation are likely to drive the Europe SCADA market over the forthcoming years.

Asia Pacific is projected to be driven by the increasing demand for process automation in the oil and gas industry, swift development of industrial infrastructure that supports the integration of process automation, augmented efficiency in wastewater management, and the rising exploration activities in new renewable energy resources in the near future. The Middle East and Africa, on the other hand, is anticipated to derive growth from the massive investments in automated control systems in the process industries, up-gradation and replacement of old infrastructure, and the augmenting demand for safer operations within the power, petrochemical, water and wastewater management, and the chemical industries over the next few years.

ABB Ltd., Honeywell International Inc., Emerson Electric Co., Rockwell Automation Inc., Siemens AG, OMRON Corp., General Electric Co., Yokogawa Electric Corp., Schneider Electric SE, and Afcon Holdings Group are some of the leading players in the global SCADA market.

Section 1 Preface

Section 2 Assumptions and Research Methodology

2.1 Assumptions and Acronyms used

2.2 Research Methodology

Section 3 Executive Summary : Global Supervisory Control and Data Acquisition (SCADA) Market

3.1 Executive Summary

Section 4 Global Supervisory Control and Data Acquisition (SCADA) Market Overview

Section 5 Global Supervisory Control and Data Acquisition (SCADA) Market Overview

5.1 Introduction

5.2 Product Definition

5.3 Value Chain Analysis

5.4 Market Dynamics: Drivers and Restraints Snapshot Analysis

5.4.1 Drivers

5.4.2 Restraints

5.4.3 Opportunities

5.5 Porter’s Five Forces Analysis

5.6 Market Attractiveness Analysis, by Applications

5.7 Competitive Landscape (2015)

Section 6 Global Supervisory Control and Data Acquisition (SCADA) Market by Components 2015 – 2024 (Revenue)

6.1 Global SCADA Market , By Components, 2015-2024

6.1.1 Global SCADA Market Definitions, By Components, 2015-2024

6.2 Global SCADA Market Revenue Share Analysis, By Components, 2015-2024

Section 7 Global Supervisory Control and Data Acquisition (SCADA) Market by Architecture 2015 – 2024 (Revenue)

7.1 Global SCADA Market , By Architecture, 2015-2024

7.1.1 Global SCADA Market Definitions, By Architecture, 2015-2024

7.2 Global SCADA Market Revenue Share Analysis, By Architecture, 2015-2024

Section 8 Global Supervisory Control and Data Acquisition (SCADA) Market by End Use Industry 2015 – 2024 (Revenue)

8.1 Global SCADA Market , By End Use Industry, 2015-2024

8.1.1 Global SCADA Market Definitions, By End Use Industry, 2015-2024

8.2 Global SCADA Market Revenue Share Analysis, By End Use Industry, 2015-2024

Section 9 Global Supervisory Control and Data Acquisition (SCADA) Market by Region 2015 – 2024 (Revenue)

9.1 Geographical Scenario (By Revenue)

9.2 Global SCADA Market Revenue Share Analysis, By Region, 2015-2024

Section 10 North America Supervisory Control and Data Acquisition (SCADA) Market by Geography 2015 – 2024 (Revenue)

10.1 North America SCADA Market Analysis and Forecast, 2015-2024

10.1.1 Overview

10.1.2 Key Trends Analysis – North America

10.2 North America SCADA Market Analysis and Forecast, By Components, 2015-2024

10.3 North America SCADA Market Analysis and Forecast, By Architecture, 2015-2024

10.4 North America SCADA Market Analysis and Forecast, By End Use Industry, 2015-2024

10.5 North America SCADA Market Analysis and Forecast, By Country, 2015-2024

Section 11 Europe Supervisory Control and Data Acquisition (SCADA) Market by Geography 2015 – 2024 (Revenue)

11.1 Europe SCADA Market Analysis and Forecast, 2015-2024

11.1.1 Overview

11.1.2 Key Trends Analysis – Europe

11.2 Europe SCADA Market Analysis and Forecast, By Components, 2015-2024

11.3 Europe SCADA Market Analysis and Forecast, By Architecture, 2015-2024

11.4 Europe SCADA Market Analysis and Forecast, By End Use Industry, 2015-2024

11.5 Europe SCADA Market Analysis and Forecast, By Country, 2015-2024

Section 12 Asia Pacific Supervisory Control and Data Acquisition (SCADA) Market by Geography 2015 – 2024 (Revenue)

12.1 Asia Pacific SCADA Market Analysis and Forecast, 2015-2024

12.1.1 Overview

12.1.2 Key Trends Analysis – Asia Pacific

12.2 Asia Pacific SCADA Market Analysis and Forecast, By Components, 2015-2024

12.3 Asia Pacific SCADA Market Analysis and Forecast, By Architecture, 2015-2024

12.4 Asia Pacific SCADA Market Analysis and Forecast, By End Use Industry, 2015-2024

12.5 Asia Pacific SCADA Market Analysis and Forecast, By Country, 2015-2024

Section 13 Middle east and Africa (MEA) Supervisory Control and Data Acquisition (SCADA) Market by Geography 2015 – 2024 (Revenue)

13.1 Middle east and Africa (MEA) SCADA Market Analysis and Forecast, 2015-2024

13.1.1 Overview

13.1.2 Key Trends Analysis – Middle east and Africa (MEA)

13.2 Middle east and Africa (MEA)SCADA Market Analysis and Forecast, By Components, 2015-2024

13.3 Middle east and Africa (MEA) SCADA Market Analysis and Forecast, By Architecture, 2015-2024

13.4 Middle east and Africa (MEA) SCADA Market Analysis and Forecast, By End Use Industry, 2015-2024

13.5 Middle east and Africa (MEA) SCADA Market Analysis and Forecast, By Country, 2015-2024

Section 14 South America Supervisory Control and Data Acquisition (SCADA) Market by Geography 2015 – 2024 (Revenue)

14.1 South America SCADA Market Analysis and Forecast, 2015-2024

14.1.1 Overview

14.1.2 Key Trends Analysis – South America

14.2 South America SCADA Market Analysis and Forecast, By Components, 2015-2024

14.3 South America SCADA Market Analysis and Forecast, By Architecture, 2015-2024

14.4 South America SCADA Market Analysis and Forecast, By End Use Industry, 2015-2024

14.5 South America SCADA Market Analysis and Forecast, By Country, 2015-2024

Section 15 Company Profiles

15.1 ABB, Ltd.

15.1.1 Company Details

15.1.2 Company Description

15.1.3 Business Overview

15.1.4 SWOT Analysis

15.1.5 Financial Overview

15.1.6 Strategic Overview

15.2 Honeywell International, Inc.

15.2.1 Company Details

15.2.2 Company Description

15.2.3 Business Overview

15.2.4 SWOT Analysis

15.2.5 Financial Overview

15.2.6 Strategic Overview

15.3 Emerson Electric, Co.

15.3.1 Company Details

15.3.2 Company Description

15.3.3 Business Overview

15.3.4 SWOT Analysis

15.3.5 Financial Overview

15.3.6 Strategic Overview

15.4 Rockwell Automation, Inc.

15.4.1 Company Details

15.4.2 Company Description

15.4.3 Business Overview

15.4.4 SWOT Analysis

15.4.5 Financial Overview

15.4.6 Strategic Overview

15.5 Siemens AG

15.5.1 Company Details

15.5.2 Company Description

15.5.3 Business Overview

15.5.4 SWOT Analysis

15.5.5 Financial Overview

15.5.6 Strategic Overview

15.6 OMRON Corporation

15.6.1 Company Details

15.6.2 Company Description

15.6.3 Business Overview

15.6.4 SWOT Analysis

15.6.5 Financial Overview

15.6.6 Strategic Overview

15.7 General Electric, Co.

15.7.1 Company Details

15.7.2 Company Description

15.7.3 Business Overview

15.7.4 SWOT Analysis

15.7.5 Financial Overview

15.7.6 Strategic Overview

15.8 Yokogawa Electric Corporation

15.8.1 Company Details

15.8.2 Company Description

15.8.3 Business Overview

15.8.4 SWOT Analysis

15.8.5 Financial Overview

15.8.6 Strategic Overview

15.9 Schneider Electric SE

15.9.1 Company Details

15.9.2 Company Description

15.9.3 Business Overview

15.9.4 SWOT Analysis

15.9.5 Financial Overview

15.9.6 Strategic Overview

15.10 Afcon Holdings Group

15.10.1 Company Details

15.10.2 Company Description

15.10.3 Business Overview

15.10.4 SWOT Analysis

15.10.5 Financial Overview

15.10.6 Strategic Overview

List of Tables

TABLE 1 Global SCADA Market Size (USD Bn) Forecast, By Components, 2015–2024

TABLE 2 Global SCADA Market Size (USD Bn) Forecast, By Architecture, 2015–2024

TABLE 3 Global SCADA Market Size (USD Bn) Forecast, By End Use Industry, 2015–2024

TABLE 4 North America SCADA Market, by Components, 2015 - 2024 (Revenue, in USD Billion)

TABLE 5 North America SCADA Market, by Architecture, 2015 - 2024 (Revenue, in USD Billion)

TABLE 6 North America SCADA Market, by End Use Industry, 2015 - 2024 (Revenue, in USD Billion)

TABLE 7 North America SCADA Market, by Country, 2015 - 2024 (Revenue, in USD Billion)

TABLE 8 Europe SCADA Market, by Components, 2015 - 2024 (Revenue, in USD Billion)

TABLE 9 Europe SCADA Market, by Architecture, 2015 - 2024 (Revenue, in USD Billion)

TABLE 10 Europe SCADA Market, by End Use Industry, 2015 - 2024 (Revenue, in USD Billion)

TABLE 11 Europe SCADA Market, by Country, 2015 - 2024 (Revenue, in USD Billion)

TABLE 12 Asia Pacific SCADA Market, by Components, 2015 - 2024 (Revenue, in USD Billion)

TABLE 13 Asia Pacific SCADA Market, by Architecture, 2015 - 2024 (Revenue, in USD Billion)

TABLE 14 Asia Pacific SCADA Market, by End Use Industry, 2015 - 2024 (Revenue, in USD Billion)

TABLE 15 Asia Pacific SCADA Market, by Country, 2015 - 2024 (Revenue, in USD Billion)

TABLE 16 Middle-East and Africa SCADA Market, by Components, 2015 - 2024 (Revenue, in USD Billion)

TABLE 17 Middle-East and Africa SCADA Market, by Architecture, 2015 - 2024 (Revenue, in USD Billion)

TABLE 18 Middle-East and Africa SCADA Market, by End Use Industry, 2015 - 2024 (Revenue, in USD Billion)

TABLE 19 Middle-East and Africa SCADA Market, by Country, 2015 - 2024 (Revenue, in USD Billion)

TABLE 20 South America SCADA Market, by Components, 2015 - 2024 (Revenue, in USD Billion)

TABLE 21 South America SCADA Market, by Architecture, 2015 - 2024 (Revenue, in USD Billion)

TABLE 22 South America SCADA Market, by End Use Industry, 2015 - 2024 (Revenue, in USD Billion)

TABLE 23 South America SCADA Market, by Country, 2015 - 2024 (Revenue, in USD Billion)

List of Figures

FIG. 1 Global SCADA Market – Value Chain Analysis

FIG. 2 Market Attractiveness Analysis, by Applications (2015)

FIG. 3 Global SCADA Market Share Analysis, By Company

FIG. 4 Global SCADA Market Revenue Share Analysis, By Components, 2015 Vs 2024

FIG. 5 Global SCADA Market Revenue Share Analysis, By Architecture, 2015 Vs 2024

FIG. 6 Global SCADA Market Revenue Share Analysis, By End Use Industry, 2015 Vs 2024

FIG. 7 Geographical Scenario (By Revenue)

FIG. 8 Global SCADA Market Revenue Share Analysis, By Region, 2015 Vs 2024

FIG. 9 North America SCADA Market Size (USD Billion) Forecast, 2015 – 2024

FIG. 10 North America SCADA Market Size (USD Billion) Forecast, by Components, 2015 – 2024

FIG. 11 North America SCADA Market Size (USD Billion) Forecast, by Architecture, 2015 – 2024

FIG. 12 North America SCADA Market Size (USD Billion) Forecast, by End Use Industry, 2015 – 2024

FIG. 13 North America SCADA Market Size (USD Billion) Forecast, by Country, 2015 – 2024

FIG. 14 Europe SCADA Market Size (USD Billion) Forecast, 2015 – 2024

FIG. 15 Europe SCADA Market Size (USD Billion) Forecast, by Components, 2015 – 2024

FIG. 16 Europe SCADA Market Size (USD Billion) Forecast, by Architecture, 2015 – 2024

FIG. 17 Europe SCADA Market Size (USD Billion) Forecast, by End Use Industry, 2015 – 2024

FIG. 18 Europe SCADA Market Size (USD Billion) Forecast, by Country, 2015 – 2024

FIG. 19 Asia Pacific SCADA Market Size (USD Billion) Forecast, 2015 – 2024

FIG. 20 Asia Pacific SCADA Market Size (USD Billion) Forecast, by Components, 2015 – 2024

FIG. 21 Asia Pacific SCADA Market Size (USD Billion) Forecast, by Architecture, 2015 – 2024

FIG. 22 Asia Pacific SCADA Market Size (USD Billion) Forecast, by End Use Industry, 2015 – 2024

FIG. 23 Asia Pacific SCADA Market Size (USD Billion) Forecast, by Country, 2015 – 2024

FIG. 24 Middle-East and Africa SCADA Market Size (USD Billion) Forecast, 2015 – 2024

FIG. 25 Middle-East and Africa SCADA Market Size (USD Billion) Forecast, by Components, 2015 – 2024

FIG. 26 Middle-East and Africa SCADA Market Size (USD Billion) Forecast, by Architecture, 2015 – 2024

FIG. 27 Middle-East and Africa SCADA Market Size (USD Billion) Forecast, by End Use Industry, 2015 – 2024

FIG. 28 Middle-East and Africa SCADA Market Size (USD Billion) Forecast, by Country, 2015 – 2024

FIG. 29 South America SCADA Market Size (USD Billion) Forecast, 2015 – 2024

FIG. 30 South America SCADA Market Size (USD Billion) Forecast, by Components, 2015 – 2024

FIG. 31 South America SCADA Market Size (USD Billion) Forecast, by Architecture, 2015 – 2024

FIG. 32 South America SCADA Market Size (USD Billion) Forecast, by End Use Industry, 2015 – 2024

FIG. 33 South America SCADA Market Size (USD Billion) Forecast, by Country, 2015 – 2024