Reports

Reports

Analysts’ Viewpoint on Propane Market Scenario

Propane is primarily a byproduct obtained after the processing of domestic natural gas. The usage of propane helps reduce the emission of greenhouse gases such as carbon dioxide and air pollutants such as carbon monoxide and nitrogen oxide. Therefore, demand for propane gas is rising across the globe. Consumption of propane for residential heating and cooking purposes is also rising globally. Furthermore, substitution of fuels such as gasoline and fuel oil with propane is a cost-effective and viable step toward cleaner air. In chemical & refinery applications, propane is used an essential feedstock to manufacture various materials and compounds, especially plastic raw material. Increase in R&D activities in plastic, recycling, and petrochemical industries is expected to provide lucrative opportunities for market players.

Propane is a compressed liquid petroleum gas that is kept in liquid form for storage. The gas has no poisonous properties and is colorless. Propane is odorless; however, a distinguishing odor is purposefully provided to aid in detection in the event of a release or leak from a pressurized container. Propane is a byproduct obtained from the processing of crude oil, natural gas, and petroleum. The group of liquid petroleum gases, which also contains butane, propylene, isobutylene, butadiene, butylene, and various other hydrocarbon gases, includes propane as one of its members. Propane is extensively used across the globe. It is used in its purest form, devoid of any other gases, in select countries, including the U.S., Canada, Australia, and a few provinces in China.

Liquefied Petroleum Gas (LPG) is a mixture of flammable hydrocarbon gases, including propane, which is commonly used as fuel. Propane is one of the major constituents of LPG. It contributes to around 100% content of LPG in several countries. Rise in global population and sharp increase in disposable income, particularly in developing countries, such as India, are key factors that are boosting the demand for LPG for home energy needs. LPG is a contemporary energy source with little effect on the environment. It is employed in diverse applications, including agriculture, power generation, heating, cooking, and recreation. Increase in extraction of shale gas has augmented the supply of LPG.

Initiatives by international and local bodies to encourage end-users to switch from conventional energy sources to clean energy sources have boosted the global consumption of LPG. Thus, increase in consumption of LPG in domestic applications is projected to drive the demand for propane across the globe during the forecast period.

Conventional fuels, such as diesel and petrol, produce high amounts of carbon dioxide on combustion. This increases the overall carbon footprint. However, propane is moderately cleaner and produces less COx and SOx. Propane has 85% lesser volatile organic content than diesel. Thus, on combustion, it produces 70% lesser COx and NOx by-products as compared to conventional fuels. Government agencies are implementing regulations and legislations for the adoption of less COx and NOx emitting fuels. Rise in fuel prices and depletion of natural resources are driving the demand for cleaner and green fuels. Propane engines emit 12% less CO2 emissions, 20% less NOX emissions, and 60% less CO emissions than petrol engines. Furthermore, propane produces 80% less smog-producing hydrocarbon emissions than diesel engines. LNG offers attractive advantages over crude oil in terms of its price, energy content (energy per unit mass), and environmental footprint. This is expected to drive the demand for propane.

Thus, consumption of propane as a fuel is rising as compared to oil, owing to the former’s clean form of existence. Crude oil, even after several rounds of processing, has not been able to match up with the cleanliness of propane gas. Propane has become the primary fuel due to its major applications in transportation and industrial activities.

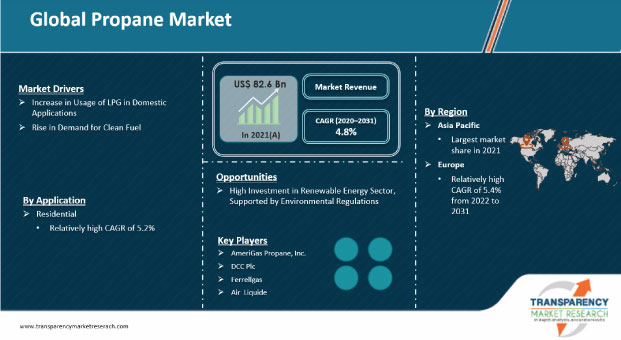

In terms of application, the residential segment held major share of 46.4% of the global propane market in 2021. It is expected to grow at a CAGR of more than 5.2% during the forecast period. Residential applications of propane include space heating, cooking, and burning. Propane is widely used in water heating applications and several other applications in various countries. This is likely to augment the demand for propane in the next few years.

The industrial segment accounted for 18.7% share of the global propane market in 2021. The segment is expected to be highly attractive, after the residential segment, during the forecast period. Propane is largely used in several industries such as glass, metal, plastics, and recycling. Rapid industrialization is projected to bolster the global propane market during the forecast period.

In terms of value, Asia Pacific held major share of 50.1% of the global propane market in 2021. It is one of the fastest growing markets for propane. The market in the region is estimated to grow at a CAGR of 4.4% during the forecast period. Increase in demand for cooking gas in Asia Pacific is a key factor driving the propane market in the region. Rise in population and implementation of cooking gas subsidy in countries such as India are key factors propelling the demand for propane in Asia Pacific. Increase in demand for automotive vehicles is also fuelling the demand for propane in the region.

Europe is one of the leading regions of the global propane market, owing to the presence of well-established economies and rise in commercial and industrial usage of propane in the region. North America is a mature market for propane. It one of the leading producers of propane gas across the world. Growth in usage of heating appliances and burning stoves is a key factor propelling the market in North America.

The global propane market is consolidated, with a few number of large-scale vendors controlling a majority of the share. Most of the firms are spending significantly on comprehensive research and development activities, primarily to develop their infrastructure and operations. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. AmeriGas Propane, Inc., DCC Plc, China Petroleum & Chemical Corporation (SINOPEC), Ferrell Gas, Saudi Arabian Oil co., Gazprom, Air Liquid, GAIL (India) Limited, Indian oil corporation Ltd, Suburban Propane, L.P., Lykins Energy solutions, Marsh L.P. Gas Co. Inc., Sparlings, and Thompson Gas are the prominent entities operating in the market.

Each of these players has been profiled based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments in the propane market.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 82.6 Bn |

| Market Forecast Value in 2031 | US$ 132.1 Bn |

| Growth Rate (CAGR) | 4.8% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2020 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The propane market stood at US$ 82.6 Bn in 2021

The market is expected to grow at a CAGR of 4.8% from 2022 to 2031

Increase in usage of LPG in domestic applications and rise in demand for clean fuel are key factors driving the propane market

Residential was the largest application segment that held 46.4% share in 2021

Asia Pacific was the most lucrative region of the global propane market in 2021

AmeriGas Propane, Inc., DCC Plc, China Petroleum & Chemical Corporation (SINOPEC), Ferrell Gas, Saudi Arabian Oil co., Gazprom, Air Liquid, GAIL (India) Limited, Indian Oil Corporation Ltd, and Suburban Propane, L.P.

1. Executive Summary

1.1. Propane Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. Impact of Current Geopolitical Scenario

5. Global Propane Market Analysis and Forecast, by Application, 2020-2031

5.1. Introduction and Definitions

5.2. Global Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

5.2.1. Residential

5.2.2. Commercial

5.2.3. Chemical & Refinery

5.2.4. Industrial

5.2.5. Transportation

5.2.6. Agriculture

5.3. Global Propane Market Attractiveness, by Application

6. Global Propane Market Analysis and Forecast, by Region, 2020-2031

6.1. Key Findings

6.2. Global Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2020-2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East & Africa

6.3. Global Propane Market Attractiveness, by Region

7. North America Propane Market Analysis and Forecast, 2020-2031

7.1. Key Findings

7.2. North America Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

7.3. North America Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2020-2031

7.3.1. U.S. Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

7.3.2. Canada Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

7.4. North America Propane Market Attractiveness Analysis

8. Europe Propane Market Analysis and Forecast, 2020-2031

8.1. Key Findings

8.2. Europe Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

8.3. Europe Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

8.3.1. Germany Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

8.3.2. France Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

8.3.3. U.K. Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

8.3.4. Italy Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

8.3.5. Spain Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

8.3.6. Russia & CIS Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

8.3.7. Rest of Europe Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

8.4. Europe Propane Market Attractiveness Analysis

9. Asia Pacific Propane Market Analysis and Forecast, 2020-2031

9.1. Key Findings

9.2. Asia Pacific Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

9.3. Asia Pacific Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

9.3.1. China Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

9.3.2. Japan Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

9.3.3. India Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

9.3.4. ASEAN Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

9.3.5. Rest of Asia Pacific Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

9.4. Asia Pacific Propane Market Attractiveness Analysis

10. Latin America Propane Market Analysis and Forecast, 2020-2031

10.1. Key Findings

10.2. Latin America Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

10.3. Latin America Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

10.3.1. Brazil Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

10.3.2. Mexico Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

10.3.3. Rest of Latin America Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

10.4. Latin America Propane Market Attractiveness Analysis

11. Middle East & Africa Propane Market Analysis and Forecast, 2020-2031

11.1. Key Findings

11.2. Middle East & Africa Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

11.3. Middle East & Africa Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

11.3.1. GCC Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

11.3.2. South Africa Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

11.3.3. Rest of Middle East & Africa Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2020-2031

11.4. Middle East & Africa Propane Market Attractiveness Analysis

12. Competition Landscape

12.1. Global Propane Company Market Share Analysis, 2021

12.2. Competition Matrix

12.3. Market Footprint Analysis

12.3.1. By Application

12.4. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

12.4.1. AmeriGas Propane, Inc.

12.4.1.1. Company Description

12.4.1.2. Business Overview

12.4.1.3. Financial Details

12.4.1.4. Strategic Overview

12.4.2. DCC Plc

12.4.2.1. Company Description

12.4.2.2. Business Overview

12.4.2.3. Financial Details

12.4.2.4. Strategic Overview

12.4.3. China Petroleum & Chemical Corporation (SINOPEC)

12.4.3.1. Company Description

12.4.3.2. Business Overview

12.4.3.3. Financial Details

12.4.3.4. Strategic Overview

12.4.4. Ferrellgas

12.4.4.1. Company Description

12.4.4.2. Business Overview

12.4.4.3. Financial Details

12.4.4.4. Strategic Overview

12.4.5. Saudi Arabian Oil Co

12.4.5.1. Company Description

12.4.5.2. Business Overview

12.4.5.3. Financial Details

12.4.5.4. Strategic Overview

12.4.6. Gazprom

12.4.6.1. Company Description

12.4.6.2. Business Overview

12.4.6.3. Financial Details

12.4.6.4. Strategic Overview

12.4.7. Air Liquide

12.4.7.1. Company Description

12.4.7.2. Business Overview

12.4.7.3. Financial Details

12.4.7.4. Strategic Overview

12.4.8. GAIL (India) Limited

12.4.8.1. Company Description

12.4.8.2. Business Overview

12.4.8.3. Financial Details

12.4.8.4. Strategic Overview

12.4.9. Indian Oil Corporation Ltd

12.4.9.1. Company Description

12.4.9.2. Business Overview

12.4.9.3. Financial Details

12.4.9.4. Strategic Overview

12.4.10. Suburban Propane, L.P.

12.4.10.1. Company Description

12.4.10.2. Business Overview

12.4.10.3. Financial Details

12.4.10.4. Strategic Overview

12.4.11. Lykins Energy Solutions.

12.4.11.1. Company Description

12.4.11.2. Business Overview

12.4.11.3. Financial Details

12.4.11.4. Strategic Overview

12.4.12. Marsh L.P. Gas Co. Inc.

12.4.12.1. Company Description

12.4.12.2. Business Overview

12.4.12.3. Financial Details

12.4.12.4. Strategic Overview

12.4.13. Sparlings

12.4.13.1. Company Description

12.4.13.2. Business Overview

12.4.13.3. Financial Details

12.4.13.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: Global Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 2: Global Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 3: Global Propane Market Volume (Kilo Tons) Forecast, by Region, 2020-2031

Table 4: Global Propane Market Value (US$ Bn) Forecast, by Region, 2020-2031

Table 5: North America Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 6: North America Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 7: North America Propane Market Volume (Kilo Tons) Forecast, by Country, 2020-2031

Table 8: North America Propane Market Value (US$ Bn) Forecast, by Country, 2020-2031

Table 9: U.S. Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 10: U.S. Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 11: Canada Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 12: Canada Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 13: Europe Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 14: Europe Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 15: Europe Propane Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020-2031

Table 16: Europe Propane Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 17: Germany Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 18: Germany Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 19: France Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 20: France Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 21: U.K. Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 22: U.K. Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 23: Spain Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 24: Spain Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 25: Russia & CIS Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 26: Russia & CIS Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 27: Rest of Europe Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 28: Rest of Europe Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 29: Asia Pacific Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 30: Asia Pacific Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 31: Asia Pacific Propane Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020-2031

Table 32: Asia Pacific Propane Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 33: China Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 34: China Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 35: Japan Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 36: Japan Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 37: India Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 38: India Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 39: ASEAN Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 40: ASEAN Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 41: Rest of Asia Pacific Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 42: Rest of Asia Pacific Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 43: Latin America Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 44: Latin America Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 45: Latin America Propane Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020-2031

Table 46: Latin America Propane Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 47: Brazil Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 48: Brazil Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 49: Mexico Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 50: Mexico Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 51: Rest of Latin America Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 52: Rest of Latin America Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 53: Middle East & Africa Propane Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2020-2031

Table 54: Middle East & Africa Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 55: Middle East & Africa Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 56: Middle East & Africa Propane Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020-2031

Table 57: Middle East & Africa Propane Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 58: GCC Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 59: GCC Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 60: South Africa Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 61: South Africa Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 62: Rest of Middle East & Africa Propane Market Volume (Kilo Tons) Forecast, by Application, 2020-2031

Table 63: Rest of Middle East & Africa Propane Market Value (US$ Bn) Forecast, by Application, 2020-2031

List of Figures

Figure 1: Global Propane Market Share Analysis, by Application

Figure 2: Global Propane Market Attractiveness Analysis, by Application

Figure 3: Global Propane Market Share Analysis, by Region

Figure 4: Global Propane Market Attractiveness Analysis, by Region

Figure 5: North America Propane Market Share Analysis, by Application

Figure 6: North America Propane Market Attractiveness Analysis, by Application

Figure 7: North America Propane Market Share Analysis, by Country

Figure 8: Europe Propane Market Attractiveness Analysis, by Country and Sub-region

Figure 9: Europe Propane Market Share Analysis, by Application

Figure 10: Europe Propane Market Attractiveness Analysis, by Application

Figure 11: Europe Propane Market Share Analysis, by Country and Sub-region

Figure 12: Europe Propane Market Attractiveness Analysis, by Country and Sub-region

Figure 13: Asia Pacific Propane Market Share Analysis, by Application

Figure 14: Asia Pacific Propane Market Attractiveness Analysis, by Application

Figure 15: Asia Pacific Propane Market Share Analysis, by Country and Sub-region

Figure 16: Asia Pacific Propane Market Attractiveness Analysis, by Country and Sub-region

Figure 17: Latin America Propane Market Share Analysis, by Application

Figure 18: Latin America Propane Market Attractiveness Analysis, by Application

Figure 19: Latin America Propane Market Share Analysis, by Country and Sub-region

Figure 20: Latin America Propane Market Attractiveness Analysis, by Country and Sub-region

Figure 21: Middle East & Africa Propane Market Share Analysis, by Application

Figure 22: Middle East & Africa Propane Market Attractiveness Analysis, by Application

Figure 23: Middle East & Africa Propane Market Share Analysis, by Country and Sub-region

Figure 24: Middle East & Africa Propane Market Attractiveness Analysis, by Country and Sub-region