Reports

Reports

Quantum dots are semiconducting nanoparticles that range from 1nm to 10nm diameter in size and demonstrate quantum mechanical properties. The peculiarity of quantum dots is that they have ability to unite their semiconductor properties with those of nanomaterials. In addition, tunable nanocrystal size and superior optical properties have made quantum dots attractive semiconducting material for variety of applications in the field of healthcare, optoelectronics, solar energy, and security among others.

Growing demand for energy efficient displays coupled with regulated demand from the healthcare sector are the major factors driving this market in the current scenario. In addition, superior optical properties exhibited by quantum dots in terms of quantum yield, energy efficiency, optical stability and emission control have collectively fuelled market momentum, especially in optoelectronics and solar energy segment. Thus, use of quantum dots for producing energy efficient displays as well as VLSI (Very Large Scale Integration) design offers sound opportunity for the growth in the coming years.

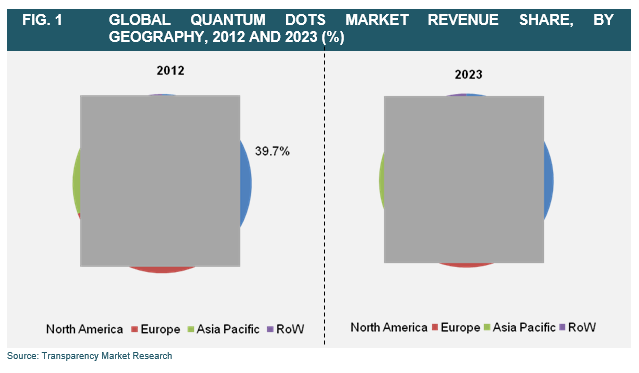

North America accounted for the largest market share in 2012, which is expected to lure heavy investment and at the same time high end research is expected to be carried out in the field of quantum dots. In addition, growing demand from optoelectronics segment and regulated demand from healthcare sector in the region has ensured its dominance. The Asia Pacific quantum dots market was valued at USD 22.4 million in 2012, and is expected to be the fastest growing quantum dots market in the coming years. Surging demand from optoelectronics and solar energy applications is the key growth factor for this geography.

Healthcare segment represented the largest quantum dots application segment in 2012. However, optoelectronics segment is expected to exhibit the fastest growth over the forecast period from 2013 to 2023. Their unique optical properties such as high quantum yield, emission tenability, narrow emission band, and optical stability make quantum dots preferred materials for display and lighting solutions. In terms of products, QD medical device was the largest product segment in 2012 owing to dominant healthcare applications. However, with exponential growth forecast in optoelectronics segment, QD LED displays and QD lighting solutions are expected to grow at the fastest growth rate. In 2012, cadmium selenium (CdSe) was the most preferred ram material used in quantum dots. However, with restrictions on the use of cadmium getting more stringent, the use of cadmium free (non-toxic) quantum dots is expected to swell in the coming years.

Major industry participants include Life Technologies Corporation (U.S.), QD Vision, Inc. (U.S.), Nanosys, Inc. (U.S.), Nanoco Technologies Ltd (U.K.), Ocean NanoTech LLC (U.S), QD Laser, Inc. (Japan), and Quantum Material Corporation (U.S.) among others.

Chapter 1 Preface

1.1 Report description

1.2 Market segmentation

1.4 Research methodology

Chapter 2 Executive Summary

Chapter 3 Quantum Dots Market Overview

3.1 Introduction

3.2 Trends and future outlook

3.3 Market dynamics

3.3.1 Drivers

3.3.1.1 Energy efficient technology

3.3.1.2 Growing demand for energy efficient displays and lighting applications

3.3.1.3 Regulated demand from healthcare segment

3.3.1.4 Miniaturization property

3.3.2 Restraints

3.3.2.1 Volume manufacturing problems and investments in competing technologies

3.3.2.2 Toxicity and restricted use of heavy materials

3.3.3 Opportunities

3.3.3.1 Penetration in optoelectronics and solar energy segments

3.3.3.1.1 Optoelectronics

3.3.3.1.2 Solar energy

3.3.3.2 Increasing scope in VLSI designs

3.4 Value chain analysis

3.5 Porters five force analysis

3.5.1 Bargaining power of suppliers

3.5.2 Bargaining power of buyers

3.5.3 Threat of substitute products

3.5.5 Degree of competition

3.6 Market share analysis, 2012

3.7 Market attractiveness analysis by end-use, 2012

Chapter 4 QD Technology: Assembly & Fabrication Analysis

4.1 Introduction

4.2 Types of fabrication techniques

4.2.1 Lithography

4.2.1.1 Electron beam lithography

4.2.1.2 Soft lithography

4.2.1.3 Stencil lithography

4.2.2 Colloidal synthesis

4.2.3 Epitaxy

4.2.4 Others

4.2.4.1 Viral assembly

4.2.4.2 Nanolithography

4.2.4.3 Electrochemical assembly

4.3 Bulk manufacture

Chapter 5 Global Quantum Dots Market, by Application

5.1 Introduction

5.1.1 Quantum dots market, by application 2012 & 2023 (%)

5.2 Healthcare

5.2.1 Healthcare quantum dots market size and forecast, 2011 - 2023 (USD million)

5.2.1.1 Flow cytometry

5.2.1.2 Biomedical imaging (in-vivo, in-vitro, tissue mapping, and so on)

5.2.1.3 Drug delivery

5.2.1.4 Cell tracking

5.2.1.5 Photodynamic therapy

5.3 Optoelectronics

5.3.1 Optoelectronics quantum dots market size and forecast, 2011 - 2023 (USD million)

5.4 Energy

5.4.1 Energy quantum dots market size and forecast, 2011 - 2023 (USD million)

5.5 Quantum computing

5.5.1 Quantum computing quantum dots market size and forecast, 2011 - 2023 (USD million)

5.6 Quantum optics

5.6.1 Quantum optics quantum dots market size and forecast, 2011 - 2023 (USD million)

5.7 Security and surveillance

5.7.1 Security and Surveillance quantum dots Market, 2011 - 2023 (USD million)

Chapter 6 Global Quantum Dots Market, By Products

6.1 Introduction

6.2 QD medical devices

6.2.1 QD medical devices market size and forecast, 2011 - 2023 (USD million)

6.3 QD lasers

6.3.1 QD laser market size and forecast, 2011 - 2023 (USD million)

6.4 QD sensors

6.4.1 QD sensors market size and forecast, 2011 - 2023 (USD million)

6.5 QD chips

6.5.1 QD chips market size and forecast, 2011 - 2023 (USD million)

6.6 QD lighting devices

6.6.1 QD lighting devices market size and forecast, 2011 - 2023 (USD million)

6.7 QD LED display

6.7.1 QD LED display market size and forecast, 2011 - 2023 (USD million)

6.8 QD solar cells

6.8.1 QD solar cell market size and forecast, 2011 - 2023 (USD million)

Chapter 7 Global Quantum Dots Market, by Raw Materials

7.1 Introduction

7.1.1 Quantum dots market, by raw materials 2012 & 2023 (%)

7.2 Cadmium selenium (CdSe)

7.2.1 Cadmium selenium quantum dots market size and forecast, 2011 - 2023 (USD million)

7.3 Cadmium tellurium

7.3.1 Cadmium tellurium quantum dots market size and forecast, 2011 - 2023 (USD million)

7.4 Non-toxic raw materials (Cadmium free)

7.4.1 Non-toxic (cadmium free) quantum dots market size and forecast, 2011 - 2023 (USD million)

7.5 Others

7.5.1 Others (InAs, InP, PbS, etc.) quantum dots market size and forecast, 2011 - 2023 (USD million)

Chapter 8 Global Quantum Dots Market, by Geography

8.1 Introduction

8.2 North America

8.2.1 North America quantum dots market size and forecast, 2011 - 2023 (USD million) (million grams)

8.2.2 North America quantum dots market, by application, 2012 – 2023 (USD million)

8.2.3 North America quantum dots market, by products, 2012 – 2023 (USD million)

8.2.4 North America quantum dots market, by raw materials, 2012 – 2023 (USD million)

8.3 Europe

8.3.1 Europe quantum dots Market, 2011 - 2023 (USD million) (million grams)

8.3.2 Europe quantum dots market, by application, 2012 – 2023 (USD Million)

8.3.3 Europe quantum dots market, by products, 2012 – 2023 (USD Million)

8.3.4 Europe quantum dots market, by raw materials, 2012 – 2023 (USD Million)

8.4 Asia Pacific

8.4.1 Asia Pacific quantum dots market, 2011 - 2023 (USD million) (million grams)

8.4.2 Asia-Pacific quantum dots market, by application, 2012 – 2023 (USD Million)

8.4.3 Asia Pacific quantum dots market, by products, 2012 – 2023 (USD million)

8.4.4 Asia Pacific quantum dots market, by raw materials, 2012 – 2023 (USD million)

8.5 RoW

8.5.1 RoW quantum dots market, 2011 - 2023 (USD million)(Million grams)

8.5.2 RoW quantum dots market, by application, 2012 – 2023 (USD million)

8.5.3 RoW quantum dots market, by products, 2012 – 2023 (USD million)

8.5.4 RoW quantum dots market, by raw materials, 2012 – 2023 (USD million)

Chapter 9 Company Profiles

9.1 Life Technologies Corporation

9.1.1 Company overview

9.1.2 Financial Overview

9.1.3 Business strategies

9.1.3.1 Research and development

9.1.3.2 Mergers and acquisitions

9.1.4 Recent developments

9.2 QD Vision, Inc.

9.2.1 Company overview

9.2.2 Financial overview

9.2.3 Business strategies

9.2.4 Recent developments

9.3 Nanosys, Inc.

9.3.1 Company overview

9.3.2 Financial overview

9.3.3 Business strategies

9.3.3.1 Inorganic expansion

9.3.4 Recent developments

9.4 Nanoco Technologies Ltd.

9.4.1 Company overview

9.4.2 Financial overview

9.4.3 Business strategy

9.4.3.1 Use of Cadmium-Free quantum dots

9.4.3.2 Expansion through mergers and licensing

9.4.4 Recent Developments

9.5 QD Laser, Inc.

9.5.1 Company overview

9.5.2 Financial overview

9.5.3 Business strategy

9.5.3.1 Strengthening of product portfolio leading to penetration in different markets

9.5.3.2 Reinforcing technology development

9.5.4 Recent developments

9.6 Ocean NanoTech LLC

9.6.1 Company overview

9.6.2 Financial overview

9.6.3 Business strategy

9.6.3.1 New product development

9.6.3.2 Focus of research and development

9.6.4 Recent Developments

9.7 Evident Technologies, Inc.

9.7.1 Company overview

9.7.2 Financial overview

9.7.3 Business strategy

9.7.4 Recent Developments

9.8 NanoAxis LLC

9.8.1 Company overview

9.8.2 Financial overview

9.8.3 Business strategy

9.8.3.1 Business expansion by partnerships and joint ventures:

9.8.3.2 Cost effective production:

9.8.4 Recent developments

9.9 LG Display Co. Ltd.

9.9.1 Company overview

9.9.2 Financial overview

9.9.3 Business strategy

9.9.3.1 Product differentiation

9.9.3.2 Focus on futuristic technologies

9.9.4 Recent developments

9.10 Samsung Electronics Co. Ltd.

9.10.1 Company overview

9.10.2 Financial overview

9.10.3 Business strategies

9.10.3.1 Inorganic expansion

9.10.3.2 Focus on research and development

9.10.4 Recent developments

9.11 Quantum Materials Corporation

9.11.1 Company overview

9.11.2 Business strategies

9.11.2.1 Scale up quantum dot production

9.11.2.2 Focus on technological advanced products

9.11.2.3 Focus on research and development

9.11.3 Recent developments

9.12 InVisage Technologies, Inc.

9.12.1 Company overview

9.12.2 Financial overview

9.12.3 Business strategies

9.12.4 Recent developments

9.13 NN-Labs, LLC

9.13.1 Company overview

9.13.2 Financial overview

9.13.3 Business strategies

9.13.3.1 Strategic alliance and scaling-up production

9.13.4 Recent developments

List of Tables

TABLE 1 Snapshot: Global quantum dots market

TABLE 2 Impact analysis of drivers

TABLE 3 Impact analysis of restraints

TABLE 4 Global quantum dots market, by products, 2012 and 2023 (USD million and % share)

TABLE 5 Comparison between conventional quantum dots and non toxic (phosphor) quantum dots

TABLE 6 North America quantum dots market, by application, 2012 – 2023 (USD million)

TABLE 7 North America quantum dots market, by products, 2012 – 2023 (USD million)

TABLE 8 North America quantum dots market, by raw materials, 2012 – 2023 (USD million)

TABLE 9 Europe quantum dots market, by application, 2012 – 2023 (USD Million)

TABLE 10 Europe quantum dots market, by products, 2012 – 2023 (USD Million)

TABLE 11 Europe quantum dots market, by raw materials, 2012 – 2023 (USD Million)

TABLE 12 Asia-Pacific quantum dots market, by application, 2012 – 2023 (USD million)

TABLE 13 Asia Pacific quantum dots market, by products, 2012 – 2023 (USD million)

TABLE 14 Asia Pacific quantum dots market, by raw materials, 2012 – 2023 (USD million)

TABLE 15 RoW quantum dots market, by application, 2012 – 2023 (USD million)

TABLE 16 RoW quantum dots market, by products, 2012 – 2023 (USD million)

TABLE 17 RoW quantum dots market, by raw materials, 2012 – 2023 (USD million)

List of Figures

FIG. 1 Market segmentation: Global market

FIG. 2 Global quantum dots market, 2011 – 2023 (USD million) (million grams)

FIG. 3 Value Chain Analysis

FIG. 1 Quantum Dots: Porters five forces analysis

FIG. 2 Market share analysis, by key players 2012 (%)

FIG. 3 Market attractiveness analysis, by end use 2012

FIG. 4 Major quantum dots fabrication techniques

FIG. 5 Quantum dots market, by application 2012 & 2023 (%)

FIG. 6 Healthcare quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 7 Optoelectronics quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 8 Energy quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 9 Quantum computing quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 10 Quantum optics quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 11 Security and surveillance quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 12 QD medical devices market size and forecast, 2011 - 2023 (USD million)

FIG. 13 QD laser market size and forecast, 2011 - 2023 (USD million)

FIG. 14 QD sensors market size and forecast, 2011 - 2023 (USD million)

FIG. 15 QD chips market size and forecast, 2011 - 2023 (USD million)

FIG. 16 QD lighting devices market size and forecast, 2011 - 2023 (USD million)

FIG. 17 QD LED display market size and forecast, 2011 - 2023 (USD million)

FIG. 18 QD solar cell market size and forecast, 2011 - 2023 (USD million)

FIG. 19 Quantum dots market, by raw materials 2012 & 2023 (%)

FIG. 20 Cadmium selenium quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 21 Cadmium tellurium quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 22 Non-toxic (cadmium free) quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 23 Others (InAs, InP, PbS, etc.) quantum dots market size and forecast, 2011 - 2023 (USD million)

FIG. 24 Quantum dots market, by geography 2012 & 2023 (%)

FIG. 25 North America quantum dots market size and forecast, 2011 - 2023 (USD million) (million grams)

FIG. 26 Europe quantum dots market, 2011 - 2023 (USD million) (Million grams)

FIG. 27 Asia Pacific quantum dots market, 2011 - 2023 (USD million) (Million grams)

FIG. 28 RoW quantum dots market, 2011 - 2023 (USD million) (million grams)

FIG. 29 Life Technologies Corporation annual revenue, 2010 – 2012 (USD million)

FIG. 30 QD Vision, Inc. annual revenue, 2012 – 2013 (USD million)

FIG. 31 Nanoco Technologies Ltd. revenue, 2010 – 2012 (USD million)

FIG. 32 LG Display Co. Ltd. Revenue (USD billion)

FIG. 33 Samsung Electronics Co. Ltd. annual revenue, 2010 – 2012 (USD billion)