Reports

Reports

The international LNG bunkering market is witnessing robust growth, which is being mainly fueled by the shipping industry moving toward cleaner fuels and a push to meet the strict international regulations regarding sulfur emissions. Liquefied natural gas, is a low greenhouse gas emissions marine fuel and an alternative with reduced greenhouse gas emissions (low sulfur oxide emissions) as compared to the conventional marine fuels that render it a fit fuel to environmentally compliant vessels.

The major market participants have been aggressive in expanding infrastructure, building strategic alliances, and investing in innovative LNG storage and transportation technologies in an effort to improve their fuel supply and reliability.

Measures to build specialized LNG bunkering ports, convert ships to operate on LNG fuel, and the introduction of uniform safety measures are speeding up the process of uptake in the market. All these steps are preparing a positive environment in which adoption of LNG could be a sustainable alternative in line with the energy shift of the maritime industry.

The LNG bunkering market is the sector that engages in the deliveries of liquefied natural gas (LNG) as ship fuel. LNG fuel is a cleaner fuel as compared to the usual marine-based fuel and it has enabled vessels to minimize sulfur oxide, nitrogen oxide, and carbon emissions. The market includes LNG manufacturing, storage, transport, and fueling infrastructure, assisting the shipping sector to move toward green and environmental friendly operation.

The bunkering process may be performed by truck-to-ship, ship-to-ship or taking place at a terminals-based LNG transfer, which enables fluid fueling to a variety of vessels such as container ships, ferries or cruise liners. Among the major actions in the market are planned LNG bunkering port development, and retrofitting vessels with LNG technology, as well as assuring the storage and transport solutions. These developments are catalyzing growth that is seeing shipping companies transition to cleaner fuels and meet emissions rules in various countries of the world.

| Attribute | Detail |

|---|---|

| LNG Bunkering Market Drivers |

|

The current trend toward environmental sustainability in the global domain is leading to a rapid transformation in the marine sector, toward cleaner marine fuels, where LNG bunkering has become an important option. Conventional marine fuels like heavy fuel oil are among the leading contributors to sulfur oxides (SOx), nitrogen oxides (NOx), and greenhouse gases and, therefore, regulatory agencies and shipping companies are seeking alternative sources of fuel. Liquefied natural gas (LNG) also presents a solution that can reduce harmful emissions by large percentages and be in line with the International Maritime Organization (IMO) global sulfur cap regulations. This ecological necessity is also being amplified by the increasing social and corporate desire to have a greener supply chain and a sustainable solution to logistics.

Operators of shipping vessels are also focusing on fuel that has a minimum impact on the environment and one that has no effects on their performance. LNG bunkering is beneficial in two aspects; adherence to emission regulations and practicability of operations, as the global network of LNG supply is built and extended in the major ports worldwide. This is prompting gradual market pull by the increasing refueling needs of ship owners, port agents, and even governments who realize the long-term economic and regulatory advantages of cleaner sources of energy.

Innovation in technological advances on LNG storage and transfer systems is playing a major role as an LNG bunkering market growth driver where ease of working, safety and scalability are increased. Conventionally, the process of handling fuels came with the problems of limited storage space, complicated transportation, and safety issues that hindered extensive use of LNG in spheres of navigation. New trends in cryogenic storage, automated fueling systems, and real-time monitoring processes greatly help to alleviate these fears, and LNG has become an increasingly viable and available shipping fuel to operators globally. Modernized tank storage with better insulation technology, higher pressure ratings, and modular designs permit more efficient fuel storage capability and safer handling as the fuel is being bunkered.

The transfer side infrastructure innovation is enhancing the bunkering experience in terms of both efficiency and safety, such as automated ship-to-ship and terminal-to-ship LNG bunkering systems that shorten the process and reduce downtime of ships and associated risks. Advanced digital monitoring such as sensors to track temperature, pressure, flow, and their placement allows real-time monitoring, proactive maintenance, and quick mitigation of possible problems, improving reliability and operational efficiency.

The ongoing research in the area of storage and transfer of LNG, coupled with unabating technology development, are not only logistical and safety-related problems being solved but adds to the commercial feasibility of this type of marine fuel. This makes LNG bunkering a sustainable and cost effective alternative, not only encouraging the growth of market but also the broader greening of shipping operations so as to meet strict environmental controls.

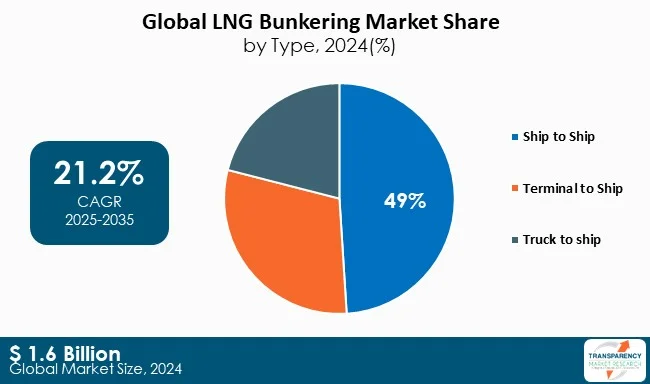

The ship-to-ship segment is dominating the LNG bunkering industry due to its flexibility, efficiency, and operations that have mobility. It can be used to send LNG between vessels without the need to use infrastructure located in ports and thus can be used to reduce downtime and to refuel ships anywhere along the global shipping lanes. The growth of specialized LNG bunkering ships, fuel barges, and related facilities also complements the ship-to-ship, which is why it is the desired solution among shipping operators as an efficient and scalable source of reliable and environmentally sound fueling.

| Attribute | Detail |

|---|---|

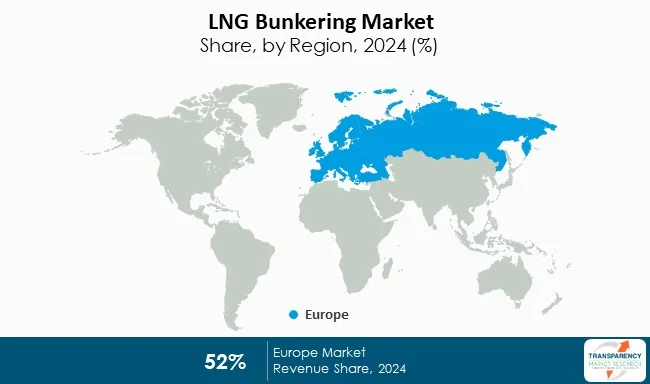

| Leading Region | Europe |

Europe leads the LNG bunkering industry since the region had early adoption of LNG powered vessels, good infrastructure in the port area, and strict environmental policies. The major ports in The Netherlands, Belgium, and Norway offer large LNG storage and bunker services. The impetus to achieve regulatory compliance with IMO sulfur limits and EU emission standards is one of the factors driving shipping operators to adopt LNG.

Shell plc, TotalEnergies SE, Gasum Ltd., and Korea Gas Corporation (KOGAS) are major players in LNG bunkering market that provide liquefied natural gas (LNG) as a cleaner marine fuel. Their facilities comprise LNG supply, storage, and ship-to-ship or port-based bunkering services, backed by specialized LNG bunker ships and infrastructure, which allow shipping companies to meet IMO emissions regulations and shift toward sustainable, low-sulfur fuel options.

Additionally, LyondellBasell Industries, Mitsubishi, Teijin Limited, and SABIC also play a major role in the global LNG Bunkering market, with a competitive landscape governed by innovation and productivity.

| Attribute | Detail |

|---|---|

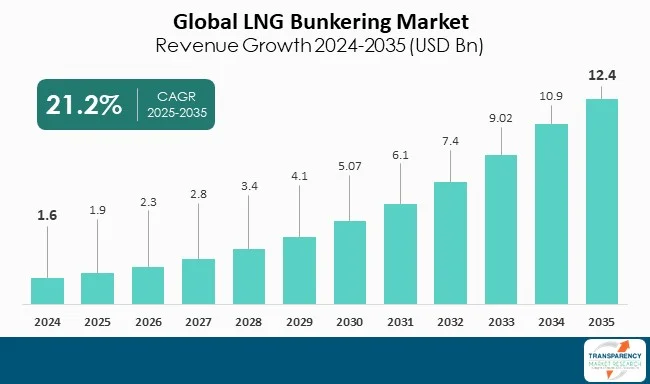

| Market Size Value in 2024 | US$ 1.6 Bn |

| Market Forecast Value in 2035 | US$ 12.4 Bn |

| Growth Rate (CAGR) | 21.2% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 1.6 Bn in 2024

The LNG bunkering market is expected to grow at a CAGR of 21.2% from 2025 to 2035

Growing demand for cleaner marine fuels globally and technological advancements in LNG storage and transfer

Ship-to-Ship (STS) held the largest share under type segment in 2024

Europe was the most lucrative region of the LNG bunkering market in 2024

Shell Plc, Total Energies, ABS Group, Air Liquide, Gasum Ltd., Probunkers, Harvey Gulf International Marine, Nauticor GmbH & Co.KG, GAZ System, Korea Gas Corporation

Table 1 Global LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 2 Global LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 3 Global LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 4 Global LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 5 Global LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 6 Global LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 7 Global LNG Bunkering Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 8 Global LNG Bunkering Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 9 North America LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 10 North America LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 11 North America LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 12 North America LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 13 North America LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 14 North America LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 15 North America LNG Bunkering Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 16 North America LNG Bunkering Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17 USA LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 18 USA LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 19 USA LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 20 USA LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 21 USA LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 USA LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 Canada LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 24 Canada LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 25 Canada LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 26 Canada LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 27 Canada LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 Canada LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Europe LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 30 Europe LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 31 Europe LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 32 Europe LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 33 Europe LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 Europe LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Europe LNG Bunkering Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe LNG Bunkering Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 38 Germany LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 39 Germany LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 40 Germany LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 41 Germany LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 42 Germany LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 43 France LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 44 France LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 45 France LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 46 France LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 47 France LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 48 France LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 49 UK LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 50 UK LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 51 UK LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 52 UK LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 53 UK LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 UK LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 55 Italy LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 56 Italy LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 57 Italy LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 58 Italy LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 59 Italy LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 60 Italy LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 61 Spain LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 62 Spain LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 63 Spain LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 64 Spain LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 65 Spain LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Spain LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 67 Russia & CIS LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 68 Russia & CIS LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 69 Russia & CIS LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 70 Russia & CIS LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 71 Russia & CIS LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 72 Russia & CIS LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 73 Rest of Europe LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 74 Rest of Europe LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 75 Rest of Europe LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 76 Rest of Europe LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 77 Rest of Europe LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Rest of Europe LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 79 Asia Pacific LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 80 Asia Pacific LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 81 Asia Pacific LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 82 Asia Pacific LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 83 Asia Pacific LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 84 Asia Pacific LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 85 Asia Pacific LNG Bunkering Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific LNG Bunkering Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 88 China LNG Bunkering Market Value (US$ Bn) Forecast, by Type 2020 to 2035

Table 89 China LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 90 China LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 91 China LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 92 China LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 93 Japan LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 94 Japan LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 95 Japan LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 96 Japan LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 97 Japan LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 98 Japan LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 99 India LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 100 India LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 101 India LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 102 India LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 103 India LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 104 India LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 105 India LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 India LNG Bunkering Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 ASEAN LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 108 ASEAN LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 109 ASEAN LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 110 ASEAN LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 111 ASEAN LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 112 ASEAN LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 113 Rest of Asia Pacific LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 114 Rest of Asia Pacific LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 115 Rest of Asia Pacific LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 116 Rest of Asia Pacific LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 117 Rest of Asia Pacific LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 118 Rest of Asia Pacific LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 119 Latin America LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 120 Latin America LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 121 Latin America LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 122 Latin America LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 123 Latin America LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 124 Latin America LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 125 Latin America LNG Bunkering Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America LNG Bunkering Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 128 Brazil LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 129 Brazil LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 130 Brazil LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 131 Brazil LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 132 Brazil LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 133 Mexico LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 134 Mexico LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 135 Mexico LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 136 Mexico LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 137 Mexico LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 138 Mexico LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 139 Rest of Latin America LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 140 Rest of Latin America LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 141 Rest of Latin America LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 142 Rest of Latin America LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 143 Rest of Latin America LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 Rest of Latin America LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 145 Middle East & Africa LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 146 Middle East & Africa LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 147 Middle East & Africa LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 148 Middle East & Africa LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 149 Middle East & Africa LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 150 Middle East & Africa LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 151 Middle East & Africa LNG Bunkering Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa LNG Bunkering Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 154 GCC LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 155 GCC LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 156 GCC LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 157 GCC LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 GCC LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 159 South Africa LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 160 South Africa LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 161 South Africa LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 162 South Africa LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 163 South Africa LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 164 South Africa LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 165 Rest of Middle East & Africa LNG Bunkering Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 166 Rest of Middle East & Africa LNG Bunkering Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 167 Rest of Middle East & Africa LNG Bunkering Market Volume (Tons) Forecast, by Bunkering Method, 2020 to 2035

Table 168 Rest of Middle East & Africa LNG Bunkering Market Value (US$ Bn) Forecast, by Bunkering Method, 2020 to 2035

Table 169 Rest of Middle East & Africa LNG Bunkering Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Rest of Middle East & Africa LNG Bunkering Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Figure 1 Global LNG Bunkering Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 2 Global LNG Bunkering Market Attractiveness, by Type

Figure 3 Global LNG Bunkering Market Volume Share Analysis, by Bunkering Method, 2024, 2027, and 2035

Figure 4 Global LNG Bunkering Market Attractiveness, by Bunkering Method

Figure 5 Global LNG Bunkering Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 6 Global LNG Bunkering Market Attractiveness, by End-use

Figure 7 Global LNG Bunkering Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 8 Global LNG Bunkering Market Attractiveness, by Region

Figure 9 North America LNG Bunkering Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 10 North America LNG Bunkering Market Attractiveness, by Type

Figure 11 North America LNG Bunkering Market Attractiveness, by Type

Figure 12 North America LNG Bunkering Market Volume Share Analysis, by Bunkering Method, 2024, 2027, and 2035

Figure 13 North America LNG Bunkering Market Attractiveness, by Bunkering Method

Figure 14 North America LNG Bunkering Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 15 North America LNG Bunkering Market Attractiveness, by End-use

Figure 16 North America LNG Bunkering Market Attractiveness, by Country and Sub-region

Figure 17 Europe LNG Bunkering Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 18 Europe LNG Bunkering Market Attractiveness, by Type

Figure 19 Europe LNG Bunkering Market Volume Share Analysis, by Bunkering Method, 2024, 2027, and 2035

Figure 20 Europe LNG Bunkering Market Attractiveness, by Bunkering Method

Figure 21 Europe LNG Bunkering Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 22 Europe LNG Bunkering Market Attractiveness, by End-use

Figure 23 Europe LNG Bunkering Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Europe LNG Bunkering Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific LNG Bunkering Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 26 Asia Pacific LNG Bunkering Market Attractiveness, by Type

Figure 27 Asia Pacific LNG Bunkering Market Volume Share Analysis, by Bunkering Method, 2024, 2027, and 2035

Figure 28 Asia Pacific LNG Bunkering Market Attractiveness, by Bunkering Method

Figure 29 Asia Pacific LNG Bunkering Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 30 Asia Pacific LNG Bunkering Market Attractiveness, by End-use

Figure 31 Asia Pacific LNG Bunkering Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 32 Asia Pacific LNG Bunkering Market Attractiveness, by Country and Sub-region

Figure 33 Latin America LNG Bunkering Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 34 Latin America LNG Bunkering Market Attractiveness, by Type

Figure 35 Latin America LNG Bunkering Market Volume Share Analysis, by Bunkering Method, 2024, 2027, and 2035

Figure 36 Latin America LNG Bunkering Market Attractiveness, by Bunkering Method

Figure 37 Latin America LNG Bunkering Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 38 Latin America LNG Bunkering Market Attractiveness, by End-use

Figure 39 Latin America LNG Bunkering Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Latin America LNG Bunkering Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa LNG Bunkering Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 42 Middle East & Africa LNG Bunkering Market Attractiveness, by Type

Figure 43 Middle East & Africa LNG Bunkering Market Volume Share Analysis, by Bunkering Method, 2024, 2027, and 2035

Figure 44 Middle East & Africa LNG Bunkering Market Attractiveness, by Bunkering Method

Figure 45 Middle East & Africa LNG Bunkering Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 46 Middle East & Africa LNG Bunkering Market Attractiveness, by End-use

Figure 47 Middle East & Africa LNG Bunkering Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Middle East & Africa LNG Bunkering Market Attractiveness, by Country and Sub-region