Reports

Reports

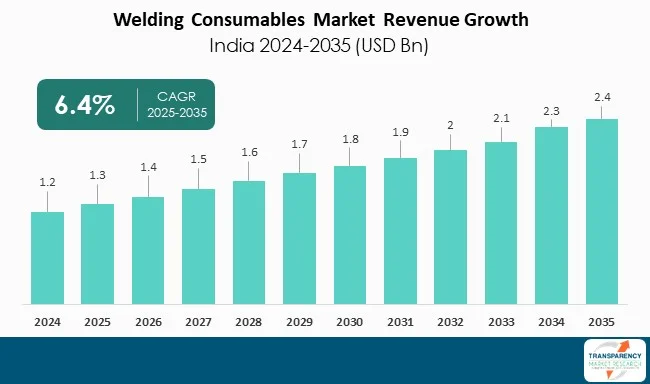

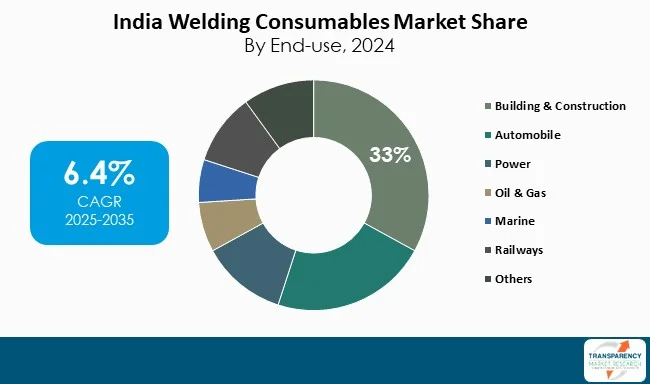

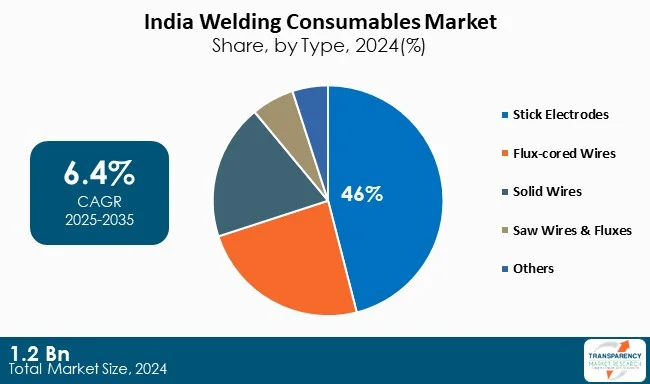

India welding consumables market is expected to witness a decent CAGR of 6.4%, driven by infrastructure development, automotive manufacturing momentum, and upgrades in the manufacturing vertical in India. The fact that stick electrodes dominate all weld consumables with 46.0% of the market share is indicative of the price-conscious nature of the market and the extent of the construction and repair sectors' reliance on welding in developing urbanized areas.

Maharashtra retains a strong position in welding as it has a large industrial state share, contributing to 18.0% of the national share, due to industrial mixed sectors including automotive, engineering, and shipbuilding, thereby driving demand in greater volumes. ESAB India and Ador Welding, who are dominant suppliers, significantly shape the market leveraging volumetric advantages, substantial product offerings and capabilities, and distribution to retain high leadership positions in the overall consumables market.

The PLI plan from government and push for self-reliance through the “Make in India” initiative is likely to spur the adoption of technological and performance advancements in consumables - particularly flux-cored and MIG/TIG wires in fast-growing sectors.

India Welding consumables are critical in the welding process to join two or more metal parts for structural integrity and strength. These materials assist and give more strength to the equipment used for welding. The choice of consumable will depend on the type of metal being welded and the welding method. They determine the rate of deposition, arc stability, and filler material’s ability to resist corrosion and wear.

With the advancement of welding technologies, it is possible to manufacture consumables with the aim of attaining better efficiencies and accuracy as well as reducing environmental impacts. India Welding consumables are employed in a range of industries such as construction, automotive, shipbuilding, and energy. They have been a source of ingenuity where reliability and options are concerned with their services or properties.

| Attribute | Detail |

|---|---|

| India Welding Consumables Market Drivers |

|

The extensive infrastructure projects in the country significantly propel the demand for welding supplies. Government’s initiatives like Bharatmala Pariyojana (construction of >34,800 km of highways) and the Smart Cities Mission (>100 cities) generate significant demand for welding electrodes, filler wires, and fluxes. The Ministry of Road Transport and Highways estimated of more than US$ 431.9 Bn investment on infrastructure development in FY2023, which is almost 30% more than it did in FY2022. The housing and urban development pillar targets to construct 11 million urban homes under the Pradhan Mantri Awas Yojana, which is boosting the need for structural welder consumables for India welding consumables manufacturers.

The rapid growth of India’s automotive and manufacturing industries is another vital factor driving the growth of the India welding consumables market. India is the world’s third-largest automobile market with vehicle production hitting 25.9 million during the forecast period. This is supported by strong domestic demand and exports.

India Welding consumables (MIG and TIG wires) are required to produce frames, chassis, and various critical automobile components. The “Make in India” initiative and Production Linked Incentive (PLI) scheme worth US$ 14.9 Bn is further promoting local production of electronic devices and military and heavy industrial equipment, which rely on welding technology.

India’s automotive exports witnessed a growth of 15% in the fiscal year 2023. This hike in exports further intensifies the demand for high-performance India welding consumables so that global standards can be met. Furthermore, India’s GDP is nearly 17% accounted for by the machinery and equipment manufacturing sector, which is increasingly embracing automated and robotic welding solutions. This change increases the demand for advanced welding wires and flux-cored products and the suppliers in this sector stand to gain a lot in aligning to the changes in the industry.

Stick electrodes account for over 46% of the market share. They are broadly used in railways, construction, and repair applications. Their easy application, suitability for manual welding, and capability to perform well even under suboptimal conditions or outdoors make them highly preferred in the infrastructure-driven Indian economy. Large-scale infrastructural projects such as the Bharatmala highway project and metro rail expansion in over 15 cities mainly rely on structural welding, where stick electrodes are broadly used.

| Attribute | Detail |

|---|---|

| Leading State |

|

Maharashtra, due to its industrial dominance and widespread manufacturing base, leads India welding consumables market. The state accounts for about 20% of India's industrial output, and 11% of its factories are registered there, thereby creating a lot of demand for India welding consumables.

Shipbuilding, construction, automotive, and engineering industries that consume large quantities of solid wires, stick electrodes, and flux-cored wires operate in industrial clusters around Pune, Mumbai, and Nashik. The presence of leading OEMs and fabrication centers, robust infrastructure, and the automobile industries and engineering sectors do increase demand.

Mega infrastructure projects such as the Mumbai Trans Harbour Link and Pune Metro ensure continuous demand for welding products, and in fact, Maharashtra is the leader in infrastructure development. The combination of a high level of contribution to industry, advanced manufacturing systems, and large infrastructure projects means that Maharashtra is the most important regional market for India welding consumables in India, with 18% of the national market.

In India welding consumables market, ESAB India Limited takes the top spot. It offers an extensive selection of electrodes, wires, and fluxes, sewing consumables. Its effective distribution systems and developed R&D lead to the strongest consumer base in areas like construction, shipbuilding, and heavy engineering. Heavily reliant industries and welding solution users in India looking for a market leader turn to ESAB.

Ador Welding Limited comes in second in the Indian welding consumables sector. It has an extensive selection of stick electrodes, wires, and fluxes. It leverages its proficient supply chain and Ador’s technical know-how in automotive, industrial, and infrastructure sectors. Due to its command over electrodes, it is a preferred name in the manufacturing industry, which is flourishing in India.

Alpha Electrodes, D & H India Limited, D&H Sécheron Electrodes Pvt. Ltd., ESS AAR Industries, Eureka Systems & Electrodes Private Ltd., Kobe Steel, Ltd., Lincoln Electric Company (India) Pvt. Ltd., Mailam India Private Limited, Raajratna Electrodes Pvt. Ltd., Royal Arc, Sharp Electrodes (P) Ltd., Voestalpine Bohler Welding India Private Limited, and Rasi Electrodes Ltd. are some of the major companies operating in market.

Each of these players has been profiled in India welding consumables market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 1.2 Bn |

| Market Forecast Value in 2035 | US$ 2.4 Bn |

| Growth Rate (CAGR) | 6.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, India Welding Consumables market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The India welding consumables market was valued at US$ 1.2 Bn in 2024

The India welding consumables industry is expected to grow at a CAGR of 6.4% from 2025 to 2035

Rapid infrastructure development and urbanization and expanding automotive and manufacturing sector

Stick electrodes was the largest type segment in the India welding consumables market.

Maharashtra was the most lucrative state in 2024

Ador Welding Limited, Alpha Electrodes, D & H India Limited, D&H Sécheron Electrodes Pvt. Ltd., ESAB India Limited, ESS AAR Industries, Eureka Systems & Electrodes Private Ltd., Kobe Steel, Ltd., Lincoln Electric Company (India) Pvt. Ltd., Mailam India Private Limited, Raajratna Electrodes Pvt. Ltd., Royal Arc, Sharp Electrodes (P) Ltd., Voestalpine Bohler Welding India Private Limited, and Rasi Electrodes Ltd. are some of the major companies in India welding consumables market.

Table 1 India Welding Consumables Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 2 India Welding Consumables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 3 India Welding Consumables Market Volume (Tons) Forecast, by Technique 2020 to 2035

Table 4 India Welding Consumables Market Value (US$ Bn) Forecast, by Technique 2020 to 2035

Table 5 India Welding Consumables Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 6 India Welding Consumables Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 7 India Welding Consumables Market Volume (Tons) Forecast, by State, 2020 to 2035

Table 8 India Welding Consumables Market Value (US$ Bn) Forecast, by State, 2020 to 2035

Figure 1 India Welding Consumables Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 India Welding Consumables Market Attractiveness, by Type

Figure 3 India Welding Consumables Market Volume Share Analysis, by Technique, 2024, 2028, and 2035

Figure 4 India Welding Consumables Market Attractiveness, by Technique

Figure 5 India Welding Consumables Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 6 India Welding Consumables Market Attractiveness, by End-use

Figure 7 India Welding Consumables Market Volume Share Analysis, by State, 2024, 2028, and 2035