Reports

Reports

Plant growth regulators have been gaining a marked popularity, in agriculture-driven economies, as bio-stimulants or bio-inhibitors that modify the physiological processes of plants. As agriculture becomes more mechanized and scientific development ensures the possibilities of using novel inputs to improve production, demand for plant growth regulators continue to increase, with sales of approximately US$ 5,600 million in 2018. However, the fact that uncontrolled use of plant growth regulators leads to exceptionally fast crop development, which results into ripening of the fruit surface while its core remains raw, remains a key concern among producers of plant growth regulators and end-users alike.

The use of plant growth regulators among landscape contractors and lawn care operators has been on the rise, as they become aware about the potential benefits including slow grass growth, improved health & stress tolerance of turf, and better root development, which help reduce the amount of clippings and frequency of mowing. Emerging trends of in-house gardening and farming favoring growth of the plant growth regulators market growth, as more farmers shift towards the use of agrochemicals to enhance crop protection and provide nutrition-rich produce. Demand for natural plant growth regulators also continues to grow, with rapid adoption of organic farming that is influenced by the rising demand for organic and natural products worldwide.

Sensing the unmet needs of the consumers, key plant growth regulators manufacturers are making efforts to identify the white space which is essential to stimulate their business growth; several initiatives and investments in R&D activities are key strategies of plant growth regulators manufacturers for gaining a competitive edge. Increasing government investments and remarkable growth in adoption of integrated crop management practices will further impact the prospects of the plant growth regulators market.

The preference for organic farming is significant in Europe, representing nearly 7% of the total EU agricultural land in 2017, which has significantly influenced the demand for plant growth regulators. The onus on green and sustainable farming practices, along with the focus of consumers on decorative farming and roof gardening, has been paving lucrative avenues for manufacturers of plant growth regulators in Europe.

From the regulatory control perspective, plant growth regulators are identified as ‘pesticide’, and therefore Codex Alimentarius Commission and European Union (EU) have set the ‘Maximum Residue Limits (MRLs)’ for plant growth regulators. Such regulatory constraints along with minimal product innovations may hinder adoption of plant growth regulators in Europe.

As increasing agricultural production coupled with ever-rising demand for food continue to support the expansion of plant growth regulators market, while gains are complemented by investments, and introduction of favorable agriculture policies for farmers. The impact of these aspects on plant growth regulators sales have been particularly prevalent in the developing nations of Asia Pacific - estimated to emerge as a high-growth market for plant growth regulators. Degradation of soil quality owing to overgrazing, deforestation, urbanization, and industrialization, has led farmers in the region to opt for plant growth regulators, which promote effective cultivation of fruits & vegetables, cereals & grains, and oilseeds & pulses.

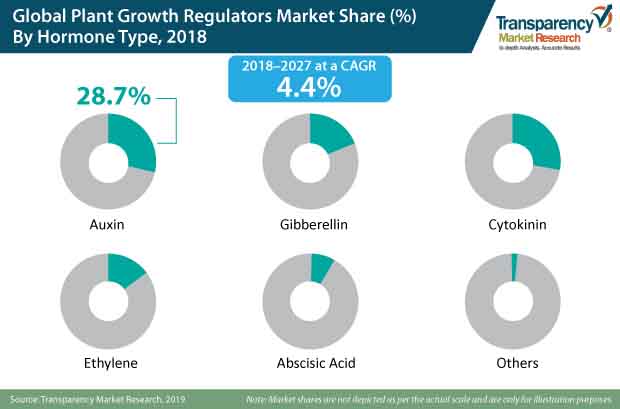

The competitive landscape of the plant growth regulators market has witnessed a perfect balance between the command of leading and emerging players, each group collectively accounting for 35-45% shares. However, local producers of plant growth regulators have been finding it difficult to eat into the shares of their leading competitors – accounting for a marginal market share. In order to maintain their position in the market, leading plant growth regulators manufacturers continue to exploit strategies such as innovative product developments, R&D investments, and joint ventures with government organizations.

In 2017, BASF invested nearly US$ 58 million to build a new innovation Campus Asia Pacific in Mumbai, India. In addition, Tata Chemicals follows their organic format to sell plant growth regulators under the name FarmGro and FarmGro G.

“Plant growth regulators manufacturing companies have to comply with a number of regulations, including those outlining the maximum residue level and side effects of the products. With limited products and inhibitions of product innovation due to lack of investments, especially among local players, it is highly likely that competition in the plant growth regulators market will remain less intense at a country level.” says TMR.

The companies profiled in the study includes BASF SE, Syngenta AG, Dow Chemical Company, Bayer Cropscience, FMC Corporation, Nufarm Limited, Valent Bioscience Corporation, WinField Solutions, Xinyi Industrial Co., Ltd., TATA Chemicals, Adama Agricultural Solutions Ltd, Nippon Soda Co. Ltd, Sumitomo Chemical Co. Ltd, Arysta LifeScience Corporation, and Redox Industries Limited.

1. Global Plant Growth Regulators Market - Executive Summary

1.1. Global Plant Growth Regulators Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Competition Blueprint

1.5. Technology Time Line Mapping

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Global GDP Growth Outlook

3.1.2. Regional Production Vs. Consumption

3.1.3. Per Capita Disposable Income

3.1.4. Global Crop Production

3.1.5. Global Retail Dynamics

3.1.6. Global Trade Scenario

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Market Restraints

3.3.1. Fluctuating Input Costs

3.3.2. Weak Supply Chain Infrastructure

3.3.3. Adulteration of Plant Growth Regulators

3.4. Market Trends

3.4.1. Increasing Awareness for Plant Growth Regulators

3.4.2. Preference for Quality Plant Growth Regulators

3.4.3. Increasing Demand for Clean Labelling

3.5. Trend Analysis- Impact on Time Line (2018-2027)

3.6. Forecast Factors – Relevance and Impact

3.7. Key Regulations and Claims

3.7.1. Food Packaging Claims

3.7.2. Labeling and Claims

3.7.3. Import/Export Regulations

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.1.1. Market Size and Forecast

4.1.2. Market Size and Y-o-Y Growth

4.1.3. Absolute $ Opportunity

5. Supply Chain Analysis

5.1. Profitability and Gross Margin Analysis By Competition

5.2. List of Active Participants- By Region

5.2.1. Raw Material Suppliers

5.2.2. Key Manufacturers

5.2.3. Key Distributor/Retailers

6. Global Plant Growth Regulators Market Pricing Analysis

6.1. Price Point Assessment by Product Type

6.2. Regional Average Pricing Analysis

6.2.1. North America

6.2.2. Latin America

6.2.3. Europe

6.2.4. Asia Pacific Ex. Japan (APEJ)

6.2.5. Japan

6.2.6. Oceania

6.2.7. Middle East and Africa

6.3. Price Forecast till 2027

6.4. Factors Influencing Pricing

7. Global Plant Growth Regulators Market Analysis and Forecast

7.1. Market Size Analysis (2013-2017) and Forecast (2018-2027)

7.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

7.1.2. Absolute $ Opportunity

7.2. Global Plant Growth Regulators Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

7.2.1. Forecast Factors and Relevance of Impact

7.2.2. Regional Plant Growth Regulators Market Business Performance Summary

8. Global Plant Growth Regulators Market Analysis By Hormone Type

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison By Hormone Type

8.1.2. Basis Point Share (BPS) Analysis By Hormone Type

8.2. Plant Growth Regulators Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Hormone Type

8.2.1. Auxin or Indole Acetic Acid (IAA)

8.2.2. Gibberellin or Gibberellic Acid (GA)

8.2.3. Cytokinin (Ck)

8.2.4. Ethylene (C2H4)

8.2.5. Abscisic Acid (AbA)

8.2.6. Others (salicylic acid, jasmonates, brassinolides, etc.)

8.3. Market Attractiveness Analysis By Hormone Type

9. Global Plant Growth Regulators Market Analysis By Function

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Function

9.1.2. Basis Point Share (BPS) Analysis By Function

9.2. Plant Growth Regulators Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Function

9.2.1. Seed Dormancy

9.2.2. Seed Growth

9.2.3. Vegetative Growth

9.2.4. Flower and Fruit Growth

9.2.5. Organ Abscission

9.3. Market Attractiveness Analysis By Function

10. Global Plant Growth Regulators Market Analysis By Crop Type

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison By Crop Type

10.1.2. Basis Point Share (BPS) Analysis By Crop Type

10.2. Plant Growth Regulators Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Crop Type

10.2.1. Fruits & Vegetables

10.2.2. Cereals & Grains

10.2.3. Oilseeds & Pulses

10.2.4. Turf & Ornamentals

10.3. Market Attractiveness Analysis By Crop Type

11. Global Plant Growth Regulators Market Analysis By Formulation

11.1. Introduction

11.1.1. Y-o-Y Growth Comparison By Formulation

11.1.2. Basis Point Share (BPS) Analysis By Formulation

11.2. Plant Growth Regulators Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Formulation

11.2.1. Solutions

11.2.2. Wettable Powders

11.2.3. Soluble Powders

11.2.4. Tablets

11.2.5. Water-Dispersible Granules

11.3. Market Attractiveness Analysis By Formulation

12. Global Plant Growth Regulators Market Analysis By Distribution Channel

12.1. Introduction

12.1.1. Y-o-Y Growth Comparison By Distribution Channel

12.1.2. Basis Point Share (BPS) Analysis By Distribution Channel

12.2. Plant Growth Regulators Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Distribution Channel

12.2.1. Direct Sales

12.2.2. Indirect Sales

12.2.2.1. Modern Trade

12.2.2.2. Specialty Stores

12.2.2.3. Online Stores

12.3. Market Attractiveness Analysis By Distribution Channel

13. Global Plant Growth Regulators Market Analysis and Forecast, By Region

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Region

13.1.2. Y-o-Y Growth Projections By Region

13.2. Plant Growth Regulators Market Size (US$ Mn) and Volume (MT) & Forecast (2018-2027) Analysis By Region

13.2.1. North America

13.2.2. Europe

13.2.3. APEJ

13.2.4. Japan

13.2.5. Oceania

13.2.6. Latin America

13.2.7. Middle East and Africa

13.3. Market Attractiveness Analysis By Region

14. North America Plant Growth Regulators Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.2. Plant Growth Regulators Market Size (Value (US$) and Volume (MT) Analysis (2013-2017) and Forecast (2018-2027)

14.2.1. Market Attractiveness By Country

14.2.1.1. U.S.

14.2.1.2. Canada

14.2.2. By Hormone Type

14.2.3. By Function

14.2.4. By Crop Type

14.2.5. By Formulation

14.2.6. By Distribution Channel

14.3. Market Attractiveness Analysis

14.3.1. By Country

14.3.2. By Hormone Type

14.3.3. By Function

14.3.4. By Crop Type

14.3.5. By Formulation

14.3.6. By Distribution Channel

14.4. Drivers and Restraints: Impact Analysis

15. Latin America Plant Growth Regulators Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Plant Growth Regulators Market Size (Value (US$) and Volume (MT) Analysis (2013-2017) and Forecast (2018-2027)

15.2.1. By Country

15.2.1.1. Brazil

15.2.1.2. Mexico

15.2.1.3. Chile

15.2.1.4. Peru

15.2.1.5. Argentina

15.2.1.6. Rest of Latin America

15.2.2. By Hormone Type

15.2.3. By Function

15.2.4. By Crop Type

15.2.5. By Formulation

15.2.6. By Distribution Channel

15.3. Market Attractiveness Analysis

15.3.1. By Country

15.3.2. By Hormone Type

15.3.3. By Function

15.3.4. By Crop Type

15.3.5. By Formulation

15.3.6. By Distribution Channel

15.4. Drivers and Restraints: Impact Analysis

16. Europe Plant Growth Regulators Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Plant Growth Regulators Market Size (Value (US$) and Volume (MT) Analysis (2013-2017) and Forecast (2018-2027)

16.2.1. By Country

16.2.1.1. EU-4 (Germany, France, Italy, Spain)

16.2.1.2. U.K.

16.2.1.3. BENELUX

16.2.1.4. Nordic

16.2.1.5. Russia

16.2.1.6. Poland

16.2.1.7. Rest of Europe

16.2.2. By Hormone Type

16.2.3. By Function

16.2.4. By Crop Type

16.2.5. By Formulation

16.2.6. By Distribution Channel

16.3. Market Attractiveness Analysis

16.3.1. By Hormone Type

16.3.2. By Function

16.3.3. By Crop Type

16.3.4. By Formulation

16.3.5. By Distribution Channel

16.4. Drivers and Restraints: Impact Analysis

17. APEJ Plant Growth Regulators Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.1.3. Key Regulations

17.2. Plant Growth Regulators Market Size (Value (US$) and Volume (MT) Analysis (2013-2017) and Forecast (2018-2027)

17.2.1. By Country

17.2.1.1. China

17.2.1.2. India

17.2.1.3. South Korea

17.2.1.4. ASEAN

17.2.2. By Hormone Type

17.2.3. By Function

17.2.4. By Crop Type

17.2.5. By Formulation

17.2.6. By Distribution Channel

17.3. Market Attractiveness Analysis

17.3.1. By Country

17.3.2. By Hormone Type

17.3.3. By Function

17.3.4. By Crop Type

17.3.5. By Formulation

17.3.6. By Distribution Channel

17.4. Drivers and Restraints: Impact Analysis

18. Japan Plant Growth Regulators Market Analysis and Forecast

18.1. Introduction

18.1.1. Basis Point Share (BPS) Analysis By Country

18.1.2. Y-o-Y Growth Projections By Country

18.1.3. Key Regulations

18.2. Plant Growth Regulators Market Size (Value (US$) and Volume (MT) Analysis (2013-2017) and Forecast (2018-2027)

18.2.1. By Hormone Type

18.2.2. By Function

18.2.3. By Crop Type

18.2.4. By Formulation

18.2.5. By Distribution Channel

18.3. Market Attractiveness Analysis

18.3.1. By Hormone Type

18.3.2. By Function

18.3.3. By Crop Type

18.3.4. By Formulation

18.3.5. By Distribution Channel

18.4. Drivers and Restraints: Impact Analysis

19. Oceania Plant Growth Regulators Market Analysis and Forecast

19.1. Introduction

19.1.1. Basis Point Share (BPS) Analysis By Country

19.1.2. Y-o-Y Growth Projections By Country

19.1.3. Key Regulations

19.2. Plant Growth Regulators Market Size (Value (US$) and Volume (MT) Analysis (2013-2017) and Forecast (2018-2027)

19.2.1. By Hormone Type

19.2.2. By Function

19.2.3. By Crop Type

19.2.4. By Formulation

19.2.5. By Distribution Channel

19.3. Market Attractiveness Analysis

19.3.1. By Hormone Type

19.3.2. By Function

19.3.3. By Crop Type

19.3.4. By Formulation

19.3.5. By Distribution Channel

19.4. Drivers and Restraints: Impact Analysis

20. Middle East and Africa (MEA) Plant Growth Regulators Market Analysis and Forecast

20.1. Introduction

20.1.1. Basis Point Share (BPS) Analysis By Country

20.1.2. Y-o-Y Growth Projections By Country

20.1.3. Key Regulations

20.2. Plant Growth Regulators Market Size (Value (US$) and Volume (MT) Analysis (2013-2017) and Forecast (2018-2027)

20.2.1. By Country

20.2.1.1. GCC Countries

20.2.1.2. South Africa

20.2.1.3. North Africa

20.2.1.4. Rest of MEA

20.2.2. By Hormone Type

20.2.3. By Function

20.2.4. By Crop Type

20.2.5. By Formulation

20.2.6. By Distribution Channel

20.3. Market Attractiveness Analysis

20.3.1. By Country

20.3.2. By Hormone Type

20.3.3. By Function

20.3.4. By Crop Type

20.3.5. By Formulation

20.3.6. By Distribution Channel

20.4. Drivers and Restraints: Impact Analysis

21. Competition Assessment

21.1. Global Plant Growth Regulators Market Competition - a Dashboard View

21.2. Global Plant Growth Regulators Market Structure Analysis

21.3. Global Plant Growth Regulators Market Company Share Analysis

21.3.1. For Tier 1 Market Players, 2017

21.3.2. Company Market Share Analysis of Top 10 Players, By Region

21.4. Key Participants Market Presence (Intensity Mapping) by Region

22. Brand Assessment

22.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

22.2. Plant Growth Regulators Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

22.3. Brand Strategy

23. Competition Deep-dive (Manufacturers/Suppliers)

23.1. Dow Chemical Company

23.1.1. Overview

23.1.2. Product Portfolio

23.1.3. Sales Footprint

23.1.4. Channel Footprint

23.1.4.1. Distributors List

23.1.4.2. Sales Channel (Clients)

23.1.5. Strategy Overview

23.1.5.1. Marketing Strategy

23.1.5.2. Culture Strategy

23.1.5.3. Channel Strategy

23.1.6. SWOT Analysis

23.1.7. Financial Analysis

23.1.8. Revenue Share

23.1.8.1. By Product Type

23.1.8.2. By Region

23.1.9. Key Clients

23.1.10. Analyst Comments

23.2. WinField Solutions

23.2.1. Overview

23.2.2. Product Portfolio

23.2.3. Sales Footprint

23.2.4. Channel Footprint

23.2.4.1. Distributors List

23.2.4.2. Sales Channel (Clients)

23.2.5. Strategy Overview

23.2.5.1. Marketing Strategy

23.2.5.2. Culture Strategy

23.2.5.3. Channel Strategy

23.2.6. SWOT Analysis

23.2.7. Financial Analysis

23.2.8. Revenue Share

23.2.8.1. By Product Type

23.2.8.2. By Region

23.2.9. Key Clients

23.2.10. Analyst Comments

23.3. Valent Bioscience Corporation

23.3.1. Overview

23.3.2. Product Portfolio

23.3.3. Sales Footprint

23.3.4. Channel Footprint

23.3.4.1. Distributors List

23.3.4.2. Sales Channel (Clients)

23.3.5. Strategy Overview

23.3.5.1. Marketing Strategy

23.3.5.2. Culture Strategy

23.3.5.3. Channel Strategy

23.3.6. SWOT Analysis

23.3.7. Financial Analysis

23.3.8. Revenue Share

23.3.8.1. By Product Type

23.3.8.2. By Region

23.3.9. 23.2.9. Key Clients

23.3.10. 23.2.10. Analyst Comments

23.4. Syngenta AG

23.4.1. Overview

23.4.2. Product Portfolio

23.4.3. Sales Footprint

23.4.4. Channel Footprint

23.4.4.1. Distributors List

23.4.4.2. Sales Channel (Clients)

23.4.5. Strategy Overview

23.4.5.1. Marketing Strategy

23.4.5.2. Culture Strategy

23.4.5.3. Channel Strategy

23.4.6. SWOT Analysis

23.4.7. Financial Analysis

23.4.8. Revenue Share

23.4.8.1. By Product Type

23.4.8.2. By Region

23.4.9. Key Clients

23.4.10. Analyst Comments

23.5. Nufarm Limited

23.5.1. Overview

23.5.2. Product Portfolio

23.5.3. Sales Footprint

23.5.4. Channel Footprint

23.5.4.1. Distributors List

23.5.4.2. Sales Channel (Clients)

23.5.5. Strategy Overview

23.5.5.1. Marketing Strategy

23.5.5.2. Culture Strategy

23.5.5.3. Channel Strategy

23.5.6. SWOT Analysis

23.5.7. Financial Analysis

23.5.8. Revenue Share

23.5.8.1. By Product Type

23.5.8.2. By Region

23.5.9. Key Clients

23.5.10. Analyst Comments

23.6. Xinyi Industrial Co., Ltd.

23.6.1. Overview

23.6.2. Product Portfolio

23.6.3. Sales Footprint

23.6.4. Channel Footprint

23.6.4.1. Distributors List

23.6.4.2. Sales Channel (Clients)

23.6.5. Strategy Overview

23.6.5.1. Marketing Strategy

23.6.5.2. Culture Strategy

23.6.5.3. Channel Strategy

23.6.6. SWOT Analysis

23.6.7. Financial Analysis

23.6.8. Revenue Share

23.6.8.1. By Product Type

23.6.8.2. By Region

23.6.9. Key Clients

23.7. BASF SE

23.7.1. Overview

23.7.2. Product Portfolio

23.7.3. Sales Footprint

23.7.4. Channel Footprint

23.7.4.1. Distributors List

23.7.4.2. Sales Channel (Clients)

23.7.5. Strategy Overview

23.7.5.1. Marketing Strategy

23.7.5.2. Culture Strategy

23.7.5.3. Channel Strategy

23.7.6. SWOT Analysis

23.7.7. Financial Analysis

23.7.8. Revenue Share

23.7.8.1. By Product Type

23.7.8.2. By Region

23.7.9. Key Clients

23.8. Bayer Cropscience

23.8.1. Overview

23.8.2. Product Portfolio

23.8.3. Sales Footprint

23.8.4. Channel Footprint

23.8.4.1. Distributors List

23.8.4.2. Sales Channel (Clients)

23.8.5. Strategy Overview

23.8.5.1. Marketing Strategy

23.8.5.2. Culture Strategy

23.8.5.3. Channel Strategy

23.8.6. SWOT Analysis

23.8.7. Financial Analysis

23.8.8. Revenue Share

23.8.8.1. By Product Type

23.8.8.2. By Region

23.8.9. Key Clients

23.9. FMC Corporation

23.9.1. Overview

23.9.2. Product Portfolio

23.9.3. Sales Footprint

23.9.4. Channel Footprint

23.9.4.1. Distributors List

23.9.4.2. Sales Channel (Clients)

23.9.5. Strategy Overview

23.9.5.1. Marketing Strategy

23.9.5.2. Culture Strategy

23.9.5.3. Channel Strategy

23.9.6. SWOT Analysis

23.9.7. Financial Analysis

23.9.8. Revenue Share

23.9.8.1. By Product Type

23.9.8.2. By Region

23.9.9. Key Clients

23.10. TATA Chemicals

23.10.1. Overview

23.10.2. Product Portfolio

23.10.3. Sales Footprint

23.10.4. Channel Footprint

23.10.4.1. Distributors List

23.10.4.2. Sales Channel (Clients)

23.10.5. Strategy Overview

23.10.5.1. Marketing Strategy

23.10.5.2. Culture Strategy

23.10.5.3. Channel Strategy

23.10.6. SWOT Analysis

23.10.7. Financial Analysis

23.10.8. Revenue Share

23.10.8.1. By Product Type

23.10.8.2. By Region

23.10.9. Key Clients

23.11. Adama Agricultural Solutions Ltd

23.11.1. Overview

23.11.2. Product Portfolio

23.11.3. Sales Footprint

23.11.4. Channel Footprint

23.11.4.1. Distributors List

23.11.4.2. Sales Channel (Clients)

23.11.5. Strategy Overview

23.11.5.1. Marketing Strategy

23.11.5.2. Culture Strategy

23.11.5.3. Channel Strategy

23.11.6. SWOT Analysis

23.11.7. Financial Analysis

23.11.8. Revenue Share

23.11.8.1. By Product Type

23.11.8.2. By Region

23.11.9. Key Clients

23.12. Nippon Soda Co. Ltd

23.12.1. Overview

23.12.2. Product Portfolio

23.12.3. Sales Footprint

23.12.4. Channel Footprint

23.12.4.1. Distributors List

23.12.4.2. Sales Channel (Clients)

23.12.5. Strategy Overview

23.12.5.1. Marketing Strategy

23.12.5.2. Culture Strategy

23.12.5.3. Channel Strategy

23.12.6. SWOT Analysis

23.12.7. Financial Analysis

23.12.8. Revenue Share

23.12.8.1. By Product Type

23.12.8.2. By Region

23.12.9. Key Clients

23.13. Redox Industries Limited

23.13.1. Overview

23.13.2. Product Portfolio

23.13.3. Sales Footprint

23.13.4. Channel Footprint

23.13.4.1. Distributors List

23.13.4.2. Sales Channel (Clients)

23.13.5. Strategy Overview

23.13.5.1. Marketing Strategy

23.13.5.2. Culture Strategy

23.13.5.3. Channel Strategy

23.13.6. SWOT Analysis

23.13.7. Financial Analysis

23.13.8. Revenue Share

23.13.8.1. By Product Type

23.13.8.2. By Region

23.13.9. Key Clients

23.14. Ecobiocides & Botanicals Pvt Ltd

23.14.1. Overview

23.14.2. Product Portfolio

23.14.3. Sales Footprint

23.14.4. Channel Footprint

23.14.4.1. Distributors List

23.14.4.2. Sales Channel (Clients)

23.14.5. Strategy Overview

23.14.5.1. Marketing Strategy

23.14.5.2. Culture Strategy

23.14.5.3. Channel Strategy

23.14.6. SWOT Analysis

23.14.7. Financial Analysis

23.14.8. Revenue Share

23.14.8.1. By Product Type

23.14.8.2. By Region

23.14.9. Key Clients

23.15. United Animal Health

23.15.1. Overview

23.15.2. Product Portfolio

23.15.3. Sales Footprint

23.15.4. Channel Footprint

23.15.4.1. Distributors List

23.15.4.2. Sales Channel (Clients)

23.15.5. Strategy Overview

23.15.5.1. Marketing Strategy

23.15.5.2. Culture Strategy

23.15.5.3. Channel Strategy

23.15.6. SWOT Analysis

23.15.7. Financial Analysis

23.15.8. Revenue Share

23.15.8.1. By Product Type

23.15.8.2. By Region

23.15.9. Key Clients

23.16. Laboratorios Agroenzymas SA de CV

23.16.1. Overview

23.16.2. Product Portfolio

23.16.3. Sales Footprint

23.16.4. Channel Footprint

23.16.4.1. Distributors List

23.16.4.2. Sales Channel (Clients)

23.16.5. Strategy Overview

23.16.5.1. Marketing Strategy

23.16.5.2. Culture Strategy

23.16.5.3. Channel Strategy

23.16.6. SWOT Analysis

23.16.7. Financial Analysis

23.16.8. Revenue Share

23.16.8.1. By Product Type

23.16.8.2. By Region

23.16.9. Key Clients

23.17. Central Drug House (P) Ltd.

23.17.1. Overview

23.17.2. Product Portfolio

23.17.3. Sales Footprint

23.17.4. Channel Footprint

23.17.4.1. Distributors List

23.17.4.2. Sales Channel (Clients)

23.17.5. Strategy Overview

23.17.5.1. Marketing Strategy

23.17.5.2. Culture Strategy

23.17.5.3. Channel Strategy

23.17.6. SWOT Analysis

23.17.7. Financial Analysis

23.17.8. Revenue Share

23.17.8.1. By Product Type

23.17.8.2. By Region

23.17.9. Key Clients

23.18. Dhanuka Agritech Ltd.

23.18.1. Overview

23.18.2. Product Portfolio

23.18.3. Sales Footprint

23.18.4. Channel Footprint

23.18.4.1. Distributors List

23.18.4.2. Sales Channel (Clients)

23.18.5. Strategy Overview

23.18.5.1. Marketing Strategy

23.18.5.2. Culture Strategy

23.18.5.3. Channel Strategy

23.18.6. SWOT Analysis

23.18.7. Financial Analysis

23.18.8. Revenue Share

23.18.8.1. By Product Type

23.18.8.2. By Region

23.18.9. Key Clients

23.19. Others (On Request)

23.19.1. Overview

23.19.2. Product Portfolio

23.19.3. Sales Footprint

23.19.4. Channel Footprint

23.19.4.1. Distributors List

23.19.4.2. Sales Channel (Clients)

23.19.5. Strategy Overview

23.19.5.1. Marketing Strategy

23.19.5.2. Culture Strategy

23.19.5.3. Channel Strategy

23.19.6. SWOT Analysis

23.19.7. Financial Analysis

23.19.8. Revenue Share

23.19.8.1. By Product Type

23.19.8.2. By Region

23.19.9. Key Clients

24. Recommendation- Critical Success Factors

25. Research Methodology

26. Assumptions & Acronyms Used

List of Table

Table 1: Global Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Hormone Type, 2017-2027

Table 2: Global Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Hormone Type, 2017-2027

Table 3: Global Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 4: Global Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 5: Global Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Formulation Type, 2017-2027

Table 6: Global Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Formulation Type, 2017-2027

Table 7: Global Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 8: Global Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 9: Global Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Region, 2017-2027

Table 10: Global Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Region, 2017-2027

Table 11: North America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Hormone Type, 2017-2027

Table 12: North America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Hormone Type, 2017-2027

Table 13: North America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 14: North America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 15: North America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Formulation Type, 2017-2027

Table 16: North America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Formulation Type, 2017-2027

Table 17: North America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 18: North America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 19: North America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 20: North America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 21: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Hormone Type, 2017-2027

Table 22: Latin America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Hormone Type, 2017-2027

Table 23: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 24: Latin America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 25: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Formulation Type, 2017-2027

Table 26: Latin America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Formulation Type, 2017-2027

Table 27: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 28: Latin America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 29: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 30: Latin America Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 31: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Hormone Type, 2017-2027

Table 32: Europe Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Hormone Type, 2017-2027

Table 33: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 34: Europe Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 35: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Formulation Type, 2017-2027

Table 36: Europe Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Formulation Type, 2017-2027

Table 37: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 38: Europe Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 39: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 40: Europe Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 41: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Hormone Type, 2017-2027

Table 42: APAC Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Hormone Type, 2017-2027

Table 43: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 44: APAC Plant Growth Regulators Market Volume(MT) Analysis and Forecast by Crop Type, 2017-2027

Table 45: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Formulation Type, 2017-2027

Table 46: APAC Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Formulation Type, 2017-2027

Table 47: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 48: APAC Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 49: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 50: APAC Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 51: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Hormone Type, 2017-2027

Table 52: MEA Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Hormone Type, 2017-2027

Table 53: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 54: MEA Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 55: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Formulation Type, 2017-2027

Table 56: MEA Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Formulation Type, 2017-2027

Table 57: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 58: MEA Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 59: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 60: MEA Plant Growth Regulators Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 61: Global Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Region, 2017-2027

Table 62: Global Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Region, 2017-2027

Table 63: Global Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 64: Global Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 65: Global Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 66: Global Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 67: North America Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 68: North America Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 69: North America Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 70: North America Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 71: North America Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 72: North America Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 73: Latin America Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 74: Latin America Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 75: Latin America Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 76: Latin America Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 77: Latin America Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 78: Latin America Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 79: Europe Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 80: Europe Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 81: Europe Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 82: Europe Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 83: Europe Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 84: Europe Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 85: APAC Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 86: APAC Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 87: APAC Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 88: APAC Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 89: APAC Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 90: APAC Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

Table 91: MEA Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Country, 2017-2027

Table 92: MEA Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Country, 2017-2027

Table 93: MEA Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Function, 2017-2027

Table 94: MEA Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Function, 2017-2027

Table 95: MEA Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis and Forecast by Crop Type, 2017-2027

Table 96: MEA Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis and Forecast by Crop Type, 2017-2027

List of Figure

Figure 01: Global Plant Growth Regulators Market Share (%) & BPS Analysis by Hormone Type, 2018 & 2027

Figure 2: Global Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Hormone Type, 2018-2027

Figure 3: Global Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Hormone Type, 2018-2027

Figure 4: Global Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Hormone Type, 2018-2027

Figure 5: Global Plant Growth Regulators Market Share (%) & BPS Analysis by Crop Type, 2018 & 2027

Figure 6: Global Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Crop Type, 2018-2027

Figure 7: Global Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Crop Type, 2018-2027

Figure 8: Global Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Crop Type, 2018-2027

Figure 9: Global Plant Growth Regulators Market Share (%) & BPS Analysis by Formulation Type, 2018 & 2027

Figure 10: Global Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Formulation Type, 2018-2027

Figure 11: Global Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Formulation Type, 2018-2027

Figure 12: Global Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Formulation Type, 2018-2027

Figure 13: Global Plant Growth Regulators Market Share (%) & BPS Analysis by Function, 2018 & 2027

Figure 14: Global Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Function, 2018-2027

Figure 15: Global Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Function, 2018-2027

Figure 16: Global Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Function, 2018-2027

Figure 17: Global Plant Growth Regulators Market Share (%) & BPS Analysis by Region, 2018 & 2027

Figure 18: Global Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Region, 2018-2027

Figure 19: Global Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Region, 2018-2027

Figure 20: Global Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Region, 2018-2027

Figure 21: Global Plant Growth Regulators Market Attractiveness Index by Hormone Type, 2018-2027

Figure 22: Global Plant Growth Regulators Market Attractiveness Index by Crop Type, 2018-2027

Figure 23: Global Plant Growth Regulators Market Attractiveness Index by Formulation Type, 2018-2027

Figure 24: Global Plant Growth Regulators Market Attractiveness Index by Function, 2018-2027

Figure 25: Global Plant Growth Regulators Market Attractiveness Index by Region, 2018-2027

Figure 26: North America Plant Growth Regulators Market Share (%) & BPS Analysis by Hormone Type, 2018 & 2027

Figure 27: North America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Hormone Type, 2018-2027

Figure 28: North America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Hormone Type, 2018-2027

Figure 29: North America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Hormone Type, 2018-2027

Figure 30: North America Plant Growth Regulators Market Share (%) & BPS Analysis by Crop Type, 2018 & 2027

Figure 31: North America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Crop Type, 2018-2027

Figure 32: North America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Crop Type, 2018-2027

Figure 33: North America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Crop Type, 2018-2027

Figure 34: North America Plant Growth Regulators Market Share (%) & BPS Analysis by Formulation Type, 2018 & 2027

Figure 35: North America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Formulation Type, 2018-2027

Figure 36: North America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Formulation Type, 2018-2027

Figure 37: North America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Formulation Type, 2018-2027

Figure 38: North America Plant Growth Regulators Market Share (%) & BPS Analysis by Function, 2018 & 2027

Figure 39: North America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Function, 2018-2027

Figure 40: North America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Function, 2018-2027

Figure 41: North America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Function, 2018-2027

Figure 42: North America Plant Growth Regulators Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 43: North America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 44: North America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Country, 2018-2027

Figure 45: North America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Country, 2018-2027

Figure 46: North America Plant Growth Regulators Market Attractiveness Index by Hormone Type, 2018-2027

Figure 47: North America Plant Growth Regulators Market Attractiveness Index by Crop Type, 2018-2027

Figure 48: North America Plant Growth Regulators Market Attractiveness Index by Formulation Type, 2018-2027

Figure 49: North America Plant Growth Regulators Market Attractiveness Index by Function, 2018-2027

Figure 50: North America Plant Growth Regulators Market Attractiveness Index by Region, 2018-2027

Figure 51: Latin America Plant Growth Regulators Market Share (%) & BPS Analysis by Hormone Type, 2018 & 2027

Figure 52: Latin America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Hormone Type, 2018-2027

Figure 53: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Hormone Type, 2018-2027

Figure 54: Latin America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Hormone Type, 2018-2027

Figure 55: Latin America Plant Growth Regulators Market Share (%) & BPS Analysis by Crop Type, 2018 & 2027

Figure 56: Latin America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Crop Type, 2018-2027

Figure 57: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Crop Type, 2018-2027

Figure 58: Latin America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Crop Type, 2018-2027

Figure 59: Latin America Plant Growth Regulators Market Share (%) & BPS Analysis by Formulation Type, 2018 & 2027

Figure 60: Latin America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Formulation Type, 2018-2027

Figure 61: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Formulation Type, 2018-2027

Figure 62: Latin America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Formulation Type, 2018-2027

Figure 63: Latin America Plant Growth Regulators Market Share (%) & BPS Analysis by Function, 2018 & 2027

Figure 64: Latin America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Function, 2018-2027

Figure 65: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Function, 2018-2027

Figure 66: Latin America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Function, 2018-2027

Figure 67: Latin America Plant Growth Regulators Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 68: Latin America Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 69: Latin America Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Country, 2018-2027

Figure 70: Latin America Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Country, 2018-2027

Figure 71: Latin America Plant Growth Regulators Market Attractiveness Index by Hormone Type, 2018-2027

Figure 72: Latin America Plant Growth Regulators Market Attractiveness Index by Crop Type, 2018-2027

Figure 73: Latin America Plant Growth Regulators Market Attractiveness Index by Formulation Type, 2018-2027

Figure 74: Latin America Plant Growth Regulators Market Attractiveness Index by Function, 2018-2027

Figure 75: Latin America Plant Growth Regulators Market Attractiveness Index by Region, 2018-2027

Figure 76: Europe Plant Growth Regulators Market Share (%) & BPS Analysis by Hormone Type, 2018 & 2027

Figure 77: Europe Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Hormone Type, 2018-2027

Figure 78: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Hormone Type, 2018-2027

Figure 79: Europe Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Hormone Type, 2018-2027

Figure 80: Europe Plant Growth Regulators Market Share (%) & BPS Analysis by Crop Type, 2018 & 2027

Figure 81: Europe Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Crop Type, 2018-2027

Figure 82: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Crop Type, 2018-2027

Figure 83: Europe Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Crop Type, 2018-2027

Figure 84: Europe Plant Growth Regulators Market Share (%) & BPS Analysis by Formulation Type, 2018 & 2027

Figure 85: Europe Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Formulation Type, 2018-2027

Figure 86: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Formulation Type, 2018-2027

Figure 87: Europe Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Formulation Type, 2018-2027

Figure 88: Europe Plant Growth Regulators Market Share (%) & BPS Analysis by Function, 2018 & 2027

Figure 89: Europe Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Function, 2018-2027

Figure 90: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Function, 2018-2027

Figure 91: Europe Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Function, 2018-2027

Figure 91: Europe Plant Growth Regulators Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 92: Europe Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 93: Europe Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Country, 2018-2027

Figure 94: Europe Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Country, 2018-2027

Figure 95: Europe Plant Growth Regulators Market Attractiveness Index by Hormone Type, 2018-2027

Figure 96: Europe Plant Growth Regulators Market Attractiveness Index by Crop Type, 2018-2027

Figure 97: Europe Plant Growth Regulators Market Attractiveness Index by Formulation Type, 2018-2027

Figure 98: Europe Plant Growth Regulators Market Attractiveness Index by Function, 2018-2027

Figure 99: Europe Plant Growth Regulators Market Attractiveness Index by Region, 2018-2027

Figure 100: APAC Plant Growth Regulators Market Share (%) & BPS Analysis by Hormone Type, 2018 & 2027

Figure 101: APAC Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Hormone Type, 2018-2027

Figure 102: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Hormone Type, 2018-2027

Figure 103: APAC Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Hormone Type, 2018-2027

Figure 104: APAC Plant Growth Regulators Market Share (%) & BPS Analysis by Crop Type, 2018 & 2027

Figure 105: APAC Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Crop Type, 2018-2027

Figure 106: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Crop Type, 2018-2027

Figure 107: APAC Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Crop Type, 2018-2027

Figure 108: APAC Plant Growth Regulators Market Share (%) & BPS Analysis by Formulation Type, 2018 & 2027

Figure 109: APAC Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Formulation Type, 2018-2027

Figure 110: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Formulation Type, 2018-2027

Figure 111: APAC Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Formulation Type, 2018-2027

Figure 112: APAC Plant Growth Regulators Market Share (%) & BPS Analysis by Function, 2018 & 2027

Figure 113: APAC Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Function, 2018-2027

Figure 114: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Function, 2018-2027

Figure 115: APAC Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Function, 2018-2027

Figure 116: APAC Plant Growth Regulators Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 117: APAC Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 118: APAC Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Country, 2018-2027

Figure 119: APAC Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Country, 2018-2027

Figure 120: APAC Plant Growth Regulators Market Attractiveness Index by Hormone Type, 2018-2027

Figure 121: APAC Plant Growth Regulators Market Attractiveness Index by Crop Type, 2018-2027

Figure 122: APAC Plant Growth Regulators Market Attractiveness Index by Formulation Type, 2018-2027

Figure 123: APAC Plant Growth Regulators Market Attractiveness Index by Function, 2018-2027

Figure 124: APAC Plant Growth Regulators Market Attractiveness Index by Region, 2018-2027

Figure 125: MEA Plant Growth Regulators Market Share (%) & BPS Analysis by Hormone Type, 2018 & 2027

Figure 126: MEA Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Hormone Type, 2018-2027

Figure 127: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Hormone Type, 2018-2027

Figure 128: MEA Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Hormone Type, 2018-2027

Figure 129: MEA Plant Growth Regulators Market Share (%) & BPS Analysis by Crop Type, 2018 & 2027

Figure 130: MEA Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Crop Type, 2018-2027

Figure 131: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Crop Type, 2018-2027

Figure 132: MEA Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Crop Type, 2018-2027

Figure 133: MEA Plant Growth Regulators Market Share (%) & BPS Analysis by Formulation Type, 2018 & 2027

Figure 134: MEA Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Formulation Type, 2018-2027

Figure 135: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Formulation Type, 2018-2027

Figure 136: MEA Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Formulation Type, 2018-2027

Figure 137: MEA Plant Growth Regulators Market Share (%) & BPS Analysis by Function, 2018 & 2027

Figure 138: MEA Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Function, 2018-2027

Figure 139: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Function, 2018-2027

Figure 140: MEA Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Function, 2018-2027

Figure 141: MEA Plant Growth Regulators Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 142: MEA Plant Growth Regulators Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 143: MEA Plant Growth Regulators Market Value (US$ Mn) Analysis & Forecast by Country, 2018-2027

Figure 144: MEA Plant Growth Regulators Market Volume (MT) Analysis & Forecast by Country, 2018-2027

Figure 145: MEA Plant Growth Regulators Market Attractiveness Index by Hormone Type, 2018-2027

Figure 146: MEA Plant Growth Regulators Market Attractiveness Index by Crop Type, 2018-2027

Figure 147: MEA Plant Growth Regulators Market Attractiveness Index by Formulation Type, 2018-2027

Figure 149: MEA Plant Growth Regulators Market Attractiveness Index by Function, 2018-2027

Figure 150: MEA Plant Growth Regulators Market Attractiveness Index by Region, 2018-2027

Figure 151: Global Plant Growth Regulators (Ethylene) Market Share (%) & BPS Analysis by Region, 2018 & 2027

Figure 152: Global Plant Growth Regulators (Ethylene) Market Y-o-Y Growth Rate (%) by Region, 2018-2027

Figure 153: Global Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis & Forecast by Region, 2018-2027

Figure 154: Global Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis & Forecast by Region, 2018-2027

Figure 155: Global Plant Growth Regulators (Ethylene) Market Share (%) & BPS Analysis by Function, 2018 & 2027

Figure 156: Global Plant Growth Regulators (Ethylene) Market Y-o-Y Growth Rate (%) by Function, 2018-2027

Figure 157: Global Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis & Forecast by Function, 2018-2027

Figure 158: Global Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis & Forecast by Function, 2018-2027

Figure 159: Global Plant Growth Regulators (Ethylene) Market Share (%) & BPS Analysis by Crop Type, 2018 & 2027

Figure 160: Global Plant Growth Regulators (Ethylene) Market Y-o-Y Growth Rate (%) by Crop Type, 2018-2027

Figure 161: Global Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis & Forecast by Crop Type, 2018-2027

Figure 162: Global Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis & Forecast by Crop Type, 2018-2027

Figure 163: Global Plant Growth Regulators (Ethylene) Market Attractiveness Index by Function, 2018-2027

Figure 164: Global Plant Growth Regulators (Ethylene) Market Attractiveness Index by Crop Type, 2018-2027

Figure 165: Global Plant Growth Regulators (Ethylene) Market Attractiveness Index by Country, 2018-2027

Figure 166: North America Plant Growth Regulators (Ethylene) Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 167: North America Plant Growth Regulators (Ethylene) Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 168: North America Plant Growth Regulators (Ethylene) Market Attractiveness Index by Function, 2018-2027

Figure 169: North America Plant Growth Regulators (Ethylene) Market Attractiveness Index by Crop Type, 2018-2027

Figure 170: North America Plant Growth Regulators (Ethylene) Market Attractiveness Index by Country, 2018-2027

Figure 171: Latin America Plant Growth Regulators (Ethylene) Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 172: Latin America Plant Growth Regulators (Ethylene) Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 173: Latin America Plant Growth Regulators (Ethylene) Market Attractiveness Index by Function, 2018-2027

Figure 174: Latin America Plant Growth Regulators (Ethylene) Market Attractiveness Index by Crop Type, 2018-2027

Figure 175: Latin America Plant Growth Regulators (Ethylene) Market Attractiveness Index by Country, 2018-2027

Figure 176: Europe Plant Growth Regulators (Ethylene) Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 177: Europe Plant Growth Regulators (Ethylene) Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 178: Europe Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis & Forecast by Country, 2018-2027

Figure 179: Europe Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis & Forecast by Country, 2018-2027

Figure 180: Europe Plant Growth Regulators (Ethylene) Market Attractiveness Index by Function, 2018-2027

Figure 181: Europe Plant Growth Regulators (Ethylene) Market Attractiveness Index by Crop Type, 2018-2027

Figure 182: Europe Plant Growth Regulators (Ethylene) Market Attractiveness Index by Country, 2018-2027

Figure 183: APAC Plant Growth Regulators (Ethylene) Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 184: APAC Plant Growth Regulators (Ethylene) Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 185: APAC Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis & Forecast by Country, 2018-2027

Figure 186: APAC Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis & Forecast by Country, 2018-2027

Figure 187: APAC Plant Growth Regulators (Ethylene) Market Attractiveness Index by Function, 2018-2027

Figure 188: APAC Plant Growth Regulators (Ethylene) Market Attractiveness Index by Crop Type, 2018-2027

Figure 189: APAC Plant Growth Regulators (Ethylene) Market Attractiveness Index by Country, 2018-2027

Figure 190: MEA Plant Growth Regulators (Ethylene) Market Share (%) & BPS Analysis by Country, 2018 & 2027

Figure 191: MEA Plant Growth Regulators (Ethylene) Market Y-o-Y Growth Rate (%) by Country, 2018-2027

Figure 192: MEA Plant Growth Regulators (Ethylene) Market Value (US$ Mn) Analysis & Forecast by Country, 2018-2027

Figure 193: MEA Plant Growth Regulators (Ethylene) Market Volume (MT) Analysis & Forecast by Country, 2018-2027

Figure 194: MEA Plant Growth Regulators (Ethylene) Market Attractiveness Index by Function, 2018-2027

Figure 195: MEA Plant Growth Regulators (Ethylene) Market Attractiveness Index by Crop Type, 2018-2027

Figure 196: MEA Plant Growth Regulators (Ethylene) Market Attractiveness Index by Country, 2018-2027