Reports

Reports

Analysts’ Viewpoint

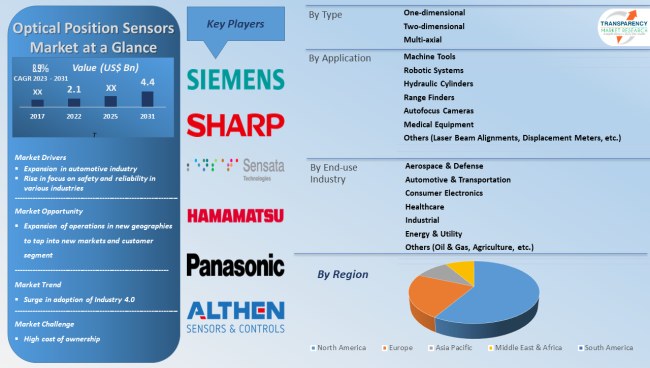

Increase in adoption of smart manufacturing technologies and rise in focus on safety and reliability are driving the global optical position sensors market development. Industrial automation is gaining traction in emerging economies. This is expected to boost the demand for optical position sensors in the near future.

Asia Pacific is projected to dominate the market for optical position sensors during the forecast period, led by surge in usage of consumer electronics, presence of key manufacturers, and abundant availability of raw materials in the region.

Key players are investing significantly in R&D activities to improve accuracy, reliability, and response times of sensors. They are also introducing new sensor technologies to cater to the rise in demand in automotive, robotics, and consumer electronics industries.

Optical position sensor is a type of sensor that uses light to detect the position or motion of an object. The sensor measures the movement of light as it interacts with the object being monitored. An optical signal is transmitted from one end and received at the other. Change in one of the properties, such as light intensity, polarization, or wavelength/frequency of the light, is monitored.

Optical position sensors are used in various applications, including robotics, automation, and precision measurement. They offer high accuracy, reliability, and durability. This makes them ideal for usage in harsh environments or applications where high precision is required.

An optical encoder is a common example of an optical position sensor. It employs a rotating disk with transparent and opaque segments to interrupt a light beam. As the disk rotates, the sensor detects the interruptions in the light beam and can determine the position and speed of rotation.

Optical position sensors are becoming increasingly popular in the automotive industry due to their accuracy, reliability, and durability. These sensors are used to measure the position of various components within a vehicle, such as a throttle position, brake position, and steering angle.

Optical position sensors provide precise measurements, which is crucial for safety-critical applications in the automotive industry. They can also withstand harsh environmental conditions, including high temperature, moisture, and vibration. Thus, they are ideal for usage in automotive applications.

Optical position sensors are more compact and lighter than traditional mechanical sensors, which makes them suitable for use in modern, lightweight vehicles. They also offer faster response times and can provide real-time feedback, which can improve vehicle performance and safety. Thus, growth in demand for optical position sensors is boosting optical position sensors market expansion.

According to the Society of Indian Automobile Manufacturers (SIAM), the overall sales of commercial vehicles increased from 568,559 units to 716,566 units from April 2021 to March 2022. Medium and heavy commercial vehicle sales rose from 160,688 units to 240,577 units, while light commercial vehicle sales grew from 407,871 units to 475,989 units during the same period. Thus, expansion in the automotive sector is projected to positively impact the optical position sensors market growth in the near future.

Optical position sensors are widely employed to enhance safety and reliability in a variety of applications, including industrial automation, robotics, automotive, aerospace, and medical devices. These sensors offer fast response time, high precision, low noise, and non-contact measurements.

Optical position sensors use light to detect the position of an object or the movement of a system, thus providing precise and accurate measurements in real time. Their non-contact nature eliminates the need for mechanical parts that can wear out or fail over time. This makes optical position sensors more reliable and durable than traditional mechanical sensors.

Optical position sensors are commonly used in safety-critical applications. In the automotive sector, optical position sensors are employed in airbag deployment systems, braking systems, and throttle control systems to ensure the safety of drivers and passengers. Hence, growth in demand for automation and precision in manufacturing and robotics industries is projected to augment market progress in the next few years.

According to the latest optical position sensors market trends, the two-dimensional type segment is estimated to hold the largest share during the forecast period. Two-dimensional optical position sensor can detect the position of an object in two dimensions using optical techniques. This type of sensor is often used in applications where precise positioning is required such as in robotics, computer mice, and trackpads.

Two-dimensional optical sensors are also gaining popularity in the healthcare sector. These sensors are employed in various medical devices (including endoscopes and surgical robots). They aid surgeons in the navigation and manipulation of instruments with greater precision. Two-dimensional optical sensors are utilized in satellite positioning systems to detect the position of objects in space.

According to the latest optical position sensors market analysis, the medical equipment application segment held 17.0% share in 2022. Growth of the segment can be ascribed to surge in adoption of advanced electronic devices in the healthcare sector and rise in healthcare expenditure in developed economies.

Optical position sensors are critical components of many medical devices, as they help improve accuracy and precision in medical procedures and treatment. These sensors allow medical professionals to perform complex procedures with greater confidence and efficiency, ultimately leading to better patient outcomes.

Optical position sensors are used in surgical robots to guide instruments and ensure precise movements during surgeries. This can help reduce the risk of complications. Optical position sensors can also be employed to track the movement of patients during physical therapy or rehabilitation, thereby aiding therapists to monitor progress and adjust treatment plans as needed.

According to the latest optical position sensors market forecast, Asia Pacific is expected to account for the largest share from 2023 to 2031. Increase in adoption of automation and robotics in various end-use industries and rise in demand for consumer electronics are driving market dynamics of the region.

Several countries in Asia Pacific are witnessing rapid industrialization due to surge in investment in Industry 4.0 and other advanced manufacturing technologies. China, Japan, and South Korea are major markets for optical position sensors in the region.

North America held more than 20.0% share in 2022. High penetration of advanced devices in manufacturing and healthcare industries and growth in usage of smart home devices are boosting market statistics in the region.

The global industry is fragmented, with a stronghold of established players such as AK Industries, Althen Sensors & Controls, Automation Sensorik Messtechnik GmbH, Exxelia Group, Hamamatsu Photonics K.K., Micro-Epsilon, Ognibene Power, Panasonic Corporation, Sensata Technologies, Inc., Sharp Corporation, Siemens AG, TT Electronics, and Zygo Corporation.

Each of these players has been profiled in the optical position sensors market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Key players are offering unique features, functionalities, or designs to differentiate their products from competitors. They are also acquiring or merging with other companies to increase their optical position sensors market share.

| Attribute | Details |

|---|---|

| Market Size Value in 2022 | US$ 2.1 Bn |

| Market Forecast Value in 2031 | US$ 4.4 Bn |

| Growth Rate (CAGR) | 8.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.1 Bn in 2022

It is anticipated to grow at a CAGR of 8.9% from 2023 to 2031

It is anticipated to reach US$ 4.4 Bn by the end of 2031

Expansion in automotive industry and rise in focus on safety and reliability in various sectors

The medical equipment application segment held 17.0% share in 2022

Asia Pacific is a more lucrative region for companies

The U.S. accounted for 22.0% share in 2022

AK Industries, Althen Sensors & Controls, Automation Sensorik Messtechnik GmbH, Exxelia Group, Hamamatsu Photonics K.K., Micro-Epsilon, Ognibene Power, Panasonic Corporation, Sensata Technologies, Inc., Sharp Corporation, Siemens AG, TT Electronics, and Zygo Corporation

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Optical Position Sensors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Sensors Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Optical Position Sensors Market Analysis, By Type

5.1. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

5.1.1. One-dimensional

5.1.2. Two-dimensional

5.1.3. Multi-axial

5.2. Market Attractiveness Analysis, By Type

6. Global Optical Position Sensors Market Analysis, By Application

6.1. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

6.1.1. Machine Tools

6.1.2. Robotic Systems

6.1.3. Hydraulic Cylinders

6.1.4. Range Finders

6.1.5. Autofocus Cameras

6.1.6. Medical Equipment

6.1.7. Others (Laser Beam Alignments, Displacement Meters, etc.)

6.2. Market Attractiveness Analysis, By Application

7. Global Optical Position Sensors Market Analysis, By End-use Industry

7.1. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

7.1.1. Aerospace & Defense

7.1.2. Automotive & Transportation

7.1.3. Consumer Electronics

7.1.4. Healthcare

7.1.5. Industrial

7.1.6. Energy & Utility

7.1.7. Others (Oil & Gas, Agriculture, etc.)

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global Optical Position Sensors Market Analysis and Forecast, By Region

8.1. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Optical Position Sensors Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

9.3.1. One-dimensional

9.3.2. Two-dimensional

9.3.3. Multi-axial

9.4. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

9.4.1. Machine Tools

9.4.2. Robotic Systems

9.4.3. Hydraulic Cylinders

9.4.4. Range Finders

9.4.5. Autofocus Cameras

9.4.6. Medical Equipment

9.4.7. Others (Laser Beam Alignments, Displacement Meters, etc.)

9.5. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

9.5.1. Aerospace & Defense

9.5.2. Automotive & Transportation

9.5.3. Consumer Electronics

9.5.4. Healthcare

9.5.5. Industrial

9.5.6. Energy & Utility

9.5.7. Others (Oil & Gas, Agriculture, etc.)

9.6. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe Optical Position Sensors Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

10.3.1. One-dimensional

10.3.2. Two-dimensional

10.3.3. Multi-axial

10.4. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

10.4.1. Machine Tools

10.4.2. Robotic Systems

10.4.3. Hydraulic Cylinders

10.4.4. Range Finders

10.4.5. Autofocus Cameras

10.4.6. Medical Equipment

10.4.7. Others (Laser Beam Alignments, Displacement Meters, etc.)

10.5. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

10.5.1. Aerospace & Defense

10.5.2. Automotive & Transportation

10.5.3. Consumer Electronics

10.5.4. Healthcare

10.5.5. Industrial

10.5.6. Energy & Utility

10.5.7. Others (Oil & Gas, Agriculture, etc.)

10.6. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific Optical Position Sensors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

11.3.1. One-dimensional

11.3.2. Two-dimensional

11.3.3. Multi-axial

11.4. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

11.4.1. Machine Tools

11.4.2. Robotic Systems

11.4.3. Hydraulic Cylinders

11.4.4. Range Finders

11.4.5. Autofocus Cameras

11.4.6. Medical Equipment

11.4.7. Others (Laser Beam Alignments, Displacement Meters, etc.)

11.5. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

11.5.1. Aerospace & Defense

11.5.2. Automotive & Transportation

11.5.3. Consumer Electronics

11.5.4. Healthcare

11.5.5. Industrial

11.5.6. Energy & Utility

11.5.7. Others (Oil & Gas, Agriculture, etc.)

11.6. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa Optical Position Sensors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

12.3.1. One-dimensional

12.3.2. Two-dimensional

12.3.3. Multi-axial

12.4. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

12.4.1. Machine Tools

12.4.2. Robotic Systems

12.4.3. Hydraulic Cylinders

12.4.4. Range Finders

12.4.5. Autofocus Cameras

12.4.6. Medical Equipment

12.4.7. Others (Laser Beam Alignments, Displacement Meters, etc.)

12.5. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

12.5.1. Aerospace & Defense

12.5.2. Automotive & Transportation

12.5.3. Consumer Electronics

12.5.4. Healthcare

12.5.5. Industrial

12.5.6. Energy & Utility

12.5.7. Others (Oil & Gas, Agriculture, etc.)

12.6. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America Optical Position Sensors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

13.3.1. One-dimensional

13.3.2. Two-dimensional

13.3.3. Multi-axial

13.4. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

13.4.1. Machine Tools

13.4.2. Robotic Systems

13.4.3. Hydraulic Cylinders

13.4.4. Range Finders

13.4.5. Autofocus Cameras

13.4.6. Medical Equipment

13.4.7. Others (Laser Beam Alignments, Displacement Meters, etc.)

13.5. Optical Position Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

13.5.1. Aerospace & Defense

13.5.2. Automotive & Transportation

13.5.3. Consumer Electronics

13.5.4. Healthcare

13.5.5. Industrial

13.5.6. Energy & Utility

13.5.7. Others (Oil & Gas, Agriculture, etc.)

13.6. Optical Position Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Optical Position Sensors Market Competition Matrix - a Dashboard View

14.1.1. Global Optical Position Sensors Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. AK Industries

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Althen Sensors & Controls

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Automation Sensorik Messtechnik GmbH

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Exxelia Group

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Hamamatsu Photonics K.K.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Micro-Epsilon

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Ognibene Power

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Panasonic Corporation

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Sensata Technologies, Inc.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Sharp Corporation

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Siemens AG

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. TT Electronics

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Zygo Corporation

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

16. Go To Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Understanding Buying Process of Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Optical Position Sensors Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 2: Global Optical Position Sensors Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 3: Global Optical Position Sensors Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 4: Global Optical Position Sensors Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 5: Global Optical Position Sensors Market Size & Forecast, By Region, Value (US$ Mn), 2017-2031

Table 6: Global Optical Position Sensors Market Size & Forecast, By Region, Volume (Million Units), 2017-2031

Table 7: North America Optical Position Sensors Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 8: North America Optical Position Sensors Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 9: North America Optical Position Sensors Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 10: North America Optical Position Sensors Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 11: North America Optical Position Sensors Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 12: North America Optical Position Sensors Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 13: Europe Optical Position Sensors Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 14: Europe Optical Position Sensors Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 15: Europe Optical Position Sensors Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 16: Europe Optical Position Sensors Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 17: Europe Optical Position Sensors Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 18: Europe Optical Position Sensors Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 19: Asia Pacific Optical Position Sensors Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 20: Asia Pacific Optical Position Sensors Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 21: Asia Pacific Optical Position Sensors Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 22: Asia Pacific Optical Position Sensors Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 23: Asia Pacific Optical Position Sensors Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 24: Asia Pacific Optical Position Sensors Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 25: Middle East & Africa Optical Position Sensors Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 26: Middle East & Africa Optical Position Sensors Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 27: Middle East & Africa Optical Position Sensors Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 28: Middle East & Africa Optical Position Sensors Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 29: Middle East & Africa Optical Position Sensors Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 30: Middle East & Africa Optical Position Sensors Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 31: South America Optical Position Sensors Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 32: South America Optical Position Sensors Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 33: South America Optical Position Sensors Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 34: South America Optical Position Sensors Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 35: South America Optical Position Sensors Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 36: South America Optical Position Sensors Market Size & Forecast, By Country Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Optical Position Sensors Market Share Analysis, by Region

Figure 02: Global Optical Position Sensors Market Price Trend Analysis (Average Price, Thousand US$)

Figure 03: Global Optical Position Sensors Market, Value (US$ Mn), 2017-2031

Figure 04: Global Optical Position Sensors Market, Volume (Million Units), 2017-2031

Figure 05: Global Optical Position Sensors Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 06: Global Optical Position Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 07: Global Optical Position Sensors Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 08: Global Optical Position Sensors Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 09: Global Optical Position Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 10: Global Optical Position Sensors Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 11: Global Optical Position Sensors Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 12: Global Optical Position Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 13: Global Optical Position Sensors Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 14: Global Optical Position Sensors Market Size & Forecast, By Region, Revenue (US$ Mn), 2017-2031

Figure 15: Global Optical Position Sensors Market Share Analysis, by Region, 2023 and 2031

Figure 16: Global Optical Position Sensors Market Attractiveness, By Region, Value (US$ Mn), 2023-2031

Figure 17: North America Optical Position Sensors Market, Value (US$ Mn), 2017-2031

Figure 18: North America Optical Position Sensors Market, Volume (Million Units), 2017-2031

Figure 19: North America Optical Position Sensors Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 20: North America Optical Position Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 21: North America Optical Position Sensors Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 22: North America Optical Position Sensors Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 23: North America Optical Position Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 24: North America Optical Position Sensors Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 25: North America Optical Position Sensors Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 26: North America Optical Position Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 27: North America Optical Position Sensors Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 28: North America Optical Position Sensors Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 29: North America Optical Position Sensors Market Share Analysis, by Country 2023 and 2031

Figure 30: North America Optical Position Sensors Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 31: Europe Optical Position Sensors Market, Value (US$ Mn), 2017-2031

Figure 32: Europe Optical Position Sensors Market, Volume (Million Units), 2017-2031

Figure 33: Europe Optical Position Sensors Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 34: Europe Optical Position Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 35: Europe Optical Position Sensors Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 36: Europe Optical Position Sensors Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 37: Europe Optical Position Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 38: Europe Optical Position Sensors Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 39: Europe Optical Position Sensors Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 40: Europe Optical Position Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 41: Europe Optical Position Sensors Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 42: Europe Optical Position Sensors Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 43: Europe Optical Position Sensors Market Share Analysis, by Country 2023 and 2031

Figure 44: Europe Optical Position Sensors Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 45: Asia Pacific Optical Position Sensors Market, Value (US$ Mn), 2017-2031

Figure 46: Asia Pacific Optical Position Sensors Market, Volume (Million Units), 2017-2031

Figure 47: Asia Pacific Optical Position Sensors Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 48: Asia Pacific Optical Position Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 49: Asia Pacific Optical Position Sensors Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 50: Asia Pacific Optical Position Sensors Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 51: Asia Pacific Optical Position Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 52: Asia Pacific Optical Position Sensors Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 53: Asia Pacific Optical Position Sensors Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 54: Asia Pacific Optical Position Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 55: Asia Pacific Optical Position Sensors Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 56: Asia Pacific Optical Position Sensors Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 57: Asia Pacific Optical Position Sensors Market Share Analysis, by Country 2023 and 2031

Figure 58: Asia Pacific Optical Position Sensors Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 59: Middle East & Africa Optical Position Sensors Market, Value (US$ Mn), 2017-2031

Figure 60: Middle East & Africa Optical Position Sensors Market, Volume (Million Units), 2017-2031

Figure 61: Middle East & Africa Optical Position Sensors Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 62: Middle East & Africa Optical Position Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 63: Middle East & Africa Optical Position Sensors Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 64: Middle East & Africa Optical Position Sensors Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 65: Middle East & Africa Optical Position Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 66: Middle East & Africa Optical Position Sensors Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 67: Middle East & Africa Optical Position Sensors Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 68: Middle East & Africa Optical Position Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 69: Middle East & Africa Optical Position Sensors Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 70: Middle East & Africa Optical Position Sensors Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 71: Middle East & Africa Optical Position Sensors Market Share Analysis, by Country 2023 and 2031

Figure 72: Middle East & Africa Optical Position Sensors Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 73: South America Optical Position Sensors Market, Value (US$ Mn), 2017-2031

Figure 74: South America Optical Position Sensors Market, Volume (Million Units), 2017-2031

Figure 75: South America Optical Position Sensors Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 76: South America Optical Position Sensors Market Share Analysis, by Type, 2023 and 2031

Figure 77: South America Optical Position Sensors Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 78: South America Optical Position Sensors Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 79: South America Optical Position Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 80: South America Optical Position Sensors Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 81: South America Optical Position Sensors Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 82: South America Optical Position Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 83: South America Optical Position Sensors Market Attractiveness, By End-use Industry, Value (US$ Mn), 2023-2031

Figure 84: South America Optical Position Sensors Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 85: South America Optical Position Sensors Market Share Analysis, by Country 2023 and 2031

Figure 86: South America Optical Position Sensors Market Attractiveness, By Country Value (US$ Mn), 2023-2031