Reports

Reports

As electronic producers seek to pace up with the latest technologies, miniaturization will emerge at fore as the latest trend in the industry. This trend is likely to continue in the forthcoming years thus boosting opportunities for the global nanosilver market. As per Transparency Market Research, based on revenue the global nanosilver market is expected to rise at a CAGR of 15.4% between 2014 and 2020. The market was valued at US$682.0 mn in 2013 and is expected to reach US$1.8 bn by the end of 2020.

Despite witnessing positive growth, the market has been witnessing challenge from the volatility of nanosilver prices. The higher cost of nanosilver than conventional silver also restrains the market’s growth to an extent. Besides these, stringent regulations and controversies surrounding the harmful effect of using nanosilver on environment will create further bottlenecks for the market.

Nevertheless, the advent of novel applications of nanosilver is expected to boost prospects for its sales. While the booming consumer electronics industry remains the prime driver of the nanosilver market, its increasing application in the healthcare sector will bolster opportunities for the market in the forthcoming years.

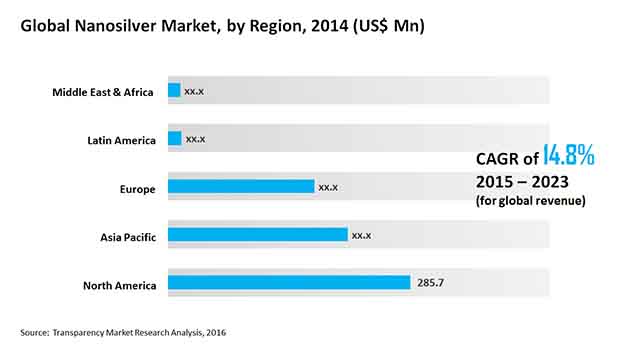

Regionally, North America has been exhibiting the most lucrative prospects for nanosilver sales. The region emerged dominant in the global market holding a share of 41.8% in 2013. Overall demand for nanosilver in North America stood at 212.8 tons in 2013. TMR expects it to rise to 484.8 tons by the end of 2020, exhibiting a CAGR of 12.9% during the period. The healthcare industry will majorly contribute to the rising demand for nanosilver in North America.

The flourishing electrical and electronics industry in Europe has been attracting the most prominent vendors of nanosilver. The rising food and beverages market in the region is also expected to boost sales of nanosilver considerably.

Asia Pacific is also expected to exhibit attractive opportunities for vendors in the global nanosilver market. The region as per TMR holds the second-largest share in the overall market and is expected to rise at a CAGR of 13.5% between 2014 and 2020. High production capacities of the consumer electronics industries in South Korea and China have proven extremely profitable for the regional market. Apart from this, the rising willingness of the emerging middle-class population to spend on the latest models of electronics will also boost nanosilver sales in the region.

The electrical and electronics industry has emerged as the largest end-use segment for nanosilver. It held a dominant share of 37.8% in the market in 2013. The increasing use of nanosilver in printing electronics equipment such as inkjet and flexographic printers will further boost its sales in the electrical and electronics industry. It is also used in miniature printed circuit boards, capacitors, and printed sensors. The nanosilver market will therefore considerably gain from the expansion of the electronics industry.

During the same time, the healthcare industry emerged as the second-largest application segment of nanosilver. It accounted for a share of 27.6% in the market in 2013. Nanosilver is widely used in surgical blazes, bandages, and wound dressing. TMR projects the demand from this segment to rise at a significant pace during the forecast period. The application of nanosilver is also expected to increase in the food and beverages and the textile industry. The rising use of nanosilver in water treatment will open novel prospects for the market’s growth.

Some of the most prominent companies operating in the market include Bayer MaterialScience, Nano Silver Manufacturing Sdn Bhd, NovaCentrix, Advanced Nano Products Co. Ltd., Ames Goldsmith Corporation, Applied Nanotech Holdings, Inc. and others.

1. Preface

1.1. Report Description

1.2. Research Scope

1.3. Assumptions

1.4. Market Segmentation

1.5. Research Methodology

2. Executive Summary

2.1. Global Nanosilver Market, 2014-2023, (Tons) (US$ Mn)

2.2. Nanosilver: Market Snapshot

3. Nanosilver Market - Industry Analysis

3.1. Introduction

3.2. Value Chain Analysis

3.3. Market Drivers

3.3.1. Significant Growth in Consumer Electronics Industry is Expected to Drive Nanosilver Market

3.3.2. Increasing Demand for Antimicrobial Coatings in Various Applications is Anticipated to Propel Nanosilver Market

3.4. Restraints

3.5. 3.4.1 High Price of Nanosilver Expected to Act as Barrier in the Growth of Nanosilver Market

3.6. 3.4.2 Concerns of Regulatory Bodies Regarding Harmful Effects of Nanosilver to Health and Environment is Estimated to Act as Restrain for the Growth of Nanosilver Market

3.7. Opportunity

3.7.1. Technological Innovation and Economies of Scale is Projected to Act as Opportunity for the Nanosilver Market

3.8. Porter’s Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Degree of Competition

3.9. Global Nanosilver Market Attractiveness, by End-user, 2014

3.10. Global Nanosilver Market Attractiveness, by Country, 2014

4. Raw Material and Price Trend Analysis

4.1. Raw Material Analysis

4.2. Silver Price Trend, 2014-2023 (US$/Gm)

4.3. Nanosilver Price Trend, 2014-2023 (US$/Gm)

5. Nanosilver Market - End-user Analysis

5.1. Global Nanosilver Market: End-user Overview

5.2. Global Nanosilver Market for Electrical & Electronics, 2014-2023 (Tons) (US$ Mn)

5.3. Global Nanosilver Market for Healthcare, 2014-2023 (Tons) (US$ Mn)

5.4. Global Nanosilver Market for Food & Beverages, 2014-2023 (Tons) (US$ Mn)

5.5. Global Nanosilver Market for Textile, 2014-2023 (Tons) (US$ Mn)

5.6. Global Nanosilver Market for Water Treatment, 2014-2023 (Tons) (US$ Mn)

5.7. Global Nanosilver Market for Others, 2014-2023 (Tons) (US$ Mn)

6. Nanosilver Market - Regional Analysis

6.1. Global Nanosilver Market: Regional Overview

6.2. North America Nanosilver Market, 2014 and 2023

6.2.1. North America Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.2.2. North America Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.2.3. U.S. Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.2.4. U.S. Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.2.5. Rest of North America Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.2.6. Rest of North America Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.3. Europe Nanosilver Market, 2014 and 2023

6.3.1. Europe Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.3.2. Europe Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.3.3. France Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.3.4. France Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.3.5. Germany Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.3.6. Germany Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.3.7. Italy Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.3.8. Italy Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.3.9. Spain Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.3.10. Spain Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.3.11. UK Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.3.12. UK Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.3.13. Rest of Europe Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.3.14. Rest of Europe Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.4. Asia Pacific (APAC) Nanosilver Market, 2014 and 2023

6.4.1. Asia Pacific Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.4.2. Asia Pacific Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.4.3. China Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.4.4. China Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.4.5. Japan Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.4.6. Japan Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.4.7. ASEAN Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.4.8. ASEAN Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.4.9. Rest of APAC Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.4.10. Rest of APAC Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.5. Latin America (LA) Nanosilver Market, 2014 and 2023

6.5.1. Latin America Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.5.2. Latin America Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.5.3. Brazil Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.5.4. Brazil Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.5.5. Rest of LA Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.5.6. Rest of LA Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.6. Middle East & Africa (MEA) Nanosilver Market, 2014 and 2023

6.6.1. Middle East & Africa Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.6.2. Middle East & Africa Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.6.3. GCC Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.6.4. GCC Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.6.5. South Africa Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.6.6. South Africa Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

6.6.7. Rest of Middle East & Africa Nanosilver Market Volume, by End-user, 2014-2023 (Tons)

6.6.8. Rest of Middle East & Africa Nanosilver Market Revenue, by End-user, 2014-2023 (US$ Mn)

7. Company Profiles

7.1. NSM (Nano Silver Manufacturing SDN BHD)

7.2. NovaCentrix

7.3. Advanced Nano Products Co. Ltd.

7.4. Ames Goldsmith Corp.

7.5. Creative Technology Solutions Co. Ltd.

7.6. Applied Nanotech, Inc.

7.7. ras materials GmbH

7.8. Clariant International Ltd.

7.9. SILVIX Co., Ltd.

7.10. C3NANO

8. Primary Research - Key Findings

9. List of Customers of Nanosilve