Reports

Reports

Analyst Viewpoint

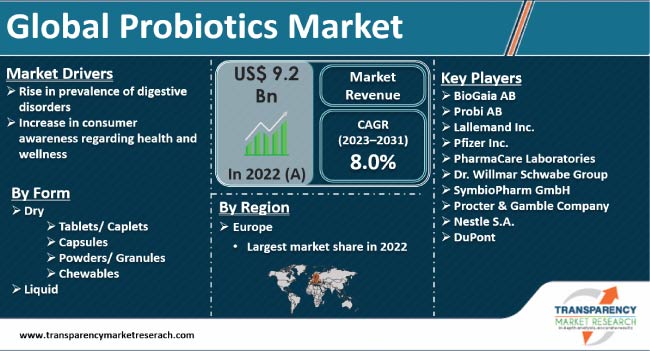

Rise in prevalence of digestive disorders and growth in geriatric population are projected to propel the probiotics market size during the forecast period. Increase in consumer awareness regarding health and wellness and surge in consumption of functional food and beverages are also boosting demand for probiotic food products.

Functional food products are gaining traction among the populace, especially post the COVID-19 pandemic. Vendors in the global probiotics industry are investing in the R&D of natural and organic products to expand their product portfolio. They are also investing in e-commerce and online retailing to increase their probiotics market share.

Probiotics are foods or supplements containing live microorganisms, usually bacteria or yeast. These microbiota supplements help maintain or improve the gut-friendly bacteria (normal microflora) in the body. Probiotics are found in various forms such as yogurt, fermented foods, and probiotic supplements. The most common types of bacteria found in probiotic products belong to the genera Lactobacillus and Bifidobacterium.

Digestive health supplements influence the immune response of the body and aid in maintaining a healthy community of microorganisms in the body. Governments in various countries across the globe regulate the production and use of probiotics. In the U.S., the FDA regulates probiotics as dietary supplements, food ingredients, or drugs, depending on the product’s intended use.

Several public and private organizations are funding research on the microbiome, which is projected to spur the probiotics market growth in the near future. Most studies are focusing on interactions between components of food and microorganisms in the digestive tract. They are also assessing the use of probiotics for weight loss and metabolism.

Probiotics have been widely used for the treatment and management of several gastrointestinal diseases. They are effective in the treatment of acute infectious diarrhea, antibiotic-associated diarrhea, and clostridium difficile-associated diarrhea. Probiotics can also be employed in the management of necrotizing enterocolitis, irritable bowel syndrome, hepatic encephalopathy, ulcerative colitis, and functional gastrointestinal disorders.

According to the World Health Organization, globally, there are nearly 1.7 billion cases of childhood diarrhoeal disease every year. Diarrhea is the third leading cause of childhood mortality in India. Probiotics, in the form of tablets and powders, play a role in the pathogenesis of many GI disorders. Thus, increase in prevalence of digestive disorders is propelling the probiotics market value.

GI disorders, such as dysphagia, dyspepsia, anorexia, constipation, and fecal incontinence, are common among elderly patients. Aging affects various gastrointestinal functions including motility, enzyme and hormone secretion, digestion, and absorption. According to the WHO, the proportion of the world's population over 60 years is expected to nearly double from 12% in 2015 to 22% in 2050. Hence, growth in geriatric population is driving the probiotics market progress.

A robust balance between bad and good bacteria helps maintain good gastronomical health. Lactobacillus acidophilus controls the population of bad bacteria that can otherwise grow in your gut due to illness or antibiotics whereas Lactobacillus fermentum strengthens the immune system. This, in turn, aids in preventing gastrointestinal and upper respiratory infections. Consumers are increasingly aware regarding health and wellness of their bodies. Thus, they are spending on various types of probiotics.

Surge in consumption of functional food and beverages is propelling the probiotics market revenue. According to Agriculture Canada, the sale of fortified/functional foods and beverages in the U.S. was valued at US$ 67.9 Bn in 2020. The demand for functional packaged food products increased significantly post the COVID-19 pandemic, with sales growing from US$ 32.3 Bn in 2016 to US$ 34.2 Bn in 2020.

According to the latest probiotics market trends, the dry form segment is expected to hold largest share from 2023 to 2031. Growth of the segment can be ascribed to the availability of several product variants and increase in product offerings in powder/granule format.

The containers packaging type segment is projected to dominate the industry during the forecast period. On the basis of distribution channel, the market is segmented into hypermarkets/ supermarkets, pharmacies/ drugstores, specialty stores, and online sales.

According to the latest probiotics market forecast, Europe is projected to hold largest share from 2023 to 2031. Rise in adoption of functional foods is propelling the market dynamics of the region. In January 2023, France allowed the use of the term ‘probiotic’ in food and food supplements. Earlier in November 2020, Spain permitted the use of the term ‘probiotic’ on labels for foods and food supplements.

Surge in launch of new functional food and beverage products is driving the probiotics market statistics in North America. According to Mintel's Global New Products Database (GNPD), there were 8,249 launches of functional food and beverage products in the U.S. from January 2016 to December 2020.

Most probiotics manufacturers are investing in the R&D of natural and organic products to cater to environmentally conscious customers. They are also investing in e-commerce and online retailing to expand their market presence.

Chr. Hansen Holding A/S, BioGaia AB, Probi AB, Nestle S.A., DuPont, The Procter & Gamble Company, ADM, Lallemand Inc., Pfizer Inc., PharmaCare Laboratories, Dr. Willmar Schwabe Group, and SymbioPharm GmbH are key entities operating in this market.

Each of these players has been profiled in the probiotics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 9.2 Bn |

| Market Forecast Value in 2031 | US$ 18.4 Bn |

| Growth Rate (CAGR) | 8.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis and regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 9.2 Bn in 2022

It is expected to be 8.0% from 2023 to 2031

Rise in prevalence of digestive disorders and growth in geriatric population

Europe accounted for major share in 2022

Chr. Hansen Holding A/S, BioGaia AB, Probi AB, Nestle S.A., DuPont, The Procter & Gamble Company, ADM, Lallemand Inc., Pfizer Inc., PharmaCare Laboratories, Dr. Willmar Schwabe Group, and SymbioPharm GmbH

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

4.3. Strategic Promotional Strategies

5. Global Probiotics Demand Analysis 2018-2022 and Forecast, 2023-2031

5.1. Historical Market Volume (Tons) Analysis, 2018-2022

5.2. Current and Future Market Volume (Tons) Projections, 2023-2031

6. Global Probiotics - Pricing Analysis

6.1. Regional Pricing Trend Analysis

6.2. Global Average Pricing Analysis Benchmark

7. Global Probiotics Demand (in Value or Size in US$ Mn) Analysis 2018-2022 and Forecast, 2023-2031

7.1. Historical Market Value (US$ Mn) Analysis, 2018-2022

7.2. Current and Future Market Value (US$ Mn) Projections, 2023-2031

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.1.1. Global GDP Growth Outlook

8.1.2. Global Industry Value Added

8.1.3. Global Urbanization Growth Outlook

8.1.4. Global Rank - Ease of Doing Business

8.1.5. Global Rank - Trading Across Borders

8.2. Global Market Outlook of Food Industry

8.3. Key Regulation

8.4. Industry Value and Supply Chain Analysis

8.4.1. Profit Margin Analysis at each point of sales

8.4.1.1. Probiotics Processors

8.4.1.2. Distributors/Suppliers/Wholesalers

8.4.1.3. Traders/Retailers

8.4.1.4. End-Users

8.5. Market Dynamics

8.5.1. Drivers

8.5.2. Restraints

8.5.3. Opportunity Analysis

8.6. Forecast Factors - Relevance & Impact

9. Global Probiotics Analysis 2018-2022 and Forecast 2023-2031, By Form

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Mn) and Volume Analysis By Form, 2018-2022

9.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Form, 2023-2031

9.3.1. Dry

9.3.1.1. Tablets/ Caplets

9.3.1.2. Capsules

9.3.1.3. Powder/ Granules

9.3.1.4. Chewables

9.3.2. Liquid

9.4. Market Attractiveness Analysis By Form

10. Global Probiotics Analysis 2018-2022 and Forecast 2023-2031, By Packaging Type

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume Analysis By Packaging Type, 2018-2022

10.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Packaging Type, 2023-2031

10.3.1. Blisters

10.3.2. Bottles

10.3.3. Containers

10.3.4. Sachets

10.3.5. Stick packs

10.3.6. Droppers

10.3.7. Others

10.4. Market Attractiveness Analysis By Packaging Type

11. Global Probiotics Analysis 2018-2022 and Forecast 2023-2031, By Sales Channel

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume Analysis By Sales Channel, 2018-2022

11.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Sales Channel, 2023-2031

11.3.1. Hypermarkets/Supermarkets

11.3.2. Specialty Stores

11.3.3. Online Sales

11.3.4. Pharmacies/Drugstores

11.4. Market Attractiveness Analysis By Sales Channel

12. Global Probiotics Analysis 2018-2022 and Forecast 2023-2031, by Region

12.1. Introduction

12.2. Historical Market Size (US$ Mn) and Volume Analysis By Region, 2018-2022

12.3. Current Market Size (US$ Mn) and Volume Analysis and Forecast By Region, 2023-2031

12.3.1. North America

12.3.2. Latin America

12.3.3. Western Europe

12.3.4. Eastern Europe

12.3.5. South Asia & Pacific

12.3.6. East Asia

12.3.7. Middle East and Africa (MEA)

12.4. Market Attractiveness Analysis By Region

13. North America Probiotics Analysis 2018-2022 and Forecast 2023-2031

13.1. Introduction

13.2. Pricing Analysis

13.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2018-2022

13.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2023-2031

13.4.1. By Country

13.4.1.1. U.S.

13.4.1.2. Canada

13.4.1.3. Mexico

13.4.2. By Form

13.4.3. By Packaging Type

13.4.4. By Sales Channel

13.5. Market Attractiveness Analysis

13.5.1. By Country

13.5.2. By Form

13.5.3. By Packaging Type

13.5.4. By Sales Channel

13.6. Drivers and Restraints - Impact Analysis

14. Latin America Probiotics Analysis 2018-2022 and Forecast 2023-2031

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2018-2022

14.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2023-2031

14.4.1. By Country

14.4.1.1. Brazil

14.4.1.2. Chile

14.4.1.3. Rest of Latin America

14.4.2. By Form

14.4.3. By Packaging Type

14.4.4. By Sales Channel

14.5. Market Attractiveness Analysis

14.5.1. By Country

14.5.2. By Form

14.5.3. By Packaging Type

14.5.4. By Sales Channel

14.6. Drivers and Restraints - Impact Analysis

15. Western Europe Probiotics Analysis 2018-2022 and Forecast 2023-2031

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2018-2022

15.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2023-2031

15.4.1. By Country

15.4.1.1. Germany

15.4.1.2. Italy

15.4.1.3. France

15.4.1.4. U.K.

15.4.1.5. Spain

15.4.1.6. BENELUX

15.4.1.7. Nordic

15.4.1.8. Rest of W. Europe

15.4.2. By Form

15.4.3. By Packaging Type

15.4.4. By Sales Channel

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Form

15.5.3. By Packaging Type

15.5.4. By Sales Channel

15.6. Drivers and Restraints - Impact Analysis

16. Eastern Europe Probiotics Analysis 2018-2022 and Forecast 2023-2031

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2018-2022

16.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2023-2031

16.4.1. By Country

16.4.1.1. Russia

16.4.1.2. Hungary

16.4.1.3. Poland

16.4.1.4. Balkan & Baltics

16.4.1.5. Rest of E. Europe

16.4.2. By Form

16.4.3. By Packaging Type

16.4.4. By Sales Channel

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Form

16.5.3. By Packaging Type

16.5.4. By Sales Channel

16.6. Drivers and Restraints - Impact Analysis

17. South Asia & Pacific Probiotics Analysis 2018-2022 and Forecast 2023-2031

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2018-2022

17.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2023-2031

17.4.1. By Country

17.4.1.1. India

17.4.1.2. ASEAN

17.4.1.3. ANZ

17.4.1.4. Rest of SAP

17.4.2. By Form

17.4.3. By Packaging Type

17.4.4. By Sales Channel

17.5. Market Attractiveness Analysis

17.5.1. By Country

17.5.2. By Form

17.5.3. By Packaging Type

17.5.4. By Sales Channel

17.6. Drivers and Restraints - Impact Analysis

18. East Asia Probiotics Analysis 2018-2022 and Forecast 2023-2031

18.1. Introduction

18.2. Pricing Analysis

18.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2018-2022

18.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2023-2031

18.4.1. By Country

18.4.1.1. China

18.4.1.2. Japan

18.4.1.3. South Korea

18.4.2. By Form

18.4.3. By Packaging Type

18.4.4. By Sales Channel

18.5. Market Attractiveness Analysis

18.5.1. By Country

18.5.2. By Form

18.5.3. By Packaging Type

18.5.4. By Sales Channel

18.6. Drivers and Restraints - Impact Analysis

19. Middle East and Africa Probiotics Analysis 2018-2022 and Forecast 2023-2031

19.1. Introduction

19.2. Pricing Analysis

19.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2018-2022

19.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2023-2031

19.4.1. By Country

19.4.1.1. KSA

19.4.1.2. Other GCC

19.4.1.3. Turkiye

19.4.1.4. South Africa

19.4.1.5. Other African Union

19.4.1.6. Rest of MEA

19.4.2. By Form

19.4.3. By Packaging Type

19.4.4. By Sales Channel

19.5. Market Attractiveness Analysis

19.5.1. By Country

19.5.2. By Form

19.5.3. By Packaging Type

19.5.4. By Sales Channel

19.6. Drivers and Restraints - Impact Analysis

20. Country Wise Probiotics Market Analysis, 2022

20.1. Introduction

20.1.1. Market Value Proportion Analysis, By Key Countries

20.1.2. Global Vs. Country Growth Comparison

20.2. U.S. Probiotics Market Analysis

20.2.1. By Form

20.2.2. By Packaging Type

20.2.3. By Sales Channel

20.3. Canada Probiotics Market Analysis

20.3.1. By Form

20.3.2. By Packaging Type

20.3.3. By Sales Channel

20.4. Mexico Probiotics Market Analysis

20.4.1. By Form

20.4.2. By Packaging Type

20.4.3. By Sales Channel

20.5. Brazil Probiotics Market Analysis

20.5.1. By Form

20.5.2. By Packaging Type

20.5.3. By Sales Channel

20.6. Argentina Probiotics Market Analysis

20.6.1. By Form

20.6.2. By Packaging Type

20.6.3. By Sales Channel

20.7. Chile Probiotics Market Analysis

20.7.1. By Form

20.7.2. By Packaging Type

20.7.3. By Sales Channel

20.8. Germany Probiotics Market Analysis

20.8.1. By Form

20.8.2. By Packaging Type

20.8.3. By Sales Channel

20.9. Italy Probiotics Market Analysis

20.9.1. By Form

20.9.2. By Packaging Type

20.9.3. By Sales Channel

20.10. France Probiotics Market Analysis

20.10.1. By Form

20.10.2. By Packaging Type

20.10.3. By Sales Channel

20.11. U.K. Probiotics Market Analysis

20.11.1. By Form

20.11.2. By Packaging Type

20.11.3. By Sales Channel

20.12. Spain Probiotics Market Analysis

20.12.1. By Form

20.12.2. By Packaging Type

20.12.3. By Sales Channel

20.13. Russia Probiotics Market Analysis

20.13.1. By Form

20.13.2. By Packaging Type

20.13.3. By Sales Channel

20.14. Poland Probiotics Market Analysis

20.14.1. By Form

20.14.2. By Packaging Type

20.14.3. By Sales Channel

20.15. China Probiotics Market Analysis

20.15.1. By Form

20.15.2. By Packaging Type

20.15.3. By Sales Channel

20.16. Japan Probiotics Market Analysis

20.16.1. By Form

20.16.2. By Packaging Type

20.16.3. By Sales Channel

20.17. S. Korea Probiotics Market Analysis

20.17.1. By Form

20.17.2. By Packaging Type

20.17.3. By Sales Channel

20.18. India Probiotics Market Analysis

20.18.1. By Form

20.18.2. By Packaging Type

20.18.3. By Sales Channel

20.19. Indonesia Probiotics Market Analysis

20.19.1. By Form

20.19.2. By Packaging Type

20.19.3. By Sales Channel

20.20. Malaysia Probiotics Market Analysis

20.20.1. By Form

20.20.2. By Packaging Type

20.20.3. By Sales Channel

20.21. Thailand Probiotics Market Analysis

20.21.1. By Form

20.21.2. By Packaging Type

20.21.3. By Sales Channel

20.22. Australia Probiotics Market Analysis

20.22.1. By Form

20.22.2. By Packaging Type

20.22.3. By Sales Channel

20.23. New Zealand Probiotics Market Analysis

20.23.1. By Form

20.23.2. By Packaging Type

20.23.3. By Sales Channel

20.24. Turkey Probiotics Market Analysis

20.24.1. By Form

20.24.2. By Packaging Type

20.24.3. By Sales Channel

20.25. South Africa Probiotics Market Analysis

20.25.1. By Form

20.25.2. By Packaging Type

20.25.3. By Sales Channel

21. Market Structure Analysis

21.1. Market Analysis by Tier of Companies

21.2. Market Concentration

21.3. Market Presence Analysis

22. Competition Analysis

22.1. Competition Dashboard

22.2. Competition Deep Dive

22.2.1. Chr. Hansen Holding A/S

22.2.1.1. Overview

22.2.1.2. Product Portfolio

22.2.1.3. Sales Footprint

22.2.1.4. Key Developments/Key Takeaways

22.2.1.5. Strategy Overview

22.2.1.6. Financial Overview

22.2.2. BioGaia AB

22.2.2.1. Overview

22.2.2.2. Product Portfolio

22.2.2.3. Sales Footprint

22.2.2.4. Key Developments/Key Takeaways

22.2.2.5. Strategy Overview

22.2.2.6. Financial Overview

22.2.3. Probi AB

22.2.3.1. Overview

22.2.3.2. Product Portfolio

22.2.3.3. Sales Footprint

22.2.3.4. Key Developments/Key Takeaways

22.2.3.5. Strategy Overview

22.2.3.6. Financial Overview

22.2.4. Probiotics International Limited

22.2.4.1. Overview

22.2.4.2. Product Portfolio

22.2.4.3. Sales Footprint

22.2.4.4. Key Developments/Key Takeaways

22.2.4.5. Strategy Overview

22.2.4.6. Financial Overview

22.2.5. Lallemand Inc.

22.2.5.1. Overview

22.2.5.2. Product Portfolio

22.2.5.3. Sales Footprint

22.2.5.4. Key Developments/Key Takeaways

22.2.5.5. Strategy Overview

22.2.5.6. Financial Overview

22.2.6. Pfizer Inc.

22.2.6.1. Overview

22.2.6.2. Product Portfolio

22.2.6.3. Sales Footprint

22.2.6.4. Key Developments/Key Takeaways

22.2.6.5. Strategy Overview

22.2.6.6. Financial Overview

22.2.7. PharmaCare Laboratories

22.2.7.1. Overview

22.2.7.2. Product Portfolio

22.2.7.3. Sales Footprint

22.2.7.4. Key Developments/Key Takeaways

22.2.7.5. Strategy Overview

22.2.7.6. Financial Overview

22.2.8. Dr. Willmar SchwabeGroup

22.2.8.1. Overview

22.2.8.2. Product Portfolio

22.2.8.3. Sales Footprint

22.2.8.4. Key Developments/Key Takeaways

22.2.8.5. Strategy Overview

22.2.8.6. Financial Overview

22.2.9. SymbioPharm GmbH

22.2.9.1. Overview

22.2.9.2. Product Portfolio

22.2.9.3. Sales Footprint

22.2.9.4. Key Developments/Key Takeaways

22.2.9.5. Strategy Overview

22.2.9.6. Financial Overview

22.2.10. Procter & Gamble Company

22.2.10.1. Overview

22.2.10.2. Product Portfolio

22.2.10.3. Sales Footprint

22.2.10.4. Key Developments/Key Takeaways

22.2.10.5. Strategy Overview

22.2.10.6. Financial Overview

22.2.11. Nestle SA

22.2.11.1. Overview

22.2.11.2. Product Portfolio

22.2.11.3. Sales Footprint

22.2.11.4. Key Developments/Key Takeaways

22.2.11.5. Strategy Overview

22.2.11.6. Financial Overview

22.2.12. DowDuPont Inc.

22.2.12.1. Overview

22.2.12.2. Product Portfolio

22.2.12.3. Sales Footprint

22.2.12.4. Key Developments/Key Takeaways

22.2.12.5. Strategy Overview

22.2.12.6. Financial Overview

22.2.13. SymbioPharm GmbH

22.2.13.1. Overview

22.2.13.2. Product Portfolio

22.2.13.3. Sales Footprint

22.2.13.4. Key Developments/Key Takeaways

22.2.13.5. Strategy Overview

22.2.13.6. Financial Overview

22.2.14. Dr. Willmar Schwabe Group

22.2.14.1. Overview

22.2.14.2. Product Portfolio

22.2.14.3. Sales Footprint

22.2.14.4. Key Developments/Key Takeaways

22.2.14.5. Strategy Overview

22.2.14.6. Financial Overview

22.2.15. Others (on addition request)

22.2.15.1. Overview

22.2.15.2. Product Portfolio

22.2.15.3. Sales Footprint

22.2.15.4. Key Developments/Key Takeaways

22.2.15.5. Strategy Overview

22.2.15.6. Financial Overview

23. Assumptions and Acronyms Use

24. Research Methodology

List of Tables

Table 1: Global Probiotic Market Value (US$ Mn) Analysis and Forecast by Form, 2018-2033

Table 2: Global Probiotic Market Volume (Tons) Analysis and Forecast by Form, 2018-2033

Table 3: Global Probiotic Market Value (US$ Mn) Analysis and Forecast by Packaging Type, 2018-2033

Table 4: Global Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 5: Global Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2033

Table 6: Global Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 7: Global Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 8: Global Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 9: Global Probiotic Market Value (US$ Mn) Analysis and Forecast by Region, 2018-2033

Table 10: Global Probiotic Market Volume (Tons) Analysis and Forecast by Region, 2018-2033

Table 11: North America Probiotic Market Value (US$ Mn) Analysis and Forecast by Form, 2018-2033

Table 12: North America Probiotic Market Volume (Tons) Analysis and Forecast by Form, 2018-2033

Table 13: North America Probiotic Market Value (US$ Mn) Analysis and Forecast by Packaging Type, 2018-2033

Table 14: North America Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 15: North America Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2033

Table 16: North America Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel, 2018-2033

Table 17: North America Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel Segment2018-2033

Table 18: North America Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 19: North America Probiotic Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2033

Table 20: North America Probiotic Market Volume (Tons) Analysis and Forecast by Country, 2018-2033

Table 21: Latin America Probiotic Market Value (US$ Mn) Analysis and Forecast by Form, 2018-2033

Table 22: Latin America Probiotic Market Volume (Tons) Analysis and Forecast by Form, 2018-2033

Table 23: Latin America Probiotic Market Value (US$ Mn) Analysis and Forecast by Packaging Type2018-2033

Table 24: Latin America Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 25: Latin America Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2033

Table 26: Latin America Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel, 2018-2033

Table 27: Latin America Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 28: Latin America Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 29: Latin America Probiotic Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2033

Table 30: Latin America Probiotic Market Volume (Tons) Analysis and Forecast by Country, 2018-2033

Table 31: Western Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Form, 2018-2033

Table 32: Western Europe Probiotic Market Volume (Tons) Analysis and Forecast by Form, 2018-2033

Table 33: Western Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Packaging Type, 2018-2033

Table 34: Western Europe Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 35: Western Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2033

Table 36: Western Europe Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel, 2018-2033

Table 37: Western Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 38: Western Europe Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 39: Western Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2033

Table 40: Western Europe Probiotic Market Volume (Tons) Analysis and Forecast by Country, 2018-2033

Table 41: Eastern Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Form, 2018-2033

Table 42: Eastern Europe Probiotic Market Volume (Tons) Analysis and Forecast by Form, 2018-2033

Table 43: Eastern Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Packaging Type, 2018-2033

Table 44: Eastern Europe Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 45: Eastern Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2033

Table 46: Eastern Europe Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel, 2018-2033

Table 47: Eastern Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 48: Eastern Europe Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 49: Eastern Europe Probiotic Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2033

Table 50: Eastern Europe Probiotic Market Volume (Tons) Analysis and Forecast by Country, 2018-2033

Table 51: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Form, 2018-2033

Table 52: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Form, 2018-2033

Table 53: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Packaging Type, 2018-2033

Table 54: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 55: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2033

Table 56: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel, 2018-2033

Table 57: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 58: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 59: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2033

Table 60: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Country, 2018-2033

Table 61: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Form, 2018-2033

Table 62: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Form, 2018-2033

Table 63: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Packaging Type, 2018-2033

Table 64: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 65: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2033

Table 66: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel, 2018-2033

Table 67: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 68: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel Segment, 2014-2029

Table 69: East Asia Probiotic Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2033

Table 70: East Asia Probiotic Market Volume (Tons) Analysis and Forecast by Country, 2018-2033

Table 71: South Asia & Pacific Probiotic Market Value (US$ Mn) Analysis and Forecast by Form2018-2033

Table 72: South Asia & Pacific Probiotic Market Volume (Tons) Analysis and Forecast by Form, 2018-2033

Table 73: South Asia & Pacific Probiotic Market Value (US$ Mn) Analysis and Forecast by Packaging Type, 2018-2033

Table 74: South Asia & Pacific Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 75: South Asia & Pacific Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2033

Table 76: South Asia & Pacific Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel, 2018-2033

Table 77: South Asia & Pacific Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 78: South Asia & Pacific Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 79: South Asia & Pacific Probiotic Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2033

Table 80: South Asia & Pacific Probiotic Market Volume (Tons) Analysis and Forecast by Country, 2018-2033

Table 81: Middle East & Africa Probiotic Market Value (US$ Mn) Analysis and Forecast by Form2018-2033

Table 82: Middle East & Africa Probiotic Market Volume (Tons) Analysis and Forecast by Form, 2018-2033

Table 83: Middle East & Africa Probiotic Market Value (US$ Mn) Analysis and Forecast by Packaging Type, 2018-2033

Table 84: Middle East & Africa Probiotic Market Volume (Tons) Analysis and Forecast by Packaging Type, 2018-2033

Table 85: Middle East & Africa Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2033

Table 86: Middle East & Africa Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel, 2018-2033

Table 87: Middle East & Africa Probiotic Market Value (US$ Mn) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 88: Middle East & Africa Probiotic Market Volume (Tons) Analysis and Forecast by Sales Channel Segment, 2018-2033

Table 89: Middle East & Africa Probiotic Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2033

Table 90: Middle East & Africa Probiotic Market Volume (Tons) Analysis and Forecast by Country, 2018-2033

List of Figures

Figure 01: Global Probiotics Market Value (US$ Mn) Forecast, 2023-2031

Figure 02: Global Probiotics Market Volume (Tons) Forecast, 2023-2031

Figure 03: Global Probiotics Market Value Share Analysis by Form, 2023 E

Figure 04: Global Probiotics Market Y-o-Y Growth Rate by Form, 2023-2033

Figure 05: Global Probiotics Market Value (US$ Mn) Analysis & Forecast by Form, 2023-2031

Figure 06: Global Probiotics Market Volume (Tons) Analysis & Forecast by Form, 2023-2031

Figure 07: Global Probiotics Market Value Share Analysis by Packaging Type, 2023 E

Figure 08: Global Probiotics Market Y-o-Y Growth Rate by Packaging Type, 2023-2033

Figure 09: Global Probiotics Market Value (US$ Mn) Analysis & Forecast by Packaging Type, 2023-2031

Figure 10: Global Probiotics Market Volume (Tons) Analysis & Forecast by Packaging Type, 2023-2031

Figure 11: Global Probiotics Market Value Share Analysis by Sales Channel, 2023 E

Figure 12: Global Probiotics Market Y-o-Y Growth Rate by Sales Channel, 2023-2033

Figure 13: Global Probiotics Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2023-2031

Figure 14: Global Probiotics Market Volume (Tons) Analysis & Forecast by Sales Channel, 2023-2031

Figure 15: Global Probiotics Market Value Share Analysis by Region, 2023 E

Figure 16: Global Probiotics Market Y-o-Y Growth Rate by Region, 2023-2033

Figure 17: Global Probiotics Market Value (US$ Mn) Analysis & Forecast by Region, 2023-2031

Figure 18: Global Probiotics Market Volume (Tons) Analysis & Forecast by Region, 2023-2031

Figure 19: Global Probiotics Market Attractiveness Analysis by Region, 2023-2033

Figure 20: Global Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 21: Global Probiotics Market Attractiveness Analysis by Packaging Type, 2023-2033

Figure 22: Global Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 23: North America Probiotics Market Value (US$ Mn) Analysis & Forecast by Form, 2023-2031

Figure 24: North America Probiotics Market Volume (Tons) Analysis & Forecast by Form, 2023-2031

Figure 25: North America Probiotics Market Value (US$ Mn) Analysis & Forecast by Packaging Type, 2023-2031

Figure 26: North America Probiotics Market Volume (Tons) Analysis & Forecast by Packaging Type, 2023-2031

Figure 27: North America Probiotics Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2023-2031

Figure 28: North America Probiotics Market Volume (Tons) Analysis & Forecast by Sales Channel, 2023-2031

Figure 29: North America Probiotics Market Value (US$ Mn) Analysis & Forecast by Country, 2023-2031

Figure 30: North America Probiotics Market Volume (Tons) Analysis & Forecast by Country, 2023-2031

Figure 31: North America Probiotics Market Attractiveness Analysis by Region, 2023-2033

Figure 32: North America Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 33: North America Probiotics Market Attractiveness Analysis by Packaging Type, 2023-2033

Figure 34: North America Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 35: Latin America Probiotics Market Value (US$ Mn) Analysis & Forecast by Form, 2023-2031

Figure 36: Latin America Probiotics Market Volume (Tons) Analysis & Forecast by Form, 2023-2031

Figure 37: Latin America Probiotics Market Value (US$ Mn) Analysis & Forecast by Packaging Type, 2023-2031

Figure 38: Latin America Probiotics Market Volume (Tons) Analysis & Forecast by Packaging Type, 2023-2031

Figure 39: Latin America Probiotics Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2023-2031

Figure 40: Latin America Probiotics Market Volume (Tons) Analysis & Forecast by Sales Channel, 2023-2031

Figure 41: Latin America Probiotics Market Value (US$ Mn) Analysis & Forecast by Country, 2023-2031

Figure 42: Latin America Probiotics Market Volume (Tons) Analysis & Forecast by Country, 2023-2031

Figure 43: Latin America Probiotics Market Attractiveness Analysis by Region, 2023-2033

Figure 44: Latin America Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 45: Latin America Probiotics Market Attractiveness Analysis by Packaging Type, 2023-2033

Figure 46: Latin America Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 47: West Europe Probiotics Market Value (US$ Mn) Analysis & Forecast by Form, 2023-2031

Figure 48: West Europe Probiotics Market Volume (Tons) Analysis & Forecast by Form, 2023-2031

Figure 49: West Europe Probiotics Market Value (US$ Mn) Analysis & Forecast by Packaging Type, 2023-2031

Figure 50: West Europe Probiotics Market Volume (Tons) Analysis & Forecast by Packaging Type, 2023-2031

Figure 51: West Europe Probiotics Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2023-2031

Figure 52: West Europe Probiotics Market Volume (Tons) Analysis & Forecast by Sales Channel, 2023-2031

Figure 53: West Europe Probiotics Market Value (US$ Mn) Analysis & Forecast by Country, 2023-2031

Figure 54: West Europe Probiotics Market Volume (Tons) Analysis & Forecast by Country, 2023-2031

Figure 55: West Europe Probiotics Market Attractiveness Analysis by Region, 2023-2033

Figure 56: West Europe Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 57: West Europe Probiotics Market Attractiveness Analysis by Packaging Type, 2023-2033

Figure 58: West Europe Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 59: Eastern Europe Probiotics Market Value (US$ Mn) Analysis & Forecast by Form, 2023-2031

Figure 60: Eastern Europe Probiotics Market Volume (Tons) Analysis & Forecast by Form, 2023-2031

Figure 61: Eastern Europe Probiotics Market Value (US$ Mn) Analysis & Forecast by Packaging Type, 2023-2031

Figure 62 Eastern Europe Probiotics Market Volume (Tons) Analysis & Forecast by Packaging Type, 2023-2031

Figure 63: Eastern Europe Probiotics Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2023-2031

Figure 64: Eastern Europe Probiotics Market Volume (Tons) Analysis & Forecast by Sales Channel, 2023-2031

Figure 65: Eastern Europe Probiotics Market Value (US$ Mn) Analysis & Forecast by Country, 2023-2031

Figure 66: Eastern Europe Probiotics Market Volume (Tons) Analysis & Forecast by Country, 2023-2031

Figure 67: Eastern Europe Probiotics Market Attractiveness Analysis by Region, 2023-2033

Figure 68: Eastern Europe Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 69: Eastern Europe Probiotics Market Attractiveness Analysis by Packaging Type, 2023-2033

Figure 70: Eastern Europe Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 71: Eastern Europe Probiotics Market Value (US$ Mn) Analysis & Forecast by Form, 2023-2031

Figure 72: South Asia & Pacific Probiotics Market Volume (Tons) Analysis & Forecast by Form, 2023-2031

Figure 73: South Asia & Pacific Probiotics Market Value (US$ Mn) Analysis & Forecast by Packaging Type, 2023-2031

Figure 74: South Asia & Pacific Probiotics Market Volume (Tons) Analysis & Forecast by Packaging Type, 2023-2031

Figure 75: South Asia & Pacific Probiotics Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2023-2031

Figure 76: South Asia & Pacific Probiotics Market Volume (Tons) Analysis & Forecast by Sales Channel, 2023-2031

Figure 77: South Asia & Pacific Probiotics Market Value (US$ Mn) Analysis & Forecast by Country, 2023-2031

Figure 78: South Asia & Pacific Probiotics Market Volume (Tons) Analysis & Forecast by Country, 2023-2031

Figure 79: South Asia & Pacific Probiotics Market Attractiveness Analysis by Region, 2023-2033

Figure 80: South Asia & Pacific Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 81: South Asia & Pacific Probiotics Market Attractiveness Analysis by Packaging Type, 2023-2033

Figure 82: South Asia & Pacific Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 83: East Asia Probiotics Market Value (US$ Mn) Analysis & Forecast by Form, 2023-2031

Figure 84: East Asia Probiotics Market Volume (Tons) Analysis & Forecast by Form, 2023-2031

Figure 85: East Asia Probiotics Market Value (US$ Mn) Analysis & Forecast by Packaging Type, 2023-2031

Figure 86: East Asia Probiotics Market Volume (Tons) Analysis & Forecast by Packaging Type, 2023-2031

Figure 87: East Asia Probiotics Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2023-2031

Figure 88: East Asia Probiotics Market Volume (Tons) Analysis & Forecast by Sales Channel, 2023-2031

Figure 89: East Asia Probiotics Market Value (US$ Mn) Analysis & Forecast by Country, 2023-2031

Figure 90: East Asia Probiotics Market Volume (Tons) Analysis & Forecast by Country, 2023-2031

Figure 91: East Asia Probiotics Market Attractiveness Analysis by Region, 2023-2033

Figure 92: East Asia Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 93: East Asia Probiotics Market Attractiveness Analysis by Packaging Type, 2023-2033

Figure 94: East Asia Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 95: Middle East & Africa Probiotics Market Value (US$ Mn) Analysis & Forecast by Form, 2023-2031

Figure 96: Middle East & Africa Probiotics Market Volume (Tons) Analysis & Forecast by Form, 2023-2031

Figure 97: Middle East & Africa Probiotics Market Value (US$ Mn) Analysis & Forecast by Packaging Type, 2023-2031

Figure 98: Middle East & Africa Probiotics Market Volume (Tons) Analysis & Forecast by Packaging Type, 2023-2031

Figure 99: Middle East & Africa Probiotics Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2023-2031

Figure 100: Middle East & Africa Probiotics Market Volume (Tons) Analysis & Forecast by Sales Channel, 2023-2031

Figure 101: Middle East & Africa Probiotics Market Value (US$ Mn) Analysis & Forecast by Country, 2023-2031

Figure 102: Middle East & Africa Probiotics Market Volume (Tons) Analysis & Forecast by Country, 2023-2031

Figure 103: Middle East & Africa Probiotics Market Attractiveness Analysis by Region, 2023-2033

Figure 104: Middle East & Africa Probiotics Market Attractiveness Analysis by Form, 2023-2033

Figure 105: Middle East & Africa Probiotics Market Attractiveness Analysis by Packaging Type, 2023-2033

Figure 106: Middle East & Africa Probiotics Market Attractiveness Analysis by Form, 2023-2033