Global Oil and Gas Pipeline Leak Detection Equipment Market: Snapshot

The torchbearers in the global oil and gas pipeline leak detection equipment market are leveraging their core business strengths in this highly competitive market. They are also focused on acquisitions to augment their technological strengths in a bid to develop new products. Expansion of product portfolio is another popular growth strategy adopted by key players for increased market share.

Some of the key growth drivers in the global oil and gas pipeline leak detection equipment market are stringent environmental rules regarding handling oil and gas, policies regarding pipeline leakages and obligations on part of pipeline operators to compensate for a leak. The growth of oil and gas pipeline leak detection equipment market can also be attributed to aging pipeline, large number of planned projects for pipeline construction, and increasing number of incidents of pipeline leakages.

As per a report by Transparency Market Research, the global oil and gas pipeline leak detection equipment market to expected to expand at a CAGR of 6.8% for the forecast period between 2016 and 2024. Progressing at this rate, the revenue of the market is projected to be become US$3.65 bn by 2024 increasing from US$2.02 bn in 2015.

Acoustic/ultrasonic Technology Segment to emerge at fore due to Economic Reliability

In terms of technology, the oil and gas pipeline leak detection equipment market is segmented into mass-volume balance, fiber optics, acoustic/ultrasonic, vapor sensing, and others. The segment of mass-volume balance, among these, held the leading share of 39.3% of the overall market in 2015. On the other hand, the segment of acoustic/ultrasonic is expected to expand at a significant CAGR over the forecast period due to economic reliability of the technology.

Based on location, the oil and gas pipeline leak detection equipment market is divided into onshore and offshore. Between the two, onshore led the global oil and gas pipeline leak detection equipment market in 2015 and is predicted to account for a significant share over the forecast period.

On the basis of equipment type, flowmeters, cable sensors, acoustic sensors, and others are the segments into which the global oil and gas pipeline leak detection equipment market is divided. Among these, the segment of flowmeters held a significant share in the oil and gas pipeline leak detection equipment market in 2015 and is expected to hold a sizable share over the forecast period.

Planned Pipeline Construction Projects Power Growth in Middle East and Africa

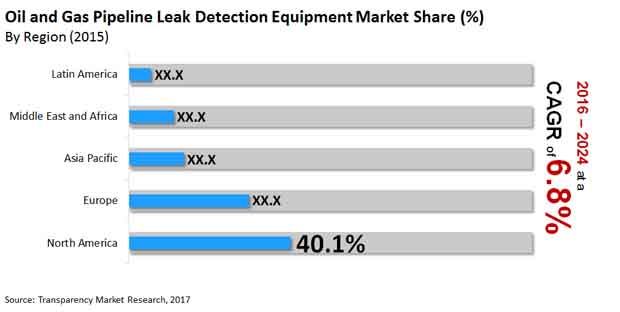

The regional segments into which the global oil and gas pipeline leak detection equipment market is segmented are North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America is a key regional market due to an extensive network of pipelines in the region. North America contributed the leading revenue of 40% to the overall market in 2015, of which the U.S. stood as the leading contributor.

Europe followed North America in terms of market share in the global market in 2015. However, the regional market of Middle East and Africa is predicted to expand at a rapid pace during the forecast period and display an increased market share between 2015 and 2024. The growth of the Middle East and Africa oil and gas pipeline leak detection equipment market is due to a large number of planned projects for pipeline construction.

The key players in the global oil and gas pipeline leak detection equipment market profiled in this study are Siemens AG, KROHNE Messtechnik GmbH, Schneider Electric SE, Perma-Pipe Inc., FLIR Systems Inc., TTK-Liquid Leak Detection Systems, PSI AG, Honeywell International Inc., ATMOS International, Pentair Thermal Management, Pure Technologies Ltd., and AREVA NP.

Advanced Sensor Technologies to Drive Innovation in Oil and Gas Pipeline Leak Detection Equipment Market

Systems and devices in the global oil and gas pipeline leak detection equipment market detect faults and leaks in oil and gas pipelines and convey precise data to the controllers and operations of the pipelines. These products are used to increase safety, reliability, and efficiency of the oil and gas pipelines. They also help in reducing the downtime caused by broken or leaking pipelines and decrease the amount of time required to inspect the long and massive oil and gas pipelines. Devices in oil and gas pipeline leak detection equipment market provide operators with accurate data regarding the leakage through specific type of alarming systems. This allows pipeline controllers to make informed decisions and choose the most appropriate course of action to fix the issue or divert the supply if possible. Rising instances of leaks in oil and gas production facilities, transporting pipelines, and storage tanks is a key driver stimulating growth in the global oil and gas pipeline leak detection equipment market. Other market drivers include strict government regulations that are enforced to ensure security and safety pertaining to the transportation of highly flammable and toxic oil and gas products.

Increasing focus on upgrading the oil and gas pipelines, exploring new drilling sites, and enhancing the refineries infrastructure are also motivating the growth in global oil and gas pipeline leak detection equipment market. Awareness among the population and governments regarding the environmental and public health impacts caused by oil leaks are contributing to the rapid growth of the market. On the other hand, limitations in feasibility and high cost of setup can hamper the growth of the global oil and gas pipeline leak detection equipment market in coming years. Increasing uptake of technologically advanced sensor technologies by players in oil and gas along with energy industries is expected to create lucrative opportunities for players in oil and gas pipeline leak detection equipment market. Using these smart sensor technologies can aid in optimizing industrial and manufacturing processes. Integration of cutting-edge technologies such as machine learning, deep learning, and artificial intelligence can help in the development of seamless detection technologies in the global oil and gas pipeline leak detection equipment market.

The report segments the global oil and gas pipeline leak detection equipment market as:

|

Technology Analysis |

|

|

Location Analysis |

|

|

Equipment Type Analysis |

|

|

Regional Analysis |

|

Oil and Gas Pipeline Leak Detection Equipment Market is expected to reach US$3.65 bn by 2024

Oil and Gas Pipeline Leak Detection Equipment Market is estimated to rise at a CAGR of 6.8% during forecast period

Stringent environmental rules regarding handling oil and gas, policies regarding pipeline leakages and obligations on part of pipeline operators to compensate for a leak is driving the growth of the Oil and Gas Pipeline Leak Detection Equipment Market

North America is more attractive for vendors in the Oil and Gas Pipeline Leak Detection Equipment Market

Key players of Oil and Gas Pipeline Leak Detection Equipment Market are Siemens AG, KROHNE Messtechnik GmbH, Schneider Electric SE, Perma-Pipe Inc., FLIR Systems Inc., TTK-Liquid Leak Detection Systems, PSI AG, Honeywell International Inc., ATMOS International, Pentair Thermal Management, Pure Technologies Ltd., and AREVA NP

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Market Snapshot

3.2. Top Trends

4. Market Overview

4.1. Product Overview

4.2. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunity

5.2. Global Oil and Gas Pipeline Leak Detection Equipment Market Analysis and Forecast

5.3. Porter’s Analysis

5.3.1. Threat of Substitutes

5.3.2. Bargaining Power of Buyers

5.3.3. Bargaining Power of Suppliers

5.3.4. Threat of New Entrants

5.3.5. Degree of Competition

5.4. Value Chain Analysis

5.5. Global Oil and Gas Pipeline Leak Detection Equipment Market Outlook

6. Global Oil and Gas Pipeline Leak Detection Equipment Market Analysis, by Technology

6.1. Introduction

6.2. Key Findings

6.3. Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology

6.4. Global Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Technology

6.4.1. Mass–Volume Balance

6.4.2. Acoustic/Ultrasonic

6.4.3. Fiber Optic

6.4.4. Vapor Sensing

6.4.5. Others

6.5. Global Oil and Gas Pipeline Leak Detection Equipment Market Analysis, by Technology

6.6. Key Trends

7. Global Oil and Gas Pipeline Leak Detection Equipment Market Analysis, by Location

7.1. Introduction

7.2. Key Findings

7.3. Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location

7.4. Global Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Location

7.4.1. Onshore

7.4.2. Offshore

7.5. Global Oil and Gas Pipeline Leak Detection Equipment Market Analysis, by Location

7.6. Key Trends

8. Global Oil and Gas Pipeline Leak Detection Equipment Market Analysis, by Equipment Type

8.1. Introduction

8.2. Key Findings

8.3. Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type

8.4. Global Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Equipment Type

8.4.1. Flowmeters

8.4.2. Acoustic Sensors

8.4.3. Cable Sensors

8.4.4. Others

8.5. Global Oil and Gas Pipeline Leak Detection Equipment Market Analysis, by Equipment Type

8.6. Key Trends

9. Global Oil and Gas Pipeline Leak Detection Equipment Market Analysis, by Region

9.1. Global Oil and Gas Pipeline Leak Detection Equipment Market Growth Scenario,by Region, 2015

9.2. Key Findings

9.3. Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Region

9.4. Global Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Region

9.4.1. North America

9.4.2. Europe

9.4.3. Asia Pacific

9.4.4. Middle East & Africa

9.4.5. Latin America

9.5. Global Oil and Gas Pipeline Leak Detection Equipment Market Attractiveness Analysis, by Region

10. North America Oil and Gas Pipeline Leak Detection Equipment Market Analysis

10.1. Key Findings

10.2. North America Oil and Gas Pipeline Leak Detection Equipment Market Overview

10.3. North America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology

10.4. North America Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Technology

10.5. North America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location

10.6. North America Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Location

10.7. North America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type

10.8. North America Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Equipment Type

10.9. North America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country

10.10. North America Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Country

10.10.1. U.S.

10.10.2. Canada

10.11. North America Oil and Gas Pipeline Leak Detection Equipment Market Attractiveness Analysis

10.12. Market Trends

11. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Analysis

11.1. Key Findings

11.2. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Overview

11.3. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology

11.4. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Technology

11.5. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location

11.6. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Location

11.7. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type

11.8. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Equipment Type

11.9. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country

11.10. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Country

11.10.1. Brazil

11.10.2. Argentina

11.10.3. Rest of Latin America

11.11. Latin America Oil and Gas Pipeline Leak Detection Equipment Market Attractiveness Analysis

11.12. Market Trends

12. Europe Oil and Gas Pipeline Leak Detection Equipment Market Analysis

12.1. Key Findings

12.2. Europe Oil and Gas Pipeline Leak Detection Equipment Market Overview

12.3. Europe Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology

12.4. Europe Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Technology

12.5. Europe Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location

12.6. Europe Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Location

12.7. Europe Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type

12.8. Europe Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Equipment Type

12.9. Europe Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country

12.10. Europe Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Country

12.10.1. U.K.

12.10.2. France

12.10.3. Germany

12.10.4. Italy

12.10.5. Spain

12.10.6. Rest of EU

12.11. Europe Oil and Gas Pipeline Leak Detection Equipment Market Attractiveness Analysis

12.12. Market Trends

13. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Analysis

13.1. Key Findings

13.2. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Overview

13.3. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology

13.4. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Technology

13.5. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location

13.6. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Location

13.7. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type

13.8. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Forecast,by Equipment Type

13.9. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country

13.10. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Forecast,by Country

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. ASEAN

13.10.5. Rest of APAC

13.11. Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Attractiveness Analysis

13.12. Market Trends

14. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Analysis

14.1. Key Findings

14.2. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Overview

14.3. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology

14.4. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Technology

14.5. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location

14.6. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Location

14.7. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type

14.8. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Equipment Type

14.9. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country

14.10. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Forecast, by Country

14.10.1. South Africa

14.10.2. Egypt

14.10.3. GCC

14.10.4. Rest of MEA

14.11. Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Attractiveness Analysis

14.12. Market Trends

15. Company Landscape

15.1. Global Oil and Gas Pipeline Leak Detection Equipment Market Share Analysis, by Company (2015)

15.2. Company Competition Matrix

15.3. Company Profiles

15.3.1. Siemens AG

15.3.1.1. Company Description

15.3.1.2. Business Overview

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. PSI AG

15.3.2.1. Company Description

15.3.2.2. Business Overview

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. KROHNE Messtechnik GmbH

15.3.3.1. Company Description

15.3.3.2. Business Overview

15.3.4. Honeywell International Inc.

15.3.4.1. Company Description

15.3.4.2. Business Overview

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Schneider Electric SE

15.3.5.1. Company Description

15.3.5.2. Business Overview

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. ATMOS International

15.3.6.1. Company Description

15.3.6.2. Business Overview

15.3.7. Perma-Pipe Inc.

15.3.7.1. Company Description

15.3.7.2. Business Overview

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Pentair Thermal Management

15.3.8.1. Company Description

15.3.8.2. Business Overview

15.3.9. FLIR Systems Inc.

15.3.9.1. Company Description

15.3.9.2. Business Overview

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Pure Technologies Ltd.

15.3.10.1. Company Description

15.3.10.2. Business Overview

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. TTK-Liquid Leak Detection Systems

15.3.11.1. Company Description

15.3.11.2. Business Overview

15.3.12. AREVA NP

15.3.12.1. Company Description

15.3.12.2. Business Overview

16. Key Takeaways

List of Tables

Table 01: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Technology, 2015–2024

Table 02: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Location, 2015–2024

Table 03: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Equipment Type, 2015–2024

Table 04: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Region, 2015–2024

Table 05: North America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Technology, 2015–2024

Table 06: North America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Location, 2015–2024

Table 07: North America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Equipment Type, 2015–2024

Table 08: North America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Country, 2015–2024

Table 09: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Technology, 2015–2024

Table 10: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Location, 2015–2024

Table 11: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Equipment Type, 2015–2024

Table 12: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Country, 2015–2024

Table 13: Europe Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Technology, 2015–2024

Table 14: Europe Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Location, 2015–2024

Table 15: Europe Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Equipment Type, 2015–2024

Table 16: Europe Oil and Gas Pipeline Leak Detection Equipment Market Volume (Thousand Sq. Mts.) and Revenue (US$ Mn) Forecast, by Country, 2015–2024 (1/2)

Table 17: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Technology, 2015–2024

Table 18: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Location, 2015–2024

Table 19: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Equipment Type, 2015–2024

Table 20: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Country, 2015–2024

Table 21: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Technology, 2015–2024

Table 22: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Location, 2015–2024

Table 23: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Equipment Type, 2015–2024

Table 24: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Country, 2015–2024

List of Figures

Figure 01: Market Snapshot

Figure 02: Proportion, by Segment, 2015

Figure 03: Revenue Share held by North America, 2015–2024

Figure 04: Global Oil and Gas Pipeline Leak Detection Equipment Market Size (US$ Mn) Forecast, 2015–2024

Figure 05: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue, Y-o-Y Growth Projection, 2015–2024

Figure 07: Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share (US$ Mn), by Location (2015)

Figure 06: Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share (US$ Mn), by Technology (2015)

Figure 09: Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share (US$ Mn), by Region (2015)

Figure 08: Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share (US$ Mn), by Equipment Type (2015)

Figure 10: Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology, 2015 and 2024

Figure 11: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Mass–Volume Balance, 2015–2024

Figure 12: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Acoustic/Ultrasonic, 2015–2024

Figure 13: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Fiber Optic Sensor, 2015–2024

Figure 14: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Vapor Sensing, 2015–2024

Figure 15: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Others, 2015–2024

Figure 16: Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location, 2015 and 2024

Figure 17: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Onshore, 2015–2024

Figure 18: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Offshore, 2015–2024

Figure 19: Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type, 2015 and 2024

Figure 20: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Flowmeters, 2015–2024

Figure 21: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Acoustic Sensors, 2015–2024

Figure 22: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Cable Sensors, 2015–2024

Figure 23: Global Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, by Others, 2015–2024

Figure 24: Global Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Region, 2015 and 2024

Figure 25: Global Oil and Gas Pipeline Leak Detection Equipment Market Attractiveness Analysis, by Region

Figure 26: North America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, 2015–2024

Figure 27: North America Oil and Gas Pipeline Leak Detection Equipment Market Revenue, Y-o-Y Growth Projections, 2015–2024

Figure 28: North America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology, 2015 and 2024

Figure 29: North America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location, 2015 and 2024

Figure 30: North America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type, 2015 and 2024

Figure 31: North America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country, 2015 and 2024

Figure 32: Technology

Figure 33: Location

Figure 34: Equipment Type

Figure 35: Country

Figure 36: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, 2015–2024

Figure 37: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Revenue, Y-o-Y Growth Projections, 2015–2024

Figure 38: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology, 2015 and 2024

Figure 39: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location, 2015 and 2024

Figure 40: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type, 2015 and 2024

Figure 41: Latin America Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country, 2016 and 2024

Figure 42: Technology

Figure 43: Location

Figure 44: Equipment Type

Figure 45: Country

Figure 46: Europe Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, 2015–2024

Figure 47: Europe Oil and Gas Pipeline Leak Detection Equipment Market Revenue and Volume, Y-o-Y Growth Projections, 2015–2024

Figure 48: Europe Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology, 2015 and 2024

Figure 49: Europe Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location, 2015 and 2024

Figure 50: Europe Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type, 2015 and 2024

Figure 51: Europe Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country, 2015 and 2024

Figure 52: Technology

Figure 53: Location

Figure 54: Equipment Type

Figure 55: Country

Figure 56: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, 2015–2024

Figure 57: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Revenue, Y-o-Y Growth Projections, 2015–2024

Figure 58: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology, 2015 and 2024

Figure 59: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location, 2015 and 2024

Figure 60: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type, 2015 and 2024

Figure 61: Asia Pacific Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country, 2015 and 2024

Figure 62: Technology

Figure 63: Location

Figure 64: Equipment Type

Figure 65: Country

Figure 66: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Revenue (US$ Mn) Forecast, 2015–2024

Figure 67: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Revenue, Y-o-Y Growth Projections, 2015–2024

Figure 68: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Technology, 2015 and 2024

Figure 69: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Location, 2015 and 2024

Figure 70: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Equipment Type, 2015 and 2024

Figure 71: Middle East & Africa Oil and Gas Pipeline Leak Detection Equipment Market Value Share Analysis, by Country, 2015 and 2024

Figure 72: Technology

Figure 73: Location

Figure 74: Equipment Type

Figure 75: Country

Figure 76: Global Oil and Gas Pipeline Leak Detection Equipment Market Share Analysis, by Company (2015)