Reports

Reports

Paraxylene known as p-xylene, is a chemical important for the production of PET plastic containers and polyester fiber. Paraxylene is used as a feedstock to make other modern synthetics, prominently terephthalic acid (TPA), cleansed terephthalic acid (PTA) and dimethyl-terephthalate (DMT). TPA, PTA and DMT are utilized to produce polyethylene terephthalate (PET) polyesters, a sort of plastic.

Bottles produced using PET plastic are generally utilized to store water, soft drinks, and different refreshments since PET is lightweight, break safe, and strong. Moreover, PET helps keep the bubble in carbonated drinks since it has solid carbon dioxide barrier properties.

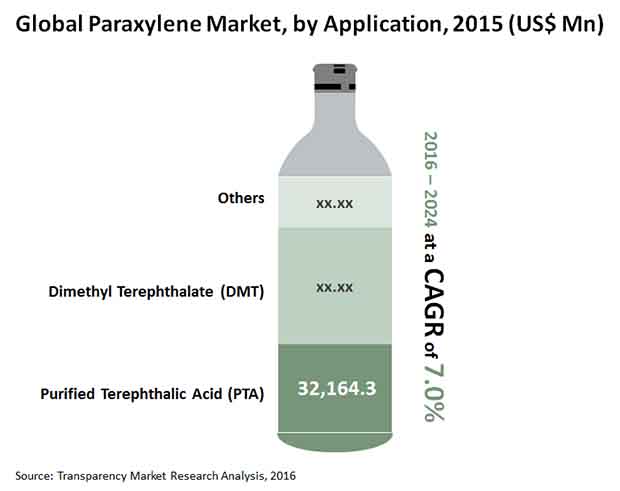

The global paraxylene market size is expected to reach US$60.04 bn by 2024, it is expected to expand at a CAGR of 7.0% over the forecast period. Increasing demand for polyester and fiber resin from various businesses is projected to move item request over the coming years. Fast development popular for polyester texture is going about as a noteworthy market driver. Rising demand for filtered terephthalic acid (PTA) in polyester creation process is expected to give fillip to the paraxylene market.

PTA See Swift Uptake due to High Demand

By application, the market is divided into PTA and DMT. PTA rose as the overwhelming application portion with a noteworthy market share. Various uses incorporate dissolvable. For all intents and purposes, PTA is the sole driver for item demand as around 97% of the all PX demand goes into PTA manufacturing.

Extreme demand for PTA in polyester application is giving considerable development potential to this item section. PET is generally used in packaging and bundling of soda pops. Development in drink industry alongside improvement in bundling and packaging advances is projected to create demand for PTA over the coming years.

In contrast with DMT, PTA has better manufacturing financial matters and lower capital cost which makes it a favored feedstock for various end-use businesses. Polyester makers lean toward PTA over DMT inferable from its financial nature which is confining development of DMT application. Nonetheless, demand from assembling of designing polymers, for example, polybutylene terephthalate is foreseen to push development of DMT over the estimate time frame.

Expanding utilization of bio-based paraxylene in bioplastics PET bottles (Bio-PET) and different bioplastics applications, for example, providing food utensils is making new open doors for the Paraxylene market.

Asia Pacific, Powered by China, Leads Market

Asia Pacific is leading the market for Paraxylene followed by Europe and North America, Latin America, Middle East and Africa, and RoW are the fastest-growing Paraxylene markets in recent years. Country wise, China, India, and the U.S. have some of the largest paraxylene market. China held the largest market share in terms of regional consumption of paraxylene. The size of the peracetic acid market is relatively low in the RoW region. However, it is expected to witness healthy growth throughout the forecasted period, especially in petroleum-rich countries of the Middle East.

Some of the key vendors operating in the global paraxylene market are Sinopec Corporation, China National Petroleum Corporation, BP plc, Exxon Mobil Corporation, and JX Nippon Oil & Energy Corporation, among others.

Increasing Demand for bio-based PET products will bolster Paraxylene Market

Rising interest for normal substitutes to customary items and advancement of bio-based items are projected to hamper development of the market for paraxylene in not so distant future. PX being respectably risky to oceanic life forms and climate, a few administrative bodies carefully screen creation units to control plant-produced emanation. Rising worries about non-superfluity of PET and costs of sap are making prerequisite for bio-based PET. This is pushing makers to create bio courses to PX and PTA, which are key crude materials for PET. Significant clients of PET, for example, PepsiCo and Coca-Cola have declared joint endeavors and associations with sustainable substance innovation designers like Virent, Gevo, and Avantium.

Expanding interest for polyester and fiber tar from different organizations is projected to move thing demand throughout the next few years. Quick advancement famous for polyester surface is going probably as a significant market driver. Rising interest for sifted terephthalic corrosive (PTA) in polyester creation measure is required to offer fillip to the paraxylene market. The huge utilization of PET holders among individuals, particularly in creating locales of Asia Pacific, is highlighting the market development. The rising take-up of PET holders, credited to them being viewed as protected and prudent, in the food and refreshments industry is boosting the market. The broad take-up of polyester in the material business world over has reinforced the interest for paraxylene.

The generous use of paraxylene in making PTA which is a key crude material for making PET gives a strong supporting to the fast extension of the market during the figure time frame. The boundless take-up of PET in various applications in the material business is a key factor boosting the market. The utilization of paraxylene in production of goods, specialized materials, and dress, is significantly adding to the by and large worldwide incomes on the lookout. The appealing development of the market will be supported by the quick walks being taken by the material business across the globe.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Market Size, Indicative (US$ Mn)

3.2. 3Top 3 Trends

4. Market Overview

4.1. Product Overview

4.2. Key Industry Developments

4.3. Market Indicators

4.4. Drivers and Restraints Analysis

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity Analysis

4.4.4. Opportunities

4.5. Global Paraxylene Market Analysis and Forecast

4.6. Paraxylene Market: Global Demand-Supply Scenario

4.7. Porter’s Analysis

4.7.1. Threat of Substitutes

4.7.2. Bargaining Power of Buyers

4.7.3. Bargaining Power of Suppliers

4.7.4. Threat of New Entrants

4.7.5. Degree of Competition

4.8. Value Chain Analysis

5. Paraxylene Market Analysis, by Application

5.1. Key Findings

5.2. Introduction

5.3. Market Value Share Analysis

5.4. Paraxylene Market Forecast

5.5. Application Comparison Matrix

5.6. Market Attractiveness Analysis

6. Paraxylene Market Analysis, by Region

6.1. Global Regulatory Scenario

6.2. Paraxylene Market Value Share Analysis

6.3. Paraxylene Market Forecast

6.4. Market Attractiveness Analysis

6.5. Paraxylene Market Prices

7. North America Paraxylene Market Analysis

7.1. Key Findings

7.2. North America Paraxylene Market Size and Volume Forecast, by Application

7.3. North America Market Value Share Analysis, by Application

7.4. North America Paraxylene Market Forecast, by Application

7.5. North America Paraxylene Market Attractiveness Overview, by Application

8. Europe Paraxylene Market Analysis

8.1. Key Findings

8.2. Europe Paraxylene Market Size and Volume Forecast, by Application

8.3. Europe Market Value Share Analysis, by Application

8.4. Europe Paraxylene Market Forecast, by Application

8.5. Europe Paraxylene Market Attractiveness Overview, by Application

9. Asia Pacific Paraxylene Market Analysis

9.1. Key Findings

9.2. Asia Pacific Paraxylene Market Size and Volume Forecast, by Application

9.3. Asia Pacific Market Value Share Analysis, by Application

9.4. Asia Pacific Paraxylene Market Forecast, by Application

9.5. Asia Pacific Paraxylene Market Attractiveness Overview, by Application

10. Latin America Paraxylene Market Analysis

10.1. Key Findings

10.2. Latin America Paraxylene Market Size and Volume Forecast, by Application

10.3. Latin America Market Value Share Analysis, by Application

10.4. Latin America Paraxylene Market Forecast, by Application

10.5. Latin America Paraxylene Market Attractiveness Overview, by Application

11. Middle East & Africa Paraxylene Market Analysis

11.1. Key Findings

11.2. Middle East & Africa Market Size and Volume Forecast, by Application

11.3. Middle East & Africa Market Value Share Analysis, by Application

11.4. Middle East & Africa Paraxylene Market Forecast, by Application

11.5. Middle East & Africa Paraxylene Market Attractiveness Overview, by Application

12. Competition Landscape

12.1. Paraxylene Market Share Analysis by Company (2015)

12.2. Competition Matrix

12.2.1. BP plc.

12.2.2. Reliance Industries Limited

12.3. Company Profiles

12.3.1. BP plc.

12.3.1.1. Company Description

12.3.1.2. Business Overview

12.3.1.3. SWOT Analysis

12.3.1.4. Financial Details

12.3.1.5. Strategic Overview

12.3.2. Exxon Mobil Corporation

12.3.2.1. Company Description

12.3.2.2. Business Overview

12.3.2.3. SWOT Analysis

12.3.2.4. Financial Details

12.3.2.5. Strategic Overview

12.3.3. Sinopec Corporation

12.3.3.1. Company Description

12.3.3.2. Business Overview

12.3.3.3. SWOT Analysis

12.3.3.4. Financial Details

12.3.3.5. Strategic Overview

12.3.4. China National Petroleum Corporation

12.3.4.1. Company Description

12.3.4.2. Business Overview

12.3.4.3. SWOT Analysis

12.3.4.4. Financial Details

12.3.4.5. Strategic Overview

12.3.5. S-OIL CORPORATION

12.3.5.1. Company Description

12.3.5.2. Business Overview

12.3.5.3. SWOT Analysis

12.3.5.4. Financial Details

12.3.5.5. Strategic Overview

12.3.6. JX Nippon Oil & Energy Corporation

12.3.6.1. Company Description

12.3.6.2. Business Overview

12.3.6.3. SWOT Analysis

12.3.6.4. Financial Details

12.3.6.5. Strategic Overview

12.3.7. Reliance Industries Limited

12.3.7.1. Company Description

12.3.7.2. Business Overview

12.3.7.3. SWOT Analysis

12.3.7.4. Financial Details

12.3.7.5. Strategic Overview

12.3.8. Jurong Aromatics Corporation

12.3.8.1. Company Description

12.3.8.2. Business Overview

12.3.8.3. Strategic Initiative

12.3.9. CNOOC Limited

12.3.9.1. Company Description

12.3.9.2. Business Overview

12.3.9.3. Strategic Initiative

12.3.10. LOTTE CHEMICAL Corporation

12.3.10.1. Company Description

12.3.10.2. Business Overview

12.3.10.3. Strategic Initiative

12.3.11. BASF SE

12.3.11.1. Company Description

12.3.11.2. Business Overview

12.3.11.3. Strategic Initiative

13. Key Takeaways

List of Tables

Table 1: Global Paraxylene Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2015–2024

Table 2: Global Paraxylene Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Region, 2015–2024

Table 3: North America Paraxylene Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2015–2024

Table 4: Europe Paraxylene Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2015–2024

Table 5: Asia Pacific Paraxylene Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2015–2024

Table 6: Latin America Paraxylene Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2015–2024

Table 7: Middle East & Africa Paraxylene Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Application, 2015–2024

List of Figures

Figure 1: Global Paraxylene Market

Figure 2: Global Paraxylene Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015-2024

Figure 3: Global Paraxylene Average Price (US$/Ton), 2015–2024

Figure 4: Global Paraxylene Market Value Share Analysis by Application, 2015 and 2024

Figure 5: Global Paraxylene Market Attractiveness Analysis, by Application

Figure 6: Global Paraxylene Market Value Share Analysis, by Region, 2015 and 2024

Figure 7: Global Paraxylene Market Attractiveness Analysis, by Region

Figure 8: Prices of Paraxylene, by Application, US$/Ton, 2016–2024

Figure 9: North America Paraxylene Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 10: North America Paraxylene Market Attractiveness Analysis, by Country, 2015

Figure 11: North America Market Value Share Analysis, by Application, 2015 and 2024

Figure 12: North America Market Attractiveness Analysis, by Application, 2015

Figure 13: Europe Paraxylene Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 14: Europe Paraxylene Market Attractiveness Analysis, by Country, 2015

Figure 15: Europe Market Value Share Analysis, by Application, 2015 and 2024

Figure 16: Europe Market Attractiveness Analysis, by Application, 2015

Figure 17: Asia Pacific Paraxylene Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 18: Asia Pacific Paraxylene Market Attractiveness Analysis, by Country, 2015

Figure 19: Asia Pacific Market Value Share Analysis, by Application, 2015 and 2024

Figure 20: Asia Pacific Market Attractiveness Analysis, by Application, 2015

Figure 21: Latin America Paraxylene Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 22: Latin America Paraxylene Market Attractiveness Analysis, by Country

Figure 23: Latin America Market Value Share Analysis, by Application, 2015 and 2024

Figure 24: Latin America Market Attractiveness Analysis, by Application, 2015

Figure 25: Middle East & Africa Paraxylene Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 26: Middle East & Africa Paraxylene Market Attractiveness Analysis, by Country, 2015

Figure 27: Middle East & Africa Market Value Share Analysis, by Application, 2015 and 2024

Figure 28: Middle East & Africa Market Attractiveness Analysis, by Application, 2015

Figure 29: Global Paraxylene Market Share Analysis, by Company (2015)