Reports

Reports

The global X-Ray market is witnessing decent growth due to growing prevalence of chronic diseases, higher demand for diagnostic imaging, and greater acceptance of digital X-Ray systems as compared to traditional analog systems. The emergence of imaging technologies such as 3D imaging and AI-enabled radiology solutions have considerably increased diagnostic accuracy, which, in turn, has encouraged adoption of X-ray systems.

The X-Ray market is expected to benefit from supportive government funding to improve effectiveness in diagnosing diseases through early detection, and modernizing healthcare systems to improve healthcare infrastructure. Key players in the global market include Siemens Healthineers, GE HealthCare, Philips Healthcare, and Canon Medical Systems, who have adopted new product strategies containing digital radiography systems integrated with AI, mobile X-Ray systems with enhanced capabilities, as well as high performance flat-panel detectors. Strategic mergers acquire emerging companies to improve X-Ray diagnostic operations and increase software services and improve capabilities.

The pandemic has heightened the focus on respiratory imaging and operational readiness, which has resulted in the higher use of portable and digital X-Ray systems, and incorporated respiratory diagnostic testing that confirms online connectivity of portable digital systems, which increased operational development in intact respiratory diagnostic practices.

Overall, the X-Ray market conditions will support sustainable growth to advance patient care using more innovative, enhanced, and digital technologies, which provide enhanced competitive basis for leaders in the X-Ray Industry.

The X-Ray market is driven by growing demand related to diagnostic imaging including cardiovascular, musculoskeletal, and oncological disorders. The increasing number of injuries (specifically bone fractures) that arise from road accidents, combined with the growing segment of the geriatric population prone to osteoporosis and fractures, contribute to overall market growth. The increasing trend of employing minimally invasive diagnostic procedures also supports the demand for modern imaging modalities.

The industry is experiencing a veritable shift from film-based systems to digital radiography across a spectrum of healthcare facilities, primarily owing to the reduction of both - processing time and required radiation doses (as well as the other elements of digital imaging, like better archiving options).

Emerging markets continue to see more investment in healthcare capabilities, which will mean improving access to X-Ray image services. Artificial intelligence is also coming on line in radiology. When utilized in conjunction with X-Ray imaging, it has the potential to help radiologists with their decision making by providing another level of automated image interpretation. All of these contribute to the understanding that the X-Ray market is and will remain as an integral part of delivery in diagnostic healthcare.

| Attribute | Detail |

|---|---|

| X-Ray Market Drivers |

|

The increasing prevalence rates of chronic disease, especially neoplastic, cardiovascular, and respiratory diseases, are the leading drivers to the X-Ray market. Each of these diseases requires significant imaging to initiate diagnosis and monitor disease progression over the period of time, causing demand to remain high.

According to the World Health Organization (WHO), chronic diseases cause almost 74% of all deaths in the world (approximately 41 million deaths annually), resulting in an ongoing and indispensable requirement for diagnostic imaging in the management of these diseases. X-Ray imaging, of all the imaging modalities, has remained the simplest and cheapest imaging option outside of a basic physical exam, which is paramount to support early diagnosis and timely treatment plans with respective healthcare providers.

For example, the American Cancer Society estimated that 1.9 million new cancer cases were detected in the United States during 2023 alone, many of which required imaging as a part of the diagnosis and treatment monitoring process. Screening guidelines for chest X-Rays are recommended for detecting lung metastases in oncology patients. Mammography (an X-Ray technology) is included in screening or diagnostic guidelines for breast cancer.

The reliance on X-Ray technologies illustrates the necessity for imaging with chronic disease management and ultimately supports the burden of disease. With the continued prevalence of chronic disease, especially in advancing age populations, the demand for improved, high quality digital X-Ray, less exposure to radiation, and more accessible sources of AI-based diagnostic imaging will extend beyond historical levels.

The shift from traditional analog systems to digital radiography is transforming the X-Ray market, facilitating faster, safer, and more precise diagnostic imaging. Digital X-Ray systems provide enhanced image resolution, lower exposure to radiation, and seamless integration with Picture Archiving and Communication Systems (PACS), thereby facilitating efficient workflows in diagnostic centers and hospitals. The integration of AI during image analysis further improves diagnostic capabilities by automating anomaly detection and reducing reporting times.

For instance, in 2022, GE HealthCare introduced its Definium 656 HD digital radiography system designed to provide high-resolution images with lower radiation doses. The system is inclusive of AI-based features for image positioning and quality checks, thereby streamlining radiology workflows.

Additionally, digital systems lend support to cloud-based storage and tele-radiology, ascertaining broader accessibility to imaging results even in the remote areas. With healthcare providers increasingly emphasizing efficiency and patient safety, the shift toward advanced digital systems is accelerating. The speedy adoption of flat-panel detectors, AI-enabled imaging solutions, and portable systems underscores the rising demand for next-generation radiography technologies.

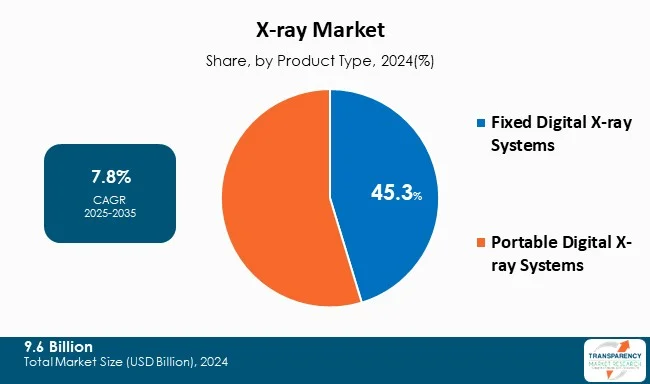

Fixed digital X-Ray systems lead the X-Ray market due to their superlative image quality, ability to handle high patient volumes, and broad adoption across large diagnostic centers and hospitals. Such systems are often equipped with advanced flat-panel detectors and automated workflow features that improve diagnostic accuracy and efficiency.

Unlike mobile units, fixed systems are designed for high-throughput, consistent imaging, making them indispensable in facilities with heavy patient loads. Their long-term cost-effectiveness, in spite of higher initial installation costs, further drives adoption in well-established healthcare institutions.

For instance, Siemens Healthineers’ Ysio Max fixed digital radiography system is broadly adopted across hospitals for its advanced dose management, flexible positioning, and ability to conduct a wide range of examinations inclusive of chest, abdominal, and skeletal scans. Such systems are especially valuable in orthopedic and oncology departments where precise and repeated imaging is required.

Hospitals prefer fixed systems for their integration capabilities with hospital information systems and longevity. As the demand for advanced imaging grows with rising prevalence of chronic diseases, the segment is expected to maintain dominance, especially in developed regions where large-scale hospital infrastructure supports such investments.

| Attribute | Detail |

|---|---|

|

Leading Region |

|

North America is the market leader for X-Ray worldwide, driven by an excellent healthcare infrastructure, high adoption of technology, and the presence of leading market players. The region benefits from reimbursement structure and funding into healthcare; particularly, in the U.S. it contributes for the largest share in regional spending. Emerging diseases such as chronic diseases in cancer and cardiovascular diseases have increased the demand for diagnostic imaging.

According to the Centers for Medicare & Medicaid Services (CMS), U.S. federal healthcare expenditure reached US$ 4.5 Tn in 2022, and there was spending for digital radiography systems, AI-assisted imaging, and PACS solutions since these are essential components in the healthcare industry. The U.S. also exhibits a high adoption rate of screening programs (e.g. CDC National Breast and Cervical Cancer Early Detection Program), which offers mammography as an X-Ray modality. In a similar manner, Canada promotes spending in digital healthcare and modernizing hospitals.

Industry leading companies are located in North America (GE HealthCare, Carestream Health), ensuring that organizations in Canada and the U.S. will stay anchored in technological innovation.

Key players operating in the X-Ray industry are investing in innovation, technological advancements, and strategic partnerships. They are focusing on enhancing imaging clarity and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

Acteon, Agfa-Gevaert Group, Allengers Medical System Limited, SureScan Corporation, Carestream Health, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Hologic Inc., Koninklijke Philips N.V., Mindray medical International Limited, New Medical Imaging, Shimadzu Corporation, Samsung Electronics Co., Ltd., GE Healthcare and others are the key players in X-Ray market.

Each of these players has been profiled in the X-Ray market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 9.6 Bn |

| Forecast Value in 2035 | US$ 21.9 Bn |

| CAGR | 7.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| X-Ray Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The X-Ray market was valued at US$ 9.6 Bn in 2024

The X-Ray market is projected to cross US$ 21.9 Bn by the end of 2035

Rising prevalence of chronic diseases and technological advancements in digital radiography

The CAGR is anticipated to be 7.8% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Acteon, Agfa-Gevaert Group, Allengers Medical System Limited, SureScan Corporation, Carestream Health, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Hologic Inc., Koninklijke Philips N.V., Mindray medical International Limited, New Medical Imaging, Shimadzu Corporation, Samsung Electronics Co., Ltd., GE HealthCare, and others

Table 01: Global X-ray Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 02: Global X-ray Market Value (US$ Bn) Forecast, by Fixed Digital X-ray Systems, 2020 to 2035

Table 03: Global X-ray Market Value (US$ Bn) Forecast, by Portable Digital X-ray Systems, 2020 to 2035

Table 04: Global X-ray Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 05: Global X-ray Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 06: Global X-ray Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 07: Global X-ray Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 08: North America X-ray Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America X-ray Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 10: North America X-ray Market Value (US$ Bn) Forecast, by Fixed Digital X-ray Systems, 2020 to 2035

Table 11: North America X-ray Market Value (US$ Bn) Forecast, by Portable Digital X-ray Systems, 2020 to 2035

Table 12: North America X-ray Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 13: North America X-ray Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 14: North America X-ray Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Europe X-ray Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 16: Europe X-ray Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 17: Europe X-ray Market Value (US$ Bn) Forecast, by Fixed Digital X-ray Systems, 2020 to 2035

Table 18: Europe X-ray Market Value (US$ Bn) Forecast, by Portable Digital X-ray Systems, 2020 to 2035

Table 19: Europe X-ray Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 20: Europe X-ray Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21: Europe X-ray Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 22: Asia Pacific X-ray Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 23: Asia Pacific X-ray Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 24: Asia Pacific X-ray Market Value (US$ Bn) Forecast, by Fixed Digital X-ray Systems, 2020 to 2035

Table 25: North America X-ray Market Value (US$ Bn) Forecast, by Portable Digital X-ray Systems, 2020 to 2035

Table 26: Asia Pacific X-ray Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 27: Asia Pacific X-ray Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 28: Asia Pacific X-ray Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 29: Latin America X-ray Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 30: Latin America X-ray Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 31: Latin America X-ray Market Value (US$ Bn) Forecast, by Fixed Digital X-ray Systems, 2020 to 2035

Table 32: Latin America X-ray Market Value (US$ Bn) Forecast, by Portable Digital X-ray Systems, 2020 to 2035

Table 33: Latin America X-ray Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 34: Latin America X-ray Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35: Latin America X-ray Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 36: Middle East & Africa X-ray Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 37: Middle East and Africa X-ray Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 38: Middle America and Africa X-ray Market Value (US$ Bn) Forecast, by Fixed Digital X-ray Systems, 2020 to 2035

Table 39: Middle America and Africa X-ray Market Value (US$ Bn) Forecast, by Portable Digital X-ray Systems, 2020 to 2035

Table 40: Middle East and Africa X-ray Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 41: Middle East and Africa X-ray Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 42: Middle East and Africa X-ray Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global X-ray Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 02: Global X-ray Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 03: Global X-ray Market Revenue (US$ Bn), by Fixed Digital X-ray Systems, 2020 to 2035

Figure 04: Global X-ray Market Revenue (US$ Bn), by Portable Digital X-ray Systems, 2020 to 2035

Figure 05: Global X-ray Market Value Share Analysis, by Technology, 2024 and 2035

Figure 06: Global X-ray Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 07: Global X-ray Market Revenue (US$ Bn), by Computed Radiography, 2020 to 2035

Figure 08: Global X-ray Market Revenue (US$ Bn), by Direct Digital Radiography, 2020 to 2035

Figure 09: Global X-ray Market Value Share Analysis, by Application, 2024 and 2035

Figure 10: Global X-ray Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 11: Global X-ray Market Revenue (US$ Bn), by Dental, 2020 to 2035

Figure 12: Global X-ray Market Revenue (US$ Bn), by Neurology, 2020 to 2035

Figure 13: Global X-ray Market Revenue (US$ Bn), by Cardiovascular, 2020 to 2035

Figure 14: Global X-ray Market Revenue (US$ Bn), by Gastroenterology, 2020 to 2035

Figure 15: Global X-ray Market Revenue (US$ Bn), by Urology, 2020 to 2035

Figure 16: Global X-ray Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 17: Global X-ray Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global X-ray Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global X-ray Market Value Share Analysis, by End-user, 2024 and 2035

Figure 20: Global X-ray Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 21: Global X-ray Market Revenue (US$ Bn), by Hospitals , 2020 to 2035

Figure 22: Global X-ray Market Revenue (US$ Bn), by Diagnostic Centers , 2020 to 2035

Figure 23: Global X-ray Market Revenue (US$ Bn), by Specialty Clinics, 2020 to 2035

Figure 24: Global X-ray Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 25: Global X-ray Market Value Share Analysis, by Region, 2024 and 2035

Figure 26: Global X-ray Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 27: North America X-ray Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America X-ray Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America X-ray Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America X-ray Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 31: North America X-ray Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 32: North America X-ray Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 33: North America X-ray Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 34: North America X-ray Market Value Share Analysis, by Application, 2024 and 2035

Figure 35: North America X-ray Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 36: North America X-ray Market Value Share Analysis, by End-user, 2024 and 2035

Figure 37: North America X-ray Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 38: Europe X-ray Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Europe X-ray Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: Europe X-ray Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: Europe X-ray Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 42: Europe X-ray Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 43: Europe X-ray Market Attractiveness Analysis, by Technology, 2024 and 2035

Figure 44: Europe X-ray Market Value Share Analysis, by Technology, 2025 to 2035

Figure 45: Europe X-ray Market Value Share Analysis, by Application, 2024 and 2035

Figure 46: Europe X-ray Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 47: Europe X-ray Market Value Share Analysis, by End-user, 2024 and 2035

Figure 48: Europe X-ray Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 49: Asia Pacific X-ray Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: Asia Pacific X-ray Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 51: Asia Pacific X-ray Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 52: Asia Pacific X-ray Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 53: Asia Pacific X-ray Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 54: Asia Pacific X-ray Market Attractiveness Analysis, by Technology, 2024 and 2035

Figure 55: Asia Pacific X-ray Market Value Share Analysis, by Technology, 2025 to 2035

Figure 56: Asia Pacific X-ray Market Value Share Analysis, by Application, 2024 and 2035

Figure 57: Asia Pacific X-ray Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 58: Asia Pacific X-ray Market Value Share Analysis, by End-user, 2024 and 2035

Figure 59: Asia Pacific X-ray Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 60: Latin America X-ray Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Latin America X-ray Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 62: Latin America X-ray Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 63: Latin America X-ray Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 64: Latin America X-ray Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 65: Latin America X-ray Market Attractiveness Analysis, by Technology, 2024 and 2035

Figure 66: Latin America X-ray Market Value Share Analysis, by Technology, 2025 to 2035

Figure 67: Latin America X-ray Market Value Share Analysis, by Application, 2024 and 2035

Figure 68: Latin America X-ray Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 69: Latin America X-ray Market Value Share Analysis, by End-user, 2024 and 2035

Figure 70: Latin America X-ray Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 71: Middle East & Africa X-ray Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 72: Middle East & Africa X-ray Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 73: Middle East & Africa X-ray Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 74: Middle East and Africa X-ray Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 75: Middle East and Africa X-ray Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 76: Middle East and Africa X-ray Market Attractiveness Analysis, by Technology, 2024 and 2035

Figure 77: Middle East and Africa X-ray Market Value Share Analysis, by Technology, 2025 to 2035

Figure 78: Middle East and Africa X-ray Market Value Share Analysis, by Application, 2024 and 2035

Figure 79: Middle East and Africa X-ray Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 80: Middle East and Africa X-ray Market Value Share Analysis, by End-user, 2024 and 2035

Figure 81: Middle East and Africa X-ray Market Attractiveness Analysis, by End-user, 2025 to 2035