Reports

Reports

Global Superabsorbent Polymer Market: Snapshot

The global superabsorbent polymer market is driven by the rise in demand for disposable baby diapers and sanitary products. Asia Pacific accounts for major share of the global superabsorbent polymer market, led by the increase in population and growth in awareness about hygienic products, diabetic wounds, and wound care products in the region.

Especially India and China, is another lucrative region for wound dressings. This can be ascribed to the large population, increase in patient awareness levels, and surge in incidence of diabetes ulcer in the region. These factors are likely to boost the superabsorbent polymer market in Asia Pacific during the forecast period.

According to the report by TMR, the global market for superabsorbent polymer was valued at US$ 9,106.02 Mn in 2017 and is anticipated to expand at a CAGR of 6.0% from 2018 to 2026.

Rising Demand for High Performance Hygiene Products to be Beneficial for Growth

On the basis of resin, the superabsorbent polymer market is segmented into sodium polyacrylate, potassium polyacrylate, polyacrylamide copolymer, ethylene maleic anhydride copolymer, polysaccharides, and others. Of these, sodium polyacrylate is leading the global superabsorbent market owing to rise in the need of reliable and high performance hygiene products, growth in awareness about health among people, and surge in demand for female hygiene products such as adult incontinence pads. However, potassium acrylate is expanding with faster pace owing to higher demand for potassium polyacrylate is used as soil water in the agriculture industry and gardening application. It improves seed germination and increases yield.

On the basis of application, the superabsorbent polymer market is segmented into hygienic, diapers, adult incontinence products, sanitary products, non-hygienic, packaging, medical & health care, agriculture, and industrial. Of these, hygiene is a dominant segment of the global market. This segment is witnessing faster growth owing to the various initiatives and programs regarding hygiene programs especially in the developing countries such as India and China.

Expansion of Chemical and Pharmaceuticals industries in the Asia Pacific to Influence Growth

On the basis of region, the global superabsorbent polymer market is segmented into North America, Europe, Asia Pacific, Latin America, and Rest of the World. Of these, Asia Pacific is dominating the global market for superabsorbent polymer followed by the Middle East & Africa. Growth of both the regions is attributable to the numerous manufacturers of superabsorbent polymers and expansion of chemical and pharmaceuticals in the regions. These manufacturers are gradually shifting their focus away from developed economies. However, North America and Europe have the wide consumer base for wound dressings owing to rise in geriatric population and increase in prevalence of chronic wounds and high demand for high-quality health care products in the regions.

Some of the players operating in the global market for superabsorbent polymer are Nippon Shokubai Co., Ltd, BASF SE, Evonik Industries, Songwon Industrial Co., Ltd, and KAO Corporation. These players are focusing on the improvement of capacity and expansion of their businesses, to achieve this, these players are increasingly taking part in the strategies such as mergers and acquisitions. The top three players – Nippon Shokubai Co., Ltd, BASF SE, and Evonik Industries – cumulatively accounted for more than 45% share of the market in 2017. Manufacturers of superabsorbent polymers are primarily concentrated in China, the U.S., Japan, and Germany.

Chapter 1 Preface

1.1 Research Description

1.2 Research Scope

1.3 Assumptions

1.4 Market Segmentation

1.5 Research Methodology

Chapter 2 Executive Summary

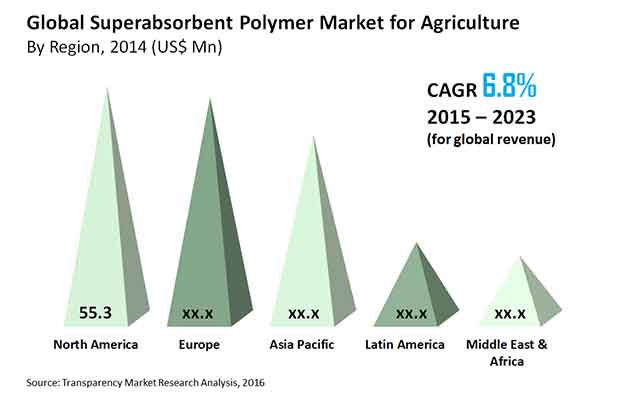

2.1 Global Superabsorbent Polymer Market for Agriculture, 2014 – 2023 (Kilo Tons) (US$ Mn)

2.2 Global Superabsorbent Polymer Market for Agriculture: Market Snapshot

Chapter 3 Superabsorbent Polymer Market for Agriculture - Industry Analysis

3.1 Introduction

3.2 Value Chain Analysis

3.3 Market Drivers

3.3.2 Increasing Need for Food Among Booming Global Population

3.4 Restraints

3.4.1 Volatile raw material prices expected to hamper growth of superabsorbent polymer market

3.5 Opportunity

3.5.1 Bio-based superabsorbent polymer (SAP) to create future potential for SAP market

3.6 Porter’s Five Forces Analysis

3.6.1 Bargaining Power of Suppliers

3.6.2 Bargaining Power of Buyers

3.6.3 Threat of New Entrants

3.6.4 Threat of Substitutes

3.6.5 Degree of Competition

3.7 Superabsorbent Polymers Market for Agriculture: Market Attractiveness Analysis - By Region

Chapter 4 Price Trend Analysis

4.1 Major Raw Material Price Trend, 2014–2023 (US$/Ton)

Chapter 5 Global Superabsorbent Polymer Market for Agriculture - Regional Analysis

5.1 Global SuperabsorbentPolymers Market for Agriculture Market: Regional Overview

5.2 North America Superabsorbent Polymer Market for Agriculture- By Regional Sub-segment, 2014-2023

5.2.1 North America Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.2.2 U.S. Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.2.3 Rest of North America Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.3 Europe Superabsorbent Polymer Market for Agriculture Market – By Regional Sub-segment, 2014 - 2023

5.3.1 Europe Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.3.2 Germany Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.3.3 U.K. Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.3.4 France Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.3.5 Spain Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.3.6 Italy Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.3.7 Rest of Europe Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.4 Asia Pacific Superabsorbent Polymer Market for Agriculture Market – By Regional Sub-segment, 2014 - 2023

5.4.1 Asia Pacific Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.4.2 China Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.4.3 Japan Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.4.4 ASEAN Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.4.5 Rest of Asia Pacific Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.5 Latin America Superabsorbent Polymer Market for Agriculture- By Regional Sub-segment, 2014-2023

5.5.1 Latin America Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.5.2 Brazil Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.5.3 Rest of Latin America Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.6 Middle East & Africa Superabsorbent Polymer Market for Agriculture Market – By Regional Sub-segment, 2014 - 2023

5.6.1 Middle East & Africa Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.6.2 GCC Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.6.3 South Africa Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

5.6.3 Rest of Middle East & Africa Superabsorbent Polymer Market for Agriculture, 2014–2023 (Kilo Tons) (US$ Mn)

Chapter 6 Company Profiles

6.1 LG Chem Ltd.

6.2 BASF SE

6.3 Evonik Industries

6.4 Sumitomo Seika Chemicals Co., Ltd.

6.5 NIPPON SHOKUBAI Co., Ltd.

6.6 Songwon Industrial Co., Ltd.

Chapter 7 Primary Findings

Chapter 8 List of Customers