Reports

Reports

Analysts’ Viewpoint

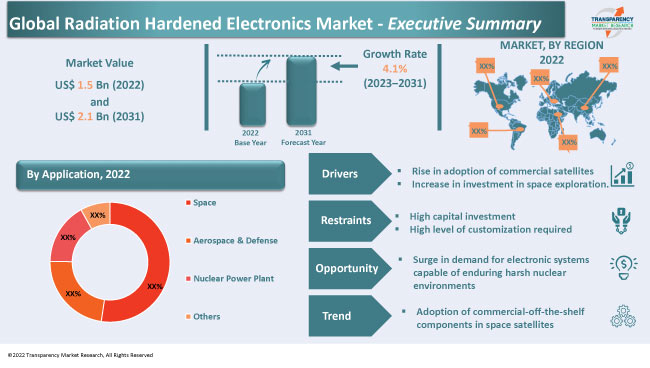

The global radiation hardened electronics market size is driven by the rise in adoption of commercial satellites and increase in investment in space exploration. The industry consists of advanced systems designed for usage in a range of applications, including military microprocessors, power supplies for satellite systems, switching regulators, and nuclear reactor control systems.

Surge in investment in Intelligence, Surveillance, and Reconnaissance (ISR) operations and growth in funding for military and space exploration are also expected to augment market expansion during the forecast period. Key players operating in the sector are adopting advanced design and manufacturing techniques to ensure that their components offer high radiation tolerance.

Radiation hardened electronics are designed and produced to withstand exposure to extreme temperatures (-55°C to 125°C). These electronics include mixed-signal ICs, transistors, resistors, diodes, capacitors, single-board computer CPUs, and sensors.

Radiation can cause various types of damage to electronic components, including single-event upsets (SEUs), latch-up, and total dose effects. SEUs occur when a single ionizing particle strikes a sensitive area of an electronic component and changes its state. Latch-up occurs when a component is exposed to a high-energy ionizing particle and becomes permanently conductive, causing a short circuit. Total dose effects occur when a component is exposed to a high dose of radiation over a long period of time and its performance deteriorates.

Radiation hardened electronics are designed to mitigate these effects using materials and designs that are less susceptible to radiation damage. For instance, radiation-hardened microprocessors are often made using silicon-on-insulator (SOI) technology, which uses an insulating layer between the silicon substrate and the active layer to reduce the susceptibility to SEUs. Other techniques to harden electronics against radiation include redundant circuits, shielding, and radiation-hardened packaging.

Increase in demand for economical satellite communication in diverse fields, such as agricultural surveillance, TV broadcasting, military surveillance, cellular connectivity, and monitoring, is prompting the development of small satellites. Radiation hardened electronics are widely employed in manufacture of these satellites.

Various companies in space and telecom industries are investing significantly in satellite communication to increase the reach of internet. They are launching large constellations of satellites to reach this goal. In July 2020, Amazon received approval from the U.S. Federal Communications Commission (FCC) to promote and control its constellation of 3,236 internet satellites.

Several developing countries in Asia Pacific, such as China and India, are also launching communication satellites. These countries have successfully launched high-power communication and broadcasting satellites, including CMS-01, APSTAR-7, and GSAT-10. Thus, surge in investment in satellite communication is projected to spur radiation hardened electronics market growth in the near future.

Major governments of countries across the globe are investing in space exploration. Space radiation can cause a variety of problems for electronics, including single-event effects (SEEs) and total ionizing dose (TID) effects. These effects can cause system failures and reduce the lifespan of electronic components. Radiation hardened electronics are designed to withstand these effects and continue to function reliably in space for extended periods.

In April 2022, SpaceX and NASA launched their Crew-4 mission, comprising an all-civilian crew, to carry out microgravity research onboard the International Space Station. Thus, increase in number of space missions is boosting market statistics.

According to the latest radiation hardened electronics market analysis, the power management component segment is expected to dominate the global landscape during the forecast period. Power devices are crucial components of any electronic system, as their proper functioning is essential for a successful operation.

Power management devices are particularly in demand for outer space requirements due to their remarkable strength against ionizing radiation and high-energy-charged particles. Manufacturers are incorporating advanced materials such as gallium nitride to enhance the performance of power devices in environments with high radiation.

In July 2020, VPT Inc. partnered with Efficient Power Conversion Corporation for design and manufacture of radiation hardened GaN-on-Si for high-reliability semiconductor applications in satellites.

According to the latest radiation hardened electronics market trends, the Radiation Hardening by Design (RHBD) manufacturing technique segment accounted for the largest share of 41.2% in 2022.

RHBD manufacturing technique is affordable and can produce radiation-resistant goods on a large scale. The technique relies on various principles, including component configuration and layout solutions.

RHBD allows for the rearrangement of circuit operation to prevent cell failure during missions and enhances durability in harsh conditions. Consequently, many areas of application that require protection from high levels of radiation are incorporating the RHBD approach into their electronic components.

According to the latest radiation hardened electronics market forecast, North America is projected to constitute the largest share from 2023 to 2031. The region dominated the industry with 43.2% share in 2022.

Rise in adoption of satellite-based telemetry and communication systems along with network-centric warfare techniques and increase in investment in space exploration are driving market progress in the region. In April 2022, BlackSky, an operator of a network of satellites in low Earth orbit, launched two satellites, thereby expanding its constellation from 12 to 14 high-resolution satellites.

The business in Asia Pacific is estimated to grow at a significant pace in the near future. Surge in investment in space exploration and the military and defense sector is boosting market development in the region. China is home to approximately 78 commercial space enterprises.

The global landscape is fragmented, with a stronghold of established players, including BAE Systems, Cobham Advanced Electronic Solutions (CAES), Honeywell International Inc., Infineon Technologies AG, Microchip Technology Inc., Renesas Electronics Corporation, Solitron Devices, Inc., STMicroelectronics, Teledyne Technologies Inc., Texas Instruments Incorporated, TTM Technologies Inc., and Xilinx Inc.

Each of these players has been profiled in the radiation hardened electronics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Manufacturers are investing significantly in research and development activities to introduce new technologies and products that are more resistant to radiation. They are expanding their product lines to include a wider range of components and systems with growth in demand for radiation-hardened electronics.

Manufacturers are also collaborating with government agencies, research institutions, and other companies to increase their radiation hardened electronics market share.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 1.5 Bn |

|

Market Forecast Value in 2031 |

US$ 2.1 Bn |

|

Growth Rate (CAGR) |

4.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.5 Bn in 2022.

It is anticipated to grow at a CAGR of 4.1% from 2023 to 2031.

It is projected to reach US$ 2.1 Bn by the end of 2031.

Rise in adoption of commercial satellites and increase in investment in space exploration.

The space application segment held 63.2% share in 2022.

North America is a more lucrative region for vendors.

The U.S. accounted for 28.2% share in 2022.

BAE Systems, Cobham Advanced Electronic Solutions (CAES), Honeywell International Inc., Infineon Technologies AG, Microchip Technology Inc., Renesas Electronics Corporation, Solitron Devices, Inc., STMicroelectronics, Teledyne Technologies Inc., Texas Instruments Incorporated, TTM Technologies Inc., and Xilinx Inc.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Radiation Hardened Electronics Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global High Reliability Electronics Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Radiation Hardened Electronics Market Analysis, By Component

5.1. Radiation Hardened Electronics Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017–2031

5.1.1. Mixed Signal ICs

5.1.2. Processors & Controllers

5.1.3. Memory

5.1.4. Power Management

5.1.5. Logic

5.1.6. Others (Sensors, etc.)

5.2. Market Attractiveness Analysis, By Component

6. Global Radiation Hardened Electronics Market Analysis, By Manufacturing Technique

6.1. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Manufacturing Technique, 2017–2031

6.1.1. Radiation Hardening by Design (RHBD)

6.1.2. Radiation Hardening by Process (RHBP)

6.1.3. Radiation Hardening by Shielding (RHBS)

6.2. Market Attractiveness Analysis, By Manufacturing Technique

7. Global Radiation Hardened Electronics Market Analysis, By Solution

7.1. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Solution, 2017–2031

7.1.1. Commercial-off-the-Shelf (COTS)

7.1.2. Custom-made

7.2. Market Attractiveness Analysis, By Solution

8. Global Radiation Hardened Electronics Market Analysis, By Application

8.1. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Application, 2017–2031

8.1.1. Space

8.1.2. Aerospace & Defense

8.1.3. Nuclear Power Plant

8.1.4. Others (Research & Development, Metal & Mining, etc.)

8.2. Market Attractiveness Analysis, By Application

9. Global Radiation Hardened Electronics Market Analysis and Forecast, By Region

9.1. Radiation Hardened Electronics Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Radiation Hardened Electronics Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Radiation Hardened Electronics Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017–2031

10.3.1. Mixed Signal ICs

10.3.2. Processors & Controllers

10.3.3. Memory

10.3.4. Power Management

10.3.5. Logic

10.3.6. Others (Sensors, etc.)

10.4. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Manufacturing Technique, 2017–2031

10.4.1. Radiation Hardening by Design (RHBD)

10.4.2. Radiation Hardening by Process (RHBP)

10.4.3. Radiation Hardening by Shielding (RHBS)

10.5. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Solution, 2017–2031

10.5.1. Commercial-off-the-Shelf (COTS)

10.5.2. Custom-made

10.6. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Application, 2017–2031

10.6.1. Space

10.6.2. Aerospace & Defense

10.6.3. Nuclear Power Plant

10.6.4. Others (Research & Development, Metal & Mining, etc.)

10.7. Radiation Hardened Electronics Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Component

10.8.2. By Manufacturing Technique

10.8.3. By Solution

10.8.4. By Application

10.8.5. By Country/Sub-region

11. Europe Radiation Hardened Electronics Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Radiation Hardened Electronics Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017–2031

11.3.1. Mixed Signal ICs

11.3.2. Processors & Controllers

11.3.3. Memory

11.3.4. Power Management

11.3.5. Logic

11.3.6. Others (Sensors, etc.)

11.4. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Manufacturing Technique, 2017–2031

11.4.1. Radiation Hardening by Design (RHBD)

11.4.2. Radiation Hardening by Process (RHBP)

11.4.3. Radiation Hardening by Shielding (RHBS)

11.5. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Solution, 2017–2031

11.5.1. Commercial-off-the-Shelf (COTS)

11.5.2. Custom-made

11.6. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Application, 2017–2031

11.6.1. Space

11.6.2. Aerospace & Defense

11.6.3. Nuclear Power Plant

11.6.4. Others (Research & Development, Metal & Mining, etc.)

11.7. Radiation Hardened Electronics Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Component

11.8.2. By Manufacturing Technique

11.8.3. By Solution

11.8.4. By Application

11.8.5. By Country/Sub-region

12. Asia Pacific Radiation Hardened Electronics Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Radiation Hardened Electronics Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017–2031

12.3.1. Mixed Signal ICs

12.3.2. Processors & Controllers

12.3.3. Memory

12.3.4. Power Management

12.3.5. Logic

12.3.6. Others (Sensors, etc.)

12.4. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Manufacturing Technique, 2017–2031

12.4.1. Radiation Hardening by Design (RHBD)

12.4.2. Radiation Hardening by Process (RHBP)

12.4.3. Radiation Hardening by Shielding (RHBS)

12.5. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Solution, 2017–2031

12.5.1. Commercial-off-the-Shelf (COTS)

12.5.2. Custom-made

12.6. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Application, 2017–2031

12.6.1. Space Application

12.6.2. Aerospace & Defense

12.6.3. Nuclear Power Plant

12.6.4. Others (Research & Development, Metal & Mining, etc.)

12.7. Radiation Hardened Electronics Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Component

12.8.2. By Manufacturing Technique

12.8.3. By Solution

12.8.4. By Application

12.8.5. By Country/Sub-region

13. Middle East & Africa Radiation Hardened Electronics Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Radiation Hardened Electronics Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017–2031

13.3.1. Mixed Signal ICs

13.3.2. Processors & Controllers

13.3.3. Memory

13.3.4. Power Management

13.3.5. Logic

13.3.6. Others (Sensors, etc.)

13.4. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Manufacturing Technique, 2017–2031

13.4.1. Radiation Hardening by Design (RHBD)

13.4.2. Radiation Hardening by Process (RHBP)

13.4.3. Radiation Hardening by Shielding (RHBS)

13.5. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Solution, 2017–2031

13.5.1. Commercial-off-the-Shelf (COTS)

13.5.2. Custom-made

13.6. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Application, 2017–2031

13.6.1. Space Application

13.6.2. Aerospace & Defense

13.6.3. Nuclear Power Plant

13.6.4. Others (Research & Development, Metal & Mining, etc.)

13.7. Radiation Hardened Electronics Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Component

13.8.2. By Manufacturing Technique

13.8.3. By Solution

13.8.4. By Application

13.8.5. By Country/Sub-region

14. South America Radiation Hardened Electronics Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Radiation Hardened Electronics Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017–2031

14.3.1. Mixed Signal ICs

14.3.2. Processors & Controllers

14.3.3. Memory

14.3.4. Power Management

14.3.5. Logic

14.3.6. Others (Sensors, etc.)

14.4. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Manufacturing Technique, 2017–2031

14.4.1. Radiation Hardening by Design (RHBD)

14.4.2. Radiation Hardening by Process (RHBP)

14.4.3. Radiation Hardening by Shielding (RHBS)

14.5. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Solution, 2017–2031

14.5.1. Commercial-off-the-Shelf (COTS)

14.5.2. Custom-made

14.6. Radiation Hardened Electronics Market Value (US$ Mn) Analysis & Forecast, By Application, 2017–2031

14.6.1. Space Application

14.6.2. Aerospace & Defense

14.6.3. Nuclear Power Plant

14.6.4. Others (Research & Development, Metal & Mining, etc.)

14.7. Radiation Hardened Electronics Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Component

14.8.2. By Manufacturing Technique

14.8.3. By Solution

14.8.4. By Application

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Radiation Hardened Electronics Market Competition Matrix - a Dashboard View

15.1.1. Global Radiation Hardened Electronics Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. BAE Systems

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Cobham Advanced Electronic Solutions (CAES)

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Honeywell International Inc.

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Infineon Technologies AG

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Microchip Technology Inc.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Renesas Electronics Corporation.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Solitron Devices, Inc.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. STMicroelectronics

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Teledyne Technologies Inc.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Texas Instruments Incorporated

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. TTM Technologies Inc.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Xilinx Inc.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Component

17.1.2. By Manufacturing Technique

17.1.3. By Solution

17.1.4. By Application

17.1.5. By Region

List of Tables

Table 1: Global Radiation Hardened Electronics Market Size & Forecast, By Component, Value (US$ Mn), 2017-2031

Table 2: Global Radiation Hardened Electronics Market Size & Forecast, By Component, Volume (Million Units), 2017-2031

Table 3: Global Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Value (US$ Mn), 2017-2031

Table 4: Global Radiation Hardened Electronics Market Size & Forecast, By Solution, Value (US$ Mn), 2017-2031

Table 5: Global Radiation Hardened Electronics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 6: Global Radiation Hardened Electronics Market Size & Forecast, By Region, Value (US$ Mn), 2017-2031

Table 7: Global Radiation Hardened Electronics Market Size & Forecast, By Region, Volume (Million Units), 2017-2031

Table 8: North America Radiation Hardened Electronics Market Size & Forecast, By Component, Value (US$ Mn), 2017-2031

Table 9: North America Radiation Hardened Electronics Market Size & Forecast, By Component, Volume (Million Units), 2017-2031

Table 10: North America Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Value (US$ Mn), 2017-2031

Table 11: North America Radiation Hardened Electronics Market Size & Forecast, By Solution, Value (US$ Mn), 2017-2031

Table 12: North America Radiation Hardened Electronics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 13: North America Radiation Hardened Electronics Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 14: North America Radiation Hardened Electronics Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 15: Europe Radiation Hardened Electronics Market Size & Forecast, By Component, Value (US$ Mn), 2017-2031

Table 16: Europe Radiation Hardened Electronics Market Size & Forecast, By Component, Volume (Million Units), 2017-2031

Table 17: Europe Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Value (US$ Mn), 2017-2031

Table 18: Europe Radiation Hardened Electronics Market Size & Forecast, By Solution, Value (US$ Mn), 2017-2031

Table 19: Europe Radiation Hardened Electronics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 20: Europe Radiation Hardened Electronics Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 21: Europe Radiation Hardened Electronics Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 22: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Component, Value (US$ Mn), 2017-2031

Table 23: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Component, Volume (Million Units), 2017-2031

Table 24: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Value (US$ Mn), 2017-2031

Table 25: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Solution, Value (US$ Mn), 2017-2031

Table 26: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 27: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 28: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 29: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Component, Value (US$ Mn), 2017-2031

Table 30: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Component, Volume (Million Units), 2017-2031

Table 31: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Value (US$ Mn), 2017-2031

Table 32: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Solution, Value (US$ Mn), 2017-2031

Table 33: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 34: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 35: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 36: South America Radiation Hardened Electronics Market Size & Forecast, By Component, Value (US$ Mn), 2017-2031

Table 37: South America Radiation Hardened Electronics Market Size & Forecast, By Component, Volume (Million Units), 2017-2031

Table 38: South America Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Value (US$ Mn), 2017-2031

Table 39: South America Radiation Hardened Electronics Market Size & Forecast, By Solution, Value (US$ Mn), 2017-2031

Table 40: South America Radiation Hardened Electronics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 41: South America Radiation Hardened Electronics Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 42: South America Radiation Hardened Electronics Market Size & Forecast, By Country Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Radiation Hardened Electronics Market Share Analysis, by Region

Figure 02:Global Radiation Hardened Electronics Market Price Trend Analysis (Average Price, Thousand US$)

Figure 03: Global Radiation Hardened Electronics Market, Value (US$ Mn), 2017-2031

Figure 04: Global Radiation Hardened Electronics Market, Volume (Million Units), 2017-2031

Figure 05: Global Radiation Hardened Electronics Market Size & Forecast, By Component, Revenue (US$ Mn), 2017-2031

Figure 06: Global Radiation Hardened Electronics Market Share Analysis, by Component, 2023 and 2031

Figure 07: Global Radiation Hardened Electronics Market Attractiveness, By Component, Value (US$ Mn), 2023-2031

Figure 08: Global Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Revenue (US$ Mn), 2017-2031

Figure 09: Global Radiation Hardened Electronics Market Share Analysis, by Manufacturing Technique, 2023 and 2031

Figure 10: Global Radiation Hardened Electronics Market Attractiveness, By Manufacturing Technique, Value (US$ Mn), 2023-2031

Figure 11: Global Radiation Hardened Electronics Market Size & Forecast, By Solution, Revenue (US$ Mn), 2017-2031

Figure 12: Global Radiation Hardened Electronics Market Share Analysis, by Solution, 2023 and 2031

Figure 13: Global Radiation Hardened Electronics Market Attractiveness, By Solution, Value (US$ Mn), 2023-2031

Figure 14: Global Radiation Hardened Electronics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 15: Global Radiation Hardened Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 16: Global Radiation Hardened Electronics Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 17: Global Radiation Hardened Electronics Market Size & Forecast, By Region, Revenue (US$ Mn), 2017-2031

Figure 18: Global Radiation Hardened Electronics Market Share Analysis, by Region, 2023 and 2031

Figure 19: Global Radiation Hardened Electronics Market Attractiveness, By Region, Value (US$ Mn), 2023-2031

Figure 20: North America Radiation Hardened Electronics Market Size & Forecast, By Component, Revenue (US$ Mn), 2017-2031

Figure 21: North America Radiation Hardened Electronics Market Share Analysis, by Component, 2023 and 2031

Figure 22: North America Radiation Hardened Electronics Market Attractiveness, By Component, Value (US$ Mn), 2023-2031

Figure 23: North America Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Revenue (US$ Mn), 2017-2031

Figure 24: North America Radiation Hardened Electronics Market Share Analysis, by Manufacturing Technique, 2023 and 2031

Figure 25: North America Radiation Hardened Electronics Market Attractiveness, By Manufacturing Technique, Value (US$ Mn), 2023-2031

Figure 26: North America Radiation Hardened Electronics Market Size & Forecast, By Solution, Revenue (US$ Mn), 2017-2031

Figure 27: North America Radiation Hardened Electronics Market Share Analysis, by Solution, 2023 and 2031

Figure 28: North America Radiation Hardened Electronics Market Attractiveness, By Solution, Value (US$ Mn), 2023-2031

Figure 29: North America Radiation Hardened Electronics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 30: North America Radiation Hardened Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 31: North America Radiation Hardened Electronics Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 32: North America Radiation Hardened Electronics Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 33: North America Radiation Hardened Electronics Market Share Analysis, by Country 2023 and 2031

Figure 34: North America Radiation Hardened Electronics Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 35: Europe Radiation Hardened Electronics Market Size & Forecast, By Component, Revenue (US$ Mn), 2017-2031

Figure 36: Europe Radiation Hardened Electronics Market Share Analysis, by Component, 2023 and 2031

Figure 37: Europe Radiation Hardened Electronics Market Attractiveness, By Component, Value (US$ Mn), 2023-2031

Figure 38: Europe Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Revenue (US$ Mn), 2017-2031

Figure 39: Europe Radiation Hardened Electronics Market Share Analysis, by Manufacturing Technique, 2023 and 2031

Figure 40: Europe Radiation Hardened Electronics Market Attractiveness, By Manufacturing Technique, Value (US$ Mn), 2023-2031

Figure 41: Europe Radiation Hardened Electronics Market Size & Forecast, By Solution, Revenue (US$ Mn), 2017-2031

Figure 42: Europe Radiation Hardened Electronics Market Share Analysis, by Solution, 2023 and 2031

Figure 43: Europe Radiation Hardened Electronics Market Attractiveness, By Solution, Value (US$ Mn), 2023-2031

Figure 44: Europe Radiation Hardened Electronics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 45: Europe Radiation Hardened Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 46: Europe Radiation Hardened Electronics Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 47: Europe Radiation Hardened Electronics Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 48: Europe Radiation Hardened Electronics Market Share Analysis, by Country 2023 and 2031

Figure 49: Europe Radiation Hardened Electronics Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 50: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Component, Revenue (US$ Mn), 2017-2031

Figure 51: Asia Pacific Radiation Hardened Electronics Market Share Analysis, by Component, 2023 and 2031

Figure 52: Asia Pacific Radiation Hardened Electronics Market Attractiveness, By Component, Value (US$ Mn), 2023-2031

Figure 53: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Revenue (US$ Mn), 2017-2031

Figure 54: Asia Pacific Radiation Hardened Electronics Market Share Analysis, by Manufacturing Technique, 2023 and 2031

Figure 55: Asia Pacific Radiation Hardened Electronics Market Attractiveness, By Manufacturing Technique, Value (US$ Mn), 2023-2031

Figure 56: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Solution, Revenue (US$ Mn), 2017-2031

Figure 57: Asia Pacific Radiation Hardened Electronics Market Share Analysis, by Solution, 2023 and 2031

Figure 58: Asia Pacific Radiation Hardened Electronics Market Attractiveness, By Solution, Value (US$ Mn), 2023-2031

Figure 59: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 60: Asia Pacific Radiation Hardened Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 61: Asia Pacific Radiation Hardened Electronics Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 62: Asia Pacific Radiation Hardened Electronics Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 63: Asia Pacific Radiation Hardened Electronics Market Share Analysis, by Country 2023 and 2031

Figure 64: Asia Pacific Radiation Hardened Electronics Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 65: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Component, Revenue (US$ Mn), 2017-2031

Figure 66: Middle East & Africa Radiation Hardened Electronics Market Share Analysis, by Component, 2023 and 2031

Figure 67: Middle East & Africa Radiation Hardened Electronics Market Attractiveness, By Component, Value (US$ Mn), 2023-2031

Figure 68: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Revenue (US$ Mn), 2017-2031

Figure 69: Middle East & Africa Radiation Hardened Electronics Market Share Analysis, by Manufacturing Technique, 2023 and 2031

Figure 70: Middle East & Africa Radiation Hardened Electronics Market Attractiveness, By Manufacturing Technique, Value (US$ Mn), 2023-2031

Figure 71: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Solution, Revenue (US$ Mn), 2017-2031

Figure 72: Middle East & Africa Radiation Hardened Electronics Market Share Analysis, by Solution, 2023 and 2031

Figure 73: Middle East & Africa Radiation Hardened Electronics Market Attractiveness, By Solution, Value (US$ Mn), 2023-2031

Figure 74: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 75: Middle East & Africa Radiation Hardened Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 76: Middle East & Africa Radiation Hardened Electronics Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 77: Middle East & Africa Radiation Hardened Electronics Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 78: Middle East & Africa Radiation Hardened Electronics Market Share Analysis, by Country 2023 and 2031

Figure 79: Middle East & Africa Radiation Hardened Electronics Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 80: South America Radiation Hardened Electronics Market Size & Forecast, By Component, Revenue (US$ Mn), 2017-2031

Figure 81: South America Radiation Hardened Electronics Market Share Analysis, by Component, 2023 and 2031

Figure 82: South America Radiation Hardened Electronics Market Attractiveness, By Component, Value (US$ Mn), 2023-2031

Figure 83: South America Radiation Hardened Electronics Market Size & Forecast, By Manufacturing Technique, Revenue (US$ Mn), 2017-2031

Figure 84: South America Radiation Hardened Electronics Market Share Analysis, by Manufacturing Technique, 2023 and 2031

Figure 85: South America Radiation Hardened Electronics Market Attractiveness, By Manufacturing Technique, Value (US$ Mn), 2023-2031

Figure 86: South America Radiation Hardened Electronics Market Size & Forecast, By Solution, Revenue (US$ Mn), 2017-2031

Figure 87: South America Radiation Hardened Electronics Market Share Analysis, by Solution, 2023 and 2031

Figure 88: South America Radiation Hardened Electronics Market Attractiveness, By Solution, Value (US$ Mn), 2023-2031

Figure 89: South America Radiation Hardened Electronics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 90: South America Radiation Hardened Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 91: South America Radiation Hardened Electronics Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 92: South America Radiation Hardened Electronics Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 93: South America Radiation Hardened Electronics Market Share Analysis, by Country 2023 and 2031

Figure 94: South America Radiation Hardened Electronics Market Attractiveness, By Country Value (US$ Mn), 2023-2031