Reports

Reports

1. Preface

1.1. Research description

1.2. Market segmentation

1.2.1. Global salicylic acid market segmentation

1.3. Research scope and methodology

1.3.1. Assumptions

1.4. Abbreviations

2. Executive Summary

2.1. Global demand for salicylic acid, 2013-2019 (Tons) (USD Million)

2.2. Salicylic acid: Market snapshot (2012 and 2019)

3. Salicylic Acid: Industry Analysis

3.1. Introduction

3.2. Value chain analysis

3.3. Market drivers

3.3.1. Increasing skincare and hair care applications augmenting demand for salicylic acid

3.3.2. Growing demand for aspirin

3.4. Market restraints

3.4.1. Growing concerns regarding salicylic acid side-effects

3.5. Market opportunities

3.5.1. Research studies proving the effectiveness of aspirin on life-threatening diseases

3.6. Porter’s five forces analysis

3.6.1. Bargaining power of suppliers

3.6.2. Bargaining power of buyers

3.6.3. Threat of new entrants

3.6.4. Threat of substitutes

3.6.5. Degree of competition

3.7. Salicylic acid: Market attractiveness analysis

4. Salicylic Acid Market: Application Analysis

4.1. Global salicylic acid market: Application overview

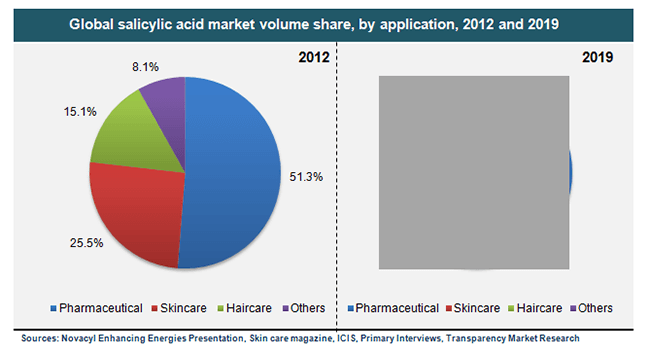

4.1.1. Global salicylic acid market volume share, by application, 2012 and 2019

4.2. Salicylic acid market, by application

4.2.1. Pharmaceutical

4.2.1.1. Global salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

4.2.2. Skincare

4.2.2.1. Global salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

4.2.3. Haircare

4.2.3.1. Global salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

4.2.4. Others

4.2.4.1. Global salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)

5. Salicylic Acid Market: Regional Analysis

5.1. Global salicylic acid market: Regional overview

5.1.1. Global salicylic acid market volume share, by region, 2012 and 2019

5.2. North America

5.2.1. North America salicylic acid demand, volume and revenue, 2012-2019 (Tons) (USD Million)

5.2.2. North America salicylic acid demand, by application, 2012-2019 (Tons) (USD Million)

5.2.2.1. North America salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

5.2.2.2. North America salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

5.2.2.3. North America salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

5.2.2.4. North America salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)

5.3. Europe

5.3.1. Europe salicylic acid demand, volume and revenue, 2012-2019 (Tons) (USD Million)

5.3.2. Europe salicylic acid demand, by application, 2012-2019 (Tons) (USD Million)

5.3.2.1. Europe salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

5.3.2.2. Europe salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

5.3.2.3. Europe salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

5.3.2.4. Europe salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)

5.4. Asia Pacific

5.4.1. Asia Pacific salicylic acid demand, volume and revenue, 2012-2019 (Tons) (USD Million)

5.4.2. Asia Pacific salicylic acid demand, by application, 2012-2019 (Tons) (USD Million)

5.4.2.1. Asia Pacific salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

5.4.2.2. Asia Pacific salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

5.4.2.3. Asia Pacific salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

5.4.2.4. Asia Pacific salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)

5.5. Rest of the World

5.5.1. RoW salicylic acid demand, volume and revenue, 2012-2019 (Tons) (USD Million)

5.5.2. RoW salicylic acid demand, by application, 2012-2019 (Tons) (USD Million)

5.5.2.1. RoW salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

5.5.2.2. RoW salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

5.5.2.3. RoW salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

5.5.2.4. RoW salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)

6. Company Profiles

6.1. Alfa Aesar

6.1.1. Company overview

6.1.2. Product portfolio

6.1.3. Financial overview

6.1.4. Business strategy

6.1.5. SWOT analysis

6.1.6. Recent developments

6.2. Alta Laboratories Limited

6.2.1. Company overview

6.2.2. Product portfolio

6.2.3. Business strategy

6.2.4. SWOT analysis

6.3. J.M. Loveridge Limited

6.3.1. Company overview

6.3.2. Product portfolio

6.3.3. Business strategy

6.3.4. SWOT analysis

6.4. Novacap

6.4.1. Company overview

6.4.2. Product portfolio

6.4.3. Financial overview

6.4.4. Business strategy

6.4.5. SWOT analysis

6.4.6. Recent developments

6.5. Siddharth Carbochem Products Ltd.

6.5.1. Company overview

6.5.2. Product portfolio

6.5.3. Business strategy

6.5.4. SWOT analysis

6.6. Simco Chemicals Inc.

6.6.1. Company overview

6.6.2. Product portfolio

6.6.3. Business strategy

6.6.4. SWOT analysis

6.7. Zhenjiang Gaopeng Pharmaceutical Co. Ltd.

6.7.1. Company overview

6.7.2. Product portfolio

6.7.3. Business strategy

6.7.4. SWOT analysis

List of Tables

TABLE 1: Salicylic acid: Global snapshot

TABLE 2: Drivers for salicylic acid market: Impact analysis

TABLE 3: Restraints for salicylic acid market: Impact analysis

List of Figures

FIG. 1: Global salicylic acid market segmentation

FIG. 2: Global demand for salicylic acid, 2013-2019 (Tons) (USD Million)

FIG. 3: Salicylic acid: Value chain analysis

FIG. 4: Growth of global skincare and hair care market, estimate and forecast, 2011-2018 (USD billion)

FIG. 5: Porter’s five force analysis

FIG. 6: Salicylic acid: Market attractiveness analysis (2012)

FIG. 7: Global salicylic acid market volume share, by application, 2012 and 2019

FIG. 8: Global salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

FIG. 9: Global salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

FIG. 10: Global salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

FIG. 11: Global salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)

FIG. 12: Global salicylic acid market volume share, by region, 2012 and 2019

FIG. 13: North America salicylic acid demand, volume and revenue, 2012-2019 (Tons) (USD Million)

FIG. 14: North America salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

FIG. 15: North America salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

FIG. 16: North America salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

FIG. 17: North America salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)

FIG. 18: Europe salicylic acid demand, volume and revenue, 2012-2019 (Tons) (USD Million)

FIG. 19: Europe salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

FIG. 20: Europe salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

FIG. 21: Europe salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

FIG. 22: Europe salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)

FIG. 23: Asia Pacific salicylic acid demand, volume and revenue, 2012-2019 (Tons) (USD Million)

FIG. 24: Asia Pacific salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

FIG. 25: Asia Pacific salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

FIG. 26: Asia Pacific salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

FIG. 27: Asia Pacific salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)

FIG. 28: RoW salicylic acid demand, volume and revenue, 2012-2019 (Tons) (USD Million)

FIG. 29: RoW salicylic acid demand in pharmaceuticals, 2012-2019 (Tons) (USD Million)

FIG. 30: RoW salicylic acid demand in skincare, 2012-2019 (Tons) (USD Million)

FIG. 31: RoW salicylic acid demand in haircare, 2012-2019 (Tons) (USD Million)

FIG. 32: RoW salicylic acid demand in other applications, 2012-2019 (Tons) (USD Million)