Reports

Reports

The global construction chemicals market is gaining momentum based on rapid urbanization, infrastructure development, and demand for durable and energy-efficient structures. It is well-known that concrete admixture, waterproofing, adhesive and sealants, and coatings help in performance enhancement, lifecycle extension in buildings, infrastructure works, and construction chemicals are applied in residential, commercial, industrial, and civil and structural works, enhancing the strength and workability, and making them more resistant to environmental duress.

Market growth is driven by growing inclination toward green building solutions and regulations specifying sustainable, low-VOC and the ones capable of sustaining high performance. Leading players like Sika, BASF, Saint-Gobain, and Mapei are funding R&D initiatives for carbon reducing admixtures, advanced waterproofing alternatives, and smart material technologies.

Construction chemicals are more durable and optimize performance via specialized chemical formulations. There are numerous kinds of construction chemicals, viz adhesives, concrete admixtures, sealants, flooring compounds, water proofing chemicals, and protective coatings.

Construction chemicals allow for improved workability, thereby accelerating or delaying the time it takes for materials to set. As such, the overall lifecycle of a building or infrastructure gets enhanced. Applications of construction chemicals span across residential, industrial, commercial, and civil engineering projects, with the basic intent of ensuring the building's safety and structural integrity during the construction and use.

| Attribute | Detail |

|---|---|

| Drivers |

|

The global wave of urbanization is one of the most intriguing factors driving the growth of the construction chemicals industry. Nearly 60% of the world’s population is set to live in cities by 2030, thereby placing tremendous pressure on governments and developers to provide medium to long term housing, transportation, and utility infrastructure. Emerging economies such as India, China, Indonesia, and parts of Africa have led the way, with sizable investments being made in smart cities, highways, metro systems, airports, and affordable housing.

The use of construction chemicals guarantees that these projects are completed to the required demand of durability, safety, and sustainability. For example, concrete admixtures are commonly used in construction to improve the workability, compressive strength, and strength retention of concrete while minimizing water and cement usage. These means construction chemicals reduce project costs while delivering and supporting faster builds.

The growing emphasis on resilient infrastructure has intensified the demand for specialty protective coatings and sealants. Governments as well as private investors are increasingly focused on green building certifications that need the use of high performance, environmentally-friendly materials, thereby positively impacting the developments of construction chemicals market.

Governments, regulators, and global organizations are enforcing stringent norms for energy efficiency, emissions reduction, and green construction. Green building certifications such as LEED, BREEAM, and IGBC require low-VOC adhesives, solvent-free coatings, and admixtures or products that allow cement replacement and reduce the emissions associated with the production of cement. Construction chemicals are at the center of this transformation as they are enabling resource-efficient construction by using less cement, thereby providing better building energy performance and improving durability.

For example, new superplasticizers, along with mineral admixture materials, allow partial replacement of cement with the use of supplementary materials, thereby resulting in reductions of up to 30% to 40% in CO₂ emissions on sizeable projects. Leading players including Sika, Saint-Gobain, and BASF are making huge investments in R&D to design bio-based admixtures, waterborne sealants, and recyclable chemical solutions, as well as real partnerships with academic institutes and start-ups to facilitate the acceleration of green innovations to stay ahead of imminent regulations.

Additionally, there is a groundswell of customer demand from real estate developers to institutional investors seeking sustainable products to increase asset value and appeal to ESG-oriented stakeholders.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

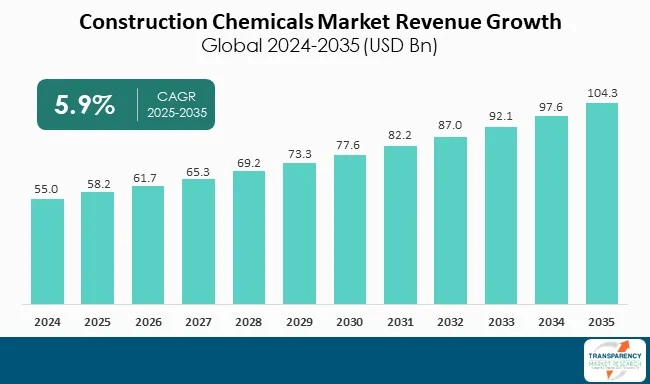

| Market Size Value in 2024 | US$ 55.5 Bn |

| Market Forecast Value in 2035 | US$ 104.3 Bn |

| Growth Rate (CAGR) | 5.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Construction Chemicals market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The construction chemicals market was valued at US$ 55.5 Bn in 2024

The construction chemicals industry is expected to grow at a CAGR of 5.9% from 2025 to 2035

Rapid urbanization and infrastructure modernization sustainability mandates and green building initiatives

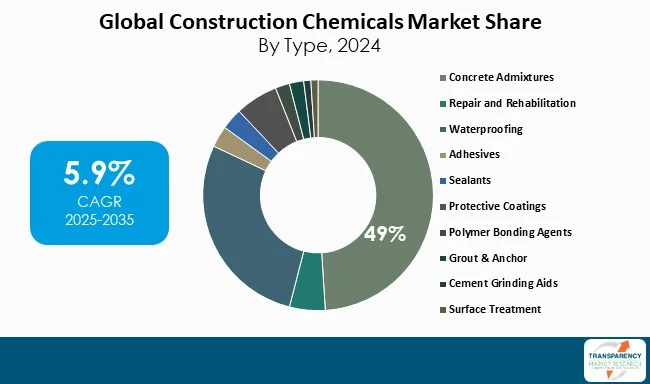

Concrete admixtures was the largest type segment and its value was anticipated to grow at an estimated CAGR of 7.2% during the forecast period

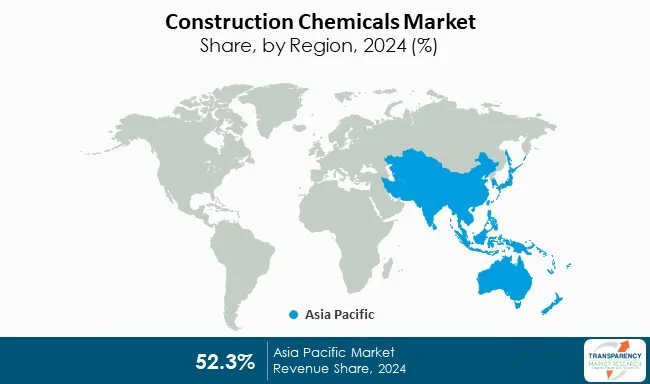

Asia Pacific was the most lucrative region in 2024

Nouryon, W.R. Grace, BASF SE, Sika AG, Dow Inc., Evonik Industries and Huntsman Corporation are the major players in the construction chemicals market

Table 1 Global Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 2 Global Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 3 Global Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 4 Global Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 5 Global Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 6 Global Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 7 Global Market Volume (Tons) Forecast, by Region, 2025 to 2035

Table 8 Global Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9 North America Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 10 North America Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 11 North America Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 12 North America Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 13 North America Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 14 North America Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 15 North America Market Volume (Tons) Forecast, by Country, 2025 to 2035

Table 16 North America Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17 U.S. Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 18 U.S. Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 19 U.S. Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 20 U.S. Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 21 U.S. Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 22 U.S. Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 23 Canada Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 24 Canada Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 25 Canada Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 26 Canada Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 27 Canada Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 28 Canada Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 29 Europe Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 30 Europe Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 31 Europe Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 32 Europe Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 33 Europe Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 34 Europe Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 35 Europe Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 36 Europe Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37 Germany Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 38 Germany Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 39 Germany Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 40 Germany Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 41 Germany Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 42 Germany Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 43 France Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 44 France Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 45 France Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 46 France Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 47 France Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 48 France Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 49 U.K. Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 50 U.K. Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 51 U.K. Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 52 U.K. Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 53 U.K. Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 54 U.K. Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 55 Italy Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 56 Italy Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 57 Italy Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 58 Italy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 59 Italy Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 60 Italy Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 61 Spain Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 62 Spain Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 63 Spain Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 64 Spain Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 65 Spain Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 66 Spain Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 67 Russia & CIS Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 68 Russia & CIS Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 69 Russia & CIS Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 70 Russia & CIS Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 71 Russia & CIS Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 72 Russia & CIS Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 73 Rest of Europe Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 74 Rest of Europe Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 75 Rest of Europe Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 76 Rest of Europe Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 77 Rest of Europe Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 78 Rest of Europe Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 79 Asia Pacific Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 80 Asia Pacific Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 81 Asia Pacific Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 82 Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 83 Asia Pacific Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 84 Asia Pacific Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 85 Asia Pacific Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Asia Pacific Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 China Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 88 China Market Value (US$ Bn) Forecast, by Type 2025 to 2035

Table 89 China Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 90 China Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 91 China Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 92 China Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 93 Japan Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 94 Japan Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 95 Japan Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 96 Japan Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 97 Japan Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 98 Japan Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 99 India Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 100 India Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 101 India Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 102 India Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 103 India Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 104 India Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 105 India Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 106 India Market Value (US$ Bn) Forecast, by End-use 2025 to 2035

Table 107 ASEAN Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 108 ASEAN Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 109 ASEAN Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 110 ASEAN Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 111 ASEAN Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 112 ASEAN Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 113 Rest of Asia Pacific Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 114 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 115 Rest of Asia Pacific Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 116 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 117 Rest of Asia Pacific Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 118 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 119 Latin America Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 120 Latin America Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 121 Latin America Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 122 Latin America Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 123 Latin America Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 124 Latin America Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 125 Latin America Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 126 Latin America Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127 Brazil Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 128 Brazil Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 129 Brazil Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 130 Brazil Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 131 Brazil Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 132 Brazil Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 133 Mexico Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 134 Mexico Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 135 Mexico Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 136 Mexico Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 137 Mexico Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 138 Mexico Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 139 Rest of Latin America Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 140 Rest of Latin America Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 141 Rest of Latin America Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 142 Rest of Latin America Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 143 Rest of Latin America Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 144 Rest of Latin America Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 145 Middle East & Africa Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 146 Middle East & Africa Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 147 Middle East & Africa Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 148 Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 149 Middle East & Africa Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 150 Middle East & Africa Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 151 Middle East & Africa Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 152 Middle East & Africa Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153 GCC Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 154 GCC Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 155 GCC Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 156 GCC Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 157 GCC Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 158 GCC Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 159 South Africa Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 160 South Africa Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 161 South Africa Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 162 South Africa Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 163 South Africa Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 164 South Africa Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 165 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Type, 2025 to 2035

Table 166 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Type, 2025 to 2035

Table 167 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 168 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 169 Rest of Middle East & Africa Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 170 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Figure 1 Global Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 Global Market Attractiveness, by Type

Figure 3 Global Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 4 Global Market Attractiveness, by Application

Figure 5 Global Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 6 Global Market Attractiveness, by End-use

Figure 7 Global Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global Market Attractiveness, by Region

Figure 9 North America Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 10 North America Market Attractiveness, by Type

Figure 11 North America Market Attractiveness, by Type

Figure 12 North America Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 13 North America Market Attractiveness, by Application

Figure 14 North America Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 15 North America Market Attractiveness, by End-use

Figure 16 North America Market Attractiveness, by Country and Sub-region

Figure 17 Europe Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 18 Europe Market Attractiveness, by Type

Figure 19 Europe Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 20 Europe Market Attractiveness, by Application

Figure 21 Europe Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 22 Europe Market Attractiveness, by End-use

Figure 23 Europe Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 24 Europe Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 26 Asia Pacific Market Attractiveness, by Type

Figure 27 Asia Pacific Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 28 Asia Pacific Market Attractiveness, by Application

Figure 29 Asia Pacific Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 30 Asia Pacific Market Attractiveness, by End-use

Figure 31 Asia Pacific Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 32 Asia Pacific Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 34 Latin America Market Attractiveness, by Type

Figure 35 Latin America Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 36 Latin America Market Attractiveness, by Application

Figure 37 Latin America Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 38 Latin America Market Attractiveness, by End-use

Figure 39 Latin America Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 40 Latin America Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 42 Middle East & Africa Market Attractiveness, by Type

Figure 43 Middle East & Africa Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 44 Middle East & Africa Market Attractiveness, by Application

Figure 45 Middle East & Africa Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 46 Middle East & Africa Market Attractiveness, by End-use

Figure 47 Middle East & Africa Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Middle East & Africa Market Attractiveness, by Country and Sub-region