Refinery Catalysts Market : Overview

Refinery catalysts are widely used in petroleum refineries owing to their property to alter the rate of chemical reactions. Apart from this, it also enhances quality of gasoline products produced through FCC and hydro-processing. Refinery catalysts market are known to minimize the adverse effects of gasoline and diesel on the environment. This is because they help in removing sulfur from crude oil. The growth in the global refinery catalysts market is mainly attributed to stringent government regulations on the use of crude oil products.

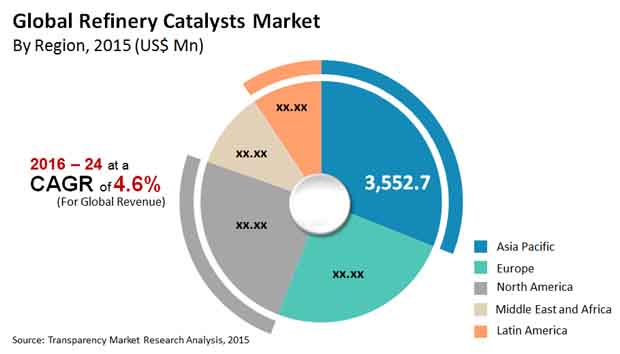

As per a research report by Transparency Market Research, the global refinery catalysts market is likely to reach a valuation of US$11.4 bn in 2015. The market is projected to expand at a steady CAGR of 4.60% from 2016 to 2024. Rising at this CAGR, the global refinery catalysts market is anticipated to reach a valuation US$17.0 bn by the end of the forecast period.

Demand for Hydrocracking Catalysts to Remain High During the Forecast Period

The global refinery catalysts market is classified on the basis of refining unit, material, and physical form. In terms of refining unit, the global refinery catalysts market is segmented into fluid catalytic cracking, hydrocracking, H-oil, hydrotreating, catalytic reforming, and alkylation. Among all them, hydrocracking catalysts segment of the refinery catalyst market is projected to display a highest CAGR during the forecast period. This is because, it has a higher demand across all end user industries owing to its general characteristics. In addition, hydrotreating does not produce coke as a by-product, thereby resulting in the improved conversion of feedstock.

On the basis of material, the global refinery catalysts market is segmented into zeolites, molybdenum, cobalt nickel, others (including platinum, etc.). Among all of them, the cobalt nickel segment accounts for the largest share of the refinery catalyst market. This is because they are primarily used to remove unwanted impurities from diesel and petrol into the environment. Apart from this, they are also used in desulfurization and denitrification processes. As the demand for fuels containing less sulfur content increases, the demand for metals is anticipated to witness steady growth in the near future.

Based on physical form, the global refinery catalysts market is segmented into powders, beads, and extrudates

Asia Pacific to Continue its Dominance in Global Refinery Catalysts Market

In terms of region, the global base oil market has been divided into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Among all of them, Asia Pacific is projected to account for the largest market in the overall refinery catalysts market. This is because of the presence of key consumers, which includes countries like India and China. The increase in demand for transportation fuels in these countries have contributed to the growth of the refinery catalyst market in this region.

The leading players operating in the global refinert catalysts market are Sinopec Corp., ExxonMobil Corp., Royal Dutch Shell Plc., and Chevron Corp.

Refinery Catalysts Market to Observe Growth in rising Demand for Transportation Fuel

The increasing demand for various petroleum derivatives is responsible for the rise of the global refinery catalysts market. The said market is also expected to rise due to the rising demand for high-octane fuels. As demand for transportation fuel increases worldwide, the market is expected to observe considerable growth. Strict regulations combined with increasing demand for petroleum and products and chemicals obtained from petroleum is likely to propel growth of the market. In the petroleum refining industry, refinery catalysts are utilized to improve operating performance. Furthermore, the rising demand for high-octane fuel, especially in countries such as the US, India, Japan, Germany, and the UK is expected to positively influence the development of the global refinery catalyst market.

Sustainable Production methods and Technological Advancements are likely to Push Demand in the Market

Zeolites, metals, and chemical compounds are amongst some of the products utilized in the production of refinery catalysts. Manufacturing companies may make hydrocracking refinery catalysts, fluid catalytic cracking refinery catalysts, hydrotreating refinery catalysts, and alkylation refinery catalysts using these processes in different formulations or in conjunction with other chemicals.

Global manufacturers of catalytic processers are extremely focused on catalytic design, which can manage all types of feedstuff, ensuring that hydrocracking and hydrotreating are secure, credible, simple and financially beneficial. Deployment of performance refinery catalyst innovation, patented equipment, and superior process designs all have enabled manufacturers to achieve a competitive advantage over their rivals. Furthermore, companies are gradually using a mix of technological skills and sustainable production methods.

Alternative fuels such as biofuels are expected to be available in conjunction with the implementation of environmental policies and Go Green campaigns initiated by several countries to limit refinery catalysts' market expansion. Asia pacific region is likely to come up as one of the rapidly growing regions in the global refinery catalysts market. The most critical factor ascribed to the overall growth of the regional market is due to the growing population, increased industrialization, stringent regulatory standards, and environmental laws. Continuing oil capacity improvements in the oil refineries of the developing countries of the territory is likely to provide the catalyst refinery market with considerable growth prospects.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Market Snapshot, Indicative (US$ Mn)

3.2. Top 3 Trends

4. Market Overview

4.1. Product Overview

4.2. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Global Refinery catalysts market Analysis and Forecasts

5.3. Porter’s Analysis

5.3.1. Threat of Substitutes

5.3.2. Bargaining Power of Buyers

5.3.3. Bargaining Power of Suppliers

5.3.4. Threat of New Entrants

5.3.5. Degree of Competition

5.4. Value Chain Analysis

5.5. Refinery Catalysts Market Outlook

6. Global Refinery catalysts market Analysis, by Refining Unit

6.1. Key Findings

6.2. Introduction

6.3. Refining Unit Comparison Matrix

6.4. Global Refinery Catalysts Market Value Share Analysis, by Refining Unit

6.4.1. Fluid Catalytic Cracking

6.4.2. Hydrocracking

6.4.3. H-Oil

6.4.4. Catalytic Reforming

6.4.5. Alkylation

6.4.6. Hydrotreating

6.4.6.1. Naphtha Hydrotreating

6.4.6.2. Distillate Hydrotreating

6.5. Refinery Catalysts Market Attractiveness Analysis, by Refining Unit

6.6. Key Trends

7. Global Refinery catalysts market Value Share Analysis, by Material

7.1. Key Findings

7.2. Introduction

7.3. Material Comparison Matrix

7.4. Global Refinery Catalysts Market Value Share Analysis, by Refining Unit

7.4.1. Zeolites

7.4.2. Molybdenum

7.4.3. Cobalt

7.4.4. Nickel

7.4.5. Others

7.5. Refinery Catalysts Market Attractiveness Analysis, by Material

7.6. Key Trends

8. Global Refinery catalysts market Value Share Analysis, by Physical Form

8.1. Key Findings

8.2. Introduction

8.3. Physical Form Comparison Matrix

8.4. Global Refinery Catalysts Market Value Share Analysis, by Refining Unit

8.4.1. Powders

8.4.2. Beads

8.4.3. Extrudates

8.5. Refinery Catalysts Market Attractiveness Analysis, by Physical Form

8.6. Key Trends

9. Refinery catalysts market Analysis by Region

9.1. Global Refinery catalysts Market Growth Scenario

9.2. Global Refinery catalysts market Value Share Analysis, by Region

9.3. Refinery Catalysts Market Attractiveness Analysis, by Region

10. North America Refinery catalysts market Analysis

10.1. Key Findings

10.2. North America Refinery catalysts market Overview

10.2.1. North America Market Value Share Analysis, By Refining Unit

10.2.2. North America Market Forecast by Refining Unit

10.2.3. North America Market Value Share Analysis, by Material

10.2.4. North America Market Forecast, by Material

10.2.5. North America Market Value Share Analysis, by Physical Form

10.2.6. North America Market Forecast, by Physical Form

10.2.7. North America Market Value Share Analysis, By Country

10.2.8. North America Market Forecast, By Country

10.3. U.S. Refinery Catalysts Market Analysis and Forecast

10.3.1. U.S. Market Forecast, by Refining Unit

10.3.2. U.S. Market Forecast, by Material

10.3.3. U.S. Market Forecast, by Physical Form

10.4. Canada Refinery Catalysts Market Analysis and Forecast

10.4.1. Canada Market Forecast, by Refining Unit

10.4.2. Canada Market Forecast, by Material

10.4.3. Canada Market Forecast, by Physical Form

10.5. North America Market Attractiveness Analysis

10.6. Market Trends

11. Asia Pacific Refinery catalysts market Analysis

11.1. Key Findings

11.2. Asia Pacific Refinery catalysts market Overview

11.2.1. Asia Pacific Market Value Share Analysis, By Refining Unit

11.2.2. Asia Pacific Market Forecast by Refining Unit

11.2.3. Asia Pacific Market Value Share Analysis, by Material

11.2.4. Asia Pacific Market Forecast, by Material

11.2.5. Asia Pacific Market Value Share Analysis, by Physical Form

11.2.6. Asia Pacific Market Forecast, by Physical Form

11.2.7. Asia Pacific Market Value Share Analysis, By Country

11.2.8. Asia Pacific Market Forecast, By Country

11.3. China Refinery Catalysts Market Analysis and Forecast

11.3.1. China Market Forecast, by Refining Unit

11.3.2. China Market Forecast, by Material

11.3.3. China Market Forecast, by Physical Form

11.4. India Refinery Catalysts Market Analysis and Forecast

11.4.1. India Market Forecast, by Refining Unit

11.4.2. India Market Forecast, by Material

11.4.3. India Market Forecast, by Physical Form

11.5. ASEAN Refinery Catalysts Market Analysis and Forecast

11.5.1. ASEAN Market Forecast, by Refining Unit

11.5.2. ASEAN Market Forecast, by Material

11.5.3. ASEAN Market Forecast, by Physical Form

11.6. Rest of Asia pacific Refinery Catalysts Market Analysis and Forecast

11.6.1. Rest of Asia pacific Market Forecast, by Refining Unit

11.6.2. Rest of Asia pacific Market Forecast, by Material

11.6.3. Rest of Asia pacific Market Forecast, by Physical Form

11.7. Asia Pacific Market Attractiveness Analysis

11.8. Market Trends

12. Europe Refinery catalysts market Analysis

12.1. Key Findings

12.2. Europe Refinery catalysts market Overview

12.2.1. Europe Market Value Share Analysis, By Refining Unit

12.2.2. Europe Market Forecast by Refining Unit

12.2.3. Europe Market Value Share Analysis, by Material

12.2.4. Europe Market Forecast, by Material

12.2.5. Europe Market Value Share Analysis, by Physical Form

12.2.6. Europe Market Forecast, by Physical Form

12.2.7. Europe Market Value Share Analysis, By Country

12.2.8. Europe Market Forecast, By Country

12.3. Germany Refinery Catalysts Market Analysis and Forecast

12.3.1. Germany Market Forecast, by Refining Unit

12.3.2. Germany Market Forecast, by Material

12.3.3. Germany Market Forecast, by Physical Form

12.4. France Refinery Catalysts Market Analysis and Forecast

12.4.1. France Market Forecast, by Refining Unit

12.4.2. France Market Forecast, by Material

12.4.3. France Market Forecast, by Physical Form

12.5. Italy Refinery Catalysts Market Analysis and Forecast

12.5.1. Italy Market Forecast, by Refining Unit

12.5.2. Italy Market Forecast, by Material

12.5.3. Italy Market Forecast, by Physical Form

12.6. Spain Refinery Catalysts Market Analysis and Forecast

12.6.1. Spain Market Forecast, by Refining Unit

12.6.2. Spain Market Forecast, by Material

12.6.3. Spain Market Forecast, by Physical Form

12.7. U.K. Refinery Catalysts Market Analysis and Forecast

12.7.1. U.K Market Forecast, by Refining Unit

12.7.2. U.K Market Forecast, by Material

12.7.3. U.K Market Forecast, by Physical Form

12.8. Rest of Europe Refinery Catalysts Market Analysis and Forecast

12.8.1. Rest of Europe Market Forecast, by Refining Unit

12.8.2. Rest of Europe Market Forecast, by Material

12.8.3. Rest of Europe Market Forecast, by Physical Form

12.9. Europe Market Attractiveness Analysis

12.10. Market Trends

13. Latin America Refinery catalysts market Analysis

13.1. Key Findings

13.2. Latin America Refinery catalysts market Overview

13.2.1. Latin America Market Value Share Analysis, By Refining Unit

13.2.2. Latin America Market Forecast by Refining Unit

13.2.3. Latin America Market Value Share Analysis, by Material

13.2.4. Latin America Market Forecast, by Material

13.2.5. Latin America Market Value Share Analysis, by Physical Form

13.2.6. Latin America Market Forecast, by Physical Form

13.2.7. Latin America Market Value Share Analysis, By Country

13.2.8. Latin America Market Forecast, By Country

13.3. Brazil Refinery Catalysts Market Analysis and Forecast

13.3.1. Brazil Market Forecast, by Refining Unit

13.3.2. Brazil Market Forecast, by Material

13.3.3. Brazil Market Forecast, by Physical Form

13.4. Mexico Refinery Catalysts Market Analysis and Forecast

13.4.1. Mexico Market Forecast, by Refining Unit

13.4.2. Mexico Market Forecast, by Material

13.4.3. Mexico Market Forecast, by Physical Form

13.5. Rest of Latin America Refinery Catalysts Market Analysis and Forecast

13.5.1. Rest of Latin America Market Forecast, by Refining Unit

13.5.2. Rest of Latin America Market Forecast, by Material

13.5.3. Rest of Latin America Market Forecast, by Physical Form

13.6. Latin America Market Attractiveness Analysis

13.7. Market Trends

14. Middle East & Africa Refinery catalysts market Analysis

14.1. Key Findings

14.2. Middle East & Africa Refinery catalysts market Overview

14.2.1. Middle East & Africa Market Value Share Analysis, By Refining Unit

14.2.2. Middle East & Africa Market Forecast by Refining Unit

14.2.3. Middle East & Africa Market Value Share Analysis, by Material

14.2.4. Middle East & Africa Market Forecast, by Material

14.2.5. Middle East & Africa Market Value Share Analysis, by Physical Form

14.2.6. Middle East & Africa Market Forecast, by Physical Form

14.2.7. Middle East & Africa Market Value Share Analysis, By Country

14.2.8. Middle East & Africa Market Forecast, By Country

14.3. GCC Refinery Catalysts Market Analysis and Forecast

14.3.1. GCC Market Forecast, by Refining Unit

14.3.2. GCC Market Forecast, by Material

14.3.3. GCC Market Forecast, by Physical Form

14.4. Nigeria Refinery Catalysts Market Analysis and Forecast

14.4.1. Nigeria Market Forecast, by Refining Unit

14.4.2. Nigeria Market Forecast, by Material

14.4.3. Nigeria Market Forecast, by Physical Form

14.5. Rest of Middle East & Africa Refinery Catalysts Market Analysis and Forecast

14.5.1. Rest of Middle East & Africa Market Forecast, by Refining Unit

14.5.2. Rest of Middle East & Africa Market Forecast, by Material

14.5.3. Rest of Middle East & Africa Market Forecast, by Physical Form

14.6. Middle East & Africa Market Attractiveness Analysis

14.7. Market Trends

15. Competition Landscape

15.1. Refinery catalysts market Share Analysis by Company (2015)

15.2. Competition Matrix

15.2.1. Royal Dutch Shell Plc.

15.2.2. ExxonMobil Corporation

15.2.3. BASF SE

15.2.4. Honeywell International Inc.

15.3. Company Profiles

15.3.1. Albemarle Corporation Company Description

15.3.1.1. Business Overview

15.3.1.2. SWOT Analysis

15.3.1.3. Financial Details

15.3.1.4. Strategic Overview

15.3.2. BASF SE

15.3.2.1. Company Description

15.3.2.2. Business Overview

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Details

15.3.2.5. Strategic Overview

15.3.3. Chevron Corporation

15.3.3.1. Company Description

15.3.3.2. Business Overview

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Details

15.3.3.5. Strategic Overview

15.3.4. ExxonMobil Corporation

15.3.4.1. Company Description

15.3.4.2. Business Overview

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Details

15.3.4.5. Strategic Overview

15.3.5. Haldor Topsoe A/S

15.3.5.1. Company Description

15.3.5.2. Business Overview

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Details

15.3.5.5. Strategic Overview

15.3.6. Honeywell International Inc.

15.3.6.1. Company Description

15.3.6.2. Business Overview

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Details

15.3.6.5. Strategic Overview

15.3.7. Johnson Matthey Plc.

15.3.7.1. Company Description

15.3.7.2. Business Overview

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Details

15.3.7.5. Strategic Overview

15.3.8. Royal Dutch Shell plc

15.3.8.1. Company Description

15.3.8.2. Business Overview

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Details

15.3.8.5. Strategic Overview

15.3.9. Sinopec Corporation

15.3.9.1. Company Description

15.3.9.2. Business Overview

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Details

15.3.9.5. Strategic Overview

15.3.10. W. R. Grace & Co.-Conn

15.3.10.1. Company Description

15.3.10.2. Business Overview

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Details

15.3.10.5. Strategic Overview

15.3.11. JGC Catalysts and Che Refinery Catalysts Ltd.

15.3.11.1. Company Description

15.3.11.2. Business Overview

15.3.12. Magma Ceramics & Catalysts

15.3.12.1. Company Description

15.3.12.2. Business Overview

15.3.13. Zeochem AG

15.3.13.1. Company Description

15.3.13.2. Business Overview

15.4. Key Takeaways

List of Tables

Table 01: Global Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 02: Global Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 03: Global Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 04: Global Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 05: Global Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Region , 2015–2024

Table 06: North America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 07: North America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 08: North America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 09: North America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 10: North America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, By Country, 2015–2024

Table 11: U.S. Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 12: U.S. Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 13: U.S. Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 14: U.S. Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 15: Canada Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 16: Canada Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 17: Canada Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 18: Canada Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 19: Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 20: Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 21: Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 22: Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 23: Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 24: China Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 25: China Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 26: China Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 27: China Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 28: India Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 29: India Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 30: India Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 31: India Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 32: ASEAN Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 33: ASEAN Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 34: ASEAN Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 35: ASEAN Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 36: Rest of Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 37: Rest of Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 38: Rest of Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 39: Rest of Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 40: Rest of Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 41: Rest of Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 42: Europe Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 43: Europe Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 44: Europe Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 45: Germany Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 46: Germany Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 47: Germany Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 48: Germany Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 49: France Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 50: France Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 51: France Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 52: France Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 53: Italy Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 54: Italy Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 55: Italy Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 56: Italy Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 57: Spain Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 58: Spain Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 59: Spain Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 60: Spain Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 61: U.K. Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 62: U.K. Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 63: U.K. Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 64: U.K. Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 65: Rest of Europe Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 66: Rest of Europe Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 67: Rest of Europe Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 68: Rest of Europe Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 69: Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 70: Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 71: Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 72: Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 73: Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 74: Brazil Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 75: Brazil Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 76: Brazil Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 77: Brazil Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 78: Mexico Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 79: Mexico Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 80: Mexico Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 81: Mexico Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 82: Rest of Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 83: Rest of Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 84: Rest of Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 85: Rest of Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 86: Middle East and Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 87: Middle East and Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 88: Middle East and Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 89: Middle East and Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 90: Middle East and Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 91: GCC Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 92: GCC Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 93: GCC Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 94: GCC Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 95: Nigeria Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 96: Nigeria Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 97: Nigeria Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 98: Nigeria Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

Table 99: Rest of Middle East & Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 100: Rest of Middle East & Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Refining Unit, 2015–2024

Table 101: Rest of Middle East & Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Material, 2015–2024

Table 102: Rest of Middle East & Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Physical Form, 2015–2024

List of Figures

Figure 01: Global Refinery Catalysts Volume (Kilo Tons) and Market Size (US$ Mn) Forecast, 2015–2024

Figure 02: Global Refinery Catalysts Average Price (US$/ Unit) 2015–2024

Figure 03: Global Refinery Catalysts Market Value Share Analysis, by Refining Unit, 2016 and 2024

Figure 04: Refinery Catalysts Market Attractiveness Analysis, by Refining Unit

Figure 05: Global Refinery Catalysts Market Value Share Analysis, by Material, 2016 and 2024

Figure 06: Refinery Catalysts Market Attractiveness Analysis, by Material

Figure 07: Global Refinery Catalysts Market Value Share Analysis, by Physical Form, 2016 and 2024

Figure 08: Refinery Catalysts Market Attractiveness Analysis, by Refining Unit

Figure 09: Global Refinery Catalysts Market Value Share Analysis, by Region, 2016 and 2024

Figure 10: Refinery Catalysts Market Attractiveness Analysis, by Region

Figure 11: North America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 12: North America Refinery Catalysts Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 13: North America Market Attractiveness Analysis, By Country

Figure 14: North America Market Value Share Analysis, by Refining Unit, 2016 and 2024

Figure 15: North America Market Value Share Analysis, by Material, 2016 and 2024

Figure 16: North America Market Value Share Analysis, by Physical Form, 2016 and 2024

Figure 17: North America Market Value Share Analysis, By Country, 2016 and 2024

Figure 18: Asia Pacific Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 19: Asia Pacific Refinery Catalysts Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 20: Asia Pacific Market Attractiveness Analysis, by Country

Figure 21: Asia Pacific Market Value Share Analysis, by Refining Unit, 2016 and 2024

Figure 22: Asia Pacific Market Value Share Analysis, by Material, 2016 and 2024

Figure 23: Asia Pacific Market Value Share Analysis, by Physical Form, 2016 and 2024

Figure 24: Asia Pacific Market Value Share Analysis, by Country, 2016 and 2024

Figure 25: Europe Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 26: Europe Refinery Catalysts Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 27: Europe Market Attractiveness Analysis, by Country

Figure 28: Europe Market Value Share Analysis, by Refining Unit, 2016 and 2024

Figure 29: Europe Market Value Share Analysis, by Material, 2016 and 2024

Figure 30: Rest of Asia Pacific Market Value Share Analysis, by Physical Form, 2016 and 2024

Figure 31: Europe Market Value Share Analysis, by Country, 2016 and 2024

Figure 32: Latin America Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 33: Latin America Refinery Catalysts Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 34: Latin America Market Attractiveness Analysis, by Country

Figure 35: Latin America Market Value Share Analysis, by Refining Unit, 2016 and 2024

Figure 36: Latin America Market Value Share Analysis, by Material, 2016 and 2024

Figure 37: Latin America Market Value Share Analysis, by Physical Form, 2016 and 2024

Figure 38: Latin America Market Value Share Analysis, by Country, 2016 and 2024

Figure 39: Middle East & Africa Refinery Catalysts Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 40: Middle East & Africa Refinery Catalysts Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 41: Middle East & Africa Market Attractiveness Analysis, By Country

Figure 42: Middle East and Africa Market Value Share Analysis, by Refining Unit, 2016 and 2024

Figure 43: Middle East and Africa Market Value Share Analysis, by Material, 2016 and 2024

Figure 44: Middle East and Africa Market Value Share Analysis, by Material, 2016 and 2024

Figure 45: Middle East and Africa Market Value Share Analysis, by Country, 2016 and 2024

Figure 46: Global Refinery Catalysts Market Share Analysis, by Company (2015)