North America Sulfur Dioxide Market - Snapshot

The North America sulfur dioxide market is predicted to experience considerable growth over the timeframe of forecast. Sulfur dioxide refers to a colorless neutral gas and this gas is almost 2.5 times heavier than air. It comes with a suffocating aroma, which has a pale sweetish fragrance. It is a chemical compound with the formula SO? and it is a poisonous gas at normal atmospheric pressure with a very bad smell.

Sulfur dioxide is mainly produced for the purpose of making sulfuric acid. It is utilized as a preserving agent in the process of winemaking. In addition, it is also used as a dipping agent in biomedical and biochemical applications as a solvent and as a mixture in laboratories. This chemical compound finds wide use in the food and beverage industry as an antioxidant and as a preservative. All these properties of the product are likely to propel the growth of the North America sulfur dioxide market in the years to come.

Rapid Growth of the Paper and Pulp Industry to Generate Demand for the Chemical

The North America sulfur dioxide market is mainly driven by the extensive use of sulfur dioxide in the production of sodium hydrosulfite. It is a popular agent for bleaching in paper and pulp industry. Paper and pulp is growing rapidly due to the growing prominence of paper recycling industry in North America, which is further contributing toward the growth of the North America sulfur dioxide market.

In addition, a rise in demand for sulfur dioxide for various industrial application in North America, such in the production of sulfites, sulfur trioxide, and sulfuric acid is likely to fuel the market in the region. Sulfur dioxide also finds use in the following sectors

Such rising demand across multiple industry is likely to drive the demand for sulfur dioxide in North America.

In the past few years, the demand for sulfur dioxide in several industrial applications has witnessed significant growth. Although the primary applications of sulfur dioxide are in the preparation of sulfuric acid, sulfur trioxide, and sulfites, it also finds application as a refrigerant, disinfectant, reducing agent, food preservative, and bleach.

The sulfur dioxide market has been growing at a gradual pace in North America. The market was valued at US$8.2 bn in 2015 and is projected to reach US$16.0 bn by 2024 at a CAGR of 7.8% therein.

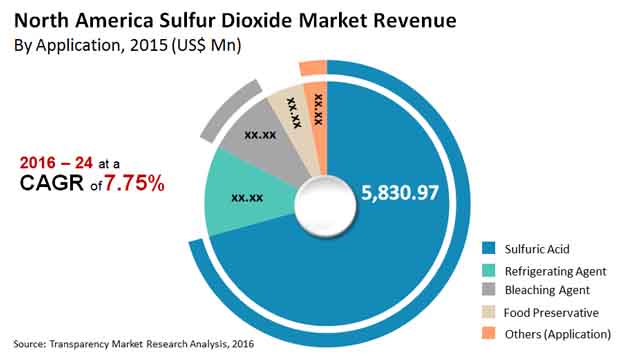

The market for sulfur dioxide in North America has been segmented on the basis of application into sulfuric acid, bleaching agents, refrigerating agents, food preservatives and antioxidants, and others. Sulfuric acid is the leading application segment, followed by refrigerating agents and bleaching agents. Food preservatives is also a prominent application of sulfur dioxide in North America. During the forecast period, the revenue generated by the food preservation application segment is anticipated to rise at a CAGR of 8.4%. The consumption of sulfur dioxide in the food and beverages industry is increasing as the demand for packaged and processed food material is on the rise. The production of sulfur dioxide for the food and beverages sector is projected to display an attractive growth rate by the end of the forecast period.

Chemicals was the leading end-use segment in North America in 2015. The total revenue share of this end-use segment was nearly 60% that year. However, the food and beverages segment is likely to gain much traction in North America between 2016 and 2024. The textile segment is also projected to expand at a steady pace during the forecast period, with the revenue rising at a CAGR of 6.7%.

Geographically, the North America sulfur dioxide market has been segmented into the U.S. and Canada. The U.S. was the leading market for sulfur dioxide in 2015 and one of the most significant consumers of sulfur dioxide in the world. The U.S. is a mature national market for sulfur dioxide and as the economy improves, the country is expected to provide previously unexplored avenues for the market to grow. Chemicals formed the leading end-user segment in the U.S. in 2015, followed by textiles and the food and beverages industry. The revenue generated by the food and beverages end-use segment toward the sulfur dioxide market is anticipated to expand at a CAGR of 7.9% during the forecast period.

Canada is another flourishing market for sulfur dioxide in North America, with a revenue share of 37% in 2015. Canada is one of the fastest growing economies in the world and favorable government regulations and the emergence of medium and small enterprises have contributed significantly to the sulfur dioxide market in the country. Sulfuric acid is the most prominent application segment in Canada’s sulfur dioxide market. During the forecast period, the sulfuric acid application segment is expected to rise at a steady CAGR of 6.4%, followed by the food preservatives application segment. The total revenue generated by the Canada sulfur dioxide market is anticipated to rise at rapid pace from 2016 to 2024.

Key players in the North America sulfur dioxide market include Boliden Group, INEOS Group AG, Praxair Technology, Inc., The Linde Group, Kemira Oyj, Chemtrade Logistics Inc., Calabrian Corporation, Grillo-Werke AG, PVS Chemicals Inc., and Esseco Group Srl.

Section 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

1.3 Research Objectives

1.4 Key Questions Answered

Section 2 Assumptions and Research Methodology

2.1 Report Assumptions

2.2 Acronyms Used

Section 3 Executive Summary

3.1 Global Sulfur Dioxide Market Size, By Market Value (US$ Mn) and Market Value Share

3.2 Market Size, Indicative (US$ Bn)

3.3 Top 3 Trends

Section 4 Market Overview

4.1 Segregation Overview

4.2 Plastic Production – Global Scenario

4.3 Drivers and Restraints Snapshot Analysis

4.4 Drivers

4.5 Restraints

4.6 Opportunity Analysis

4.7 Porter’s Analysis

4.7.1 Threat of Substitutes

4.7.2 Threat of Buyers

4.7.3 Threat of New Entrants

4.7.4 Threat of Suppliers

4.7.5 Degree of Competition

4.8 Value Chain Analysis

4.9 North America Sulfur Dioxide Market Analysis and Forecasts, 2015 – 2024

4.10 Key Insights

Section 5 North America Sulfur Dioxide Market Analysis

5.1 Key Findings

5.2 North America Sulfur Dioxide Market Overview

5.3 North America Sulfur Dioxide Market Forecast, By Application

5.4 North America Sulfur Dioxide Market Forecast, By End-Users

5.5 North America Sulfur Dioxide Market Analysis, By Country

5.6 U.S. Sulfur Dioxide Market Forecast, By Application

5.7 U.S. Sulfur Dioxide Market Forecast, By End-Users

5.8 Canada Sulfur Dioxide Market Forecast, By Application

5.9 Canada Sulfur Dioxide Market Forecast, By End-Users

5.10 North America Market Attractiveness Analysis

5.11 North America Market Trends

Section 6 Company Profile

6.1 Competition Matrix

6.2 Key Global Players

6.2.1 Boliden Group

6.2.1.1 Company Details

6.2.1.2 Company Description

6.2.1.3 Business Overview

6.2.1.4 SWOT Analysis

6.2.1.5 Strategic Overview

6.2.2 INEOS Group AG

6.2.2.1 Company Details

6.2.2.2 Company Description

6.2.2.3 Business Overview

6.2.2.4 SWOT Analysis

6.2.2.5 Strategic Overview

6.2.3 Praxair Technology, Inc.

6.2.3.1 Company Details

6.2.3.2 Company Description

6.2.3.3 Business Overview

6.2.3.4 SWOT Analysis

6.2.3.5 Strategic Overview

6.2.4 The Linde Group

6.2.4.1 Company Details

6.2.4.2 Company Description

6.2.4.3 Business Overview

6.2.4.4 SWOT Analysis

6.2.4.5 Strategic Overview

6.2.5 Kemira Oyj

6.2.5.1 Company Details

6.2.5.2 Company Description

6.2.5.3 Business Overview

6.2.5.4 SWOT Analysis

6.2.5.5 Strategic Overview

6.2.6 Chemtrade Logistics Inc.

6.2.6.1 Company Details

6.2.6.2 Company Description

6.2.6.3 Business Overview

6.2.6.4 SWOT Analysis

6.2.6.5 Strategic Overview

6.3 Key Regional Players

6.3.1 Calabrian Corporation

6.3.1.1 Company Details

6.3.1.2 Company Description

6.3.1.3 Business Overview

6.3.2 Grillo-Werke AG

6.3.2.1 Company Details

6.3.2.2 Company Description

6.3.2.3 Business Overview

6.3.3 PVS Chemicals Inc.

6.3.3.1 Company Details

6.3.3.2 Company Description

6.3.3.3 Business Overview

6.3.4 Esseco Group Srl

6.3.4.1 Company Details

6.3.4.2 Company Description

6.3.4.3 Business Overview

List of Tables

Table 1: Market Size (Kilo Tons) Forecast, By Application

Table 2: Market Size (US$ Mn) Forecast, By Application

Table 3: Market Size (Kilo Tons) Forecast, By End-Users

Table 4: Market Size (US$ Mn) Forecast, By End-Users

Table 5: Market Size (Kilo Tons) Forecast, By Application

Table 6: Market Size (US$ Mn) Forecast, By Application

Table 7: Market Size (Kilo Tons) Forecast, By End Users

Table 8: Market Size (US$ Mn) Forecast, By End Users

Table 9: Market Size (Kilo Tons) Forecast, By Application

Table 10: Market Size (US$ Mn) Forecast, By Application

Table 11: Market Size (Kilo Tons) Forecast, By End Users

Table 12: Market Size (US$ Mn) Forecast, By End Users

List of Figures

Figure 1: North America Sulfur Dioxide Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 2: North America Sulfur Dioxide Average Price (US$/ Kilo Tons) 2015–2024

Figure 3: North America Sulfur Dioxide Market Size (US$ Mn) and Volume (KT) Forecast, 2015–2024

Figure 4: North America Sulfur Dioxide Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 5: North America Market Attractiveness Analysis By Country

Figure 6: U.S. Sulfur Dioxide Market Analysis

Figure 7: Canada Sulfur Dioxide Market Analysis

Figure 8: By Application

Figure 9: By End User