Reports

Reports

The rooftop solar PV market is developing into one of the most exciting areas of the global clean energy economy. Governments and regulators in both - emerging and developed economies are partially accountable to policy changes and growing consumer and corporate sensitivity around sustainability.

Rooftop solar PV systems are installed on residential, commercial, and industrial buildings, and stimulate decentralized power generation, meaning individuals can generate their own electricity and become less reliant on grid electricity while taking steps to reduce electricity costs over the medium-to-long-term.

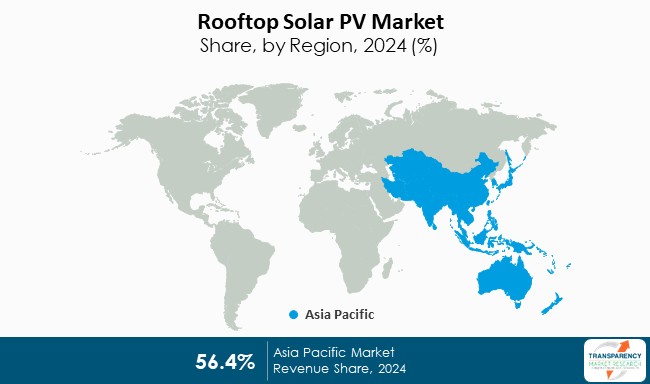

Adoption is particularly robust in the Asia-Pacific and European geographies, with the U.S. benefiting from progressive development frameworks like the Inflation Reduction Act.

Rooftop Solar Photovoltaic (PV) systems imply distributed energy systems placed on the roofs of businesses, residential, and industrial buildings. They generate energy by converting solar energy into usable energy.

Electricity can be consumed on-site or exported to the grid via net metering. Rooftop solar is one of the most effective ways to minimize the electricity bill, help achieve energy independence, and contribute toward sustainability objectives by reducing carbon footprint.

| Attribute | Detail |

|---|---|

| Drivers |

|

The most significant force behind the rooftop solar PV market is the declining cost of solar technologies combined with new financing options that make the market available to end-users. Over the last 10 years the costs of solar modules have decreased by nearly 80%, with solar module efficiency improving each quarter, thereby making rooftop solar one of the most relative cost-competitive sources of renewable energy available today. Balance-of-system (BOS) components such as inverters and mounting structures have also realized the importance of reductions in costs from the economies of scale and improved supply chains through mass-market production. For example, businesses and homeowners alike are still reluctant to take on capital costs that are often high, but structures supported by third-party ownership, such as RESCO, leasing, and Power Purchase Agreements (PPAs), are breaking down these barriers.

This model is especially appealing for commercial and industrial (C&I) consumers, who get the peace of mind of predictable energy prices under long term contracts and do not have to worry about managing the asset for its expected lifecycle. Moreover, with the increasing use of digital technology for performance tracking, predictive maintenance reliant on artificial intelligence (AI), and blockchain-based peer-to-peer energy trading, more transparency is witnessed in the supply chain.

Further, with financial institutions, green funds, and multilateral agencies stepping in to support rooftop solar with concessional loans and green bonds, damages have diminished. Collectively, all of these factors are taking rooftop solar out of the land of niche, thereby emphasizing clean energy solution for both - developed and emerging markets.

Another significant driver to rooftop solar PV deployment is that governments are committing policies to align with corporate and consumer sustainability commitments. Many governments have realized the role played by solar energy to fulfill renewable energy initiatives and decarbonization goals, and have enacted a supportive framework for distributed solar such as net metering, feed-in tariffs, tax credits, and capital subsidies.

For instance, the U.S. Inflation Reduction Act provides a long term certainty through the investment tax credit, while India’s rooftop solar program provides financial incentives and priority for grid connectivity. These mechanisms, both - decreased payback period and provision of market stability to encourage the investment on the part of small scale (homeowners) and large C&I players. On the corporate side, strong demand for clean energy sourcing as companies focus on Environmental, Social, and Governance (ESG) goals and Net Zero pledges has been created. Mulitnational corporations are adopting rooftop solar PVs to reduce Scope 2 emissions from factories, warehouses, and office campuses, while also lowering operating costs. The major adopters are retail chains, logistics hubs, and data centers due to the significant roof space available with power intensity of these facilities.

Additionally, international climate financing programs and regional renewable energy targets (such as the EU's Fit for 55 or India’s 500 GW renewable goal by 2030) supports the move to rooftop solar.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

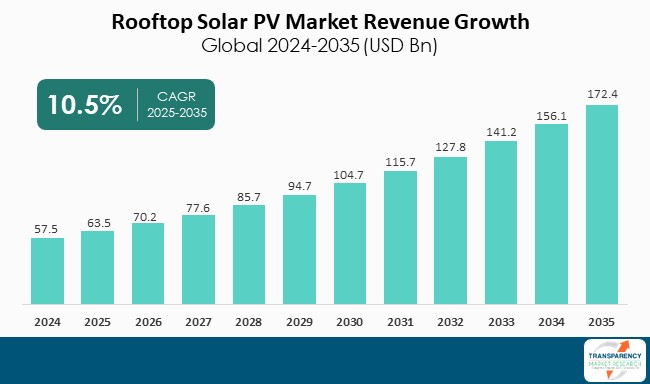

| Market Size Value in 2024 | US$ 57.5 Bn |

| Market Forecast Value in 2035 | US$ 172.4 Bn |

| Growth Rate (CAGR) | 10.5% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn for Value and Mn Carat for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Rooftop Solar PV market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The rooftop solar PV market was valued at US$ 57.5 Bn in 2024

The rooftop solar PV industry is expected to grow at a CAGR of 10.5% from 2025 to 2035

Declining technology costs, financial innovation and policy support and sustainability commitments

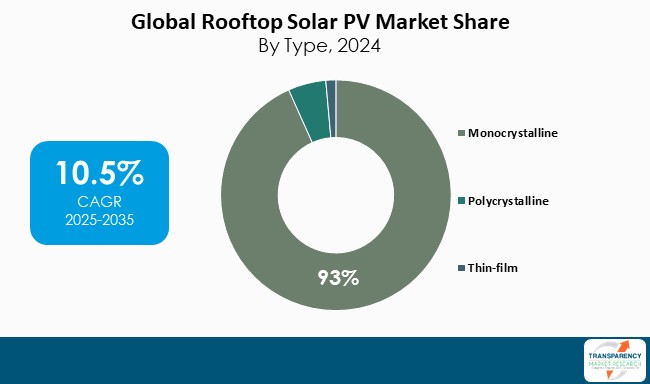

Monocrystalline was the largest type segment and its value was anticipated to grow at an estimated CAGR of 12.2% during the forecast period

Asia Pacific was the most lucrative region in 2024

First Solar, Inc., Pristine Sun LLC, JinkoSolar Holding Co., Ltd., LONGi, Hanwha Qcells, Trina Solar Limited, SolarEdge Technologies Inc. are the major players in the rooftop solar PV market

Table 1 Global Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 2 Global Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 3 Global Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 4 Global Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 5 Global Market Volume (MW) Forecast, by Connectivity 2020 to 2035

Table 6 Global Market Value (US$ Bn) Forecast, by Connectivity 2020 to 2035

Table 7 Global Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 8 Global Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 9 Global Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 10 Global Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 11 Global Market Volume (MW) Forecast, by Region, 2020 to 2035

Table 12 Global Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 13 North America Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 14 North America Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 15 North America Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 16 North America Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 17 North America Market Volume (MW) Forecast, by Connectivity 2020 to 2035

Table 18 North America Market Value (US$ Bn) Forecast, by Connectivity 2020 to 2035

Table 19 North America Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 20 North America Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 21 North America Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 22 North America Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 23 North America Market Volume (MW) Forecast, by Country, 2020 to 2035

Table 24 North America Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 25 U.S. Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 26 U.S. Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 27 U.S. Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 28 U.S. Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 29 U.S. Market Volume (MW) Forecast, by Connectivity 2020 to 2035

Table 30 U.S. Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 31 U.S. Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 32 U.S. Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 33 U.S. Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 34 U.S. Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 35 Canada Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 36 Canada Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 37 Canada Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 38 Canada Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 39 Canada Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 40 Canada Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 41 Canada Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 42 Canada Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 43 Canada Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 44 Canada Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 45 Europe Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 46 Europe Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 47 Europe Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 48 Europe Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 49 Europe Market Volume (MW) Forecast, by Connectivity 2020 to 2035

Table 50 Europe Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 51 Europe Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 52 Europe Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 53 Europe Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 54 Europe Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 55 Europe Market Volume (MW) Forecast, by Country and Sub-region, 2020 to 2035

Table 56 Europe Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 57 Germany Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 58 Germany Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 59 Germany Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 60 Germany Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 61 Germany Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 62 Germany Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 63 Germany Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 64 Germany Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 65 Germany Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 66 Germany Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 67 France Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 68 France Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 69 France Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 70 France Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 71 France Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 72 France Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 73 France Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 74 France Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 75 France Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 76 France Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 77 U.K. Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 78 U.K. Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 79 U.K. Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 80 U.K. Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 81 U.K. Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 82 U.K. Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 83 U.K. Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 84 U.K. Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 85 U.K. Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 86 U.K. Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 87 Italy Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 88 Italy Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 89 Italy Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 90 Italy Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 91 Italy Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 92 Italy Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 93 Italy Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 94 Italy Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 95 Italy Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 96 Italy Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 97 Spain Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 98 Spain Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 99 Spain Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 100 Spain Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 101 Spain Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 102 Spain Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 103 Spain Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 104 Spain Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 105 Spain Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 106 Spain Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 107 Russia & CIS Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 108 Russia & CIS Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 109 Russia & CIS Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 110 Russia & CIS Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 111 Russia & CIS Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 112 Russia & CIS Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 113 Russia & CIS Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 114 Russia & CIS Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 115 Russia & CIS Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 116 Russia & CIS Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 117 Rest of Europe Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 118 Rest of Europe Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 119 Rest of Europe Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 120 Rest of Europe Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 121 Rest of Europe Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 122 Rest of Europe Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 123 Rest of Europe Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 124 Rest of Europe Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 125 Rest of Europe Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 126 Rest of Europe Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 127 Asia Pacific Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 128 Asia Pacific Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 129 Asia Pacific Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 130 Asia Pacific Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 131 Asia Pacific Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 132 Asia Pacific Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 133 Asia Pacific Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 134 Asia Pacific Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 135 Asia Pacific Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 136 Asia Pacific Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 137 Asia Pacific Market Volume (MW) Forecast, by Country and Sub-region, 2020 to 2035

Table 138 Asia Pacific Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 139 China Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 140 China Market Value (US$ Bn) Forecast, by Type 2020 to 2035

Table 141 China Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 142 China Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 143 China Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 144 China Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 145 China Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 146 China Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 147 China Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 148 China Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 149 Japan Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 150 Japan Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 151 Japan Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 152 Japan Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 153 Japan Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 154 Japan Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 155 Japan Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 156 Japan Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 157 Japan Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 158 Japan Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 159 India Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 160 India Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 161 India Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 162 India Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 163 India Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 164 India Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 165 India Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 166 India Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 167 India Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 168 India Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 169 ASEAN Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 170 ASEAN Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 171 ASEAN Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 172 ASEAN Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 173 ASEAN Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 174 ASEAN Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 175 ASEAN Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 176 ASEAN Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 177 ASEAN Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 178 ASEAN Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 179 Rest of Asia Pacific Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 180 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 181 Rest of Asia Pacific Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 182 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 183 Rest of Asia Pacific Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 184 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 185 Rest of Asia Pacific Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 186 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 187 Rest of Asia Pacific Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 188 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 189 Latin America Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 190 Latin America Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 191 Latin America Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 192 Latin America Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 193 Latin America Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 194 Latin America Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 195 Latin America Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 196 Latin America Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 197 Latin America Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 198 Latin America Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 199 Latin America Market Volume (MW) Forecast, by Country and Sub-region, 2020 to 2035

Table 200 Latin America Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 201 Brazil Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 202 Brazil Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 203 Brazil Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 204 Brazil Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 205 Brazil Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 206 Brazil Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 207 Brazil Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 208 Brazil Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 209 Brazil Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 210 Brazil Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 211 Mexico Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 212 Mexico Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 213 Mexico Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 214 Mexico Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 215 Mexico Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 216 Mexico Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 217 Mexico Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 218 Mexico Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 219 Mexico Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 220 Mexico Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 221 Rest of Latin America Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 222 Rest of Latin America Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 223 Rest of Latin America Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 224 Rest of Latin America Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 225 Rest of Latin America Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 226 Rest of Latin America Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 227 Rest of Latin America Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 228 Rest of Latin America Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 229 Rest of Latin America Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 230 Rest of Latin America Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 231 Middle East & Africa Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 232 Middle East & Africa Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 233 Middle East & Africa Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 234 Middle East & Africa Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 235 Middle East & Africa Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 236 Middle East & Africa Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 237 Middle East & Africa Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 238 Middle East & Africa Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 239 Middle East & Africa Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 240 Middle East & Africa Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 241 Middle East & Africa Market Volume (MW) Forecast, by Country and Sub-region, 2020 to 2035

Table 242 Middle East & Africa Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 243 GCC Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 244 GCC Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 245 GCC Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 246 GCC Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 247 GCC Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 248 GCC Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 249 GCC Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 250 GCC Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 251 GCC Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 252 GCC Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 253 South Africa Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 254 South Africa Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 255 South Africa Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 256 South Africa Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 257 South Africa Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 258 South Africa Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 259 South Africa Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 260 South Africa Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 261 South Africa Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 262 South Africa Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Table 263 Rest of Middle East & Africa Market Volume (MW) Forecast, by Type, 2020 to 2035

Table 264 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 265 Rest of Middle East & Africa Market Volume (MW) Forecast, by Capacity, 2020 to 2035

Table 266 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Capacity, 2020 to 2035

Table 267 Rest of Middle East & Africa Market Volume (MW) Forecast, by Connectivity, 2020 to 2035

Table 268 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 269 Rest of Middle East & Africa Market Volume (MW) Forecast, by Installation Type, 2020 to 2035

Table 270 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 271 Rest of Middle East & Africa Market Volume (MW) Forecast, by End-user, 2020 to 2035

Table 272 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by End-user 2020 to 2035

Figure 1 Global Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 Global Market Attractiveness, by Type

Figure 3 Global Market Volume Share Analysis, by Capacity, 2024, 2028, and 2035

Figure 4 Global Market Attractiveness, by Capacity

Figure 5 Global Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 6 Global Market Attractiveness, by Connectivity

Figure 7 Global Market Volume Share Analysis, by Installation Type, 2024, 2028, and 2035

Figure 8 Global Market Attractiveness, by Installation Type

Figure 9 Global Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 10 Global Market Attractiveness, by End-user

Figure 11 Global Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 12 Global Market Attractiveness, by Region

Figure 13 North America Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 14 North America Market Attractiveness, by Type

Figure 15 North America Market Attractiveness, by Type

Figure 16 North America Market Volume Share Analysis, by Capacity, 2024, 2028, and 2035

Figure 17 North America Market Attractiveness, by Capacity

Figure 18 North America Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 19 North America Market Attractiveness, by Connectivity

Figure 20 North America Market Volume Share Analysis, by Installation Type, 2024, 2028, and 2035

Figure 21 North America Market Attractiveness, by Installation Type

Figure 22 North America Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 23 North America Market Attractiveness, by End-user

Figure 24 North America Market Attractiveness, by Country and Sub-region

Figure 25 Europe Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 26 Europe Market Attractiveness, by Type

Figure 27 Europe Market Volume Share Analysis, by Capacity, 2024, 2028, and 2035

Figure 28 Europe Market Attractiveness, by Capacity

Figure 29 Europe Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 30 Europe Market Attractiveness, by Connectivity

Figure 31 Europe Market Volume Share Analysis, by Installation Type, 2024, 2028, and 2035

Figure 32 Europe Market Attractiveness, by Installation Type

Figure 33 Europe Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 34 Europe Market Attractiveness, by End-user

Figure 35 Europe Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 36 Europe Market Attractiveness, by Country and Sub-region

Figure 37 Asia Pacific Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 38 Asia Pacific Market Attractiveness, by Type

Figure 39 Asia Pacific Market Volume Share Analysis, by Capacity, 2024, 2028, and 2035

Figure 40 Asia Pacific Market Attractiveness, by Capacity

Figure 41 Asia Pacific Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 42 Asia Pacific Market Attractiveness, by Connectivity

Figure 43 Asia Pacific Market Volume Share Analysis, by Installation Type, 2024, 2028, and 2035

Figure 44 Asia Pacific Market Attractiveness, by Installation Type

Figure 45 Asia Pacific Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 46 Asia Pacific Market Attractiveness, by End-user

Figure 47 Asia Pacific Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Asia Pacific Market Attractiveness, by Country and Sub-region

Figure 49 Latin America Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 50 Latin America Market Attractiveness, by Type

Figure 51 Latin America Market Volume Share Analysis, by Capacity, 2024, 2028, and 2035

Figure 52 Latin America Market Attractiveness, by Capacity

Figure 53 Latin America Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 54 Latin America Market Attractiveness, by Connectivity

Figure 55 Latin America Market Volume Share Analysis, by Installation Type, 2024, 2028, and 2035

Figure 56 Latin America Market Attractiveness, by Installation Type

Figure 57 Latin America Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 58 Latin America Market Attractiveness, by End-user

Figure 59 Latin America Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 60 Latin America Market Attractiveness, by Country and Sub-region

Figure 61 Middle East & Africa Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 62 Middle East & Africa Market Attractiveness, by Type

Figure 63 Middle East & Africa Market Volume Share Analysis, by Capacity, 2024, 2028, and 2035

Figure 64 Middle East & Africa Market Attractiveness, by Capacity

Figure 65 Middle East & Africa Market Volume Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 66 Middle East & Africa Market Attractiveness, by Connectivity

Figure 67 Middle East & Africa Market Volume Share Analysis, by Installation Type, 2024, 2028, and 2035

Figure 68 Middle East & Africa Market Attractiveness, by Installation Type

Figure 69 Middle East & Africa Market Volume Share Analysis, by End-user, 2024, 2028, and 2035

Figure 70 Middle East & Africa Market Attractiveness, by End-user

Figure 71 Middle East & Africa Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 72 Middle East & Africa Market Attractiveness, by Country and Sub-region